Marker Therapeutics, Inc. (Nasdaq: MRKR), a clinical-stage

immuno-oncology company focusing on developing next-generation T

cell-based immunotherapies for the treatment of hematological

malignancies and solid tumors, today reported corporate updates and

financial results for the second quarter ended June 30, 2024.

“The second quarter of 2024 was characterized by

ongoing momentum in our clinical programs,” said Juan Vera, M.D.,

President and Chief Executive Officer of Marker Therapeutics.

“Following the positive outcomes reported in the first quarter, we

continued to advance our Phase 1 APOLLO study investigating MT-601

in patients with lymphoma who have relapsed after anti-CD19 CAR-T

cell therapy or where CAR-T therapy is not an option. In April,

Geoffrey Shouse, D.O., Ph.D., the Principal Investigator at City of

Hope National Medical Center, presented encouraging data from the

APOLLO study, at the 11th Global Summit on Hematologic

Malignancies. The data showed that three out of three participants

had objective responses, and that treatment was well tolerated

among all patients with no significant treatment-related adverse

events, further signifying the potential benefit of MT-601 in

patients with lymphoma. We are gratified by these preliminary

results and expect to provide a more comprehensive clinical update

on the APOLLO study in the upcoming quarter.”

“Additionally, after the close of the quarter,

we announced that Marker has been awarded a $2 million Small

Business Innovation Research (SBIR) grant from the National

Institutes of Health (NIH) to support our Phase 1 APOLLO study

evaluating the safety and efficacy of MT-601 in patients with

non-Hodgkin’s lymphoma (NHL) who have relapsed following anti-CD19

CAR-T cell therapy. We were pleased to receive this highly

competitive grant, which reinforces the potential scientific merit

and the capacity of the APOLLO study to address an unmet medical

need,” added Dr. Vera.

PROGRAM UPDATES & EXPECTED

MILESTONES

MT-601 (Lymphoma)

- Marker’s lead

program is investigating MT-601 in the nationwide multicenter Phase

1 APOLLO study (clinicaltrials.gov identifier: NCT05798897) in

patients with lymphoma who relapsed after anti-CD19 CAR-T cell

therapy or where CAR-T cells are not an option.

- The Company

previously reported preliminary safety and efficacy with sustained

objective responses observed in three study participants treated at

City of Hope National Medical Center (Press Release, April 8,

2024). Treatment was well tolerated among all study participants

with no observation of cytokine release syndrome (CRS) or immune

effector cell associated neurotoxicity syndrome (ICANS).

- All study

participants continue to be observed for long-term treatment

effects and durability of response. The Company is enrolling

additional study participants in the Phase 1 APOLLO trial and

expect to provide an update on safety and durability during the

third quarter.

- The Company was

awarded a $2 million grant from NIH Small Business Innovation

Research Program (SBIR) to support the clinical investigation of

MT-601 in patients with lymphoma who have relapsed following

anti-CD CAR-T cell therapy (Press Release, August 12, 2024).

MT-601 (Pancreatic)

- Investigational

New Drug (IND) application cleared by U.S. Food and Drug

Administration (FDA) for multicenter Phase 1 trial to investigate

MT-601 in combination with front-line chemotherapy in patients with

metastatic pancreatic cancer.

- Clinical

advancement will be pending additional financial support from

non-dilutive funding activities.

MT-401-OTS (Acute Myeloid Leukemia or

Myelodysplastic Syndrome)

- U.S. FDA has

granted an IND to investigate MT-401 as an “Off-the-Shelf”

(MT-401-OTS) product in patients with Acute Myeloid Leukemia (AML)

or Myelodysplastic Syndrome (MDS).

- MT-401-OTS is

manufactured from healthy donors, and Marker has established a

cellular inventory for MT-401-OTS with ongoing efforts to further

expansion.

- Marker has

non-clinical proof-of-concept data supporting the potential

clinical benefits of MT-401-OTS in patients with AML or MDS (Press

Release, August 7, 2023).

- The Company

secured non-dilutive funding to support the clinical investigation

of MT-401-OTS and anticipates the clinical program initiation of

MT-401-OTS during the fourth quarter of 2024.

SECOND QUARTER 2024 FINANCIAL

HIGHLIGHTS

Cash Position and Guidance: At

June 30, 2024, Marker had cash and cash equivalents of $7.8

million. The Company believes that its existing cash and cash

equivalents will fund its operating expenses into the fourth

quarter of 2025, inclusive of available drawdowns from grant

funds.

R&D Expenses: Research and

development expenses were $2.3 million for the quarter ended June

30, 2024, compared to $2.4 million for the quarter ended June 30,

2023.

G&A Expenses: General and

administrative expenses were $1.1 million for the quarter ended

June 30, 2024, compared to $2.5 million for the quarter ended June

30, 2023.

Net Loss: Marker reported a net

loss from continuing operations of $2.2 million for the quarter

ended June 30, 2024, compared to $4.1 million for the quarter ended

June 30, 2023.

“The financial performance in the past quarter

demonstrates the benefits that we are seeing from our restructuring

efforts that we initiated in the second quarter of 2023, including

our agreement with Cell Ready, and the favorable impact that they

are having on our business, especially our Operating Expenses.

Unlike most small, pre-revenue companies in the Cell Therapy space,

our extremely efficient structure, combined with our successful

grant funding initiatives, are allowing us to maximize our cash

runway and to focus the majority of our available funds on our

clinical programs,” concluded Dr. Vera.

About multiTAA-specific T

cells

The multi-tumor associated antigen

(multiTAA)-specific T cell platform is a novel, non-genetically

modified cell therapy approach that selectively expands

tumor-specific T cells from a patient's/donor’s blood capable of

recognizing a broad range of tumor antigens. Unlike other T cell

therapies, multiTAA-specific T cells allow the recognition of

hundreds of different epitopes within up to six tumor-specific

antigens, thereby reducing the possibility of tumor escape. Since

multiTAA-specific T cells are not genetically engineered, Marker

believes that its product candidates will be easier and less

expensive to manufacture, with an improved safety profile, compared

to current engineered T cell approaches, and may provide patients

with meaningful clinical benefits.

About Marker Therapeutics,

Inc.

Marker Therapeutics, Inc. is a Houston, TX-based

clinical-stage immuno-oncology company specializing in the

development of next-generation T cell-based immunotherapies for the

treatment of hematological malignancies and solid tumors. Clinical

trials that enrolled more than 200 patients across various

hematological and solid tumor indications showed that the Company’s

autologous and allogeneic multiTAA-specific T cell products were

well tolerated and demonstrated durable clinical responses.

Marker’s goal is to introduce novel T cell therapies to the market

and improve patient outcomes. To achieve these objectives, the

Company prioritizes the preservation of financial resources and

focuses on operational excellence. Marker’s unique T cell platform

is strengthened by non-dilutive funding from U.S. state and federal

agencies supporting cancer research.

To receive future press releases via email,

please visit: https://www.markertherapeutics.com/email-alerts.

Forward-Looking Statements

This release contains forward-looking statements

for purposes of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Statements in this news

release concerning the Company’s expectations, plans, business

outlook or future performance, and any other statements concerning

assumptions made or expectations as to any future events,

conditions, performance or other matters, are “forward-looking

statements.” Forward-looking statements include statements

regarding our intentions, beliefs, projections, outlook, analyses

or current expectations concerning, among other things: our

research, development and regulatory activities and expectations

relating to our non-engineered multi-tumor antigen specific T cell

therapies; the effectiveness of these programs or the possible

range of application and potential curative effects and safety in

the treatment of diseases; and the timing, conduct and success of

our clinical trials of our product candidates, including MT-601 for

the treatment of patients with lymphoma. Forward-looking statements

are by their nature subject to risks, uncertainties and other

factors which could cause actual results to differ materially from

those stated in such statements. Such risks, uncertainties and

factors include, but are not limited to the risks set forth in the

Company’s most recent Form 10-K, 10-Q and

other SEC filings which are available through EDGAR

at WWW.SEC.GOV. The Company assumes no obligation to update

its forward-looking statements whether as a result of new

information, future events or otherwise, after the date of this

press release except as may be required by law.

|

|

|

|

Marker Therapeutics, Inc.Condensed

Consolidated Balance

Sheets(Unaudited) |

|

|

|

|

|

|

June 30,2024 |

|

December 31,2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

7,800,464 |

|

|

$ |

15,111,450 |

|

|

|

Prepaid expenses and deposits |

|

1,384,394 |

|

|

|

988,126 |

|

|

|

Other receivables |

|

2,490,147 |

|

|

|

1,027,815 |

|

|

|

Total current assets |

|

11,675,005 |

|

|

|

17,127,391 |

|

|

|

Total assets |

$ |

11,675,005 |

|

|

$ |

17,127,391 |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

1,679,672 |

|

|

$ |

1,745,193 |

|

|

|

Related party payable |

|

292,569 |

|

|

|

1,329,655 |

|

|

|

Total current liabilities |

|

1,972,241 |

|

|

|

3,074,848 |

|

|

|

Total liabilities |

|

1,972,241 |

|

|

|

3,074,848 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value, 5 million shares authorized, 0

shares issued andoutstanding at June 30, 2024 and December 31,

2023, respectively |

|

- |

|

|

|

- |

|

|

|

Common stock, $0.001 par value, 30 million shares authorized, 8.9

million sharesissued and outstanding as of June 30, 2024 and

December 31, 2023, respectively(see Note 8) |

|

8,922 |

|

|

|

8,891 |

|

|

|

Additional paid-in capital |

|

450,565,204 |

|

|

|

450,329,515 |

|

|

|

Accumulated deficit |

|

(440,871,362 |

) |

|

|

(436,285,863 |

) |

|

|

Total stockholders' equity |

|

9,702,764 |

|

|

|

14,052,543 |

|

|

|

Total liabilities and stockholders' equity |

$ |

11,675,005 |

|

|

$ |

17,127,391 |

|

|

|

|

|

|

|

|

|

Marker Therapeutics, Inc.Condensed Consolidated Statements

of Operations(Unaudited) |

|

|

|

|

|

|

For the Three Months EndedJune 30, |

|

For the Six Months EndedJune 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grant income |

$ |

1,169,236 |

|

|

$ |

762,658 |

|

|

$ |

2,413,297 |

|

|

$ |

1,996,995 |

|

|

|

Total revenues |

|

1,169,236 |

|

|

|

762,658 |

|

|

|

2,413,297 |

|

|

|

1,996,995 |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

2,335,430 |

|

|

|

2,377,993 |

|

|

|

4,910,446 |

|

|

|

5,754,492 |

|

|

|

General and administrative |

|

1,141,871 |

|

|

|

2,518,725 |

|

|

|

2,359,934 |

|

|

|

4,686,044 |

|

|

|

Total operating expenses |

|

3,477,301 |

|

|

|

4,896,718 |

|

|

|

7,270,380 |

|

|

|

10,440,536 |

|

|

|

Loss from operations |

|

(2,308,065 |

) |

|

|

(4,134,060 |

) |

|

|

(4,857,083 |

) |

|

|

(8,443,541 |

) |

|

|

Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

115,388 |

|

|

|

35,080 |

|

|

|

271,584 |

|

|

|

119,734 |

|

|

|

Loss from continuing operations |

|

(2,192,677 |

) |

|

|

(4,098,980 |

) |

|

|

(4,585,499 |

) |

|

|

(8,323,807 |

) |

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations, net of tax |

|

- |

|

|

|

(2,179,657 |

) |

|

|

- |

|

|

|

(2,922,406 |

) |

|

|

Gain on disposal of discontinued operations |

|

- |

|

|

|

8,794,426 |

|

|

|

- |

|

|

|

8,794,426 |

|

|

|

Income from discontinued operations |

|

- |

|

|

|

6,614,769 |

|

|

|

- |

|

|

|

5,872,020 |

|

|

|

Net income/(loss) |

$ |

(2,192,677 |

) |

|

$ |

2,515,789 |

|

|

$ |

(4,585,499 |

) |

|

$ |

(2,451,787 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations, basic and diluted |

$ |

(0.25 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.95 |

) |

|

|

Income from discontinued operations, basic and diluted |

$ |

- |

|

|

$ |

0.75 |

|

|

$ |

- |

|

|

$ |

0.67 |

|

|

|

Net income/(loss) per share, basic and diluted |

$ |

(0.25 |

) |

|

$ |

0.29 |

|

|

$ |

(0.51 |

) |

|

$ |

(0.28 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

8,918,233 |

|

|

|

8,798,956 |

|

|

|

8,910,097 |

|

|

|

8,760,209 |

|

|

|

Diluted |

|

8,918,233 |

|

|

|

8,798,956 |

|

|

|

8,910,097 |

|

|

|

8,760,209 |

|

|

|

|

|

|

|

|

|

Marker Therapeutics, Inc.Condensed Consolidated Statements

of Cash Flows(Unaudited) |

|

|

|

|

|

|

For the Six Months EndedJune 30, |

|

|

|

2024 |

|

2023 |

|

|

Cash Flows from Operating Activities: |

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(4,585,499 |

) |

|

$ |

(2,451,787 |

) |

|

|

Less: income from discontinued operations, net of tax |

|

- |

|

|

|

5,872,020 |

|

|

|

Net loss from continuing operations |

|

(4,585,499 |

) |

|

|

(8,323,807 |

) |

|

|

Reconciliation of net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

142,018 |

|

|

|

539,858 |

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Prepaid expenses and deposits |

|

(396,268 |

) |

|

|

(238,223 |

) |

|

|

Other receivables |

|

(1,462,332 |

) |

|

|

655,904 |

|

|

|

Related party payable |

|

(1,037,086 |

) |

|

|

- |

|

|

|

Accounts payable and accrued expenses |

|

(65,521 |

) |

|

|

197,030 |

|

|

|

Net cash used in operating activities - continuing

operations |

|

(7,404,688 |

) |

|

|

(7,169,238 |

) |

|

|

Net cash used in operating activities - discontinued

operations |

|

- |

|

|

|

(5,775,680 |

) |

|

|

Net cash used in operating activities |

|

(7,404,688 |

) |

|

|

(12,944,918 |

) |

|

|

Cash Flows from Investing Activities: |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities - discontinued

operations |

|

- |

|

|

|

18,664,122 |

|

|

|

Net cash provided by (used in) investing activities |

|

- |

|

|

|

18,664,122 |

|

|

|

Cash Flows from Financing Activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock, net |

|

36,902 |

|

|

|

619,974 |

|

|

|

Proceeds from stock options exercise |

|

56,800 |

|

|

|

736 |

|

|

|

Net cash provided by financing activities |

|

93,702 |

|

|

|

620,710 |

|

|

|

Net (decrease)/increase in cash and cash equivalents |

|

(7,310,986 |

) |

|

|

6,339,914 |

|

|

|

Cash and cash equivalents at beginning of the period |

|

15,111,450 |

|

|

|

11,782,172 |

|

|

|

Cash and cash equivalents at end of the

period |

$ |

7,800,464 |

|

|

$ |

18,122,086 |

|

|

|

|

|

ContactsInvestorsTIBEREND

STRATEGIC ADVISORS, INC.Jonathan

Nugent205-566-3026jnugent@tiberend.com

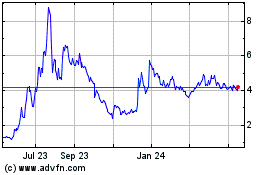

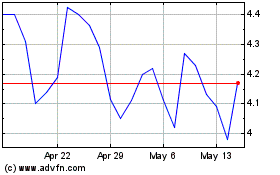

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Nov 2023 to Nov 2024