0001084554false--12-31FY2024false0.001100000000000.00125000000falsefalsefalsefalse100000.0500000.0100000.00.25300000.04160015000P2Y1M6D00010845542024-01-012024-12-310001084554us-gaap:SubsequentEventMemberltbr:BoardOfDirectorsMemberltbr:TopMember2025-02-260001084554us-gaap:SubsequentEventMemberltbr:BoardOfDirectorsMemberltbr:BottomMember2025-02-260001084554us-gaap:SubsequentEventMember2025-01-012025-02-260001084554us-gaap:SubsequentEventMemberltbr:CRADAAgreementMember2025-02-012025-02-160001084554us-gaap:SubsequentEventMemberltbr:CRADAAgreementMember2025-02-160001084554us-gaap:SubsequentEventMember2025-02-270001084554us-gaap:SubsequentEventMember2025-01-012025-02-280001084554ltbr:CODMMember2023-01-012023-12-310001084554ltbr:CODMMember2024-01-012024-12-310001084554ltbr:WeDontHaveTimeIncMember2024-01-012024-12-310001084554ltbr:WeDontHaveTimeIncMember2023-01-012023-12-310001084554ltbr:WeDontHaveTimeIncMember2022-02-012022-02-090001084554ltbr:CommonShareIssuancesOneMemberltbr:BottomMember2023-01-012023-12-310001084554ltbr:TopMemberltbr:CommonShareIssuancesMember2024-01-012024-12-310001084554ltbr:CommonShareIssuancesOneMemberltbr:BottomMember2024-01-012024-12-310001084554ltbr:TopMemberltbr:CommonShareIssuancesMember2023-01-012023-12-310001084554ltbr:TwoThousandTwentyEquityIncentivePlanMember2024-02-012024-02-270001084554ltbr:AvailableForSaleSecuritiesMember2023-01-012023-12-310001084554ltbr:AvailableForSaleSecuritiesMember2024-01-012024-12-310001084554ltbr:TwoThousandTwentyEquityIncentivePlanMember2024-12-310001084554ltbr:TwoThousandTwentyEquityIncentivePlanMember2024-01-012024-12-310001084554srt:BoardOfDirectorsChairmanMember2024-12-0400010845542024-03-012024-03-290001084554ltbr:TwentyTwentyFourTransactionsMember2024-01-012024-12-310001084554ltbr:TwentyTwentyThreeTransactionsMember2023-01-012023-12-310001084554ltbr:TwentyTwentyThreeTransactionsMember2023-05-012023-05-030001084554ltbr:CommonShareIssuancesMember2023-01-012023-12-310001084554ltbr:CommonShareIssuancesMember2024-01-012024-12-310001084554srt:BoardOfDirectorsChairmanMember2024-01-012024-12-310001084554ltbr:PrepaidExpenseAndOtherCurrentAssetMember2024-01-012024-12-310001084554srt:BoardOfDirectorsChairmanMember2023-11-200001084554srt:BoardOfDirectorsChairmanMember2024-08-190001084554ltbr:TwentyTwentyFourTransactionsMember2024-12-040001084554srt:BoardOfDirectorsChairmanMember2024-08-012024-08-190001084554ltbr:TwentyTwentyThreeTransactionsMember2023-11-200001084554ltbr:RestrictedStockUnitsRSAMembersrt:BoardOfDirectorsChairmanMember2023-05-030001084554ltbr:CommonShareIssuancesMember2024-12-3100010845542019-05-012019-05-280001084554ltbr:CommonShareIssuancesMember2023-12-310001084554ltbr:RestrictedStockAwardActivityMember2024-01-012024-12-310001084554ltbr:RestrictedStockAwardActivityMember2023-01-012023-12-310001084554ltbr:OptionsMember2024-01-012024-12-310001084554ltbr:TwoConsultantsMember2024-01-012024-12-310001084554ltbr:TwoConsultantsMember2023-01-012023-12-310001084554ltbr:TwoConsultantsMember2024-12-310001084554ltbr:TwoConsultantsMember2023-12-310001084554ltbr:TwentyTwentyFourTransactionsMember2024-12-012024-12-040001084554ltbr:TwentyTwentyThreeTransactionsMember2023-11-012023-11-200001084554ltbr:RestrictedStockUnitsRSAMembersrt:BoardOfDirectorsChairmanMember2023-05-012023-05-030001084554srt:BoardOfDirectorsChairmanMember2024-12-012024-12-040001084554srt:BoardOfDirectorsChairmanMember2023-11-012023-11-200001084554ltbr:RestrictedStockAwardsSummaryMember2023-01-012023-12-310001084554ltbr:RestrictedStockAwardsSummaryMember2024-01-012024-12-310001084554us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001084554us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001084554us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001084554us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001084554ltbr:RestrictedStockAwardMember2024-12-310001084554ltbr:RestrictedStockAwardMember2024-01-012024-12-310001084554ltbr:RestrictedStockAwardMember2023-12-310001084554ltbr:MaxiimumMember2023-12-310001084554ltbr:MiniimumMember2023-12-310001084554ltbr:MaxiimumMember2024-12-310001084554ltbr:MiniimumMember2024-12-310001084554ltbr:MaxiimumMember2023-01-012023-12-310001084554ltbr:MiniimumMember2023-01-012023-12-310001084554ltbr:MaxiimumMember2024-01-012024-12-310001084554ltbr:MiniimumMember2024-01-012024-12-310001084554ltbr:CentrusEnergyMember2024-01-012024-12-310001084554ltbr:INLMember2024-01-012024-12-310001084554ltbr:CentrusEnergyMember2023-01-012023-12-310001084554ltbr:RATENICNMember2023-01-012023-12-310001084554ltbr:INLMember2023-01-012023-12-310001084554ltbr:RATENICNMember2024-01-012024-12-310001084554ltbr:RATENICNMember2024-12-310001084554ltbr:TopMemberltbr:PrepaidExpenseAndOtherCurrentAssetMember2023-05-310001084554ltbr:BottomMemberltbr:PrepaidExpenseAndOtherCurrentAssetMember2023-05-310001084554ltbr:PrepaidExpenseAndOtherCurrentAssetMember2024-12-310001084554ltbr:PrepaidExpenseAndOtherCurrentAssetMember2023-12-310001084554ltbr:BattelleEnergyAllianceLLCMember2022-12-310001084554ltbr:GAINMember2023-01-012023-12-310001084554ltbr:GAINMember2024-01-012024-12-310001084554ltbr:TreasuryBillsLevelTwoMember2024-12-310001084554ltbr:TreasuryBillsLevelThreeMember2024-12-310001084554ltbr:TreasuryBillsLevelOneMember2024-12-310001084554ltbr:TreasuryBillsLevelThreeMember2023-12-310001084554ltbr:TreasuryBillsLevelTwoMember2023-12-310001084554ltbr:TreasuryBillsLevelOneMember2023-12-310001084554us-gaap:RetainedEarningsMember2024-12-310001084554us-gaap:AdditionalPaidInCapitalMember2024-12-310001084554us-gaap:CommonStockMember2024-12-310001084554us-gaap:RetainedEarningsMember2024-01-012024-12-310001084554us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001084554us-gaap:CommonStockMember2024-01-012024-12-310001084554us-gaap:RetainedEarningsMember2023-12-310001084554us-gaap:AdditionalPaidInCapitalMember2023-12-310001084554us-gaap:CommonStockMember2023-12-310001084554us-gaap:RetainedEarningsMember2023-01-012023-12-310001084554us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001084554us-gaap:CommonStockMember2023-01-012023-12-3100010845542022-12-310001084554us-gaap:RetainedEarningsMember2022-12-310001084554us-gaap:AdditionalPaidInCapitalMember2022-12-310001084554us-gaap:CommonStockMember2022-12-3100010845542023-01-012023-12-3100010845542023-12-3100010845542024-12-3100010845542025-03-0200010845542024-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-34487

LIGHTBRIDGE CORPORATION |

(Exact name of registrant as specified in its charter) |

Nevada | | 91-1975651 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

11710 Plaza America Drive, Suite 2000 Reston, VA 20190

(Address of principal executive offices) (Zip Code)

(571) 730-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.001 par value | | LTBR | | The Nasdaq Capital Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

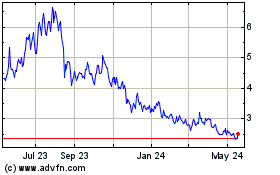

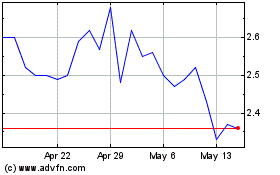

At June 30, 2024, the aggregate market value of shares held by non-affiliates of the registrant (based upon the closing sale price of such shares on the Nasdaq Capital Market on June 30, 2024) was $46,721,670.

At March 2, 2025 there were 20,357,551 shares of the registrant’s common stock issued and outstanding.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with its 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

LIGHTBRIDGE CORPORATION

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

In addition to historical information, this Annual Report on Form 10-K, including, but not limited to, the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will,” “may,” or similar expressions, which are intended to identify forward-looking statements. Such statements include, among others:

| · | those concerning market and business segment growth, demand, and acceptance of our nuclear fuel technology and other steps toward the commercialization of Lightbridge Fuel™; |

| | |

| · | any projections of sales, earnings, revenue, margins, or other financial items; |

| | |

| · | any statements of the plans, strategies, and objectives of management for future operations and the timing and outcome of the development of our nuclear fuel technology; |

| | |

| · | any statements regarding future economic conditions or performance; |

| | |

| · | any statements about future financings and liquidity; |

| | |

| · | the Company’s anticipated financial resources and position; and |

| | |

| · | all assumptions, expectations, predictions, intentions, or beliefs about future events and other statements that are not historical facts. |

You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions that if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties, among others, include:

| · | our ability to commercialize our nuclear fuel technology, including risks related to the design and testing of nuclear fuel incorporating our technology and the degree of market adoption of the Company’s product and service offerings; |

| | |

| · | dependence on strategic partners; |

| | |

| · | any adverse changes to our agreements or relationship with the U.S. government and its national laboratories; |

| | |

| · | our ability to fund our future operations, including general corporate overhead and outside research and development (R&D) expenses, and continue as a going concern; |

| | |

| · | the future market and demand for our fuel for nuclear reactors and our ability to attract customers; |

| | |

| · | our ability to manage the business effectively in a rapidly evolving market; |

| | |

| · | our ability to employ and retain qualified employees and consultants that have experience in the nuclear industry; |

| · | competition and competitive factors in the markets in which we compete, including from accident tolerant fuels (ATFs); |

| | |

| · | access to and availability of nuclear test reactors and the risks associated with unexpected changes in our nuclear fuel development timeline; |

| | |

| · | access to and availability of adequate resources and manufacturing capabilities at national laboratories that affect our nuclear fuel development timeline and project costs; |

| | |

| · | the increased costs associated with metallization of our nuclear fuel; |

| | |

| · | uncertainties related to conducting business in foreign countries; |

| | |

| · | public perception of nuclear energy generally; |

| | |

| · | changes in laws, rules, and regulations governing our business; |

| | |

| · | changes in the political environment; |

| | |

| · | development and utilization of, and challenges to, our intellectual property domestically and abroad; |

| | |

| · | the trading price of our securities is likely to be volatile, and purchasers of our securities could incur substantial losses; and |

| | |

| · | the other risks and uncertainties identified in Item 1A. Risk Factors included herein. |

Most of these factors are beyond our ability to predict or control and you should not put undue reliance on any forward-looking statement. Future events and actual results could differ materially from those set forth in, contemplated by or underlying the forward-looking statements. Forward-looking statements speak only as of the date on which they are made. The Company assumes no obligation and does not intend to update these forward-looking statements for any reason after the date of the filing of this report, to conform these statements to actual results or to changes in our expectations, except as required by law.

PART I

ITEM 1. BUSINESS

When used in this Annual Report on Form 10-K, the terms “Lightbridge”, the “Company”, “we”, “our”, and “us” refer to Lightbridge Corporation together with its wholly-owned subsidiaries Lightbridge International Holding LLC and Thorium Power Inc. Lightbridge’s principal executive offices are located at 11710 Plaza America Drive, Suite 2000, Reston, Virginia 20190 USA.

Overview

At Lightbridge, we believe that increasing the supply of reliable electric power is necessary for people and economies to flourish. We are developing next generation nuclear fuel for water-cooled reactors that could significantly improve the economics and safety of existing and new nuclear power plants, large and small, and enhance proliferation resistance of spent nuclear fuel while supplying clean energy to the electric grid or to “behind the meter” customers for electric power, including data centers. We project that the world’s energy and climate needs can only be met if nuclear power’s share of the energy-generating mix grows substantially in the coming decades. We believe Lightbridge can benefit from a growing nuclear power industry, and that our nuclear fuel can help enable that growth to happen.

We believe our metallic fuel will offer significant economic and safety benefits over traditional nuclear fuel, primarily because of the superior heat transfer properties and the resulting lower operating temperature of all-metal fuel.

Technology industry companies believe that nuclear energy can offer a strategic, sustainable, and reliable solution for powering data centers. Advances in reactor technology, combined with growing corporate and governmental support for clean energy, can position nuclear power to be the cornerstone of future energy strategies for data-intensive industries. We believe that, by integrating nuclear power, the data center sector can achieve operational efficiency, energy security, and sustainability. We believe uses of our fuel could include providing additional power via power uprates of existing reactors, which may be willing to pay a premium for reliable, clean, and sustainable baseload electricity. Oil and gas producing companies are investing in low-emission energy technologies to reduce fossil fuel emissions from oil and gas production. Advances in nuclear reactor and fuel technology can position nuclear power as a key energy source for this purpose.

Emerging nuclear technologies include small modular reactors (SMRs), which are now in the development and licensing phases. We expect that Lightbridge Fuel™ can provide water-cooled SMRs with the same benefits our technology brings to large reactors, with such benefits being even more meaningful to the economic case for deployment of SMRs, including potential load following capability when included on a virtually zero-carbon electric grid with renewable energy sources. We expect Lightbridge Fuel™ to enable power uprates in SMRs.

We have built a significant portfolio of patents, and we anticipate testing our nuclear fuel through third-party vendors and others, including the United States Department of Energy’s (DOE) national laboratories. Currently, we are performing the majority of our R&D activities within and in collaboration with the DOE’s national laboratories.

Our Nuclear Fuel

Since 2008, we have been engaged in the design and development of proprietary, innovative nuclear fuels to improve the cost-competitiveness, safety, proliferation resistance and performance of nuclear power generation. In 2010, we announced the concept of all-metal fuel (i.e., non-oxide fuel) for use in currently operating and new-build reactors. Our focus on metallic fuel was inspired by the anticipated needs of prospective customers, as nuclear utilities have expressed interest in the improved economics and enhanced safety that we believe metallic fuel can provide via power uprates.

The fuel in a nuclear reactor generates energy in the form of heat. That heat is then converted through steam into electricity that is delivered to the transmission and distribution grid. We have designed our innovative, proprietary metallic fuels to be capable of significantly higher burnup and power density compared to conventional oxide nuclear fuels. Burnup is the total amount of electricity generated per unit mass of nuclear fuel consumed and is a function of the power density of a nuclear fuel and the amount of time the fuel operates in the reactor. Power density is the amount of heat power generated per unit mass of nuclear fuel. Conventional oxide fuel used in existing commercial reactors is nearing the limit of its power density capability. As a result, further optimization is needed to (i) increase power output from the same core size to improve reactor economics, and (ii) enhance the fuel performance of nuclear power generation. We believe Lightbridge Fuel™ can meet these goals.

As the nuclear power industry prepares to meet the increasing global demand for electricity production, nuclear utilities are seeking longer operating cycles and higher reactor power outputs for current and future reactor fleets. We believe our proprietary nuclear fuel designs have the potential to improve the nuclear power industry’s economics by:

| · | enabling increased reactor power output via a power uprate (potentially up to a 30% increase) without changing the core size in new build pressurized water reactors (PWRs), including future SMRs; or |

| | |

| · | providing an increase in power output of potentially up to 17% or more in existing PWRs. |

We believe our fuel designs will allow current and new-build nuclear reactors to safely increase power production and reduce operations and maintenance costs on a per kilowatt-hour basis. New-build nuclear reactors could also benefit from the reduced upfront capital investment per kilowatt of generating capacity in the case of new-build reactors implementing a power uprate. In addition to projected electricity production cost savings, we believe our technology may allow utilities or countries to deploy fewer new reactors to generate the same amount of electricity (in the case of a power uprate), resulting in significant capital cost savings. For utilities or countries that already have operating reactors, we expect that our nuclear fuel could be utilized to both increase the power output of those reactors as well as enable them to load follow with electric grid demands, which demands have become increasingly variable with large additions of intermittent renewable energy generation.

Nuclear Industry and Addressable Market

Overview of the Nuclear Power Industry

Nuclear power provides a non-fossil fuel, low-carbon energy solution that can meet baseload electricity needs. According to the U.S. Energy Information Administration, nuclear power provided approximately 4% of the world’s total energy consumption from all sources in 2023, including approximately 9% of global electricity generation. According to the World Nuclear Association (WNA), as of January 2024, there were 417 operable nuclear power reactors worldwide, mostly light water reactors, with the most common types being PWRs, including Russian-designed water-cooled, water-moderated energetic reactors (VVERs), and boiling-water reactors (BWRs).

Of the world’s reactors currently in operation, PWRs account for approximately 74% of the net operating capacity, with Pressurized Heavy – Water Reactors (PHWRs) and BWRs being the second and third most prevalent and accounting for approximately 11% and 10% of net operating capacity, respectively.

We expect Lightbridge Fuel™ to be able to operate in various types of water-cooled reactors, including existing or future light water reactors, which include water-cooled SMRs, as well as for Canada Deuterium Uranium (CANDU)-type pressurized heavy water reactors. The existing U.S. fleet of nuclear reactors represents a large market segment for which Lightbridge Fuel™ could provide significant economic and safety benefits through power uprates.

Target Market for Lightbridge Fuel™

Our target market segments include water-cooled commercial power reactors, such as PWRs, BWRs, VVERs, CANDU heavy water reactors, water-cooled SMRs, as well as water-cooled research reactors.

We believe that most significant economic benefit of Lightbridge Fuel™ may be its potential to provide a 30% power uprate in new-build water-cooled reactors, as existing large reactors cannot realize that benefit because their systems are not designed to handle that much of an increase in power. Accordingly, the expected power uprate for existing large PWRs could take from Lightbridge Fuel™ is estimated to be 17% or potentially higher.

For SMRs and other reactors integrated with renewable grids, we believe Lightbridge Fuel™ may be able to enhance load-following capabilities, making it particularly valuable in markets with increasing renewable energy penetration.

The annual cost of nuclear fuel for a single reactor depends on several factors, including the type of reactor, its power output, fuel design, and market prices for uranium, enrichment, and fabrication. According to the September 2023 WNA report, the estimated total cost per reactor per year was approximately $40.0 million based on the September 2021 prices of natural uranium and other inputs. The prices of natural uranium and other inputs have increased since 2021, so we expect the annual nuclear fuel costs to be higher now.

Nuclear Power as Clean and Low Carbon Emissions Energy Source

Nuclear power provides clean, reliable baseload electricity. According to the WNA, nuclear reactors produce no greenhouse gas emissions during operation, and over the course of their lifecycles, produce about the same amount of CO2 equivalent emissions per unit of electricity generated as wind power. The WNA further notes that almost all proposed pathways to achieving significant decarbonization suggest an increased role for nuclear power, including those published by the International Energy Agency, Massachusetts Institute of Technology Energy Initiative, U.S. Energy Information Administration, and World Energy Council.

We believe that deep cuts to CO2 emissions are only possible with electrification of most of the transportation and industrial sectors globally and powering such sectors, and other current global electricity needs, with non-emitting or low-emitting energy sources or no-carbon liquid fuels. We believe this can be done only with a large increase in nuclear power, several times the amount that is generated globally today. We believe that our nuclear fuel technology could play an important role toward reaching this goal.

Growing Importance of Energy Security

We believe that Russia’s invasion of Ukraine has made clear the need for countries to diversify their energy production and wean off dependency on fossil fuels provided by countries that may threaten their national security. As a result of this military conflict, oil and natural gas prices surged in early 2022, and many countries have imposed sanctions upon Russia in response. Some European countries have responded by reconsidering their plans for domestically produced nuclear energy by either keeping existing nuclear power plants running or moving ahead with plans for new plants or both. For example, the United Kingdom and France are deploying new nuclear power plants, Belgium has decided to reverse its decision to close all its nuclear plants in the wake of Russia’s invasion of Ukraine and Canada, Sweden, Romania, Ghana, and several other countries have announced plans to deploy new nuclear power plants. It has become clear that a stable domestic energy supply ensures energy security and provides the strongest protection against energy price volatility. Increasingly, policymakers view nuclear energy as critical to a secure energy future.

Anticipated Safety Benefits of Lightbridge Fuel™

The anticipated safety benefits of Lightbridge Fuel™ are as follows:

| · | Lightbridge Fuel™ operates at lower operating temperatures than current conventional nuclear fuel, contributing to lower stored thermal energy in the fuel rods; it is therefore not expected to generate explosive hydrogen gas under design-basis accidents when there is a loss of coolant in the reactor; |

| | |

| · | enhances structural integrity of the nuclear fuel rods; and |

| | |

| · | has lighter and stiffer fuel assembly, which may contribute to improved seismic performance. |

Due to the significantly lower fuel operating temperature and higher thermal conductivity, our metallic nuclear fuel rods are expected to provide major improvements to safety margins during certain off-normal events. The U.S. Nuclear Regulatory Commission (NRC) licensing processes require engineering analysis of a large break loss-of-coolant accident (LOCA), as well as other scenarios. The LOCA scenario assumes failure of a large water pipe in the reactor coolant system. Under LOCA conditions, the fuel and cladding temperatures rise due to reduced cooling capacity. A recent analytical modeling study of Lightbridge Fuel™ by Structural Integrity Associates that was funded by the U.S. Department of Energy shows that under a design-basis LOCA scenario in a PWR reactor, unlike conventional uranium dioxide fuel, the cladding of the Lightbridge-designed metallic fuel rods would stay below the 850-900 degrees Celsius temperature at which steam begins to react with the zirconium cladding to generate hydrogen gas. Build-up of hydrogen gas in a nuclear power plant can lead to a hydrogen explosion, which contributed to the damage at the Fukushima Daiichi nuclear power plant. Lightbridge Fuel™ is expected to mitigate hydrogen gas generation in design-basis LOCA situations.

Lightbridge Spent Fuel - Proliferation Resistance

The April 2018 issue of Nuclear Engineering and Design, a technical journal affiliated with the European Nuclear Society, included a peer-reviewed article stating that after analyzing Lightbridge’s fuel, the authors concluded that any plutonium extracted from Lightbridge’s spent fuel would not be useable for weapon purposes. We anticipate the following proliferation resistance advantages for our metallic fuel:

| · | one-half of the amount of plutonium produced and remaining in the spent fuel as compared to conventional uranium dioxide fuels; and |

| | |

| · | lower Plutonium-239 fraction compared to uranium dioxide fuel; therefore, our spent fuel would be unsuitable as a source for weapon purposes. |

A modified variant of Lightbridge Fuel™ incorporating plutonium instead of, or in addition to, uranium in the metallic fuel rods could potentially be used to dispose of plutonium from reprocessed used reactor fuel, utilizing the plutonium to generate electricity. We believe a modified variant of our fuel also has the potential to be used to dispose of excess plutonium from nuclear weapons.

Development of Lightbridge Fuel™

We believe our metallic fuel could be able to operate in different types of water-cooled commercial power reactors, such as pressurized water reactors (including VVERs), boiling-water reactors, heavy water pressurized reactors, such as CANDUs, water-cooled SMRs, and water-cooled research reactors.

We have obtained patent protection in a number of countries and will continue to seek patent validation in countries that either currently operate or are expected to build and operate a large number of nuclear power reactors compatible with our fuel technology.

Recent Developments

Idaho National Laboratory Agreements

In December 2022, Lightbridge entered into agreements with Battelle Energy Alliance, LLC (BEA), the DOE’s operating contractor for Idaho National Laboratory (INL), to support the development of Lightbridge Fuel™. The framework agreements use an innovative structure that consists of an “umbrella” Strategic Partnership Project Agreement (SPPA) and an “umbrella” Cooperative Research and Development Agreement (CRADA), each with BEA, with an initial duration of seven years.

We anticipate that the initial phase of work under the two agreements that has been released will culminate in casting and extrusion of unclad fuel material samples using enriched uranium supplied by the DOE that will subsequently be inserted for irradiation testing in the Advanced Test Reactor (ATR) at INL. The initial phase of work aims to generate irradiation performance data for Lightbridge’s delta-phase uranium-zirconium alloy relating to various thermophysical properties. The data will support fuel performance modeling and regulatory licensing efforts for commercial deployment of Lightbridge Fuel™. We use a rolling wave planning approach for project management purposes on the released scopes of work. It is an iterative planning technique in which the work to be accomplished in the near term is planned in detail, while work further in the future is planned at a higher level. As such, periodic revisions to the scope and/or cost estimates are anticipated.

In 2023, we worked with INL to complete and issue a Quality Implementation Plan (QIP) for our collaborative project at INL, which was an essential first step to ensure all future work performed at INL on the project would meet the U.S. nuclear industry quality assurance requirements. Additionally, we worked with INL to demonstrate casting of delta-phase uranium-zirconium ingots with depleted uranium using existing INL equipment. As part of that effort, we cast several laboratory-scale ingots using depleted uranium and zirconium alloy materials.

On March 18, 2024, we announced a successful extrusion demonstration at INL of a billet into an unclad cylindrical rod, made of depleted uranium and zirconium alloy using the same composition of uranium and zirconium elements in the alloy as what is planned to be ultimately used in Lightbridge Fuel™. Subsequent to that, INL has successfully completed the extrusion of another unclad cylindrical rod, made of depleted uranium and zirconium alloy.

On February 12, 2025, we announced a successful co-extrusion demonstration of a coupon sample consisting of an alloy of depleted uranium and zirconium with an outer cladding made of nuclear-grade zirconium alloy material at INL. The co-extrusion process demonstration conducted at INL entailed pressing the metallic alloy billet encased in zirconium alloy cladding through a die to produce a cylindrical rod with a length of approximately eight feet. INL is currently performing characterization of the co-extruded sample to confirm the as-fabricated specifications and other parameters.

FEED Study with Centrus Energy for a Lightbridge Pilot Fuel Fabrication Facility

On December 5, 2023 we entered into an agreement with Centrus Energy Corp. (Centrus Energy) to conduct a front-end engineering and design (FEED) study to evaluate feasibility of constructing a Lightbridge Pilot Fuel Fabrication Facility (LPFFF) to manufacture Lightbridge Fuel™ using high-assay low-enriched uranium (HALEU) at the American Centrifuge Plant in Piketon, Ohio. The FEED study was to identify infrastructure and licensing requirements as well as the estimated cost and construction schedule for the LPFFF.

In the second quarter of 2024, the Company and Centrus Energy completed Phase 1 of the FEED Study. On June 27, 2024, Lightbridge and Centrus Energy agreed to a Change Order modifying the remaining scope, schedule, and cost for the FEED study. The total fee was $0.3 million with $0.1 million due upon acceptance of the final report by the Company. In the third quarter of 2024, Centrus completed the remaining scope of work as modified under the Change Order and submitted its final report that was accepted by the Company. The Company determined the labor effort and schedule estimates show that the Piketon site may be better suited for deployment of an industrial-scale facility rather than a much smaller pilot-scale fuel fabrication facility the Company is looking to establish over the next few years. As such, we will not proceed with deployment of a LPFFF at the Piketon site at this time. We are currently exploring other options/sites for deployment of the LPFFF.

The Company expensed approximately $0.3 million for the year ended December 31, 2024 in connection with the work that has been completed by Centrus Energy and has no further obligations to Centrus under the agreement or Change Order.

Romania Feasibility Study of Lightbridge Fuel™ for use in CANDU reactors

On October 16, 2023, we engaged Institutul de Cercetări Nucleare Pitești, a subsidiary of Regia Autonoma Tehnologii pentru Energia Nucleara (RATEN ICN) in Romania to perform an engineering study to assess the compatibility and suitability of Lightbridge Fuel™ for use in CANDU reactors. This assessment covers key areas including mechanical design, neutronics analysis, and thermal and thermal-hydraulic evaluations. The findings from this engineering study will play an important role in guiding future economic evaluations and navigating potential regulatory licensing-related issues for potential use of Lightbridge Fuel™ in CANDU reactors.

The results of this Feasibility Study indicate that Lightbridge Fuel™ can double the discharged burnup in a CANDU reactor at U-235 enrichment levels of less than 3% compared to conventional uranium dioxide fuel. Based on these favorable initial results, we plan to continue further evaluation of Lightbridge Fuel™ in CANDU reactors.

Nuclear Energy University Program Awards

We are working with Texas A&M University (TAMU), NuScale Power, and Structural Integrity Associates on a 3-year study led by TAMU. In mid-2023, TAMU was awarded $1 million by the DOE’s Nuclear Energy University Program (NEUP) R&D Awards to conduct this study. The project entails a characterization of the performance of the Lightbridge Fuel™ Helical Cruciform advanced fuel design, which will generate sets of experimental data on friction factor, flow, and heat transfer behavior under NuScale’s small modular reactors (SMRs) simulated normal and off-normal conditions.

We previously announced our ongoing NEUP project with the Massachusetts Institute of Technology (MIT). The study led by MIT and funded by DOE relates to evaluation of accident tolerant fuels in various SMRs. The project aims to simulate the fuel and safety performance of Lightbridge Fuel™ for the NuScale SMR and provide scoping analysis to improve the safety and economics of water-cooled SMRs. In October 2024, MIT presented a technical paper with preliminary safety evaluation results at the TopFuel 2024 Conference in Grenoble, France. According to MIT, the results show promising safety and performance benefits for Lightbridge Fuel™. Compared to conventional fuel, Lightbridge Fuel™ demonstrated improved thermal-hydraulic margins, lower operating temperatures, and greater potential for power uprates, which contributes to enhancing reactor economics.

We do not have any performance obligations with the collaboration teams working on the above-mentioned projects and will not receive any revenue or record any benefits from these awards.

Future Steps Toward Our Fuel Development and Timeline For The Commercialization of Our Nuclear Fuel Assemblies

We anticipate fuel development milestones for Lightbridge Fuel™ over the next 2-3 years will consist of the following:

| · | INL: To produce samples, coupons, and rodlets necessary for testing to be performed under our INL agreements. We will continue to execute the SPPA/CRADA work at INL leading to casting and extrusion of fuel material samples using enriched uranium and their subsequent insertion for irradiation testing in the ATR. |

| | |

| · | Modeling: Continue development and/or validation (benchmarking) of Lightbridge-specific methods and modifications to existing modeling codes to accurately predict Lightbridge Fuel™ performance over the full domain of operating conditions for which Lightbridge Fuel™ will be licensed. |

| | |

| · | Fuel Qualification Plan: Develop a Fuel Qualification Plan that describes our approach to characterizing and validating the performance our fuel rods, assemblies, and assembly components in relevant operation scenarios, and validation of the modeling tools that accurately describe the performance of Lightbridge Fuel™ in the relevant conditions. |

| | |

| · | NRC Engagement Plan: Prepare and submit the NRC Engagement Plan that outlines how and when Lightbridge will engage the NRC regarding submission of relevant information and supporting documentation for license applications. |

| | |

| · | Fabrication: Continue manufacturing efforts relating to establishing a manufacturing process for the co-extrusion of cladded rodlets for loop irradiation testing and other fuel testing. In addition, we plan to complete site selection and begin deployment of a LPFFF with capacity to produce fuel samples, fuel coupons, fuel rodlets, and full-length fuel rods for lead test rods and lead test assemblies for demonstration of our fuel in commercial reactors. |

| | |

| · | Thermal-Hydraulic Analysis and Experiments: Perform thermal-hydraulic modeling of Lightbridge Fuel™ to prepare for a series of thermal-hydraulic experiments to confirm pressure drop, critical heat flux performance, and other thermal-hydraulic parameters of Lightbridge Fuel™ under various operating conditions in different types of reactors. |

The long-term milestones towards development and commercialization of nuclear fuel assemblies include, among other things, irradiating nuclear material samples and prototype fuel rods with enriched uranium in test reactors, conducting post-irradiation examination of irradiated material samples and/or prototype fuel rods, performing thermal-hydraulic experiments, performing seismic and other out-of-reactor experiments, performing advanced computer modeling and simulations to support fuel qualification, designing a lead test assembly (LTA), entering into a lead test rod/assembly agreement(s) with a host reactor(s), demonstrating the production process of lead test rods and/or lead test assemblies at a pilot-scale fuel fabrication facility and demonstrating the operation of lead test rods and/or lead test assemblies in commercial reactors.

The above future steps describe our current proposed approach to deploying Lightbridge Fuel™ in CANDU and/or U.S. PWR reactors.

There are inherent uncertainties in the cost and outcomes of the many steps needed for successful deployment of our fuel in commercial nuclear reactors, which makes it difficult to accurately predict the timing of the commercialization of our nuclear fuel technology. However, based on our best estimate and assuming adequate R&D funding levels, we expect to begin demonstration of lead test rods and/or possibly LTAs with our metallic fuel in commercial reactors in the 2030s and begin receiving purchase orders for initial fuel reload batches from utilities 15-20 years from now, with deployment of our nuclear fuel in the first reload batch in a commercial reactor taking place approximately two years thereafter. We are exploring ways of shortening this timeframe that may include securing access to expanded irradiation test loop capacity in existing or new research reactor facilities. Lightbridge aims to engage early with relevant nuclear regulators to inform them of our future R&D activities.

Certain Challenges and Uncertainties

1. Funding and/or in-kind support from government and/or strategic partners and/or other third-party sources

Presently, our ability to fund our fuel development program at a level necessary to adhere to our projected fuel development timelines is limited due to funding constraints. In addition to our fuel development costs, we have ongoing corporate overhead and other fixed costs, such as in-house project management and project control personnel. As a result, we believe seeking and securing significant funding and/or in-kind contributions from government and/or strategic partners and/or other third-party sources to support our fuel development program is essential for us to adhere to our expected timelines for our fuel development and commercialization efforts.

2. Availability of suitable test loops in the ATR

After the Halden research reactor located in Halden, Norway, was shut down in 2018, we embarked on a global search for an alternative for loop irradiation testing of our metallic fuel rods. Ultimately, we chose the ATR at INL and applied to the DOE for and in December 2019, won a Gateway for Accelerated Innovation in Nuclear (GAIN) Voucher for an ATR experiment design and this project was completed during the third quarter of 2021.

Since the shutdown of the Halden reactor, availability of irradiation test loops for fuel in the ATR has become limited and highly competitive, limiting how much nuclear fuel can be inserted into the reactor as well as its duration in the reactor.

If sufficient loop capacity within the ATR is not available, we may not be able to obtain sufficient data to justify regulatory approval for LTA demonstration in a large commercial PWR in a commercially feasible timeframe. This would likely necessitate additional loop irradiation testing in another test reactor or LTR demonstration in a large commercial PWR in addition to the ATR loop testing before LTA demonstration could commence. As a result, our anticipated fuel development timelines are 15-20 years before we expect to secure our first orders for fuel batch reloads in large commercial PWRs. Consequently, the projected fuel development costs and timelines make it challenging for Lightbridge to fund this fuel development effort on its own.

3. Partnerships with fuel vendors and nuclear utilities

The ability to design and fabricate a LTR and/or LTAs and engagement with a nuclear utility that is willing to accept our LTR/LTAs, is required to demonstrate our nuclear fuel in a commercial reactor. In the U.S., the nuclear fuel fabricator and the nuclear utility will be primarily responsible for securing the necessary regulatory licensing approvals for the LTR/LTA operation. We plan to also build relationships with large reactor and/or SMR reactor fuel vendors, as well as existing nuclear utilities and/or potential SMR customers.

4. Supply chain infrastructure for HALEU

Establishment of required supply chain infrastructure to support HALEU metallic fuel is a necessary step in the commercialization of our nuclear fuel. Existing commercial nuclear infrastructure, including conversion facilities, enrichment facilities, de-conversion facilities, fabrication facilities, fuel storage facilities, fuel handling procedures, fuel operation at reactor sites, used fuel storage facilities and shipping containers, were designed and are in most cases currently licensed to handle uranium in oxide form with enrichment up to 5% in the isotope uranium-235. Our fuel designs for light water reactors are expected to use uranium metal with uranium enrichment levels up to 19.75% and would therefore require certain modifications to existing commercial nuclear infrastructure to enable commercial nuclear facilities to receive and handle our fuels. Those nuclear facilities will need to complete a regulatory licensing process and obtain regulatory approvals to be able to process, handle, or ship uranium metal with enrichment levels up to 19.75% and operate commercial reactors and spent fuel storage facilities using our metallic fuel.

To support establishment of domestic HALEU infrastructure, the DOE announced on December 7, 2022 the creation of a HALEU Consortium. According to the DOE, the purposes of the HALEU Consortium include: (i) providing the Secretary of Energy HALEU demand estimates for domestic commercial use, (ii) purchasing HALEU made available to members for commercial use under the program, (iii) carrying out demonstration projects using HALEU under the program, and (iv) identifying actionable opportunities to improve the reliability of the HALEU supply chain. On December 15, 2022, the Company submitted a formal request to the DOE to join the HALEU Consortium to mitigate HALEU supply risk. On January 12, 2023, the Company received written confirmation from the DOE of Lightbridge’s membership in the HALEU Consortium. HALEU is a key component necessary for the fabrication and operation of Lightbridge Fuel™ in light water reactors.

5. Need for experimental data on our metallic fuel

There is a lack of publicly available experimental data on our metallic fuel. We will need to conduct various irradiation experiments to confirm fuel performance under normal and off-normal reactor conditions. Loop irradiation in a test reactor environment prototypic of commercial reactor operating conditions and other experiments on unirradiated and irradiated metallic fuel samples will be essential to demonstrate the performance and advantages of our metallic fuel. We are planning loop irradiation testing of our metallic fuel samples in the ATR at INL as part of this effort. Additionally, we need to conduct thermal-hydraulic experiments to collect experimental data relating to pressure drop, critical heat flux performance, and other thermal-hydraulic parameters for Lightbridge Fuel™. There are a limited number of experimental facilities with suitable capabilities for performing these experiments.

6. Need for development of new analytical models to support our metallic fuel

Existing analytical models may be inadequate to fully analyze our metallic fuel. New analytical models, capable of accurately predicting the behavior of our metallic fuel during normal operation and off-normal events, may be required. Experimental data measured from our planned irradiation demonstrations and thermal-hydraulic tests will help to identify areas where new analytical models, or modifications to existing ones, may be required.

7. Need to develop and demonstrate a qualified fabrication process for our metallic fuel rods

Demonstration of a qualified fabrication process both for partial-length irradiation fuel rod samples and subsequently for full-length (approximately 12 to 14 feet) metallic fuel rods for large PWR LTAs and shorter length for SMRs (approximately 6 feet) is required. Past operating experience in icebreaker reactors (a nuclear-powered icebreaker ship), with differently shaped fuel rods with a similar metallic fuel composition involved fabrication of metallic fuel rods up to 3 feet in length. Fabrication of full-length PWR metallic fuel rods with uranium and zirconium alloy for large PWRs has yet to be fully demonstrated. In 2021, we demonstrated the co-extrusion of full-length rods using surrogate materials (i.e., rods which replaced the uranium component with a suitable physical analogue). On February 12, 2025, we announced a successful co-extrusion demonstration of a clad cylindrical rod comprising depleted uranium and zirconium alloy with the length of approximately eight feet. Co-extrusion is the primary forming operation in the manufacturing of our fuel and these demonstrations were important milestones on the path to developing and qualifying the full manufacturing process for actual fuel rods with enriched uranium and zirconium alloy.

See Item 1A. Risk Factors in this Annual Report on Form 10-K for a discussion of certain risks that may delay or impair such developments, including without limitation the availability of financing and the many risks inherent in developing a new type of nuclear fuel.

Future Potential Collaborations and Other Opportunities

In the ordinary course of business, we engage in periodic reviews of opportunities to invest in or acquire companies or units within companies to leverage operational synergies and establish new streams of revenue. We will be opportunistic in this regard and may also partner or contract with entities that could be synergistic to our fuel business or present an attractive stable business and/or growth opportunity in the nuclear space.

Competition

Currently, competition with respect to the design of commercially viable nuclear fuel products is limited to conventional uranium dioxide fuels, which are reaching the limits in terms of their capability to enable power uprates. While we believe conventional uranium dioxide fuel may be capable of achieving power up-rates of up to 10% in existing PWRs or extending the fuel cycle length from 18 to 24 months, doing so would require uranium-235 enrichment levels above 5% (as is also the case with our metallic fuel), higher reload batch sizes, or a combination thereof. This is the direction the commercial U.S. nuclear power industry is currently pursuing.

In addition to conventional uranium dioxide fuel, potential competition to our metallic fuel technology can come from so-called Accident Tolerant Fuels (ATF). We regard ATF as part of a series of incremental changes to conventional uranium dioxide fuel over time. ATF uses uranium dioxide with added substances and/or changes to the cladding tube. After the accident at the Fukushima Daiichi nuclear power plant in March 2011, the U.S. Congress directed the DOE to investigate every aspect of nuclear plant operation including the existing uranium dioxide fuel pellets contained in zirconium-based alloy tubes (cladding). According to the February 2019 Nuclear Energy Institute technical report on ATF titled “Safety and Economic Benefits of Accident Tolerant Fuel,” advanced fuel design concepts (such as ATF) were accelerated by combining recent operating experience with worldwide research and development. Over the past decade, the ATF program has received significant DOE funding support and initial interest from utility customers conducting ATF demonstration programs in their operating reactors. For example, in January 2022, Southern Nuclear agreed to load four lead test assemblies with a chromia and alumina doped ATF design. Similar ATF concepts are being tested by Framatome and GE Nuclear.

When the DOE originally launched the ATF program, the program was focused solely on achieving enhanced safety benefits, such as extra “coping time” during severe accidents. Over the past few years, we believe many ATF vendors concluded that the unexpectedly small accident tolerance benefits their ATF fuel concepts offered (such as several extra hours of coping time during severe accidents rather than their original goal of approximately 72 hours) were not enough of an incentive for nuclear utilities to adopt ATF designs, which would cost more and have reduced efficiency relative to conventional uranium dioxide fuels. As a result, ATF vendors have begun exploring opportunities for extending the operating cycle length in existing PWRs and/or power uprates in BWRs by going to higher enrichments (i.e., from approximately 5% to 7-8% enrichments) with ATF designs. If they are successful in extending the cycle length and/or achieving power uprates in a cost-effective way, this could give sufficient economic incentive for nuclear utilities to switch to the ATF designs in the coming years. This recent shift in positioning by many ATF vendors represents a competitive threat to Lightbridge for use in existing large PWRs, as ATF vendors are now trying to encroach into a critical element of Lightbridge’s value proposition, i.e., the ability of Lightbridge Fuel™ to extend the cycle length from 18 to 24 months in existing large PWRs and/or offer power rate uprates opportunities. While it is not certain that the ATF vendors will be successful in this approach, if ATF could enable longer cycles and/or power uprates, it could severely weaken or undermine our economic value proposition in existing large LWRs. That said, we believe Lightbridge Fuel™ remains the only advanced light-water reactor fuel in development that can provide power uprates, cycle length extensions, improved safety, and load following in a single product as desired by the utilities.

Nuclear power faces competition from other sources of electricity as well, including natural gas, which at times in recent years has been the cheapest option for power generation in the U.S. and has resulted in some utilities abandoning nuclear initiatives. Other sources of electricity, such as renewables like wind and solar, may also be viewed as safer than nuclear power, although we believe that generating nuclear energy with Lightbridge Fuel™ is the safest way to produce baseload electricity.

Raw Materials

We plan to utilize small quantities of raw materials for our testing and demonstration efforts over the next several years. During the commercial phase of our operations, we will ultimately need to procure significant quantities of enriched uranium and zirconium materials necessary for fabrication of our metallic fuel rods. The availability of uranium metal enriched to 19.75% in the isotope uranium-235 is currently limited to small quantities sufficient only for research and testing purposes. Deployment of our fuel in light water reactors will necessitate increasing enrichment level from 5% up to 19.75% at enrichment facilities, as well as deployment of de-conversion/metallization capability at a commercial scale, and the design and licensing of a shipping container capable of accommodating fuel assemblies with uranium metal enriched up to 19.75%.

Government Support/Approvals Needed, Relationships with Critical Development Partners/Vendors and Other Government Regulation

Due to the long fuel development timelines to commercialization and the significant amount of R&D funding required to bring our next generation nuclear fuel technology to market, substantial funding and/or in-kind contributions from government and/or strategic partners and/or other third-party sources as well as political support for our project will be essential to the success of our nuclear fuel development program. Without significant funding and cost sharing contributions from government and/or strategic partners and/or other third-party sources toward our fuel development activities, it will be challenging for the Company to fund all its future fuel development efforts on its own within the expected timelines or at all.

In addition to external funding and/or in-kind support, political support for our project is similarly important. The sales and marketing of our services and technology internationally may be subject to U.S. export control regulations, including 10 C.F.R. Part 810 and 10 C.F.R. Part 110 and the export control laws of other countries. Governmental authorizations may be required before we can export our services or technology or collaborate with foreign entities. NRC regulations at 10 C.F.R. Part 110 govern the export and import of nuclear equipment and material. Part 810 generally governs the exports of technology for development, production, or use (see 10 C.F.R. §810.3 for definitions of these terms) of reactors, equipment, and material subject to Part 110. If authorizations are required and not granted, our international business could be materially affected. Furthermore, the export authorization process is often time consuming and any delays could impact our fuel development and commercialization timelines. Violation of export control regulations could subject us to fines and other penalties, such as losing the ability to export for a period of years, which would limit our revenue growth opportunities and significantly hinder our attempts to expand our business internationally.

The testing, fabrication, and use of nuclear fuels by our future partners, licensees and nuclear power generators will be heavily regulated. The test facilities and other locations where our fuel designs may be tested before commercial use require governmental approvals from the host country’s nuclear regulatory authority. The responsibility for obtaining the necessary regulatory approvals will lie with our research and development contractors that conduct such tests and experiments. Nuclear fuel fabricators, which may ultimately fabricate fuel using our technology under commercial licenses from us, are similarly regulated. Utilities that operate nuclear power plants that may utilize the fuel produced by these fuel fabricators require specific licenses relating to possession and use of nuclear materials as well as numerous other governmental approvals for the ownership and operation of nuclear power plants.

Our Intellectual Property

Our intellectual property rights include multiple U.S. and international patents and patent applications, trade secrets, trademark rights, and contractual agreements. Our patent applications are directed to our proprietary nuclear fuel technology and we seek additional patent protection for our fuel designs, development, and related alternatives by filing patent applications in the U.S. and other countries as appropriate.

We received one new patent (worldwide) in 2024 and currently have 22 pending patent applications (worldwide). As of December 31, 2024, we held 11 U.S. patents and more than 146 foreign patents.

The expiration dates of these patents, unless they are a divisional patent filing, are generally 20 years from their application dates. Our U.S. patents begin to expire in 2027.

We ensure that we own intellectual property created for us by employees, independent contractors, consultants, companies, and any other third-party by signing agreements with them that assign any intellectual property rights to us.

We have established business procedures designed to maintain the confidentiality of our proprietary information, including the use of confidentiality agreements with employees, independent contractors, consultants, and entities with which we conduct business.

In addition to our patent portfolio, we also own trademarks to the Lightbridge corporate name and the Lightbridge logo.

Human Capital Resources

As of December 31, 2024, we had ten full-time employees and utilized a network of independent contractors, outside agencies, and technical facilities with specific skills to assist with various business functions including, but not limited to, corporate, financial, personnel, research and development, and communications. This allows us to draw upon resources that are specifically tailored to our internal needs. We have a competitive compensation plan and benefits plan that is designed to attract, retain, and reward individuals and includes an employee stock purchase plan and a 401k plan with a 100% matching employer contribution with immediate vesting.

Our Culture

Our mission is to help the world combat climate change and meet energy goals. We are passionate about understanding the needs of our society, and we work hard to develop our next generation nuclear fuel. We also believe that supporting our team with a wonderful work environment supports and empowers us to accomplish our goals. The Company’s human resource professional is a resource available for employees regarding the development of their careers and training. We also have physical and mental health programs that are available to our employees. We believe that our relationship with our employees and contractors is satisfactory.

Diversity and Inclusion

To truly help the world combat climate change, we need to work with a diversity of partners as well as have a diverse workforce. We also must operate with a high degree of awareness of evolving social conditions and social justice and create policy accordingly. We acknowledge that these measures evolve over time, and we are committed to improving our policies as awareness of social inequities or injustice arise. We believe an equitable and inclusive environment with diverse teams produces more creative solutions and results in better outcomes for our employees and stakeholders. We strive to attract, retain, and promote diverse talent at all levels of the organization.

Available Information

We make available, free of charge on our website, www.ltbridge.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits, and amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). The SEC also maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The information posted on our website is not incorporated into this Annual Report on Form 10-K, and any reference to our website is intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

Our business faces significant risks. You should carefully consider all the information set forth in this annual report and in our other filings with the SEC, including the following risk factors which we face, and which are faced by our industry. Our business, financial condition, and results of operations could be materially and adversely affected by any of these risks. In that event, the trading price of our common stock would likely decline, and you might lose all or part of your investment. This report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this report and our other SEC filings. See also “Forward-Looking Statements” above.

Risks Related to Our Business

We will need to raise significant additional capital in the future to expand our operations and continue our R&D activities and we may be unable to raise such funds when needed on acceptable terms, or at all. Any capital raises may cause significant dilution to our shareholders.

As of December 31, 2024, we had approximately $40.0 million in cash and cash equivalents. We have experienced substantial and recurring losses from operations, which has created an accumulated deficit of $164.2 million as of December 31, 2024. We will continue to incur losses because we are in the early development stage of commercializing our nuclear fuel.

We will need to raise significant additional capital (up to several hundred million dollars in total over the next 10-15 years) in order to continue our R&D activities and fund our operations through the commercialization of our nuclear fuel. R&D costs may exceed our budget estimates, leading to financial strain and suspending our R&D activities. Our current plan is to maximize external funding from third-party sources, including potentially the DOE, to support the remaining development, testing and demonstration activities relating to our metallic nuclear fuel technology.

When we elect to raise additional funds or additional funds are required, we may raise such funds from time to time through public or private equity offerings, debt financings or other financing alternatives. Additional equity or debt financing, or other alternative sources of capital may not be available to us on acceptable terms, if at all. If we are unable to meet our future financial obligations, we could be forced to delay, reduce, or cease our operations, including substantially decrease or suspend our R&D activities, or otherwise impede our ongoing business efforts, which could have a material adverse effect on our business, operating results, financial condition, and long-term prospects, and, investors may lose their entire investment in the Company. In addition, if we are unable to demonstrate meaningful progress to further the development of our fuel products, it may be difficult for us to raise additional capital on terms acceptable to us or at all.

When we raise additional funds by issuing equity securities, including using our at-the-market (ATM) facility, our stockholders will experience dilution. Sales of substantial amounts of our common stock may cause the trading price of our common stock to decline in the future. New investors may have rights superior to existing securityholders. Debt financing, if available, would result in substantial fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures, or declaring dividends. Any debt financing or additional equity that we raise may contain terms, such as liquidation and other preferences, which are not favorable to us or our stockholders. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may not be able to fully develop our nuclear fuel designs, our future operations will be limited, and our ability to generate revenues and achieve or sustain future profitability will be substantially harmed. In particular, we may be required to delay, reduce the scope of or terminate one or more of our research projects, sell rights to our nuclear fuel technology or license the rights to such technologies on terms that are less favorable to us than might otherwise be available.

We are dependent upon significant U.S. government funding and/or in-kind contributions and political support for nuclear power in order to complete our fuel development efforts and commercialize our nuclear fuel technology.

Our projected fuel development timeline is dependent upon receiving significant funding and/or in-kind contributions from the U.S. government to not only support our ongoing R&D efforts, but to also provide confidence to our investors and reduce the need to raise funds through the issuance of additional dilutive equity securities. Government funding of R&D is subject to the political process, which is inherently unpredictable and highly competitive. The funding of government programs is dependent on budgetary limitations, congressional appropriations, and administrative allotment of funds, all of which are uncertain and may be affected by changes in U.S. government policies resulting from various political developments. If political support for the prioritization of the development of nuclear energy decreases, including due to policy changes by current or future administrations and changing congressional funding priorities, it may affect our ability to secure government funding which would adversely affect our business, fuel development timeline, financial condition, and results of operations.

Changes to, or termination of, any agreements with the U.S. government national laboratories, or deterioration in our relationship with the U.S. government, could adversely affect our research and development activities.

We are a party to agreements and arrangements with U.S. national laboratories that are subject to review and approval by the DOE and which are important to our R&D activities. Termination, expiration, or modification of one or more of these agreements or their agreements with others could adversely affect our future prospects to develop our fuel and/or commercially deploy it. In addition, deterioration in our relationship with the U.S. national laboratories that are parties to these agreements and/or the DOE could impair or impede our ability to successfully implement these agreements, which could adversely affect our R&D activities.

The amount of time and funding needed to bring our nuclear fuel to market may greatly exceed our projections.

The development of our nuclear fuel will take a significant amount of time and funding, and any shortfall in R&D funding levels or a delay in achieving fuel development milestones, or uncertainty in regulatory licensing timelines could result in significant delays and cost overruns. We cannot at this stage accurately predict the amount of funding or the time required to successfully manufacture and sell our nuclear fuel in the future. However, our best estimate at this time is that our metallic fuel development program is expected to take 15-20 years and cost several hundred million U.S. dollars before we can secure our initial commercial order for a batch reload. The actual cost and time required to commercialize our fuel technology may vary significantly depending on, among other things, the results of our research and product development efforts; the cost of developing or licensing our nuclear fuel; changes in the focus and direction of our research and product development programs; access to test reactor loops and/or other test facilities; competitive and technological advances; the cost of filing, prosecuting, defending and enforcing claims with respect to patents; the regulatory approval process; fuel manufacturing process; availability of metallic high assay low enriched uranium, and marketing and other costs associated with commercialization of these technologies. Because of this uncertainty, even if financing is available to us, we may need significantly more capital than anticipated, which may not be available on terms acceptable to us or at all, and the expected revenues and other expected benefits from our nuclear fuel technology may be delayed or never realized.

Our current economic model for selling our nuclear fuel may prove to be inaccurate and subject to competition and our nuclear fuel technology products may not be cost effective.

Although our preliminary economic model concludes that our nuclear fuel technology may provide economic benefits to utilities by enabling power uprates, it is based upon a number of assumptions that may not prove to be accurate. If our model is inaccurate, our nuclear fuel product may not provide nuclear utility customers with sufficient economic incentive to switch from existing nuclear fuels, and we could lose or fail to develop customers. For example, if ATF is successful in extending the cycle length from 18 to 24 months and/or enabling significant power uprates in existing PWRs, this could severely weaken or undermine the anticipated economic value of our nuclear fuel for large PWRs.

Separately, our economic model for SMRs is in the development stage and its viability is subject to favorable wholesale power prices in the markets in which our nuclear fuel may be used, the necessary upfront capital investment to enable up to a 30% power uprate in future SMRs using our nuclear fuel and the future costs of uranium metallization and fabrication of our fuel rods and fuel assemblies at commercial scale, all of which are inherently unpredictable.

Additionally, we believe our metallic fuel can be used in CANDU heavy water reactors. While the initial feasibility study indicates the potential for Lightbridge Fuel™ to double the burnup in CANDU reactors, we do not yet have an economic model for CANDU-type reactors and are uncertain at this time as to potential economic benefits, if any, our metallic fuel could provide in those types of reactors.

A failure of our current and future economic models, or a failure to find a strategic alternative, such as a potential business combination partner, would adversely affect our business, financial condition, and results of operations and may result in the failure of the Company.

Development of our nuclear fuel technology is dependent upon the availability of a test reactor and access to adequate resources and manufacturing capabilities at national laboratories.

Our fuel designs are still in the research and development stage and further research, development, and demonstration will be required in test facilities. We had intended to conduct further testing of our fuel designs at the Halden research reactor located in Halden, Norway. However, the Halden research reactor, which became operational in 1958, was shut down in June 2018 and will not reopen. The Company has identified alternative options to generate the irradiation data we need to support regulatory licensing of our LTA operation in a commercial reactor, such as the ATR at INL, but pursuing such alternatives to the Halden research reactor may significantly delay further testing of our fuel designs. We may not be able to contractually secure another reactor in which to test our fuel designs. As a result, commercialization of our nuclear fuel technology may be significantly delayed, perhaps indefinitely, which would adversely affect our business, financial condition, and results of operations.

Our current R&D plan includes the use of research reactors made available by the U.S. government and the DOE, including but not limited to the ATR at INL. These reactors are limited in terms of technical capabilities, operating cycles, and prior reservations for similar research and development services. While the ATR may have enough space for additional flow loops where fuel rods can be irradiated, the reactor currently has only one such loop available, limiting how much fuel rod material that can be inserted into the reactor as well as its duration in the reactor. If sufficient capacity within the ATR is not available on a timely basis, we may not be able to obtain sufficient data to justify regulatory approval for LTA demonstration in a large commercial PWR in a commercially feasible timeframe. This would likely necessitate additional loop irradiation testing in another test reactor or LTR demonstration in a large commercial PWR in addition to the ATR loop testing before LTA demonstration could commence.

Funding for any improvement of capabilities or continued operations of these reactors is subject to the priorities of the U.S. government, as well as the appropriation of funding by the U.S. Congress, and cannot be assured. Changes in these factors are outside of the Company’s control and could cause significant delays and/or cost increases in our R&D programs.

Furthermore, we currently rely on existing manufacturing equipment and capabilities at INL to demonstrate our co-extrusion fabrication process using depleted uranium and zirconium alloy and to eventually manufacture samples using enriched uranium and zirconium alloy for irradiation testing in a test reactor environment. INL has indicated to the Company that due to resource and manufacturing equipment constraints, it may not be able to meet the Company’s preferred project timeline. Based on the actual costs and project performance to date, we believe that the total project cost will likely exceed the previously anticipated budgets.

Our fuel designs have never been tested in an existing commercial reactor and actual fuel performance, as well as the willingness of commercial reactor operators and fuel fabricators to adopt a new design, is uncertain.