Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-270814

Prospectus

Mesoblast

Limited

2,275,000

Ordinary Shares represented by

455,000 American Depositary Shares

This

prospectus relates to the offer and sale from time to time by the persons identified in this prospectus (the “Oaktree Shareholders”)

of up to 2,275,000 ordinary shares of Mesoblast Limited, represented by 455,000 American Depositary Shares, or ADSs. Each ADS represents

5 ordinary shares.

The

ADSs are listed on the Nasdaq Global Select Market under the symbol “MESO”. Our ordinary shares are listed on the Australian

Securities Exchange under the symbol “MSB”.

The

Oaktree Shareholders will receive all the proceeds from any sales of ADSs offered pursuant to this prospectus. We will not receive any

of these proceeds but we will incur expenses in connection with this offering.

The

Oaktree Shareholders may offer and sell the ADSs at various times and in various types of transactions, including sales in the open market,

sales in negotiated transactions and sales by a combination of these methods. ADSs may be offered and sold at the market price at the

time of a sale, at prices relating to the market price over a period of time or at prices negotiated with the buyers of ADSs. See “Plan

of Distribution” for more information.

Investing

in our ADSs involves a high degree of risk. You should review carefully the risks referenced under the heading “Risk Factors”

beginning on page 4 of this prospectus and under similar headings in any amendment or supplement to this prospectus or as updated by

any subsequent filing with the Securities and Exchange Commission that is incorporated by reference herein.

Neither

the Securities and Exchange Commission nor any U.S. state or other securities commission has approved or disapproved of these securities

or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is April 3, 2023

TABLE

OF CONTENTS

You

should rely only on the information provided by this prospectus, any prospectus supplement and any information incorporated by reference.

We have not authorized anyone else to provide you with different or additional information or to make any representations other than

those contained in or incorporated by reference to this prospectus or any accompanying prospectus supplement.

We

have not taken any action to permit a public offering of the ADSs outside the United States or to permit the possession or distribution

of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must observe

any restrictions relating to the offering of the ADSs and the distribution of this prospectus outside of the United States. This prospectus

is not an offer to sell, or solicitation of an offer to buy, any securities in any circumstances under which the offer of solicitation

is unlawful.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a Registration Statement that we have filed with the SEC on Form F-3. This

prospectus relates to the offer and sale from time to time by the Oaktree Shareholders identified in this prospectus of up to 455,000

ADSs (2,275,000 ordinary shares) issuable upon the exercise of warrants of Mesoblast Limited.

This

prospectus only provides you with a general description of the securities being offered. Each time an Oaktree Shareholder sells any of

the offered ADSs, such Oaktree Shareholder will provide this prospectus and a prospectus supplement, if applicable, that will contain

specific information about the terms of the offering.

The

prospectus supplement may also add, update or change information contained in this prospectus, and may also contain information about

any material federal income tax considerations relating to the ADSs. You should read both this prospectus and any prospectus supplement,

together with additional information described below under the heading “Where You Can Find More Information,” and “Information

Incorporated by Reference” before deciding whether to invest in any of the ADSs being offered by the Oaktree Shareholders. This

prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering

of the ADSs, you should refer to the registration statement, including the exhibits. You may access the registration statement, exhibits

and other reports we file with the SEC on the SEC’s website. More information regarding how you can access such documents is included

under the heading “Where You Can Find More Information” below.

The

information in this prospectus is accurate as of the date on the front cover of this prospectus, and the information in any free writing

prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus.

Neither the delivery of this prospectus nor the sale of any securities means that information contained in this prospectus is correct

after the date of this prospectus or as of any other date. To the extent there is any conflict between the information contained in this

prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date, the statement in the document having

the later date modifies or supersedes the earlier statement. Any information incorporated by reference is only accurate as of the date

of the document incorporated by reference.

Unless

otherwise indicated or the context implies otherwise:

| |

● |

“ADSs” refers to our American depositary

shares, each of which represents five ordinary shares, and “ADRs” refers to the American depositary receipts that evidence

our ADSs; |

| |

● |

“ASX” refers to the Australian Securities

Exchange, where our ordinary shares are listed; |

| |

● |

“A$” or “Australian dollars”

refers to the legal currency of Australia; |

| |

● |

“IFRS” refers to the International Financial

Reporting Standards as issued by the International Accounting Standards Board, or IASB; and |

| |

● |

“Mesoblast,” “we,” “us”

or “our” refer to Mesoblast Limited, an Australian corporation (Australian Business Number 68 109 431 870), and its subsidiaries. |

All

references to “$”, “US$” and “U.S. dollar” in this prospectus refer to United States dollars. Except

as otherwise stated, all monetary amounts in this prospectus are presented in United States dollars. Unless otherwise indicated, the

consolidated financial statements and related notes included, or incorporated by reference, in this prospectus have been prepared in

accordance with Australian Accounting Standards and also comply with IFRS as issued by the International Accounting Standards Board,

which differs in certain significant respects from Generally Accepted Accounting Principles in the United States. Our fiscal year ends

on June 30 of each year. References to “fiscal 2022” means the 12-month period ended June 30, 2022, and other fiscal years

are referred to in a corresponding manner.

We

own or have rights to trademarks and trade names that we use in connection with the operation of our business, including our corporate

name, logos, product names and website names. Other trademarks and trade names appearing in this prospectus and the documents incorporated

by reference are the property of their respective owners. Solely for your convenience, some of the trademarks and trade names referred

to in this prospectus and the documents incorporated by reference are listed without the ® and TM symbols, but we will assert, to

the fullest extent under applicable law, our rights to our trademarks and trade names.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements in this prospectus, any prospectus supplement, any free writing prospectus and in the documents incorporated by reference

may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities

Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We intend such forward-looking statements

to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act

of 1995. The forward-looking statements relate to future events or our future financial performance and involve known and unknown risks,

uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially

from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Words

such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“plan,” “targets,” “likely,” “will,” “would,” “could,” and similar

expressions or phrases identify forward-looking statements. We have based these forward-looking statements largely on our current expectations

and future events and financial trends that we believe may affect our financial condition, results of operation, business strategy and

financial needs. Forward-looking statements include, but are not limited to, statements about:

| |

● |

the initiation, timing, progress and results of our

preclinical and clinical studies, and our research and development programs; |

| |

● |

our ability to advance product candidates into, enroll

and successfully complete, clinical studies, including multi-national clinical trials; |

| |

● |

our ability to advance our manufacturing capabilities; |

| |

● |

the timing or likelihood of regulatory filings and

approvals, manufacturing activities and product marketing activities, if any; |

| |

● |

the impact that the COVID-19 pandemic could have on

our operations; |

| |

● |

the commercialization of our product candidates, if

approved; |

| |

● |

regulatory or public perceptions and market acceptance

surrounding the use of stem-cell based therapies; |

| |

● |

the potential for our product candidates, if they are

approved, to be withdrawn from the market due to patient adverse events or deaths; |

| |

● |

the potential benefits of strategic collaboration agreements

and our ability to enter into and maintain established strategic collaborations; |

| |

● |

our ability to establish and maintain intellectual

property on our product candidates and our ability to successfully defend these in cases of alleged infringement; |

| |

● |

the scope of protection we are able to establish and

maintain for intellectual property rights covering our product candidates and technology; |

| |

● |

our ability to obtain additional financing; |

| |

● |

estimates of our expenses, future revenues, capital

requirements and our needs for additional financing; |

| |

● |

our financial performance; |

| |

● |

developments relating to our competitors and our industry; |

| |

● |

the pricing and reimbursement

of our product candidates, if approved; and |

| |

● |

other risks and uncertainties, including those listed

under the caption “Risk Factors” in our Current Report on Form 6-K for the six months ended December 31, 2022, and our

other reports and filings we make with the SEC from time to time. |

You

should read thoroughly this prospectus, any prospectus supplement, any free writing prospectus and in the documents incorporated by reference

with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all

of our forward-looking statements by these cautionary statements. Other sections of this prospectus and in the documents incorporated

by reference include additional factors which could adversely impact our business and financial performance. Moreover, we operate in

an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors,

nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements.

This

prospectus and documents incorporated by reference may contain third-party data relating to the biopharmaceutical market that includes

projections based on a number of assumptions. The biopharmaceutical market may not grow at the rates projected by market data, or at

all. The failure of this market to grow at the projected rates may have a material adverse effect on our business and the market price

of our ADSs. Furthermore, if any one or more of the assumptions underlying the market data turns out to be incorrect, actual results

may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this prospectus

relate only to events or information as of the date on which the statements are made in this prospectus (or, in the case of a document

incorporated by reference, the date on which the statements are made in such document). We undertake no obligation to update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise.

PROSPECTUS

SUMMARY

This

summary highlights selected information from this prospectus or incorporated by reference in this prospectus and does not contain all

information that you should consider in making your investment decision. You should carefully read the entire prospectus, including the

risks of investing in our ADSs discussed under the heading “Risk Factors” and under similar headings in the other documents

that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into

this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Overview

Mesoblast

has developed a range of late-stage product candidates derived from our first and second generation proprietary mesenchymal lineage cell

therapy technology platforms.

Remestemcel-L

is our first generation mesenchymal lineage stromal cell (“MSC”) product platform and is in late-stage development for treatment

of systemic inflammatory diseases including:

| |

● |

pediatric

steroid refractory acute Graft versus Host Disease (SR-aGVHD); |

| |

● |

acute

respiratory distress syndrome (ARDS); and |

| |

● |

biologic

refractory inflammatory bowel disease. |

Rexlemestrocel-L

is our second generation mesenchymal lineage precursor cell product platform and is in late-stage development for treatment of:

| |

● |

advanced

chronic heart failure (CHF); and |

| |

● |

chronic

low back pain (CLBP) due to degenerative disc disease. |

Both

platforms have life cycle management strategies with promising emerging pipelines.

Mesoblast’s

proprietary manufacturing processes yield industrial-scale, cryopreserved, off-the-shelf, cellular medicines. These cell therapies, with

defined pharmaceutical release criteria, are planned to be readily available to patients worldwide upon receiving marketing authorizations.

Mesoblast’s

immuno-selected, culture expanded cellular medicines are based on mesenchymal precursor cells (“MPCs”) and their progeny,

MSCs. These are rare cells (approximately 1:100,000 in bone marrow) found around blood vessels that are central to blood vessel maintenance,

repair and regeneration. These cells have a unique immunological profile with immunomodulatory effects that reduce inflammation allowing

healing and repair. This mechanism of action enables the targeting of multiple disease pathways across a wide spectrum of complex diseases

with significant unmet medical needs.

Mesenchymal

lineage cells are collected from the bone marrow of healthy adult donors and proprietary processes are utilized to expand them to a uniform,

well characterized, and highly reproducible cell population. This enables manufacturing at industrial scale for commercial purposes.

Another key feature of Mesoblast’s cells is they can be administered to patients without the need for donor–recipient matching

or recipient immune suppression.

Mesoblast’s

approach to product development is to ensure rigorous scientific investigations are performed with well-characterized cell populations

in order to understand mechanisms of action for each potential indication. Extensive preclinical translational studies guide clinical

trials that are structured to meet stringent safety and efficacy criteria set by international regulatory agencies. All trials are conducted

under the continuing review of independent Data Safety Monitoring Boards comprised of independent medical experts and statisticians.

These safeguards are intended to ensure the integrity and reproducibility of results, and to ensure that outcomes observed are scientifically

reliable.

Debt

Refinancing and this Offering

In

November 2021, we refinanced our existing senior debt facility (“Refinancing”) by entering into a new US$90 million debt

facility (“New Debt Facility”) with Oaktree Fund Administration, LLC, as administrative agent and collateral agent, and an

initial lender (“Initial Lender”). Under the terms of the New Debt Facility, we immediately drew loans of US$60 million,

US$54.5 million of which was used to repay the outstanding balance of our existing debt facility with Hercules Capital, Inc. The New

Debt Facility has a three-year interest only period, at a rate of 9.75% per annum, after which time 40% of the principal amount is payable

over two years and a final payment is due no later than November 2026.

On

December 20, 2021, the Initial Lender assigned the initial loan and all its interests in the New Debt Facility to affiliated funds of

Oaktree Capital Management, L.P. (“Oaktree Capital”).

On

December 22, 2022, we entered into the First Amendment to the New Debt Facility (“First Amendment”). Under the terms of the

First Amendment, the availability of the up to additional US$30.0 million under the New Debt Facility was extended, subject to the achieving

of certain milestones on or before September 30, 2023. As consideration, we issued warrants to purchase 455,000 ADSs to affiliated funds

of Oaktree Capital in a private placement (the “Private Placement”) at an exercise price of US$3.70 per ADS. The Warrants

have an expiry date of seven years from the date of issuance.

This

prospectus relates to the offer and sale by the affiliated funds of Oaktree Capital of the 2,275,000 ordinary shares represented by the

455,000 ADSs issuable under the Warrants. For purposes of this prospectus, we refer to affiliated funds of Oaktree Capital as the “Oaktree

Shareholders”. See “Debt Refinancing and Private Placement of Warrants” for more information.

Corporate

Information

Mesoblast

Limited was incorporated in June 2004 in Australia under the Australian Corporations Act. In December 2004 we completed an initial public

offering of our ordinary shares in Australia and our shares have since been listed on the ASX under the symbol “MSB.” In

November 2015 we completed an initial public offering of ADSs in the United States and our ADSs have since been listed on the NASDAQ

Global Select Market, or NASDAQ, under the symbol “MESO”. JPMorgan Chase Bank N.A. acts as the depositary for our ADSs, each

of which represents five ordinary shares.

Our

principal executive offices are located at Level 38, 55 Collins Street, Melbourne, Victoria 3000, Australia. Our telephone number at

this address is +61 3 9639 6036. Our website is www.mesoblast.com. Information contained on our website is not part of this prospectus.

Our agent for service of process in the United States is our subsidiary Mesoblast, Inc., located at 505 Fifth Avenue, Third Floor, New

York, NY 10017.

THE

OFFERING

| Securities offered by the Oaktree

Shareholders |

|

455,000 ADSs, representing 2,275,000

ordinary shares, issuable upon the exercise of Warrants. |

| |

|

|

| The ADSs |

|

Each ADS represents five ordinary shares. The depositary

(as identified below) is the holder of the ordinary shares underlying the ADSs and ADS holders have the rights provided in the deposit

agreement among us, the depositary and holders and beneficial owners of ADSs from time to time. To better understand the terms of

the ADSs, please see the section entitled “Description of American Depositary Shares.” |

| |

|

|

| Depositary |

|

JPMorgan Chase Bank, N.A. |

| |

|

|

Ordinary

shares outstanding after the Offering,

including shares underlying ADSs offered by the Oaktree Shareholders |

|

739,396,218 ordinary shares. |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the sale of the

ADSs representing the ordinary shares offered hereby except that we may receive up to US$1.7 million upon exercise of the Warrants

issued to the Oaktree Shareholders. |

| |

|

|

| NASDAQ Global Select Market symbol |

|

“MESO”. |

| |

|

|

| Risk Factors |

|

This investment involves a high degree of risk. See

“Risk Factors” beginning on the next page of this prospectus supplement for a discussion of risks you should consider

carefully before making an investment decision. |

RISK

FACTORS

Investing

in the ADSs involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” in our

Current Report on Form 6-K for the six months ended December 31, 2022, filed with the SEC, and all other information contained in or

incorporated by reference in this prospectus and any prospectus supplement or related free writing prospectus before deciding whether

to purchase any of our ADSs. If any of those risks actually occurs, our business, financial condition and results of operations could

be materially and adversely affected. In that event, the trading price of our ADSs could decline, and you may lose part or all of your

investment.

Certain

risks described under the “Risk Factors” section in our Current Report on Form 6-K for the six months ended December 31,

2022, are summarized below:

Risks

Related to Our Financial Position and Capital Requirements

| |

● |

We have incurred operating losses since our inception

and anticipate that we will continue to incur substantial operating losses for the foreseeable future. We may never achieve or sustain

profitability. |

| |

● |

We have never generated

revenue from product sales and may never be profitable. |

| |

● |

We require substantial additional financing to achieve

our goals, and our failure to obtain this necessary capital or establish and maintain strategic partnerships to provide funding support

for our development programs could force us to delay, limit, reduce or terminate our product development or commercialization efforts. |

| |

● |

The terms of our loan facilities with funds associated

with Oaktree Capital Management, L.P. and NovaQuest Capital Management, L.L.C. could restrict our operations, particularly our ability

to respond to changes in our business or to take specified actions. |

Risks

Related to Clinical Development and Regulatory Review and Approval of Our Product Candidates

| |

● |

Our product candidates are based on our novel mesenchymal

lineage cell technology, which makes it difficult to accurately and reliably predict the time and cost of product development and

subsequently obtaining regulatory approval. At the moment, no industrially manufactured, non-hematopoietic, allogeneic cell products

have been approved in the United States. |

| |

● |

We may fail to demonstrate safety and efficacy to the

satisfaction of applicable regulatory agencies. |

| |

● |

We may encounter substantial delays in our clinical

studies, including as a result of the COVID-19 or any future pandemic. |

| |

● |

Our completed BLA resubmission for pediatric SR-aGVHD

may not be approved and even if it is approved, we will continue to be closely regulated by FDA. Even if we obtain regulatory approval

for our product candidates, our products will be subject to ongoing regulatory scrutiny. |

Risks

Related to Collaborators

| |

● |

We rely on third parties to conduct our nonclinical

and clinical studies and perform other tasks for us. If these third parties do not successfully carry out their contractual duties,

meet expected deadlines, or comply with regulatory requirements, we may not be able to obtain regulatory approval for or commercialize

our product candidates in a timely and cost-effective manner or at all, and our business could be substantially harmed. |

Risks

Related to Our Manufacturing and Supply Chain

| |

● |

We have no experience manufacturing our product candidates

at a commercial scale. We may not be able to manufacture our product candidates in quantities sufficient for development and commercialization

if our product candidates are approved, or for any future commercial demand for our product candidates. |

| |

● |

We rely on contract manufacturers to supply and manufacture

our product candidates. Our business could be harmed if Lonza fails to provide us with sufficient quantities of these product candidates

or fails to do so at acceptable quality levels or prices. |

Risks

Related to Commercialization of Our Product Candidates

| |

● |

Our future commercial success depends upon attaining

significant market acceptance of our product candidates, if approved, among physicians, patients and healthcare payors. |

| |

● |

If, in the future, we are unable to establish our own

commercial capabilities across sales, marketing and distribution, or enter into licensing or collaboration agreements for these purposes,

we may not be successful in independently commercializing any future products. |

Risks

Related to Our Intellectual Property

| |

● |

We may not be able to protect our proprietary technology

in the marketplace. |

| |

● |

The patent positions of biopharmaceutical products

are complex and uncertain. |

Risks

Related to Our Business and Industry

| |

● |

If we fail to attract and keep senior management and

key scientific, commercial, regulatory affairs and other personnel, we may be unable to successfully develop our product candidates,

conduct our clinical trials and commercialize our product candidates. |

| |

● |

Our employees, principal investigators, consultants

and collaboration partners may engage in misconduct or other improper activities, including noncompliance with laws and regulatory

standards and requirements and insider trading. |

Risks

Related to Our Trading Markets

| |

● |

The market price and trading volume of our ordinary

shares and ADSs may be volatile and may be affected by economic conditions beyond our control. Such volatility may lead to securities

litigation. |

| |

● |

The dual listing of our ordinary shares and the ADSs

may adversely affect the liquidity and value of these securities. |

Risks

Related to Ownership of Our ADSs

| |

● |

An active trading market for the ADSs may not develop

in the United States. |

| |

● |

We currently report our financial

results under IFRS, which differs in certain significant respect from U.S. GAAP. |

| |

● |

As a foreign private issuer,

we are permitted and expect to follow certain home country corporate governance practices in lieu of certain Nasdaq requirements

applicable to domestic issuers and we are permitted to file less information with the Securities and Exchange Commission than a company

that is not a foreign private issuer. This may afford less protection to holders of our ADSs; and |

| |

● |

U.S. investors may have difficulty

enforcing civil liabilities against our company, our directors or members of our senior management. |

The

summary above is not exhaustive. For a more detailed discussion, see the “Risk Factors” section in our Current Report on

Form 6-K for the six months ended December 31, 2022. In addition, we may face additional risks that are presently unknown to us or that

we believe to be immaterial as of the date of this prospectus. Known and unknown risks and uncertainties may significantly impact and

impair our business operations.

USE

OF PROCEEDS

We

will not receive any proceeds from the resale of the ADSs by the Oaktree

Shareholders except that we may receive up to US$1.7 million upon exercise of the Warrants

issued to the Oaktree Shareholders.

CAPITALIZATION

The

following table sets forth our cash and cash equivalents and capitalization as of December 31, 2022.

The

table below does give effect to the issue of the warrants in connection with the refinancing. The table below does not, however, give

effect to the ADSs (and the underlying ordinary shares) that are issuable upon exercise of such warrants.

Investors

should read this table in conjunction with our consolidated financial statements and related notes incorporated by reference in this

prospectus.

| (in

thousands) | |

As

of

December 31,

2022 | |

| | |

(US$) | |

| Cash

and cash equivalents | |

$ | 67,619 | |

| | |

| | |

| Current

borrowing | |

$ | 5,938 | |

| Non-current

borrowings | |

$ | 96,984 | |

| Equity: | |

| | |

| Issued capital (737,121,218

ordinary shares outstanding as of December 31, 2022) | |

$ | 1,207,714 | |

| Reserves | |

$ | 72,574 | |

| Accumulated

losses | |

$ | (780,286 | ) |

| Total

equity | |

$ | 500,002 | |

| Total

capitalization | |

$ | 602,924 | |

DEBT

REFINANCING AND PRIVATE PLACEMENT OF WARRANTS

In

November 2021, we refinanced our existing senior debt facility by entering into the New Debt Facility. Under the terms of the New Debt

Facility, we immediately drew loans of US$60 million, US$54.5 million of which was used to repay the outstanding balance of our existing

debt facility with Hercules Capital, Inc. The New Debt Facility has a three-year interest only period, at a rate of 9.75% per annum,

after which time 40% of the principal amount is payable over two years and a final payment is due no later than November 2026.

The

New Debt Facility is secured by substantially all our assets and contains covenants that impose certain restrictions, including a limitation

on incurring additional debt and maintaining a minimum cash reserve. Mesoblast is required to maintain a minimum unrestricted cash balance

of US$35 million, which would reduce to US$25 million upon FDA approval of Remestemcel-L for SR-aGVHD.

On

December 20, 2021, the Initial Lender assigned the initial loan and all its interests in the New Debt Facility to the Oaktree Shareholders.

On

December 22, 2022, we entered into the First Amendment to the New Debt Facility. Under the terms of the First Amendment, the availability

of up to an additional US$30.0 million under the New Debt Facility was extended, subject to the achieving of certain milestones on or

before September 30, 2023. As consideration, we issued warrants to purchase 455,000 ADSs to affiliated funds of Oaktree Capital in the

Private Placement at an exercise price of US$3.70 per ADS. The Warrants have an expiry date of seven years from the date of issuance.

Warrants

and this Offering

Under

the terms of the First Amendment, on March 7, 2023, we issued Warrants to purchase 455,000 ADSs to the Oaktree Shareholders in a private

placement. The Warrants have an exercise price of US$3.70 per ADS and an expiry date of seven years from the date of issuance. We refer

to Oaktree Capital’s affiliated funds as the Oaktree Shareholders for purpose of this prospectus. They may exercise warrants in

any manner permitted under the Warrants at any time until the expiry date.

This

prospectus relates to the offer and sale by the Oaktree Shareholders of the 2,275,000 ordinary shares represented by the 455,000 ADSs

issuable under the Warrants.

PRINCIPAL

TRADING MARKETS

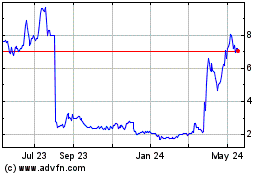

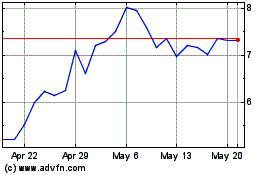

Our

ordinary shares have traded on the Australian Securities Exchange, or ASX, since December 2004 and trade under the symbol “MSB”.

Our ADSs have traded on the Nasdaq Global Select Market since November 2015 and trade under the symbol “MESO”. Each ADS represents

5 ordinary shares.

Historical

information on the trading prices for our ordinary shares can be found on the website of the ASX (www.asx.com.au) and for our ADSs on

the website of Nasdaq (www.nasdaq.com).

SELLING

SHAREHOLDERS

We

are registering ordinary shares issuable upon exercise of the Warrants as represented by ADSs to permit the Oaktree Shareholders to offer

such shares for resale from time to time upon exercise of the Warrants. Except for the ownership of the securities purchased from us

in the Private Placement, and as may be otherwise described below, none of the Oaktree Shareholders has had any material relationship

with us within the past three years.

The

table below lists the Oaktree Shareholders and other information regarding the beneficial ownership of our ordinary shares (including

ordinary shares represented by ADSs) by each of the Oaktree Shareholders as of January 31, 2023.

| |

|

Ordinary

Shares Beneficially

Owned prior to the

Offering(2) |

|

|

Maximum Number of

Ordinary Shares to

Be Sold pursuant to |

|

|

Ordinary

Shares Beneficially

Owned after the

Offering(2)(4) |

|

| Name of Oaktree

Shareholders(1) |

|

Number |

|

|

Percentage(3) |

|

|

this

Prospectus |

|

|

Number |

|

|

Percentage(4) |

|

| SC

Investments E Holdings, LLC(5)(14) |

|

|

679,620 |

|

|

|

* |

|

|

|

174,735 |

|

|

|

679,620 |

|

|

|

* |

|

| SC

Investments NE Holdings, LLC(6) (14) |

|

|

927,385 |

|

|

|

* |

|

|

|

238,440 |

|

|

|

927,385 |

|

|

|

* |

|

| Oaktree

Gilead Investment Fund AIF (Delaware), L.P.(7) (14) |

|

|

733,725 |

|

|

|

* |

|

|

|

188,650 |

|

|

|

733,725 |

|

|

|

* |

|

| Oaktree

Diversified Income Fund, Inc.(8) (15) |

|

|

232,215 |

|

|

|

* |

|

|

|

59,705 |

|

|

|

232,215 |

|

|

|

* |

|

| Oaktree

Specialty Lending Corporation(9) (15) |

|

|

1,299,385 |

|

|

|

* |

|

|

|

334,085 |

|

|

|

1,299,385 |

|

|

|

* |

|

| Oaktree

AZ Strategic Lending Fund, L.P.(10) (14) |

|

|

1,326,935 |

|

|

|

* |

|

|

|

341,170 |

|

|

|

1,326,935 |

|

|

|

* |

|

| Oaktree

Strategic Credit Fund(11) (15) |

|

|

331,735 |

|

|

|

* |

|

|

|

85,290 |

|

|

|

331,735 |

|

|

|

* |

|

| Oaktree

LSL Fund Holdings EURRC S.à r.l.(12) (14) |

|

|

2,488,010 |

|

|

|

* |

|

|

|

639,695 |

|

|

|

2,488,010 |

|

|

|

* |

|

| Oaktree

LSL Fund Delaware Holdings EURCC L.P., (U.S.)(13) (14) |

|

|

829,335 |

|

|

|

* |

|

|

|

213,230 |

|

|

|

829,335 |

|

|

|

* |

|

| (1) |

Unless otherwise indicated, this table is based on

information supplied to us by the Oaktree Shareholders and our records. |

| |

|

| (2) |

Beneficial ownership is determined in accordance with

Section 13(d) of the Exchange Act and generally includes voting and investment power with respect to securities and including

any securities that grant the investor the right to acquire our ordinary shares within 60 days of the date of this prospectus.

|

| |

|

| (3) |

Applicable percentage of ownership is based on 737,121,218

ordinary shares outstanding as of January 31, 2023 and 11,123,345 ordinary shares beneficially owned by the Oaktree Shareholders

as of such date. |

| |

|

| (4) |

Assumes that the Oaktree Shareholders dispose of all

the ordinary shares covered by this prospectus and do not acquire beneficial ownership of any additional ordinary shares (including

ordinary shares represented by ADSs). The registration of these ordinary shares represented by ADSs does not necessarily mean, however,

that the Oaktree Shareholders will sell all or any portion of the securities covered by this prospectus |

| |

|

| (5) |

SC Investments E Holdings, LLC is managed by Oaktree

Fund GP IIA, LLC (“GP IIA LLC”). The managing member of GP IIA LLC is Oaktree Fund GP II, L.P. (“GP

II”). The general partner of GP II is Oaktree Capital II, L.P. (General Series) (“Capital II General”). The

general partner of Capital II General is Oaktree Capital II GP LLC (“Capital II GP”). The managing member

of Capital II GP is Atlas OCM Holdings LLC (“Atlas”). Atlas is managed by its eleven-member board of directors.

Each of the managing members, general partners and directors described above expressly disclaims beneficial ownership of any

securities beneficially or of record owned by SC Investments E Holdings, LLC, except to the extent of their respective pecuniary

interest therein, if any. The address for all of the entities and individuals identified above is c/o Oaktree Capital

Management, L.P., 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071. |

| (6) |

SC Investments NE Holdings, LLC is managed by GP IIA

LLC. The managing member of GP IIA LLC is GP II. The general partner of GP II is Capital II General. The

general partner of Capital II General is Capital II GP. The managing member of Capital II GP is Atlas. Atlas

is managed by its eleven-member board of directors. Each of the managing members, general partners and directors described

above expressly disclaims beneficial ownership of any securities beneficially or of record owned by SC Investments NE Holdings, LLC,

except to the extent of their respective pecuniary interest therein, if any. |

| (7) |

The general partner of Oaktree Gilead Investment Fund

AIF (Delaware), L.P. is Oaktree Fund AIF Series, L.P. – Series T. The general partner of Oaktree Fund AIF Series, L.P. –

Series T is Oaktree Fund GP AIF, LLC. The managing member of Oaktree Fund GP AIF, LLC is Oaktree Fund GP III, L.P. The

general partner of Oaktree Fund GP III, L.P. is Oaktree AIF Investments, L.P. The general partner of Oaktree AIF Investments,

L.P. is Oaktree AIF Investment GP LLC (“AIF Investment GP”). The managing member of AIF Investment GP is Atlas. Atlas

is managed by its eleven-member board of directors. Each of the managing members, general partners and directors described

above expressly disclaims beneficial ownership of any securities beneficially or of record owned by Oaktree Gilead Investment Fund

AIF (Delaware), L.P., except to the extent of their respective pecuniary interest therein, if any. |

| |

|

| (8) |

Oaktree Diversified Income Fund, Inc. is managed by

Oaktree Fund Advisors, LLC (“Fund Advisors”). The managing member of Fund Advisors is Oaktree Capital II,

L.P. (Manager Series) (“Capital II Manager”). The general partner of Capital II Manager is Capital II GP. The

managing member of Capital II GP is Atlas. Atlas is managed by its eleven-member board of directors. Each of the

managers, managing members, general partners and directors described above expressly disclaims beneficial ownership of any securities

beneficially or of record owned by Oaktree Diversified Income Fund, Inc., except to the extent of their respective pecuniary interest

therein, if any. |

| (9) |

Oaktree Specialty Lending Corporation is managed by

Fund Advisors. The managing member of Fund Advisors is Capital II Manager. The general partner of Capital II

Manager is Capital II GP. The managing member of Capital II GP is Atlas. Atlas is managed by its eleven-member

board of directors. Each of the managers, managing members, general partners and directors described above expressly disclaims

beneficial ownership of any securities beneficially or of record owned by Oaktree Specialty Lending Corporation, except to the extent

of their respective pecuniary interest therein, if any. |

| |

|

| (10) |

The

general partner of Oaktree AZ Strategic Lending Fund, L.P. is Oaktree AZ Strategic Lending Fund GP, L.P. The general partner

of Oaktree AZ Strategic Lending Fund GP, L.P.is GP IIA LLC. The managing member of GP IIA LLC is GP II. The

general partner of GP II is Capital II General. The general partner of Capital II General is Capital II GP. The

managing member of Capital II GP is Atlas. Atlas is managed by its eleven-member board of directors. Each of

the managers, managing members, general partners and directors described above expressly disclaims beneficial ownership of any

securities beneficially or of record owned by Oaktree AZ Strategic Lending Fund, L.P., except to the extent of their respective

pecuniary interest therein, if any. |

| |

|

| (11) |

Oaktree Strategic Credit Fund is managed by Fund Advisors. The

managing member of Fund Advisors is Capital II Manager. The general partner of Capital II Manager is Capital II GP. The

managing member of Capital II GP is Atlas. Atlas is managed by its eleven-member board of directors. Each of the

managers, managing members, general partners and directors described above expressly disclaims beneficial ownership of any securities

beneficially or of record owned by Oaktree Strategic Credit Fund, except to the extent of their respective pecuniary interest therein,

if any. |

| |

|

(12) |

Oaktree

LSL Fund Holdings EURRC S.à r.l. is managed by its three-member board of managers. Each of the managers described

above expressly disclaims beneficial ownership of any securities beneficially or of record owned by Oaktree LSL Fund Holdings

EURRC S.à r.l., except to the extent of their respective pecuniary interest therein, if any. |

(13) |

The

general partner of Oaktree LSL Fund Delaware Holdings EURRC, L.P. is Oaktree Life Sciences Lending Fund GP, L.P. (“LSL

GP”). The general partner of LSL GP is Oaktree Life Sciences Lending Fund GP Ltd. (“LSL GP Ltd.”).

The sole director of LSL GP Ltd. is Oaktree Capital Management, L.P. (“OCM”). The general partner of OCM is

Oaktree Capital Management GP LLC (“OCM GP LLC”). The managing member of OCM GP LLC is Atlas. Atlas is

managed by its eleven-member board of directors. Each of the managing members, general partners and directors described

above expressly disclaims beneficial ownership of any securities beneficially or of record owned by Oaktree LSL Fund Delaware

Holdings EURRC, L.P., except to the extent of their respective pecuniary interest therein, if any. |

| |

|

| (14) |

OCM Investments LLC, a direct subsidiary of OCM, the

Investment Manager of this Oaktree Shareholder, and an indirect subsidiary of Atlas, is a registered broker dealer. OCM Investments

LLC acts as a broker only for purposes of the placement of interests in Oaktree’s managed funds. Brookfield Oaktree

Wealth Management Solutions LLC, an indirect subsidiary of Brookfield Corporation, a majority economic interest holder in OCM, is

also a registered broker dealer and serves as a broker for placing Oaktree’s managed funds with high-net-worth individuals. |

| |

|

| (15) |

OCM Investments LLC, a direct subsidiary of OCM, which,

together with Fund Advisors, the Investment Manager of this Oaktree Shareholder, are both indirect subsidiaries of Atlas, is a registered

broker dealer. OCM Investments LLC acts as a broker only for purposes of the placement of interests in Oaktree’s managed funds. Brookfield

Oaktree Wealth Management Solutions LLC, an indirect subsidiary of Brookfield Corporation, a majority economic interest holder in

Fund Advisors, is also a registered broker dealer and serves as a broker for placing Oaktree’s managed funds with high-net-worth

individuals. |

DESCRIPTION

OF SHARE CAPITAL

General

We

are a public company limited by shares registered under the Corporations Act by the Australian Securities and Investments Commission,

or ASIC. Our corporate affairs are principally governed by our Constitution, the Corporations Act, the ASX Listing Rules and NASDAQ Marketplace

Rules. Our ordinary shares trade on the ASX and our ADSs trade on the NASDAQ Global Select Market.

The

Australian law applicable to our Constitution is not significantly different than a U.S. company’s charter documents except we

do not have the concept of, or a limit on, our authorized share capital, the concept of par value is not recognized under Australian

law and as further discussed under “—Our Constitution.”

Subject

to restrictions on the issue of securities in our Constitution, the Corporations Act and the ASX Listing Rules and any other applicable

law, we may at any time issue ordinary shares and grant options or warrants on any terms, with the rights and restrictions and for the

consideration that our board of directors determines.

The

rights and restrictions attaching to ordinary shares are derived through a combination of our Constitution, the common law applicable

to Australia, the ASX Listing Rules, the Corporations Act and other applicable law. A general summary of some of the rights and restrictions

attaching to our ordinary shares is set forth below. Each shareholder is entitled to receive notice of, and to be present, vote and speak

at, general meetings.

Changes

to Our Share Capital

As

December 31, 2022, we had (i) 737,121,218 fully paid ordinary shares outstanding and (ii) employee options outstanding to purchase 44,563,802

of our ordinary shares at a weighted average exercise price of A$2.21.

Since

July 1, 2019, the following changes have been made to our ordinary share capital:

| |

● |

we granted share options to purchase an aggregate of

37,481,740 ordinary shares with a weighted-average exercise price of A$2.48 per share to employees, directors, officers and consultants.

Options to purchase an aggregate of 10,630,501 ordinary have been exercised for aggregate consideration of A$19,200,076; |

| |

● |

we granted incentive rights equivalent to an aggregate

of 1,500,000 ordinary shares to employees, directors, officers and consultants. Incentive rights equivalent to 1,500,000 ordinary

shares have been exercised for aggregate consideration of A$3,300,000; |

| |

● |

in October 2019, we issued 37,500,000 ordinary shares

to institutional investors in a private placement for total consideration of A$75 million; |

| |

● |

in May 2020, we issued 43,000,000 ordinary shares to

institutional investors in a private placement for total consideration of A$138 million; |

| |

● |

in July 2020, we issued 74,924 ordinary shares to Kentgrove

Capital for total consideration of A$275,000 as payment in connection with the terms of the Kentgrove Facility Agreement; |

| |

● |

in August 2020, we issued 212,244 ordinary shares to

a third party for services provided in connection with the license of intellectual property rights, for total consideration of US$240,000; |

| |

● |

in March 2021, we issued 60,109,290 ordinary shares

to accredited investors in a private placement for a total consideration of US$110 million as well as warrants to purchase up to

15,027,327 ordinary shares at an exercise price of A$2.88 per share; |

| |

|

|

| |

● |

in January 2022, we issued 1,547,753 ordinary shares as consideration

under an existing license from a third party to certain intellectual property assets, and 210,728 ordinary shares as payment in connection

with the Kentgrove Facility Agreement; and |

| |

|

|

| |

● |

in August 2022, we issued 86,666,667 ordinary shares

to accredited investors in the United States and elsewhere in a private placement for a total consideration of approximately US$45

million. |

Our

Constitution

Our

Constitution is similar in nature to the bylaws of a U.S. corporation. It does not provide for or prescribe any specific objectives or

purposes of Mesoblast. Our Constitution is subject to the terms of the ASX Listing Rules and the Australian Corporations Act. It may

be modified or repealed and replaced by special resolution passed at a meeting of shareholders, which resolution requires at least 75%

of the votes cast by shareholders (including proxies and representatives of shareholders) entitled to vote on the resolution.

Under

Australian law, a company has the legal capacity and powers of an individual both within and outside Australia. The material provisions

of our Constitution are summarized below. This summary is not intended to be complete nor to constitute a definitive statement of the

rights and liabilities of our shareholders, and is qualified in its entirety by reference to the complete text of our Constitution, a

copy of which is on file with the SEC.

Directors

Interested

Directors

Except

as permitted by the Corporations Act and the ASX Listing Rules, a director must not vote in respect of a matter that is being considered

at a directors’ meeting in which the director has a material personal interest according to our Constitution. Such director must

not be counted in a quorum, must not vote on the matter and must not be present at the meeting while the matter is being considered.

Pursuant

to our Constitution, the fact that a director holds office as a director, and has fiduciary obligations arising out of that office will

not require the director to account to us for any profit realized by or under any contract or arrangement entered into by or on behalf

of Mesoblast and in which the director may have an interest.

Unless

a relevant exception applies, the Corporations Act requires our directors to provide disclosure of certain interests and prohibits directors

of companies listed on the ASX from voting on matters in which they have a material personal interest and from being present at the meeting

while the matter is being considered. In addition, unless a relevant exception applies, the Corporations Act and the ASX Listing Rules

require shareholder approval of any provision of financial benefits (including the issue by us of ordinary shares and other securities)

to our directors, including entities controlled by them and certain members of their families.

Borrowing

Powers Exercisable by Directors

Pursuant

to our Constitution, our business is managed by our board of directors. Our board of directors has the power to raise or borrow money,

and charge any of our property or business or all or any of our uncalled capital, and may issue debentures or give any other security

for any of our debts, liabilities or obligations or of any other person, and may guarantee or become liable for the payment of money

or the performance of any obligation by or of any other person.

Election,

Removal and Retirement of Directors

We

may appoint or remove any director by resolution passed in a general meeting of shareholders. Additionally, our directors are elected

to serve three-year terms in a manner similar to a “staggered” board of directors under Delaware law. No director except

the Managing Director (currently designated as our chief executive officer, Silviu Itescu) may hold office for a period in excess of

three years, or beyond the third annual general meeting following the director’s last election, whichever is the longer, without

submitting himself or herself for re-election.

A

director who is appointed during the year by the other directors only holds office until the next annual general meeting at which time

the director may stand for election by shareholders at that meeting.

In

addition, provisions of the Corporations Act apply where at least 25% of the votes cast on a resolution to adopt our remuneration report

(which resolution must be proposed each year at our annual general meeting) are against the adoption of the report at two successive

annual general meetings. Where these provisions apply, a resolution must be put to a vote at the second annual general meeting to the

effect that a further meeting, or a spill meeting, take place within 90 days. At the spill meeting, the directors in office when the

remuneration report was considered at the second annual general meeting (other than the Managing Director) cease to hold office and resolutions

to appoint directors (which may involve re-appointing the former directors) are put to a vote.

Voting

restrictions apply in relation to the resolutions to adopt our remuneration report and to propose a spill meeting. These restrictions

apply to our key management personnel and their closely related parties. See “Rights and Restrictions on Classes of Shares—Voting

Rights” below.

Pursuant

to our Constitution, a person is eligible to be elected as a director at a general meeting if:

| |

● |

the person is in office as a director immediately before

the meeting, in respect of an election of directors at a general meeting that is a spill meeting as provided in the Corporations

Act; |

| |

● |

the person has been nominated by the directors before

the meeting; |

| |

● |

where the person is a shareholder, the person has,

at least 35 business days but no more than 90 business days before the meeting, given to us a notice signed by the person stating

the person’s desire to be a candidate for election at the meeting; or |

| |

● |

where the person is not a shareholder, a shareholder

intending to nominate the person for election at that meeting has, at least 35 business days but no more than 90 business days before

the meeting, given to us a notice signed by the shareholder stating the shareholder’s intention to nominate the person for

election, and a notice signed by the person stating the person’s consent to the nomination. |

Share

Qualifications

There

are currently no requirements for directors to own our ordinary shares in order to qualify as directors.

Rights

and Restrictions on Classes of Shares

Subject

to the Corporations Act and the ASX Listing Rules, the rights attaching to our ordinary shares are detailed in our Constitution. Our

Constitution provides that any of our ordinary shares may be issued with preferential, deferred or special rights, privileges or conditions,

with any restrictions in regard to dividends, voting, return of share capital or otherwise as our board of directors may determine from

time to time. Subject to the Corporations Act, the ASX Listing Rules and any rights and restrictions attached to a class of shares, we

may issue further ordinary shares on such terms and conditions as our board of directors may resolve. Currently, our outstanding ordinary

share capital consists of only one class of ordinary shares.

Dividend

Rights

Our

board of directors may from time to time determine to pay or declare dividends to shareholders; however, no dividend is payable except

in accordance with the thresholds set out in the Corporations Act.

Voting

Rights

Under

our Constitution, the general conduct and procedures of each general meeting of shareholders will be determined by the chairperson, including

any procedures for casting or recording votes at the meeting whether on a show of hands or on a poll. For so long we are listed on the

Australian Securities Exchange, a resolution put to the vote at a general meeting must be decided on a poll (and not a show of hands)

if the notice of the general meeting set out an intention to propose the resolution and stated the resolution. In addition, a poll may

be demanded by the chairperson of the meeting; by at least five shareholders present and having the right to vote on at the meeting;

or any shareholder or shareholders representing at least 5% of the votes that may be cast on the resolution on a poll. On a show of hands,

each shareholder entitled to vote at the meeting has one vote regardless of the number of ordinary shares held by such shareholder. If

voting takes place on a poll, rather than a show of hands, each shareholder entitled to vote has one vote for each ordinary share held

and a fractional vote for each ordinary share that is not fully paid, such fraction being equivalent to the proportion of the amount

that has been paid (not credited) of the total amounts paid and payable, whether or not called (excluding amounts credited), to such

date on that ordinary share.

Under

Australian law, an ordinary resolution is passed on a show of hands if it is approved by a simple majority (more than 50%) of the votes

cast by shareholders present (in person or by proxy) and entitled to vote. If a poll is required or demanded, an ordinary resolution

is passed if it is approved by holders representing a simple majority of the total voting rights of shareholders present (in person or

by proxy) who (being entitled to vote) vote on the resolution. Special resolutions require the affirmative vote of not less than 75%

of the votes cast by shareholders present (in person or by proxy) and entitled to vote at the meeting.

Pursuant

to our Constitution, each shareholder entitled to attend and vote at a meeting may attend and vote:

| |

● |

in person physically or, if the meeting is also held

including by using virtual meeting technology, by electronic means; |

| |

● |

by proxy, attorney or by representative; or |

| |

● |

other than in relation to any clause which specifies

a quorum, a member who has duly lodged a valid vote delivered to us by post, fax or other electronic means approved by the directors

in accordance with the Constitution. |

Under

Australian law, shareholders of a public listed company are generally not permitted to approve corporate matters by written consent.

Our Constitution does not specifically provide for cumulative voting.

Note

that ADS holders may not directly vote at a meeting of the shareholders but may instruct the depositary to vote the number of deposited

ordinary shares their ADSs represent. Under voting by a show of hands, multiple “yes” votes by ADS holders will only count

as one “yes” vote and will be negated by a single “no” vote, unless a poll is demanded or required.

There

are a number of circumstances where the Corporations Act or the ASX Listing Rules prohibit or restrict certain shareholders or certain

classes of shareholders from voting. For example, key management personnel whose remuneration details are included elsewhere in this

prospectus are prohibited from voting on the resolution that must be proposed at each annual general meeting to adopt our remuneration

report, as well as any resolution to propose a spill meeting. An exception applies to exercising a directed proxy which indicates how

the proxy is to vote on the proposed resolution on behalf of someone other than the key management personnel or their closely related

parties; or that person is chair of the meeting and votes an undirected proxy where the shareholder expressly authorizes the chair to

exercise that power. Key management personnel and their closely related parties are also prohibited from voting undirected proxies

on remuneration related resolutions. A similar exception to that described above applies if the proxy is the chair of the meeting.

Right

to Share in Our Profits

Subject

to the Corporations Act and pursuant to our Constitution, our shareholders are entitled to participate in our profits by payment of dividends.

The directors may by resolution declare a dividend or determine a dividend is payable, and may fix the amount, the time for and method

of payment.

Rights

to Share in the Surplus in the Event of Winding Up

Our

Constitution provides for the right of shareholders to participate in a surplus in the event of our winding up.

Redemption

Provisions

Under

our Constitution and subject to the Corporations Act, the directors have power to issue and allot shares with any preferential, deferred

or special rights, privileges or conditions; with any restrictions in regard to the dividend, voting, return of capital or otherwise;

and preference shares which are liable to be redeemed or converted.

Sinking

Fund Provisions

Our

Constitution allows our directors to set aside any amount available for distribution as a dividend such amounts by way of reserves as

they think appropriate before declaring or determining to pay a dividend, and may apply the reserves for any purpose for which an amount

available for distribution as a dividend may be properly applied. Pending application or appropriation of the reserves, the directors

may invest or use the reserves in our business or in other investments as they think fit.

Liability

for Further Capital Calls

According

to our Constitution, our board of directors may make any calls from time to time upon shareholders in respect of all monies unpaid on

partly paid shares respectively held by them, subject to the terms upon which any of the partly paid shares have been issued. Each shareholder

is liable to pay the amount of each call in the manner, at the time and at the place specified by our board of directors. Calls may be

made payable by instalment.

Provisions

Discriminating Against Holders of a Substantial Number of Shares

There

are no provisions under our Constitution discriminating against any existing or prospective holders of a substantial number of our ordinary

shares.

Variation

or Cancellation of Share Rights

The

rights attached to shares in a class of shares may only be varied or cancelled by a special resolution of shareholders, together with

either:

| |

● |

a special resolution passed at a separate meeting of

members holding shares in the class; or |

| |

● |

the written consent of members with at least 75% of

the votes in the class. |

General

Meetings of Shareholders

General

meetings of shareholders may be called by our board of directors or, under the Corporations Act, by a single director. Except as permitted

under the Corporations Act, shareholders may not convene a meeting. Under the Corporations Act, shareholders with at least 5% of the

votes that may be cast at a general meeting may call and arrange to hold a general meeting. The Corporations Act requires the directors

to call and arrange to hold a general meeting on the request of shareholders with at least 5% of the votes that may be cast at a general

meeting. Notice of the proposed meeting of our shareholders is required at least 28 days prior to such meeting under the Corporations

Act.

A

general meeting may be held at one or more physical venues or at one or more physical venues and using virtual meeting technology.

No

business shall be transacted at any general meeting unless a quorum is present at the time when the meeting proceeds to business. Under

our Constitution, the presence, in person or by proxy, attorney or representative, of two shareholders constitutes a quorum, or if we

have less than two shareholders, then those shareholders constitute a quorum. If a quorum is not present within 30 minutes after the

time appointed for the meeting, the meeting must be either dissolved if it was requested or called by shareholders or adjourned in any

other case. A meeting adjourned for lack of a quorum is adjourned to the same day in the following week at the same time and place, unless

otherwise decided by our directors. The reconvened meeting is dissolved if a quorum is not present within 30 minutes after the time appointed

for the meeting.

Regulation

of acquisition by foreign entities

Under

Australian law, in certain circumstances foreign persons are prohibited from acquiring more than a limited percentage of the shares in

an Australian company without approval from the Australian Treasurer. These limitations are set forth in the Australian Foreign Acquisitions

and Takeovers Act 1975 (Cth) (“FATA”), associated legislation and regulations. These limitations are in addition to the

more general overarching Takeovers Prohibition of an acquisition of more than a 20% interest in a public company (in the absence of an

applicable exception) under the takeover provisions of Australia’s Corporations Act by any person whether foreign or otherwise.

The

Australian foreign investment regime applies differently to ‘foreign government investors’ and private foreign persons. Broadly,

entities are considered as foreign persons if (i) a foreign holder (together with its associates) holds a direct or indirect interest

of 20% or more in the entity or (ii) multiple foreign holders hold an aggregate interest (direct or indirect) of at least 40%.

Under

the FATA, foreign persons are required to notify and obtain prior approval from the Foreign Investment Review Board for a range of acquisitions

of an interest in an Australian entity on a mandatory basis, including:

| |

● |

acquisitions of a direct interest (generally 10% or

more) by a foreign government investor in an Australian entity, irrespective of value; |

| |

● |

acquisitions by any foreign person of: |

| |

– |

a ‘substantial interest’ (generally 20%

or more) in an Australian entity valued above the relevant monetary threshold. This is generally A$310 million (indexed annually)

or A$1,339 million in the case of U.S. investors (reduced to A$310 million for investment in ‘sensitive businesses’),

in each case calculated by the higher of the total asset value and the total value of the issued securities of the Australian entity;

or |

| |

– |

a direct interest in a ‘national security business’

or entity that carries on a national security business, or holds ‘national security land’ or an Australian media business,

irrespective of value; and |

| |

● |

acquisitions of interests in Australian entities operating

in sensitive industries (such as media, telecommunications, transport, defence and military related industries and activities, encryption

and security technologies and communications systems, as well as the extraction of uranium and plutonium or the operation of nuclear

facilities), land-rich Australian entities or agribusiness Australian entities. |

Each

foreign person seeking to acquire holdings in excess of the above caps (including their associates) would need to complete an application

form setting out the proposal and relevant particulars of the acquisition/shareholding and pay the relevant application fees. The Australian

Treasurer then has 30 days to consider the application and make a decision. However, the Australian Treasurer may extend the period by

up to a further 90 days by publishing an interim order. The Australian Foreign Investment Review Board, an Australian advisory board

to the Australian Treasurer has published a number of guidance notes, including Guidance Note 1 titled Overview: Australia’s

Foreign Investment Framework, which provides an outline of the policy. As for the risk associated with seeking approval, Guidance

Note 2, Key Concepts provides, among other things, that the Treasurer may make an order which prohibits a proposed acquisition

(among other things) if the Treasurer is satisfied that proceeding with the acquisition would be contrary to the national interest or

national security (as applicable).

If

the necessary approvals are not obtained, the Treasurer has a range of enforcement powers, including the power to make an order requiring

the acquirer to dispose of the shares it has acquired within a specified period of time. Once a foreign person (together with any associate)

holds a direct interest or a substantial interest in an entity, any further acquisition of interests, including in the course of trading

in the secondary market, would require a new FIRB approval unless an exemption applies.

Change

of Control

Takeovers

of listed Australian public companies, such as Mesoblast, are regulated by the Corporations Act, which prohibits the acquisition of a

“relevant interest” in issued voting shares in a listed company if the acquisition will lead to that person’s or someone

else’s voting power in Mesoblast increasing from 20% or below to more than 20% or increasing from a starting point that is above

20% and below 90% (“Takeovers Prohibition”), subject to a range of exceptions.

Generally,

a person will have a relevant interest in securities if the person:

| |

● |

is the holder of the securities or the holder of an

ADS over the shares; |

| |

● |

has power to exercise, or control the exercise of,

a right to vote attached to the securities; or |

| |

● |

has the power to dispose of, or control the exercise

of a power to dispose of, the securities (including any indirect or direct power or control) |

If,

at a particular time:

| |

● |

a person has a relevant interest in issued securities;

and |

| |

o |

entered or enters into an agreement with another person

with respect to the securities; |

| |

o |

given or gives another person an enforceable right,

or has been or is given an enforceable right by another person, in relation to the securities; or |

| |

o |

granted or grants an option to, or has been or is granted

an option by, another person with respect to the securities; and |

| |

● |

the other person would have a relevant interest in

the securities if the agreement were performed, the right enforced or the option exercised, |

then,

the other person is taken to already have a relevant interest in the securities.

There

are a number of exceptions to the above Takeovers Prohibition on acquiring a relevant interest in issued voting shares above 20%. In

general terms, some of the more significant exceptions include:

| |

● |

when the acquisition results from the acceptance of

an offer under a formal takeover bid; |

| |

● |

when the acquisition is conducted on market by or on

behalf of the bidder during the bid period for a full takeover bid that is unconditional or only conditional on certain ‘prescribed’

matters set out in the Corporations Act; |

| |

● |

when the acquisition has been previously approved by

resolution passed at general meeting by shareholders of Mesoblast; |

| |

● |

an acquisition by a person if, throughout the six months

before the acquisition, that person or any other person has had voting power in Mesoblast of at least 19% and, as a result of the

acquisition, none of the relevant persons would have voting power in Mesoblast more than three percentage points higher than they

had six months before the acquisition; |

| |

● |

when the acquisition results from the issue of securities

under a pro rata rights issue to existing shareholders; |

| |

● |

when the acquisition results from the issue of securities

under a dividend reinvestment plan or bonus share plan; |

| |

● |

when the acquisition results from the issue of securities

under certain underwriting arrangements; |

| |

● |

when the acquisition results from the issue of securities

through a will or through operation of law; |

| |

● |

an acquisition that arises through the acquisition

of a relevant interest in another company listed on the ASX or another Australian financial market or a foreign stock exchange approved

in writing by ASIC; |

| |

● |

an acquisition arising from an auction of forfeited

shares; or |

| |

● |

an acquisition arising through a compromise, arrangement,

liquidation or buy-back. |

A

formal takeover bid may either be a bid for all securities in the bid class or a fixed proportion of such securities, with each holder

of bid class securities receiving a bid for that proportion of their holding. Under our Constitution, a proportionate takeover bid must

first be approved by resolution of our shareholders in a general meeting before it may proceed.

Breaches

of the takeovers provisions of the Corporations Act are criminal offenses. In addition, ASIC and, on application by ASIC or an interested

party, such as a shareholder, the Australian Takeovers Panel have a wide range of powers relating to breaches of takeover provisions

as well as, in the case of the Takeovers Panel circumstances that the Panel determines to be 'unacceptable' (whether or not there is

a breach), including the ability to make orders cancelling contracts, freezing transfers of, and rights (including voting rights) attached

to, securities, and forcing a party to dispose of securities including by vesting the securities in ASIC for sale. There are limited

defenses to breaches of the takeover provisions provided in the Corporations Act.

Ownership

Threshold

There