Materialise NV (NASDAQ:MTLS), a leading provider of additive

manufacturing and medical software solutions and of sophisticated

3D printing services, today announced its financial results for the

fourth quarter and full year ended December 31, 2024.

Highlights – Fourth Quarter 2024

- Total revenue increased 0.6% to 65,680 kEUR for the fourth

quarter of 2024 from 65,295 kEUR for the corresponding 2023 period

boosted by 14.3% growth in our Materialise Medical segment.

- Total deferred revenues from software maintenance and license

fees increased by 5,878 kEUR this quarter to 46,948 kEUR.

- Adjusted EBITDA amounted to 4,306 kEUR for the fourth quarter

of 2024 compared to 8,474 kEUR for the corresponding 2023 period.

Adjusted EBIT amounted to (1,195) kEUR for the fourth quarter of

2024 compared to 3,154 kEUR for the 2023 period.

- Net result for the fourth quarter of 2024 was 2,907 kEUR, or

0.05 EUR per diluted share, compared to a net result of (539) kEUR,

or (0.01) EUR per diluted share for the corresponding 2023

period.

Highlights – Full Year 2024

- Total revenue increased 4.2% to 266,765 kEUR for 2024 from

256,127 kEUR for 2023 boosted by 14.8% growth in our Materialise

Medical segment.

- Gross profit as a percentage of revenue for 2024 remained

stable at 56.5%, compared to 56.7% for 2023.

- Adjusted EBITDA was 31,484 kEUR for 2024 compared to 31,397

kEUR for 2023. Adjusted EBIT decreased slightly to 9,741 kEUR for

2024 from 9,886 kEUR for 2023.

- Net profit for 2024 was 13,406 kEUR, or 0.23 EUR per diluted

share, compared to a net profit of 6,695 kEUR, or 0.11 EUR per

diluted share, for 2023.

- Total cash reserves amounted to 102,304 kEUR at the end of

2024.

CEO Brigitte de Vet-Veithen commented, “In the final quarter of

2024 our Materialise Medical segment continued on its growth path,

again posting record-high revenues. At the same time, global

macro-economic headwinds persisted particularly in the European

industrial sector, impacting Materialise Manufacturing segment’s

performance. Our Materialise Software segment continued to make

good progress in its conversion to a recurring revenue business

model and delivered results in line with our expectations.

Continued high R&D expenditures especially in our Materialise

Medical and Software segments combined with integration and

restructuring costs in our Materialise Manufacturing segment and in

our corporate support departments impacted Adjusted EBIT in the

fourth quarter of 2024. Over the full year 2024 we delivered a

positive net result of 0.23 EUR per diluted share and increased our

operational cash flow by 56% to 31.5 million EUR.”

Fourth Quarter 2024 Results

Total revenue for the fourth quarter of 2024 increased 0.6% to

65,680 kEUR from 65,295 kEUR for the fourth quarter of 2023.

Adjusted EBITDA decreased to 4,306 kEUR for the fourth quarter of

2024 from 8,474 kEUR for the 2023 period. Adjusted EBIT amounted to

(1,195) kEUR, compared to 3,154 kEUR for the same period in

2023.

Revenue from our Materialise Medical segment increased 14.3% to

31,837 kEUR for the fourth quarter of 2024, compared to 27,848 kEUR

for the same period in 2023. Adjusted EBITDA for the segment was

9,547 kEUR compared to 9,365 kEUR, while the Adjusted EBITDA margin

for the segment was 30.0%, compared to 33.6% for the prior-year

period.

Revenue from our Materialise Software segment decreased 1.1% to

11,124 kEUR from 11,250 kEUR for the same quarter last year.

Adjusted EBITDA for the segment amounted to 1,123 kEUR compared to

1,259 kEUR, while the Adjusted EBITDA margin for the segment was

10.1%, compared to 11.2% for the prior-year period.

Revenue from our Materialise Manufacturing segment decreased

13.3% to 22,719 kEUR from 26,198 kEUR for the fourth quarter of

2023. Adjusted EBITDA for the segment decreased to (2,989) kEUR

compared to 557 kEUR, while the Adjusted EBITDA margin for the

segment was (13.2)%, compared to 2.1% for the prior-year

period.

Gross profit decreased 3.2% to 36,365 kEUR for the fourth

quarter of 2024 from 37,548 kEUR for the same period last year.

Gross profit as a percentage of revenue was 55.4%, compared to

57.5%.

Research and development (“R&D”), sales and marketing

(“S&M”) and general and administrative (“G&A”) expenses

increased, in the aggregate, 10.2% to 38,990 kEUR for the fourth

quarter of 2024 from 35,375 kEUR for the fourth quarter of 2023

mainly driven by a 19.6% increase in R&D spend.

Net other operating income was 1,357 kEUR compared to (3,287)

kEUR for the fourth quarter of 2023, whereas the last quarter of

2023 included non-recurring charges from the impairment of

goodwill, tangible and intangible assets of 4,228 kEUR.

The operating result was (1,268) kEUR, compared to (1,113) kEUR

for the fourth quarter of 2023.

Net financial result for the fourth quarter of 2024 was 3,301

kEUR, compared to (234) kEUR for the corresponding period of 2023

reflecting favorable effects from exchange rate fluctuations.

The fourth quarter of 2024 contained net tax income of 874 kEUR,

compared to net tax income of 809 kEUR for the fourth quarter of

2023.

As a result of the above, net profit for the fourth quarter of

2024 was 2,907 kEUR, compared to a net loss of (539) kEUR for the

same period in 2023. Total comprehensive income for the fourth

quarter of 2024 was 1,432 kEUR, compared to (112) kEUR for the 2023

period.

Cash flow from operating activities for the fourth quarter of

the year 2024 was 6,218 kEUR, compared to 195 kEUR for the same

period in 2023. Total capital expenditures for the fourth quarter

of the year 2024 amounted to 7,760 kEUR.

Full Year 2024 Results

Total revenues for the year ended December 31, 2024 increased

4.2% to 266,765 kEUR from 256,127 kEUR for the year ended December

31, 2023. Adjusted EBITDA for 2024 amounted to 31,484 kEUR compared

to 31,397 kEUR for 2023. The Adjusted EBITDA margin was 11.8% in

2024, compared to 12.3% in 2023. Adjusted EBIT for 2024 amounted to

9,741 kEUR compared to 9,886 kEUR for 2023. The Adjusted EBIT

margin for 2024 was 3.7%, compared to 3.9% for 2023.

Revenues from our Materialise Medical segment grew by 14.8% for

the year ended December 31, 2024 to 116,358 kEUR from 101,376 kEUR

for the year ended December 31, 2023. The segment’s Adjusted EBITDA

increased to 35,562 kEUR from 26,544 kEUR. The segment’s Adjusted

EBITDA margin was 30.6% in 2024, compared to 26.2% in 2023.

Revenues from our Materialise Software segment decreased 1.2% to

43,899 kEUR for the year ended December 31, 2024 compared to 44,442

kEUR for the year ended December 31, 2023. The segment’s Adjusted

EBITDA decreased to 5,562 kEUR from 7,450 kEUR in 2023. The

segment’s Adjusted EBITDA margin was 12.7% in 2024, compared to

16.8% in 2023.

Revenues from our Materialise Manufacturing segment decreased

3.4% to 106,508 kEUR for the year ended December 31, 2024 from

110,310 kEUR for the year ended December 31, 2023. The segment’s

Adjusted EBITDA amounted to 1,660 kEUR compared to 7,537 kEUR. The

segment’s Adjusted EBITDA margin was 1.6% in 2024, compared to 6.8%

in 2023.

Gross profit increased 3.9% to 150,826 kEUR from 145,131 kEUR

last year. Gross profit as a percentage of revenue was 56.5%,

compared to 56.7% in 2023.

Net other operating income was 4,223 kEUR compared to (6,524)

kEUR for 2023, whereas 2023 included non-recurring charges from the

impairment of goodwill, tangible and intangible assets of 4,228

kEUR.

Operating result amounted to 9,432 kEUR for the year ended

December 31, 2024 compared to 5,619 kEUR in the prior year.

Net financial result amounted to 4,707 kEUR, compared to net

financial result of 1,154 kEUR for the year ended December 31,

2023. Income taxes amounted to (733) kEUR compared to (78) kEUR for

the year ended December 31, 2023. As a result, net profit was

13,406 kEUR for 2024 compared to a net profit of 6,695 kEUR in

2023.

At December 31, 2024, we had cash and equivalents of 102,304

kEUR compared to 127,573 kEUR at December 31, 2023. Gross debt

reduced to 41,284 kEUR (of which 12,997 kEUR was short term),

compared to 64,398 kEUR at December 31, 2023.

Cash flow from operating activities for the year ended December

31, 2024 was 31,456 kEUR compared to 20,157 kEUR in the year ended

December 31, 2023. Total capital expenditures for the year ended

December 31, 2024 amounted to 26,377 kEUR.

Net shareholders’ equity at December 31, 2024 was 248,492 kEUR

compared to 236,594 kEUR at December 31, 2023, representing an

increase of 5.0%.

2025 Guidance

Mrs. de Vet-Veithen concluded, “For calendar year 2025, we

expect our three reporting segments to evolve at a different pace.

We anticipate the strongest revenue growth to come from our

Materialise Medical segment. Materialise Software will continue its

transition towards a cloud-based subscription business model, which

will impact its revenue growth potential. Furthermore, we

anticipate the difficult macroeconomic environment will persist

throughout 2025, specifically in the European industrial sector,

which will impact the performance of our Materialise Manufacturing

segment. On a consolidated level we expect our full year revenues

for 2025 to grow to a range of 270.000 to 285.000 kEUR. We will

continue investing in our Materialise Medical and Software segments

while keeping a strong focus on cost control and optimization in

particular in our Materialise Manufacturing segment and in our

corporate support departments. For calendar year 2025, we

anticipate our Adjusted EBIT will reach 6.000 to 10.000 kEUR

reflecting also increased depreciation charges.”

Non-IFRS Measures

Materialise uses EBIT, EBITDA, Adjusted EBIT and Adjusted EBITDA

as supplemental financial measures of its financial performance.

EBIT is calculated as net profit plus income taxes, financial

expenses (less financial income) and shares of profit or loss in a

joint venture. EBITDA is calculated as net profit plus income

taxes, financial expenses (less financial income), shares of profit

or loss in a joint venture and depreciation and amortization.

Adjusted EBIT and Adjusted EBITDA are determined by adding

share-based compensation expenses, acquisition-related expenses of

business combinations, impairments and revaluation of fair value

due to business combinations to EBIT and EBITDA, respectively.

Management believes these non-IFRS measures to be important

measures as they exclude the effects of items which primarily

reflect the impact of financing decisions and, in the case of

EBITDA and Adjusted EBITDA, long term investment, rather than the

performance of the company’s day-to-day operations. The company

also uses segment Adjusted EBITDA to evaluate the performance of

its three business segments. As compared to net profit, these

measures are limited in that they do not reflect the cash

requirements necessary to service interest or principal payments on

the company’s indebtedness and, in the case of EBITDA and Adjusted

EBITDA, these measures are further limited in that they do not

reflect the periodic costs of certain capitalized tangible and

intangible assets used in generating revenues in the company’s

business, or the changes associated with impairments. Management

evaluates such items through other financial measures such as

financial expenses, capital expenditures and cash flow provided by

operating activities. The company believes that these measurements

are useful to measure a company’s ability to grow or as a valuation

measurement. The company’s calculation of EBIT, EBITDA, Adjusted

EBIT and Adjusted EBITDA may not be comparable to similarly titled

measures reported by other companies. EBIT, EBITDA, Adjusted EBIT

and Adjusted EBITDA should not be considered as alternatives to net

profit or any other performance measure derived in accordance with

IFRS. The company’s presentation of EBIT, EBITDA, Adjusted EBIT and

Adjusted EBITDA should not be construed to imply that its future

results will be unaffected by unusual or non-recurring items.

Exchange Rate

This document contains translations of certain euro amounts into

U.S. dollars at specified rates solely for the convenience of

readers. Unless otherwise noted, all translations from euros to

U.S. dollars in this document were made at a rate of EUR 1.00 to

USD 1.039, the reference rate of the European Central Bank on

December 31, 2024.

Conference Call and Webcast

Materialise will hold a conference call and simultaneous webcast

to discuss its financial results for the fourth quarter of 2024 and

other matters on Thursday, February 20, 2025, at 8:30 a.m. ET/2:30

p.m. CET. Company participants on the call will include Brigitte de

Vet-Veithen, Chief Executive Officer; and Koen Berges, Chief

Financial Officer. A question-and-answer session will follow

management’s remarks. To access the call by phone, please click the

link below at least 15 minutes prior to the scheduled start time

and you will be provided with dial-in details. Participants can

choose to dial in or receive a call to connect to Materialise’s

conference call.

-

https://register.vevent.com/register/BI291a6f2c7454403ba50a5ec3e4455faa

The conference call will also be broadcast live over the

internet with an accompanying slide presentation, which can be

accessed on the company’s website at

http://investors.materialise.com. A webcast of the conference call

will be archived on the company's website for one year.

About Materialise

Materialise incorporates over 30 years of 3D printing experience

into a range of software solutions and 3D printing services, which

form the backbone of the 3D printing industry. Materialise’s open

and flexible solutions enable players in a wide variety of

industries, including healthcare, automotive, aerospace, art and

design, and consumer goods, to build innovative 3D printing

applications that aim to make the world a better and healthier

place. Headquartered in Belgium, with branches worldwide,

Materialise combines one of the largest groups of software

developers in the industry with one of the largest and most

complete 3D printing facilities in the world. For additional

information, please visit: www.materialise.com.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our intentions, beliefs,

assumptions, projections, outlook, analyses or current

expectations, plans, objectives, strategies and prospects, both

financial and business, including statements concerning, among

other things, our estimates for the current fiscal year’s revenue

and Adjusted EBIT, our results of operations, cash needs, capital

expenditures, expenses, financial condition, liquidity, prospects,

growth and strategies (including how our business, results of

operations and financial condition could be impacted by the current

armed geopolitical conflicts around the world and governmental

responses thereto, inflation, increased labor, energy and materials

costs), policy changes resulting from the U.S. presidential

administration, changes in tariffs and trade restrictions, and the

trends and competition that may affect the markets, industry or us.

Such statements are subject to known and unknown uncertainties and

risks. When used in this press release, the words “estimate,”

“expect,” “anticipate,” “project,” “plan,” “intend,” “believe,”

“forecast,” “will,” “may,” “could,” “might,” “aim,” “should,” and

variations of such words or similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are based upon the expectations of management under

current assumptions at the time of this press release. These

expectations, beliefs and projections are expressed in good faith

and the company believes there is a reasonable basis for them.

However, the company cannot offer any assurance that our

expectations, beliefs and projections will actually be achieved. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events, competitive dynamics

and industry change, and depend on economic circumstances that may

or may not occur in the future or may occur on longer or shorter

timelines than anticipated. We caution you that forward-looking

statements are not guarantees of future performance and involve

known and unknown risks, uncertainties and other factors that are

in some cases beyond our control. All of the forward-looking

statements are subject to risks and uncertainties that may cause

the company's actual results to differ materially from our

expectations, including risk factors described in the company's

most recent annual report on Form 20-F filed with the U.S.

Securities and Exchange Commission. There are a number of risks and

uncertainties that could cause the company's actual results to

differ materially from the forward-looking statements contained in

this press release.

The company is providing this information as of the date of this

press release and does not undertake any obligation to update any

forward-looking statements contained in this press release as a

result of new information, future events or otherwise, unless it

has obligations under the federal securities laws to update and

disclose material developments related to previously disclosed

information.

Consolidated income statements

(Unaudited)

for the three months

ended December 31,

for the twelve months

ended December 31,

In '000

2024

2024

2023

2024

2023

U.S.$

€

€

€

€

Revenue

68,235

65,680

65,295

266,765

256,127

Cost of Sales

(30,455)

(29,315)

(27,747)

(115,940)

(110,996)

Gross Profit

37,780

36,365

37,548

150,826

145,131

Gross profit as % of revenue

55.4%

55.4%

57.5%

56.5%

56.7%

Research and development expenses

(12,569)

(12,099)

(10,116)

(44,400)

(38,098)

Sales and marketing expenses

(17,131)

(16,490)

(15,403)

(61,620)

(57,822)

General and administrative expenses

(10,806)

(10,402)

(9,855)

(39,597)

(37,068)

Net other operating income (expenses)

1,410

1,357

(3,287)

4,223

(6,524)

Operating (loss) profit

(1,316)

(1,268)

(1,113)

9,432

5,619

Financial expenses

(451)

(434)

(266)

(4,516)

(3,865)

Financial income

3,880

3,735

32

9,224

5,019

(Loss) profit before taxes

2,113

2,033

(1,348)

14,139

6,772

Income Taxes

908

874

809

(733)

(78)

Net (loss) profit for the period

3,021

2,907

(539)

13,406

6,695

Net (loss) profit attributable to: The owners of the parent

3,030

2,917

(529)

13,436

6,722

Non-controlling interest

(10)

(10)

(10)

(30)

(27)

Earning per share attributable to owners of the

parent Basic

0.05

0.05

(0.01)

0.23

0.11

Diluted

0.05

0.05

(0.01)

0.23

0.11

Weighted average basic shares outstanding

59,067

59,067

59,067

59,067

59,067

Weighted average diluted shares outstanding

59,148

59,148

59,067

59,105

59,085

Consolidated statements of

comprehensive income (Unaudited)

for the three months

ended December 31,

for the twelve months

ended December 31,

In 000€

2024

2024

2023

2024

2023

U.S.$ € € € € Net profit

(loss) for the period

3,021

2,907

(539)

13,406

6,695

Other comprehensive income Recycling Exchange

difference on translation of foreign operations

(1,536)

(1,478)

759

(1,795)

1,255

Non-recycling Fair value adjustments through OCI - Equity

instruments

3

3

(331)

3

(331)

Other comprehensive income (loss), net of taxes

(1,532)

(1,475)

428

(1,792)

924

Total comprehensive income (loss) for the year, net of taxes

1,487

1,432

(112)

11,615

7,619

Total comprehensive income (loss) attributable to: The owners of

the parent

1,501

1,445

(102)

11,647

7,644

Non-controlling interests

(13)

(13)

(10)

(33)

(25)

Consolidated statement of financial

position (Unaudited)

As of

December 31,

As of

December 31,

In 000€

2024

2023

Assets Non-current assets Goodwill

43,391

43,158

Intangible assets

29,973

31,464

Property, plant & equipment

111,331

95,400

Right-of-Use assets

7,719

8,102

Deferred tax assets

3,523

2,797

Investments in convertible loans

3,994

3,744

Other non-current assets

5,892

5,501

Total non-current assets

205,823

190,166

Current assets Inventories

16,992

17,034

Trade receivables

53,052

52,698

Other current assets

18,165

9,161

Cash and cash equivalents

102,304

127,573

Total current assets

190,513

206,465

Total assets

396,336

396,630

As of

December 31,

As of

December 31,

In 000€

2024

2023

Equity and liabilities Equity Share capital

4,487

4,487

Share premium

234,228

233,942

Retained earnings and other reserves

9,863

(1,783)

Equity attributable to the owners of the parent

248,578

236,646

Non-controlling interest

(86)

(53)

Total equity

248,492

236,594

Non-current liabilities Loans & borrowings

23,175

33,582

Lease liabilities

5,112

5,333

Deferred tax liabilities

3,202

3,725

Deferred income

13,268

10,701

Other non-current liabilities

909

1,745

Total non-current liabilities

45,666

55,086

Current liabilities Loans & borrowings

10,383

22,873

Lease liabilities

2,614

2,610

Trade payables

23,348

21,196

Tax payables

1,432

1,777

Deferred income

45,998

40,791

Other current liabilities

18,403

15,703

Total current liabilities

102,178

104,950

Total equity and liabilities

396,336

396,630

Consolidated statement of cash flows

(Unaudited)

for the twelve months

ended December 31,

In 000€

2024

2023

Operating activities Net (loss) profit for the period

13,406

6,695

Non-cash and operational adjustments

18,655

24,571

Depreciation of property plant & equipment

15,372

15,065

Amortization of intangible assets

6,435

6,504

Impairment of goodwill and intangible assets

-

4,228

(Gain) on bargain purchase

(23)

Share-based payment expense

285

39

Loss (gain) on disposal of intangible assets and property, plant

& equipment

(312)

(415)

Government grants

(57)

Movement in provisions

539

(181)

Movement reserve for bad debt and slow moving inventory

236

499

Financial income

(9,122)

(5,033)

Financial expense

4,559

3,886

Impact of foreign currencies

29

(94)

(Deferred) income taxes

714

73

Working capital adjustments

(1,418)

(12,576)

Decrease (increase) in trade receivables and other receivables

(1,037)

(3,335)

Decrease (increase) in inventories and contracts in progress

(372)

(806)

Increase (decrease) in deferred revenue

1,270

525

Increase (decrease) in trade payables and other payables

(1,279)

(8,961)

Income tax paid & Interest received

813

1,469

Net cash flow from operating activities

31,456

20,157

for the twelve months

ended December 31,

In 000€

2024

2023

Investing activities Purchase of property, plant &

equipment

(24,649)

(9,235)

Purchase of intangible assets

(1,728)

(2,525)

Proceeds from the sale of property, plant & equipment &

intangible assets (net)

458

723

Acquisition of subsidiary (net of cash)

(2,670)

-

Net cash flow used in investing activities

(28,588)

(11,037)

Financing activities Repayment of loans & borrowings

(23,267)

(16,723)

Repayment of leases

(3,122)

(3,549)

Capital increase

-

-

Interest paid

(1,337)

(1,750)

Other financial income (expense)

81

(346)

Net cash flow from (used in) financing activities

(27,644)

(22,368)

Net increase/(decrease) of cash & cash equivalents

(24,776)

(13,248)

Cash & Cash equivalents at the beginning of the year

127,573

140,867

Exchange rate differences on cash & cash equivalents

(492)

(46)

Cash & cash equivalents at end of the period

102,304

127,573

Reconciliation of Net Profit (Loss) to EBITDA and Adjusted

EBITDA (Unaudited)

for the three months

ended December 31,

for the twelve months

ended December 31,

In 000€

2024

2023

2024

2023

Net profit (loss) for the period

2,907

(539)

13,406

6,695

Income taxes

(874)

(809)

733

78

Financial expenses

434

266

4,516

3,865

Financial income

(3,735)

(32)

(9,224)

(5,019)

Depreciation and amortization

5,501

5,320

21,742

21,511

EBITDA

4,234

4,207

31,175

27,130

Share-based compensation expense (1)

72

39

285

39

Impairments (2)

-

4,228

-

4,228

Acquisition-related expenses of business combinations (3)

-

-

24

-

Adjusted EBITDA

4,306

8,474

31,484

31,397

(1) Share-based compensation expense represents the cost of

equity-settled and share-based payments to employees. (2)

Impairments represent the impairment of goodwill and intangible

assets of Materialise Motion (3,572 kEUR) and the impairment of

tangible and intangible assets of Engimplan (656 kEUR). (3)

Acquisition-related expenses of business combinations represent

expenses incurred in connection with the acquisition of Feops.

Reconciliation of Net Profit (Loss) to EBIT and Adjusted EBIT

(Unaudited)

for the three months

ended December 31,

for the twelve months

ended December 31,

In 000€

2024

2023

2024

2023

Net profit (loss) for the period

2,907

(539)

13,406

6,695

Income taxes

(874)

(809)

733

78

Financial expenses

434

266

4,516

3,865

Financial income

(3,735)

(32)

(9,224)

(5,019)

EBIT

(1,268)

(1,113)

9,432

5,619

Share-based compensation expense (1)

72

39

285

39

Impairments (2)

-

4,228

-

4,228

Acquisition-related expenses of business combinations (3)

-

-

24

-

Adjusted EBIT

(1,195)

3,154

9,741

9,886

(1) Share-based compensation expense represents the cost of

equity-settled and share-based payments to employees. (2)

Impairments represent the impairment of goodwill and intangible

assets of Materialise Motion (3,572 kEUR) and the impairment of

tangible and intangible assets of Engimplan (656 kEUR). (3)

Acquisition-related expenses of business combinations represent

expenses incurred in connection with the acquisition of Feops.

Segment P&L (Unaudited)

In 000€

Materialise

Medical

Materialise

Software

Materialise

Manufacturing

Total

segments

Unallocated

(1)

Consolidated

For the three months ended December 31, 2024 Revenues

31,837

11,124

22,719

65,680

0

65,680

Segment (adj) EBITDA

9,547

1,123

(2,989)

7,681

(3,375)

4,306

Segment (adj) EBITDA %

30.0%

10.1%

-13.2%

11.7%

6.6%

For the three months ended December 31, 2023 Revenues

27,848

11,250

26,198

65,295

0

65,295

Segment (adj) EBITDA

9,365

1,259

557

11,181

(2,708)

8,474

Segment (adj) EBITDA %

33.6%

11.2%

2.1%

17.1%

13.0%

In 000€

Materialise

Medical

Materialise

Software

Materialise

Manufacturing

Total

segments

Unallocated

(1)

Consolidated

For the twelve months ended December 31, 2024 Revenues

116,358

43,899

106,508

266,765

0

266,765

Segment (adj) EBITDA

35,562

5,562

1,660

42,784

(11,300)

31,484

Segment (adj) EBITDA %

30.6%

12.7%

1.6%

16.0%

11.8%

For the twelve months ended December 31, 2023 Revenues

101,376

44,442

110,310

256,127

0

256,127

Segment (adj) EBITDA

26,544

7,450

7,537

41,530

(10,133)

31,397

Segment (adj) EBITDA %

26.2%

16.8%

6.8%

16.2%

12.3%

(1) Unallocated segment adjusted EBITDA consists of

corporate research and development and corporate other operating

income (expense), and the added share-based compensation expenses,

acquisition related expenses of business combinations, impairments

and fair value of business combinations that are included in

Adjusted EBITDA.

Reconciliation of Net Profit (Loss) to

Segment adjusted EBITDA (Unaudited)

for the three months

ended December 31,

for the twelve months

ended December 31,

In 000€

2024

2023

2024

2023

Net profit (loss) for the period

2,907

(539)

13,406

6,695

Income taxes

(874)

(809)

733

78

Financial cost

434

266

4,516

3,865

Financial income

(3,735)

(32)

(9,224)

(5,019)

Operating (loss) profit

(1,268)

(1,113)

9,432

5,619

Depreciation and amortization

5,501

5,320

21,742

21,511

Corporate research and development

1,006

721

3,681

2,785

Corporate headquarter costs

2,717

2,869

10,254

10,464

Other operating income (expense)

(276)

(844)

(2,350)

(3,077)

Impairments (1)

-

4,228

-

4,228

Segment EBITDA adjustments (2)

-

-

24

-

Segment adjusted EBITDA

7,681

11,181

42,784

41,530

(1) Impairments represent the impairment of goodwill and

intangible assets of Materialise Motion (3,572 kEUR) and the

impairment of tangible and intangible assets of Engimplan (656

kEUR). (2) Acquisition-related expenses of business combinations

represent expenses incurred in connection with the acquisition of

Feops.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219144310/en/

Harriet Fried Alliance Advisors Investor Relations 212.838.3777

hfried@allianceadvisors.com

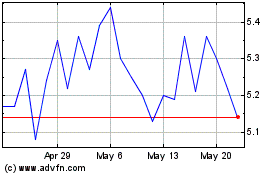

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Mar 2024 to Mar 2025