Marker Therapeutics, Inc. (Nasdaq: MRKR), a clinical-stage

immuno-oncology company focusing on developing next-generation T

cell-based immunotherapies for the treatment of hematological

malignancies and solid tumors, today reported recent corporate

developments and financial results for the year ended December 31,

2023.

“The progress achieved in 2023 we believe

establishes a robust foundation for Marker and sets the stage for

continued advancement in our clinical programs and business

operations in the upcoming year,” commented Juan Vera, M.D.

President and Chief Executive Officer of Marker Therapeutics. “A

pinnacle of last year's success was the Phase 1 lymphoma study

milestone, where we observed a sustained complete response in our

first study participant treated with MT-601 following CAR T

relapse. This patient relapsed within 90 days of CAR T therapy but

has remained in a complete remission for at least six months after

MT-601 treatment, indicating that MT-601 has superior durability in

this study participant. The promising clinical and non-clinical

observations from our lymphoma study reinforced our strategic

decision, made public this January, to prioritize the development

of MT-601 in patients with lymphoma who have failed or are

ineligible for CAR T therapy. Focusing on this unique niche of

patients and by targeting multiple antigens, our approach differs

significantly from competitors, and we believe that MT-601 could

address an unmet medical need in this patient population with a

better safety profile and at lower costs when compared to

gene-modified cell therapy approaches.”

Further bolstering Marker’s position is the

award of $2 million in non-dilutive funding from the NIH last year,

which is instrumental in supporting the advancement of the

Company’s MT-401 “Off-the-Shelf” (MT-401-OTS) program in patients

with Acute Myeloid Leukemia (AML).

Dr. Vera added, “This award is expected to

enable us to proceed with the OTS program without affecting our

ongoing study for patients with lymphoma. Decreasing time to

treatment is critical for rapidly progressing cancers, such as

patients with minimal residual disease (MRD) in AML.”

Utilizing an OTS product manufactured from

healthy donors will help to bypass the treatment delay that is

associated with patient-specific manufacture and should shorten the

time until the product is made available to patients, while

reducing manufacturing costs. Additionally, receiving Orphan Drug

Designation (ODD) by the European Medicines Agency (EMA)

substantiates the potential impact of MT-401 in patients with AML

and presents an opportunity to develop the therapy on an expedited

basis.

Marker also executed a comprehensive

non-dilutive agreement with Cell Ready which included a sale of

select cell manufacturing assets from Marker for approximately $19

million in cash. This major transaction, which we expect will

enable a reduction of overhead expenses of about $11 million

annually, not only improves our financial health but, we believe,

also positions us uniquely in the cell therapy industry — a sector

where such significant non-dilutive funding and operational savings

are remarkably rare. This strategic foresight, together with the

drawdowns available from our grant funds, should extend the cash

runway into the fourth quarter of 2025.

“These accomplishments underline our commitment

to driving scientific innovation, our vision in making major impact

with our novel multiTAA technology for patients in need, and our

emphasis on cash preservation and operational excellence. As we

have pivoted into 2024, we remain poised to advance our clinical

endeavors with the goal of introducing transformative therapies to

the market and improving patient outcomes,” concluded Dr. Vera.

2023 PROGRAM UPDATES & OPERATIONAL

HIGHLIGHTS

MT-601 (Lymphoma)

Non-Clinical Data on MT-601

- Marker developed a long-term in

vitro killing assay 1) to investigate resistance mechanisms after

CAR T cell treatment, and 2) to analyze if MT-601 (targeting 6

TAAs) can eliminate CAR-resistant lymphoma cells.

- Anti-CD19 CAR T cell treatment

killed 98% of lymphoma cells in vitro. However, after three weeks,

CD19-negative tumor cells started to grow. Further anti-CD19 CAR T

cell treatments were ineffective as these tumor cells lack target

antigen (CD19) expression (Pre-Clinical Data in Lymphoma, May 31,

2023).

- Treatment with MT-601 demonstrated

long-term growth inhibition (over three weeks) of CAR-resistant

lymphoma cells, highlighting that MT-601 has the potential to

effectively treat CD19 CAR-resistant tumors (Press Release, May 31,

2023).

Clinical Highlights

- Phase 1 multicenter APOLLO trial

(clinicaltrials.gov identifier: NCT05798897), investigating MT-601

in patients with lymphoma who relapsed or are ineligible for

anti-CD19 CAR T cell therapies, was selected as lead program based

on promising preliminary clinical results and non-clinical

proof-of-concept data.

- The first study participant, a

57-year-old female with diffuse large B cell lymphoma (DLBCL), was

enrolled in the Phase 1 dose escalation stage of the trial after

failing 4 prior lines of therapy, including relapsing within 90

days of anti-CD19 CAR T cell therapy. Without prior

lymphodepletion, the participant was treated with MT-601. In

December 2023, the Company announced that the study participant

tolerated initial dose level well and had maintained a complete

response to therapy six months after initial treatment with MT-601

(Press Release, December 11, 2023).

- The Company is enrolling additional

patients in the Phase 1 APOLLO trial and expects to report further

data in the first half of 2024.

- MT-601 designated non-proprietary

name “Neldaleucel” by United States Adopted Name (USAN) Counsel and

International Nonproprietary Names (INN) Expert Committee.

MT-601 (Pancreatic)

- Investigational New Drug (IND)

application cleared by U.S. Food and Drug Administration

(FDA) for multicenter Phase 1 trial of MT-601 in patients with

metastatic pancreatic cancer in combination with front-line

chemotherapy.

- Clinical advancement will be

pending additional financial support from non-dilutive grant

activities.

MT-401-OTS (Acute Myeloid Leukemia or

Myelodysplastic Syndrome)

- U.S. FDA has granted an

Investigational New Drug (IND) to investigate MT-401 as an

“Off-the-Shelf” (MT-401-OTS) product in patients with AML or

Myelodysplastic Syndrome (MDS). MT-401-OTS is manufactured from

healthy donors and a cellular inventory has been established with

ongoing efforts to expand.

- Marker announced non-clinical

proof-of-concept data supporting the clinical benefits of

MT-401-OTS in AML.

- The Company has secured $2M in

non-dilutive funding from the NIH Small Business Innovation

Research (SBIR) program. These funds will support the clinical

investigation of MT-401-OTS in patients with AML without affecting

the ongoing Phase 1 APOLLO study in patients with lymphoma.

- Granted ODD from the Committee for

Orphan Medicinal Products of the EMA for the treatment of patients

with AML in 2023. ODD was received from the U.S. FDA in 2020.

- Clinical program initiation of

MT-401-OTS anticipated for the second half of 2024.

2023 CORPORATE HIGHLIGHTS

- Announced clinical pipeline

prioritization in January 2024 to strategically focus on MT-601 in

patients with lymphoma. This announcement also included program

updates that highlighted the potential of the Company’s MT-401-OTS

program for AML.

- Appointed Juan Vera, M.D., as

President and Chief Executive Officer and Monic Stuart, M.D., MPH,

as Chief Medical Officer. Dr. Vera was also appointed the Company’s

Principal Financial and Accounting Officer.

- On June 26, 2023, Marker completed

a non-dilutive transaction with Cell Ready, under which Cell Ready

purchased certain cell manufacturing assets from Marker for

approximately $19 million in cash. On February 22, 2024, Marker

entered into a Master Services Agreement for Product Supply with

Cell Ready. Under this agreement, Cell Ready will perform a wide

variety of services for Marker, including research and development,

and manufacturing in support of Marker’s clinical trials.

- Terminated common stock purchase

agreement with Lincoln Park Capital.

- Extended financial runway into the

fourth quarter of 2025.

FISCAL YEAR 2023 FINANCIAL

HIGHLIGHTS

Cash Position and Guidance: At

December 31, 2023, Marker had cash and cash equivalents of $15.1

million. The Company believes that its existing cash and cash

equivalents will fund its operating expenses into the fourth

quarter of 2025, inclusive of available drawdowns from grant

funds.

R&D Expenses: Research and

development expenses were $10.4 million for the year ended December

31, 2023, compared to $12.0 million for the year ended December 31,

2022.

G&A Expenses: General and

administrative expenses were $7.5 million for the year ended

December 31, 2023, compared to $11.3 million for the year ended

December 31, 2022.

Net Loss: Marker reported a net

loss of $8.2 million for the year ended December 31, 2023, compared

to a net loss of $29.9 million for the year ended December 31,

2022.

About multiTAA-specific T

cells

The multi-tumor associated antigen

(multiTAA)-specific T cell platform is a novel, non-genetically

modified cell therapy approach that selectively expands

tumor-specific T cells from a patient's/donor’s blood capable of

recognizing a broad range of tumor antigens. Since

multiTAA-specific T cells are not genetically engineered, Marker

believes that its product candidates will be easier and less

expensive to manufacture, with reduced toxicities, compared to

current engineered CAR-T and TCR-based approaches, and may provide

patients with meaningful clinical benefits. As a result, Marker

believes that its portfolio of T cell therapies has a compelling

product profile, as compared to current gene-modified CAR-T and

TCR-based therapies.

About Marker Therapeutics,

Inc.

Marker Therapeutics, Inc. is a Houston, TX-based

clinical-stage immuno-oncology company specializing in the

development of next-generation T cell-based immunotherapies for the

treatment of hematological malignancies and solid tumors. Clinical

trials that enrolled more than 200 patients across various

hematological and solid tumor indications showed that the Company’s

autologous and allogeneic multiTAA-specific T cell products were

well tolerated and demonstrated durable clinical responses.

Marker’s goal is to introduce novel T cell therapies to the market

and improve patient outcomes. To achieve these objectives, the

Company prioritizes the preservation of financial resources and

focuses on operational excellence. Marker’s unique T cell platform

is strengthened by non-dilutive funding from U.S. state and federal

agencies supporting cancer research.

To receive future press releases via email,

please visit: https://www.markertherapeutics.com/email-alerts.

Forward-Looking Statements

This release contains forward-looking statements

for purposes of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Statements in this news

release concerning the Company’s expectations, plans, business

outlook or future performance, and any other statements concerning

assumptions made or expectations as to any future events,

conditions, performance or other matters, are “forward-looking

statements.” Forward-looking statements include statements

regarding our intentions, beliefs, projections, outlook, analyses

or current expectations concerning, among other things: our

research, development and regulatory activities and expectations

relating to our non-engineered multi-tumor antigen specific T cell

therapies; the effectiveness of these programs or the possible

range of application and potential curative effects and safety in

the treatment of diseases; and the timing, conduct and success of

our clinical trials of our product candidates, including MT-601 and

MT-401-OTS. Forward-looking statements are by their nature subject

to risks, uncertainties and other factors which could cause actual

results to differ materially from those stated in such statements.

Such risks, uncertainties and factors include, but are not limited

to the risks set forth in the Company’s most recent Form 10-K, 10-Q

and other SEC filings which are available through EDGAR at

www.sec.gov. The Company assumes no obligation to update our

forward-looking statements whether as a result of new information,

future events or otherwise, after the date of this press

release.

|

Marker Therapeutics, Inc.Consolidated Balance

Sheets(Audited) |

|

|

|

December 31, |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

15,111,450 |

|

|

$ |

11,782,172 |

|

|

Prepaid expenses and deposits |

|

|

988,126 |

|

|

|

1,849,239 |

|

|

Other receivables |

|

|

1,027,815 |

|

|

|

2,402,004 |

|

|

Current assets of discontinued operations |

|

|

– |

|

|

|

585,840 |

|

|

Total current assets |

|

|

17,127,391 |

|

|

|

16,619,255 |

|

|

Non-current assets of discontinued operations |

|

|

– |

|

|

|

17,802,929 |

|

|

Total assets |

|

$ |

17,127,391 |

|

|

$ |

34,422,184 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

1,745,193 |

|

|

$ |

2,521,193 |

|

|

Related party payable |

|

|

1,329,655 |

|

|

|

– |

|

|

Current liabilities of discontinued operations |

|

|

– |

|

|

|

5,260,616 |

|

|

Total current liabilities |

|

|

3,074,848 |

|

|

|

7,781,809 |

|

|

Non-current liabilities of discontinued operations |

|

|

– |

|

|

|

7,039,338 |

|

|

Total liabilities |

|

|

3,074,848 |

|

|

|

14,821,147 |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Preferred stock, $0.001 par value, 5 million shares authorized, 0

shares issued and outstanding at December 31, 2023 and 2022,

respectively |

|

|

– |

|

|

|

– |

|

|

Common stock, $0.001 par value, 30 million shares authorized, 8.9

million and 8.4 million shares issued and outstanding as of

December 31, 2023 and 2022, respectively (see Note 10) |

|

|

8,891 |

|

|

|

8,406 |

|

|

Additional paid-in capital |

|

|

450,329,515 |

|

|

|

447,641,680 |

|

|

Accumulated deficit |

|

|

(436,285,863 |

) |

|

|

(428,049,049 |

) |

|

Total stockholders' equity |

|

|

14,052,543 |

|

|

|

19,601,037 |

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

17,127,391 |

|

|

$ |

34,422,184 |

|

|

Marker Therapeutics, Inc.Consolidated

Statements of Operations(Audited) |

|

|

|

For the Years Ended |

|

|

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

Grant income |

|

$ |

3,311,133 |

|

|

$ |

3,513,544 |

|

|

Total revenues |

|

|

3,311,133 |

|

|

|

3,513,544 |

|

|

Operating expenses: |

|

|

|

|

|

Research and development |

|

|

10,416,789 |

|

|

|

11,968,428 |

|

|

General and administrative |

|

|

7,475,722 |

|

|

|

11,336,120 |

|

|

Total operating expenses |

|

|

17,892,511 |

|

|

|

23,304,548 |

|

|

Loss from operations |

|

|

(14,581,378 |

) |

|

|

(19,791,004 |

) |

|

Other income (expenses): |

|

|

|

|

|

Arbitration settlement |

|

|

– |

|

|

|

(232,974 |

) |

|

Interest income |

|

|

539,158 |

|

|

|

248,063 |

|

|

Loss from continuing operations before income taxes |

|

|

(14,042,220 |

) |

|

|

(19,775,915 |

) |

|

Income tax expense |

|

|

3,675 |

|

|

|

– |

|

|

Net loss from continuing operations |

|

|

(14,045,895 |

) |

|

|

(19,775,915 |

) |

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

Loss from discontinued operations |

|

|

(2,922,406 |

) |

|

|

(10,154,779 |

) |

|

Gain on disposal of discontinued operations, net of $63,000 in

tax |

|

|

8,731,487 |

|

|

|

– |

|

|

Income (loss) from discontinued operations |

|

|

5,809,081 |

|

|

|

(10,154,779 |

) |

|

Net loss |

|

$ |

(8,236,814 |

) |

|

$ |

(29,930,694 |

) |

|

|

|

|

|

|

|

Net earnings (loss) per share: |

|

|

|

|

|

Loss from continuing operations, basic and diluted |

|

$ |

(1.59 |

) |

|

$ |

(2.37 |

) |

|

Income (loss) from discontinued operations, basic and diluted |

|

$ |

0.66 |

|

|

$ |

(1.22 |

) |

|

Net loss per share, basic and diluted |

|

$ |

(0.94 |

) |

|

$ |

(3.58 |

) |

| |

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

Basic |

|

|

8,809,382 |

|

|

|

8,351,003 |

|

|

Diluted |

|

|

8,809,382 |

|

|

|

8,351,003 |

|

|

Marker Therapeutics, Inc.Consolidated Statements

of Cash Flows(Audited) |

|

|

|

For the Years Ended |

|

|

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Cash Flows from Operating Activities: |

|

|

|

|

|

Net loss |

|

$ |

(8,236,814 |

) |

|

$ |

(29,930,694 |

) |

|

Less: gain (loss) from discontinued operations, net of $63,000 in

tax |

|

|

5,809,081 |

|

|

|

(10,154,779 |

) |

|

Net loss from continuing operations |

|

|

(14,045,895 |

) |

|

|

(19,775,915 |

) |

|

Reconciliation of net loss to net cash used in operating

activities: |

|

|

|

|

|

Stock-based compensation |

|

|

858,269 |

|

|

|

3,304,634 |

|

|

Gain on lease termination |

|

|

– |

|

|

|

(278,681 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Prepaid expenses and deposits |

|

|

861,113 |

|

|

|

104,147 |

|

|

Other receivables |

|

|

1,374,189 |

|

|

|

(2,401,767 |

) |

|

Accounts payable and accrued expenses |

|

|

611,262 |

|

|

|

(1,319,710 |

) |

|

Deferred revenue |

|

|

– |

|

|

|

(1,146,186 |

) |

|

Net cash used in operating activities – continuing

operations |

|

|

(10,341,062 |

) |

|

|

(21,513,478 |

) |

|

Net cash used in operating activities – discontinued

operations |

|

|

(6,098,899 |

) |

|

|

(5,458,675 |

) |

|

Net cash used in operating activities |

|

|

(16,439,961 |

) |

|

|

(26,972,153 |

) |

|

Cash Flows from Investing Activities: |

|

|

|

|

|

Net cash provided by (used in) investing activities –

discontinued operations |

|

|

18,664,122 |

|

|

|

(4,945,136 |

) |

|

Net cash provided by (used in) investing activities |

|

|

18,664,122 |

|

|

|

(4,945,136 |

) |

|

Cash Flows from Financing Activities: |

|

|

|

|

|

Proceeds from issuance of common stock, net |

|

|

1,014,640 |

|

|

|

202,130 |

|

|

Proceeds from stock options exercise |

|

|

90,477 |

|

|

|

– |

|

|

Net cash provided by financing activities |

|

|

1,105,117 |

|

|

|

202,130 |

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

3,329,278 |

|

|

|

(31,715,159 |

) |

|

Cash and cash equivalents at beginning of the year |

|

|

11,782,172 |

|

|

|

43,497,331 |

|

|

Cash and cash equivalents at end of the year |

|

$ |

15,111,450 |

|

|

$ |

11,782,172 |

|

| |

|

|

|

|

Contacts

TIBEREND STRATEGIC ADVISORS,

INC.InvestorsDaniel Kontoh-Boateng(862)

213-1398dboateng@tiberend.com

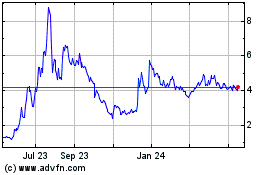

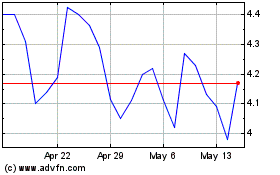

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Nov 2023 to Nov 2024