UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

LexinFintech Holdings Ltd.

(Name of Issuer)

Class A ordinary shares, par value $0.0001

(Title of Class of Securities)

528877 103(1)

(CUSIP Number)

Yi Wu

Rosy Time Global Limited

27/F CES Tower

No. 3099 Keyuan South Road

Nanshan District, Shenzhen 518057

People’s Republic of China

Telephone: +86 0755-3637-8888

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 29, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because § 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g) check the following box. ¨

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

(1) This CUSIP number applies to the Issuer’s

American depositary shares, each representing two Class A ordinary shares, which are quoted on the Nasdaq Global Select Market under

the symbol “LX.”

| 1 |

NAME OF REPORTING PERSONS

Yi Wu

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e) ¨

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

People’ Republic of China

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

24,719,016(1)

|

| 8 |

SHARED VOTING POWER

0

|

| 9 |

SOLE DISPOSITIVE POWER

24,719,016(1)

|

| 10 |

SHARED DISPOSITIVE POWER

0

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,719,016(1)

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See

Instructions) ¨

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.5%

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

(1) Represents 23,123,466

Class A ordinary shares held by Rosy Time Global Limited, a company incorporated in the British Virgin Islands and wholly-owned by

Mr. Yi Wu, and 431,108 ADSs representing 862,216 Class A ordinary shares and 783,334 Class A ordinary shares issuable to

Mr. Yi Wu upon exercise of options granted to him within 60 days after December 29, 2023.

| 1 |

NAME OF REPORTING PERSONS

Rosy Time Global Limited

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e) ¨

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

23,123,466(1)

|

| 8 |

SHARED VOTING POWER

0

|

| 9 |

SOLE DISPOSITIVE POWER

23,123,466(1)

|

| 10 |

SHARED DISPOSITIVE POWER

0

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

23,123,466(1)

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See

Instructions) ¨

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.0%

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO

|

(1) Represents 23,123,466

Class A ordinary shares held by Rosy Time Global Limited.

Item 1. Security and Issuer.

This Schedule 13D relates to the ordinary shares

of LexinFintech Holdings Ltd., a Cayman Islands company (the “Issuer”), whose principal executive offices are located

at 27/F, CES Tower, No. 3099 Keyuan South Road, Nanshan District, Shenzhen 518052, the People’s Republic of China. The ordinary

shares of the Issuer consist of Class A ordinary shares (including Class A ordinary shares represented by ADSs) and Class B

ordinary shares, par value US$0.0001 each.

The ADSs of the Issuer are listed on the Nasdaq

Global Select Market under the symbol “LX.” Each ADS represents two Class A ordinary shares.

Item 2. Identity and Background

(a): This Schedule 13D is being filed jointly by

Yi Wu and Rosy Time Global Limited (together, the “Reporting Persons”, and each, a “Reporting Person”) pursuant

to Rule 13d-1(k) promulgated by the SEC under Section 13 of the Act. The agreement between the Reporting Persons relating

to the joint filing of this Schedule 13D is attached hereto as Exhibit A.

Information with respect to each Reporting Person

is given solely by such Reporting Person, and no Reporting Person assumes responsibility for the accuracy or completeness of the information

concerning the other Reporting Person except as otherwise provided in Rule 13d-1(k).

(b), (c), and (f): Mr. Yi Wu is a citizen

of the People’s Republic of China. Mr. Yi Wu is the president and a director of the Issuer. The business address of Mr. Yi

Wu is 27/F, CES Tower, No. 3099 Keyuan South Road, Nanshan District, Shenzhen 518052, the People’s Republic of China.

Rosy Time Global Limited is a company incorporated

in the British Virgin Islands and wholly-owned by Mr. Yi Wu. The registered address of Rosy Time Global Limited is P.O. Box

957, Offshore Incorporations Centre, Road Town, Tortola, British Virgin Islands.

(d) and (e): During the last five years, none

of the Reporting Persons has been: (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors)

or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Considerations.

On December 29, 2024, Installment Payment

Investment Inc., a company incorporated in the British Virgin Islands and controlled by Mr. Jay Wenjie Xiao, the chief executive

officer and chairman of the board of the Issuer, transferred 8,846,936 Class A ordinary shares (which were automatically converted

from 8,846,936 Class B ordinary shares) to Rosy Time Global Limited. The consideration for the transfer was US$0.885 per share, which

equals to the closing price of the Issuer’s ADSs on December 26, 2023, adjusted to reflect the ADS-to-share ratio.

Item 4. Purpose of Transaction.

The information set forth in Item 3 is hereby incorporated

by reference in its entirety.

The beneficial ownership that is the subject of

this Schedule 13D was acquired for long-term investment purposes. The Reporting Persons review its investments on a continuing basis.

Depending on overall market conditions, performance and prospects of the Issuer, subsequent developments affecting the Issuer, other investment

opportunities available to the Reporting Persons and other investment considerations, the Reporting Persons may hold, vote, acquire or

dispose of or otherwise deal with securities of the Issuer. Any of the foregoing actions may be effected at any time or from time to time,

subject to applicable law.

Except as set forth above, none of the Reporting

Persons has any present plan or proposal which related to or would result in any transaction, change or event specified in clauses (a) through

(j) of Item 4 of Schedule 13D. The Reporting Persons reserve the right to take such actions in the future as they deem appropriate,

including changing the purpose described above or adopting plans or proposals with respect to one or more of the items described in subparagraphs

(a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

(a) and (b):

The responses of each Reporting Person to Rows

(7) through (13) of the cover pages of this Schedule 13D are hereby incorporated by reference in this Item 5.

The percentage of the class of securities is calculated

by dividing the number of shares beneficially owned by the reporting person by a total of 328,993,585 issued and outstanding ordinary

shares (consisting of Class A ordinary shares and Class B ordinary shares) of the Issuer as of December 29, 2023 as a single

class. The percentage of voting power is calculated by dividing the voting power beneficially owned by the reporting person by the voting

power of all of the Issuer’s holders of Class A ordinary shares and Class B ordinary shares as a single class as of December 29,

2023. Each holder of Class B ordinary shares is entitled to ten votes per share, subject to certain conditions, and each holder of

Class A ordinary shares is entitled to one vote per share on all matters submitted to them for a vote.

(c): Except as disclosed in this Schedule 13D,

none of the Reporting Persons has effected any transaction in the ordinary shares of the Issuer during the past 60 days.

(d): Except as disclosed in this Schedule

13D, no other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of,

the ordinary shares beneficially owned by the Reporting Persons.

(e): Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

The information set forth in Item 3 is hereby incorporated

by reference in its entirety.

To the best knowledge of the Reporting Persons,

except as provided herein, there are no other contracts, arrangements, understandings or relationships (legal or otherwise) between the

Reporting Persons and between any of the Reporting Persons and any other person with respect to any securities of the Issuer, joint ventures,

loan or option arrangements, puts or calls, guarantees of profits, divisions of profits or loss, or the giving or withholding of proxies,

or a pledge or contingency, the occurrence of which would give another person voting power over the securities of the Issuer.

Item 7. Material to Be Filed as Exhibits.

Exhibit A Joint Filing Agreement by and between the Reporting Persons, dated January 8, 2024.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: January 8, 2024

| | Yi Wu |

| | | |

| | | /s/ Yi Wu |

| | | |

| | | Rosy Time Global Limited |

| | | |

| | | By: |

/s/ Yi Wu |

| | | |

Name: Yi Wu |

| | | |

Title: Director |

[Signature Page to Schedule 13D]

Exhibit A

AGREEMENT

OF JOINT FILING

In

accordance with Rule 13d-1(k) promulgated under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree

to the joint filing with all other Reporting Persons (as such term is defined in the Schedule 13D referred to below) on behalf of each

of them of a statement on Schedule 13D (including amendments thereto) with respect to the ordinary shares, par value US$0.0001 per share,

of LexinFintech Holdings Ltd., a Cayman Islands company, and that this Agreement may be included as an Exhibit to such joint filing.

This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one and the same instrument.

IN

WITNESS WHEREOF, the undersigned hereby execute this Agreement as of January 8, 2024.

| | Yi

Wu |

| | | |

| | | /s/

Yi Wu |

| | | |

| | | Rosy

Time Global Limited |

| | | |

| | | By: |

/s/

Yi Wu |

| | | |

Name:

Yi Wu |

| | | |

Title:

Director |

[Signature

Page to Agreement of Joint Filing]

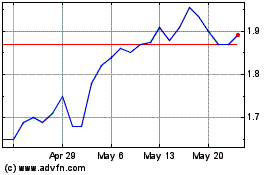

LexinFintech (NASDAQ:LX)

Historical Stock Chart

From Jan 2025 to Feb 2025

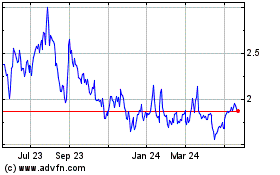

LexinFintech (NASDAQ:LX)

Historical Stock Chart

From Feb 2024 to Feb 2025