Matthews International Corporation (NASDAQ GSM: MATW) (“Matthews”

or the “Company”) today issued the following statement in response

to the recent statement and nomination notice the Company has

received from Barington Capital Group (“Barington”):

Our recent operating results reflect

solid performance by our core businesses and demonstrate the

resilience of our team in the face of a challenging market

environment. As a result of strong execution and oversight by the

Matthews Board of Directors and management team, the fundamentals

of our businesses and their long-term outlook are strong:

• Memorialization has benefited from

pricing actions and several smaller strategic acquisitions, while

delivering on cremation and mausoleum-related products that

underscore the segment’s long-term commitment to diversify its

best-in-class offerings within the deathcare industry. Cost control

measures taken during the fiscal year have also contributed to an

improvement in operating margins.

• SGK recently reported its third

consecutive quarter of higher sequential sales and solid margins.

Notably, the strategic decision to invest in resources to support

the transitioning of components of our core business to an

e-commerce digital marketing platform differentiates us from our

peers and led to an increase in revenues and organic business

opportunities that position us well for 2025.

• Within Industrial Technologies we

expect the demand recovery to have a positive impact at the start

of our new fiscal year, which should result in meaningful revenue

results in the latter part of fiscal 2025 and into 2026.

• Interest in the innovative

solutions being offered through our Energy Solutions business

remains strong, and we are well positioned both financially and

operationally to lead the ongoing transition to electric vehicles

through our multi-decade investment in advanced rotary processing

technologies and alternative solutions for such technologies.

As previously announced on our fourth

quarter earnings call, Matthews has retained J.P. Morgan to support

the evaluation of potential strategic alternatives. The Board is

dedicated to driving long-term value creation, and the strategic

alternatives process is a reflection of that commitment.

Importantly, in late November, Matthews also declared its 31st

consecutive annual dividend increase since becoming a public

company.

As Chief Executive Officer, Joseph

Bartolacci has led the Company’s growth from approximately $700

million in revenues in fiscal 2006, to approximately $1.8 billion

today. Mr. Bartolacci’s strategic vision, including various

strategic acquisitions over several years aimed at expanding the

Company’s casket manufacturing and distribution capabilities, has

fostered an organization that is a strong, diversified and

resilient provider of innovative solutions for customers around the

globe. Under Mr. Bartolacci’s leadership, Matthews remains

dedicated to driving improved performance and sustainable growth

for all of the Company’s stakeholders.

Matthews’ refreshed, diverse and

fit-for-purpose Board actively oversees the Company’s strategy.

Members of the Board bring many years of expertise at public

companies, including across industrial and manufacturing

industries, as well as corporate governance, finance, marketing,

sales, strategy and human resources.

The Board will continue its regular

refreshment and believes a variety of perspectives facilitates

effective decision-making, helps drive long-term value, and

encourages different views on risk, business strategy and

innovation. Notably, the Board has added two new independent

directors over the past two years and three independent directors

over the past five years.

Engagement with Barington

Capital

The Board and leadership team have a

long-term relationship with Barington and remain open to

constructive dialogue. As previously announced on December 30,

2022, Matthews entered into an agreement with Barington, pursuant

to which Barington served as a consultant to Matthews. On October

18, 2023, Matthews and Barington agreed to extend the agreement,

allowing Jim Mitarotonda to continue to meet with the Company’s

business leaders on a quarterly basis. Contrary to his position

today, Mitarotonda has previously commended the management team and

its performance.

In October 2024, Matthews attempted

to continue consulting with Mr. Mitarotonda about the Company’s

evaluation of its portfolio to unlock value. Mr. Mitarotonda

refused. Now that the agreement with Barington has expired, rather

than engage in a private dialogue with our Board and potentially

exploring a constructive path forward, Barington has decided to

wage a costly and disruptive proxy contest.

The Matthews Board and management

team are committed to serving in the best interests of all our

shareholders, and as the evaluation of strategic alternatives

underscores, we will continue to take actions that are in the best

interests of driving long-term value creation for all our

shareholders.

Shareholders are not required to take any action at this time.

The Board will present its recommendations with respect to the

election of directors in the Company's definitive proxy statement,

which will be filed with the Securities and Exchange Commission and

mailed to all shareholders eligible to vote at the 2025 Annual

Meeting.

J.P. Morgan Securities LLC is serving as financial advisor and

Jones Day is serving as legal counsel to Matthews.

About Matthews International Corporation

Matthews International Corporation is a global provider of

memorialization products, industrial technologies, and brand

solutions. The Memorialization segment is a leading provider of

memorialization products, including memorials, caskets,

cremation-related products, and cremation and incineration

equipment, primarily to cemetery and funeral home customers that

help families move from grief to remembrance. The Industrial

Technologies segment includes the design, manufacturing, service

and sales of high-tech custom energy storage solutions; product

identification and warehouse automation technologies and solutions,

including order fulfillment systems for identifying, tracking,

picking and conveying consumer and industrial products; and coating

and converting lines for the packaging, pharma, foil, décor and

tissue industries. The SGK Brand Solutions segment is a leading

provider of packaging solutions and brand experiences, helping

companies simplify their marketing, amplify their brands and

provide value. The Company has over 11,000 employees in more than

30 countries on six continents that are committed to delivering the

highest quality products and services.

Additional Information

In connection with the Company’s 2025 Annual Meeting, the

Company will file with the U.S. Securities and Exchange Commission

(“SEC”) and mail to the shareholders of record entitled to vote at

the 2025 Annual Meeting a definitive proxy statement and other

documents, including a WHITE proxy card. SHAREHOLDERS ARE

ENCOURAGED TO READ THE PROXY STATEMENT AND ALL OTHER RELEVANT

DOCUMENTS WHEN FILED WITH THE SEC AND WHEN THEY BECOME AVAILABLE

BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. When

filed with the SEC, the definitive proxy statement and WHITE proxy

card will also be mailed to shareholders of record. Investors and

other interested parties will be able to obtain the documents free

of charge at the SEC’s website, www.sec.gov, or from the Company at

its website: http://www.matw.com/investors/sec-filings. You may

also obtain copies of the Company’s definitive proxy statement and

other documents, free of charge, by contacting the Company’s

Investor Relations Department at Matthews International

Corporation, Two NorthShore Center, Pittsburgh, Pennsylvania

15212-5851, Attention: Investor Relations, telephone (412)

442-8200.

Participants in Solicitation

The participants in the solicitation of proxies in connection

with the 2025 Annual Meeting are currently anticipated to be the

Company, Alvaro Garcia-Tunon, Gregory S. Babe, Joseph C.

Bartolacci, Katherine E. Dietze, Terry L. Dunlap, Lillian D.

Etzkorn, Morgan K. O’Brien, Aleta W. Richards, David A. Schawk,

Jerry R. Whitaker, Francis S. Wlodarczyk, Steven F. Nicola and

Brian D. Walters.

As of November 30, 2024, Mr. Garcia-Tunon beneficially owns

27,259 shares of Class A Common Stock of the Company, par value

$1.00 (the “Common Stock”), which includes 12,109 shares of Common

Stock held in the SGT 2021 Family Trust for the benefit of members

of Mr. Garcia-Tunon’s family for which Mr. Garcia-Tunon serves as

trustee. Mr. Garcia-Tunon also holds 36,352 deferred stock

compensation shares. Mr. Babe beneficially owns 85,775 shares of

Common Stock. Mr. Babe also holds 5,798 deferred stock compensation

shares. Mr. Bartolacci owns 551,047 shares of Common Stock. Ms.

Dietze owns 40,658 shares of Common Stock. Mr. Dunlap owns 24,910

shares of Common Stock. Ms. Etzkorn owns 9,886 shares of Common

Stock. Mr. O’Brien owns 32,850 shares of Common Stock. Ms. Richards

owns 1,090 shares of Common Stock. Mr. Schawk owns 211,859 shares

of Common Stock, which includes 35,548 shares of Common Stock held

in the Teryl Alyson Schawk 1998 Trust; 51,514 shares of Common

Stock held in trusts for the benefit of Mr. Schawk’s children for

which Mr. Schawk or his spouse serves as trustee; 124,699 shares of

Common Stock held in the David A. Schawk 1998 Trust for which Mr.

Schawk serves as trustee with voting and investment power over such

shares; 77,395 shares of Common Stock held in trust for the benefit

of Mr. Schawk’s niece for which Mr. Schawk serves as custodian with

voting and investment power but no pecuniary interest; and 97

shares of Common Stock held as custodian. Mr. Whitaker owns 26,221

shares of Common Stock. Mr. Whitaker also holds 8,997 deferred

stock compensation shares. Mr. Nicola owns 187,981 shares of Common

Stock. Mr. Walters owns 75,267 shares of Common Stock. As of the

date hereof, Mr. Wlodarczyk does not beneficially own any shares of

Common Stock.

Certain information about the compensation of the Company’s

named executive officers and non-employee directors and their

holdings’ of the Company’s Common Stock is set forth in the

sections entitled “Compensation of Directors,” “Executive

Compensation and Retirement Benefits” and “Stock Ownership of

Certain Beneficial Owners and Management,” respectively, in the

Company’s definitive proxy statement, dated January 16, 2024, for

its 2024 annual meeting of shareholders as filed with the SEC on

Schedule 14A, available here, and the Company’s Current Report,

dated April 26, 2024, as filed with the SEC on Form 8-K, available

here. Additional information regarding the interests of these

participants in the solicitation of proxies in respect of the 2025

Annual Meeting and other relevant materials will be filed with the

SEC when they become available.

Forward-looking Information

Any forward-looking statements contained in this release are

included pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, statements regarding

the expectations, hopes, beliefs, intentions or strategies of the

Company regarding the future, and may be identified by the use of

words such as “expects,” “believes,” “intends,” “projects,”

“anticipates,” “estimates,” “plans,” “seeks,” “forecasts,”

“predicts,” “objective,” “targets,” “potential,” “outlook,” “may,”

“will,” “could” or the negative of these terms, other comparable

terminology and variations thereof. Such forward-looking statements

involve known and unknown risks and uncertainties that may cause

the Company’s actual results in future periods to be materially

different from management’s expectations, and no assurance can be

given that such expectations will prove correct. Factors that could

cause the Company's results to differ materially from the results

discussed in such forward-looking statements principally include

uncertainties regarding future actions that may be taken by

Barington in furtherance of its intention to nominate director

candidates for election at the Company’s 2025 Annual Meeting,

potential operational disruption caused by Barington’s actions that

may make it more difficult to maintain relationships with

customers, employees or partners, changes in domestic or

international economic conditions, changes in foreign currency

exchange rates, changes in interest rates, changes in the cost of

materials used in the manufacture of the Company's products, any

impairment of goodwill or intangible assets, environmental

liability and limitations on the Company’s operations due to

environmental laws and regulations, disruptions to certain

services, such as telecommunications, network server maintenance,

cloud computing or transaction processing services, provided to the

Company by third-parties, changes in mortality and cremation rates,

changes in product demand or pricing as a result of consolidation

in the industries in which the Company operates, or other factors

such as supply chain disruptions, labor shortages or labor cost

increases, changes in product demand or pricing as a result of

domestic or international competitive pressures, ability to achieve

cost-reduction objectives, unknown risks in connection with the

Company's acquisitions and divestitures, cybersecurity concerns and

costs arising with management of cybersecurity threats,

effectiveness of the Company's internal controls, compliance with

domestic and foreign laws and regulations, technological factors

beyond the Company's control, impact of pandemics or similar

outbreaks, or other disruptions to our industries, customers, or

supply chains, the impact of global conflicts, such as the current

war between Russia and Ukraine, the outcome of the Company's

dispute with Tesla, Inc. ("Tesla"), the Company’s plans and

expectations with respect to its exploration, and contemplated

execution, of various strategies with respect to its portfolio of

businesses, the Company’s plans and expectations with respect to

its Board, and other factors described in the Company’s Annual

Report on Form 10-K and other periodic filings with the U.S.

Securities and Exchange Commission.

Matthews International CorporationCorporate OfficeTwo NorthShore

CenterPittsburgh, PA 15212-5851Phone: (412) 442-8200

|

Contact: |

Steven F. Nicola |

Dan Moore / Clayton Erwin |

| |

Chief Financial Officerand

Secretary |

Collected

StrategiesMATW-CS@collectedstrategies.com |

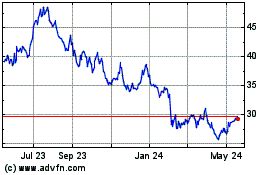

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Nov 2024 to Dec 2024

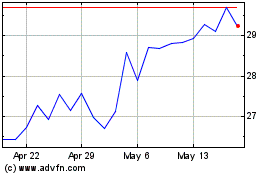

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Dec 2023 to Dec 2024