23andMe Announces Completion of 1-for-20 Reverse Stock Split

October 16 2024 - 7:15AM

23andMe Holding Co. (Nasdaq: ME) (the “Company” or “23andMe”),

announced today the completion of the previously announced 1-for-20

reverse stock split of the Company’s Class A and Class B common

stock and confirmed that such reverse stock split became effective

as of 12:01 a.m. EST on October 16, 2024 (the “Effective Time”).

The Company effected the reverse stock split by filing an

amendment to the Company’s Certificate of Incorporation with the

Secretary of State of the State of Delaware. The Company’s Class A

common stock began trading on The Nasdaq Capital Market on a

split-adjusted basis when the market opened today, October 16,

2024, under a new CUSIP number, 90138Q306.

As a result of the reverse stock split, each 20 shares of the

Company’s Class A and Class B common stock issued and outstanding

immediately prior to the Effective Time were automatically combined

into one share of Class A common stock and Class B common stock,

respectively. No fractional shares were issued to stockholders.

Stockholders who otherwise would have been entitled to receive

fractional shares because they held a number of shares not evenly

divisible by the reverse stock split ratio were automatically

entitled to receive an additional fraction of a share of Class A

common stock or Class B common stock to round up to the next whole

share.

The same 1-for-20 reverse stock split ratio was used to effect

the reverse stock split of both Class A and Class B common stock,

and accordingly, all stockholders were affected proportionately.

The reverse stock split reduced the Company’s issued and

outstanding shares of common stock from approximately 350,292,546

shares of Class A common stock and 166,443,192 shares of Class B

common stock to approximately 17,514,628 and 8,322,160 shares,

respectively.

The number of shares of Class A common stock subject to the

Company’s outstanding restricted stock unit and stock option

awards, as well as the relevant exercise price per share with

respect to such outstanding stock option awards, were

proportionately adjusted to reflect the reverse stock split. The

number of shares authorized and available for issuance under the

Company’s incentive equity plan and employee stock purchase plan

was also reduced to 10,034,656 shares of Class A common stock and

580,456 shares of Class A common stock, respectively, using the

same 1-for-20 split ratio.

About 23andMe

23andMe is a genetics-led consumer healthcare and therapeutics

company empowering a healthier future. For more information, please

visit www.23andme.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical fact,

included or incorporated in this press release are forward-looking

statements. The words “believes,” “anticipates,” “estimates,”

“plans,” “expects,” “intends,” “may,” “could,” “should,”

“potential,” “likely,” “projects,” “predicts,” “continue,” “will,”

“schedule,” and “would” or, in each case, their negative or other

variations or comparable terminology, are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. These forward-looking

statements are predictions based on 23andMe’s current expectations

and projections about future events and various assumptions.

23andMe cannot guarantee that it will actually achieve the plans,

intentions, or expectations disclosed in its forward-looking

statements and you should not place undue reliance on 23andMe’s

forward-looking statements. These forward-looking statements

involve a number of risks, uncertainties (many of which are beyond

the control of 23andMe), or other assumptions that may cause actual

results or performance to differ materially from those expressed or

implied by these forward-looking statements. Among such risks and

uncertainties are unexpected developments with respect to the

reverse stock split, including, without limitation, future

decreases in the price of the Company’s Class A common stock

whether due to, among other things, the completion of the reverse

stock split, the Company’s inability to make its Class A common

stock more attractive to a broader range of institutional or other

investors, or an inability to increase the stock price in an amount

sufficient to satisfy compliance with the Nasdaq’s minimum closing

bid price requirement for continued listing. The forward-looking

statements contained herein are also subject generally to other

risks and uncertainties that are described from time to time in the

Company’s filings with the Securities and Exchange Commission,

including under Item 1A, “Risk Factors” in the Company’s most

recent Annual Report on Form 10-K, as filed with the Securities and

Exchange Commission, and as revised and updated by the Company’s

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The

statements made herein are made as of the date of this press

release and, except as may be required by law, the Company

undertakes no obligation to update them, whether as a result of new

information, developments, or otherwise.

For further information, please contact:

23andMe

press@23andme.com

investors@23andme.com

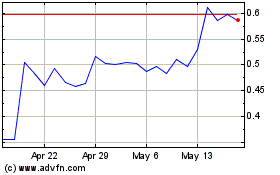

23andMe (NASDAQ:ME)

Historical Stock Chart

From Dec 2024 to Jan 2025

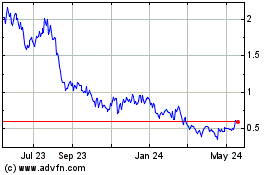

23andMe (NASDAQ:ME)

Historical Stock Chart

From Jan 2024 to Jan 2025