- Topline data from PORTOLA Phase 2a clinical trial

evaluating zetomipzomib in patients with autoimmune

hepatitis (AIH) expected in first half 2025

- Cash, cash equivalents and marketable securities totaled $148

million as of September 30, 2024

Kezar Life Sciences, Inc. (Nasdaq: KZR), a clinical-stage

biotechnology company developing novel small molecule therapeutics

to treat unmet needs in immune-mediated diseases, today reported

financial results for the third quarter ended September 30, 2024,

and provided a business update.

“The team at Kezar has made great progress towards completing

the double-blind portion of the PORTOLA trial as we prepare for a

data release in first half of 2025,” said Chris Kirk, PhD, Kezar’s

Chief Executive Officer. “There are currently no approved drugs for

the treatment of autoimmune hepatitis, and we are focused on

bringing zetomipzomib to patients living with this life-threatening

disease. In addition, we are working to understand the safety

events that occurred in the PALIZADE trial in lupus nephritis,

including deaths that occurred in both the placebo and drug arms,

so that we can provide patients and physicians appropriate guidance

during our ongoing and future clinical trials.”

Zetomipzomib: Selective

Immunoproteasome Inhibitor

PORTOLA – Phase 2a clinical trial of zetomipzomib in patients

with AIH (ClinicalTrials.gov: NCT05569759)

- PORTOLA is a placebo-controlled, randomized, double-blind Phase

2a clinical trial evaluating the efficacy and safety of

zetomipzomib in patients with AIH that are insufficiently

responding to standard of care or have relapsed. The study has

completed enrollment of 24 patients, randomized (2:1) to receive 60

mg of zetomipzomib or placebo in addition to background therapy for

24 weeks, with a protocol-suggested steroid taper. The primary

efficacy endpoint will measure the proportion of patients who

achieve a complete biochemical response by Week 24 measured as

normalization of alanine aminotransferase (ALT), aspartate

aminotransferase (AST) and Immunoglobulin G (IgG) values (if

elevated at baseline), with steroid dose levels not higher than

baseline.

- Kezar plans to report topline data in the first half of 2025.

In October, the Independent Data Monitoring Committee (IDMC)

recommended that the PORTOLA trial proceed without modification.

The IDMC examined safety data from all patients enrolled in the

trial, including data from patients who completed the 24-week

double-blind treatment period (DBTP) and continued to the

open-label extension (OLE) portion of the trial that includes an

additional 24 weeks of treatment. To date, no Grade 4 or 5 serious

adverse events (SAEs) have been observed in this trial, which is

being conducted at clinical trial sites in the United States. This

recommendation occurred following the FDA’s clinical hold on the

PALIZADE trial, as described below.

- Following the recommendation made by the IDMC, the FDA notified

Kezar that it is allowing enrolled patients to complete the DBTP of

the PORTOLA trial without modification. However, the FDA has placed

a partial clinical hold on PORTOLA requiring that the four

remaining patients currently in the DBTP should not continue to the

OLE portion of the trial. Patients who are currently participating

in the OLE may continue treatment on zetomipzomib, but their

prednisone dosage may not be tapered below 5 mg/day, and any

patients who tapered below this amount will raise their prednisone

back to 5 mg/day.

PALIZADE – Phase 2b clinical trial of zetomipzomib in patients

with active lupus nephritis (LN) (ClinicalTrials.gov:

NCT05781750)

- In October, Kezar made the strategic decision to terminate the

PALIZADE Phase 2b clinical trial in patients with active LN and

focus clinical development efforts on zetomipzomib in AIH. PALIZADE

was placed on full clinical hold following the recommendation of

the PALIZADE IDMC after its assessment of four Grade 5 (fatal) SAEs

that occurred in patients enrolled in the Philippines and Argentina

(including one patient on placebo).

- Kezar is unblinding the trial and will perform a full

investigation into all safety events from the study. 84 patients

were enrolled in PALIZADE as of termination, and Kezar expects to

report available data from PALIZADE at a later date.

MISSION – Kezar will present results from the open-label Phase

1b/2 MISSION trial in patients with systemic lupus erythematosus

(SLE) with or without LN showing zetomipzomib demonstrated

improvements in SLE/LN disease measures and biomarkers in patients

with highly active SLE or nephrotic range proteinuria at the

upcoming American College of Rheumatology (ACR) Convergence 2024,

which is taking place November 14 – 19, 2024, in Washington,

D.C.

Business Updates

In October, Kezar effected a one-for-ten reverse stock split of

its outstanding shares of common stock (Reverse Stock Split) to

regain compliance with the minimum bid price requirement of $1.00

per share required to maintain continued listing on The Nasdaq

Capital Market. The Reverse Stock Split reduced the number of

shares of Kezar’s outstanding common stock from 72,962,220 shares

to 7,296,222 shares, subject to adjustment due to the issuance of

full shares in lieu of fractional shares.

Financial Results

- Cash, cash equivalents and marketable securities totaled

$148.4 million as of September 30, 2024, compared to $201.4 million

as of December 31, 2023. The decrease was primarily attributable to

cash used in operations to advance clinical-stage programs.

- Research and development (R&D) expenses for the

third quarter of 2024 decreased by $7.5 million to $16.2 million,

compared to $23.7 million in the third quarter of 2023. This

decrease was primarily due to the Company’s strategic restructuring

in October 2023 to prioritize its clinical-stage programs, reducing

personnel-related costs and spending in its early-stage research

activities. The decrease was partially offset by the increased

clinical trial costs related to the PALIZADE and PORTOLA

trials.

- General and administrative (G&A) expenses for the

third quarter of 2024 decreased by $3.1 million to $5.7 million

compared to $8.8 million in the third quarter of 2023. The decrease

was primarily due to a decrease in legal and professional service

expenses and non-cash stock-based compensation.

- Net loss for the third quarter of 2024 was $20.3

million, or $2.78 per basic and diluted common share, compared to a

net loss of $23.1 million, or $3.18 per basic and diluted common

share, for the third quarter of 2023. The weighted-average shares

used to compute net loss per basic and diluted common share have

been retroactively adjusted to reflect the one-for-ten reverse

stock split completed on October 29, 2024.

- Total shares of common stock outstanding were 7.3

million shares as of September 30, 2024, after taking into effect

the retroactive application of the one-for-ten reverse stock split

completed on October 29, 2024.

About Kezar Life Sciences

Kezar Life Sciences is a clinical-stage biopharmaceutical

company developing novel small molecule therapeutics to treat unmet

needs in immune-mediated diseases. Zetomipzomib, a selective

immunoproteasome inhibitor, is currently being evaluated in a Phase

2a clinical trial for autoimmune hepatitis. This product candidate

also has the potential to address multiple chronic immune-mediated

diseases. For more information, visit www.kezarlifesciences.com,

and follow us on LinkedIn, Facebook, Twitter and Instagram.

Cautionary Note on Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Words such as “may,” “will,” “can,” “should,” “expect,”

“believe,” “potential,” “anticipate” and similar expressions (as

well as other words or expressions referencing future events,

conditions or circumstances) are intended to identify

forward-looking statements. These forward-looking statements are

based on Kezar’s expectations and assumptions as of the date of

this press release. Each of these forward-looking statements

involves risks and uncertainties that could cause Kezar’s clinical

development programs, future results or performance to differ

materially from those expressed or implied by the forward-looking

statements. Forward-looking statements contained in this press

release include, but are not limited to, statements about the

design, initiation, progress, timing, scope and results of clinical

trials, the enrollment and expected timing of reporting topline

data from our clinical trials, the likelihood that data will

support future development and therapeutic potential, the

association of data with treatment outcomes and the likelihood of

obtaining regulatory approval of Kezar’s product candidates. Many

factors may cause differences between current expectations and

actual results, including unexpected safety or efficacy data

observed during clinical studies, difficulties enrolling and

conducting our clinical trials, changes in expected or existing

competition, changes in the regulatory environment, the

uncertainties and timing of the regulatory approval process, and

unexpected litigation or other disputes. Other factors that may

cause actual results to differ from those expressed or implied in

the forward-looking statements in this press release are discussed

in Kezar’s filings with the U.S. Securities and Exchange

Commission, including the “Risk Factors” contained therein. Except

as required by law, Kezar assumes no obligation to update any

forward-looking statements contained herein to reflect any change

in expectations, even as new information becomes available.

KEZAR LIFE SCIENCES, INC.

Selected Balance Sheets Data

(In thousands)

September 30, 2024

December 31, 2023

(unaudited)

Cash, cash equivalents and marketable

securities

$

148,388

$

201,372

Total assets

164,086

221,235

Total current liabilities

20,429

17,744

Total noncurrent liabilities

9,608

15,921

Total stockholders' equity

134,049

187,570

Summary of Operations Data (In thousands except share and

per share data)

Three Months Ended

Nine Months Ended

September 30

September 30

2024

2023

2024

2023

(unaudited)

(unaudited)

Collaboration revenue

$

-

$

7,000

$

-

$

7,000

Operating expenses:

Research and development

16,242

23,738

49,712

63,055

General and administrative

5,706

8,789

17,848

20,780

Impairment charge

-

-

1,482

-

Total operating expenses

21,948

32,527

69,042

83,835

Loss from operations

(21,948

)

(25,527

)

(69,042

)

(76,835

)

Interest income

2,038

2,820

6,728

8,376

Interest expense

(403

)

(396

)

(1,204

)

(1,151

)

Net loss

$

(20,313

)

$

(23,103

)

$

(63,518

)

$

(69,610

)

Net loss per common share, basic and

diluted

$

(2.78

)

$

(3.18

)

$

(8.72

)

$

(9.60

)

Weighted-average shares used to compute

net loss per common share, basic and diluted (1)

7,296,222

7,268,165

7,286,967

7,249,188

(1)

Shares outstanding have been retroactively

adjusted to reflect the one-for-ten reverse stock split that

completed on October 29, 2024, subject to adjustment due to the

issuance of full shares in lieu of fractional shares.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112979408/en/

Investor and Media Contact: Gitanjali Jain Senior Vice

President, Investor Relations and External Affairs Kezar Life

Sciences, Inc. gjain@kezarbio.com

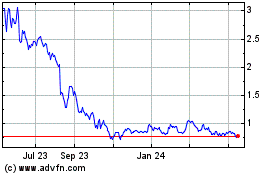

Kezar Life Sciences (NASDAQ:KZR)

Historical Stock Chart

From Jan 2025 to Feb 2025

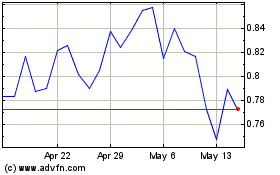

Kezar Life Sciences (NASDAQ:KZR)

Historical Stock Chart

From Feb 2024 to Feb 2025