0001218683

false

0001218683

2023-08-22

2023-08-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 22, 2023

Mawson Infrastructure Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40849 |

|

88-0445167 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 201 Clark Street Sharon PA USA |

|

16146 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code +1 - 412 – 515 - 0896

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value |

|

MIGI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On August 22, 2023, Mawson Infrastructure Group

Inc. (the “Company”) issued a press release announcing its unaudited business and operational update for July 2023.

A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company cautions that statements in this

report that are not a description of historical fact are forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such

as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,”

among others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed

or implied by such forward-looking statements. These forward-looking statements are based upon Mawson’s current expectations and

involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially

from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation,

the possibility of Mawson’s need and ability to raise additional capital, the development and acceptance of digital asset networks

and digital assets and their protocols and software, the reduction in incentives to mine digital assets over time, the costs associated

with digital asset mining, the volatility in the value and prices of cryptocurrencies, and further or new regulation of digital assets.

More detailed information about the risks and uncertainties affecting the Company is contained under the heading “Risk Factors”

included in the Company’s Annual Report on Form 10-K filed with the SEC on March 23, 2023, and Mawson’s Quarterly Report

on Form 10-Q filed with the SEC on May 15, 2023, August 21, 2023, and in other filings that the Company has made and may make with the

SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of the date on which

they were made. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed

or implied by such forward-looking statements. Mawson undertakes no obligation to update such statements to reflect events that occur

or circumstances that exist after the date on which they were made, except as may be required by law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Mawson Infrastructure Group Inc. |

| |

|

|

| Date: August 23, 2023 |

By: |

/s/ Rahul Mewawalla |

| |

|

Rahul Mewawalla |

| |

|

President & Chief Executive Officer |

-2-

Exhibit 99.1

Mawson Infrastructure Group Inc. Announces Monthly

Operational Update for July 2023

Total Revenue Equivalent in BTC Increased 23%

M/M

Total Operational Capacity as of July 31, 2023

was approximately 96 Megawatts

Capacity to support approximately 27,636 miners

Sharon, PA — August 22, 2023 —

Mawson Infrastructure Group Inc. (NASDAQ:MIGI) (“Mawson” or the “Company”), a digital infrastructure company,

announced today its unaudited business and operational update for July 2023.

Rahul Mewawalla, CEO and President, commented, “During

July, we continued to optimize our self-mining capabilities and throughput by enhancing our operational structure along with increased

emphasis on our hardware management and miner management software analysis and enhancements. Our uptime and miner performance has been

robust despite the increased summer temperatures. Interest from potential hosting customers has also been positive given our sites being

strategically located in the desirable PJM power market. Operational focus, information systems, competitive power, strategically located

sites, and Mawson’s capabilities to adapt to market dynamics are amongst the Company’s growing competitive advantages.”

2023 Strategic Focus

Mawson looks to continue to drive growth in 2023

through:

| 1. | Exploring expansion opportunities in the PJM energy markets, especially in Pennsylvania and Ohio. |

| 2. | Continue to secure a portfolio of sites in its preferred geographies and markets for long-term digital

infrastructure capacity. |

| 3. | Continue participation in the Energy Markets Program which generates additional revenue. |

| 4. | Develop strategic partnerships and commercial relationships within industry ecosystem. |

| 5. | Drive a diversified revenue mix of self-mining, hosting, and energy markets participation. |

| 6. | Continue drive towards our “Operational Excellence” management approach. |

June Bitcoin Self-Mining, Energy Market Program

& Hosting Co-location Results Update1:

| | |

May | | |

June | | |

July | | |

July Variance | |

| Total Revenue Equivalent in BTC3 | |

| 127 | | |

| 132 | | |

| 163 | | |

| +23 | % |

| Total Self-Mining BTC | |

| 67 | | |

| 71 | | |

| 69 | | |

| -2.8 | % |

| Total Installed2 Self- Miners | |

| 13,750 | | |

| 16,350 | | |

| 16,350 | | |

| - | |

| Total Available Owned Miners | |

| 20,000 | | |

| 20,000 | | |

| 20,000 | | |

| - | |

| Total Power Online | |

| 88 MW | | |

| 96 MW | | |

| 96 MW | | |

| - | |

| ● | Total

Revenue equivalent in BTC:1633 |

| ● | Total Self-Mining Bitcoin Production: 69 |

| ● | Approximately $4.89 M in Monthly Revenue for July 2023 |

| ● | Self-Mining Monthly Revenue: $2.07 M |

| ● | Hosting Co-location Monthly Revenue: $1.78M |

| ● | Energy Market Program Monthly Revenue: approximately $1.04M |

| ● | Total Power Online: 96MW |

| ● | Total revenue in BTC equivalent increased 23% M/M |

| 1 | All figures unaudited, and as of July 31, 2023. |

| 2 | “Installed” may include miners that are deployed

in Mawson’s datacenters but may not be online or hashing 100% of the time. |

| 3 | Revenue equivalent BTC is the total revenue of the company

for the period divided by the average BTC price. For the month of July, the figure used is $30,063.60. |

About Mawson Infrastructure

Mawson Infrastructure Group (NASDAQ: MIGI) is a digital infrastructure

company with multiple operations throughout the USA. Mawson’s vertically integrated model is based on a long-term strategy to promote

the global transition to the new digital economy. Mawson matches digital infrastructure, sustainable energy, and next-generation Mobile

Data Center (MDC) solutions, enabling efficient Bitcoin production and on-demand deployment of infrastructure assets. With a strong focus

on shareholder returns and strategic growth, Mawson Infrastructure Group is emerging as a global leader in ESG focused digital infrastructure

and Bitcoin mining.

For more information, visit: https://mawsoninc.com/

Statements about hashrate capacity

Statements in the press release about hashrate capacity (including

‘installed capacity’ or ‘nameplate capacity’), will often differ from the actual or observed hashrate. These

terms generally make certain assumptions about the efficiency of the ASIC miners that are in use. Some ASIC miner models will consume

less power to create the same amount of hashing power than other ASIC miner models (typically more recent models are more efficient).

Many ASIC miner fleets are blended fleets, including various ASIC miner models each with different efficiency ratings. Hashrate capacity

figures typically assume 100% deployment of ASIC miners. Given the large numbers of computing units (often numbering in the tens of thousands),

ASIC mining fleets are rarely 100% deployed and online at any one time. This can be due to a variety of factors, including ASIC miners

being under maintenance, in repair workshops, in storage, in transit, or due to technical faults and breakdowns. Once deployed and online,

the actual or observed hashrate can be influenced by other factors such as heat, overclocking (causing the ASIC miner to perform at levels

higher than the manufacturer’s specifications), the age, and wear and tear exhibited by the ASIC miners and also by the limitations

of the surrounding infrastructure, such as power outages, and MDC and transformer breakdowns. Construction and development delays are

a common risk for mining data centers, for example due to weather, permitting delays, or labor and equipment shortages. Investors should

consider all risk factors related to uptime when considering these figures, which are a best-case scenario.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Mawson cautions that statements in this press release that are not

a description of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such as “expect,”

“intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Because

such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking

statements. These forward-looking statements are based upon Mawson’s current expectations and involve assumptions that may never

materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such

forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the possibility that Mawson’s

need and ability to raise additional capital, the development and acceptance of digital asset networks and digital assets and their protocols

and software, the reduction in incentives to mine digital assets over time, the costs associated with digital asset mining, the volatility

in the value and prices of cryptocurrencies and further or new regulation of digital assets. More detailed information about the risks

and uncertainties affecting Mawson is contained under the heading “Risk Factors” included in Mawson’s Annual Report

on Form 10-K filed with the SEC on March 23, 2023, and Mawson’s Quarterly Report on Form 10-Q filed with the SEC on May 15, 2023,

August 21, 2023, and in other filings Mawson has made and may make with the SEC in the future. One should not place undue reliance on

these forward-looking statements, which speak only as of the date on which they were made. Because such statements are subject to risks

and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Mawson undertakes

no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made,

except as may be required by law.

Investor Contact:

Sandy Harrison

Chief Financial Officer

IR@mawsoninc.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

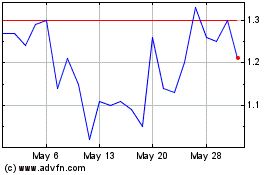

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Apr 2024 to May 2024

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From May 2023 to May 2024