0001032975false00010329752024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

LOGITECH INTERNATIONAL S.A.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Canton of Vaud, | Switzerland | 0-29174 | None |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| Logitech International S.A. |

| EPFL - Quartier de l'Innovation |

| Daniel Borel Innovation Center |

1015 Lausanne, Switzerland |

c/o Logitech Inc. |

3930 North First Street |

San Jose, | California | 95134 |

(Address of principal executive offices and zip code) |

| | | | | |

| (510) | 795-8500 |

(Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Registered Shares | LOGN | SIX Swiss Exchange |

| Registered Shares | LOGI | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(c) Appointment of Chief Financial Officer

On August 6, 2024, Logitech International S.A. (the “Company” or “Logitech”) announced that Matteo Anversa will be joining the Company as the Chief Financial Officer, effective on September 1, 2024 (the “Start Date”).

Mr. Anversa, age 52, served as Executive Vice President of Finance, Chief Financial Officer and Treasurer of Gentherm Incorporated, a thermal management technology company, from January 2019 to August 2024. Prior to joining Gentherm, Mr. Anversa served as Executive Vice President and Chief Financial Officer of Myers Industries, Inc., an international manufacturer of polymer-based material handling products and a distributor of tire repair and retread products, from December 2016 to December 2018. Prior to Myers Industries, Mr. Anversa worked since 2013 at Fiat Chrysler Automobiles N.V., a global automobile manufacturer, where he held executive management positions, including Vice President, Group FP&A Fiat Chrysler and Chief Financial Officer for Ferrari SpA where he helped prepare Ferrari for its initial public offering. Mr. Anversa began his career with General Electric Company, a multinational conglomerate, where he held various leadership roles during his 16-year tenure. Mr. Anversa has served as a director of Gabelli Value for Italy (VALU), an Italian company listed on AIM Italia, since March 2018. Mr. Anversa holds a degree in Mechanical Engineering from the University of Parma, Italy.

The material compensatory terms of Mr. Anversa’s employment are set forth in an offer letter dated August 5, 2024. The following summary of the offer letter does not purport to be complete and is subject to and qualified in its entirety by the offer letter filed herewith as Exhibit 10.1 and incorporated herein by reference.

Salary

Mr. Anversa’s annual base salary will be $700,000. Mr. Anversa will be eligible to participate in Logitech’s Leadership Team Bonus Program (the “Bonus Program”), with target payout at 95% of his base salary for a potential total target cash compensation of $1,365,000. For fiscal year 2025 (April 2024 – March 2025), Mr. Anversa’s payout under the Bonus Program will be prorated based upon his Start Date, provided he is an active employee of Logitech on March 31, 2025.

Equity Award

Mr. Anversa will also be eligible to participate in Logitech’s annual equity program. Grants in this annual equity program are subject to market conditions, Company performance and Compensation Committee approval and granted in the form of Performance Share Units (“PSUs”). The annual equity grants for a three-year performance period are generally granted on or about April 15 each year. Due to Mr. Anversa’s Start Date, on October 15, 2024, Mr. Anversa will be eligible to receive a PSU grant of $3,000,000 subject to the terms and conditions of the applicable plan, including vesting requirements, in particular vesting following a three-year performance period, representing a vesting date of May 15, 2027. Thereafter, Mr. Anversa will be eligible to receive an annual PSU grant of $3,000,000 in accordance with the company's regular annual grant schedule and subject to the conditions of the applicable plan.

Replacement Bonus and Awards

As a result of certain compensation that Mr. Anversa forfeited from his prior employer, Mr. Anversa shall also be eligible to receive a “Share and Bonus Buy Out” as follows:

–$1,023,414 in cash to be paid in March 2025 (the “March 2025 Payout Date”);

–an additional bonus payment (the “True Up Payment”) after the filing of Mr. Anversa’s prior employer’s proxy statement in 2025 for its fiscal year ending December 31, 2024, provided that Mr. Anversa’s prior employer’s executive bonus payout is beyond 100%; provided, further, that the maximum True Up will be up to 200%; and

–restricted stock units (“RSUs”) award in the amount of $946,850, which will be granted on the 15th of the month following theStart Date, i.e. September 15, 2024, and will vest in full in March 2026.

The cash portion of the Share and Bonus Buy Out must be repaid to the Company if Mr. Anversa is terminated “for cause” or resigns within 12 months of the March 2025 Payout Date.

Benefits

Mr. Anversa will be entitled to participate in the compensation and benefit programs generally available to Logitech’s executive officers in the United States.

In addition, Mr. Anversa will be entitled to relocation assistance from Michigan to the San Francisco Bay Area and a monthly relocation allowance of $10,000 net per month for up to 12 months as well as current residence sale closing costs assistance of up to $100,000.

Mr. Anversa’s employment with the Company is for no specified period and constitutes at-will employment. Mr. Anversa may resign at any time, for any reason or for no reason, with two (2) months of notice to the Company prior to the effective date of any termination of employment. Except for termination by the Company “for cause,” as such term is defined in the Employment Agreement, the Company agrees to provide Mr. Anversa with nine (9) months of notice prior to the effective date of any termination of employment and Mr. Anversa will be entitled to the acceleration of the RSUs awarded in connection with the Share and Bonus Buy Out if those RSUs have not already vested.

The Company expects to enter into its standard form of indemnification agreement with Mr. Anversa.

Mr. Anversa has no other direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended, nor are any such transactions currently proposed. There are no arrangements or understandings between Mr. Anversa and any other persons pursuant to which Mr. Anversa was appointed as Chief Financial Officer, and there are no family relationships between Mr. Anversa and any director or executive officer of the Company.

A copy of the related news release issued by the Company on August 6, 2024 is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (Cover page XBRL tags are embedded within the Inline XBRL document) |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Logitech International S.A. |

| | | |

| | | |

| | | /s/ Johanna (Hanneke) Faber |

| | | |

| | | Johanna (Hanneke) Faber |

| | | Chief Executive Officer |

| | | |

| | | |

| | | /s/ Samantha Harnett |

| | | |

| | | Samantha Harnett |

| | | Chief Legal Officer |

| August 6, 2024 | | |

3930 N. First St., San Jose, CA 95134 August 5, 2024 Matteo Anversa Dear Matteo, On behalf of Logitech Inc. (“Logitech” or “Company”), we are pleased to offer you employment with Logitech as Chief Financial Officer (“CFO”) reporting directly to me, as Chief Executive Officer of Logitech International S.A. (“Logitech International”). Your start date will be September 1, 2024. Your annual base salary will be $700,000, payable every two weeks at a bi-weekly rate of $26,923.08. You will also be eligible to participate in Logitech International’s Leadership Team Bonus Program, targeted at 95% of your base salary for a potential total target cash compensation of $1,365,000. The Leadership Team Bonus Plan potential payouts currently range from 0 - 200% of the targeted amount. All compensation paid to you in your capacity as the Company's CFO, an executive officer or member of the Group Management Team shall be subject to social security and tax deductions as required under applicable laws. For fiscal year 2025 (April 2024 – March 2025), your payout under the Leadership Team Bonus Program will be prorated based upon your start date, provided you are an active employee of Logitech on March 31, 2025. You will also be eligible to participate in Logitech’s annual equity program. Grants in this annual equity program are subject to market conditions, Company performance and Compensation Committee approval and granted in the form of Performance Share Units (“PSUs”). The annual equity grants for a three-year performance period are approved in the March Board meeting and granted on April 15 each year. Because of your start date, on October 15, 2024, we will propose a PSU grant of $3,000,000 subject to the terms and conditions of the applicable plan, including vesting requirements, in particular vesting following a three-year performance period, here being a vesting date of May 15, 2027, which has been approved by the Compensation Committee of Logitech International’s Board of Directors. Subject to the above conditions, you will be eligible for an annual PSU grant of $3,000,000. You will be subject to Logitech's stock ownership guidelines which currently mandate that you must fully own Logitech shares with a market value equal to a multiple of three times your annual base salary. You will have 5 years to meet ownership requirements. Based on your start date, the Company shall also pay you a “Share and Bonus Buy Out” bonus of $1,023,414 awarded in cash to be paid in March 2025, which combines cash bonus and part equity replacement. Further, after the filing of Gentherm Inc.’s Proxy statement in 2025 pursuant to Section 14A for its fiscal year 2024, ending December 31, 2024, Logitech will make an additional bonus payment (the “True Up Payment”) to you if Gentherm Inc.’s executives were provided bonuses beyond 100%. The maximum True Up will be up to 200%. In addition, you will Exhibit 10.1

3930 N. First St., San Jose, CA 95134 be awarded restricted stock units (“RSUs”) totaling $946,850, which will be granted on the 15th of the month following your start date. The RSUs will be granted as follows, subject to the approval of Compensation Committee of Logitech International’s Board of Directors: $946,850 will vest in March 2026. In the event you are terminated “For Cause” or resign within 12 months of the March 2025 pay out date (Resignation is defined as the date you provide notice of your resignation to the Company), you will be required to repay the cash portion of the “Share and Bonus Buy Out” paid within the 12-month period. However, if your resignation is for “Good Reason” (defined as a change to your title of CFO or a change to your reporting structure away from directly reporting to the CEO or a material downward adjustment to your base salary or modification to Logitech’s compensation plans and programs to your material detriment, you will not be required to repay the cash portion of the “Share and Bonus Buy Out” paid within the 12-month period. Logitech offers a comprehensive benefits package, including medical, dental and vision insurance plans (effective on your date of hire), a healthcare spending account, a 401(k) retirement savings plan, commuter benefits, an Employee Share Purchase Plan, life insurance, short and long-term disability insurance, as well as sick leave and 15 paid holidays. As a senior leader of Logitech, you will also be eligible to participate in Logitech’s Management Deferred Compensation Plan. Copies of all benefit plans referenced herein will provided to you. Company will provide you with Relocation Assistance from Michigan to the San Francisco Bay Area, including but not limited to, transportation, temporary housing, destination services, household goods packing, shipping, and unpacking, as outlined in Logitech’s International Relocation Policy. Company will also assist you with the closing costs for the sale of your Michigan home. This benefit will be calculated so that after applicable tax withholding, you receive the actual amount of the closing costs, capped at $100,000. Company will also provide you a monthly Relocation Allowance for up to 12 months. The Relocation Allowance will be paid for the first twelve (12) months after your move to the San Francisco Bay Area. The monthly Relocation Allowance will be calculated so that after applicable tax withholding, you receive a net payment of $10,000, for a total Relocation Allowance (net of taxes) equal to $120,000. Further, should you move to the San Francisco Bay Area during FY2025, Company will reimburse you $5,000 per month for duplicative educational costs for your children occurring in FY25, for up to 12 months, which will be provided net, i.e., less applicable taxes. The parties will evaluate a relocation date nine (9) months after your start date. Logitech’s compensation plans and programs are reviewed each year and may be subject to change. Logitech reserves the right to cancel or change the benefit plans and programs it offers to its employees, including its executive officers, at any time. Any adjustment to your base salary or your target incentive bonus and other compensation shall be in the sole discretion of the Board of Directors or the Compensation Committee. In addition, you will be subject to Logitech’s Executive Clawback Policy, which became effective on October 1, 2023, a copy of which is enclosed. While it is our sincere hope and belief that our working relationship will be mutually beneficial, we also want to advise you that Logitech is an at-will employer. Consequently, either Logitech or you can terminate the employment relationship at-will, at any time, with or without cause, and with or without advance notice, except as specified in the Employment Agreement. This offer letter shall be deemed merged with the Employment Agreement that has also been provided to you and read as one comprehensive Agreement. You will be required to provide your legal eligibility to work in the United States on your first day of employment – instructions on what to bring will be provided before your first day.

3930 N. First St., San Jose, CA 95134 We eagerly await your acceptance by the end of the business day on August 6, 2024. Matteo, we feel that the single most important factor of our success is our people, and we look forward to having you on the Logitech team. If you have any questions or need clarification on any information contained in this letter, please do not hesitate to contact us. Please sign and return the offer letter to Elaine Laird, our Head of People & Culture. Sincerely yours, Johanna W. (Hanneke) Faber Chief Executive Officer Logitech International

3930 N. First St., San Jose, CA 95134 *********************************** I accept the position of Chief Financial Officer and will begin work on September 2, 2024. I further acknowledge that the terms and conditions specified in this letter are the only commitments the Company is making relative to my employment and that all other promises, either verbal or written, are null and void. /s/ Matteo Anversa August 6, 2024 Matteo Anversa Date

1 LOGITECH INC. EMPLOYMENT AGREEMENT August 5, 2024 WHEREAS, Matteo Anversa (“Executive”) is a member of the Group Management Team of Logitech International, S.A., a Swiss corporation (the “Parent”); WHEREAS, Executive is currently employed by Logitech Inc. (the “Company”), a wholly-owned subsidiary of the Parent (the Parent and its direct and indirect subsidiaries – including the Company – are collectively referred to as “Logitech”) and is a party to an offer letter; WHEREAS, the Parent is subject to compliance with Swiss corporate law prohibiting excessive compensation in Swiss listed companies; and WHEREAS, Swiss corporate law restricts the ability of the Parent to have severance or change of control agreements or arrangements with members of its Group Management Team. NOW, THEREFORE, Executive and the Company hereby agree, effective as of the date first written above: 1. This Employment Agreement (this “Agreement”) sets forth certain terms of Executive’s employment with the Company, as well as the parties’ understanding with respect to any termination of that employment relationship. 2. Executive will be employed by the Company as Chief Financial Officer, and will serve in the position(s) assigned to Executive by the Chief Executive Officer of the Company (the “Company CEO”) and, in his or her capacity as and to the extent he or she is designated by the Board of the Parent as a member of the Group Management Team of the Parent, by the Board of Directors of the Parent (the “Board”) or the Chief Executive Officer of the Parent (the “Parent CEO”), as applicable, from time to time. Executive agrees to devote his full business time, energy and skill to the assigned duties. Executive agrees that, without the approval of the Board, the Parent CEO or the Company CEO, as applicable, Executive shall not, during the period of employment with the Company, devote any time to any business affiliation which would interfere with or derogate from Executive’s obligations under this Agreement. Executive understands that this Agreement does not give him any claim to be or remain a member of the Group Management Team. 3. Executive will be compensated for his services to the Company as follows: (a) Cash Compensation: Executive will receive his base salary as currently set forth in the offer letter and assigned in accordance with normal payroll procedures and remain eligible to participate in the Logitech Management Performance Bonus Plan, which may be amended from time to time. Executive’s compensation will be reviewed by the Board or the Compensation Committee of the Board (the “Compensation Committee”) from time to time and may be subject to adjustment based on various factors including, but not limited to, individual performance, Logitech’s performance and the approval of the compensation of the Group Management Team by the shareholders of the Parent in compliance with the Parent’s Articles of Incorporation and Swiss corporate law. Any adjustment to Executive’s compensation shall be in the sole discretion of the Board or the Compensation Committee. (b) Benefits: Executive will have the right, on the same basis as other employees of the Company, to participate in and to receive benefits under any applicable medical, disability or other Exhibit 10.2

2 group insurance plans, as well as under the Company’s business expense reimbursement, vacation policy and other policies. The Company reserves the right to cancel or change the benefit plans, programs and policies it offers to its employees at any time. 4. Executive agrees to provide the Company not less than two (2) months of notice prior to the effective date of any termination of employment, with the length of notice (if any) within that range to be at the discretion of Executive (the “Executive Notice Period”). Except in cases where the Company terminates Executive’s employment for Cause (as defined below), the Company agrees to provide Executive with nine (9) months of notice prior to the effective date of any termination of employment (the “Company Notice Period”), and Executive will be entitled to the acceleration of the second portion of his “Share and Bonus Buy Out” if those Restricted Stock Units have not already vested; the Executive Notice Period or the Company Notice Period, as applicable, is referred to in this Agreement as the (“Notice Period”). Notice of termination by either party shall be provided in writing. Executive shall remain a full-time employee of the Company during the Notice Period and shall not accept employment with any other entity during the Notice Period. Subject to specific terms contemplated in equity award agreements or equity or bonus plans, during the Notice Period, Executive shall continue to receive his base salary at the rate in effect as of the date either party has provided the other party with a notice of termination of employment (the “Date of Notice”), and Executive shall remain eligible for (i) all employee benefits in accordance with the provisions of the plans under which the benefits are provided, (ii) the payment of bonuses to the extent they become payable during the Notice Period or that become payable after the Notice Period but relate to a performance period that commenced during any portion of the Notice Period, with the bonus amount determined at the discretion of the Board or the Compensation Committee acting in good faith based on the Executive’s target bonus (currently calculated as a percentage of base salary) in effect as of the Date of Notice and on the attainment level of the performance goals and metrics (corporate, business group and individual, as applicable) established by the Board or Compensation Committee for Executive within the applicable fiscal year bonus program and in accordance with the applicable bonus plans, and payable at the time all other members of the Group Management Team are paid their bonuses; provided, however, that any bonus relating to a performance period that ends following the last day of the Notice Period shall be prorated based on the number of days Executive is employed during the performance period, and (iii) continued vesting of awards to acquire, or that are denominated in, shares of the Parent (“Equity Awards”) that were outstanding as of the Date of Notice. Executive shall be entitled to the acceleration of vesting of Equity Awards that were outstanding as of the Date of Notice in connection with a change of control of the Parent, termination of Executive’s employment, or both, to the extent set forth in any agreement evidencing the Equity Awards and only to the extent permitted under the Laws (as defined in Section 9 below) of Switzerland and California. Executive shall not be entitled to any new Equity Awards, bonuses, promotions, or salary increases during the Notice Period. As of the Date of Notice and at any time during the Notice Period, the Company may at its absolute discretion decide to release Executive from his duty to perform any services in favor of the Company during the Notice Period. As of the Date of Notice and at any time during the Notice Period, Executive may at his absolute discretion waive the Notice Period and be released from his obligation not to accept employment with any other entity during the Notice Period, in which event Executive's employment will terminate upon the effective date of such waiver and Executive shall only be entitled to base salary, and any other compensation earned through the date of termination, and such waiver shall constitute a waiver of the compensation, benefits and continued vesting of Equity Awards set forth in this Section as of the effective date of such waiver. 5. The Company may terminate Executive’s employment at any time without notice for Cause, including during any Notice Period, as determined in the Company’s sole discretion and in good faith. Where the Company terminates Executive for Cause, the termination of employment shall occur with immediate effect. Upon the effective date of Executive’s termination for Cause, Executive shall only be entitled to base salary, and any other compensation, earned through the date

3 of termination. For purposes of this Agreement, “Cause” means Executive’s: (i) willful dishonesty or fraud with respect to the business affairs of Logitech; (ii) intentional falsification of any employment or Logitech records; (iii) misappropriation of or intentional damage to the business or property of Logitech, including (but not limited to) the improper use or disclosure of the confidential or proprietary information of Logitech (excluding misappropriation or damage that results in a loss of little or no consequence to the business or property of Logitech); (iv) conviction (including any plea of guilty or nolo contendere) of a felony that, in the judgment of the Board (excluding Executive), materially impairs Executive's ability to perform his duties for Logitech or adversely affects Logitech’s standing in the community or reputation; (v) willful misconduct that is injurious to the reputation or business of Logitech; or (vi) refusal or willful failure to perform any assigned duties reasonably expected of a person in his position (excluding during any statutory leaves of absence as permitted by law, and with reasonable accommodations for any disability required by law) after receipt of written notice by the Chief Executive Officer or Executive Chairperson of the Company or Parent of such refusal or failure and a reasonable opportunity to cure (as described below). Executive shall be given written notice by the Company of its intention to terminate Executive for Cause, which notice (a) shall state with particularity the grounds on which the proposed termination for Cause is based and (b) shall be given no later than ninety (90) days after the occurrence of the event giving rise to such grounds (or ninety (90) days after such later date as represents the actual knowledge by an executive officer of the Company or Parent (excluding Executive) of such grounds). The termination shall be effective upon Executive's receipt of such notice; provided, however, that with respect to subsection (vi) of this Section, Executive shall have thirty (30) days after receiving such notice in which to cure any refusal or willful failure to perform (to the extent such cure is possible). If Executive fails to cure such failure to perform within such thirty-day (30- day) period, Executive’s employment with the Company shall thereupon be terminated for Cause. 6. The Company and Executive acknowledge that Executive’s employment with the Company is and shall continue to be at-will, subject to compliance with the Notice Period pursuant to Section 4 above. Specifically, either the Company or Executive may terminate Executive’s employment for any reason. 7. This Agreement shall be effective as of the date first set forth above. This Agreement shall terminate upon the earlier of (i) the expiration of the Notice Period or (ii) the expiration of the Agreement Term (as defined below); provided, however, that if notice of termination of employment by either party (other than notice of termination by the Company for Cause pursuant to Section 5 above) is provided to the other party prior to expiration of the Agreement Term, then this Agreement shall terminate upon the expiration of the Notice Period. Unless this Agreement has terminated based on expiration of the Notice Period or on termination by the Company for Cause, the expiration of the Agreement Term shall not result in the termination of Executive’s employment with the Company or, if applicable, with Logitech. The “Agreement Term” shall mean the period commencing on the effective date of this Agreement and continuing through the second anniversary of the date of this Agreement; provided, however, that the Agreement Term shall be extended automatically for an additional year upon the expiration of the original term and each anniversary thereof, unless the Company has provided a written notice of non-renewal to Executive at least nine (9) months prior to the then applicable expiration date of the term. 8. Subject to Section 9 and 11 below, this Agreement shall be governed by the laws of the State of California, without reference to conflicts of law principles, and the parties hereby consent to the exclusive jurisdiction of the competent courts, federal or state, located in Santa Clara County, California. Each party waives all defenses of lack of personal jurisdiction and forum non conveniens. Notwithstanding the foregoing, Section 11 is governed by the Federal Arbitration Act.

4 9. This Agreement may be amended only in a writing signed by both parties to this Agreement, provided that, notwithstanding Section 8 above, the parties agree that the Company has the right to unilaterally amend this Agreement without compensation solely if an amendment is determined to be reasonably necessary by the Company’s legal counsel for Logitech to comply with existing or adopted ordinances, laws, rules or regulations applicable to Executive or Logitech (“Laws”) (even if such Laws have not yet taken effect), including but not limited to Swiss corporate law prohibiting excessive compensation in Swiss listed companies, and such counsel determines that the amendment reasonably addresses such need. No amendment made to this Agreement under this provision shall affect the vested rights of the Executive. No failure or delay by either party in exercising any right hereunder or any partial exercise thereof shall operate as a waiver thereof or preclude any other or further exercise of any right hereunder. 10. In view of the personal nature of the services to be performed under this Agreement by Executive, Executive cannot assign or transfer any of his obligations under this Agreement. 11. Arbitration. (a) Scope of Arbitration Requirement. Logitech and Executive hereby waive their rights to a trial before a judge or jury and agree to arbitrate before a neutral arbitrator any and all claims or disputes arising out of this Agreement and any and all claims arising from or relating to Executive’s employment, including (but not limited to) claims against the Parent or the Company or against any current or former Executive, director or agent of the Parent or the Company, claims of wrongful termination, retaliation, discrimination, harassment, breach of contract, breach of the covenant of good faith and fair dealing, defamation, invasion of privacy, fraud, misrepresentation, constructive discharge or failure to provide a leave of absence, or claims regarding commissions, stock options or bonuses, infliction of emotional distress or unfair business practices. (b) Procedure. The arbitrator’s decision shall be written and shall include the findings of fact and law that support the decision. The arbitrator’s decision shall be final and binding on both parties, except to the extent that applicable law allows for judicial review of arbitration awards. The arbitrator may award any remedies that would otherwise be available to the parties if they were to bring the dispute in court. The arbitration shall be conducted in accordance with the National Rules for the Resolution of Employment Disputes of the American Arbitration Association; provided, however that the arbitrator shall allow the discovery authorized by the California Arbitration Act or the discovery that the arbitrator deems necessary for the parties to vindicate their respective claims or defenses. The arbitration shall take place in Santa Clara County, California, or, at Executive’s option, the county in which Executive primarily worked with the Company at the time when the arbitrable dispute or claim first arose. (c) Costs. The parties shall share the costs of arbitration equally, except that the Parent or the Company shall bear the cost of the arbitrator’s fee and any other type of expense or cost that Executive would not be required to bear if he were to bring the dispute or claim in court. The Parent, the Company and Executive shall be responsible for their own attorneys’ fees, and the arbitrator may not award attorneys’ fees unless a statute or contract at issue specifically authorizes such an award. (d) Applicability. This Section shall not apply to (i) workers’ compensation or unemployment insurance claims or (ii) claims concerning the validity, infringement or enforceability of any trade secret, patent right, copyright or any other trade secret or intellectual property held or sought by Executive or Logitech.

5 12. IRC Section 409A Matters. (a) The payments and benefits to which Executive could become entitled to under Section 4 above are intended be exempt from Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”), under the separation pay plan and short-term deferral exception to the maximum extent permitted under Section 409A and the guidance promulgated thereunder, and the Agreement shall be interpreted and administered in a manner consistent with such intent. If the Company believes, at any time, that any such payment or benefit is not exempt or does not comply with Section 409A, the Company may amend the terms of the Agreement to avoid the application of Section 409A in a particular circumstance or as necessary or desirable to satisfy any of the requirements under Section 409A or to mitigate any additional tax, interest and/or penalties that may apply under Section 409A if exemption or compliance is not practicable, but the Company shall not be under any obligation to make any such amendment. Nothing in this Agreement shall provide a basis for any person to take action against Logitech or any affiliate thereof based on matters covered by Section 409A, including the tax treatment of any amount paid under the Agreement, and neither Logitech nor any of its affiliates shall under any circumstances have any liability to Executive or his estate or any other party for any taxes, penalties or interest due on amounts paid or payable under this Agreement, including taxes, penalties or interest imposed under Section 409A. (b) Anything in this Agreement to the contrary notwithstanding, no amount payable under this Agreement upon or on a date or period of time that is by reference to a termination of Executive’s employment that is non-qualified deferred compensation subject to Section 409A, as determined in the Company’s sole discretion, will be paid unless Executive experiences a “separation from service” (within the meaning of Section 409A). In addition, to the extent any non- qualified deferred compensation subject to Section 409A is payable upon Executive’s separation from service and Executive is a “specified employee” (within the meaning of Section 409A) as of the date of the separation from service, such amount shall instead be paid or provided to Executive on the earlier of (i) the first business day after the date that is six (6) months following Executive’s separation from service or (ii) the date of Executive’s death, to the extent such delayed payment is required to avoid a prohibited distribution under Section 409A. The provisions of this Section 13 will qualify and supersede all other provisions of this Agreement as necessary to fulfill the foregoing intention. Each payment and benefit payable under this Agreement is intended to constitute a separate payment for purposes of Section 409A. 13. To the extent that Executive remains or is otherwise performing the duties of an executive officer of Logitech during the periods under this Agreement (including but not limited to any applicable Notice Period) or as otherwise required pursuant to applicable Laws, all compensation payable under this Agreement is subject to any clawback provisions in Logitech’s compensation plans, programs or agreements applicable to Executive or clawback policy that Logitech is required to adopt pursuant to any applicable Laws, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, or that Logitech determines is necessary or appropriate. 14. This Agreement and the Offer Letter of this same date constitute the entire agreement between Executive and the Company regarding the subject matter covered by this Agreement, and supersedes all prior negotiations, representations or agreements between Executive and the Company regarding the subject matter covered by this Agreement, whether written or oral.

6 ACCEPTED AND AGREED. LOGITECH INC. By: /s/ Johanna W. (Hanneke) Faber Name: Johanna W. (Hanneke) Faber Title: Chief Executive Officer EXECUTIVE: Matteo Anversa By: /s/ Matteo Anversa

Exhibit 99.1

Editorial Contacts:

Nate Melihercik, Head of Global Investor Relations - ir@logitech.com

Nicole Kenyon, Head of Global Corporate and Internal Communications - nkenyon@logitech.com (USA)

Ben Starkie, Corporate Communications - +41 (0) 79-292-3499, bstarkie1@logitech.com (Europe)

Matteo Anversa to Join Logitech as Chief Financial Officer

LAUSANNE, Switzerland and SAN JOSE, Calif., Aug. 6, 2024 — SIX Swiss Exchange Ad hoc announcement pursuant to Art. 53 LR — Logitech International (SIX: LOGN) (Nasdaq: LOGI) today announced that Matteo Anversa will join the Company as chief financial officer (CFO) and member of Logitech's Group Management Team, effective September 1, 2024, reporting to chief executive officer (CEO) Hanneke Faber.

“I’m delighted to welcome Matteo to Logitech’s leadership team,” said Hanneke Faber, Logitech CEO. “As a seasoned public company CFO with a background in engineering and industrial technology, Matteo brings skills and experiences well suited to Logitech. His diverse B2B experience will also be a strong addition to the team as we accelerate our focus on serving a broad range of enterprise customers. And Matteo brings a uniquely global perspective with significant experience drawn from living and working in Asia, Europe and North America.”

“I would also like to thank our chief accounting officer, Meeta Sunderwala. As interim CFO, she has been a strong partner throughout the CFO transition.”

“I’m delighted to be joining Logitech at this exciting time in the company’s history,” Matteo Anversa said. “With strong business momentum, an innovation-driven culture, and rigorous operational discipline, Logitech has exceptional growth potential. I look forward to partnering with Hanneke, the board and leadership team to execute on our clear strategic priorities and drive shareholder value creation.”

Anversa’s CFO and leadership experience spans global brands including Fiat Chrysler Automobiles, Ferrari, General Electric, and most recently Gentherm, a leader in innovative thermal management and pneumatic comfort technologies for the automotive industry and medical patient temperature management systems. Anversa holds a degree in Mechanical Engineering from the University of Parma, Italy. He is a dual citizen of the United States and Italy.

About Logitech

Logitech designs software-enabled hardware solutions that help businesses thrive and bring people together when working, creating, gaming and streaming. As the point of connection between people and the digital world, our purpose is to extend human potential in work and play, in a way that is good for people and the planet. Founded in 1981, Logitech International is a Swiss public company listed on the SIX Swiss Exchange (LOGN) and on the Nasdaq Global Select Market (LOGI). Find Logitech and its other brands, including Logitech G, at www.logitech.com or company blog.

# # #

Logitech and other Logitech marks are trademarks or registered trademarks of Logitech Europe S.A. and/or its affiliates in the U.S. and other countries. All other trademarks are the property of their respective owners. For more information about Logitech and its products, visit the company’s website at www.logitech.com.

(LOGIIR)

v3.24.2.u1

COVER PAGE

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

LOGITECH INTERNATIONAL S.A.

|

| Entity Incorporation, State or Country Code |

V8

|

| Entity File Number |

0-29174

|

| Entity Address, Address Line One |

1015 Lausanne, Switzerland

|

| Entity Address, Address Line Two |

c/o Logitech Inc.

|

| Entity Address, Address Line Three |

3930 North First Street

|

| Entity Address, City or Town |

San Jose,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95134

|

| City Area Code |

(510)

|

| Local Phone Number |

795-8500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Registered Shares

|

| Trading Symbol |

LOGI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001032975

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

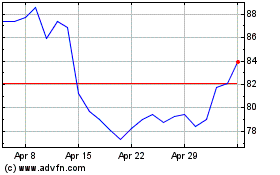

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Sep 2024 to Oct 2024

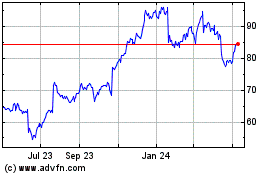

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Oct 2023 to Oct 2024