Mesoblast Limited (Nasdaq:MESO; ASX:MSB), global leader in

allogeneic cellular medicines for inflammatory diseases, today

provided an operational update and reported financial results for

the period ended June 30, 2024.

Mesoblast Chief Executive Silviu Itescu said:

“During the past year we have built significant momentum in our

interactions with the United States Food and Drug Administration

(FDA) across each of our Phase 3 products.

I am very pleased that our Biologics License

Application (BLA) resubmission for approval of Ryoncil®

(remestemcel-L) in the treatment of children with

steroid-refractory acute graft versus host disease (SR-aGVHD) was

accepted by the FDA. We are in active discussions with the agency

and anticipate a decision prior to or on the Prescription Drug User

Fee Act (PDUFA) goal date of January 7, 2025. Concurrently we are

implementing a go-to-market plan to bring RYONCIL to the many

children suffering with this devastating disease, picking up the

substantial amount of work completed last year.”

“We have commenced enrolling patients across

multiple U.S. sites in our confirmatory Phase 3 trial for

inflammatory back pain which is in alignment with FDA, we have

received a Rare Pediatric Disease Designation from FDA for

Revascor® (rexlemestrocel-L) in children with a congenital heart

disease, and have additionally been notified that FDA supports a

potential accelerated approval pathway for REVASCOR in end-stage

heart failure patients.”

OPERATIONAL RESULTS FOR THE FULL-YEAR ENDED JUNE 30,

2024 (FY2024)

1. RYONCIL (REMESTEMCEL-L) FOR

ACUTE GRAFT VERSUS HOST DISEASE IN CHILDREN

Potential FDA Approval

- Mesoblast

resubmitted its BLA for approval of RYONCIL on July 8, 2024,

addressing remaining CMC (Chemistry, Manufacturing, and Controls)

items in the August 2023 Complete Response Letter (CRL).

- FDA previously

informed Mesoblast that the available clinical data from its Phase

3 study appears sufficient to support resubmission of the BLA.

- FDA accepted the

BLA resubmission within two weeks, considering it to be a complete

response.

- Mesoblast and FDA

are in ongoing interactions in relation to the active BLA

review.

- FDA has already

conducted the Pre-License Inspection (PLI) of the manufacturing

process for RYONCIL in May 2023 and this did not result in the

issuance of any Form 483.

- Mesoblast

anticipates a decision prior to or on the FDA’s Prescription Drug

User Fee Act (PDUFA) goal date of January 7, 2025.

Activities For Go to Market

Strategy

- Hiring of select

senior positions to build targeted commercial team has

commenced.

- Key Pre-Launch

Activities include:

- Market Access

initiates payer outreach

- Medical provides

education to payers

- Corporate

leadership initiates engagement with Top 15 centers

- Regional sales

directors lead center profiling

- Ongoing KOL

engagement with greatest experience using RYONCIL at highest volume

centers

- Non-promotional

activities including profiling high-volume centers, education on

disease awareness & unmet needs, and payer engagement

- Post-launch -

Staged approach based on centers with highest volume and experience

with product.

- Targeted sales

force with experience in bone marrow transplant centers - 15

highest volume centers account for ~50% of patients.

2. RYONCIL (REMESTEMCEL-L) FOR

ACUTE GRAFT VERSUS HOST DISEASE IN ADULTS

- Mesoblast strategy

is to first gain pediatric approval for RYONCIL, followed by label

extension in the larger adult population.

- As part of its

label extension strategy for RYONCIL, Mesoblast is planning to

conduct a study in the larger adult population once it has gained

pediatric approval.

- Survival in adults

with SR-aGVHD who have failed at least one additional agent, such

as ruxolitinib, remains as low as 20-30% by 100 days.1,2 In

contrast, 100-day survival was 67% after RYONCIL treatment was used

under expanded access in 51 adults and children with SR-aGVHD who

failed to respond to at least one additional agent, such as

ruxolitinib.

- Mesoblast is

collaborating with Blood and Marrow Transplant Clinical Trials

Network (BMT CTN) in the United States, a body that is funded by

the National Institutes of Health (NIH) and is responsible for

approximately 80% of all US allogeneic BMTs, to conduct a pivotal

trial in adults with SR-aGVHD.

3. REXLEMESTROCEL-L FOR CHRONIC LOW

BACK PAIN ASSOCIATED WITH DEGENERATIVE DISC DISEASE

- The confirmatory

Phase 3 trial of Mesoblast’s second generation allogeneic,

STRO3-immunoselected, and industrially manufactured stromal cell

product rexlemestrocel-L in patients with chronic low back pain

(CLBP) due to inflammatory degenerative disc disease (DDD) of less

than five years duration has commenced enrollment at multiple sites

across the United States.

- FDA has previously

agreed on the design of this 300-patient randomized,

placebo-controlled confirmatory Phase 3 trial, and the 12-month

primary endpoint of pain reduction as an approvable

indication.

- This endpoint was

successfully met in Mesoblast’s first Phase 3 trial.

- Key secondary

measures include improvement in quality of life and function.

- A particular focus

is on treatment of patients on opioids, since discogenic back pain

accounts for approximately 50% of prescription opioid usage in the

US.

- Significant pain

reduction and opioid cessation were observed in Mesoblast’s first

Phase 3 trial.

- FDA has designated

rexlemestrocel-L a Regenerative Medicine Advanced Therapy (RMAT)

for the treatment of chronic low back pain. RMAT designation

provides all the benefits of Breakthrough and Fast Track

designations, including rolling review and eligibility for priority

review on filing of a BLA.

4. REVASCOR (REXLEMESTROCEL-L) FOR

PEDIATRIC CONGENITAL HEART DISEASE: HYPOPLASTIC LEFT HEART SYNDROME

(HLHS)

- During the year FDA

granted REVASCOR both Rare Pediatric Disease Designation (RPDD) and

Orphan-Drug Designation (ODD). This followed submission of results

from the randomized controlled trial in children with hypoplastic

left heart syndrome (HLHS), a potentially life-threatening

congenital heart condition.

- Results from a

blinded, randomized, placebo-controlled prospective trial of

REVASCOR conducted in the United States in children with HLHS were

published in the December 2023 issue of the peer reviewed The

Journal of Thoracic and Cardiovascular Surgery Open (JTCVS

Open).3

- In the HLHS trial

conducted in 19 children, a single intramyocardial administration

of REVASCOR at the time of staged surgery resulted in the desired

outcome of significantly larger increases in left ventricular (LV)

end-systolic and end-diastolic volumes over 12 months compared with

controls as measured by 3D echocardiography, (p=0.009 & p=0.020

respectively).

- These changes are

indicative of clinically important growth of the small left

ventricle, facilitating the ability to have a successful surgical

correction, known as full biventricular (BiV) conversion, which

allows for a normal two ventricle circulation. Without full BiV

conversion the right heart chamber is under excessive strain with

increased risk of heart failure and death.

- On FDA approval of

a BLA for REVASCOR for the treatment of HLHS, Mesoblast may be

eligible to receive a Priority Review Voucher (PRV) that can be

redeemed for any subsequent marketing application or may be sold or

transferred to a third party.

5. REVASCOR (REXLEMESTROCEL-L) FOR

CHRONIC HEART FAILURE WITH REDUCED EJECTION FRACTION (HFrEF) AND

PERSISTENT INFLAMMATION

- Heart failure with

low ejection fraction (HFrEF) occurs in approximately 50% of all

heart failure patients and is associated with high mortality.

- Over 60% of HFrEF

patients have underlying ischemia and these are at highest risk of

recurrent major adverse cardiac events involving large vessels

(heart attacks / strokes).

- REVASCOR has

reduced major adverse cardiac events (MACE) (cardiovascular death,

heart attacks and strokes) in a completed randomized controlled

Phase 3 trial in ischemic HFrEF patients with NYHA class II /III

disease and inflammation.

- Over 100,000

patients in the US progress annually to end-stage HFrEF and more

than 2,500 life prolonging LVADs are implanted annually in these

patients.

- Resistance to

functional recovery in ischemic HFrEF patients with LVADs is

thought to be due to excessive inflammation and microvascular

insufficiency in the ischemic myocardium.4

- In a randomized

controlled trial, a single administration of REVASCOR reduced

inflammation, strengthened left ventricular function, reduced right

ventricular failure, and reduced hospitalizations in end-stage

ischemic HFrEF patients with a left ventricular assist device

(LVAD).

- In March FDA

informed Mesoblast that it supports an accelerated approval pathway

for its second generation allogeneic, STRO3-immunoselected, and

industrially manufactured stromal cell product rexlemestrocel-L

(Revascor®), for patients with end-stage ischemic HFrEF and an

LVAD.

- Mesoblast has

received RMAT designation for rexlemestrocel-L in the treatment of

end-stage heart failure in LVAD patients and intends to meet with

FDA to discuss data presentation, timing and FDA expectations for

an accelerated approval filing in these patients.

FINANCIAL RESULTS FOR THE FULL-YEAR ENDED JUNE 30, 2024

(FY2024)

- Cash balance at

June 30, 2024 was US$63.3 million (A$95.0 million),5 with

additional US$10.0 million available from an existing facility on

FDA approval of RYONCIL.

- Reduction in net

cash usage for operating activities:

- 23% reduction

(US$14.8 million) for FY2024 compared with FY2023 (US$48.5 million

vs US$63.3 million).

- 37% reduction

(US$6.1 million) for Q4 FY2024 compared with Q4 FY2023 (US$10.2

million vs US$16.3 million).

- Reduction in cash

usage predominantly driven by reduced manufacturing activities and

lowered payroll.

Continued focus on prudent cash management for

operational activities as we undertake targeted commercial rollout

and supply chain activities for RYONCIL (remestemcel-L).

COST CONTAINMENT TARGETS ACHIEVED FOR

FY2024 AND CONTINUING IN FY2025

- Achievement of 23%

reduction (US$14.8 million) in net cash usage for operating

activities in FY2024 was due in large part to successful execution

of our payroll reduction strategy.

- Continued focus on

cost containment of headcount and payroll to be maintained in

FY2025.

- Alignment of

management salaries and incentives with shareholders as outlined

below.

DETAILS OF FINANCIAL RESULTS FOR THE

TWELVE MONTHS ENDED JUNE 30, 2024 (FY2024)

-

Royalties primarily on sales of TEMCELL® HS Inj.6

sold in Japan by our licensee for the FY2024 were US$5.9 million

and US$6.3 million on a constant currency basis, down 17% compared

with US$7.1 million for the comparative period in FY2023.7

- Research

& Development expenses reduced by US$1.8 million (7%),

down to US$25.4 million for FY2024 compared with US$27.2 million

for the comparative period in FY2023. R&D expenses primarily

supported preparations for the remestemcel-L BLA re-submission and

preparations for pivotal studies for CLBP associated with DDD and

adult SR-aGVHD.

-

Manufacturing reduced by US$12.0 million (43%),

down from US$27.7 million to US$15.7 million due to decreased

inventory build and one-off FY2023 spend on FDA Pre-License

Inspection (PLI).

- Management

and Administration expenses reduced by US$1.7 million

(7%), to US$23.6 million for FY2024.

- Revaluation

of Contingent Consideration recognized in FY2024 reflects

a greater probability of approval of remestemcel-L for the

treatment of SR-aGVHD as compared to FY2023 which reflected the

2023 CRL. In FY2024 we recognized a loss of US$9.7 million compared

to a gain of US$8.8 million in FY2023.

- Fair value

movement of warrants recognized a gain of US$0.8 million

in FY2024 on a revaluation of warrants to market value compared to

a loss of US$2.2 million in FY2023.

- Other

operating income in FY2024 was US$2.6 million compared

with US$4.2 million in FY2023 due to a reduction tax

incentives.

- Finance

Costs for borrowing arrangements include US$17.2 million

of non-cash expenditure for FY2024 comprising accruing interest and

borrowing costs.

Loss after tax for FY2024 was

US$88.0 million, a 7% increase compared to US$81.9 million for

FY2023. The net loss attributable to ordinary shareholders was 8.91

US cents per share for FY2024, compared with 10.53 US cents per

share for FY2023.

Conference CallThere will be a

webcast today, beginning at 6.30pm EDT (Wednesday, August 28);

8.30am AEST (Thursday, August 29). It can be accessed via:

https://webcast.openbriefing.com/msb-fyr-2024/

The archived webcast will be available on the

Investor page of the Company’s website: www.mesoblast.com

About Mesoblast Mesoblast (the

Company) is a world leader in developing allogeneic (off-the-shelf)

cellular medicines for the treatment of severe and life-threatening

inflammatory conditions. The Company has leveraged its proprietary

mesenchymal lineage cell therapy technology platform to establish a

broad portfolio of late-stage product candidates which respond to

severe inflammation by releasing anti-inflammatory factors that

counter and modulate multiple effector arms of the immune system,

resulting in significant reduction of the damaging inflammatory

process.

Mesoblast has a strong and extensive global

intellectual property portfolio with protection extending through

to at least 2041 in all major markets. The Company’s proprietary

manufacturing processes yield industrial-scale, cryopreserved,

off-the-shelf, cellular medicines. These cell therapies, with

defined pharmaceutical release criteria, are planned to be readily

available to patients worldwide.

Mesoblast is developing product candidates for

distinct indications based on its remestemcel-L and

rexlemestrocel-L allogeneic stromal cell technology platforms.

Remestemcel-L is being developed for inflammatory diseases in

children and adults including steroid refractory acute graft versus

host disease, biologic-resistant inflammatory bowel disease, and

acute respiratory distress syndrome. Rexlemestrocel-L is in

development for advanced chronic heart failure and chronic low back

pain. Two products have been commercialized in Japan and Europe by

Mesoblast’s licensees, and the Company has established commercial

partnerships in Europe and China for certain Phase 3 assets.

Mesoblast has locations in Australia, the United

States and Singapore and is listed on the Australian Securities

Exchange (MSB) and on the Nasdaq (MESO). For more information,

please see www.mesoblast.com, LinkedIn: Mesoblast Limited and

Twitter: @Mesoblast

References / Footnotes

- Jagasia M et al. Ruxolitinib for

the treatment of steroid-refractory acute GVHD (REACH1): a

multicenter, open-label phase 2 trial. Blood. 2020 May 14; 135(20):

1739–1749

- Abedin S, et al. Ruxolitinib

resistance or intolerance in steroid-refractory acute graft

versus-host disease — a real-world outcomes analysis. British

Journal of Haematology, 2021;195:429–43.

- Wittenberg RE, Gauvreau K, Leighton J, Moleon-Shea M, Borow KM,

Marx GR, Emani SM, Prospective randomized controlled trial of the

safety and feasibility of a novel mesenchymal precursor cell

therapy in hypoplastic left heart syndrome, JTCVS Open Volume 16,

Dec 2023, doi: https://doi.org/10.1016/j.xjon.2023.09.031

- Symons JD, Deeter L, Deeter N, et al. Effect of continuous-flow

left ventricular assist device support on coronary artery

endothelial function in ischemic and nonischemic cardiomyopathy.

Cir Heart Fail 2019; 12:e006085. DOI:

10.1161/CIRCHEARTFAILURE.119.006085.

- Using Reserve Bank of Australia

(RBA) published exchange rate from June 30, 2024 of

1A$:0.6624US$.

- TEMCELL® HS Inj. is a registered trademark of JCR

Pharmaceuticals Co. Ltd.

- TEMCELL sales by our Licensee are

recorded in Japanese Yen before being translated into USD for the

purposes of calculating the royalty paid to Mesoblast. Results have

been adjusted for the movement of the USD to Japanese Yen exchange

rate from 1USD:140.01 Yen for the twelve months ended June 30, 2023

to 1USD:151.75 Yen for the twelve months ended June 30, 2024.

Forward-Looking StatementsThis

press release includes forward-looking statements that relate to

future events or our future financial performance and involve known

and unknown risks, uncertainties and other factors that may cause

our actual results, levels of activity, performance or achievements

to differ materially from any future results, levels of activity,

performance or achievements expressed or implied by these

forward-looking statements. We make such forward-looking statements

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

Forward-looking statements should not be read as a guarantee of

future performance or results, and actual results may differ from

the results anticipated in these forward-looking statements, and

the differences may be material and adverse. Forward-looking

statements include, but are not limited to, statements about: the

initiation, timing, progress and results of Mesoblast’s preclinical

and clinical studies, and Mesoblast’s research and development

programs; Mesoblast’s ability to advance product candidates into,

enroll and successfully complete, clinical studies, including

multi-national clinical trials; Mesoblast’s ability to advance its

manufacturing capabilities; the timing or likelihood of regulatory

filings and approvals (including any future decision that the FDA

may make on the BLA for remestemcel-L for pediatric patients with

SR-aGVHD), manufacturing activities and product marketing

activities, if any; the commercialization of Mesoblast’s product

candidates, if approved; regulatory or public perceptions and

market acceptance surrounding the use of stem-cell based therapies;

the potential for Mesoblast’s product candidates, if any are

approved, to be withdrawn from the market due to patient adverse

events or deaths; the potential benefits of strategic collaboration

agreements and Mesoblast’s ability to enter into and maintain

established strategic collaborations; Mesoblast’s ability to

establish and maintain intellectual property on its product

candidates and Mesoblast’s ability to successfully defend these in

cases of alleged infringement; the scope of protection Mesoblast is

able to establish and maintain for intellectual property rights

covering its product candidates and technology; estimates of

Mesoblast’s expenses, future revenues, capital requirements and its

needs for additional financing; Mesoblast’s financial performance;

developments relating to Mesoblast’s competitors and industry; and

the pricing and reimbursement of Mesoblast’s product candidates, if

approved. You should read this press release together with our risk

factors, in our most recently filed reports with the SEC or on our

website. Uncertainties and risks that may cause Mesoblast’s actual

results, performance or achievements to be materially different

from those which may be expressed or implied by such statements,

and accordingly, you should not place undue reliance on these

forward-looking statements. We do not undertake any obligations to

publicly update or revise any forward-looking statements, whether

as a result of new information, future developments or

otherwise.

Release authorized by the Chief Executive.

For more information, please contact:

|

Corporate Communications / Investors |

Media |

|

Paul Hughes |

BlueDot Media |

|

T: +61 3 9639 6036 |

Steve Dabkowski |

|

E: investors@mesoblast.com |

T: +61 419 880 486 |

|

|

E: steve@bluedot.net.au |

|

|

|

Consolidated Income Statement

|

|

Year Ended June 30, |

|

(in U.S. dollars, in thousands, except per share

amount) |

2024 |

|

2023 |

|

Revenue |

5,902 |

|

|

7,501 |

|

|

Research & development |

(25,353 |

) |

|

(27,189 |

) |

|

Manufacturing commercialization |

(15,717 |

) |

|

(27,733 |

) |

|

Management and administration |

(23,626 |

) |

|

(25,374 |

) |

|

Fair value remeasurement of contingent consideration |

(9,693 |

) |

|

8,771 |

|

|

Fair value remeasurement of warrant liability |

779 |

|

|

(2,205 |

) |

|

Other operating income and expenses |

2,570 |

|

|

4,250 |

|

|

Finance costs |

(23,009 |

) |

|

(20,122 |

) |

|

Loss before income tax |

(88,147 |

) |

|

(82,101 |

) |

|

Income tax benefit/(expense) |

191 |

|

|

212 |

|

|

Loss attributable to the owners of Mesoblast

Limited |

(87,956 |

) |

|

(81,889 |

) |

|

|

|

|

|

|

Losses per share from continuing operations attributable to

the ordinary equity holders of the Group: |

Cents |

|

Cents |

|

Basic - losses per share |

(8.91 |

) |

|

(10.53 |

) |

|

Diluted - losses per share |

(8.91 |

) |

|

(10.53 |

) |

Consolidated Statement of Comprehensive Income

|

|

Year Ended June 30, |

|

(in U.S. dollars, in thousands) |

2024 |

|

2023 |

|

Loss for the period |

(87,956 |

) |

|

(81,889 |

) |

|

Other comprehensive (loss)/income |

|

|

|

|

Items that may be reclassified to profit and loss |

|

|

|

|

Exchange differences on translation of foreign operations |

51 |

|

|

(573 |

) |

|

Items that will not be reclassified to profit and loss |

|

|

|

|

Financial assets at fair value through other comprehensive

income |

(743 |

) |

|

(1 |

) |

|

Other comprehensive (loss)/income for the period, net of tax |

(692 |

) |

|

(574 |

) |

|

Total comprehensive losses attributable to the owners of

Mesoblast Limited |

(88,648 |

) |

|

(82,463 |

) |

Consolidated Balance Sheet

|

|

As of June 30, |

|

(in U.S. dollars, in thousands) |

2024 |

|

2023 |

|

Assets |

|

|

|

|

Current Assets |

|

|

|

|

Cash & cash equivalents |

62,960 |

|

|

71,318 |

|

|

Trade & other receivables |

20,952 |

|

|

6,998 |

|

|

Prepayments |

2,551 |

|

|

3,342 |

|

|

Total Current Assets |

86,463 |

|

|

81,658 |

|

|

|

|

|

|

|

Non-Current Assets |

|

|

|

|

Property, plant and equipment |

1,106 |

|

|

1,357 |

|

|

Right-of-use assets |

2,732 |

|

|

5,134 |

|

|

Financial assets at fair value through other comprehensive

income |

1,014 |

|

|

1,757 |

|

|

Other non-current assets |

2,102 |

|

|

2,326 |

|

|

Intangible assets |

575,736 |

|

|

577,183 |

|

|

Total Non-Current Assets |

582,690 |

|

|

587,757 |

|

|

Total Assets |

669,153 |

|

|

669,415 |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

Current Liabilities |

|

|

|

|

Trade and other payables |

7,070 |

|

|

20,145 |

|

|

Provisions |

45,038 |

|

|

6,399 |

|

|

Borrowings |

13,862 |

|

|

5,952 |

|

|

Lease liabilities |

2,626 |

|

|

4,060 |

|

|

Warrant liability |

4,647 |

|

|

5,426 |

|

|

Total Current Liabilities |

73,243 |

|

|

41,982 |

|

|

|

|

|

|

|

Non-Current Liabilities |

|

|

|

|

Provisions |

10,620 |

|

|

16,612 |

|

|

Borrowings |

100,483 |

|

|

102,811 |

|

|

Lease liabilities |

1,952 |

|

|

3,672 |

|

|

Deferred consideration |

2,500 |

|

|

2,500 |

|

|

Total Non-Current Liabilities |

115,555 |

|

|

125,595 |

|

|

Total Liabilities |

188,798 |

|

|

167,577 |

|

|

Net Assets |

480,355 |

|

|

501,838 |

|

|

|

|

|

|

|

Equity |

|

|

|

|

Issued Capital |

1,310,813 |

|

|

1,249,123 |

|

|

Reserves |

78,303 |

|

|

73,520 |

|

|

Accumulated losses |

(908,761 |

) |

|

(820,805 |

) |

|

Total Equity |

480,355 |

|

|

501,838 |

|

Consolidated Statement of Cash Flow

|

|

Year Ended June 30, |

|

(in U.S. dollars, in thousands) |

2024 |

|

2023 |

|

Cash flows from operating activities |

|

|

|

|

Commercialization revenue received |

6,776 |

|

|

7,480 |

|

|

Government grants and tax incentives and credits received |

3,819 |

|

|

1,118 |

|

|

Payments to suppliers and employees (inclusive of goods and

services tax) |

(60,835 |

) |

|

(72,683 |

) |

|

Interest received |

1,778 |

|

|

796 |

|

|

Income taxes received /(paid) |

4 |

|

|

20 |

|

|

Net cash (outflows) in operating activities |

(48,458 |

) |

|

(63,269 |

) |

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Investment in fixed assets |

(271 |

) |

|

(264 |

) |

|

Receipts from investment in sublease |

234 |

|

|

120 |

|

|

Payments for licenses |

(60 |

) |

|

(50 |

) |

|

Net cash (outflows) in investing activities |

(97 |

) |

|

(194 |

) |

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Proceeds from borrowings |

— |

|

|

— |

|

|

Repayment of borrowings |

(10,000 |

) |

|

— |

|

|

Payment of transaction costs from borrowings |

(1,559 |

) |

|

(574 |

) |

|

Interest and other costs of finance paid |

(5,717 |

) |

|

(6,014 |

) |

|

Proceeds from issue of shares |

65,406 |

|

|

88,635 |

|

|

Proceeds from issue of warrants |

— |

|

|

— |

|

|

Payments for share issue costs |

(4,356 |

) |

|

(4,889 |

) |

|

Payments for lease liabilities |

(3,522 |

) |

|

(2,656 |

) |

|

Net cash inflows/(outflows) by financing

activities |

40,252 |

|

|

74,502 |

|

|

|

|

|

|

|

Net increase/(decrease) in cash and cash equivalents |

(8,303 |

) |

|

11,039 |

|

|

Cash and cash equivalents at beginning of period |

71,318 |

|

|

60,447 |

|

|

FX (loss)/gain on the translation of foreign bank accounts |

(55 |

) |

|

(168 |

) |

|

Cash and cash equivalents at end of period |

62,960 |

|

|

71,318 |

|

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e713c6e7-f56f-48e2-bdb9-d8f82d7718d6

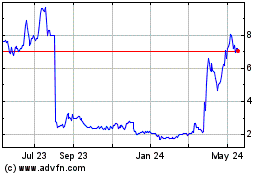

Mesoblast (NASDAQ:MESO)

Historical Stock Chart

From Nov 2024 to Dec 2024

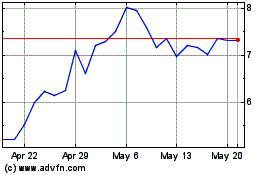

Mesoblast (NASDAQ:MESO)

Historical Stock Chart

From Dec 2023 to Dec 2024