0001377630False00013776302024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 15, 2024

National CineMedia, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 001-33296 | 20-5665602 | |

(State or Other Jurisdiction of

Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) | |

| |

| 6300 S. Syracuse Way | Suite 300 | Centennial | Colorado | 80111 | |

| (Address of Principal Executive Offices) | | | (Zip Code) | |

(303) 792-3600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 210.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Common Stock, par value $0.01 per share | NCMI | The Nasdaq Stock Market LLC |

| (Title of each class) | (Trading symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Effective May 16, 2024 (the “Effective Date”), the Compensation Committee of the Board of Directors of National CineMedia, Inc. (the “Company”) appointed Catherine Sullivan, 58, as the Company's President - Sales, Marketing and Partnerships.

Ms. Sullivan founded CSA Media, a media consulting firm, in August 2023 through which she serves as an advisor to several private companies in the media and ad tech sectors. Ms. Sullivan was previously the Chief Executive Officer of PHD Media US, a media and advertising agency, from September 2020 to June 2023. Before PHD Media US, Ms. Sullivan served as the President of Investment from October 2016 to February 2019 and Chief Investment Officer of North America from February 2019 to September 2020 for Omnicom Media Group, a media and advertising agency. Prior to working for Omnicom Media Group, Ms. Sullivan held sales leadership roles at ABC Television from 2001 to 2016 and began her career working in progressively senior roles in the sales organization at NBC Universal from 1988 to 2001.

The Company entered into an employment agreement with Ms. Sullivan (the “Employment Agreement”) dated May 15, 2024. A summary of the material terms and conditions of the Employment Agreement is set forth below.

Employment Term. The term of the Employment Agreement is the Effective Date through December 31, 2027, unless terminated earlier by the Company or Ms. Sullivan.

Base Salary and Annual Incentive Opportunities. Ms. Sullivan’s annual salary will be $650,000. Ms. Sullivan will be eligible to participate in the Company’s annual cash bonus program for senior executive officers, with a target annual bonus equal to 85% of her salary earned as President - Sales, Marketing and Partnerships during the applicable period. Ms. Sullivan will also have the opportunity to receive long-term incentive awards in such amounts and pursuant to the terms as determined by the Company’s Board of Directors. Pursuant to the terms of the Employment Agreement, Ms. Sullivan’s long-term incentive opportunity for the year 2025 will have a grant date fair value of at least $600,000.

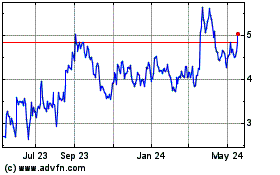

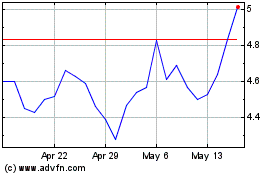

Initial Equity Grants. In connection with her appointment, Ms. Sullivan will receive a one-time equity award issued under the Company’s 2020 Omnibus Incentive Plan, as amended, consisting of time-based restricted stock units with a grant date fair value equal to $300,000 and performance-based restricted stock units with a grant date fair value equal to $300,000. The number of restricted stock units to be granted will be calculated by dividing the aforementioned fair values by the average closing share price of the Company’s common stock as reported by Nasdaq for the 30 days immediately prior to the grant date. The time-based restricted stock units and the performance-based restricted stock units will be granted under the terms of the grant agreements used in connection with the Company's Emergence Management Incentive Plan Requirement disclosed on the Current Report on Form 8-K dated February 2, 2024. The time-based and performance-based restricted stock units include the right to receive regular and special cash dividends, if and when the underlying shares vest.

Termination of Employment. If Ms. Sullivan’s employment is involuntarily terminated by the Company, she will receive an amount equal to 100% of her annual base salary plus 100% of the target bonus, payable in equal installments over a 12-month period. For up to 12 months following any such termination of employment, the Company will pay Ms. Sullivan an amount equal to 100% of the monthly premium paid by Ms. Sullivan for COBRA coverage under the Company’s group health and dental plans.

The foregoing description of the Employment Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Employment Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Ms. Sullivan does not have a family relationship with any of the executive officers or directors of the Company. There are no arrangements or understandings between Ms. Sullivan and any other persons pursuant to which Ms. Sullivan was selected as an officer of the Company. Ms. Sullivan does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Scott D. Felenstein, the Company's current President - Sales, Marketing and Partnerships, will step down from his role as of the Effective Date and depart the Company at the end of his contract on June 30, 2024. The Company intends to treat Mr. Felenstein’s termination of employment as an “Involuntary Termination” under his employment agreement with the Company, as described in the Company’s 2024 definitive proxy statement under the caption “Potential Payments Upon Termination or

Change in Control - Scott D. Felenstein - Without Cause or For Good Reason or Non-renewal by Company.” Mr. Felenstein’s termination of employment is not the result of a violation of any Company policy.

Item 7.01 Regulation FD Disclosure

On May 15, 2024, the Company issued a press release announcing the transitions disclosed under Item 5.02 above. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information in this Item 7.01, including the press release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by reference to such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

| | | | | |

| Exhibit No. | Description |

| |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | NATIONAL CINEMEDIA, INC. |

| | | |

| Dated: May 15, 2024 | | | | By: | | /s/ Ronnie Y. Ng |

| | | | | | Ronnie Y. Ng |

| | | | | | Chief Financial Officer |

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (the “Agreement”) by and between National CineMedia, Inc. (the “Company” or “Employer”), and Catherine Sullivan (“Executive”, and together with the Company or Employer, the “Parties”), is entered into as of May 15, 2024 (the “Execution Date”). In consideration of the covenants and agreements contained herein, the Parties agree as follows:

1.Employment. The Employer agrees to employ Executive and Executive agrees to be employed by the Employer pursuant to the terms set forth in this Agreement, effective as of May 16, 2024 (the “Effective Date”), and Executive’s employment under this Agreement shall terminate on the earlier of (i) December 31, 2027 (the “Term End Date”), and (ii) the termination of Executive’s employment. The period from the Effective Date until the termination of Executive’s employment under this Agreement is referred to as the “Employment Period.” To the extent Executive remains employed by the Company after the Term End Date, such employment will be subject to the terms and conditions to which the Company and Executive at that time will agree. The Company will provide notice to Executive at least 90 days prior to the Term End Date (unless the Agreement is terminated earlier) of its intent to either extend the term of this Agreement, enter into a new employment agreement or allow the Agreement to expire; provided that this provision shall not operate to increase the amount of severance benefits payable under this Agreement or otherwise limit the Company’s ability to terminate Executive without “Cause” and without notice. To the extent Executive remains employed by the Company after the expiration of the Employment Period, such employment will be subject to the terms and conditions to which the Company and Executive at that time will agree.

2.Positions and Authority. Executive shall serve in the position of President – Sales, Marketing & Partnerships of the Employer, reporting to the Chief Executive Officer, or in such other positions as the Parties may agree. Executive’s primary place of business shall be at Company headquarters in the New York City metropolitan area, or such other location as the Parties may hereafter agree. Executive agrees to serve in the position referred to in this Section 2 and to perform diligently and to the best of her abilities the duties and services appertaining to such position, as well as such additional duties and services as may be assigned to her from time to time. During the Employment Period, Executive shall devote her full business time and efforts to the business and affairs of the Company and its subsidiaries, provided that Executive shall be entitled to serve as an advisory member of the board of directors of a reasonable number of other companies, as approved by the Company, to serve on civic, charitable, educational, religious, public interest or public service boards, and to manage Executive’s personal and family investments, in each case and in the aggregate to the extent such activities do not materially interfere with the performance of Executive’s duties and responsibilities hereunder and do not conflict with Executive’s obligations under Section 6. Executive shall not become a director of any entity without first receiving the approval of the Board of Directors of the Company (the “Board”), which shall not be unreasonably withheld.

3.Compensation and Benefits.

(a)Base Salary. As compensation for Executive’s performance of Executive’s duties hereunder, Company shall, as of the Effective Date, pay to Executive a base salary at the annualized rate of $650,000.00, payable in accordance with the normal payroll practices of the Company (but not less frequently than monthly), less required deductions for state and federal withholding tax, social security and all other employment taxes and payroll deductions.

Executive’s Base Salary shall be reviewed by the Compensation and Leadership Committee of the Board of Directors (the “Compensation Committee”) not less often than annually. The term “Base Salary” shall refer to the Base Salary as may be in effect from time to time.

(b)Annual Incentive Compensation. During the Employment Period, Executive shall be eligible to participate in an annual cash bonus program maintained for senior executive officers of the Company (the “Annual Incentive Program”), with a target annual bonus equal to 85% of Base Salary (the “Target Bonus”); provided, however, that any bonus related to fiscal year 2024 shall be prorated for the period between the Effective Date and December 31, 2024. The actual amount of the annual bonus to be paid to Executive for any year or portion of a year, as applicable, shall be determined upon the satisfaction of goals and objectives established by the Compensation Committee pursuant to the Annual Incentive Program, and shall be subject to such other terms and conditions of the Annual Incentive Program as in effect from time to time. Subject to Section 4(a), Executive must be employed by the Company on the day that annual bonuses are paid to executives in order to be eligible for and to earn and receive an annual bonus. Each annual bonus paid under the Annual Incentive Program shall be paid no later than March 15th of the calendar year following the year to which the bonus relates.

(c)Initial Equity Grant. In consideration of the commencement of Executive’s employment under this Agreement and subject to approval by the Compensation Committee, Executive will receive (1) a time-based restricted share award granted effective on the commencement of employment, with the number of shares to be determined by dividing $300,000 by the average closing share price of the Company's common stock as reported on the NASDAQ for the 30 trading days immediately prior to the Effective Date, and (ii) a performance-based restricted share award granted effective on the commencement of employment, with the number of shares to be determined by dividing $300,000 by the average closing share price of the Company's common stock as reported on the NASDAQ for the 30 trading days immediately prior to the Effective Date. These grant awards shall (i) be issued under the Company’s 2020 Omnibus Incentive Plan (as amended from time to time, the “OIP”) and (ii) be subject to the same form Company’s standard form of time-based and performance-based grant agreements.

(d)Long-Term Incentive Grants. The Company shall provide to Executive, on an annual basis during the Employment Period in such amount and pursuant to such terms as may be determined in the sole discretion of the Compensation Committee, and which are generally consistent with those awarded to the Company’s other senior executive officers in each year; provided that beginning with the calendar year 2025, the opportunity to receive a long-term incentive award with a grant date fair market value of at least $600,000 per annum. These grant awards shall (i) be issued under the OIP and (ii) be subject to the same form Company’s standard form of time-based and performance-based grant agreements.

(e)Other Benefits.

i.Savings and Retirement Plans. Except as otherwise limited by applicable law, Executive shall be entitled to participate in all qualified and non-qualified savings and retirement plans applicable generally to other senior executive officers of the Company, in accordance with the terms of the plans, as may be amended from time to time.

ii.Welfare Benefit Plans. Except as otherwise limited by applicable law, Executive and/or her eligible dependents shall be eligible to participate in and shall receive all benefits under the Company’s welfare benefit plans and programs applicable generally to other senior executive officers of the Company in accordance with the terms of the plans, as may be amended from time to time.

iii.Business Expenses. Subject to Section 15, Executive shall be reimbursed for reasonable travel and other expenses incurred in the performance of Executive’s duties on behalf of the Company in a manner consistent with the Company’s policies regarding such reimbursements, as may be in effect from time to time.

iv.Other Benefits. Executive shall receive such other benefits as are then customarily provided generally to the other senior officers of the Company and of its subsidiaries, as determined from time to time by Board or the Chief Executive Officer, including, without limitation, paid vacation in accordance with the Company’s practices as in effect from time to time.

4.Termination of Employment. Executive’s employment and this Agreement may be terminated prior to the Term End Date as set forth in this Section 4. Upon the termination of Executive’s employment with the Company for any reason, Executive shall be deemed to have resigned from the Board if a member at such time and all other positions with the Employer or any of its Affiliates (defined below) held by Executive as of the date immediately preceding her termination of employment.

(a)Accrued Benefits. Except as otherwise explicitly set forth in this Section 4, if Executive’s employment ends for any reason, Executive shall cease to have any rights to any compensation (including salary, bonus, or other benefits) following her cessation of employment, other than (i) the earned but unpaid portion of Executive’s Base Salary through the date Executive’s employment terminates (the “Date of Termination”), (ii) any annual, long-term, or other incentive award that relates to a completed fiscal year or performance period, as applicable, and is payable (but not yet paid) on or before the Date of Termination, which shall be paid in accordance with the terms of such award, (iii) a lump-sum payment in respect of accrued but unused vacation days as of the Date of Termination at Executive’s per-business-day Base Salary rate, if any, under the vacation policy to which the Executive is subject, (iv) any unpaid expense or other reimbursements due to Executive through the Date of Termination, and (v) any other amounts or benefits required to be paid or provided by law or under any plan, program, policy or practice of the Company, provided that Executive shall not be entitled to any payment or benefit under any Company severance plan, or any replacement or successor plan (subsections 4(b)(i)-(v), the “Accrued Benefits”). The Accrued Benefits shall be paid as soon as administratively practicable following the Date of Termination, in accordance with Employer’s policy and applicable law, subject to all required payroll deductions and withholdings.

(b)Termination by Death. In the event that Executive’s employment is terminated by death, then in addition to the Accrued Benefits and subject to Section 15, Executive’s beneficiaries shall be entitled to: (x) Executive’s Base Salary through the Date of Termination, payable in the first payroll period that occurs after the date of Executive’s death, and (y) other benefits (other than the payment of severance) to which Executive would be entitled, that are made available to employees of the Company in general upon termination of employment under similar circumstances in accordance with applicable plans and programs of the Company.

Executive shall be entitled to select (and change, to the extent permitted under any applicable law) a beneficiary or beneficiaries to receive any compensation or benefit payable hereunder following Executive’s death by giving the Company written notice thereof. In the event of Executive’s death or of a judicial determination of her incompetence, reference in this Agreement to Executive shall be deemed to refer to her beneficiary, and if Executive shall not have designated a beneficiary, her estate or legal representative (as the case may be).

(c)Termination due to Disability. In the event that Executive’s employment is terminated by the Employer or Executive due to Executive’s Disability (as defined below), such termination to be effective 30 days after delivery of written notice thereof, then in addition to the Accrued Benefits and subject to Section 15 and Section 4(i) and Executive’s continuing compliance with Section 6 of this Agreement:

i.the Company shall pay Executive an amount equal to 50% of Base Salary, offset by any payments that Executive may receive under the Company’s long-term disability plan and any supplement thereto, whether funded or unfunded, that is adopted or provided by the Company for Executive’s benefit, payable in a lump sum on the first payroll date that occurs after the 55th day following the effective date of her termination; and

ii.If Executive is eligible for and timely elects to continue receiving group medical and/or dental insurance under the continuation coverage rules known as COBRA, the Company will pay 100% of the premium for such coverage until the earlier of (x) the end of the 12th month following the Date of Termination, and (y) the date Executive becomes eligible for coverage under a new employer’s group health plan, unless, as a result of a change in legal requirements, the Company’s provision of payments for COBRA will violate the nondiscrimination requirements of applicable law, in which case this benefit will not apply;

(d)Termination by the Company for Cause. In the event that Executive’s employment is terminated by the Employer for Cause, Executive will be entitled to only the Accrued Benefits.

(e)Involuntary Termination. If Executive’s employment hereunder shall be terminated in a manner constituting an Involuntary Termination (as defined below), then in addition to the Accrued Benefits and subject to Section 15 and Section 4(i) and Executive’s continuing compliance with Section 6 of this Agreement:

i.the Company shall pay Executive the Severance Amount (defined below); and

ii.If Executive is eligible for and timely elects to continue receiving group medical and/or dental insurance under the continuation coverage rules known as COBRA, the Company will pay 100% of the premium for such coverage until the earlier of (x) the end of the 12th month following the Date of Termination, and (y) the date Executive becomes eligible for coverage under a new employer’s group health plan, unless, as a result of a change in legal requirements, the Company’s provision of payments for COBRA will violate the nondiscrimination requirements of applicable law, in which case this benefit will not apply.

(f)Voluntary Resignation by Executive without Good Reason. Executive may voluntarily terminate her employment with the Company at any time with or without notice and without Good Reason (as defined below). Such voluntary termination shall include, without limitation,

Executive’s decision not to renew this Agreement upon expiration of the Employment Period on the then current Base Salary and Target Bonus and for a term at least equal to one year. In the event Executive voluntarily terminates her employment without Good Reason, Executive will be entitled to only the Accrued Benefits.

(g)No Excise Tax Gross-Up; Possible Reduction in Payments. Executive is not entitled to any gross-up or other payment for golden parachute excise taxes Executive may owe pursuant to Section 4999 of the Code. In the event that any amounts payable pursuant to this Agreement or other payments or benefits otherwise payable to Executive (a) constitute “parachute payments” within the meaning of Section 280G of the Code, and (b) but for this Section 4 would be subject to the excise tax imposed by Section 4999 of the Code, then such amounts payable under this Agreement and under such other plans, programs and agreements shall be either (i) delivered in full, or (ii) delivered as to such lesser extent which would result in no portion of such benefits being subject to excise tax under Section 4999 of the Code, whichever of the foregoing amounts, taking into account the applicable federal, state and local income and employment taxes and the excise tax imposed by Section 4999 of the Code (and any equivalent state or local excise taxes), results in the receipt by Executive, on an after-tax basis, of the greatest amount of benefits, notwithstanding that all or some portion of such benefits may be taxable under Section 4999 of the Code.

(h)No Mitigation; No Offset. In the event of any termination of employment under this Section 4, Executive shall be under no obligation to seek other employment; provided, however, that (without limiting any rights of the Company for any breach of this Agreement under law, equity or otherwise), if Executive violates any provision of Section 6, any obligation of Employer to make payments to Executive under Section 4 of this Agreement (other than the Accrued Benefits) shall immediately cease and Executive shall be required to immediately repay any payments previously received.

(i)Release. An express condition to Executive’s right to receive termination payments, severance, and other benefits (other than Accrued Benefits) pursuant to Section 4 of this Agreement is Executive’s execution of a severance and release of claims agreement (“Separation Agreement”) in a form to be provided by the Company (which will include, at a minimum, a complete and general release of any and all of Executive’s potential claims (other than for benefits and payments described in this Agreement or any other vested benefits from the Employer and/or their Affiliates) against the Employer, any of its affiliated companies, and their respective successors and any officers, employees, agents, directors, attorneys, insurers, underwriters, and assigns of the Employer or its affiliates and/or successors, as well as confidentiality, non-disparagement, and cooperation obligations), and any legally required revocation period applicable to such Separation Agreement having expired without Executive revoking such Separation Agreement. Executive shall be required to execute within 45 days after the Date of Termination (or such shorter period as may be directed by the Company) the Separation Agreement.

5.Definitions.

(a)“Cause” shall mean the occurrence of any one of the following, as determined in good faith by the Board:

i.(i) Executive’s gross negligence or willful misconduct in the performance of, or Executive’s abuse of alcohol or drugs rendering Executive unable to perform, the material duties and services required for Executive’s position with the Company, which

neglect or misconduct, if remediable, remains unremedied for 30 days following written notice of such by the Company to Executive;

ii.Executive’s conviction or plea of nolo contendere for any crime involving moral turpitude or a felony;

iii.Executive’s commission of an act of deceit or fraud intended to result in personal and unauthorized enrichment of Executive at the expense of the Company or any of its affiliates;

iv.Executive’s willful and material violation of the written policies of the Company or any of its affiliates as in effect from time to time, Executive’s willful breach of a material obligation of Executive to the Company pursuant to Executive’s duties and obligations under the Company’s Bylaws, or Executive’s willful and material breach of a material obligation of Executive to the Company or any of its affiliates pursuant to this Agreement or any award or other agreement between Executive and the Company or any of its affiliates; or

v.Executive’s behavior or commission of an act that materially injures or would reasonably be expected to materially injure the reputation, business or business relationships of the Company.

With respect to Section 5(a)iv, no act or failure to act, on the part of Executive, shall be considered “willful” unless it is done, or omitted to be done, by Executive in bad faith or without reasonable belief that Executive’s action or omission was in the best interests of the Employer, and provided further that no act or failure to act shall constitute Cause under Section 5(a)iv unless, if remediable, the Employer has given written notice thereof to Executive, and Executive has failed to remedy such act or failure to act within 30 days following written notice. By way of clarification, but not limitation, for purposes of this definition of the term Cause, materiality shall be determined relative to this Agreement and Executive’s employment, rather than the financial status of the Company as a whole.

(b) “Change in Control” shall be deemed to have occurred upon the occurrence of:

i.The acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) (a “Person”) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of 50% or more of either (x) the then outstanding shares of common stock of the Company (the “Outstanding Company Common Stock”) or (y) the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”); provided, however, that for purposes of this subsection (i), the following acquisitions shall not constitute a Change in Control: (A) any acquisition directly from the Company, (B) any acquisition by the Company, (C) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any corporation controlled by the Company, (D) any acquisition by any corporation pursuant to a transaction which complies with clauses (A) or (B) of paragraph (iv) below, or (E) any acquisition by a Founding Member (as defined in the National CineMedia, LLC Third Amended and Restated Limited Liability Operating Agreement, dated as of February 13, 2007); or

ii.The acquisition by any Person, other than a Founding Member or pursuant to the Director Designation Agreement dated August 6, 2023, among the Company, Consenting Creditor Designation Committee (as defined therein), and Blantyre Capital Limited, a majority of the members of the Company’s Board, of the right to (A) elect or (B) nominate for election or (C) designate for nomination, a majority of the members of the Company’s Board;

iii.The acquisition by any Person, other than the Company or a Founding Member, of beneficial ownership of more than 50% of the Units of NCM LLC; or

iv.Consummation of a reorganization, merger or consolidation or sale or other disposition of all or substantially all of the assets of the Company or an acquisition of assets of another corporation (a “Business Combination”), in each case, unless, following such Business Combination, (A) (x) all or substantially all of the individuals and entities who were the beneficial owners, respectively, of the Outstanding Company Common Stock and Outstanding Company Voting Securities immediately prior to such Business Combination beneficially own, directly or indirectly, more than 50% of, respectively, the then outstanding shares of common stock and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the corporation resulting from such Business Combination (including, without limitation, a corporation which as a result of such transaction owns the Company or all or substantially all of the Company’s assets either directly or through one or more subsidiaries) in substantially the same proportions as their ownership, immediately prior to such Business Combination of the Outstanding Company Common Stock and Outstanding Company Voting Securities, as the case may be; and (y) at least a majority of the members of the board of directors of the corporation resulting from such Business Combination were individuals who, as of the Effective Date, constitute the Board (the “Incumbent Board”); provided, however, that any individual becoming a director subsequent to the Effective Date whose election, or nomination for election by the Company’s stockholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board or was designated pursuant to a Director Designation Agreement dated February 13, 2007 among the Company and the Founding Members shall be considered as though such individual were a member of the Incumbent Board, at the time of the execution of the initial agreement, or of the action of the Board, providing for such Business Combination or (B) the Founding Members beneficially own, more than 50% of, respectively, the outstanding shares of common stock or voting power of the then outstanding voting securities entitled to vote generally in the election of directors of the corporation resulting from such Business Combination; or

v.Approval by the stockholders of the Company of a complete liquidation or dissolution of the Company; or

vi.Approval by the members of NCM LLC of a complete liquidation or dissolution of NCM LLC.

Notwithstanding the foregoing, to the extent required by Section 409A of the Internal Revenue Code, any such event must constitute a “change in control event” as defined in Treasury Regulation Section 1.409A-3(i).

(c)“Covered Period” shall mean the period beginning on the date of a Change in Control and ending 12 months after the Change in Control.

(d)“Disability” shall mean the illness or other mental or physical disability of Executive, resulting in her failure to perform substantially her duties under this Agreement for a period of six or more consecutive months, provided that such condition results in Executive being “disabled” within the meaning of Section 409A of the Internal Revenue Code.

(e)“Good Reason” shall mean Executive’s voluntary resignation of employment for one or more of the following reasons occurring without Executive’s consent:

i.a material adverse change in the nature, scope or status of Executive’s position, authorities or duties;

ii.a material reduction in Executive’s Base Salary or Target Bonus;

iii.relocation of Executive’s primary place of employment by more than thirty-five (35) miles from Executive’s primary place of employment immediately following the Effective Date (in a direction that increases Executive’s daily commute);

iv.failure by an acquirer to assume this Agreement at the time of a Change in Control; or

v.a material breach by the Company, or its successor, of this Agreement. Notwithstanding the foregoing, prior to Executive’s voluntary resignation for Good Reason, Executive must give the Company written notice of the existence of any condition set forth in clause (i) – (v) above within 30 days of such initial existence and the Company shall have 30 days from the date of such notice in which to cure the condition giving rise to Good Reason, if curable. If, during such 30-day period, the Company cures the condition giving rise to Good Reason, no benefits shall be due under Section 4 of this Agreement with respect to such occurrence. If, during such 30-day period, the Company fails or refuses to cure the condition giving rise to Good Reason and it is determined such Good Reason does exist, Executive shall be entitled to the “Involuntary Termination” benefits under Section 4 of this Agreement following such termination, provided that Executive voluntarily resigns for Good Reason within 180 days of the initial existence of the applicable condition, and Executive provides written notice of her resignation for Good Reason.

(f)“Involuntary Termination” shall mean a termination during the Employment Period either:

i.By the Company, its Affiliates or successors, other than a termination for Cause or due to Executive’s death or Disability;

ii.By Executive for Good Reason, effective upon Executive providing the Company with written notice of the resignation for Good Reason; or

iii.By reason of the Company’s refusal to renew this Agreement past the Term End Date on the then current Base Salary and Target Bonus and for a term at least equal to one year.

iv.“Severance Amount” shall mean for an Involuntary Termination, an amount equal to 100% of Base Salary, plus 100% of Target Bonus, payable in equal installments

within a 12-month period starting on the first payroll date that occurs after the 55th day following the date of the Involuntary Termination.

6.Restrictive Covenants. Executive acknowledges that the Company is engaged in a highly competitive business and that the preservation of its Proprietary or Confidential Information (as defined in Section 6(a) below) to which Executive has been exposed or acquired, and will continue to be exposed to and acquire, is critical to the Company’s continued business success. Executive also acknowledges that the Company’s relationships with its business partners hereinafter “Business Partners” which means NCM LLC, AMC, Cinemark and Regal and all their respective Affiliates together with any chain, circuit or group (of any nature of description) of movie theaters or like venues which now or hereafter enter into business relations with the Company), are extremely valuable and that, by virtue of Executive’s employment with the Company, she may have contact with such Business Partners on behalf of and for the benefit of the Company. As a result, Executive’s engaging in or working for or with any business which is directly or indirectly competitive with the Company’s business, given Executive’s knowledge of the Company’s Proprietary or Confidential Information, would cause the Company great and irreparable harm if not done in strict compliance with the provisions of this Section 6. Therefore, Executive acknowledges and agrees that in consideration of all of the above and in exchange for access to the Company’s Proprietary or Confidential Information, Executive will be bound by, and comply in all respects with, the provisions of this Section 6. For purposes of this Section 6, any references to the time period of Executive’s employment with the Company shall date back to Executive’s original hire date with the Company.

(a)Confidentiality. Executive shall at all times hold in strict confidence any Proprietary or Confidential Information related to the Company or any of its affiliates (which shall mean any entity that, directly or indirectly, is controlled by, controls or is under common control with the Company and/or any entity in which the Company has a significant equity interest, in either case as determined by the Board, hereinafter “Affiliates”) (including without limitation AMC, Cinemark, Regal and NCM, LLC), except that Executive may disclose such information as required by law, court order, regulation, or similar order provided Executive shall first have notified the Company of the pendency of such proceeding and afforded the Company an opportunity to intervene and defend against disclosure. For purposes of this Agreement, the term “Proprietary or Confidential Information” shall mean all non-public information relating to the Company or any of its Affiliates (including but not limited to all marketing, alliance, social media, advertising, and sales plans and strategies; pricing information; financial, advertising, and product development plans and strategies; compensation and incentive programs for employees; alliance agreements, plans, and processes; plans, strategies, and agreements related to the sale of assets; third party provider agreements, relationships, and strategies; business methods and processes used by the Company and its employees; all personally identifiable information regarding Company employees, contractors, and applicants; lists of actual or potential Business Partners; and all other business plans, trade secrets, or financial information of strategic importance to the Company or its Affiliates) that is not generally known in the Company’s industry, that was learned, discovered, developed, conceived, originated, or prepared during Executive’s employment with the Company, and the competitive use or disclosure of which would be harmful to the business prospects, financial status, or reputation of the Company or its Affiliates at the time of any disclosure by Executive.

The relationship between Executive and the Company and its Affiliates is and shall continue to be one in which the Company and its Affiliates repose special trust and confidence in Executive, and one in which Executive has and shall have a fiduciary relationship to the Company and its Affiliates. As a result, the Company and its Affiliates shall, in the course of Executive’s duties to the Company, entrust Executive with, and disclose to Executive, Proprietary or Confidential Information. Executive recognizes

that Proprietary or Confidential Information has been developed or acquired, or will be developed or acquired, by the Company and its Affiliates at great expense, is proprietary to the Company and its Affiliates, and is and shall remain the property of the Company and its Affiliates. Executive acknowledges the confidentiality of Proprietary or Confidential Information and further acknowledges that Executive could not competently perform Executive’s duties and responsibilities in Executive’s position with the Company and/or its Affiliates without access to such information. Executive acknowledges that any use of Proprietary or Confidential Information by persons not in the employ of the Company and its Affiliates would provide such persons with an unfair competitive advantage which they would not have without the knowledge and/or use of the Proprietary or Confidential Information and that this would cause the Company and its Affiliates irreparable harm. Executive further acknowledges that because of this unfair competitive advantage, and the Company’s and its Affiliates’ legitimate business interests, which include their need to protect their goodwill and the Proprietary or Confidential Information, Executive has agreed to the post-employment restrictions set forth in this Section 6. Nothing in this Section 6(a) is intended, or shall be construed, (i) to limit the protection of any applicable law or policy of the Company or its Affiliates that relates to the protection of trade secrets or confidential or proprietary information or (ii) to limit Executive’s ability to initiate communications directly with, or to respond to any inquiry from, or provide testimony before, the SEC, FINRA, any other self-regulatory organization or any other state or federal regulatory authority.

(b)Non-Solicitation of Employees. During Executive’s employment and for the one-year period following termination of Executive’s employment for any reason (the “Coverage Period”), Executive hereby agrees not to, directly or indirectly, solicit, hire, seek to hire, engage or assist any other person or entity (on her own behalf or on behalf of such other person or entity) in soliciting, hiring or engaging any person who is at that time an employee, consultant, independent contractor, representative, or other agent of the Company or any of its Affiliates to perform services for any entity (other than the Company or its Affiliates), or attempt to induce or encourage any such employee to leave the employ of the Company or its Affiliates.

(c)Non-Competition.

i.In return for, among other things, all of the above and the Company’s promise to provide the Proprietary or Confidential Information described herein, Executive agrees that during Executive’s employment and the Coverage Period, Executive shall not compete with the Company by providing work, services or any other form of assistance (whether or not for compensation) in any capacity, whether as an employee, consultant, partner, or otherwise, to any Competitor that (1) is the same or similar to the services Executive provided to the Company or (2) creates the reasonable risk that Executive will (willfully, inadvertently or inevitably) use or disclose the Company’s Proprietary or Confidential Information. “Competitor” includes any business that operates or does business similar in nature to that of the Company during the Employment Period in any State, territory, or protectorate of the United States in which the Company or an Affiliate does business and/or in any foreign country in which the Company or an Affiliate has or maintains any place of business, venue, facility, or otherwise conducts business, as of the date of Executive’s termination of employment with the Company. Executive further acknowledges and agrees that the restrictions imposed in this subparagraph (i) will not prevent Executive from earning a livelihood and that they are reasonable.

ii.Notwithstanding the foregoing, should Executive consider working for or with any actually, arguably, or potentially competing business following the termination of Executive’s employment with the Company or any of its Affiliates and during the Coverage

Period, then Executive agrees to provide the Company with two (2) weeks advance written notice of Executive’s intent to do so, and also to provide the Company with accurate information concerning the nature of Executive’s anticipated job responsibilities in sufficient detail to allow the Company to meaningfully exercise its rights under this Section 6. After receipt of such notice, the Company may then agree, in its sole, absolute, and unreviewable discretion, to waive, modify, or condition its rights under this Section 6. In particular, the Company may agree to modify Section 6(c)i if the Company concludes that the work Executive will be performing for a Competitor is different from the work Executive was performing during Executive’s employment with the Company or any of its Affiliates and/or (2) there is no reasonable risk that Executive will (willfully, inadvertently or inevitably) use or disclose the Company’s Proprietary or Confidential Information.

(d)Non-Solicitation of Business Partners. Executive acknowledges that, by virtue of her employment by the Company or its Affiliates, Executive has gained or will gain knowledge of the identity, characteristics, and preferences of the Company’s Business Partners, among other Proprietary or Confidential Information, and that Executive would inevitably have to draw on such information if she were to solicit or service the Company’s Business Partners on behalf of a Competitor. Accordingly, during the Employment Period and the Coverage Period, Executive agrees not to, directly or indirectly, solicit the business of or perform any services of the type she performed or sell any products of the type she sold during her employment with the Company for or to actual or prospective Business Partners of the Company (i) as to which Executive performed services, sold products or as to which employees or persons under Executive’s supervision or authority performed such services, or had direct contact, or (ii) as to which Executive had accessed Proprietary or Confidential Information during the course of Executive’s employment by the Company, or in any manner encourage or induce any such actual or prospective Business Partner to cease doing business with or in any way interfere with the relationship between the Company and its Affiliates and such actual or prospective Business Partner. Executive further agrees that during the Employment Period and the Coverage Period, Executive will not encourage or assist any Competitor to solicit or service any actual or prospective Business Partners or otherwise seek to encourage or induce any Business Partners to cease doing business with, or reduce the extent of its business dealings with the Company.

(e)Non-Interference. During Executive’s Employment Period and the Coverage Period, Executive agrees that Executive shall not, directly or indirectly, induce or encourage any Business Partner or other third party, including any provider of goods or services to the Company, to terminate or diminish its business relationship with the Company; nor will Executive take any other action that could, directly or indirectly, be detrimental to the Company’s relationships with its Business Partners and providers of goods or services or other business affiliates or that could otherwise interfere with the Company’s business.

(f)Non-Disparagement. Executive agrees during and following the Employment Period, not to make, or cause to be made, any statement, observation, or opinion, or communicate any information (whether oral or written, directly or indirectly) that (i) accuses or implies that the other Party or its Affiliates, as may be applicable, engaged in any wrongful, unlawful or improper conduct, whether relating to Executive’s employment (or the termination thereof), the business, management, or operations of the Company or its Affiliates, as may be applicable, or otherwise, or (ii) disparages, impugns, or in any way reflects adversely upon the business or reputation of the other Party or its subsidiaries or affiliates, as may be applicable. Nothing herein, however, will be deemed to preclude either Party from providing truthful testimony or information pursuant to subpoena, court order, or similar legal process, instituting and pursuing legal action, or engaging in other legally protected speech or activities or to prevent either

Party from making any disclosure required by the Exchange Act or other applicable law (including without limitation Company disclosure deemed advisable under the federal securities laws or the rules of any stock exchange).

(g)Breach. Executive acknowledges that the restrictions contained in this Section 6 are fair, reasonable, and necessary for the protection of the legitimate business interests of the Company, that the Company will suffer irreparable harm in the event of any actual or threatened breach by Executive, and that it is difficult to measure in money the damages which will accrue to the Company by reason of a failure by Executive to perform any of Executive’s obligations under this Section 6. Accordingly, if the Company or any of its subsidiaries or Affiliates institutes any action or proceeding to enforce their rights under this Section 6, to the extent permitted by applicable law, Executive hereby waives the claim or defense that the Company or its Affiliates has an adequate remedy at law, Executive shall not claim that any such remedy at law exists, and Executive consents to the entry of a restraining order, preliminary injunction, or other preliminary, provisional, or permanent court order to enforce this Agreement, and expressly waives any security that might otherwise be required in connection with such relief. Executive also agrees that any request for such relief by the Company shall be in addition and without prejudice to any claim for monetary damages and/or other relief which the Company might elect to assert. The Parties further agree that, in the event that any provision of Section 6 shall be determined by any court of competent jurisdiction to be unenforceable by reason of its being extended over too great a time, too large a geographic area or too great a range of activities, such provision shall be deemed to be modified to permit its enforcement to the maximum extent permitted by law. The length of time for which the covenants in Section 6 shall be in force shall be extended by an amount of time equal to the period of time during which a violation of such covenant is deemed by a court of competent jurisdiction to have occurred (including any period required for litigation during which the Company seeks to enforce such covenant). If, notwithstanding such provision, a court in any judicial proceeding refuses to enforce any of the separate covenants included herein, the unenforceable covenant will be considered eliminated from these provisions for the purpose of those proceedings to the extent necessary to permit the remaining separate covenants to be enforced.

(h)Notice. Notwithstanding Executive’s confidentiality and nondisclosure obligations, Executive is hereby advised as follows pursuant to the Defend Trade Secrets Act: ”An individual shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that: (A) is made (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. An individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding, if the individual: (A) files any document containing the trade secret under seal; and (B) does not disclose the trade secret, except pursuant to court order.” For the avoidance of doubt, nothing in this Agreement is intended to, nor shall be construed to, conflict with the Defend Trade Secrets Act 18 U.S.C. § 1833(b). Further, Executive understands that nothing in this Agreement or any other agreement that Executive may have with the Company or any of its Subsidiaries restricts or prohibits Executive from communicating with government agencies about possible violations of federal, state, or local laws or otherwise providing information to government agencies filing a complaint with government agencies, or participating in government agency investigations or proceedings, or from making other disclosures that are protected under the whistleblower provisions of state or federal law or regulation, and Executive does not need the Company’s prior authorization to engage in such conduct.

7.Survival. Sections 6, 7, 9, 10 and 18, and such other provisions hereof as may so indicate shall survive and continue in full force and effect in accordance with their respective terms, notwithstanding any termination of the Employment Period.

8.Notices. Any notice provided for in this Agreement shall be in writing and shall be delivered (i) personally, (ii) by UPS, Federal Express or other reputable courier service regularly providing evidence of delivery (with charges paid by the party sending the notice), or (iii) by facsimile or a PDF or similar attachment to an email, provided that such telecopy or email attachment shall be followed within one (1) business day by delivery of such notice pursuant to clause (i), (ii) or (iii) above. Any such notice to a party shall be addressed at the address set forth below (subject to the right of a party to designate a different address for itself by notice similarly given):

If to the Company:

General Counsel

National CineMedia, Inc.

6300 S. Syracuse Way

Suite 300

Centennial, Colorado 80111

If to Executive:

To the most recent address on file with the Company

9.Entire Agreement. This Agreement constitutes the entire agreement and understanding between the Parties with respect to the subject matter hereof and supersedes and preempts any prior understandings, agreements or representations by or between the Parties, written or oral, which may have related in any manner to the subject matter hereof.

10.No Conflict. Executive represents and warrants that Executive is not bound by any employment contract, restrictive covenant, or other restriction preventing Executive from carrying out Executive’s responsibilities for the Employer, or which is in any way inconsistent with the terms of this Agreement. Executive further represents and warrants that Executive shall not disclose to the Employer or induce the Employer to use any confidential or proprietary information or material belonging to any previous employer or others.

11.Successors and Assigns. This Agreement shall inure to the benefit of and be enforceable by Executive and her heirs, executors and personal representatives, and the Company and its successors and assigns. Any successor or assignee of the Company shall assume the liabilities of the Company hereunder, and for the avoidance of doubt, no such assignment shall be treated as a termination of Executive’s employment with the assignor for purposes of this Agreement.

12.Governing Law; Alternative Dispute Resolution. This Agreement shall be governed by the internal laws (as opposed to the conflicts of law provisions) of the State of Colorado. The Parties agree that any and all disputes, claims or controversies arising out of or relating to this Agreement or Executive’s employment with the Company or termination thereof, other than with respect to disputes arising out of Section 6 herein (“Non-Arbitrable Disputes”), shall be submitted to arbitration in accordance with and under the auspices of the Employment Arbitration Rules of JAMS (Denver Colorado office) or its successor. The arbitration shall take place in Denver, Colorado, unless the Parties mutually agree to conduct the arbitration in a different location. The arbitrator shall be selected by the mutual

agreement of the Parties. The arbitrator shall have exclusive authority to resolve any dispute relating to the interpretation, applicability, enforceability or formation of this Agreement, including but not limited to any claim that all or any part of this Agreement is void or voidable. The arbitrator shall apply the applicable statute of limitations to any claim. The arbitrator shall issue a written opinion and award, which shall be signed and dated. The arbitrator shall be permitted to award those remedies that are available under applicable law. The arbitrator’s decision regarding the claims shall be final and binding upon the Parties. The arbitrator’s award shall be enforceable in any court having jurisdiction thereof. Non-Arbitrable Disputes shall be commenced only in a state or federal court in Colorado, and the Company and Executive each submits to the personal jurisdiction of such courts. The Company and Executive each hereby irrevocably waives any right to a trial by jury in any action, suit or other legal proceeding arising out of or relating to this Agreement or Executive’s employment with the Company or termination thereof.

13.Amendment and Waiver. The provisions of this Agreement may be amended or waived only with the prior written consent of the Company and Executive, and no course of conduct or failure or delay in enforcing the provisions of this Agreement shall affect the validity, binding effect or enforceability of this Agreement.

14.Withholding. All payments and benefits under this Agreement are subject to withholding of all applicable taxes.

15.Code Section 409A. This Agreement is intended to be exempt from, or comply with, the requirements of Section 409A of the Internal Revenue Code, as amended (the “Code”), and shall be interpreted and construed consistently with such intent. The payments to Executive pursuant to this Agreement are also intended to be exempt from Section 409A of the Code to the maximum extent possible, under either the separation pay exemption pursuant to Treasury regulation §1.409A-1(b)(9)(iii) or as short-term deferrals pursuant to Treasury regulation §1.409A-1(b)(4). For purposes of Section 409A of the Code, Executive’s right to receive any installment payments under this Agreement (whether severance payments, reimbursements or otherwise) shall be treated as a right to receive a series of separate payments and, accordingly, each installment payment hereunder shall at all times be considered a separate and distinct payment. To the extent required to avoid the imposition of additional taxes and penalties under Section 409A of the Code, any amounts under this Agreement are payable by reference to Executive’s “termination of employment” such term and similar terms shall be deemed to refer to Executive’s “separation from service,” within the meaning of Section 409A of the Code; provided, however, that a “separation from service” means a separation from service with the Company and all other persons or entities with whom the Company would be considered a single employer under Section 414(b) or 414(c) of the Code, applying the 80% threshold used in such Code sections and the Treasury Regulations thereunder, all within the meaning of Section 409A of the Code. Executive hereby agrees to be bound by the Company’s determination of its “specified employees” (as such term is defined in Section 409A of the Code) provided such determination is in accordance with any of the methods permitted under the regulations issued under Section 409A of the Code. Notwithstanding any other provision in this Agreement, to the extent any payments made or contemplated hereunder constitute nonqualified deferred compensation, within the meaning of Section 409A of the Code, then (i) each such payment which is conditioned upon Executive’s execution of a release and which is to be paid or provided during a designated period that begins in one taxable year and ends in a second taxable year, shall be paid or provided in the later of the two taxable years and (ii) if Executive is a specified employee (within the meaning of Section 409A of the Code) as of the date of Executive’s separation from service, each such payment that constitutes deferred compensation under Section 409A of the Code and is payable upon Executive’s separation from service and would have been paid prior to the six-month anniversary of

Executive’s separation from service, shall be delayed until the earlier to occur of (A) the first day of the seventh month following Executive’s separation from service or (B) the date of Executive’s death. Any reimbursement payable to Executive pursuant to this Agreement shall be conditioned on the submission by Executive of all expense reports reasonably required by Employer under any applicable expense reimbursement policy, and shall be paid to Executive within 30 days following receipt of such expense reports, but in no event later than the last day of the calendar year following the calendar year in which Executive incurred the reimbursable expense. Any amount of expenses eligible for reimbursement, or in-kind benefit provided, during a calendar year shall not affect the amount of expenses eligible for reimbursement, or in-kind benefit to be provided, during any other calendar year. The right to any reimbursement or in-kind benefit pursuant to this Agreement shall not be subject to liquidation or exchange for any other benefit. In no event will Employer be liable for any additional tax, interest or penalties that may be imposed on Executive under Section 409A of the Code or for any damages for failing to comply with Section 409A of the Code

16.Clawbacks. The payments to Executive pursuant to this Agreement are subject to forfeiture or recovery by the Company or other action pursuant to any clawback or recoupment policy which the Company may adopt from time to time, including without limitation any such policy or provision that the Company has included in any of its existing compensation programs or plans or that it may be required to adopt under the Dodd-Frank Wall Street Reform and Consumer Protection Act and implementing rules and regulations thereunder, or as otherwise required by law.

17.Company Policies. Executive shall be subject to additional Company policies as they may exist from time-to-time, including policies with regard to stock ownership by senior executives and policies regarding trading of securities.

18.Indemnification. The Company agrees to indemnify Executive to the fullest extent permitted by applicable law consistent with the Certificate of Incorporation and By-Laws of the Company as in effect on the effective date of this Agreement, or as the Certificate of Incorporation and By-Laws may be amended from time to time to provide greater indemnification, with respect to any acts or non-acts she may have committed while she was an officer, director and/or employee (i) of the Company or any subsidiary thereof, or (ii) of any other entity if her service with such entity was at the request of the Company.

[Signature Page to Follow]

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement on the Execution Date.

| | | | | | | | |

| | |

| NATIONAL CINEMEDIA, INC. |

| |

| By: | | /s/ Thomas Lesinski |

| Name: | | Thomas Lesinski |

| Title: | | Chief Executive Officer |

|

|

| |

| | /s/ Catherine A. Sullivan |

| | CATHERINE A. SULLIVAN |

| | |

Exhibit 99.1

National CineMedia Appoints Catherine Sullivan as President of Sales, Marketing, and Partnerships

Veteran executive joins NCM to lead development and execution of go-to-market strategy to propel next stage of growth across NCM's premium video advertising platform

NEW YORK – May 15, 2024 – National CineMedia (NASDAQ: NCMI) (“the Company” or “NCM”), the largest cinema advertising platform in the US, today announced the appointment of seasoned media executive and strategist, Catherine Sullivan, as President of Sales, Marketing, and Partnerships, effective May 16, 2024. In this role, Sullivan will oversee the Company’s sales and marketing strategy and lead initiatives to continue the momentum of brands returning to the theater to reach sought-after audiences. Sullivan will join the executive leadership team, reporting directly to Chief Executive Officer Tom Lesinski.

"Catherine brings a highly accomplished track record as a visionary advertising executive and innovative, results-driven leader,” said Lesinski. “With her proven history of leading high-performing teams and driving growth, I am confident that Catherine will be an instrumental part of advancing NCM’s continued transformation into a modern, full-funnel media solution, accelerating our dynamic trajectory and strengthening our position as the market leader.”

Sullivan brings over three decades of experience at the highest levels in the media and advertising industry, driving revenue growth in digital multiplatform sales. She has served as CEO at PHD Media US, Chief Investment Officer at Omnicom Media Group (OMG), held a range of executive positions at both ABC Television and NBCUniversal Media, LLC, and most recently was a senior advisor to BranchLab, Equativ, Smartly.io, and Telly.

"I am thrilled to be joining the National CineMedia team at such a pivotal moment in the Company's journey,” said Sullivan. “The advertising industry has reached a critical juncture, and I’m excited to advance the Company’s partnerships with new and existing clients as we continue to expand our offerings. I’m grateful for the opportunity to join this accomplished team and look forward to continuing to innovate as we help our valued clients reach sought after audiences at scale.”

Scott Felenstein, current President of Sales, Marketing, and Partnerships, will be departing NCM when his contract expires at the end of this quarter and will assist with a smooth transition and ensure continuity for our team and clients.

"Scott has been an instrumental leader within the Company and dedicated partner to our executive team, as he led our sales organization through both the COVID-19 pandemic and our financial restructuring. I thank Scott for his partnership and devotion to NCM throughout his tenure with the Company, and wish him all the success in his next chapter,” said Lesinski.

About NCM

National CineMedia (NCM) is the largest cinema advertising platform in the US. With unparalleled reach and scale, NCM connects brands to sought-after young, diverse audiences through the power of movies and pop culture. A premium video, full-funnel marketing solution for advertisers, NCM enhances

marketers' ability to measure and drive results. NCM’s Noovie® Show is presented exclusively in 42 leading national and regional theater circuits including the only three national chains, AMC Entertainment Inc. (NYSE:AMC), Cinemark Holdings, Inc. (NYSE:CNK) and Regal Entertainment Group (a subsidiary of Cineworld Group PLC). NCM’s cinema advertising platform consists of more than 18,400 screens in over 1,450 theaters in 190 Designated Market Areas® (all of the Top 50). National CineMedia, Inc. (NASDAQ:NCMI) owns and is the managing member of, National CineMedia, LLC. For more information, visit www.ncm.com.

Contacts

Pam Workman

VP, PR & Corporate Communications.

pam.workman@ncm.com

v3.24.1.1.u2

Document and Entity Information Document

|

May 15, 2024 |

| Entity Central Index Key |

0001377630

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Entity File Number |

001-33296

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Trading Symbol |

NCMI

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Document Period End Date |

May 15, 2024

|

| Document Type |

8-K

|

| Entity Tax Identification Number |

20-5665602

|

| (State or Other Jurisdiction of Incorporation or Organization) |

DE

|

| Entity Address, Address Description |

6300 S. Syracuse Way

|

| Entity Address, Address Line Two |

Suite 300

|

| Document Period End Date |

May 15, 2024

|

| Entity Registrant Name |

National CineMedia, Inc.

|

| Entity Address, City or Town |

Centennial

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80111

|

| City Area Code |

303

|

| Local Phone Number |

792-3600

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |