false

0001337068

0001337068

2025-02-20

2025-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February

20, 2025

Magyar Bancorp, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

000-51726 |

20-4154978 |

| (State or Other Jurisdiction) |

(Commission File No.) |

(I.R.S. Employer |

| of Incorporation) |

|

Identification No.) |

| |

|

|

| |

|

|

| 400 Somerset Street, New Brunswick, New Jersey |

|

08901 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code:

(732) 342-7600

Not Applicable

(Former name or former address, if changed since last

report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange

on Which Registered |

|

Common

Stock, par value $0.01 per share |

|

MGYR |

|

The NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01 |

Regulation FD Disclosure |

Beginning on February 20, 2025, in connection with its annual meeting of

stockholders, Magyar Bancorp, Inc. (the “Company”) intends to make available to its stockholders, investors and others, and

to post on its Web site, a written presentation regarding the Company’s 2024 financial performance and ongoing community banking

strategy.

A copy of the stockholder presentation is attached as Exhibit 99.1 to this

report.

| Item 9.01. | Financial Statements and Exhibits |

| (a) | Financial Statements of businesses acquired. Not Applicable. |

| (b) | Pro forma financial information. Not Applicable. |

| (c) | Shell Company Transactions. Not Applicable |

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

MAGYAR BANCORP, INC. |

| |

|

|

| |

|

|

| DATE: February 20, 2025 |

By: |

/s/ John S. Fitzgerald |

| |

|

John S. Fitzgerald |

| |

|

President and Chief Executive Officer |

2025 Annual Shareholders Meeting February 20, 2025

Forward Looking Statements This presentation contains statements about future events that constitute forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward- looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those risks previously disclosed in the Company’s filings with the SEC, general economic conditions, changes in interest rates, regulatory considerations, competition, technological developments, retention and recruitment of qualified personnel, and market acceptance of the Company’s pricing, products and services, and with respect to the loans extended by the Bank and real estate owned, the following: risks related to the economic environment in the market areas in which the Bank operates, particularly with respect to the real estate market in New Jersey; the risk that the value of the real estate securing these loans may decline in value; and the risk that significant expense may be incurred by the Company in connection with the resolution of non-performing loans. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. 2

Magyar Bancorp, Inc. Overview ▪ Magyar Bank, a New Jersey chartered savings bank originally founded in 1922, is the wholly owned subsidiary of Magyar Bancorp, Inc. ▪ Magyar Bancorp, Inc., trades on NASDAQ under the symbol MGYR. ▪ As of December 31, 2024, we had $1 billion in total assets, $805 million in loans, $849 million in deposits and $112 million in stockholders’ equity. ▪ Magyar Bank conducts its business from its main office in New Brunswick and six additional branch offices located in North Brunswick, South Brunswick, Branchburg, Martinsville and two in Edison, New Jersey. 3

4 Magyar Bank Branch Locations Martinsville, NJ North Brunswick, NJ South Brunswick, NJ New Brunswick, NJ (HQ) Inman Ave, Edison, NJ TanoMall, Edison, NJ Branchburg, NJ

Deposits by Branch Totals exclude brokered deposits. $392 $121 $96 $35 $25 $28 $57 $346 $127 $103 $42 $73 $42 $86 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 Total Deposits By Branch Total Deposits - 12/31/23 Total Deposits - 12/31/24 *Bridgewater office closed November 1, 2024. Deposits were transferred to Martinsville office.

2024 Highlights ▪ Deposits increased by 5.5% ▪ 12% Loan Growth ▪ Earnings Per Share increased to $1.23 from $1.20 ▪ Increased Dividend Payments ▪ $0.26 per share paid in 2024 compared to $.20 paid in 2023 ▪ Special dividend $0.04 per share paid in December 2024 ▪ Increased shares repurchased to 195,906 in 2024 as part of buyback program ▪ Opened new location in Martinsville October 2024 6

2024 Highlights ▪ Strong Liquidity ▪ Loan-to-Deposit ratio 95% as of 12/31/24 ▪ Recognized as 5-star Bank by Bauer Financial ▪ This is the highest rating given by Bauer ▪ Named to 2024 KBW Honor Roll ▪ Recognizes high performing banks with the strongest and/or most consistent earnings growth over the past decade 7

Financial Highlights 8

Asset Trend $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 D o l l a r s i n M i l l i o n s Loans Investments & Cash Other $1,008 $774 $907 $799 $754 9 $952

Loan Composition $- $100 $200 $300 $400 $500 $600 $700 $800 $900 9/30/20 9/30/21 9/30/22 9/30/23 9/30/24 12/31/24 D o l l a r s i n M i l l i o n s 1-4 Family Residential Commercial Real Estate (CRE) Construction Commercial/Business Home Equity Line of Credit Other 10 $780 $629 $805 $594 $611 $698

Additional CRE Detail 29.3% 9.6% 11.1% 10.7% 5.4% 15.2% 18.7% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% - 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 P e r c e n t a g e o f C R E L o a n s D o l l a r s i n T h o u s a n d s Owner Occupied - 38.1% Non-Owner Occupied - 61.9% % of CRE Loans 11 CRE Ratio –280% As of 12/31/24

FY 2024 Loan Origination Residential/Home Equity 25% Consumer 0% Construction 16% SBA 7% Commercial RE 48% Commercial 4% 12 $161 MillionTotal

Non-Performing Assets/Assets 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 9/30/20 9/30/21 9/30/22 9/30/23 9/30/24 12/31/24 Non-Performing Loans Other Real Estate Owned 1.63% 13 0.29% 0.60% 0.39% 1.14% 0.42%

Deposit Composition $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 9/30/20 9/30/21 9/30/22 9/30/23 9/30/24 12/31/24 D o l l a r s i n M i l l i o n s CDs (inc. IRA) Savings Accounts Money Market Accounts Checking 14 $618 $640 $668 $755 $797 $849

Higher Interest Rates Led to Higher Funding Costs 4.44% 4.61% 4.91% 5.10% 5.26% 5.35% 5.50% 5.60% 5.59% 1.27% 1.51% 2.19% 2.55% 2.80% 2.98% 3.24% 3.29% 3.05% 4.50% 5.00% 5.50% 5.50% 5.50% 5.50% 5.50% 5.00% 4.50% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% Yield on interest earning assets Cost of interest bearing funding Federal Funds Rate 15

Quarterly Net Interest Margin 3.36% 3.29% 3.17% 3.02% 3.08% 3.22% 3.09% 3.10% 3.06% 3.09% 3.09% 3.12% 3.00% 3.05% 3.10% 3.15% 3.20% 3.25% 3.30% 3.35% 3.40% 9/30/2023 12/31/2023 3/31/2024 6/30/2024 9/30/2024 12/31/2024 MGYR Net Interest Margin Average NIM - Peer Group 16 Peer Group –Mid Atlantic Banks with Assets $800M -$1.2B Source: S&P Capital IQ

Net Income 17 $2,190 $6,120 $7,919 $7,709 $7,783 $2,085 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 FY20 FY21 FY22 FY23 FY24 Q125 D o l l a r s i n T h o u s a n d s

Earnings Per Share $0.38 $1.01 $1.17 $1.20 $1.23 $0.34 4,000,000 4,500,000 5,000,000 5,500,000 6,000,000 6,500,000 7,000,000 7,500,000 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 FY20 FY21 FY22 FY23 FY24 Q125 N u m b e r o f S h a r e s E a r n i n g s P e r S h a r e Earnings Per Share Shares Outstanding 18

Book Value Per Share 19 $13.76 $14.60 $15.70 $16.98 $17.23 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 9/30/21 9/30/22 9/30/23 9/30/24 12/31/24

Stock Price Performance 20

(15%) (10%) (5%) 0% 5% 10% 15% 20% 25% 30% 35% 40% 1/31/24 3/31/24 5/31/24 7/31/24 9/30/24 11/30/24 1/31/25 MGYR LTM Stock Performance 21 KRX MGYR Stock price on 1/31/2025 -$14.34 24.37% 24.04%

0.40x 0.67x 0.68x 0.70x 0.83x 0.86x 0.87x 0.90x 0.92x 0.93x 0.93x 1.07x 1.21x 1.23x PNBK FBIP SRBK BSPA MGYR LFGP KTHN BVFL HARL DIMC CMHF AMBK TYCB HONT Median: 0.88X P/TBV vs Peers 22 Source: S&P Global Market Intelligence as of 1/31/25 MGYR stock price on 1/31/2025 -$14.34 Note: Peer defined as banks and thrifts in the Mid-Atlantic or Northeast with assets between $850mm and $1.2bn Excludes merger targets and mutual holding companies

6.00 8.00 10.00 12.00 14.00 16.00 25 50 75 Price ($) Volume (shares 000's) Vol Price MGYR Stock Performance Since IPO 23 MGYR Stock price on 1/31/2025 -$14.34 Second Step IPO Date of 7/15/2021 at $10.00 per share. 43.4%

Fiscal Year 2025 Outlook 24

Fiscal Year 2025 Outlook • Enhance shareholder value – Quarterly dividend increased to $0.06 per share – Stock buyback • Continued emphasis on community banking strategy to grow the business – Identify quality residential and commercial lending opportunities 25

Fiscal Year 2025 Outlook • Manage interest rate risk • IT Cybersecurity • Continued focus on non-interest expenses –Martinsville office produced significant cost savings –Utilize technology to achieve more efficient branches • Evaluate additional branch locations based on marketing opportunities 26

Questions? 27

v3.25.0.1

Cover

|

Feb. 20, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 20, 2025

|

| Entity File Number |

000-51726

|

| Entity Registrant Name |

Magyar Bancorp, Inc.

|

| Entity Central Index Key |

0001337068

|

| Entity Tax Identification Number |

20-4154978

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Somerset Street

|

| Entity Address, City or Town |

New Brunswick

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08901

|

| City Area Code |

(732)

|

| Local Phone Number |

342-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

MGYR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

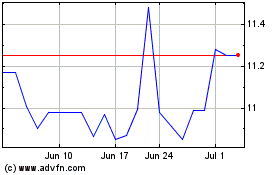

Magyar Bancorp (NASDAQ:MGYR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Magyar Bancorp (NASDAQ:MGYR)

Historical Stock Chart

From Mar 2024 to Mar 2025