0001289419false00012894192024-12-132024-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 13, 2024

MORNINGSTAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Illinois (State or other jurisdiction of incorporation) | 000-51280 (Commission File Number)

| 36-3297908 (I.R.S. Employer Identification No.) |

| | 22 West Washington Street Chicago, Illinois (Address of principal executive offices) |

60602 (Zip Code) |

| | (312) 696-6000 (Registrant’s telephone number, including area code) | |

|

N/A | | |

(Former name or former address, if changed since last report) __________________________________

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common stock, no par value | MORN | The Nasdaq Stock Market LLC |

Item 7.01. Regulation FD Disclosure

In accordance with Morningstar, Inc.’s (the “Company”) policy regarding public disclosure of corporate information, Investor questions primarily received by the Company through November 1, 2024, and Company responses (the “Investor Q&A”) are attached to this Current Report on Form 8-K (this “Report”) as Exhibit 99.1 and incorporated herein by reference. The Investor Q&A shall be deemed furnished, not filed, for purposes of this Report.

Caution Concerning Forward-Looking Statements

This Report, including the document incorporated by reference herein, contains forward-looking statements as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as "consider,” “estimate,” “forecast,” “future,” “goal,” “designed to,” “maintain,” “may,” “objective,” “ongoing,” “could,” “expect,” “intend,” “plan,” “possible,” “potential,” “anticipate,” “believe,” “predict,” “continue,” “strategy,” “strive,” “will,” “would,” "determine," "evaluate," or the negative thereof, and similar expressions. These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. For us, these risks and uncertainties include, among others:

• failing to maintain and protect our brand, independence, and reputation;

• failure to prevent and/or mitigate cybersecurity events and the failure to protect confidential information, including personal information about individuals;

• compliance failures, regulatory action, or changes in laws applicable to our credit ratings operations, investment advisory, environmental, social, and governance (ESG), and index businesses;

• failing to innovate our product and service offerings or anticipate our clients’ changing needs;

• the impact of artificial intelligence (AI) and related new technologies on our business, legal, and regulatory exposure profile and reputation;

• failure to detect errors in our products or failure of our products to perform properly due to defects, malfunctions or similar problems;

• failing to recruit, develop, and retain qualified employees;

• prolonged volatility or downturns affecting the financial sector, global financial markets, and the global economy and its effect on our revenue from asset-based fees and credit ratings business;

• failing to scale our operations and increase productivity in order to implement our business plans and strategies;

• liability for any losses that result from errors in our automated advisory tools or errors in the use of the information and data we collect;

• inadequacy of our operational risk management, business continuity programs and insurance coverage in the event of a material disruptive event;

• failing to close, or achieve the anticipated economic or other benefits of, a strategic transaction on a timely basis or at all;

• failing to efficiently integrate and leverage acquisitions and other investments, which may not realize the expected business or financial benefits, to produce the results we anticipate;

• failing to maintain growth across our businesses in today's fragmented geopolitical, regulatory and cultural world;

• liability relating to the information and data we collect, store, use, create, and distribute or the reports that we publish or are produced by our software products;

• the potential adverse effect of our indebtedness on our cash flows and financial and operational flexibility;

• challenges in accounting for tax complexities in the global jurisdictions we operate in could materially affect our tax obligations and tax rates; and

• failing to protect our intellectual property rights or claims of intellectual property infringement against us.

A more complete description of these risks and uncertainties can be found in our filings with the Securities and Exchange Commission (SEC), including our most recent Reports on Form 10-K and 10-Q. If any of these risks and uncertainties materialize, our actual future results and other future events may vary significantly from what we expect. We do not undertake to update our forward-looking statements as a result of new information, future events, or otherwise, except as may be required by law. You are advised to review any further disclosures we make on related subjects, and about new or additional risks, uncertainties, and assumptions in our filings with the SEC on Forms 10-K, 10-Q, and 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

_____________________________________________________________________________________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | MORNINGSTAR, INC. |

| Date: December 13, 2024 | | By:/s/ Jason Dubinsky |

| | Name: Jason Dubinsky |

| | Title: Chief Financial Officer |

Investor Questions and Answers: December 13, 2024 We encourage current shareholders, potential shareholders, and other interested parties to send questions to us in writing and we make written responses available on a periodic basis. The following answers respond to selected questions primarily received through November 1, 2024. We retain the discretion to combine answers for duplicate or similar questions into one comprehensive response. If you would like to submit a question, please send an e-mail to investors@morningstar.com or write to us at the following address: Morningstar Inc. Investor Relations 22 W. Washington Chicago, IL 60602 Management Transitions 1. Following the announcement that Jason Dubinsky would be stepping down as CFO effective December 31, 2024, we received a number of questions addressing our CFO search process, transition, and the finance team. We’ve provided a consolidated response below. On Tuesday, December 10th, Morningstar announced that Michael Holt, current Morningstar Chief Strategy Officer and President of Research & Investments, was named Chief Financial Officer, effective January 1, 2025. In selecting Michael as our next CFO, we followed a rigorous selection process, which included interviews with internal and external candidates. As previously noted, Jason will step down at the end of 2024 to pursue other interests and will be engaged in a consulting role to support a smooth transition through June 30, 2025. Michael brings expertise in a number of key areas, including company strategy and analysis, as well as deep insight into Morningstar’s operations. In his 15-plus years at Morningstar, he’s built a track record of managing high-performing teams and working across Morningstar to drive results. Michael has been Morningstar’s chief strategy officer for the past seven years and has been president of the Research and Investments group since 2023, where he oversees a 400-person team responsible for Morningstar’s equity and managed investment analysis and ratings as well as portfolio construction for the company’s investment management capabilities. Michael has a master’s degree in business administration from the University of Chicago Booth School of Business, and a bachelor’s degree in business from Indiana University. Michael’s expertise complements that of the finance senior leadership team, which has experience in a wide range of key finance functions, including financial planning and analysis, accounting and controllership, tax, treasury, investor relations, internal audit, procurement, and real estate. We expect continuity in our strategy through the CFO transition. We will continue to focus on growing our adjusted operating income and free cash flow to increase shareholder value. Margins and Expense Trends 2. What have the historical adjusted operating margins been for PitchBook and what has the historical incremental operating margins been for PitchBook? What are the incremental operating margins for the Wealth, Retirement, and PitchBook segments? With the introduction of our current segment reporting earlier this year, we reported three years of revenue, adjusted operating income, and adjusted operating margin for each of our reportable segments, including PitchBook, on an annual basis going back to 2021. This detail is available in our 2023 10-K. We also shared historical quarterly revenue, adjusted operating income, and adjusted operating margin for 2022 and 2023 on page 30 of our Q1 24 supplemental deck, which is available at shareholders.morningstar.com/investor-relations/financials/financial-summary/default.asp. While we do not disclose incremental margins, we have noted that in general we have seen strong margin expansion over time in our license-based products where we have established more significant operating leverage. You can see this over the last three years in PitchBook and historically in Morningstar Data and Analytics. Here, we develop platforms or

products that can be broadly sold across customer segments and geography (such as Morningstar Direct, Morningstar Data, and the PitchBook platform). In our asset-based products, we benefit from improvements in incremental margins as we reach higher levels of assets under management. For example, our managed account offering in Morningstar Retirement has a large installed base of retirement participants and record keepers operating on similar platforms and capabilities that we have developed. That has led to margin expansion over time and Morningstar Retirement now has the highest margin among our segments. In Morningstar Wealth, we have seen margin improvement as assets grow in Investment Management and we expect improvements in profitability following the AssetMark transaction transition period which will wind down as clients and assets in the Morningstar Wealth Turnkey Asset Management Program (TAMP) transfer to AssetMark. 3. When you reference returning to or exceeding historical peak margins, are you referring to your peak quarterly or annual margin? Could you provide clarity on returning to "peak margin"? How do you plan on expanding margin? Should we expect additional headcount reductions? During his presentation at the Annual Shareholder Meeting, our CFO, Jason Dubinsky, noted that our goal was to increase our adjusted operating margins to recent historical peaks and higher. He was referring to annual adjusted operating margin; recent annual peaks have been in the low 20 percent range. (The slide to which Jason was referring when he made his comments, is on page 60 of the presentation, which is available on the Events and Presentations page of our investor relations website at shareholders.morningstar.com.) Over the long term, we are focused on increasing revenues at a faster rate than our adjusted operating expenses, with the goal of margin expansion and increasing free cash flow over time. We do not share headcount projections, but as you can see, we have been focused on prudent management of our headcount and overall expenses, which has been an important contributor to the margin expansion so far in 2024. 4. Now that Operating Margins are returning to historical levels (and are thus less volatile), are there seasonal reasons why certain quarters should have higher or lower operating margins than others (all else equal)? While there is limited revenue seasonality across most of our business, we can experience more prominent swings in margins in certain areas if credit or financial markets experience heightened volatility. You can see that in the past in our asset-based and transaction-based areas, notably in 2022 and into 2023. So far in 2024, significant increases in credit issuance volume and related operating leverage have been important drivers of increases in our adjusted operating margins. Specific to Morningstar Credit, while each year is different, we typically see higher levels of credit issuance and resulting revenue in the second and fourth quarters of the year, and somewhat lower levels of issuance and revenue in the first and third quarters, which can contribute to margin fluctuation. In addition, the timing of certain accruals, including incentive plan accruals which are tied to financial performance, can have an impact on sequential, quarter-to-quarter margin trends. As a result, we are focused on year-over-year performance and it’s best to look at our year- to-date and fiscal year margin trends rather than focusing on any specific quarter. Capital Allocation 5. Considering Morningstar’s low (and decreasing) leverage and lack of appetite for transformational M&A, why hasn’t more capital been returned to shareholders? How does Morningstar decide between raising the dividend and share repurchases? Given leverage levels have come down significantly at Morningstar along with overall interest rates how should we think about your priorities with regards to capital allocation today? Do you expect share purchases to play a bigger role in capital deployment, similar to how you utilized them in 2022? Why or why not? Will we have to wait for a new CFO to get an update on your capital allocation priorities? How much further does debt need to decrease before you think about buying back stock as a use of free cash? What is keeping you from buying back shares at this point under your current authorization? Our long-term capital allocation priorities are as follows: - We seek to preserve a strong balance sheet to maintain flexibility; - We will prioritize funding organic growth and consider acquisitions where we see opportunities to generate long- term shareholder value;

- We aim to maintain and increase our dividend over time commensurate with company financial results; and - We look to repurchase shares when we have available cash and will accelerate that activity opportunistically when we believe that our shares are substantially undervalued. With the 2022 acquisition of Leveraged Commentary & Data (LCD), which we financed with debt, we saw a substantial increase in our leverage. As a result of that increase and higher interest rates, over the past 18 months we have been focused on paying down debt. As you note, our leverage has come down significantly, with consolidated funded indebtedness to EBITDA standing at approximately 1.2x as of September 30, 2024. Given current leverage levels, we are carefully assessing our best use of cash consistent with the above long-term priorities. One outcome of this evaluation was the announcement that we would increase our quarterly dividend by 12.3% from 40.5 cents per share to 45.5 cents per share in 2025. We also have ample room under our current repurchase program to make share repurchases. We report on share repurchase activity quarterly in our 10-Q and 10-K filings. 6. What will Net Debt/EBITDA be once the TAMP/Asset Mark and Commodity & Energy Data divestitures close? Our consolidated funded indebtedness to EBITDA as defined in our credit agreements was approximately 1.2x as of September 2024, down from approximately 2.5x as of March 31, 2023. If we determine to use the proceeds from the AssetMark transaction and the sale of our Commodity and Energy Data business to repay debt, you could see our leverage ratios come down further. Divestitures 7. You announced that you had sold your Commodity and Energy data business with your Q3 24 results. Are there further opportunities to divest sub-scale/non-core businesses within the portfolio? Are you considering alternatives for any other segments within your business? On an ongoing basis, we evaluate our product portfolio to allocate investment to the best opportunities for widening our economic moat and driving long-term value creation. As you note, we completed the sale of our Commodity and Energy data business in Q3 24. In addition, effective December 1, 2024, we closed the disposition to AssetMark of roughly $12 billion in assets administered on Morningstar’s Turnkey Asset Management Platform (TAMP) and we plan to sunset our TAMP after clients and assets transition to AssetMark. Cash Flows 8. Has there been a renewed focus on getting accounts receivable paid faster? Your DSOs continue to come down, what are the key drivers of that? We have long been focused on cash collections and improving working capital. That focus has included shortening certain billing cycles, payment terms, and adding tools and capacity to drive greater efficiencies in our collections process. That said, in any given quarter, our accounts receivables and days sales outstanding (DSO) can be influenced by the mix of segment contributions to revenue as well as by other factors. We tend to focus on a trailing 12-month measurement for DSO in our finance operations. Morningstar Employees 9. What is the average tenure of an employee at Morningstar? We reported our average employee tenure in our 2023 Corporate Sustainability Report, which is available at Morningstar.com/company/corporate-sustainability. As of December 31, 2023, our average employee tenure was 4.4 years. Asset-based 10. Why was Investment Management and Retirement’s topline growth slower than AUM/AUA growth? Did fees compress? Morningstar Retirement revenue grew 14.8% on a reported and organic basis in Q3 24 compared to the prior-year period, while the Investment Management product area grew 14.5% or 13.3% on an organic basis. Over the same period, Morningstar Retirement AUMA grew 24.2%, while Investment Management AUMA grew 25.6%.

The gap you observe in revenue growth compared to AUMA growth is due to several factors. First, revenue is based on quarter-end, prior-quarter end, or average asset levels during each quarter, which are often reported on a one-quarter lag for certain products. The timing of this client asset reporting and the structure of our contracts often results in a lag between changes in AUMA and the impact on revenue. This lag was a meaningful driver for Investment Management; AUMA growth for that product area was 11.3% in Q2 24, which was more closely in line with Q3 24 revenue growth. In Morningstar Retirement, there were several other factors at play. First, a small portion of revenue in the segment is tied to a flat fee and therefore does not increase with AUMA. Second, our tiered fee structures result in lower fees on higher balances. Finally, during the period, we saw AUMA growth in certain accounts with lower fee structures. Morningstar Credit 11. While it is encouraging that Morningstar Credit margins are higher and business is coming from private and middle market issuance, the structured credit ratings business overall still lags behind its competitors five years into the merger. What strategic plans does the company have to change this and grow the business overall? Following a period of softness as credit issuance declined sharply in the second half of 2022 and into 2023, Morningstar Credit revenue increased 35.7% in the nine months ended September 30, 2024, compared to the prior-year period. Overall, we have been pleased with our growth in the parts of the structured credit market where we are active, including in commercial mortgage-backed securities, asset-backed securities, and residential mortgage-backed securities. In these sectors, we have benefitted from the introduction of new methodologies, especially in residential mortgage-backed securities and asset-backed securities. That said, we do not have a significant business in rating collateralized loan obligations, while our largest competitors are more active in this sector, which has helped drive their growth. We continue to see opportunities to grow in structured credit, including in areas where we’ve introduced new methodologies and in the funds credit rating space. In corporate ratings, we continue to see attractive prospects in private and middle market corporates in the U.S. and Europe. 12. I wanted to understand the operational leverage within Morningstar Credit. If I look at Q3 24, the revenues are down vs. Q2 by ~$7m but operating profit is down ~$13m. Equally if we look YoY or vs. Q1 24 the operational leverage is disappointing - or at least not as impressive as the first half of 2024. What has changed and is this temporary (timing) or a more structural change? How should we think about mid-term operating margins in the Credit business? What drove the sequential increase in Credit operating costs? Do you expect operating costs to be similar to Q3 24 run-rate on a go-forward basis? We are trying to understand run-rate costs given quarterly variability in issuances. As you note, while Morningstar Credit revenues increased $18.0 million in Q3 24 compared to the prior-year period, they were roughly $6.7 million lower in Q3 24 compared to Q2 24 due to the different quarterly market issuance patterns. Morningstar Credit has significant operating leverage and as a result, adjusted operating income and adjusted operating margins are sensitive to changes in ratings volume and the corresponding impact on revenues. In addition, we see fluctuations in certain expense line items from quarter to quarter. The Morningstar Credit segment adjusted operating income declined $12.7 million to $15.2 million in Q3 24 compared to Q2 24. In particular, the bonus accrual for Morningstar Credit increased in Q3 24 compared to Q2 24, reflecting stronger year-to-date performance relative to targets. After taking into account the decline in revenue between Q2 24 and Q3 24, the increased bonus accrual was responsible for the majority of the sequential decrease in adjusted operating income. Morningstar Credit’s year-to-date results through September 2024 are more reflective of the segment’s profitability in comparison to the prior-year period. Morningstar Data and Analytics 13. Can you elaborate on why Advisor Workstation declined this quarter? The press release mentioned “an evolving product strategy”, what does that mean? Would Advisor Workstation product line decline YOY in future periods as a result of this change? Morningstar Advisor Workstation revenue declined 2.8% in Q3 24, or 2.3% on an organic basis compared to the prior- year period. This decline was due in part to changes in our product strategy for the App Hub. The App Hub is a two-sided digital marketplace initially introduced in 2022 which allows clients access to third-party applications that are connected into Advisor Workstation. It was designed to provide advisors access to adjacent workflows and complementary solutions

as part of Advisor Workstation experience. Based on our learnings over the past 18 months, we've adjusted our strategy to only partner with solutions that are closely connected to our core strategy and directly connected to the Advisor workflow. As a result, we are working with fewer partners going forward who are core to our strategy and directly enhance an advisor’s workflow. This shift had a negative impact on associated revenues in Q3 24. In addition, we experienced product delays which impacted the delivery of an upgraded version of Advisor Workstation and has had an impact on renewals and new client acquisition. We expect to deliver the upgrade in early 2025. Finally, softness in Advisor Workstation also reflected a more challenging environment as clients, especially in our enterprise client segment, tightened certain spending ahead of the U.S. elections as they waited to see how the election played out before committing additional investments in regulatory related solutions. 14. Noted that a large client brought research distribution coverage in-house; how big was this customer and what type of client are they? What caused them to insource at this time and how long were they a MORN customer? How big is the research distribution business from a quarterly revenue perspective? What is “Research Distribution”? While increased revenues for Morningstar Direct and Morningstar Data contributed to Morningstar Data and Analytics 5.2% revenue growth in Q3 24 compared to the prior-year period, we did see some softness in research distribution, as well as in Morningstar Advisor Workstation, which is addressed in a separate response this month. Our research distribution product includes the licensing and packaging of our research, including ratings, written analysis and reports, and other content produced by our equity research, manager research and quantitative research teams. This offering is sold to firms across the investing ecosystem, typically wealth and asset managers and institutions. The recent softness was largely driven by a client loss. The client in question was a large global bank who had been with us since 2019 and sourced our equity research and distributed it to buyside clients. The client ultimately made the strategic decision to stop using third-party research and to bring all research in house. The research distribution product suite accounted for roughly 5% of Morningstar Data and Analytics revenue for the trailing 12 months ended September 2024. While we license our research directly, we’d note that our research is also a critical component of our broader offering, distributed to a number of different client segments including individuals, financial advisors and wealth managers, asset managers, and institutions through other products including Morningstar Direct, Morningstar Advisor Workstation, Morningstar Office, Morningstar Investor, and PitchBook. 15. Can you quantify the other pieces of Morningstar Data and Analytics outside of Data, Direct, and Advisor Workstation from a revenue perspective? We know it includes direct web services, research distribution, and publishing systems, but it would be helpful to understand the respective size of those businesses. For the trailing 12 months ended September 2024, Morningstar Data, Morningstar Direct, and Morningstar Advisor Workstation together accounted for roughly 80% of Morningstar Data and Analytics revenue. In order of size, the next three largest product areas were: - Profiles and Morningstar Direct Reporting, which includes the Morningstar Publishing System. These products allow clients to harness Morningstar data and analytics to create and distribute a wide range of reports for every phase of a product’s life cycle, from product creation and internal recommendations to client sales and end investor reporting including regulatory and compliance requirements; - Direct Web Services (formerly Dynamic Service APIs and Morningstar Enterprise Components), a product that features built-in, on-the-fly services for calculations aggregations that help institutional clients build customized websites or enhance their existing solutions enriched with Morningstar’s independent data and research; and - Morningstar Research Distribution, which includes licensing and packaging of our research, including ratings, written analysis and reports, and other content produced by our equity research, manager research, and quantitative research teams. These three products are similar in size and, together with Morningstar Data, Morningstar Direct, and Advisor Workstation, accounted for more than 95% of Morningstar Data and Analytics revenue.

16. What drove the improvement in Q3 24 performance relative to Q2 24 in Morningstar Data? What is exchange market data and what is “broadcast feed” product? Could you help us understand how material exchange market data is to the business? Morningstar Data revenue of $76.6 million in Q3 24 represented an increase of $4.1 million or roughly 5.7% from Q2 24. Growth was driven by multiple products, with the largest contributions to sequential (quarter-over-quarter) growth coming from managed investment (fund) data and exchange market data, although the exchange market data product was still soft compared to the prior-year period. As part of our licensed data offerings, Morningstar offers real-time, streaming market data from roughly 200 global exchanges. The primary data set offered is live streaming equity price data, as well as open, high, low, and close prices, and trading volumes. This capability represents a small portion of our overall licensed data revenue, and market data is often consumed alongside our other data and content. We deliver the data both through web-based APIs as well as via dedicated leased lines connecting our client sites to our datacenters, in order to deliver the data with minimal latency. The latter is what we call our broadcast feed offering and represents a legacy service that is more infrastructure intensive than our web-based delivery method. 17. Operating leverage appeared to be impacted by stock-based compensation. Could you help us understand why this increased in Q3 24 for the Data & Analytics segment and broadly what ranges stock compensation should be as a percentage of revenue? Morningstar Data and Analytics adjusted operating income increased at a slower rate (+3.4%) than revenue (+5.2%) in Q3 24 compared to the prior-year period, resulting in a modest decline in adjusted operating margin to 46.0% from 46.8%. An increase in stock-based compensation contributed to the decline in adjusted operating margin, due in large part to accelerated vesting of equity awards that is triggered when certain employees leave the company. We don’t provide guidance on our expectations for stock-based compensation as a percentage of total revenue. Morningstar Sustainalytics 18. What actions have been taken to return Sustainalytics to growth? What is the strategy going forward to compete more effectively? What impact could CSRD have in 2025? What does streamlining licensed rating offering entail? Our efforts to return Morningstar Sustainalytics to growth include an ongoing focus on refining and enhancing our product portfolio. This includes several key initiatives: - In climate, we are focused on regulatory and reporting use cases and are also exploring opportunities to support emerging needs within the banking client segment. - Beyond climate, we are targeting improvements to our data set and solutions more broadly. Earlier this year, we launched an enhancement of our ESG Risk Ratings as well as the extension of our EU Action Plan Solutions. Our roadmap includes the introduction of new impact metrics, expanding the availability of data supporting our ESG Risk Ratings, and making improvements to our regulatory data set and data to support the European Union’s Corporate Sustainability Reporting Directive (CSRD). As CSRD implementation is rolled out in 2025, the initial focus will be on supporting regulatory reporting in our traditional client base. We expect further opportunities as CSRD requirements extend to other types of companies in 2026 and 2027. - We are committed to strengthening our market-leading second party-opinion product and finding opportunities to leverage our strength there in investor solutions, especially in supporting banks exploring transition-financing investment opportunities. Finally, we’ve noted a shift in our licensed ratings product to focus on licensing existing ESG Risk Ratings as we’ve moved away from a model under which corporate clients could contract with us to provide a rating. The change in our product offering has led to a recent decline in revenue for the licensed ratings product in corporate solutions, but we believe it better positions us to scale that product over time.

19. Sustainalytics results deteriorated in Q3 and in your letter you called out vendor consolidation and softness in some segments. Could you walk through the underlying drivers behind the ESG slowdown in more detail (e.g., vendor consolidation impact vs Climate suite vs corporate solutions, etc.)? Why is there such a difference between your ESG results compared to your larger competitors? Is larger vendor consolidation a key driver of the shortfall? What are the gross renewal rates in Sustainalytics’ business today and how do they compare to previous years? Together with Indexes, Sustainalytics turned a profit this quarter (Q3 24) though revenue slowed. When do you expect to return to growth? Can you comment on whether growth is still positive in Europe? Morningstar Sustainalytics revenue declined 9.7% to $27.9 million in Q3 24 compared to the prior-year period. The largest contributor to the trend was a slowdown in revenue attributable to ESG Risk Ratings driven in part by vendor consolidation, as many clients rationalized their ESG providers following a period of strong growth when they may have purchased multiple, overlapping ESG products. In addition, clients have remained focused on regulatory compliance and less on investment integration, which results in more limited opportunities for expansion. Finally, we’ve observed softness specifically in the retail asset management customer segment as ESG fund launches and flows slowed sharply in 2023 and into the first half of 2024 driven by net outflows in the U.S., and weaker inflows in Europe compared to stronger dynamics in 2021 and 2022. The second largest driver of the decline was a slowdown in our licensed ratings product in corporate solutions as we streamlined that product, as described in more detail in a response to a related question this quarter. Morningstar Sustainalytics revenue declined in both North America and in EMEA in Q3 24 compared to the prior-year period, although we’d note that growth for the year-to-date through September 2024 is positive in EMEA compared to the prior-year period and we continue to see opportunities in EMEA for both new client acquisition and expansion, supported by regulatory trends in that market. Over the past two years, we have realigned our contractual terms to provide more meaningful and comparable data around retention rates. We disclose revenue renewal rates annually. We would note that the vendor consolidation and rationalization that we’ve experienced has had a negative impact on retention rates through the first nine months of 2024. We’re limited in our ability to comment on our competitors’ results. That said, while Morningstar Sustainalytics revenue related to climate products increased in Q3 24 compared to the prior-year period, we have noted challenges in this space, and this has in turn also put pressure on our broader retention efforts with clients who have already selected one of our competitors to provide climate data. We believe that competitors are also able to leverage their strengths in other areas, including indexes, in support of their ESG products. PitchBook 20. PitchBook licenses increased 19% on a year over year basis in Q3 24. Which customer type contributed the most to the increase? How many licenses have been added to PitchBook in Q2 and Q3 excluding LCD migration? Do you still expect LCD licences to be fully transitioned by year-end? PitchBook licensed users increased 19.0% in Q3 24 compared to the prior-year period. As in earlier quarters this year, licensed user growth continued to be driven by both legacy LCD clients who are migrating to the PitchBook platform and PitchBook licensed users who did not previously have LCD access. The majority of licensed user growth year-to-date and in each of Q1, Q2, and Q3 2024 compared to the relevant prior-year periods was driven by new licensed users who did not previously have LCD access. Year-to-date licensed user growth reflects contributions from all client segments, in particular the core investor and advisor client segments, including venture capital, private equity, and investment banks. We expect to have the substantial majority of LCD users fully migrated to the PitchBook platform by the end of this month. 21. What’s next on the product roadmap for PitchBook? The PitchBook product roadmap continues to reflect a focus on expansion of data and research alongside product enhancements, including AI-driven tools. In data and research, our efforts are focused on: - Continued expansion of private credit capabilities, with a focus on business development companies (BDCs) and collateralized loan obligations (CLOs), and increased credit research coverage; - Continued expansion of data on non-backed companies;

- Continued expansion of global databases and APAC research; and - Expansion of private capital indexes, including in cooperation with Morningstar Indexes. In addition, our product enhancement roadmap includes: - Expanding research content following the recent introduction of third-party equity research on the redesigned PitchBook Research Center; - The enhancement of dashboards, building on the recent introduction of tailored dashboard experiences for credit, private capital funds, and public equity; and - Expanded AI-driven document summaries, in addition to existing AI earnings call transcript summaries. 22. To understand the underlying incremental cash profit contribution of the PitchBook segment, could you help us understand the dollar benefit to adjusted EBIT of stock-based compensation in Q1 24, Q2 24, Q3 24 in dollars as a result of the termination of the management bonus plan? As you note, the forfeiture of stock in the PitchBook management bonus plan following former PitchBook CEO John Gabbert’s departure has had a positive year-to-date impact on PitchBook adjusted operating income and adjusted operating margin. The plan was designed primarily as a compensation vehicle for John and was terminated in Q3 24. The impact of the forfeiture and the subsequent cancellation of the plan is as follows: - Q1 24: The PitchBook management bonus plan was active and there was no impact on adjusted operating income or adjusted operating margin from the forfeiture of stock or the eventual cancellation of the plan. - Q2 24: The forfeiture of stock associated with John’s departure was responsible for roughly half of the improvement in PitchBook segment adjusted operating margin to 32.2% in Q3 24 from 28.0% in the prior-year period. In Q2 24, we reversed the full year-to-date accrual for the forfeited stock, including the Q1 24 accrual. - Q3 24: In Q3 24, lower stock-based compensation associated with the termination of the PitchBook management bonus plan contributed to the increase in PitchBook segment adjusted operating margin but not to the same extent as in the second quarter. 23. PitchBook’s end market commentary seemed relatively consistent with recent quarters, so what drove the sequential (Q2 24 to Q3 24) improvement in Pitchbook sales? As you note, the key growth drivers for PitchBook in Q3 24 were similar to those that we saw in recent quarters, with strength in the core investor and advisor client segments, including venture capital, private equity, and investment banks, partially offset by softness in the corporate client segment, especially with smaller firms with more limited use cases. We did see a modest acceleration in sequential growth from Q2 24 to Q3 24, with revenue growing $4.9 million, or 3.2% compared to an increase of $4.1 million or 2.8% in Q2 24 compared to Q1 24. The key drivers of both year-over-year growth and sequential growth remained consistent with prior quarters. Japan Operations 24. How has Morningstar’s strategy evolved in Japan since the termination of the licensing agreement in 2023? As you note, we terminated our licensing agreement with Morningstar Japan K.K. (now SBI Global Asset Management) in 2023. At the time, we operated our business primarily through Ibbotson Japan (IAJ), a wholly owned Morningstar subsidiary, and were able to offer only a limited set of our products and services. Those included advisory services that we’ve offered for more than 20 years under the Ibbotson brand. With the termination completed, the Morningstar brand is in our full control. We have moved to selling most products through a new subsidiary, Morningstar Japan, which has helped eliminate the brand confusion that we previously faced. We have hired a local manager research team to cover funds domiciled in Japan and have started offering opinions and commentaries on the market consistent with our global methodologies; through our Morningstar Essentials products clients can now license our ratings as well as rankings, reports, and other metrics. Control of our brand has allowed us to expand beyond first-tier financial institutions to other clients, including fintech startups, with initial success in closing data deals. Finally, we are developing solutions for independent financial advisors in Japan. This is an emerging sector in the process of evolving from a commission-based model to a fee-based model.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

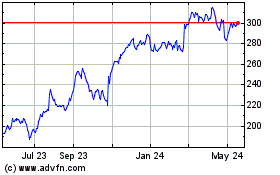

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Nov 2024 to Dec 2024

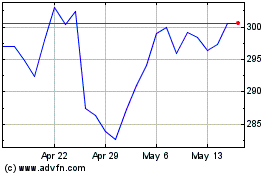

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Dec 2023 to Dec 2024