false

0001762239

0001762239

2024-10-29

2024-10-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 29, 2024

Kaival

Brands Innovations Group, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

001-40641 |

83-3492907 |

(State

or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S.

Employer

Identification No.) |

4460

Old Dixie Highway

Grant-Valkaria,

Florida 32949

(Address

of principal executive office, including zip code)

Telephone:

(833) 452-4825

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

KAVL |

The

Nasdaq Stock Market, LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Consulting Agreement with Chief Executive Officer

On

November 1, 2024, the Company entered into a consulting agreement (“Consulting Agreement”) with Mark Thoenes, the Interim

Chief Executive Officer of the Company.

Pursuant

to the Consulting Agreement, Mr. Thoenes will be paid professional fees of $25,000 per month. In addition, the Company shall grant Mr.

Thoenes 100,000 shares of common stock of the Company pursuant to the Company’s 2020 Stock and Incentive Compensation Plan as amended.

The

Consulting Agreement will be terminated on January 31, 2025, unless extended in writing by mutual consent of both parties. The Company

may also terminate the Consulting Agreement by written notice. If the Company terminates the Consulting Agreement for a reason other than

Cause (as defined in the Consulting Agreement), Mr. Thoenes is entitled to sum of $25,000 per month adjusted pro rata from the Termination

Date until January 31, 2025.

The

foregoing description of the Consulting Agreement does not purport to be complete and is qualified in its entirety by reference to the

full text of such instruments which are attached to this Report as Exhibit 10.1, respectively, which text is incorporated herein by reference.

Employment Agreement with Interim Chief Financial

Officer

On October 29, 2024, the Company

entered into an employment agreement with Eric Morris (“Employment Agreement”),

the Company’s Interim Chief Financial Officer.

Pursuant

to the Employment Agreement, Mr. Morris will be paid a base salary of $180,000 per year. In addition, the Company may grant Mr. Morris

a bonus of $20,000 subject to his continued employment with the Company. In addition, the Company will also grant Mr. Morris 250,000 shares

of restricted stock pursuant to the Company’s 2020 Stock and Incentive Compensation Plan as amended

The

Employment Agreement may be terminated by either the Company or Mr. Morris at any time and for any reason.

The

foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the

full text of such instruments which are attached to this Report as Exhibit 10.2 respectively, which text is incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| Dated: November 5, 2024 |

Kaival Brands Innovations Group, Inc. |

| |

|

|

| |

By: |

/s/ Mark Thoenes |

| |

|

Mark Thoenes |

| |

|

Chief Executive Officer |

EXHIBIT 10.1

INDEPENDENT CONTRACTOR AGREEMENT

THIS INDEPNDENT CONTRACTOR AGREEMENT

(this “Agreement”) is made and entered into by and between Kaival Brands Innovations Group, Inc. (the “Company”)

located at 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949, and Mr. Mark Thoenes (“Consultant”) (each a “Party”

and collectively the “Parties”) on this 30th day of October 2024 (“Signing Date”).

WHEREAS,

the Consultant was appointed to provide services in the position of interim Chief Executive Officer of the Company on September 12, 2024

(“Effective Date”) and the Company wishes to memorialize the terms of such engagement of Consultant as an independent consultant,

working in the capacity of the interim Chief Executive Officer on a contractual basis; and

NOW, THEREFORE,

in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency of which

are acknowledged, the Parties agree as follows:

1. Term

of Consultancy. Consultant’s engagement is at will, meaning that either party may terminate the engagement at any time for

any reason or no reason. Nothing in this Agreement is intended to create a promise or representation of continued engagement or employment

for a fixed period of time. The engagement shall be for the period of time between the Effective Date and the termination of the Consultant’s

engagement as provided in Section 5 (such period of time, the “Term.”) The Term may be extended if determined to be

necessary by the Board of Directors and accepted by the Consultant. Notwithstanding anything contained in this Agreement, the Consultant’s

engagement as a member of the Board of Directors shall continue pursuant to the amended and restated board of directors agreement dated

April 24, 2024 entered into between the Company and the Consultant.

a) Title.

The Company hereby agrees to engage the Consultant to serve as Chief Executive Officer of the Company.

b) Duties.

Consultant shall report to the Board of directors of the Company. Consultant shall perform all duties and have all powers incident to

the office he holds. Consultant shall have overall responsibility for the Company’s operations, including accurate accounting and

financial reporting, payment of the Company’s obligations, management, analysis, and negotiation, of agreements, and management

of subordinates working in the Company. Consultant shall also be required to certify to the United States Securities & Exchange Commission

(“SEC”) that the Company’s filings with the SEC fairly present in all material respects the Company’s condition,

as required. During the Term, the Consultant shall be engaged by the Company on a full-time basis and shall perform such duties and responsibilities

on behalf of the Company and all persons and entities directly or indirectly controlling, controlled by, or under common control with,

the Company. Consultant shall perform such other duties and may exercise such other powers as may be assigned by the Board from time to

time that are consistent with his title and status.

c) Board

Service. The Company may nominate Consultant to serve as a board member of Company affiliates or subsidiaries. Consultant agrees,

for no additional compensation, to serve on such boards. Upon the end of the Term for any reason, Consultant shall resign from any such

board positions Consultant holds with any Company subsidiary or affiliate.

d) Policies.

Throughout the Consultant’s engagement, the Consultant shall faithfully and industriously perform such duties. The Consultant will

be required to comply with all Company policies as may exist and be in effect from time to time.

e) Consultant

Representations. The Consultant represents and warrants to the Company that he is under no obligation or commitments, whether

contractual or otherwise, that are inconsistent with his obligations under this Agreement. The Consultant represents and warrants that

he will not use or disclose, in connection with his engagement by the Company, any trade secrets or proprietary information or intellectual

property in which any other person or entity has any right, title or interest and that his engagement by the Company as contemplated by

this Agreement will not infringe or violate the rights of any other person.

| 3. | Compensation and Benefits. |

a) Compensation.

In consideration for his work under the terms of this Agreement, the Consultant shall be paid professional fees in the gross amount of

$25,000 (Twenty-five Thousand Dollars) per month (“Compensation”). Consultant’s Compensation shall be paid in

equal semi- monthly installments. The Company and the Consultant hereby acknowledge that the payment of Compensation begin as of the Effective

Date and shall end on the Termination Date, as provided in section 5

b) Stock

Grants. On the Signing Date, the Company shall grant Consultant 100,000 (One Hundred Thousand) shares of common stock of the Company

pursuant to the Company’s 2020 Stock and Incentive Compensation Plan as amended from time to time (the “Incentive Plan”).

The issuance of such shares of common stock is subject to the Consultant’s approval.

c) Clawback

Rules. Notwithstanding any other provisions in this Agreement to the contrary, any incentive-based compensation, including any

annual incentive bonus and the Option, paid to the Consultant under this Agreement, the Incentive Plan, or any other agreement or arrangement

with the Company, which is subject to recovery under any law, government rule or regulation, or stock exchange listing requirement (“Clawback

Rules”), will be subject to such deductions and clawback as may be required to be made pursuant to such Clawback Rules or any

policy adopted by the Company pursuant to any such Clawback Rules. The Company shall decide, in its sole and absolute discretion, what

policies it must adopt in order to comply with such

d) Taxes-Withholdings.

All compensation paid or provided under this Agreement shall be subject to such deductions and withholdings for taxes and such other amounts

as are required by law or determined and elected by the Consultant, who is solely responsible their payment and remittance as a Form-1099

independent contractor.

4. Business

Expenses. The Company will reimburse or advance all reasonable business expenses that Consultant incurs in connection with

the performance of his duties under this Agreement, including travel expenses, in accordance with the Company’s policies as

established from time to time.

5. Termination

of Engagement. The Consultant’s engagement hereunder may be terminated by either the Company or the Consultant at any time

and for any reason. On termination of the Consultant’s engagement, the Consultant shall be entitled to all compensation as described

in this Section 5 and shall have no further rights to any further compensation or any other benefits from the Company or any of its affiliates

a) Release.

The Consultant will execute of and deliver to the Company a non-revocable release (as drafted by the Company at the time of Consultant’s

termination of engagement) which will include an unconditional release of all rights to any claims, charges, complaints, grievances, arising

from or relating to Consultant’s engagement or its termination plus any other potential claims, known or unknown to Consultant,

against the Company, its affiliates or assigns, or any of their officers, directors, employees and agents, through to the date of Consultant’s

termination from engagement (the “Release”). The Release shall not be mutual but may contain mutual confidentiality

and non-disparagement provisions and requirements that certain features of this Agreement remain in effect. The Release shall not require

Consultant to waive or release any rights to vested or earned compensation of any kind or to waive any rights as a shareholder, option

holder, unitholder, or as a participant in the Company’s Incentive Plan.

b) Notice

of Termination. Any termination of the Consultant engagement hereunder by the Company or by Consultant during the Term (other

than termination on account of Consultant death) shall be communicated by written notice of termination (“Notice of Termination”)

to the other party hereto. The Notice of Termination shall specify:

(i)

The termination provision of this Agreement relied upon;

(ii) To

the extent applicable, the facts and circumstances claimed to provide a basis for termination of the Consultant’s engagement under

the provision so indicated; and

(iii)

The applicable Termination Date.

c)

Termination Date. The Consultant’s “Termination Date” shall be the earliest of:

(i) January

31, 2025, unless extended by the Company and the Consultant through written mutual consent;

(ii) If

Consultant’s engagement hereunder terminates on account of Consultant’s death, the date of the Consultant’s death;

(iii) If

the Company terminates Consultant’s engagement, hereunder for any reason, the date the Notice of Termination is delivered to the

Consultant;

(iv) If

Consultant’s terminates his engagement, the date specified in the Consultant’s Notice of Termination.

d)

Termination not for Cause:

If the Consultant’s engagement is terminated by the

Company not for Cause, the Consultant shall be entitled to receive a sum of $25,000 per month adjusted pro rata from the Termination Date

until January 31, 2025.

Cause. For purposes of this Agreement,

but not for purposes of the Incentive Plan, “Cause” shall mean the Consultant

(i)

intentionally or negligently fails to perform his duties under this Agreement;

(ii)

refuses to comply with a lawful order of the Board or committees thereof;

(iii)

materially breaches a material term of this Agreement;

(iv)

willfully and materially violates a written Company policy;

(v) is

indicted for, convicted of, or pleads guilty or no contest to, a felony or crime involving moral turpitude;

(vi) engages

in conduct that constitutes gross negligence or willful misconduct in carrying out his duties;

(vii) materially

violates a federal or state law that the Board reasonably determines has had, or is reasonably likely to have, a material detrimental

effect on the Company’s reputation or business; or

(viii)

commits an act of fraud or dishonesty in the performance of his job duties;

a) Confidential

Information. The Consultant acknowledges that the Consultant will occupy a position of trust and confidence. The Company,

from time to time, may disclose to the Consultant, and the Consultant will require access to and may generate confidential and

proprietary information (no matter how created or stored) concerning the business practices, products, services, and operations of

the Company which is not known to its competitors or within its industry generally and which is of great competitive value to it,

including, but not limited to: (i) Trade Secrets (as defined herein), inventions, mask works, ideas, concepts, drawings, materials,

documentation, procedures, diagrams, specifications, models, processes, formulae, source and object codes, data, software, programs,

other works of authorship, know-how, improvements, discoveries, developments, designs and techniques; (ii) information regarding

research, development, products, marketing plans, market research and forecasts, bids, proposals, quotes, business plans, budgets,

financial information and projections, overhead costs, profit margins, pricing policies and practices, accounts, processes, planned

collaborations or alliances, licenses, suppliers and customers; (iii) operational information including deployment plans, means and

methods of performing services, operational needs information, and operational policies and practices; and (iv) any information

obtained by the Company from any third party that the Company treats or agrees to treat as confidential or proprietary information

of the third party (collectively, “Confidential Information”). The Consultant acknowledges and agrees that

Confidential Information includes Confidential Information disclosed to the Consultant prior to entering into this

Agreement.

b) Trade

Secrets. “Trade Secrets” means any information, including any data, plan, drawing, specification, pattern,

procedure, method, computer data, system, program or design, device, list, tool, or compilation, that relates to the present or planned

business of the Company and which: (i) derives economic value, actual or potential, from not being generally known to, and not readily

ascertainable by proper means to, other persons who can obtain economic value from their disclosure or use; and (ii) is the subject of

efforts that are reasonable under the circumstances to maintain their secrecy. To the extent that

the foregoing definition is inconsistent with a definition of “trade secret” under applicable law, the latter definition

shall control.

c) Restrictions

On Use and Disclosure of Confidential Information. The Consultant agrees during his engagement and after his engagement ends,

the Consultant will hold the Confidential Information in strict confidence and will neither use the information nor disclose it to anyone,

except to the extent necessary to carry out the Consultant’s responsibilities as an employee of the Company or as specifically authorized

in writing by a duly authorized officer of the Company. Nothing in this Agreement shall be deemed to prohibit the Consultant from disclosing

any concerns about suspected unlawful conduct to any proper government authority subject to proper jurisdiction. This provision shall

survive the termination of the Consultant’s engagement for so long as the Company maintains the secrecy of the Confidential Information

and the Confidential Information has competitive value; and to the extent such information is otherwise protected by statute for a longer

period, for example and not by way of limitation, the Defend Trade Secrets Act of 2016 (“DTSA”), then until such information

ceases to have statutory protection.

d) Defend

Trade Secrets Act. Misappropriation of a Trade Secret of the Company in breach of this Agreement may subject the Consultant to

liability under the DTSA, entitle the Company to injunctive relief, and require the Consultant to pay compensatory damages, double damages,

and attorneys’ fees to the Company. Notwithstanding any other provision of this Agreement, Consultant hereby is notified in accordance

with the DTSA that Consultant will not be held criminally or civilly liable under a federal or state law for the disclosure of a trade

secret that is made in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney,

and solely for the purpose of reporting or investigating a suspected violation of law; or is made in a complaint or other document filed

in a lawsuit or other proceeding, if such filing is made under seal. If the Consultant files a lawsuit for retaliation by the Company

for reporting a suspected violation of law, the Consultant may disclose the trade secret to the Consultant’s attorney and use the

trade secret information in the court proceeding, provided that the Consultant ust file any document containing the trade secret under

seal, and must not disclose the trade secret, except pursuant to court order.

| 7. | Inventions and Proprietary Information. |

(i) “Intellectual

Property Rights” means all rights in and to United States and foreign (A) patents,

patent disclosures, and inventions (whether patentable or not), (B) trademarks, service marks, trade dress, trade names,

logos, corporate names, and domain names, and other similar designations of source or origin, together with the goodwill symbolized

by any of the foregoing, (C) copyrights and works of authorship (whether copyrightable or not), including computer programs, mask

works, and rights in data and databases, (D) trade secrets, know-how, and other confidential information, (E) all other intellectual

property rights, in each case whether registered or unregistered, and including all rights of priority in and all rights to apply to

register for such rights, all registrations and applications for, and renewals or extensions of, such rights, and all similar or

equivalent rights or forms of protection in any part of the world, (F) any and all royalties, fees, income, payments, and other

proceeds with respect to any and all of the foregoing, and (G) any and all claims and causes of action with respect to any of the

foregoing, including all rights to recover for infringement, misappropriation, or dilution of the foregoing, and all rights

corresponding thereto throughout the world.

(ii) “Work

Product” means, without limitation, any and all ideas, concepts, information, materials, processes, methods, data, programs,

know-how, technology, improvements, discoveries, developments, works of authorship, designs, artwork, formulae, other copyrightable works,

and techniques and all Intellectual Property Rights that presently exist or may come to exist in the future in any of the items listed

above.

(i) All

right, title, and interest in and to all Work Product as well as any and all Intellectual Property Rights therein and all improvements

thereto shall be the sole and exclusive property of the Company.

(ii) The

Company shall have the unrestricted right (but not any obligation), in its sole and absolute discretion, to (A) use, commercialize, or

otherwise exploit any Work Product or (B) file an application for patent, copyright registration, or registration of any other Intellectual

Property Rights, and prosecute or abandon such application prior to issuance or registration. No royalty or other consideration shall

be due or owing to the Consultant now or in the future as a result of such activities.

(iii) The

Work Product is and shall at all times remain the Confidential Information of the Company.

| c) | Work Made for Hire; Assignment; Limitations. |

(i) The

Consultant acknowledges that all Work Product consisting of copyrightable subject matter is “work made for hire” as

defined in the Copyright Act of 1976 (17 U.S.C. § 101), and such copyrights are therefore owned by the Company. To the extent

that the foregoing does not apply, the Consultant hereby irrevocably assigns to the Company, and its successors and assigns, for no

additional consideration, the Consultant’s entire right, title, and interest, in and to all Work Product and Intellectual

Property Rights therein, including without limitation the right to sue, counterclaim, and recover for all past, present, and future

infringement, misappropriation, or dilution thereof, and all rights corresponding thereto throughout the world. Nothing contained in

this Agreement shall be construed to reduce or limit the Company’s right, title,

or interest in any Work Product or Intellectual Property Rights so as to be less in any respect than the Company would have had in

the absence of this Agreement.

(ii) To

the extent that the Consultant has not separately assigned any Prior Inventions, the Consultant hereby irrevocably assigns to the Company,

and its successors and assigns, for no additional consideration, the Consultant’s entire right, title, and interest in and to all

Prior Inventions, including without limitation the right to sue, counterclaim, and recover for all past, present, and future infringement,

misappropriation, or dilution thereof, and all rights corresponding thereto throughout the world. Nothing contained in this Agreement

shall be construed to reduce or limit the Company’s right, title, or interest in any Prior Inventions so as to be less in any respect

than the Company would have had in the absence of this Agreement.

(iii) The

Company expressly acknowledges that Consultant retains sole and exclusive ownership of any internet domain names that Consultant owned

prior to the Effective Date and that the Company has no ownership of such internet domain names.

8. Survival

of Provisions. The respective rights and obligations of the parties hereunder shall survive any termination of this Agreement

hereunder for any reason to the extent necessary to the intended provision of such rights and the intended performance of such obligations.

9. Return

of Property/Post-Engagement Representations. On the date of the Consultant’s termination of engagement with the Company

for any reason (or at any time prior thereto at the Company’s request), the Consultant shall return all property and documents belonging

to the Company and not retain any copies, including, but not limited to, any keys, access cards, badges, laptops, computers, cell phones,

wireless electronic mail devices, USB drives, other equipment, documents, reports, files, and other property provided by or belonging

to the Company. Consultant shall provide all usernames and passwords to all electronic devices, documents, and accounts, including any

social media accounts Consultant used in connection with his duties. Upon request, the Consultant shall return all Company-related documents

and data on personal devices and delete such documents and data upon the request of the Company. The Consultant shall give written acknowledgment

of the return and/or deletion of Company-related documents and data upon request of the Company. On and after the Termination Date, Consultant

e shall no longer represent to anyone that he remains engaged by the Company and shall take affirmative action to amend any statements

to the contrary on any social media sites, including but not limited to Linked-in and Facebook.

10. Notices.

For the purposes of this Agreement, notices, demands and all other communications provided for in the Agreement shall be in writing and

shall be deemed to have been given when delivered by email with return receipt requested, upon the obtaining of a valid return receipt

from the recipient, by hand, or mailed by nationally recognized overnight delivery service, addressed to the Parties’ addresses

specified below or to such other address as any Party may have furnished to the other in writing in accordance herewith, except that notices

of change of address shall be effective only upon receipt:

To

the Company:

Kaival Brands Innovations Group, Inc.

Attn: David Worner,

Director

4460 Old Dixie Highway

Grant-Valkaria, Florida

32949

Email: |

To

the Consultant:

Mr. Mark Thoenes

[ ]

Email: [ ] |

| |

|

With

a copy that will not constitute notice to:

Jeffrey Wofford,

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st floor,

New York, New York, 10036 |

|

11.

RESERVED

12. Assignment.

The Consultant may not assign any part of the Consultant’s rights or obligations under this Agreement. The Consultant agrees and

hereby consents that the Company may assign this Agreement to a third party that acquires or succeeds to the Company’s business,

that the provisions hereof are enforceable against the Consultant by such assignee or successor in interest, and that this Agreement shall

become an obligation of, inure to the benefit of, and be assigned to, any legal successor or successors to the Company.

13. Headings.

Titles or captions of sections or paragraphs contained in this Agreement are intended solely for the convenience of reference, and shall

not serve to define, limit, extend, modify, or describe the scope of this Agreement or the meaning of any provision hereof. The language

used in this Agreement is deemed to be the language chosen by the Parties to express their mutual intent, and no rule of strict construction

will be applied against any person.

14. Severability.

The provisions of this Agreement are severable. The unenforceability or invalidity of any provision or portion of this Agreement in any

jurisdiction shall not affect the validity, legality, or enforceability of the remainder of this Agreement, it being intended that all

rights and obligations of the Parties hereunder shall be enforceable to the full extent permitted by applicable law.

15. Waiver;

Modification. No provision of this Agreement may be modified, waived, or discharged unless such waiver, modification or discharge

is agreed to in writing and signed by the Consultant and a duly authorized officer of the Company. No waiver by either Party hereto at

any time of any breach by the other Party hereto of, or compliance with, any condition or provision of this Agreement to be performed

by such other Party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent

time.

16. Recitals;

Entire Agreement. The Recitals are hereby incorporated into this Agreement. This Agreement sets forth the entire agreement

of the Parties with respect to the subject matter contained herein and supersedes any and all prior agreements or understandings

between the Consultant and the Company with respect to the subject matter hereof. No

agreements, inducements, or representations, oral or otherwise, express, or implied, with respect to the subject matter hereof have

been made by either Party which are not expressly set forth in this Agreement.

17. Counterparts.

This Agreement may be executed in counterparts, and each executed counterpart shall have the efficacy of a signed original and may be

transmitted by facsimile or email. Each copy, facsimile copy, or emailed copy of any such signed counterpart may be used in lieu of the

original for any purpose.

IN WITNESS WHEREOF, the Parties

hereto have executed this Independent Contractor Agreement effective as of the date first written above.

| KAIVAL BRANDS INNOVATIONS GROUP, INC. |

|

| |

|

|

| By: |

|

|

| |

David Worner |

|

| |

Director |

|

CONSULTANT

Mark Thoenes

EXHIBIT 10.2

EXECUTIVE

EMPLOYMENT AGREEMENT

THIS

EXECUTIVE EMPLOYMENT AGREEMENT (this “Agreement”) is made and entered into by and between Kaival Brands Innovations

Group, Inc. (the “Company”) located at 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949, and Mr. Eric Morris(“Executive”)

(each a “Party” and collectively the “Parties”) on this 29th day of October2024 (“Signing

Date”).

WHEREAS,

the Executive was appointed to the position of interim Chief Financial Officer of the Company on March 7, 2024 (“Effective Date”)

and the Company wishes to memorialize the terms of employment of the Executive in this Agreement; and

NOW,

THEREFORE, in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency

of which are acknowledged, the Parties agree as follows:

1. Employment

Term. Executive’s employment is at will, meaning that either party may terminate the employment at any time for any reason

or no reason. Nothing in this Agreement is intended to create a promise or representation of continued employment or employment for a

fixed period of time. The period of time between the Effective Date and the termination of the Executive’s employment shall be

referred as the “Term.”

a) Title.

The Company hereby agrees to employ the Executive to serve as Chief Financial Officer, Treasurer and Secretary of the Company.

b) Duties.

Executive shall report to the Company’s Chief Executive Officer (“CEO”). Executive shall perform all

duties and have all powers incident to the office he holds. Executive shall have overall responsibility for the Company’s financial

operations, including accurate accounting and financial reporting, payment of the Company’s obligations, cash and investment management,

analysis, and negotiation, of financing agreements, and management of subordinates working in the Company’s finance function. Executive

shall also be required to certify to the United States Securities & Exchange Commission (“SEC”) that the Company’s

filings with the SEC fairly present in all material respects the Company’s financial condition. During the Term, the Executive

shall be employed by the Company on a full-time basis and shall perform such duties and responsibilities on behalf of the Company and

all persons and entities directly or indirectly controlling, controlled by, or under common control with, the Company. Executive shall

perform such other duties and may exercise such other powers as may be assigned by the CEO from time to time that are consistent with

his title and status.

c) Board

Service. The Company may nominate Executive to serve as a board member of Company affiliates or subsidiaries. Executive agrees,

for no additional compensation, to serve on such boards. Upon the end of the Term for any reason, Executive shall resign from any such

board positions Executive holds with any Company subsidiary or affiliate.

d) Full-Time

Commitment/Policies. Throughout the Executive’s employment, the Executive shall devote substantially all of his

professional time to the performance of his duties of employment with the Company (except as otherwise provided herein) and shall

faithfully and industriously perform such duties. The Executive will be required to comply with all Company policies as may exist

and be in effect from time to time.

e) Executive

Representations. The Executive represents and warrants to the Company that he is under no obligation or commitments, whether

contractual or otherwise, that are inconsistent with his obligations under this Agreement. The Executive represents and warrants that

he will not use or disclose, in connection with his employment by the Company, any trade secrets or proprietary information or intellectual

property in which any other person or entity has any right, title or interest and that his employment by the Company as contemplated

by this Agreement will not infringe or violate the rights of any other person.

| 3. | Compensation

and Benefits. |

a) Base

Salary. In consideration for his work under the terms of this Agreement, the Executive shall earn a base salary in the gross

amount of $180,000 (One Hundred Eighty Thousand Dollars) per year (“Base Salary”). Executive’s Base Salary shall

be paid in equal semi-monthly installments, in accordance with the regular payroll practices of the Company. The Company and the Executive

hereby acknowledge that the payment of the Base Salary begin as of the Effective Date.

b) Bonus.

For the calendar year 2024, the Company may, in its sole discretion, grant Executive a bonus of $20,000 (Twenty Thousand Dollars)

subject to Executive’s continued employment with the Company until termination. Executive shall be eligible for an any additional

incentive bonus based upon the sole and absolute discretion of the Board.

c) Restricted

Stock Grants. On the Signing Date, the Company shall grant Executive 250,000 (Two Hundred and Fifty Thousand) shares of restricted

stock of the Company pursuant to the Company’s 2020 Stock and Incentive Compensation Plan as amended from time to time (the “Incentive

Plan”).

d) Clawback

Rules. Notwithstanding any other provisions in this Agreement to the contrary, any incentive-based compensation, including any

annual incentive bonus and the Option, paid to the Executive under this Agreement, the Incentive Plan, or any other agreement or arrangement

with the Company, which is subject to recovery under any law, government rule or regulation, or stock exchange listing requirement (“Clawback

Rules”), will be subject to such deductions and clawback as may be required to be made pursuant to such Clawback Rules or any

policy adopted by the Company pursuant to any such Clawback Rules. The Company shall decide, in its sole and absolute discretion, what

policies it must adopt in order to comply with such Clawback Rules.

e) Benefits

and Perquisites. Executive shall be eligible for any fringe benefits offered by the Company on the same terms and conditions

as other executives. Such benefits may include group health benefits and a 401k retirement plan. The Company reserves the right, in its

sole discretion, to amend or terminate any employee benefit plan in accordance with applicable law.

f) Paid

Time Off. Executive will be entitled to 20 (twenty) paid vacation days per calendar year, pro-rated for partial years. Vacation

days shall accrue at the rate of 1/24 per pay period. Executive shall be entitled to an additional vacation day each succeeding year

up to a maximum accrual rate of 30 vacation days per year. The maximum vacation accrual shall be 1.75 times Executive’s annual

vacation allotment, at which point Executive shall not accrue any additional vacation days until Executive’s accrual balance is

reduced below that amount. Executive shall also be entitled to five paid sick days and those paid holidays recognized by the Company.

All paid time off shall be governed by the Company’s policies which the Company may, in its sole and absolute discretion, change

from time to time.

g) Taxes-Withholdings.

All compensation paid or provided under this Agreement shall be subject to such deductions and withholdings for taxes and such

other amounts as are required by law or elected by the Executive.

4. Business

Expenses. The Company will reimburse or advance all reasonable business expenses that Executive incurs in connection with the

performance of his duties under this Agreement, including travel expenses, in accordance with the Company’s policies as established

from time to time.

5. Termination

of Employment. The Executive’s employment hereunder may be terminated by either the Company or the Executive at any time

and for any reason. On termination of the Executive’s employment, the Executive shall be entitled to the compensation and benefits

described in this Section 5 and shall have no further rights to any compensation or any other benefits from the Company or any of its

affiliates.

a) For

Cause, or Without Good Reason. The Executive’s employment hereunder may be terminated by the Company for Cause, or by the

Executive without Good Reason. If the Executive’s employment is terminated by the Company for Cause, or by the Executive without

Good Reason, the Executive shall be entitled to receive:

(i) any

accrued but unpaid Base Salary which shall be paid on the pay date immediately following the Termination Date (as defined below) in accordance

with the Company’s customary payroll procedures;

(ii) reimbursement

for unreimbursed business expenses properly incurred by the Executive, which shall be subject to and paid in accordance with the Company’s

expense reimbursement policy; and

(iii) such

employee benefits (including equity compensation), if any, to which the Executive may be entitled under the Company’s employee

benefit plans as of the Termination Date; provided that, in no event shall the Executive be entitled to any payments in the nature

of severance or termination payments except as specifically provided herein.

Items

5.1(a)(i) through 5.1(a)(iii) are referred to herein collectively as the “Accrued Amounts”.

b) Cause. For

puroses of this Agreement, but not for purposes of the Incentive Plan, “Cause” shall mean the

Executive:

(i)

intentionally or negligently fails to perform his duties under this Agreement;

(ii)

refuses to comply with a lawful order of the Chief Executive Officer;

(iii)

materially breaches a material term of this Agreement;

(iv)

willfully and materially violates a written Company policy;

(v) is

indicted for, convicted of, or pleads guilty or no contest to, a felony or crime involving moral turpitude;

(vi) engages

in conduct that constitutes gross negligence or willful misconduct in carrying out his duties;

(vii) materially

violates a federal or state law that the Board reasonably determines has had, or is reasonably likely to have, a material detrimental

effect on the Company’s reputation or business; or

(iv)

commits an act of fraud or dishonesty in the performance of his job duties;

provided,

however, that in the case of (i) - (iv), if curable, the Executive shall have fifteen (15) days from the delivery of written

notice by the Company within which to cure any acts or omissions constituting Cause.

c) Release.

The Company’s obligation to paythe Accrued Amounts, is expressly conditioned upon Executive’s execution of and delivery

to the Company (and non-revocation) of a release (as drafted by the Company at the time of Executive’s termination of employment)

which will include an unconditional release of all rights to any claims, charges, complaints, grievances, arising from or relating to

Executive’s employment or its termination plus any other potential claims, known or unknown to Executive, against the Company,

its affiliates or assigns, or any of their officers, directors, employees and agents, through to the date of Executive’s termination

from employment (the “Release”). The Release shall not be mutual but may contain mutual confidentiality and non-disparagement

provisions and requirements that certain features of this Agreement remain in effect. The Release shall not require Executive to waive

or release any rights to vested or earned compensation of any kind or to waive any rights as a shareholder, option holder, unitholder,

or as a participant in the Company’s Incentive Plan.

d) Notice

of Termination. Any termination of the Executive’s employment hereunder by the Company or by Executive during the Term

(other than termination on account of Executive’s death) shall be communicated by written notice of termination (“Notice

of Termination”) to the other party hereto. The Notice of Termination shall specify:

(i)

The termination provision of this Agreement relied upon;

(ii) To

the extent applicable, the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under

the provision so indicated; and

(iii)

The applicable Termination Date.

e)

Termination Date. The Executive’s “Termination Date” shall be:

(i) If

Executive’s employment hereunder terminates on account of Executive’s death, the date of the Executive’s death;

(ii) If

the Company terminates Executive’s employment hereunder for any reason, the date the Notice of Termination is delivered to the

Executive;

(iii) If

Executive terminates his employment hereunder with or without Good Reason, the date specified in the Executive’s Notice of Termination.

a) Confidential

Information. The Executive acknowledges that the Executive will occupy a position of trust and confidence. The Company, from

time to time, may disclose to the Executive, and the Executive will require access to and may generate confidential and proprietary information

(no matter how created or stored) concerning the business practices, products, services, and operations of the Company which is not known

to its competitors or within its industry generally and which is of great competitive value to it, including, but not limited to: (i)

Trade Secrets (as defined herein), inventions, mask works, ideas, concepts, drawings, materials, documentation, procedures, diagrams,

specifications, models, processes, formulae, source and object codes, data, software, programs, other works of authorship, know-how,

improvements, discoveries, developments, designs and techniques; (ii) information regarding research, development, products, marketing

plans, market research and forecasts, bids, proposals, quotes, business plans, budgets, financial information and projections, overhead

costs, profit margins, pricing policies and practices, accounts, processes, planned collaborations or alliances, licenses, suppliers

and customers; (iii) operational information including deployment plans, means and methods of performing services, operational needs

information, and operational policies and practices; and (iv) any information obtained by the Company from any third party that the Company

treats or agrees to treat as confidential or proprietary information of the third party (collectively, “Confidential Information”).

The Executive acknowledges and agrees that Confidential Information includes Confidential Information disclosed to the Executive prior

to entering into this Agreement.

b) Trade

Secrets. “Trade Secrets” means any information, including any data, plan, drawing, specification, pattern,

procedure, method, computer data, system, program or design, device, list, tool, or compilation, that relates to the present or planned

business of the Company and which: (i) derives economic value, actual or potential, from not being generally known to, and not readily

ascertainable by proper means to, other persons who can obtain economic value from their disclosure or use; and (ii) is the subject of

efforts that are reasonable under the circumstances to maintain their secrecy. To the extent that the foregoing definition is inconsistent

with a definition of “trade secret” under applicable law, the latter definition shall control.

c) Restrictions

On Use and Disclosure of Confidential Information. The Executive agrees during his employment and after his employment ends,

the Executive will hold the Confidential Information in strict confidence and will neither use the information nor disclose it to anyone,

except to the extent necessary to carry out the Executive’s responsibilities as an employee of the Company or as specifically authorized

in writing by a duly authorized officer of the Company. Nothing in this Agreement shall be deemed to prohibit the Executive from disclosing

any concerns about suspected unlawful conduct to any proper government authority subject to proper jurisdiction. This provision shall

survive the termination of the Executive’s employment for so long as the Company maintains the secrecy of the Confidential Information

and the Confidential Information has competitive value; and to the extent such information is otherwise protected by statute for a longer

period, for example and not by way of limitation, the Defend Trade Secrets Act of 2016 (“DTSA”), then until such information

ceases to have statutory protection.

d) Defend

Trade Secrets Act. Misappropriation of a Trade Secret of the Company in breach of this Agreement may subject the Executive to

liability under the DTSA, entitle the Company to injunctive relief, and require the Executive to pay compensatory damages, double damages,

and attorneys’ fees to the Company. Notwithstanding any other provision of this Agreement, Executive hereby is notified in accordance

with the DTSA that Executive will not be held criminally or civilly liable under a federal or state law for the disclosure of a trade

secret that is made in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney,

and solely for the purpose of reporting or investigating a suspected violation of law; or is made in a complaint or other document filed

in a lawsuit or other proceeding, if such filing is made under seal. If the Executive files a lawsuit for retaliation by the Company

for reporting a suspected violation of law, the Executive may disclose the trade secret to the Executive’s attorney and use the

trade secret information in the court proceeding, provided that the Executive must file any document containing the trade secret under

seal, and must not disclose the trade secret, except pursuant to court order.

| 7. | Inventions

and Proprietary Information. |

(i) “Intellectual

Property Rights” means all rights in and to United States and foreign (A) patents, patent disclosures, and inventions

(whether patentable or not), (B) trademarks, service marks, trade dress, trade names, logos, corporate names, and domain names, and

other similar designations of source or origin, together with the goodwill symbolized by any of the foregoing, (C) copyrights and

works of authorship (whether copyrightable or not), including computer programs, mask works, and rights in data and databases, (D)

trade secrets, know-how, and other confidential information, (E) all other intellectual property rights, in each case whether

registered or unregistered, and including all rights of priority in and all rights to apply to register for such rights, all

registrations and applications for, and renewals or extensions of, such rights, and all similar or equivalent rights or forms of

protection in any part of the world, (F) any and all royalties, fees, income, payments, and other proceeds with respect to any and

all of the foregoing, and (G) any and all claims and causes of action with respect to any of the foregoing, including all rights to

recover for infringement, misappropriation, or dilution of the foregoing, and all rights corresponding thereto throughout the

world.

(ii) “Work

Product” means, without limitation, any and all ideas, concepts, information, materials, processes, methods, data,

programs, know-how, technology, improvements, discoveries, developments, works of authorship, designs, artwork, formulae, other

copyrightable works, and techniques and all Intellectual Property Rights that presently exist or may come to exist in the future in

any of the items listed above.

(i) All

right, title, and interest in and to all Work Product as well as any and all Intellectual Property Rights therein and all improvements

thereto shall be the sole and exclusive property of the Company.

(ii) The

Company shall have the unrestricted right (but not any obligation), in its sole and absolute discretion, to (A) use, commercialize, or

otherwise exploit any Work Product or (B) file an application for patent, copyright registration, or registration of any other Intellectual

Property Rights, and prosecute or abandon such application prior to issuance or registration. No royalty or other consideration shall

be due or owing to the Executive now or in the future as a result of such activities.

(iii) The

Work Product is and shall at all times remain the Confidential Information of the Company.

| c) | Work

Made for Hire; Assignment; Limitations. |

(i) The

Executive acknowledges that, by reason of being employed by the Company at the relevant times, to the extent permitted by law, all Work

Product consisting of copyrightable subject matter is “work made for hire” as defined in the Copyright Act of 1976 (17 U.S.C.

§ 101), and such copyrights are therefore owned by the Company. To the extent that the foregoing does not apply, the Executive hereby

irrevocably assigns to the Company, and its successors and assigns, for no additional consideration, the Executive’s entire right,

title, and interest, in and to all Work Product and Intellectual Property Rights therein, including without limitation the right to sue,

counterclaim, and recover for all past, present, and future infringement, misappropriation, or dilution thereof, and all rights corresponding

thereto throughout the world. Nothing contained in this Agreement shall be construed to reduce or limit the Company’s right, title,

or interest in any Work Product or Intellectual Property Rights so as to be less in any respect than the Company would have had in the

absence of this Agreement.

(ii) To

the extent that the Executive has not separately assigned any Prior Inventions, the Executive hereby irrevocably assigns to the Company,

and its successors and assigns, for no additional consideration, the Executive’s entire right, title, and interest in and to all

Prior Inventions, including without limitation the right to sue, counterclaim, and recover for all past, present, and future infringement,

misappropriation, or dilution thereof, and all rights corresponding thereto throughout the world. Nothing contained in this Agreement

shall be construed to reduce or limit the Company’s right, title, or interest in any Prior Inventions so as to be less in any respect

than the Company would have had in the absence of this Agreement.

(iii) The

Company expressly acknowledges that Executive retains sole and exclusive ownership of any internet domain names that Executive owned

prior to the Effective Date and that the Company has no ownership of such internet domain names.

8. Survival

of Provisions. The respective rights and obligations of the parties hereunder shall survive any termination of this Agreement

hereunder for any reason to the extent necessary to the intended provision of such rights and the intended performance of such obligations.

9. Return

of Property/Post-Employment Representations. On the date of the Executive’s termination of employment with the Company

for any reason (or at any time prior thereto at the Company’s request), the Executive shall return all property and documents belonging

to the Company and not retain any copies, including, but not limited to, any keys, access cards, badges, laptops, computers, cell phones,

wireless electronic mail devices, USB drives, other equipment, documents, reports, files, and other property provided by or belonging

to the Company. Executive shall provide all usernames and passwords to all electronic devices, documents, and accounts, including any

social media accounts Executive used in connection with his duties. Upon request, the Executive shall return all Company-related documents

and data on personal devices and delete such documents and data upon the request of the Company. The Executive shall give written acknowledgment

of the return and/or deletion of Company-related documents and data upon request of the Company. On and after the Termination Date, Executive

shall no longer represent to anyone that he remains employed by the Company and shall take affirmative action to amend any statements

to the contrary on any social media sites, including but not limited to Linked-in and Facebook.

10. Notices.

For the purposes of this Agreement, notices, demands and all other communications provided for in the Agreement shall be in writing

and shall be deemed to have been given when delivered by email with return receipt requested, upon the obtaining of a valid return receipt

from the recipient, by hand, or mailed by nationally recognized overnight delivery service, addressed to the Parties’ addresses

specified below or to such other address as any Party may have furnished to the other in writing in accordance herewith, except that

notices of change of address shall be effective only upon receipt:

To

the Company:

Kaival Brands Innovations Group, Inc.

Attn: Mark Thoenes,

Chief

Executive Officer

4460 Old Dixie Highway

Grant-Valkaria, Florida

32949

Email: |

To

the Executive:

Mr. Eric Morris |

| |

|

With

a copy that will not constitute notice to:

Jeffrey Wofford,

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st floor,

New York, New York, 10036

Email: |

|

11. Tax

Matters. The Company may withhold from any and all amounts payable under this Agreement or otherwise such federal, state and

local taxes as may be required to be withheld pursuant to any applicable law or regulation.

12. Assignment.

The Executive may not assign any part of the Executive’s rights or obligations under this Agreement. The Executive agrees

and hereby consents that the Company may assign this Agreement to a third party that acquires or succeeds to the Company’s business,

that the provisions hereof are enforceable against the Executive by such assignee or successor in interest, and that this Agreement shall

become an obligation of, inure to the benefit of, and be assigned to, any legal successor or successors to the Company.

13. Headings.

Titles or captions of sections or paragraphs contained in this Agreement are intended solely for the convenience of reference,

and shall not serve to define, limit, extend, modify, or describe the scope of this Agreement or the meaning of any provision hereof.

The language used in this Agreement is deemed to be the language chosen by the Parties to express their mutual intent, and no rule of

strict construction will be applied against any person.

14. Severability.

The provisions of this Agreement are severable. The unenforceability or invalidity of any provision or portion of this Agreement

in any jurisdiction shall not affect the validity, legality, or enforceability of the remainder of this Agreement, it being intended

that all rights and obligations of the Parties hereunder shall be enforceable to the full extent permitted by applicable law.

15. Waiver;

Modification. No provision of this Agreement may be modified, waived, or discharged unless such waiver, modification or discharge

is agreed to in writing and signed by the Executive and a duly authorized officer of the Company. No waiver by either Party hereto at

any time of any breach by the other Party hereto of, or compliance with, any condition or provision of this Agreement to be performed

by such other Party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent

time.

16. Recitals;

Entire Agreement. The Recitals are hereby incorporated into this Agreement. This Agreement sets forth the entire agreement of

the Parties with respect to the subject matter contained herein and supersedes any and all prior agreements or understandings between

the Executive and the Company with respect to the subject matter hereof. No agreements, inducements, or representations, oral or otherwise,

express, or implied, with respect to the subject matter hereof have been made by either Party which are not expressly set forth in this

Agreement.

17. Counterparts.

This Agreement may be executed in counterparts, and each executed counterpart shall have the efficacy of a signed original and

may be transmitted by facsimile or email. Each copy, facsimile copy, or emailed copy of any such signed counterpart may be used in lieu

of the original for any purpose.

IN

WITNESS WHEREOF, the Parties hereto have executed this Executive Employment Agreement effective as of the date first written above.

| KAIVAL BRANDS INNOVATIONS GROUP, INC. |

|

| |

|

|

| By: |

|

|

| |

Mark Thoenes |

|

| |

Chief Executive Officer |

|

EXECUTIVE

Eric

Morris

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

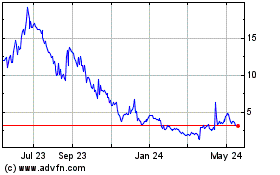

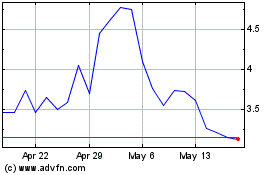

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Dec 2023 to Dec 2024