KalVista Pharmaceuticals, Inc. (Nasdaq: KALV) (“KalVista”) today

announced the pricing of an underwritten offering of 5,500,000

shares of its common stock at a price of $10.00 per share to

certain investors (the “Offering”). The gross proceeds to KalVista

from the Offering are expected to be $55 million, before deducting

underwriting discounts, commissions and other offering expenses

payable by KalVista.

Concurrently with the Offering, KalVista has entered into a

securities purchase agreement with DRI Healthcare Acquisitions LP

(“DRI”), an accredited investor affiliated with DRI Healthcare

Trust, pursuant to which KalVista agreed to offer and sell and DRI

agreed to purchase 500,000 shares of KalVista common stock in a

private placement (the “Private Placement”) at a price per share

equal to that of the public offering price. Gross proceeds to

KalVista are expected to be $5 million, before deducting fees to

the placement agents and other offering expenses payable by

KalVista. The common stock sold in the Private Placement will not

be registered as part of the Offering. The consummation of the

Offering and the Private Placement are not contingent upon each

other.

KalVista intends to use the net proceeds from the Offering and

the Private Placement, along with the proceeds from our previously

announced synthetic royalty transaction and existing cash and cash

equivalents, to fund the continued clinical development of its

product candidate sebetralstat and activities related to its

planned commercialization following approval. The remainder of the

net proceeds, if any, will be used for general corporate

purposes.

All of the shares of common stock are being offered by KalVista.

The Offering and Private Placement are expected to close on

November 5, 2024, subject to the satisfaction of customary closing

conditions.

Jefferies, BofA Securities, TD Cowen and Stifel are acting as

the joint book-running managers for the Offering and as the joint

placement agents for the Private Placement.

Jones is acting as financial advisor for the Offering.

The Offering is being made pursuant to a shelf registration

statement (File No. 333-280759) on Form S-3 that was filed by

KalVista with the Securities and Exchange Commission (“SEC”) on

July 11, 2024 and declared effective by the SEC on July 19, 2024. A

prospectus supplement and accompanying prospectus relating to and

describing the terms of the Offering was filed with the SEC and is

available on the SEC’s website at www.sec.gov. A copy of the

prospectus supplement relating to the Offering, when available, may

be obtained by contacting Jefferies LLC, Attention: Equity

Syndicate Prospectus Department, 520 Madison Avenue, New York, New

York 10022, by telephone at 877-821-7388 or by email at

Prospectus_Department@Jefferies.com; BofA Securities,

NC1-0220-02-25, Attention: Prospectus Department, 201 North Tryon

Street, Charlotte, North Carolina 28255-0001, or by email at

dg.prospectus_requests@bofa.com; TD Securities (USA) LLC, 1

Vanderbilt Avenue, New York, New York 10017, by telephone at (855)

495-9846, or by email at TD.ECM_Prospectus@tdsecurities.com; or

Stifel, Nicolaus & Company, Incorporated, Attention: Syndicate,

One Montgomery Street, Suite 3700, San Francisco, California 94104,

by telephone at (415) 364-2720 or by email at

syndprospectus@stifel.com. Electronic copies of the final

prospectus supplement and accompanying prospectus will also be

available on the SEC’s website at www.sec.gov.

The securities being issued and sold in the Private Placement

have not been registered under the Securities Act of 1933, as

amended (the “Securities Act”), or any state’s securities laws, and

are being issued and sold in reliance on Section 4(a)(2) of the

Securities Act promulgated thereunder. The securities may not be

offered or sold in the United States, except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Securities Act.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities of KalVista, nor

shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About KalVista Pharmaceuticals, Inc.

KalVista Pharmaceuticals, Inc. is a global pharmaceutical

company that seeks to develop and deliver oral medicines for

diseases with significant unmet need. KalVista is focused on

understanding the needs of patients and the limitations of current

therapies to design treatments that empower people to better manage

their disease and improve their lives. KalVista’s New Drug

Application filing for sebetralstat for the on-demand treatment of

hereditary angioedema (“HAE”) attacks has been accepted by the U.S.

Food and Drug Administration with a Prescription Drug User Fee

Amendments goal date of June 17, 2025. In addition, KalVista has

received validation of its Market Authorization Application (“MAA”)

for HAE from the European Medicines Agency and has submitted MAA

applications to regulators in the United Kingdom, Switzerland,

Australia, and Singapore.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995 and other federal securities laws. Any statements contained

herein that do not describe historical facts, including, but not

limited to, statements regarding KalVista’s expectation of market

conditions and the satisfaction of customary closing conditions

related to the offering and sale of its securities, the expected

proceeds and timing of completion of the Offering and the Private

Placement, the expected use of proceeds from the Offering, Private

Placement and royalty licensing transaction, and anticipated

preclinical and clinical development activities, the timing of

clinical trials and announcements of clinical results, and

potential benefits of KalVista’s product candidates are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from those

discussed in such forward-looking statements. Such risks and

uncertainties include, among others, the risks identified in

KalVista’s filings with the SEC, the prospectus related to the

offering, and subsequent filings with the SEC. Any of these risks

and uncertainties could materially and adversely affect KalVista’s

results of operations, which would, in turn, have a significant and

adverse impact on KalVista’s stock price. KalVista cautions you not

to place undue reliance on any forward-looking statements, which

speak only as of the date they are made. Further information on

potential risk factors that could affect KalVista’s business and

financial results are detailed in KalVista’s filings with the SEC,

including in KalVista’s annual report on Form 10-K for the year

ended April 30, 2024, quarterly reports on Form 10-Q, and other

reports made from time to time with the SEC. KalVista undertakes no

obligation to update publicly any forward-looking statements to

reflect new information, events or circumstances after the date

they were made or to reflect the occurrence of unanticipated

events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104734173/en/

KalVista Pharmaceuticals, Inc. Jenn Snyder Vice

President, Corporate Affairs (617) 448-0281

jsnyder@kalvista.com

Ryan Baker Head, Investor Relations (617) 771-5001

ryan.baker@kalvista.com

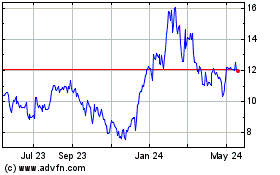

KalVista Pharmaceuticals (NASDAQ:KALV)

Historical Stock Chart

From Oct 2024 to Nov 2024

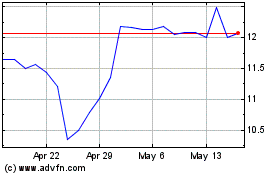

KalVista Pharmaceuticals (NASDAQ:KALV)

Historical Stock Chart

From Nov 2023 to Nov 2024