Filed Pursuant to Rule 424(b)(5)

File No. 333-279118

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 3, 2024)

Up to $50,000,000

LUMINAR TECHNOLOGIES, INC.

EQUITY FINANCING PROGRAM

Class A Common Stock

We have entered into a Financing Agreement (the “Agreement”) with Virtu Americas LLC, or Virtu, which we refer to as the sales agent, relating to shares of our Class A common stock offered by this prospectus supplement and the accompanying base prospectus pursuant to our equity financing program. We established this program with Virtu in 2023 and have periodically extended it. Pursuant to this prospectus supplement, we may offer and sell shares of our Class A common stock having an aggregate offering price of up to $50,000,000 from time to time through or to the sales agent. We intend to use the net proceeds, if any, from offerings under the Equity Financing Program for general corporate purposes, including payment of interest on debt and other manner to repay, repurchase, or service such debt.

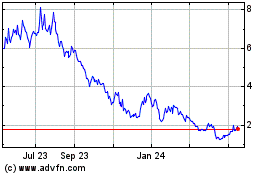

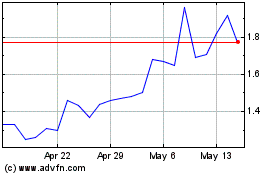

Our Class A common stock is listed on the Nasdaq Global Select Market under the symbol “LAZR”. The last reported sale price of our Class A common stock on the Nasdaq Stock Market on August 7, 2024 was $0.88 per share.

Sales of shares of Class A common stock, if any, under this prospectus supplement and the accompanying base prospectus may be made in transactions that are deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on or through the Nasdaq Stock Market or any other existing trading market for our Class A common stock. The sales agent will make all sales using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between the sales agent and us.

The sales agent will receive from us a commission equal to up to 2.0% of the gross sales price of all shares sold through it under the Agreement. See “Plan of Distribution” for additional information regarding compensation to be paid to the sales agent. In connection with the sale of Class A common stock on our behalf, the sales agent may be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the sales agent may be deemed to be underwriting commissions or discounts.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement and on page 2 of the accompanying base prospectus, as well as those risks described in our most recent Annual Report on Form 10-K and in our subsequent filings with the Securities and Exchange Commission (the “SEC”) pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), incorporated by reference in this prospectus supplement before making a decision to invest in our Class A common stock. Neither the SEC, any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying base prospectus to which it relates are truthful and complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 8, 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of a “shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC. This prospectus supplement, which describes the specific terms of this offering and the securities offered hereby, adds to and updates information contained in the accompanying base prospectus and the documents incorporated into each by reference. The accompanying base prospectus, gives more general information and disclosure. When we refer only to the “prospectus,” we are referring to both the prospectus supplement and the accompanying base prospectus combined.

If there is any inconsistency between information in or incorporated by reference into the accompanying base prospectus and information in or incorporated by reference into this prospectus supplement, you should rely only on the information contained in or incorporated by reference into this prospectus supplement. This prospectus supplement, the accompanying base prospectus and the documents incorporated into each by reference include important information about us, the Class A common stock being offered and other information you should know before investing. You should read this prospectus supplement and the accompanying base prospectus together with the additional information described under the heading, “Where You Can Find More Information” before investing in our Class A common stock.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying base prospectus. We have not, and the sales agent has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the sales agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale thereof is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying base prospectus and the documents incorporated into each by reference is accurate only as of the respective dates of the applicable documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

When we refer to “we,” “our,” “us,” “Luminar,” and the “Company” in this prospectus supplement, we mean Luminar Technologies, Inc. and its subsidiaries.

We and Virtu are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the shares of our Class A common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our Class A common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Luminar, the Luminar logo and our other registered or common law trademarks, service marks or trade names appearing in this prospectus supplement are the property of Luminar. Solely for convenience, our trademarks, tradenames and service marks referred to in this prospectus supplement appear without the ®, TM and SM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames. Other trademarks, service marks and trade names used in this prospectus supplement are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying base prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, that are forward-looking and as such are not historical facts. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology.

These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including, our history of losses and our expectation that we will continue to incur significant expenses, including substantial R&D costs, and continuing losses for the foreseeable future as well as our limited operating history which makes it difficult to evaluate our future prospects and the risks and challenges we may encounter; the level of our indebtedness; our strategic initiatives which may prove more costly than we currently anticipate and potential failure to increase our revenue to offset these initiatives; the extent to which our LiDAR products are selected for inclusion in autonomous driving or Advanced Driving Assistance Systems (“ADAS”) by automotive original equipment manufacturers (“OEMs”) or their suppliers, and whether we will be de-selected by any customers; the lengthy period of time from a major commercial win to implementation and the risks of cancellation or postponement of the contract or unsuccessful implementation; potential inaccuracies in our forward looking estimates of certain metrics, including Order Book, our future cost of goods sold (“COGS”) and bill of materials (“BOM”) and total addressable market; the discontinuation, lack of success of our customers in developing and commercializing products using our solutions or loss of business with respect to a particular vehicle model or technology package and whether end automotive consumers will demand and be willing to pay for such features; our ability to successfully fund our growth if there are considerable delays in product introductions by us or our customers; our inability to reduce and control the cost of the inputs on which we rely, which could negatively impact the adoption of our products and our profitability; the effect of continued pricing pressures, competition from other LiDAR manufacturers, OEM cost reduction initiatives and the ability of automotive OEMs to re-source or cancel vehicle or technology programs which may result in lower than anticipated margins, or losses, which may adversely affect our business; the effect of general economic conditions, including inflation, recession risks and rising interest rates, generally and on our industry and us in particular, including the level of demand and financial performance of the autonomous vehicle industry and the decline in fair value of available-for-sale debt securities in a rising interest rate environment; market adoption of LiDAR as well as developments in alternative technology and the increasingly competitive environment in which we operate, which includes established competitors and market participants that have substantially greater resources; our ability to achieve technological feasibility and commercialize our software products and the requirement to continue to develop new products and product innovations due to rapidly changing markets and government regulations of such technologies; our ability to build, launch, receive regulatory approval, sell, and service insurance products as well as market and differentiate the benefits of LiDAR-based ADAS to consumers; our ability to manage our growth and expand our business operations effectively, including into international markets, such as China, which exposes us to operational, financial, regulatory and geopolitical risks; changes in our government contracts business and our defense customers’ business due to political change and global conflicts; adverse impacts due to limited availability and quality of materials, supplies, and capital equipment, or dependency on third-party service providers and single-source suppliers; the project-based nature of our orders, which can cause our results of operations to fluctuate on a quarterly and annual basis; whether we will be able to successfully transition our engineering designs into high volume manufacturing, including our ability to transition to an outsourced manufacturing business model and whether we and our outsourcing partners and suppliers can successfully operate complex machinery; whether we can successfully select, execute or integrate our acquisitions; whether the complexity of our products results in undetected defects and reliability issues which could reduce market adoption of our new products, limit our ability to manufacture, damage our reputation and expose us to product liability, warranty and other claims; our ability to maintain and adequately manage our inventory; our ability to maintain an effective system of internal control over financial reporting; our ability to protect and enforce our intellectual property rights; availability of qualified personnel, loss of highly

skilled personnel and dependence on Austin Russell, our Founder, President and Chief Executive Officer; the impact of inflation and our stock price on our ability to hire and retain highly skilled personnel; the amount and timing of future sales and whether the average selling prices of our products could decrease rapidly over the life of the product as well as our dependence on a few key customers, who are often large corporations with substantial negotiating power; our ability to establish and maintain confidence in our long-term business prospects among customers and analysts and within our industry; whether we are subject to negative publicity; the effects of COVID-19 or other infectious diseases, health epidemics, pandemics and natural disasters on Luminar’s business; interruption or failure of our information technology and communications systems; cybersecurity risks to our operational systems, security systems, infrastructure, integrated software in our LiDAR solutions; market instability exacerbated by geopolitical conflicts, including the Israel-Hamas war and the conflict between Russia and Ukraine, as well as trade disputes with China and including the effect of sanctions and trade restrictions that may affect supply chain or sales opportunities. You should specifically consider the numerous risks outlined in “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent documents and reports we file with the SEC.

Given these uncertainties, you should not place undue reliance on these forward-looking statements as actual events or results may differ materially from those projected in the forward-looking statements. Our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements contained in this prospectus supplement, in the documents incorporated by reference herein by these cautionary statements. These forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law, you are advised to review any additional disclosures we make in the documents we subsequently file with the SEC that are incorporated by reference in this prospectus supplement. See “Where You Can Find More Information.”

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement or the accompanying prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus supplement and accompanying base prospectus, including all documents incorporated by reference herein and therein and the information set forth under the heading “Risk Factors” in this prospectus supplement and the accompanying prospectus, our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and any subsequently filed Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and any amendment or update thereto reflected in our subsequent filings with the SEC and incorporated by reference in this prospectus and the accompanying prospectus.

The Company

Luminar is a global automotive technology company ushering in a new era of vehicle safety and autonomy. Over the past decade, Luminar has been building our light detection and ranging (LiDAR) sensor from the chip-level up, which is expected to meet the demanding performance, safety, reliability and cost requirements to enable next-generation safety and autonomous capabilities for passenger and commercial vehicles, as well as other adjacent markets.

The global automotive and mobility sector is increasingly focused on safety and autonomy, specifically next-generation advanced driver assistance systems, or ADAS, and highway autonomy for passenger and commercial vehicles. Our LiDAR technology provides increased situational awareness in a broad range of driving environments through improved and higher confidence detection and planning at all vehicle speeds. Beyond sensor hardware, our product portfolio has expanded to include in-development perception and decision-making software, as well as high definition “3D” mapping that we anticipate will monetize the ecosystem of improved safety and autonomy created by our LiDAR.

Corporate Information

We were incorporated in the State of Delaware in August 2018 as a special purpose acquisition company under the name Gores Metropoulos, Inc. On February 5, 2019, we completed our initial public offering. On December 2, 2020, we consummated the business combination (the “Business Combination”) pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated August 24, 2020, with the pre-Business Combination Luminar Technologies, Inc. (“Legacy Luminar”). Legacy Luminar was incorporated in Delaware on March 31, 2015. In connection with the consummation of the Business Combination, we changed our name from Gores Metropoulos, Inc. to Luminar Technologies, Inc.

Our principal executive offices are located at 2603 Discovery Drive, Suite 100, Orlando, Florida 32826. Our telephone number is (800) 532-2417. Our website address is www.luminartech.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

The Offering

| | | | | |

Issuer | Luminar Technologies, Inc. |

| |

Shares of Class A Common Stock offered by us | Shares of our Class A common stock having an aggregate offering price of up to $50,000,000. |

| |

Plan of Distribution | “At the market offering” that may be made from time to time through or to our sales agent, Virtu. See the section titled “Plan of Distribution.” |

| |

Use of Proceeds | We intend to use the net proceeds, if any, from offerings under this program for general corporate purposes including payment of interest on debt and other manner to repay, repurchase, or service such debt. See “Use of Proceeds.” |

| |

Risk Factors | Investing in our Class A common stock involves a high degree of risk. Prospective investors should carefully consider the matters discussed or incorporated by reference under the caption titled “Risk Factors” on page S-3 of this prospectus supplement. |

| |

Nasdaq Global Select Stock Market symbol | LAZR |

RISK FACTORS

Investing in the shares of Class A common stock being offered pursuant to this prospectus supplement and the accompanying prospectus involves a high degree of risk. Before deciding whether to invest in our Class A common stock, you should consider carefully the risk factors described below. You should carefully consider the risks and uncertainties discussed under the section titled “Risk Factors” contained in our most recent Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, as well as any amendments thereto, which are incorporated by reference into this prospectus supplement, the accompanying prospectus and any applicable prospectus supplement in their entirety, together with other information in this prospectus supplement, the accompanying prospectus and any applicable prospectus supplement, and the documents incorporated by reference herein and therein, before making an investment decision. These risks and uncertainties are not the only ones facing us. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, also may become important factors that affect us. See “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our Class A common stock could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus supplement, the accompanying prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described below.

Additional Risks Related to This Offering

Our management will have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in ways that you and other stockholders may not approve.

Our management will have broad discretion in the use of the net proceeds from this offering including for any of the purposes described in the section titled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure of our management to use these funds effectively could have a material adverse effect on our business and cause the market price of our Class A common stock to decline. Pending their use, we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders.

If you purchase shares of our Class A common stock sold in this offering, you may experience immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional equity or additional convertible debt securities in the future, which may result in additional dilution to investors.

The price per share of our Class A common stock being offered may be higher than the net tangible book value per share of our outstanding Class A common stock prior to this offering. After giving effect to the sale of our Class A common stock in the aggregate amount of $50 million at an assumed offering price of $0.88 per share, the last reported sale price of our Class A common stock on the Nasdaq Global Select Market on August 7, 2024, and after deducting estimated offering commissions payable by us, our net tangible book deficit as of March 31, 2024 would have been $(259.9) million, or $(0.52) per share. This represents an immediate increase in net tangible book value of $0.18 per share to our existing stockholders and an immediate dilution in net tangible book value of $1.40 per share to new investors in this offering. For a more detailed discussion of the foregoing, see the section titled “Dilution.” To the extent outstanding stock options are exercised or convertible notes are converted, there will be further dilution to new investors. In addition, to the extent we need to raise additional capital in the future and we issue additional shares of Class A common stock or additional securities convertible or exchangeable for our Class A common stock, our then existing stockholders may experience dilution and the new securities may have rights senior to those of our Class A common stock offered in this offering.

Future sales of substantial amounts of our Class A common stock, or the possibility that such sales could occur, could adversely affect the market price of our Class A common stock.

We may issue up to $50 million of Class A common stock from time to time in this offering. The issuance from time to time of shares in this offering, as well as our ability to issue such shares in this offering, could have the effect of depressing the market price or increasing the market price volatility of our Class A common stock.

It is not possible to predict the actual number of shares of Class A common stock we will sell under the Agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations in the Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the sales agent at any time throughout the term of the Agreement. The number of shares of Class A common stock that are sold through or to the sales agent after delivering a placement notice will fluctuate based on a number of factors, including the market price of the Class A common stock during the sales period, the limits we set with the sales agent in any applicable placement notice, and the demand for our Class A common stock during the sales period. Because the price per share of each share of Class A common stock sold will fluctuate during the sales period, it is not currently possible to predict the number of shares that we will sell or the gross proceeds we will receive in connection with those sales.

The Class A common stock offered hereby will be sold in “at the market offerings”, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares of Class A common stock in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares of Class A common stock sold in this offering. In addition, there is no minimum or maximum sales price for shares of Class A common stock to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

The market price and trading volume of Class A common stock is volatile and could decline significantly.

The market price of our Class A common stock has been and is expected to continue to be volatile and has recently experienced declines. In addition, the trading volume of our Class A common stock may fluctuate and cause significant price variations to occur. We cannot assure you that the market price of Class A common stock will not fluctuate widely or decline significantly in the future in response to a number of factors, including, among others, the following:

•the realization of any of the risk factors presented in our Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent reports filed with the SEC;

•actual or anticipated differences in our estimates, or in the estimates of analysts, for our revenues, Adjusted EBITDA, results of operations, level of indebtedness, liquidity or financial condition;

•additions and departures of key personnel;

•failure to comply with the requirements of Nasdaq, Sarbanes-Oxley Act or other laws or regulations;

•future issuances, sales, resales or repurchases or anticipated issuances, sales, resales or repurchases, of our securities;

•publication of research reports about us;

•the performance and market valuations of other similar companies;

•commencement of, or involvement in, litigation involving us;

•broad disruptions in the financial markets, including sudden disruptions in the credit markets;

•speculation in the press or investment community;

•actual, potential or perceived control, accounting or reporting problems;

•changes in accounting principles, policies and guidelines; and

•other events or factors, including those resulting from infectious diseases, health epidemics and pandemics (including COVID-19), natural disasters, war, acts of terrorism or responses to these events.

In the past, securities class-action litigation has often been instituted against companies following periods of volatility in the market price of their shares. This type of litigation could result in substantial costs and divert our management’s attention and resources, which could have a material adverse effect on us.

USE OF PROCEEDS

The amount of proceeds from this offering will depend upon the number of shares of our Class A common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any or all shares under the Agreement. We intend to use the net proceeds, if any, from offerings under this program for general corporate purposes, including payment of interest on debt and other manner to repay, repurchase, or service such debt.

The amounts and timing of our actual expenditures will depend on numerous factors, including the nature and timing of future strategic opportunities that we may identify and pursue, as well as the amount of our other cash resources and growth needs of our business. We therefore cannot estimate with certainty the amount of net proceeds to be used for the purposes described above or the timing of these expenditures. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. Pending the uses described above, we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities.

Our expected use of the net proceeds from this offering represents our current intentions based upon our present plans and business conditions.

DILUTION

If you invest in our Class A common stock, your interest will be diluted to the extent of the difference between the price per share you pay in this offering and the net tangible book value per share of our Class A common stock immediately after you purchase shares in this offering.

As of March 31, 2024, our net tangible book deficit was approximately $(309.2) million, or approximately $(0.55) per share of our Class A common stock (on an as converted basis). Net tangible book deficit per share represents the amount of our total tangible assets reduced by the amount of our total liabilities, divided by the total number of shares of our common stock outstanding as of March 31, 2024.

Dilution per share to new investors represents the difference between the amount per share paid by purchasers for our Class A common stock in this offering and the net tangible book value per share of our common stock immediately following the completion of this offering.

After giving effect to the sale of our common stock offered by this prospectus supplement at an assumed offering price of $0.88 per share of Class A common stock (the last reported sale price of our Class A common stock on the Nasdaq Global Select Market on August 7, 2024), and after deduction of commissions and estimated aggregate offering expenses payable by us, our as adjusted net tangible book deficit as of March 31, 2024 would have been $(259.9) million, or $(0.52) per share. This represents an immediate increase in net tangible book value of $0.18 per share to our existing stockholders and an immediate dilution in as adjusted net tangible book value of $1.40 per share to new investors in this offering.

The following table illustrates this per share dilution to new investors:

| | | | | | | | |

| Assumed public offering price per share | | $ | 0.88 | |

| Net tangible book deficit per share at March 31, 2024 | $ | (0.70) | | |

| Increase in net tangible book value per share attributable to this offering | 0.18 | | |

| As adjusted net tangible book deficit per share after giving effect to this offering | | (0.52) | |

Dilution in as adjusted net tangible book value per share to new investors in this offering | | $ | 1.40 | |

The number of shares of our common stock to be outstanding immediately after this offering is based on 343,445,618 shares of our Class A common stock and 97,088,670 shares of our Class B common stock issued and outstanding as of March 31, 2024, and excludes as of that date:

•5,950,247 shares of Class A common stock issuable upon exercise of outstanding stock options with a weighted average exercise price of $1.75 per share;

•1,668,269 shares of Class A common stock issuable upon exercise of outstanding warrants with an exercise price of $11.50 per share;

•4,089,280 shares of Class A common stock issuable upon exercise of an outstanding warrant with an exercise price of $3.1769 per share;

•30,557,719 shares of Class A common stock issuable upon the vesting of outstanding time-based restricted stock units, and 252,692 performance-based restricted stock units;

•11,800,000 shares of Class A common stock issuable upon the vesting of outstanding executive performance-based restricted stock units;

•8,606,717 shares of Class A and Class B common stock issuable upon achievement of certain earn-out provisions;

•3,098,974 shares of Class A common stock issuable as a post combination compensation due to achievement of the service and performance conditions

•31,279,716 shares of Class A common stock issuable upon conversion of our $625.0 million aggregate principal amount of then outstanding convertible notes, at an assumed conversion price of $19.981; and

•70,477,941 shares of Class A common stock reserved for future issuance under our equity compensation plans, consisting of:

•25,818,749 shares of Class A common stock reserved for future issuance under our Management Longer Term Equity Incentive Plan;

•38,216,942 shares of Class A common stock reserved for future issuance under our Amended and Restated 2020 Equity Incentive Plan (the “EIP”); and

•6,442,250 shares of Class A common stock reserved for future issuance under our 2020 Employee Stock Purchase Plan.

The foregoing table does not give effect to the exercise of any outstanding options or warrants or the vesting of restricted stock units subsequent to March 31, 2024 or to the exchange of approximately $421.9 million in aggregate principal amount of our 1.25% Convertible Senior Notes due 2026 for approximately $274.2 million in aggregate principal amount of newly issued Convertible Senior Secured Notes due 2030 on August 8, 2024. To the extent options and warrants are exercised, there may be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent we raise additional capital by issuing equity or convertible debt securities or issue shares of Class A common stock for other purposes, there may be further dilution to new investors.

PLAN OF DISTRIBUTION

We have entered into a Financing Agreement, or the Agreement, with Virtu Americas LLC, or Virtu or the sales agent, pursuant to which we may issue and sell shares of our Class A common stock, $0.0001 par value per share, through or to Virtu, acting as sales agent or principal. We established this program with Virtu in 2023 and have periodically extended it. Pursuant to this prospectus supplement, we may issue and sell up to $50,000,000 of shares of our Class A common stock under the Agreement. Sales of our Class A common stock, if any, will be made by any method permitted by law, including by means of ordinary brokers’ transactions on the Nasdaq Stock Market at market prices, in block transactions, or as otherwise agreed with the sales agent, or by means of any other existing trading market for our Class A common stock or to or through a market maker other than on an exchange. This summary of the material provisions of the Agreement does not purport to be a complete statement of its terms and conditions. A copy of the Agreement was filed as an exhibit to our registration statement on Form S-3 (File No. 333-279118) filed with the SEC on May 3, 2024 and is incorporated by reference into the registration statement of which this prospectus supplement is a part. See “Where You Can Find More Information” below.

Upon delivery of a placement notice and subject to the terms and conditions of the Agreement, Virtu may sell our Class A common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act, including sales made directly on the Nasdaq Global Select Market or any other existing trading market for our Class A common stock.

We will pay the sales agent commissions for its services in acting as sales agent or principal in the sale of Class A common stock. The sales agent will be entitled to compensation equal to up to 2.0% of the gross sales price of each sale of Class A common stock sold through it under the Agreement. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse Virtu for certain specified expenses, in an aggregate amount not exceeding $50,000, including the fees and disbursements of its legal counsel. We estimate that the total expenses for the offering, excluding compensation payable to the sales agent under the terms of the Agreement, will be approximately $150,000.

Settlement for sales of Class A common stock will occur on the second day on which shares of our Class A common stock are purchased and sold on the Nasdaq Global Select Market (or such earlier day as is industry practice for regular-way trading) following the date on which such sales are made, or on another date that is agreed upon by us and Virtu in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The sales agent will use its commercially reasonable efforts consistent with its normal sales and trading practices and applicable state and federal laws, rules and regulations and the rules of the Nasdaq Stock Market, to sell on our behalf shares of our Class A common stock, under the terms and subject to the conditions set forth in the Agreement. We will instruct the sales agent as to the amount of Class A common stock to be sold. We may instruct the sales agent not to sell Class A common stock if the sales cannot be effected at or above the price designated by us in any instruction. We or the sales agent may suspend the offering of Class A common stock upon proper notice and subject to other conditions.

The sales agent will provide written confirmation to us no later than the opening of the trading day on the Nasdaq Global Select Market immediately following the trading day in which shares of our Class A common stock are sold under the Agreement. Each confirmation will include the number of shares sold on the preceding day, the net proceeds to us and the compensation payable by us to the sales agent in connection with the sales.

We will report at least quarterly the number of shares of Class A common stock sold through or to the sales agent under the Agreement, the net proceeds to us and the compensation paid by us to the sales agent in connection with the sales of Class A common stock.

This offering of shares of our Class A common stock pursuant to the Agreement will terminate upon the earlier of (1) the sale of all Class A common stock subject to the Agreement or (2) termination of the Agreement by us or the sales agent as permitted therein.

The sales agent and its affiliates may in the future provide various investment banking, commercial banking, fiduciary and advisory services to us and our affiliates from time to time for which they have received, and may in the future receive, customary fees and expenses. The sales agent and its affiliates may, from time to time, engage in other transactions with and perform services for us in the ordinary course of their business. To the extent required by Regulation M, Virtu will not engage in any market making activities involving our Class A common stock while the offering is ongoing under this prospectus supplement.

In connection with the sale of the Class A common stock on our behalf, the sales agent may, and will with respect to sales effected in an “at the market offering,” be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the sales agent may be deemed to be underwriting commissions or discounts. We have agreed to indemnify the sales agent against specified liabilities, including liabilities under the Securities Act, or to contribute to payments that the sales agent may be required to make because of those liabilities.

This prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by Virtu, and Virtu may distribute this prospectus supplement and the accompanying prospectus electronically.

LEGAL MATTERS

Certain legal matters will be passed upon for us by Orrick, Herrington & Sutcliffe LLP. The sales agent is being represented in connection with this offering by Duane Morris LLP. Certain attorneys with Orrick, Herrington & Sutcliffe LLP and certain funds affiliated with the firm own and/or have an indirect interest in shares of Class A common stock, which represent less than 1% of our Class A common stock.

EXPERTS

The financial statements of Luminar Technologies, Inc. as of December 31, 2023 and 2022, and for each of the three years in the period ended December 31, 2023, incorporated by reference in this Prospectus Supplement by reference to Luminar Technologies, Inc.’s annual report on Form 10-K for the year ended December 31, 2023, and the effectiveness of Luminar Technologies, Inc.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and accompanying base prospectus are part of the registration statement on Form S-3 (File No. 333-279118) we filed with the SEC under the Securities Act and do not contain all of the information set forth in the registration statement. Whenever a reference is made in this prospectus supplement or accompanying base prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus supplement and the accompanying base prospectus for a copy of such contract, agreement or other document.

For further information with respect to the Company and its Class A common stock, reference is made to the registration statement and the exhibits and any schedules filed therewith. Statements contained in this prospectus supplement as to the contents of any contract or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference.

You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website at www.sec.gov.

We are subject to the information reporting requirements of the Exchange Act and we are required to file reports, proxy statements and other information with the SEC. These reports, proxy statements, and other information are available for inspection and copying at the SEC’s website referred to above. We also maintain a website at www.luminartech.com, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Information contained on or accessible through our website is not a part of this prospectus supplement, and the inclusion of our website address in this prospectus supplement is an inactive textual reference only.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus supplement which has been previously filed with the SEC, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement, except for any information superseded by information included or subsequently incorporated by reference in this prospectus supplement. We have filed the documents listed below with the SEC under the Exchange Act, and these documents are incorporated herein by reference (except to the extent such information is furnished):

All documents that we file (but not those that we furnish) with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and prior to the termination of the offering of shares of Class A common stock hereby will be deemed to be incorporated by reference into this prospectus supplement and will automatically update and supersede the information in this prospectus supplement and any previously filed document.

We will provide to each person, including any beneficial owner, to whom a copy of this prospectus supplement is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus supplement but not delivered with this prospectus supplement (other than the exhibits to such documents which are not specifically incorporated by reference herein). We will provide this information at no cost to the requester upon written or oral request to:

Luminar Technologies, Inc.

2603 Discovery Drive, Suite 100

Orlando, Florida 32826

Telephone: (800) 532-2417

You may also access these documents, free of charge on the SEC’s website at www.sec.gov or on the “Investors” page of our website at luminartech.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information on, or that can be accessed from, our website as part of this prospectus or any accompanying prospectus supplement.

PROSPECTUS

Luminar Technologies, Inc.

Class A Common Stock

Preferred Stock

Debt Securities

Warrants

Units

From time to time, we may offer and sell any combination of the securities described in this prospectus in one or more offerings. The securities we may offer may be convertible into or exercisable or exchangeable for other securities or may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities registered hereunder, including any applicable antidilution provisions. We may offer the securities separately or together, in separate classes, series and in amounts, at prices and on terms that will be determined at the time the securities are offered.

In addition, from time to time, the selling securityholders to be named in a prospectus supplement may offer our securities. We will not receive any of the proceeds from the sale of securities by the selling securityholders.

This prospectus describes some of the general terms that may apply to these securities. Each time securities are sold, the specific terms and amounts of the securities being offered, and any other information relating to the specific offering and, if applicable, the selling securityholders, will be set forth in a supplement to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before you invest in any of the securities being offered. This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement.

Our Class A common stock is traded on the Nasdaq Global Select Market under the symbol “LAZR”. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, of the securities covered by the applicable prospectus supplement.

We or any selling securityholders may offer and sell our securities to or through one or more underwriters, dealers and agents, or directly to one or more purchasers, on a continuous or delayed basis. The names of any underwriters, dealers or agents and the terms of the arrangements with such entities will be stated in the accompanying prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “RISK FACTORS” on page 2 of this prospectus as well as those contained in the applicable prospectus supplement and any related free writing prospectus, and in the other documents that are incorporated by reference into this prospectus or the applicable prospectus supplement and any related free writing prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 3, 2024.

TABLE OF CONTENTS

Prospectus

We are responsible for the information contained and incorporated by reference in this prospectus, in any accompanying prospectus supplement, and in any related free writing prospectus we prepare or authorize. We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this documentation are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document does not extend to you. The information contained in this document speaks only as of the date of this document, unless the information specifically indicates that another date applies. Neither the delivery of this prospectus or any accompanying prospectus supplement, nor any sale of securities made under these documents, will, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus, any accompanying prospectus supplement or any free writing prospectus we may provide you in connection with an offering or that the information contained or incorporated by reference is correct as of any time subsequent to the date of such information. You should assume that the information in this prospectus or any accompanying prospectus supplement, as well as the information incorporated by reference in this prospectus or any accompanying prospectus supplement, is accurate only as of the date of the documents containing the information, unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission (“SEC”), as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. Under this process, we and/or the selling securityholders to be named in a prospectus supplement may sell any combination of the securities described in this prospectus from time to time in one or more offerings. Before purchasing any securities, you should read this prospectus and any applicable prospectus supplement together with the additional information described under the heading “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

This prospectus only provides you with a general description of the securities we or any selling securityholders may offer. Each time we or any selling securityholders sell a type or series of securities under this prospectus, we or the selling securityholders, as the case may be, will provide a prospectus supplement that will contain more specific information about the terms of the offering, including the specific amounts, prices and terms of the securities offered, and, if applicable, the selling securityholders. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. Each such prospectus supplement and any free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in documents incorporated by reference into this prospectus. If this prospectus is inconsistent with the prospectus supplement, you should rely upon the prospectus supplement. This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

Unless otherwise mentioned or unless the context requires otherwise, throughout this prospectus, any applicable prospectus supplement and any related free writing prospectus, the words “Luminar”, “we”, “us”, “our”, the “company” or similar references refer to Luminar Technologies, Inc. and its subsidiaries; and the term “securities” refers collectively to our Class A common stock, preferred stock, warrants, debt securities, or any combination of the foregoing securities.

We own various U.S. federal trademark registrations and applications and unregistered trademarks, including our corporate logo. This prospectus and the information incorporated herein by reference contains references to trademarks, service marks and trade names owned by us or other companies. Solely for convenience, trademarks, service marks and trade names referred to in this prospectus and the information incorporated herein, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names. We do not intend our use or display of other companies’ trade names, service marks or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. All trademarks, service marks and trade names included or

incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectus are the property of their respective owners.

OUR COMPANY

Luminar is a global automotive technology company ushering in a new era of vehicle safety and autonomy. Over the past decade, Luminar has been building our light detection and ranging (LiDAR) sensor from the chip-level up, which is expected to meet the demanding performance, safety, reliability and cost requirements to enable next-generation safety and autonomous capabilities for passenger and commercial vehicles, as well as other adjacent markets.

The global automotive and mobility sector is increasingly focused on safety and autonomy, specifically next-generation advanced driver assistance systems, or ADAS, and highway autonomy for passenger and commercial vehicles. Our LiDAR technology provides increased situational awareness in a broad range of driving environments through improved and higher confidence detection and planning at all vehicle speeds. Beyond sensor hardware, our product portfolio has expanded to include in-development perception and decision-making software, as well as high definition “3D” mapping that we anticipate will monetize the ecosystem of improved safety and autonomy created by our LiDAR.

We were incorporated in the State of Delaware in August 2018 as a special purpose acquisition company under the name Gores Metropoulos, Inc. On February 5, 2019, we completed our initial public offering. On December 2, 2020, we consummated the business combination (the “Business Combination”) pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated August 24, 2020, with the pre-Business Combination Luminar Technologies, Inc. (“Legacy Luminar”). Legacy Luminar was incorporated in Delaware on March 31, 2015. In connection with the consummation of the Business Combination, we changed our name from Gores Metropoulos, Inc. to Luminar Technologies, Inc.

Our principal executive offices are located at 2603 Discovery Drive, Suite 100, Orlando, Florida 32826. Our telephone number is (800) 532-2417. Our website address is www.luminartech.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making a decision to invest in our securities, you should carefully consider the risks described under the heading “Risk Factors” in the applicable prospectus supplement and any related free writing prospectus, and discussed under “Part I, Item 1A. Risk Factors” contained in our most recent annual report on Form 10-K and in “Part II, Item 1A. Risk Factors” in our most recent quarterly report on Form 10-Q filed subsequent to such Form 10-K, as well as any amendments thereto, which are incorporated by reference into this prospectus and the applicable prospectus supplement in their entirety, together with other information in this prospectus and the applicable prospectus supplement, the documents incorporated by reference herein and therein, and any free writing prospectus that we may authorize for use in connection with a specific offering. See “Where You Can Find Additional Information.”

We could be materially and adversely affected by any or all of these risks or by additional risks and uncertainties not presently known to us or that we currently deem immaterial that may adversely affect us or a particular offering in the future.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and any related free writing prospectus, including the information incorporated by reference herein and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology.

These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including, our history of losses and our expectation that we will continue to incur significant expenses, including substantial R&D costs, and continuing losses for the foreseeable future as well as our limited operating history which makes it difficult to evaluate our future prospects and the risks and challenges we may encounter; our strategic initiatives which may prove more costly than we currently anticipate and potential failure to increase our revenue to offset these initiatives; the extent to which our LiDAR products are selected for inclusion in autonomous driving or Advanced Driving Assistance Systems (“ADAS”) by automotive original equipment manufacturers (“OEMs”) or their suppliers, and whether we will be de-selected by any customers; the lengthy period of time from a major commercial win to implementation and the risks of cancellation or postponement of the contract or unsuccessful implementation; potential inaccuracies in our forward looking estimates of certain metrics, including Order Book, our future cost of goods sold (“COGS”) and bill of materials (“BOM”) and total addressable market; the discontinuation, lack of success of our customers in developing and commercializing products using our solutions or loss of business with respect to a particular vehicle model or technology package and whether end automotive consumers will demand and be willing to pay for such features; our ability to successfully fund our growth if there are considerable delays in product introductions by us or our customers; our inability to reduce and control the cost of the inputs on which we rely, which could negatively impact the adoption of our products and our profitability; the effect of continued pricing pressures, competition from other LiDAR manufacturers, OEM cost reduction initiatives and the ability of automotive OEMs to re-source or cancel vehicle or technology programs which may result in lower than anticipated margins, or losses, which may adversely affect our business; the effect of general economic conditions, including inflation, recession risks and rising interest rates, generally and on our industry and us in particular, including the level of demand and financial performance of the autonomous vehicle industry and the decline in fair value of available-for-sale debt securities in a rising interest rate environment; market adoption of LiDAR as well as developments in alternative technology and the increasingly competitive environment in which we operate, which includes established competitors and market participants that have substantially greater resources; our ability to achieve technological feasibility and commercialize our software products and the requirement to continue to develop new products and product innovations due to rapidly changing markets and government regulations of such technologies; our ability to build, launch, receive regulatory approval, sell, and service insurance products as well as market and differentiate the benefits of LiDAR-based ADAS to consumers; our ability to manage our growth and expand our business operations effectively, including into international markets, such as China, which exposes us to operational, financial, regulatory and geopolitical risks; changes in our government contracts business and our defense customers’ business due to political change and global conflicts; adverse impacts due to limited availability and quality of materials, supplies, and capital equipment, or dependency on third-party service providers and single-source suppliers; the project-based nature of our orders, which can cause our results of operations to fluctuate on a quarterly and annual basis; whether we will be able to successfully transition our engineering designs into high volume manufacturing, including our ability to transition to an outsourced manufacturing business model and whether we and our outsourcing partners and suppliers can successfully operate complex machinery; whether we can successfully select, execute or integrate our acquisitions; whether the complexity of our products results in undetected defects and reliability issues which could reduce market adoption of our new products, limit our ability to manufacture, damage our reputation and expose us to product liability, warranty and other claims; our ability to maintain and adequately manage our inventory; our ability

to maintain an effective system of internal control over financial reporting; our ability to protect and enforce our intellectual property rights; availability of qualified personnel, loss of highly skilled personnel and dependence on Austin Russell, our Founder, President and Chief Executive Officer; the impact of inflation and our stock price on our ability to hire and retain highly skilled personnel; the amount and timing of future sales and whether the average selling prices of our products could decrease rapidly over the life of the product as well as our dependence on a few key customers, who are often large corporations with substantial negotiating power; our ability to establish and maintain confidence in our long-term business prospects among customers and analysts and within our industry; whether we are subject to negative publicity; the effects of COVID-19 or other infectious diseases, health epidemics, pandemics and natural disasters on Luminar’s business; interruption or failure of our information technology and communications systems; cybersecurity risks to our operational systems, security systems, infrastructure, integrated software in our LiDAR solutions; market instability exacerbated by geopolitical conflicts, including the Israel-Hamas war and the conflict between Russia and Ukraine, as well as trade disputes with China and including the effect of sanctions and trade restrictions that may affect supply chain or sales opportunities. You should specifically consider the numerous risks outlined in “Risk Factors” in our most recent annual report on Form 10-K and subsequent documents and reports we file with the SEC.

Given these uncertainties, you should not place undue reliance on these forward-looking statements as actual events or results may differ materially from those projected in the forward-looking statements. Our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements contained in this prospectus, in the documents incorporated by reference herein and in any prospectus supplement by these cautionary statements. These forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law, you are advised to review any additional disclosures we make in the documents we subsequently file with the SEC that are incorporated by reference in this prospectus and any prospectus supplement. See “Where You Can Find Additional Information.”

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of securities offered by this prospectus and any applicable prospectus supplement for general corporate purposes. General corporate purposes may include, but are not limited to, stock repurchases, repayment or refinancing of indebtedness, additions to working capital, capital expenditures, investments in our subsidiaries, and the financing of acquisitions of complementary businesses, technologies, or other assets.

Unless otherwise set forth in a prospectus supplement, we will not receive any proceeds from the sale of any securities by any selling securityholders.

SELLING SECURITYHOLDERS

In addition to covering the offering of the securities described in this prospectus by us, this prospectus covers the offering of securities by selling securityholders. Information about selling securityholders, if any, will be set forth in a prospectus supplement, in a free writing prospectus, in an amendment to the registration statement of which this prospectus is a part, or in filings we make with the SEC under the Exchange Act, which are incorporated by reference.

DESCRIPTION OF OUR CAPITAL STOCK

General

The following is a summary of the rights of our common stock and preferred stock and certain provisions of our second amended and restated certificate of incorporation, as amended on February 27, 2024, and our amended and restated bylaws as they are currently in effect, which we refer to in this section as our certificate of incorporation and bylaws, respectively. This summary does not purport to be complete and is qualified in its entirety by the provisions of our second amended and restated certificate of incorporation, as amended and amended and restated bylaws, copies of which have been filed with the SEC.

Our authorized capital stock consists of 846,000,000 shares, of which 715,000,000 shares, par value $0.0001 per share, are designated as Class A common stock (“Class A Stock”), 121,000,000 shares, par value $0.0001 per share, are designated as Class B common stock (“Class B Stock”) and 10,000,000 shares, par value $0.0001 per share, are designated as preferred stock.

Common Stock

Holders of Class A Stock are entitled to one vote per share and holders of Class B Stock are entitled to ten votes per share, on all matters submitted to a vote of stockholders. The holders of Class A Stock and Class B Stock will generally vote together as a single class on all matters submitted to a vote of stockholders, unless otherwise required by Delaware law or our certificate of incorporation. Delaware law could require either holders of Class A Stock or Class B Stock to vote separately as a single class in the following circumstances:

•if we were to seek to amend the certificate of incorporation to increase or decrease the par value of a class of the capital stock, then that class would be required to vote separately to approve the proposed amendment; and

•if we were to seek to amend the certificate of incorporation in a manner that alters or changes the powers, preferences, or special rights of a class of capital stock in a manner that affected its holders adversely, then that class would be required to vote separately to approve the proposed amendment.

Conversion

Each outstanding share of Class B Stock is convertible at any time at the option of the holder into one share of Class A Stock. In addition, each share of Class B Stock will convert automatically into one share of Class A Stock upon any transfer, whether or not for value, except for certain permitted transfers described in the paragraph that immediately follows this paragraph and further described in the certificate of incorporation. Once converted into Class A Stock, the Class B Stock will not be reissued.

A transfer of Class B Stock will not trigger an automatic conversion of such stock to Class A Stock if it is a permitted transfer. A permitted transfer is a transfer by certain holders of Class B Stock to any of the persons or entities listed in clauses “(i)” through “(v)” below, each referred to herein as a Permitted Transferee, and from any such Permitted Transferee back to such holder of Class B Stock and/or any other Permitted Transferee established by or for such holder of Class B Stock: (i) to a trust for the benefit of the holder of Class B Stock and over which such holder of Class B Stock retains sole dispositive power and voting control, provided the holder of Class B Stock does not receive consideration in exchange for the transfer (other than as a settlor or beneficiary of such trust); (ii) to a trust for the benefit of persons other than the holder of Class B Stock so long as the holder of Class B Stock retains sole dispositive power and voting control, provided the holder of Class B Stock does not receive consideration in exchange for the transfer (other than as a settlor or beneficiary of such trust); (iii) to a trust under the terms of which such holder of Class B Stock has retained a “qualified interest” within the meaning of Section 2702(b)(1) of the U.S. Tax Code, and/or a reversionary interest so long as the holder of Class B Stock retains sole dispositive power and exclusive voting control with respect to the shares of Class B Stock held by such trust; (iv) to an Individual Retirement Account, as defined in Section 408(a) of the U.S. Tax Code, or a pension, profit sharing, stock bonus, or other type of plan or trust of which such holder of Class B Stock is a participant or beneficiary and which satisfies the requirements for qualification under Section 401 of the U.S. Tax Code, so long as such holder of Class B Stock

retains sole dispositive power and exclusive voting control with respect to the shares of Class B Stock held in such account, plan, or trust; or (v) to a corporation, partnership, or limited liability company in which such holder of Class B Stock directly, or indirectly, retains sole dispositive power and exclusive voting control with respect to the shares of Class B Stock held by such corporation, partnership, or limited liability company.

Each share of Class B Stock will convert automatically, without further action by the Company or the holder thereof, into one fully paid and nonassessable share of Class A Stock, upon: (a) the receipt by the Company of a written request for such conversion from the holders of a majority of the Class B Stock then outstanding, or, if later, the effective date for conversion specified in such request or (b) the occurrence of a transfer, other than a permitted transfer, of such share of Class B Stock.

Each outstanding share of Class B Stock held by a natural person or their Permitted Transferee will convert automatically into one share of Class A Stock upon the death or permanent disability of such holder.

Dividend Rights

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of Class A Stock and Class B Stock are entitled to receive dividends out of funds legally available if the Board of Directors of the Company (the “Board”), in its discretion, determines to issue dividends and then only at the times and in the amounts that the Board may determine.

No Preemptive or Similar Rights

Class A Stock and Class B Stock will not be entitled to preemptive rights, and are not subject to conversion (except as noted above), redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

If the Company becomes subject to a liquidation, dissolution or winding-up, the assets legally available for distribution to the stockholders would be distributable ratably among the holders of Class A Stock and Class B Stock and any participating preferred stock outstanding at that time, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights of and the payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Stock Exchange Listing

Our Class A common stock is listed on the Nasdaq Global Select Market. The trading symbol for our Class A common stock is “LAZR.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Equiniti. The transfer agent and registrar’s address is 6201 15th Avenue, Brooklyn, NY 11219, and its telephone number is (718) 921-8124.

Preferred Stock