false

0001799011

0001799011

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 12, 2024

| LUCID

DIAGNOSTICS INC. |

| (Exact

Name of Registrant as Specified in Charter) |

| Delaware |

|

001-40901 |

|

82-5488042 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 360

Madison Avenue, 25th

Floor, New

York, New

York |

|

10017 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (917) 813-1828

| N/A |

| (Former

Name or Former Address, if Changed Since Last Report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, Par Value $0.001 Per Share |

|

LUCD |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition.

On

August 12, 2024, the Company issued a press release announcing financial results for its fiscal quarter ended June 30, 2024 and providing

a business update. A copy of the press release is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

Item

7.01. Regulation FD Disclosure.

The

disclosure set forth under Item 2.02 is incorporated herein by reference.

The

information furnished under Items 2.02 and 7.01, including the exhibit related thereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any disclosure document of

the Company, except as shall be expressly set forth by specific reference in such document.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits:

| Exhibit

No. |

|

Description |

| 99.1 |

|

Press release. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

August 12, 2024 |

LUCID

DIAGNOSTICS INC. |

| |

|

|

| |

By:

|

/s/

Dennis McGrath |

| |

|

Dennis

McGrath |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Lucid

Diagnostics Provides Business Update and Second Quarter 2024 Financial Results

EsoGuard®

test volume increased 31 percent quarterly; 44 percent annually

Clinical

data now well-positioned for final push towards broad coverage and reimbursement

Over

50 high-volume #CheckYourFoodTube Precancer Testing Events in 2Q24, including first with upfront contracted payment

Conference

call and webcast to be held today, August 12th at 8:30 AM EDT

NEW

YORK, August 12, 2024 - Lucid Diagnostics Inc. (Nasdaq: LUCD) (“Lucid” or the “Company”) a commercial-stage,

cancer prevention medical diagnostics company, and subsidiary of PAVmed Inc. (Nasdaq: PAVM, PAVMZ) (“PAVmed”), today provided

a business update for the Company and presented financial results for the three months ended June 30, 2024.

Conference

Call and Webcast

The

webcast will take place on Monday, August 12, 2024, at 8:30 AM and will be accessible in the investor relations section of the Company’s

website at luciddx.com. Alternatively, to access the conference call by telephone, U.S.-based callers should dial 1-800-836-8184

and international listeners should dial 1-646-357-8785. All listeners should provide the operator with the conference call name “Lucid

Diagnostics Business Update” to join.

Following

the conclusion of the conference call, a replay will be available for 30 days on the investor relations section of the Company’s

website at luciddx.com.

Business

Update Highlights

“I

am very pleased with the excellent progress Lucid has made on multiple fronts during the second quarter and recent weeks, specifically

the progress made related to EsoGuard’s clinical data,” said Lishan Aklog, M.D., Lucid’s Chairman and Chief

Executive Officer. “We are now fully armed with a complete body of clinical data and well-positioned for our final push towards

broad coverage and reimbursement to drive EsoGuard revenue and revenue growth.”

Highlights

from the second quarter and recent weeks:

| ● | For

the quarter, EsoGuard® Esophageal DNA Test revenue was $1.0M, which

was flat compared to 1Q24 and represents a 514 percent annual increase from 2Q23. |

| ● | Lucid’s

CLIA-certified clinical laboratory performed 3,147 commercial EsoGuard tests in 2Q24, a single-quarter

record, which represents a 31 percent increase sequentially from 1Q24 and a 44 percent

annual increase from 2Q23. |

| ● | Released

ENVET-BE clinical utility study positive data showing that triaging with a noninvasive

EsoGuard test results in a 2.4-fold increased positive yield of invasive endoscopy. |

| ● | Released

ESOGUARD BE-1 clinical validation study positive data showing excellent EsoGuard sensitivity

of 88% and NPV of 99%. |

| ● | Held

productive meeting with CMS Medicare Administrative Contractor (MAC) Palmetto GBA’s

Molecular Diagnostics Program (MolDX) focused on EsoGuard’s clinical data. |

| ● | Held

first major #CheckYourFoodTube Precancer Testing Event with upfront contracted payment. |

| ● | American

Foregut Society published formal statement strongly advocating for commercial payor

coverage of EsoGuard to align with guidelines and biomarker legislation. |

| ● | Continuous

revenue cycle management improvements, including prior authorization appeals, physician advocacy,

etc., while maintaining stable out-of-network allowed amounts. |

| ● | Robust

pipeline of direct contracting engagements with benefits brokers, third-party administrators,

and self-insured entities. |

| ● | Actively

executing on aggressive market access strategy focused on securing medical policy coverage

with regional plans in biomarker legislation states and pilots with national plans. |

Financial

Results

| ● | For

the three months ended June 30, 2024, EsoGuard related revenues were $1.0 million.

Operating expenses were approximately $12.2 million, which included stock-based compensation

expenses of $1.2 million. GAAP net loss attributable to common stockholders was approximately

$11.0 million or $(0.23) per common share. |

| ● | As

shown below and for the purpose of illustrating the effect of stock-based compensation and

other non-cash income and expenses on the Company’s financial results, the Company’s

non-GAAP adjusted loss for the three months ended June 30, 2024 was approximately $9.7 million

or $(0.20) per common share. |

| ● | Lucid

had cash and cash equivalents of $24.9 million as of June 30, 2024, compared to $18.9 million

as of December 31, 2023. During the quarter ended June 30, 2024, he Company issued Series

B-1 Convertible Preferred Stock Series resulting in gross proceeds of approximately $11.6

million. |

| ● | The

unaudited financial results for the three and six months ended June 30, 2024, were filed

with the SEC on Form 10-Q on August 12, 2024, and available at www.luciddx.com or www.sec.gov. |

Lucid

Non-GAAP Measures

| ● | To

supplement our unaudited financial results presented in accordance with U.S. generally accepted

accounting principles (GAAP), management provides certain non-GAAP financial measures of

the Company’s financial results. These non-GAAP financial measures include net loss

before interest, taxes, depreciation, and amortization (EBITDA), and non-GAAP adjusted loss,

which further adjusts EBITDA for stock-based compensation expense and other non-cash income

and expenses, if any. The foregoing non-GAAP financial measures of EBITDA and non-GAAP adjusted

loss are not recognized terms under U.S. GAAP. |

| ● | Non-GAAP

financial measures are presented with the intent of providing greater transparency to the

information used by us in our financial performance analysis and operational decision-making.

We believe these non-GAAP financial measures provide meaningful information to assist investors,

shareholders, and other readers of our unaudited financial statements in making comparisons

to our historical financial results and analyzing the underlying performance of our results

of operations. These non-GAAP financial measures are not intended to be, and should not be,

a substitute for, considered superior to, considered separately from, or as an alternative

to, the most directly comparable GAAP financial measures. |

| ● | Non-GAAP

financial measures are provided to enhance readers’ overall understanding of our current

financial results and to provide further information for comparative purposes. Management

believes the non-GAAP financial measures provide useful information to management and investors

by isolating certain expenses, gains, and losses that may not be indicative of our core operating

results and business outlook. Specifically, the non-GAAP financial measures include non-GAAP

adjusted loss, and its presentation is intended to help the reader understand the effect

of the loss on the issuance or modification of convertible securities, the periodic change

in fair value of convertible securities, the loss on debt extinguishment, and the corresponding

accounting for non-cash charges on financial performance. In addition, management believes

non-GAAP financial measures enhance the comparability of results against prior periods. |

| ● | A

reconciliation to the most directly comparable GAAP measure of all non-GAAP financial measures

included in this press release for the three and six months ended June 30, 2024, and 2023

are as follows: |

Condensed

consolidated statements of operations (unaudited)

| (in thousands except per-share amounts) | |

For the three months ended

June 30, | | |

For the six months ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 976 | | |

$ | 159 | | |

$ | 1,977 | | |

$ | 605 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| 12,168 | | |

| 11,743 | | |

| 23,960 | | |

| 26,505 | |

| Other (Income) expense | |

| (187 | ) | |

| (203 | ) | |

| (366 | ) | |

| 1,728 | |

| Net Loss | |

| (11,005 | ) | |

| (11,381 | ) | |

| (21,617 | ) | |

| (27,628 | ) |

| Net income (loss) per common share, basic and diluted | |

$ | (0.23 | ) | |

$ | (0.27 | ) | |

$ | (0.62 | ) | |

$ | (0.40 | ) |

| Net loss attributable to common stockholders | |

| (11,005 | ) | |

| (11,381 | ) | |

| (29,113 | ) | |

| (27,628 | ) |

| Preferred Stock dividends and deemed dividends | |

| — | | |

| — | | |

| 7,496 | | |

| — | |

| Net income (loss) as reported | |

| (11,005 | ) | |

| (11,381 | ) | |

| (21,617 | ) | |

| (27,628 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization expense1 | |

| 229 | | |

| 633 | | |

| 730 | | |

| 1,245 | |

| Interest expense, net2 | |

| (101 | ) | |

| 87 | | |

| (157 | ) | |

| 43 | |

| EBITDA | |

| (10,877 | ) | |

| (10,661 | ) | |

| (21,044 | ) | |

| (26,340 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other non-cash or financing related expenses: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation expense3 | |

| 1,201 | | |

| 1,399 | | |

| 2,135 | | |

| 4,607 | |

| ResearchDx acquisition paid in stock1 | |

| — | | |

| — | | |

| — | | |

| 713 | |

| Operating expenses issued in stock1 | |

| 90 | | |

| 23 | | |

| 113 | | |

| 23 | |

| Change in FV convertible debt2 | |

| (599 | ) | |

| (290 | ) | |

| (890 | ) | |

| 499 | |

| Offering costs convertible debt2 | |

| — | | |

| — | | |

| — | | |

| 1,186 | |

| Debt extinguishments loss - Senior Secured Convertible Note2 | |

| 513 | | |

| — | | |

| 681 | | |

| — | |

| Non-GAAP adjusted (loss) | |

$ | (9,672 | ) | |

$ | (9,529 | ) | |

$ | (19,005 | ) | |

$ | (19,312 | ) |

| Basic and Diluted shares outstanding | |

| 48,212 | | |

| 41,834 | | |

| 46,613 | | |

| 41,405 | |

| Non-GAAP adjusted (loss) income per share | |

$ | (0.20 | ) | |

$ | (0.23 | ) | |

$ | (0.41 | ) | |

$ | (0.47 | ) |

1

Included in general and administrative expenses in the financial statements.

2

Included in other income and expenses.

3

Stock-based compensation (“SBC”) expense included in operating expenses is detailed as follows in the table below by

category within operating expenses for the non-GAAP Net operating expenses:

Reconciliation

of GAAP Operating Expenses to Non-GAAP Net Operating Expenses

| (in thousands except per-share amounts) | |

For the three months ended

June 30, | | |

For the six months ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Cost of revenues | |

$ | 1,614 | | |

$ | 1,549 | | |

$ | 3,269 | | |

$ | 2,887 | |

| Stock-based compensation expense3 | |

| (44 | ) | |

| (25 | ) | |

| (80 | ) | |

| (44 | ) |

| Net cost of revenues | |

| 1,570 | | |

| 1,524 | | |

| 3,189 | | |

| 2,843 | |

| | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| 105 | | |

| 505 | | |

| 477 | | |

| 1,010 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 4,210 | | |

| 4,032 | | |

| 8,404 | | |

| 8,159 | |

| Stock-based compensation expense3 | |

| (365 | ) | |

| (367 | ) | |

| (715 | ) | |

| (723 | ) |

| Net sales and marketing | |

| 3,845 | | |

| 3,665 | | |

| 7,689 | | |

| 7,436 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 4,867 | | |

| 3,830 | | |

| 8,937 | | |

| 10,730 | |

| Depreciation expense | |

| (124 | ) | |

| (128 | ) | |

| (253 | ) | |

| (235 | ) |

| RDx Settlement in Stock | |

| — | | |

| — | | |

| — | | |

| (713 | ) |

| Operating expenses issued in stock | |

| (90 | ) | |

| (23 | ) | |

| (113 | ) | |

| (23 | ) |

| Stock-based compensation expense3 | |

| (610 | ) | |

| (844 | ) | |

| (941 | ) | |

| (3,512 | ) |

| Net general and administrative | |

| 4,043 | | |

| 2,835 | | |

| 7,630 | | |

| 6,247 | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 1,372 | | |

| 1,827 | | |

| 2,873 | | |

| 3,719 | |

| Stock-based compensation expense3 | |

| (182 | ) | |

| (163 | ) | |

| (399 | ) | |

| (328 | ) |

| Net research and development | |

| 1,190 | | |

| 1,664 | | |

| 2,474 | | |

| 3,391 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 12,168 | | |

| 11,743 | | |

| 23,960 | | |

| 26,505 | |

| Depreciation and amortization expense | |

| (229 | ) | |

| (633 | ) | |

| (730 | ) | |

| (1,245 | ) |

| RDx Settlement in Stock | |

| — | | |

| — | | |

| — | | |

| (713 | ) |

| Operating expenses issued in stock | |

| (90 | ) | |

| (23 | ) | |

| (113 | ) | |

| (23 | ) |

| Stock-based compensation expense3 | |

| (1,201 | ) | |

| (1,399 | ) | |

| (2,135 | ) | |

| (4,607 | ) |

| Net operating expenses | |

$ | 10,648 | | |

$ | 9,688 | | |

$ | 20,982 | | |

$ | 19,917 | |

About

EsoGuard and EsoCheck

Millions

of patients with gastroesophageal reflux disease (GERD) are at risk of developing esophageal precancer and a highly lethal form of esophageal

cancer (“EAC”). Over 80 percent of EAC patients die within five years of diagnosis, making it the second most lethal cancer

in the U.S. The mortality rate is high even in those diagnosed with early stage EAC. The U.S. incidence of EAC has increased 500 percent

over the past four decades, while the incidences of other common cancers have declined or remained flat. In nearly all cases, EAC silently

progresses until it manifests itself with new symptoms of advanced disease. All EAC is believed to arise from esophageal precancer, which

occurs in approximately 5 percent to 15 percent of at-risk GERD patients. Early esophageal precancer can be monitored for progression

to late esophageal precancer which can be cured with endoscopic esophageal ablation, reliably halting progression to cancer.

Esophageal

precancer screening is already recommended by clinical practice guidelines for the millions of GERD patients with multiple risk factors,

including age over 50 years, male sex, White race, obesity, smoking history, and a family history of esophageal precancer or cancer.

Unfortunately, fewer than 10 percent of those recommended for screening undergo traditional invasive endoscopic screening. The profound

tragedy of an EAC diagnosis is that death could likely have been prevented if the at-risk GERD patient had been screened and then undergone

surveillance and curative treatment at the precancer stage.

The

only missing element for a viable esophageal cancer prevention program has been the lack of an easily-accessible, in-office screening

tool that can detect esophageal precancer. Lucid believes EsoGuard, performed on samples collected non-endoscopically with EsoCheck,

is the missing element – the first and only commercially available test capable of serving as a widespread screening tool to prevent

esophageal cancer deaths through the early detection of esophageal precancer in at-risk GERD patients. An updated American College of

Gastroenterology (ACG) clinical practice guideline and an American Gastroenterological Association (AGA) clinical practice update both

endorse non-endoscopic biomarker tests as an acceptable alternative to costly and invasive endoscopy for esophageal precancer screening.

EsoGuard is the only such test currently available in the United States.

EsoGuard

is a Next Generation Sequencing (NGS) based DNA methylation assay performed on surface esophageal cells collected with EsoCheck, which

quantifies methylation at 31 sites on two genes, Vimentin (VIM) and Cyclin A1 (CCNA1). The assay was initially evaluated in a 408-patient,

multicenter, case-control study published in Science Translational Medicine and showed greater than 90 percent sensitivity and specificity

at detecting esophageal precancer and cancer.

EsoCheck

is a CE Marked and FDA 510(k) cleared noninvasive swallowable balloon capsule catheter device capable of sampling surface esophageal

cells in a less than three-minute office procedure. It consists of a vitamin pill-sized rigid plastic capsule tethered to a thin silicone

catheter from which a soft silicone balloon with textured ridges emerges to gently swab surface esophageal cells. When vacuum suction

is applied, the balloon and sampled cells are pulled into the capsule, protecting them from contamination and dilution by cells outside

of the targeted region during device withdrawal. Lucid believes this proprietary Collect+Protect™ technology makes EsoCheck the

only noninvasive esophageal cell collection device capable of such anatomically targeted and protected sampling. The sample is sent by

overnight express mail to Lucid’s CLIA-certified, CAP-accredited, NYS CLEP approved laboratory, LucidDx Labs, for EsoGuard testing.

About

Lucid Diagnostics

Lucid

Diagnostics Inc. is a commercial-stage, cancer prevention medical diagnostics company, and subsidiary of PAVmed Inc. Lucid is focused

on the millions of patients with GERD, also known as chronic heartburn, who are at risk of developing esophageal precancer and cancer.

Lucid’s EsoGuard® Esophageal DNA Test, performed on samples collected in a brief, noninvasive office procedure with

its EsoCheck® Esophageal Cell Collection Device - the first and only commercially available tools designed with the goal

of preventing esophageal cancer and cancer deaths through widespread, early detection of esophageal precancer in at-risk patients.

For

more information, please visit luciddx.com and for more information about its parent company PAVmed, please visit pavmed.com.

Forward-Looking

Statements

This

press release includes forward-looking statements that involve risk and uncertainties. Forward-looking statements are any statements

that are not historical facts. Such forward-looking statements, which are based upon the current beliefs and expectations of Lucid Diagnostics’

management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. Risks

and uncertainties that may cause such differences include, among other things, volatility in the price of Lucid Diagnostics’ common

stock; general economic and market conditions; the uncertainties inherent in research and development, including the cost and time required

to advance Lucid Diagnostics’ products to regulatory submission; whether regulatory authorities will be satisfied with the design

of and results from Lucid Diagnostics’ clinical and preclinical studies; whether and when Lucid Diagnostics’ products are

cleared by regulatory authorities; market acceptance of Lucid Diagnostics’ products once cleared and commercialized; Lucid Diagnostics’

ability to raise additional funding as needed; and other competitive developments. These factors are difficult or impossible to predict

accurately and many of them are beyond Lucid Diagnostics’ control. In addition, new risks and uncertainties may arise from time

to time and are difficult to predict. For a further list and description of these and other important risks and uncertainties that may

affect Lucid Diagnostics’ future operations, see Part I, Item 1A, “Risk Factors,” in Lucid Diagnostics’ most

recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, as the same may be updated in Part II, Item 1A,

“Risk Factors” in any Quarterly Report on Form 10-Q filed by Lucid Diagnostics after its most recent Annual Report. Lucid

Diagnostics disclaims any intention or obligation to publicly update or revise any forward-looking statement to reflect any change in

its expectations or in events, conditions, or circumstances on which those expectations may be based, or that may affect the likelihood

that actual results will differ from those contained in the forward-looking statements.

Investor

and Media Contact

Matt

Riley

PAVmed

and Lucid Diagnostics

610.348.8926

mjr@pavmed.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

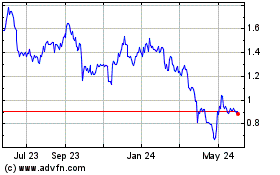

Lucid Diagnostics (NASDAQ:LUCD)

Historical Stock Chart

From Feb 2025 to Mar 2025

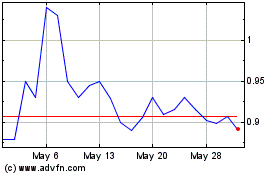

Lucid Diagnostics (NASDAQ:LUCD)

Historical Stock Chart

From Mar 2024 to Mar 2025