false

0000926423

0000926423

2024-12-10

2024-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of Earliest Event Reported):

|

December 10, 2024

|

MIND Technology, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-13490

|

|

76-0210849

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

| |

|

|

|

|

| 2002 Timberloch Place, Suite 550, |

|

|

|

|

| The Woodlands, Texas |

|

|

|

77380 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

| |

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(281) 353-4475

|

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

MIND

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition.

On December 10, 2024, MIND Technology, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended October 31, 2024. The date and time for a conference call discussing the earnings are also included in the press release. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference into this Item 2.02.

The Company’s press release contains non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or GAAP. Pursuant to the requirements of Regulation G, the Company has provided within the press release quantitative reconciliations of certain non-GAAP financial measures to the most directly comparable GAAP financial measures.

The information in this Item 2.02 (including the press release attached as Exhibit 99.1 and incorporated by reference into Item 2.02) is being furnished, not filed, for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section, and will not be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), unless specifically identified therein as being incorporated therein by reference.

Item 7.01 Regulation FD Disclosure.

On December 10, 2024, the Company issued a press release announcing its financial results for the fiscal quarter ended October 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated by reference into Item 7.01. The information set forth under Item 2.02 above regarding the press release is incorporated herein by reference.

The information in this Item 7.01 (including the press release attached as Exhibit 99.1 and incorporated by reference into Item 7.01) is being furnished, not filed, for purposes of Section 18 of the Exchange Act, is not subject to the liabilities of that section, and will not be incorporated by reference into any filing under the Exchange Act or the Securities Act unless specifically identified therein as being incorporated therein by reference.

Cautionary Note Regarding Forward-Looking Statements

Certain of the statements contained in this report should be considered forward-looking statements. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Company’s Annual Report on Form 10-K (especially in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations) and Quarterly Reports on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”), and other risks and uncertainties listed from time to time in the Company’s other filings with the SEC. There may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.

Item 9.01 Financial Statements and Exhibits.

| |

Exhibit Number

|

Description

|

|

(d) Exhibits.

|

99.1

|

|

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

MIND Technology, Inc.

|

| |

|

|

|

| December 10, 2024 |

|

By:

|

/s/ Robert P. Capps

|

| |

|

|

|

| |

|

|

Name: Robert P. Capps

|

| |

|

|

Title: President and Chief Executive Officer

|

Exhibit 99.1

|

|

NEWS RELEASE

|

| |

Contacts:

|

|

Rob Capps, President & CEO

MIND Technology, Inc.

281-353-4475

|

| |

|

|

|

| |

|

|

Ken Dennard / Zach Vaughan

Dennard Lascar Investor Relations

713-529-6600

MIND@dennardlascar.com

|

MIND TECHNOLOGY, INC. REPORTS

FISCAL 2025 Third QUARTER RESULTS

THE WOODLANDS, TX – December 10, 2024 – MIND Technology, Inc. (NASDAQ: MIND) (“MIND” or the “Company”) today announced financial results for its fiscal 2025 third quarter ended October 31, 2024.

Revenues from continuing operations for the third quarter of fiscal 2025 were approximately $12.1 million compared to approximately $5.0 million in the third quarter of fiscal 2024. The Company reported operating income from continuing operations of approximately $1.9 million for the third quarter of fiscal 2025 compared to an operating loss of $1.5 million for the third quarter of fiscal 2024. Net income for the third quarter of fiscal 2025 amounted to $1.3 million compared to $568,000 in the third quarter of fiscal 2024. Third quarter of fiscal 2025 net income attributable to common shareholders (after the effect of the conversion of preferred stock into common stock) was $15.7 million, or $2.87 per share compared to a loss of $379,000, or a loss of $0.27 per share in the third quarter last year. Adjusted EBITDA from continuing operations for the third quarter of fiscal 2025 was approximately $2.0 million compared to a loss of $1.1 million in the third quarter of fiscal 2024.

Adjusted EBITDA from continuing operations, which is a non-GAAP measure, is defined and reconciled to reported net income (loss)and cash provided by (used) in operating activities in the accompanying financial tables. These are the most directly comparable financial measures calculated and presented in accordance with United States generally accepted accounting principles, or GAAP.

The backlog of Marine Technology Products related to our Seamap segment as of October 31, 2024 was approximately $26.2 million which was flat sequentially compared to backlog as of July 31, 2024.

Rob Capps, MIND’s President and Chief Executive Officer, stated, “We are very pleased to report that third quarter revenue grew 21% sequentially and 143% over last year’s third quarter. We continue to capitalize on macro tailwinds and customer engagement to stimulate order flow and generate improved results. We are also continually working to improve our execution, efficiency and cost structure, which we expect to contribute to sustained profitability in future quarters. As in the second quarter, we generated positive cash flow from operations in this quarter, increasing our cash balance to $3.5 million as of October 31, 2024.

“We have begun our fiscal fourth quarter with a strong backlog of approximately $26.2 million, essentially flat compared to our second quarter. Looking closer, however, we made substantial order deliveries during the third quarter that contributed to our 21% sequential revenue growth, and we were able to balance this growth with new orders. We expect this trend to continue in future periods and have an active pipeline of pending orders and other prospects that total more than twice our backlog of orders received. The combination of our improved capital structure, encouraging business environment, robust backlog and exceptional pipeline of opportunities gives us confidence for improved financial results in the coming quarters and fiscal year,” concluded Capps.

CONFERENCE CALL

Management has scheduled a conference call for Wednesday, December 11, 2024 at 9:00 a.m. Eastern Time (8:00 a.m. Central Time) to discuss the Company’s fiscal 2025 third quarter results. To access the call, please dial (412) 902-0030 and ask for the MIND Technology call at least 10 minutes prior to the start time. Investors may also listen to the conference call live on the MIND Technology website, http://mind-technology.com, by logging onto the site and clicking “Investor Relations”. A telephonic replay of the conference call will be available through December 18, 2024 and may be accessed by calling (201) 612-7415 and using passcode 13750138#. A webcast archive will also be available at http://mind-technology.com shortly after the call and will be accessible for approximately 90 days. For more information, please contact Dennard Lascar Investor Relations by email at MIND@dennardlascar.com.

ABOUT MIND TECHNOLOGY

MIND Technology, Inc. provides technology to the oceanographic, hydrographic, defense, seismic and security industries. Headquartered in The Woodlands, Texas, MIND has a global presence with key operating locations in the United States, Singapore, Malaysia, and the United Kingdom. Its Seamap unit designs, manufactures and sells specialized, high performance, marine exploration and survey equipment.

Forward-looking Statements

Certain statements and information in this press release concerning results for the quarter ended October 31, 2024 may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts of our existing operations and do not include the potential impact of any future acquisitions or dispositions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. These risks and uncertainties include, without limitation, reductions in our customers’ capital budgets, our own capital budget, limitations on the availability of capital or higher costs of capital and volatility in commodity prices for oil and natural gas.

For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, unless required by law, whether as a result of new information, future events or otherwise. All forward-looking statements included in this press release are expressly qualified in their entirety by the cautionary statements contained or referred to herein.

Non-GAAP Financial Measures

Certain statements and information in this press release contain non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or GAAP. Company management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. Company management also believes that these non-GAAP financial measures enhance the ability of investors to analyze the Company's business trends and to understand the Company's performance. In addition, the Company may utilize non-GAAP financial measures as guides in its forecasting, budgeting, and long-term planning processes and to measure operating performance for some management compensation purposes. Any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Reconciliation of Backlog, which is a non-GAAP financial measure, is not included in this press release due to the inherent difficulty and impracticality of quantifying certain amounts that would be required to calculate the most directly comparable GAAP financial measures.

Tables to Follow

MIND TECHNOLOGY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

| |

|

October 31, 2024

|

|

|

January 31, 2024

|

|

|

ASSETS

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

3,505 |

|

|

$ |

5,289 |

|

|

Accounts receivable, net of allowance for credit losses of $332 at each of October 31, 2024 and January 31, 2024

|

|

|

9,471 |

|

|

|

6,566 |

|

|

Inventories, net

|

|

|

17,249 |

|

|

|

13,371 |

|

|

Prepaid expenses and other current assets

|

|

|

1,039 |

|

|

|

3,113 |

|

|

Total current assets

|

|

|

31,264 |

|

|

|

28,339 |

|

|

Property and equipment, net

|

|

|

775 |

|

|

|

818 |

|

|

Operating lease right-of-use assets

|

|

|

1,526 |

|

|

|

1,324 |

|

|

Intangible assets, net

|

|

|

2,420 |

|

|

|

2,888 |

|

|

Deferred tax asset

|

|

|

122 |

|

|

|

122 |

|

|

Total assets

|

|

$ |

36,107 |

|

|

$ |

33,491 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

2,179 |

|

|

$ |

1,623 |

|

|

Deferred revenue

|

|

|

248 |

|

|

|

203 |

|

|

Customer deposits

|

|

|

3,112 |

|

|

|

3,446 |

|

|

Accrued expenses and other current liabilities

|

|

|

1,742 |

|

|

|

2,140 |

|

|

Income taxes payable

|

|

|

2,093 |

|

|

|

2,114 |

|

|

Operating lease liabilities - current

|

|

|

660 |

|

|

|

751 |

|

|

Total current liabilities

|

|

|

10,034 |

|

|

|

10,277 |

|

|

Operating lease liabilities - non-current

|

|

|

866 |

|

|

|

573 |

|

|

Total liabilities

|

|

|

10,900 |

|

|

|

10,850 |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value; 2,000 shares authorized; no shares issued and outstanding at October 31, 2024 and 1,683 shares issued and outstanding at January 31, 2024

|

|

|

— |

|

|

|

37,779 |

|

|

Common stock, $0.01 par value; 40,000 shares authorized; 7,969 shares issued and outstanding at October 31, 2024 and 1,406 shares issued and outstanding at January 31, 2024

|

|

|

80 |

|

|

|

14 |

|

|

Additional paid-in capital

|

|

|

135,572 |

|

|

|

113,121 |

|

|

Accumulated deficit

|

|

|

(110,479 |

) |

|

|

(128,307 |

) |

|

Accumulated other comprehensive gain

|

|

|

34 |

|

|

|

34 |

|

|

Total stockholders’ equity

|

|

|

25,207 |

|

|

|

22,641 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

36,107 |

|

|

$ |

33,491 |

|

MIND TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| |

For the Three Months Ended October 31,

|

|

For the Nine Months Ended October 31,

|

|

| |

2024

|

|

2023

|

|

2024

|

|

2023

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales of marine technology products

|

$ |

12,105 |

|

$ |

4,974 |

|

|

31,819 |

|

|

23,132 |

|

|

Cost of sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales of marine technology products

|

|

6,684 |

|

|

2,721 |

|

|

17,402 |

|

|

13,402 |

|

|

Gross profit

|

|

5,421 |

|

|

2,253 |

|

|

14,417 |

|

|

9,730 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

2,762 |

|

|

2,941 |

|

|

8,305 |

|

|

9,160 |

|

|

Research and development

|

|

562 |

|

|

508 |

|

|

1,352 |

|

|

1,479 |

|

|

Depreciation and amortization

|

|

221 |

|

|

257 |

|

|

724 |

|

|

892 |

|

|

Total operating expenses

|

|

3,545 |

|

|

3,706 |

|

|

10,381 |

|

|

11,531 |

|

|

Operating income (loss)

|

|

1,876 |

|

|

(1,453 |

) |

|

4,036 |

|

|

(1,801 |

) |

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

— |

|

|

(169 |

) |

|

— |

|

|

(536 |

) |

|

Other, net

|

|

(189 |

) |

|

25 |

|

|

320 |

|

|

336 |

|

|

Total other income (expense)

|

|

(189 |

) |

|

(144 |

) |

|

320 |

|

|

(200 |

) |

|

Income (loss) from continuing operations before income taxes

|

|

1,687 |

|

|

(1,597 |

) |

|

4,356 |

|

|

(2,001 |

) |

|

Provision for income taxes

|

|

(396 |

) |

|

(112 |

) |

|

(1,313 |

) |

|

(590 |

) |

|

Net income (loss) from continuing operations

|

|

1,291 |

|

|

(1,709 |

) |

|

3,043 |

|

|

(2,591 |

) |

|

Income from discontinued operations, net of income taxes

|

|

— |

|

|

2,277 |

|

|

— |

|

|

1,424 |

|

|

Net income (loss)

|

$ |

1,291 |

|

$ |

568 |

|

$ |

3,043 |

|

$ |

(1,167 |

) |

|

Preferred stock dividends - declared

|

|

— |

|

|

(947 |

) |

|

— |

|

|

(947 |

) |

|

Preferred stock dividends - undeclared

|

|

(368 |

) |

|

— |

|

|

(2,262 |

) |

|

(1,894 |

) |

|

Effect of preferred stock conversion

|

|

14,785 |

|

|

— |

|

|

14,785 |

|

|

— |

|

|

Net Income (loss) attributable to common stockholders

|

$ |

15,708 |

|

$ |

(379 |

) |

$ |

15,566 |

|

$ |

(4,008 |

) |

|

Net Income (loss) per common share - Basic and Diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

$ |

2.87 |

|

$ |

(1.89 |

) |

$ |

5.62 |

|

$ |

(3.86 |

) |

|

Discontinued operations

|

$ |

— |

|

$ |

1.62 |

|

$ |

— |

|

$ |

1.01 |

|

|

Net income (loss)

|

$ |

2.87 |

|

$ |

(0.27 |

) |

$ |

5.62 |

|

$ |

(2.85 |

) |

|

Shares used in computing net income (loss) per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

5,473 |

|

|

1,406 |

|

|

2,772 |

|

|

1,406 |

|

MIND TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| |

|

For the Nine Months Ended October 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

3,043 |

|

|

$ |

(1,167 |

) |

|

Adjustments to reconcile net income (loss) to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

724 |

|

|

|

1,230 |

|

|

Stock-based compensation

|

|

|

141 |

|

|

|

264 |

|

|

Gain on sale of Klein

|

|

|

— |

|

|

|

(2,393 |

) |

|

Provision for inventory obsolescence

|

|

|

67 |

|

|

|

23 |

|

|

Gross profit from sale of other equipment

|

|

|

(457 |

) |

|

|

(385 |

) |

|

Changes in:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(3,006 |

) |

|

|

(688 |

) |

|

Unbilled revenue

|

|

|

164 |

|

|

|

51 |

|

|

Inventories

|

|

|

(3,944 |

) |

|

|

(3,174 |

) |

|

Prepaid expenses and other current and long-term assets

|

|

|

2,076 |

|

|

|

566 |

|

|

Income taxes receivable and payable

|

|

|

(24 |

) |

|

|

(21 |

) |

|

Accounts payable, accrued expenses and other current liabilities

|

|

|

98 |

|

|

|

(1,045 |

) |

|

Deferred revenue and customer deposits

|

|

|

(289 |

) |

|

|

1,115 |

|

|

Net cash used in operating activities

|

|

|

(1,407 |

) |

|

|

(5,624 |

) |

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(213 |

) |

|

|

(199 |

) |

|

Proceeds from the sale of Klein, net

|

|

|

— |

|

|

|

10,832 |

|

|

Sale of other equipment

|

|

|

457 |

|

|

|

385 |

|

|

Net cash provided by investing activities

|

|

|

244 |

|

|

|

11,018 |

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Preferred stock conversion transaction costs

|

|

|

(619 |

) |

|

|

— |

|

|

Net proceeds from short-term loan

|

|

|

— |

|

|

|

2,947 |

|

|

Payment on short-term loan

|

|

|

— |

|

|

|

(3,750 |

) |

|

Refund of prepaid interest on short-term loan

|

|

|

— |

|

|

|

214 |

|

|

Net cash used in financing activities

|

|

|

(619 |

) |

|

|

(589 |

) |

|

Effect of changes in foreign exchange rates on cash and cash equivalents

|

|

|

(2 |

) |

|

|

(14 |

) |

|

Net change in cash and cash equivalents

|

|

|

(1,784 |

) |

|

|

4,791 |

|

|

Cash and cash equivalents, beginning of period

|

|

|

5,289 |

|

|

|

778 |

|

|

Cash and cash equivalents, end of period

|

|

$ |

3,505 |

|

|

$ |

5,569 |

|

MIND TECHNOLOGY, INC.

Reconciliation of Net Income (Loss) and Net Cash Used in Operating Activities to EBITDA and

Adjusted EBITDA from Continuing Operations

(in thousands)

(unaudited)

| |

|

For the Three Months Ended October 31,

|

|

|

For the Nine Months Ended October 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Reconciliation of Net income (loss) to EBITDA and Adjusted EBITDA from continuing operations

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

1,291 |

|

|

$ |

568 |

|

|

$ |

3,043 |

|

|

$ |

(1,167 |

) |

|

Interest expense, net

|

|

|

— |

|

|

|

169 |

|

|

|

— |

|

|

|

536 |

|

|

Depreciation and amortization

|

|

|

221 |

|

|

|

290 |

|

|

|

724 |

|

|

|

1,230 |

|

|

Provision for income taxes

|

|

|

396 |

|

|

|

112 |

|

|

|

1,313 |

|

|

|

590 |

|

|

EBITDA (1)

|

|

|

1,908 |

|

|

|

1,139 |

|

|

|

5,080 |

|

|

|

1,189 |

|

|

Stock-based compensation

|

|

|

47 |

|

|

|

106 |

|

|

|

141 |

|

|

|

264 |

|

|

Income from discontinued operations net of depreciation and amortization

|

|

|

— |

|

|

|

(2,308 |

) |

|

|

— |

|

|

|

(1,762 |

) |

|

Adjusted EBITDA from continuing operations (1)

|

|

$ |

1,955 |

|

|

$ |

(1,063 |

) |

|

$ |

5,221 |

|

|

$ |

(309 |

) |

|

Reconciliation of Net Cash Provided by (Used in) Operating Activities to EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

$ |

2,288 |

|

|

$ |

(2,147 |

) |

|

$ |

(1,407 |

) |

|

$ |

(5,624 |

) |

|

Gain on Sale of Klein

|

|

|

— |

|

|

|

2,393 |

|

|

|

— |

|

|

|

2,393 |

|

|

Stock-based compensation

|

|

|

(47 |

) |

|

|

(106 |

) |

|

|

(141 |

) |

|

|

(264 |

) |

|

Provision for inventory obsolescence

|

|

|

(22 |

) |

|

|

(23 |

) |

|

|

(67 |

) |

|

|

(23 |

) |

|

Changes in accounts receivable (current and long-term)

|

|

|

(115 |

) |

|

|

(2,570 |

) |

|

|

2,842 |

|

|

|

637 |

|

|

Interest paid, net

|

|

|

— |

|

|

|

169 |

|

|

|

— |

|

|

|

576 |

|

|

Taxes paid, net of refunds

|

|

|

473 |

|

|

|

192 |

|

|

|

1,411 |

|

|

|

617 |

|

|

Gross profit from sale of other equipment

|

|

|

— |

|

|

|

49 |

|

|

|

457 |

|

|

|

385 |

|

|

Changes in inventory

|

|

|

(1,798 |

) |

|

|

2,841 |

|

|

|

3,944 |

|

|

|

3,174 |

|

|

Changes in accounts payable, accrued expenses and other current liabilities and deferred revenue

|

|

|

2,161 |

|

|

|

(427 |

) |

|

|

191 |

|

|

|

(70 |

) |

|

Changes in prepaid expenses and other current and long-term assets

|

|

|

(1,034 |

) |

|

|

763 |

|

|

|

(2,076 |

) |

|

|

(566 |

) |

|

Other

|

|

|

2 |

|

|

|

5 |

|

|

|

(74 |

) |

|

|

(46 |

) |

|

EBITDA (1)

|

|

$ |

1,908 |

|

|

$ |

1,139 |

|

|

$ |

5,080 |

|

|

$ |

1,189 |

|

| |

1.

|

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA is defined as net income before (a) interest income and interest expense, (b) provision for (or benefit from) income taxes and (c) depreciation and amortization. Adjusted EBITDA excludes non-cash foreign exchange gains and losses, stock-based compensation, impairment of intangible assets and other non-cash tax related items. We consider EBITDA and Adjusted EBITDA to be important indicators for the performance of our business, but not measures of performance or liquidity calculated in accordance with GAAP. We have included these non-GAAP financial measures because management utilizes this information for assessing our performance and liquidity, and as indicators of our ability to make capital expenditures, service debt and finance working capital requirements and we believe that EBITDA and Adjusted EBITDA are measurements that are commonly used by analysts and some investors in evaluating the performance and liquidity of companies such as us. In particular, we believe that it is useful to our analysts and investors to understand this relationship because it excludes transactions not related to our core cash operating activities. We believe that excluding these transactions allows investors to meaningfully trend and analyze the performance of our core cash operations. EBITDA and Adjusted EBITDA are not measures of financial performance or liquidity under GAAP and should not be considered in isolation or as alternatives to cash flow from operating activities or as alternatives to net income as indicators of operating performance or any other measures of performance derived in accordance with GAAP. In evaluating our performance as measured by EBITDA, management recognizes and considers the limitations of this measurement. EBITDA and Adjusted EBITDA do not reflect our obligations for the payment of income taxes, interest expense or other obligations such as capital expenditures. Accordingly, EBITDA and Adjusted EBITDA are only two of the measurements that management utilizes. Other companies in our industry may calculate EBITDA or Adjusted EBITDA differently than we do and EBITDA and Adjusted EBITDA may not be comparable with similarly titled measures reported by other companies.

|

v3.24.3

Document And Entity Information

|

Dec. 10, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MIND Technology, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 10, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-13490

|

| Entity, Tax Identification Number |

76-0210849

|

| Entity, Address, Address Line One |

2002 Timberloch Place

|

| Entity, Address, City or Town |

The Woodlands

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77380

|

| City Area Code |

281

|

| Local Phone Number |

353-4475

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MIND

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000926423

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

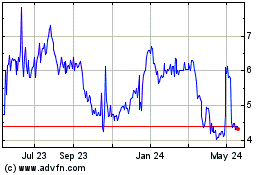

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From Jan 2025 to Feb 2025

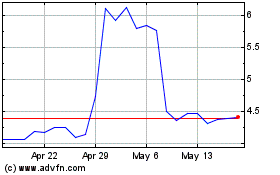

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From Feb 2024 to Feb 2025