false

0001938046

0001938046

2024-12-02

2024-12-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): December 2, 2024

MANGOCEUTICALS,

INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

001-41615 |

|

87-3841292 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

15110

N. Dallas Parkway, Suite 600

Dallas,

Texas |

|

75248 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (214) 242-9619

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 Par Value Per Share |

|

MGRX |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

December 2, 2024, Mangoceuticals, Inc. (the “Company”, “we” and “us”) entered

into a service agreement with Greentree Financial Group, Inc. (“Greentree” and the “Service Agreement”).

The Company and Greentree were previously party to a service agreement which expired pursuant to its terms on September 30, 2024. Since

February 2015, Mr. Eugene M. Johnston, our Chief Financial Officer (who was appointed October 1, 2022), has served as Audit Manager for

Greentree.

Pursuant

to the Service Agreement, Greentree agreed to perform the following services: (a) assistance to the Company with compliance filings for

the quarters ended March 31, 2025, June 30, 2025, September 30, 2025, and the year ended December 31, 2024, including the consolidation

structure and entries as well as assistance with United States Generally Accepted Accounting Principles (“US GAAP”)

footnotes; (b) reviewing, and providing advice to the Company on, all documents and accounting systems relating to its finances and transactions,

with the purpose of bringing such documents and systems into compliance with US GAAP or disclosures required by the Securities and Exchange

Commission (the “SEC”); (c) providing necessary consulting services and support as a liaison for the Company to third

party service providers, including coordination amongst the Company and its attorneys, certified public accountants and transfer agent;

and (d) preparing and filing the Company’s tax returns with the Internal Revenue Service for the 2024 tax year.

The

Company agreed to issue Greentree 40,000 shares of the Company’s restricted common stock (the “Greentree Shares”)

upon the parties’ entry into the agreement (fully-earned upon issuance), and to pay Greentree $40,000 in cash, payable as follows:

(a) $20,000 on or before December 31, 2024; and (b) $20,000 on or before March 31, 2025. We also agreed to reimburse Greentree for its

reasonable out-of-pocket expenses incurred in connection with Greentree’s activities under the agreement, including the reasonable

fees and travel expenses for the meetings on behalf of the Company.

The

Service Agreement continues in effect through October 15, 2025, but may be terminated earlier with 45 days’ notice from the Company

to Greentree, provided that in the event the Company terminates the agreement prior to the end of the Term, the entire cash fee due during

the term of the Service Agreement is immediately due and payable.

The

Service Agreement includes customary indemnification obligations requiring the Company to indemnify Greentree and its affiliates with

regard to certain matters.

A

copy of the Service Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The above description of the terms of the Service Agreement is qualified in its entirety by reference to such exhibit.

Item

3.02 Unregistered Sales of Equity Securities.

The

information set forth in Item 1.01 is incorporated into this Item 3.02 by reference. The offer and sale of the Greentree

Shares was exempt from registration pursuant to Section 4(a)(2), and/or Rule 506 of Regulation D of the Securities Act of 1933, as amended

(the “Securities Act”), since the foregoing issuance did not involve a public offering, the recipient took the securities

for investment and not resale, we took appropriate measures to restrict transfer, and the recipient was an “accredited investor”.

The securities are subject to transfer restrictions, and the securities contain an appropriate legend stating that such securities have

not been registered under the Securities Act and may not be offered or sold absent registration or pursuant to an exemption therefrom.

The securities were not registered under the Securities Act and such securities may not be offered or sold in the United States absent

registration or an exemption from registration under the Securities Act and any applicable state securities laws.

As

previously disclosed in the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on April 11,

2024, on April 5, 2024, the Company entered into an Equity Purchase Agreement (the “ELOC”) with Platinum Point

Capital (the “Purchaser”) pursuant to which the Purchaser committed to purchase up to $25,000,000 of the Company’s

common stock pursuant to the terms of the ELOC.

Pursuant

to the ELOC, the Company, subject to certain conditions, is able to direct the Purchaser to purchase shares of the Company’s common

stock (the “Advance Shares”) in a maximum amount of one hundred percent (100%) of the average daily trading volume

over the five trading days preceding the applicable advance date. At any time and from time to time during the 2-year term of the ELOC

(the “Commitment Period”), the Company may deliver a notice to Purchaser (the “Advance Notice”)

and shall deliver the Advance Shares to Purchaser via DWAC on the next trading day. The purchase price (the “Purchase Price”)

for the Advance Shares shall equal 90.0% of the gross proceeds received by the Purchaser for the resale of the Advance Shares during

the three consecutive trading days immediately following the date an Advance Notice is delivered (the “Valuation Period”).

The closing of an Advance Notice shall occur within two trading days following the end of the respective Valuation Period, whereby the

Purchaser shall deliver the purchase price for the shares (the Purchase Price, less clearing costs and transfer agent fees) to the Company

by wire transfer of immediately available funds.

On

December 4, 2024, the Company delivered an Advance Notice to the Purchaser and sold the Purchaser 75,000 shares of common stock pursuant

to the terms of the ELOC for $2.50 per share for a total of $159,950, net of fees, discounts and expenses.

The

issuance of the shares of common stock discussed above were exempt from registration pursuant to an exemption from registration provided

by, Section 4(a)(2), and/or Rule 506 of Regulation D of the Securities Act, since the foregoing issuances did not involve a public offering,

the recipient took the securities for investment and not resale, we took appropriate measures to restrict transfer, and the recipient

was an “accredited investor”. The securities are subject to transfer restrictions, and the securities contain an appropriate

legend stating that such securities have not been registered under the Securities Act and may not be offered or sold absent registration

or pursuant to an exemption therefrom. The securities were not registered under the Securities Act and such securities may not be offered

or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state

securities laws.

The

resale of the shares of common stock issuable pursuant to the ELOC have been registered by the Company under the Securities Act, on a

registration statement declared effective by the Securities and Exchange Commission.

Item

9.01. Financial Statements and Exhibits

*

Filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MANGOCEUTICALS,

INC. |

| |

|

|

| Date:

December 6, 2024 |

By: |

/s/

Jacob D. Cohen |

| |

|

Jacob

D. Cohen |

| |

|

Chief

Executive Officer |

Exhibit

10.1

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

December

2, 2024

PERSONAL

AND CONFIDENTIAL

Mangoceuticals,

Inc.

15110

Dallas Parkway, Suite 600

Dallas,

Texas 75248

| Attn: |

Jacob

D. Cohen – Chief Executive Officer |

Dear

Mr. Cohen,

This

service agreement (“Agreement”) confirms the terms and conditions of the engagement of Greentree Financial Group, Inc.

(“Greentree”) by Mangoceuticals, Inc., a Texas Corporation (the “Company”) to render certain professional

services to the Company.

| 1. | Services.

Greentree agrees to perform the following services: |

| (a) | Assist

the Company with compliance filings for the quarters ended March 31, 2025, June 30, 2025,

September 30, 2025, and one annual report for the year ended December 31, 2024, including

the consolidation structure and entries as well as assist with US GAAP footnotes; |

| (b) | Review

and advise the Company on all documents and accounting systems relating to its finances and

transactions, with the purpose of bringing such documents and systems into compliance with

US GAAP or disclosures required by SEC; |

| (c) | Provide

necessary consulting services and support as a liaison for the Company to third-party service

providers, including coordination amongst the Company and their related attorneys, CPAs and

the transfer agent. |

| (d) | Prepare

and file the Company’s tax return with the IRS for the 2024 tax year. |

| 2. | Fees.

The Company agrees to pay Greentree for its services professional service fees consisting

of $40,000

in cash and 40,000 shares of the Company’s restricted common stock (the “Service Fee” or “Securities”)

during the Term, payable as follows: |

| (a) | A

payment of $20,000 shall be made in cash via wire on or before December 31, 2024; |

| (b) | A

payment of $20,000 shall be made in cash via wire on or before March 31, 2025; |

Client

initials: __

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

The

40,000 shares of the Company’s common stock shall be issued to Greentree upon signing this Agreement and shall be deemed fully

earned upon signing this Agreement.

In

addition to any fees that may be payable to Greentree under this Agreement, the Company agrees to reimburse Greentree, upon request made

from time to time, for its reasonable out-of-pocket expenses incurred in connection with Greentree’s activities under this Agreement,

including the reasonable fees and travel expenses for the meetings on behalf of the Company. All such fees, expenses and costs will be

pre- approved by the Company in writing, and billed at any time by Greentree and are payable by the Company when invoiced. Upon expiration

of the Agreement any unreimbursed fees and expenses will be immediately due and payable.

3.

Term. The term of this Agreement shall commence on signing of this Agreement and end on October 15, 2025 (the “Term”).

This Agreement may be renewed upon mutual written agreement of the parties hereto. This agreement may be terminated by the Company prior

to its expiration or services being rendered with 45 days prior written notice to Greentree. Any obligation pursuant to this Paragraph

3, and pursuant to Paragraphs 2 (payment of fees), 4 (indemnification), 5 (matters relating to engagement), 7 (governing law); 8 (attorney

fees) and 11 (miscellaneous) hereof, shall survive the termination or expiration of this Agreement. As stated in the foregoing sentence,

the parties specifically agree that in the event the Company terminates this Agreement prior to expiration of the Term, the full Service

Fee shall become immediately due and payable.

4.

Indemnification. In addition to the payment of fees and reimbursement of fees and expenses provided for above, the Company agrees

to indemnify Greentree and its affiliates with regard to the matters contemplated herein, as set forth in Exhibit A, attached hereto,

which is incorporated by reference as if fully set forth herein.

5.

Matters Relating to Engagement. The Company acknowledges that Greentree has been retained solely to provide the services set forth

in this Agreement.

In

rendering such services, Greentree shall act as an independent contractor, and any duties of Greentree arising out of its engagement

hereunder shall be owed solely to the Company. The Company further acknowledges that Greentree may perform certain of the services described

herein through one or more of its affiliates.

Client

initials: __

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

The

Company acknowledges that Greentree is a consulting firm that is engaged in providing consulting services. The Company acknowledges and

agrees that in connection with the performance of Greentree’s services hereunder (or any other services) that neither Greentree

nor any of its employees will be providing the Company with legal, tax or accounting advice or guidance (and no advice or guidance provided

by Greentree or its employees to the Company should be construed as such) and that neither Greentree nor its employees hold itself or

themselves out to be advisors as to legal, tax, accounting or regulatory matters in any jurisdiction. Greentree may retain attorneys

and accountants that are for Greentree’s benefit, and Greentree may recommend a particular law firm or accounting firm to be engaged

by the Company and may pay the legal expenses or accounting expenses associated with that referral on behalf of the Company, after full

disclosure to the Company and the Company’s consent that Greentree make such payment on its behalf. However, Greentree makes no

recommendation as to the outcome of such referrals. The Company shall consult with its own legal, tax, accounting and other advisors

concerning all matters and advice rendered by Greentree to the Company, and the Company shall be responsible for making its own independent

investigation and appraisal of the risks, benefits and suitability of the advice and guidance given by Greentree to the Company. Neither

Greentree nor its employees shall have any responsibility or liability whatsoever to the Company or its affiliates with respect thereto.

The

Company recognizes and confirms that in performing its duties pursuant to this Agreement, Greentree will be using and relying on data,

material, and other information furnished by the Company, a third-party provider, or their respective employees and representatives (“the

Information”). The Company will cooperate with Greentree and will furnish Greentree with all Information concerning the Company

and any financial information or organizational or transactional information which Greentree deems appropriate, and Company will provide

Greentree with access to the Company’s officers, directors, employees, independent accountants and legal counsel for the purpose

of performing Greentree’s obligations pursuant to this Agreement.

The

Company hereby agrees and represents that all Information furnished to Greentree pursuant to this Agreement shall be accurate and complete

in all material respects at the time provided, and that, if the Information becomes materially inaccurate, incomplete or misleading during

the term of Greentree’s engagement hereunder, the Company shall promptly advise Greentree in writing. Accordingly, Greentree assumes

no responsibility for the accuracy and completeness of the Information. In rendering its services, Greentree will be using and relying

upon the Information without independent verification evaluation thereof.

6.

Representations and Warranties by Greentree. Greentree, by its acceptance of the Securities, represents and warrants to Company

as follows:

(a)

Greentree is acquiring the Securities with the intent to hold as an investment and not with a view of distribution.

Client

initials: __

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

(b)

Greentree is an “accredited investor” within the definition contained in Rule 501(a) under the Securities Act of 1933, as

amended (the “Securities Act”), and is acquiring the Securities for its own account, for investment, and not with a view

to, or for sale in connection with, the distribution thereof or of any interest therein. Greentree has adequate net worth and means of

providing for its current needs and contingencies and is able to sustain a complete loss of the investment in the Securities, and has

no need for liquidity in such investment. Greentree, itself or through its officers, employees or agents, has sufficient knowledge and

experience in financial and business matters to be capable of evaluating the merits and risks of an investment such as an investment

in the Securities, and Greentree, either alone or through its officers, employees or agents, has evaluated the merits and risks of the

investment in the Securities.

(c)

Greentree acknowledges and agrees that it is acquiring the Securities hereunder based upon its own inspection, examination and determination

with respect thereto as to all matters, and without reliance upon any express or implied representations or warranties of any nature,

whether in writing, orally or otherwise, made by or on behalf of or imputed to the Company.

(d)

Greentree has no contract, arrangement or understanding with any broker, finder, investment bank, financial intermediary or similar agent

with respect to any of the transactions contemplated by this Agreement.

(e)

Greentree acknowledges and agrees that the value of the Securities, at any given time, could be less than the value of the Service Fee

had Greentree elected to receive payments in cash, and Greentree accepts the investment risk associated therewith.

(f)

Greentree recognizes that the shares of the Company’s common stock to be issued hereunder (the “Securities”)

have not been registered under the Securities Act, nor under the securities laws of any state and, therefore, cannot be resold unless

the resale of the Securities is registered under the Securities Act or unless an exemption from registration is available. Greentree

acknowledges that the Company is under no obligation to register or qualify the Securities under the Securities Act or under any state

securities law, or to assist Greentree in complying with any exemption from registration and qualification. Greentree understands and

agrees that a legend has been or will be placed on any certificate(s) or other document(s) evidencing the Securities in substantially

the following form:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED OR ANY STATE SECURITIES

ACT. THE SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE SOLD, TRANSFERRED, PLEDGED OR HYPOTHECATED UNLESS (I) THEY SHALL

HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED AND ANY APPLICABLE STATE SECURITIES ACT, OR (II) THE CORPORATION SHALL

HAVE BEEN FURNISHED WITH AN OPINION OF COUNSEL, SATISFACTORY TO COUNSEL FOR THE CORPORATION, THAT REGISTRATION IS NOT REQUIRED UNDER

ANY SUCH ACTS.”

Client

initials: __

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

6.

Governing Law and Consent to Jurisdiction. This Agreement shall be governed by and construed in accordance with the laws of the

State of Florida, without regard to conflict of laws provisions. All disputes arising out of or in connection with this agreement, or

in respect of any legal relationship associated with or derived from this agreement, shall only be heard in any competent court residing

in Broward County Florida. Company agrees that a final judgment in any such action or proceeding shall be conclusive and may be enforced

in other jurisdictions by suit on the judgment or in any manner provided by law. The Company further waives any objection to venue in

any such action or proceeding on the basis of inconvenient forum. The Company agrees that any action on or proceeding brought against

the Greentree shall only be brought in such courts.

7.

Attorney Fees. In the event Greentree hereof shall refer this Agreement to an attorney to enforce the terms hereof, the Company

agrees to pay all the costs and expenses incurred in attempting or effecting the enforcement of the Greentree’s rights, including

reasonable attorney’s fees, whether or not suit is instituted.

8.

No Brokers. The Company represents and warrants to Greentree that there are no brokers, representatives or other persons which

have an interest in compensation due to Greentree from any services contemplated herein.

9.

Authorization. The Company and Greentree represent and warrant that each has all requisite power and authority, and all necessary

authorizations, to enter into and carry out the terms and provisions of this Agreement and the execution, delivery and performance of

this Agreement does not breach or conflict with any agreement, document or instrument (including contracts, wills, agreements, records

and wire receipts, etc.) to which it is a party or bound.

10.

Miscellaneous. This Agreement constitutes the entire understanding and agreement between the Company and Greentree with respect

to the subject matter hereof and supersedes all prior understandings or agreements between the parties with respect thereto, whether

oral or written, express or implied. Any amendments or modifications must be executed in writing by both parties. This Agreement and

all rights, liabilities and obligations hereunder shall be binding upon and inure to the benefit of each party’s successors but

may not be assigned without the prior written approval of the other party. If any provision of this Agreement shall be held or made invalid

by a statute, rule, regulation, decision of a tribunal or otherwise, the remainder of this Agreement shall not be affected thereby and,

to this extent, the provisions of this Agreement shall be deemed to be severable. This Agreement may be executed in any number of counterparts,

each of which shall be deemed to be an original, but such counterparts shall, together, constitute only one instrument. The descriptive

headings of the Paragraphs of this Agreement are inserted for convenience only, do not constitute a part of this Agreement and shall

not affect in any way the meaning or interpretation of this Agreement.

Client

initials: __

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

Please

confirm that the foregoing correctly sets forth our agreement by signing below in the space provided and returning this Agreement to

Greentree for execution, which shall constitute a binding agreement as of the date first above written.

Thank

you. We look forward to a mutually rewarding relationship.

| GREENTREE

FINANCIAL GROUP, INC. |

|

| |

|

|

| By: |

/s/

R. Chris Cottone |

|

| Name: |

R.

Chris Cottone |

|

| Title: |

Vice

President |

|

| |

|

|

AGREED

TO AND ACCEPTED

DATE:

DECEMBER 2, 2024 |

|

| |

|

|

| MANGOCEUTICALS

INC. |

|

| |

|

|

| By: |

/s/

Jacob D. Cohen |

|

| Name: |

Jacob

D. Cohen |

|

| Title: |

Chief

Executive Officer |

|

| |

|

|

AGREED

TO AND ACCEPTED

DATE:

DECEMBER 2, 2024 |

|

Client

initials: __

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

EXHIBIT

A: INDEMNIFICATION

The

Company agrees to indemnify Greentree, its employees, directors, officers, agents, affiliates, and each person, if any, who controls

it within the meaning of either Section 20 of the Securities Exchange Act of 1934 or Section 15 of the Securities Act of 1933 (each such

person, including Greentree is referred to as “Indemnified Party”) from and against any losses, claims, damages and liabilities,

joint or several (including all legal or other expenses reasonably incurred by an Indemnified Party in connection with the preparation

for or defense of any threatened or pending claim, action or proceeding, whether or not resulting in any liability) (“Damages”),

to which such Indemnified Party, in connection with providing its services or arising out of its engagement hereunder, may become subject

under any applicable Federal or state law or otherwise, including but not limited to liability or loss (i) caused by or arising out of

an untrue statement or an alleged untrue statement of a material fact or omission or alleged omission to state a material fact necessary

in order to make a statement not misleading in light of the circumstances under which it was made, (ii) caused by or arising out of any

act or failure to act, or (iii) arising out of Greentree’s engagement or the rendering by any Indemnified Party of its services

under this Agreement; provided, however, that the Company will not be liable to the Indemnified Party hereunder to the extent that any

Damages are found in a final non-appealable judgment by a court of competent jurisdiction to have resulted from the gross negligence

or willful misconduct of the Indemnified Party seeking indemnification hereunder.

These

indemnification provisions shall be in addition to any liability which the Company may otherwise have to any Indemnified Party.

If

for any reason, other than a final non-appealable judgment finding an Indemnified Party liable for Damages for its gross negligence or

willful misconduct the foregoing indemnity is unavailable to an Indemnified Party or insufficient to hold an Indemnified Party harmless,

then the Company shall contribute to the amount paid or payable by an Indemnified Party as a result of such Damages in such proportion

as is appropriate to reflect not only the relative benefits received by the Company and its shareholders on the one hand and the Indemnified

Party on the other, but also the relative fault of the Company and the Indemnified Party as well as any relevant equitable considerations.

Promptly

after receipt by the Indemnified Party of notice of any claim or of the commencement of any action in respect of which indemnity may

be sought, the Indemnified Party will notify the Company in writing of the receipt or commencement thereof and the Company shall have

the right to assume the defense of such claim or action (including the employment of counsel reasonably satisfactory to the Indemnified

Party and the payment of fees and expenses of such counsel), provided that the Indemnified Party shall have the right to control its

defense if, in the opinion of its counsel, the Indemnified Party’s defense is unique or separate to it as the case may be, as opposed

to a defense pertaining to the Company. In any event, the Indemnified Party shall have the right to retain counsel reasonably satisfactory

to the Company, at the Company’s sole expense, to represent it in any claim or action in respect of which indemnity may be sought

and agrees to cooperate with the Company and the Company’s counsel in the defense of such claim or action. In the event that the

Company does not promptly assume the defense of a claim or action, the Indemnified Party shall have the right to employ counsel to defend

such claim or action. Any obligation pursuant to this Annex shall survive the termination or expiration of the Agreement.

*******

Client

initials: __

|

|

Greentree

Financial Group, Inc. |

FL

Office

7951

SW 6th St., Ste. 216

Plantation,

Florida 33324

|

Tel:

954-424-2345

Fax:954-424-2230

NC

Office

19720

Jetton Road, 3rd Floor

Cornelius,

NC 28301

Tel:

704-892-8733

Fax:704-892-6487

| MANGOCEUTICALS

INC. |

|

| |

|

|

| By: |

/s/

Jacob D. Cohen |

|

| Name: |

Jacob

D. Cohen |

|

| Title: |

Chief

Executive Officer |

|

| |

|

|

AGREED

TO AND ACCEPTED

DATE:

DECEMBER 2, 2024 |

|

Client

initials: __

v3.24.3

Cover

|

Dec. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 02, 2024

|

| Entity File Number |

001-41615

|

| Entity Registrant Name |

MANGOCEUTICALS,

INC.

|

| Entity Central Index Key |

0001938046

|

| Entity Tax Identification Number |

87-3841292

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

15110

N. Dallas Parkway

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75248

|

| City Area Code |

(214)

|

| Local Phone Number |

242-9619

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 Par Value Per Share

|

| Trading Symbol |

MGRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

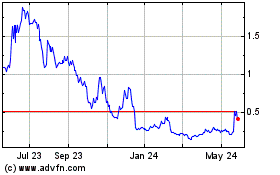

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

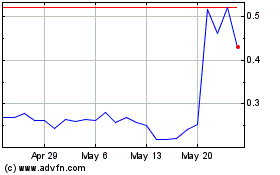

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From Dec 2023 to Dec 2024