Exceeds guidance with revenue of $62.4

million

Scatter revenue up 35% year-over-year

National CineMedia, Inc. (NASDAQ: NCMI) (“the Company” or

“NCM”), the managing member and owner of approximately 100% of

National CineMedia, LLC (NCM LLC), the operator of the largest

cinema advertising network reaching movie audiences in the U.S.,

today announced its consolidated results for the fiscal third

quarter ended September 26, 2024.

“NCM delivered its fourth consecutive quarter of consistent

results, achieving $62.4 million in revenue, and demonstrating our

strength as the box office continues to accelerate,” said Tom

Lesinski, CEO of NCM. “We continue to drive meaningful growth in

our premium Platinum offering, which has more than doubled since

last year, while attracting new, category-leading advertisers

across our platform as brands increasingly turn to NCM for

incremental reach of highly valuable audiences at scale. We are

confident in NCM’s ability to capitalize on this momentum as we

continue to focus on improving monetization and productivity.

Looking ahead to 2025, there is a lot to be excited about with a

highly anticipated film slate appealing to a diverse demographic of

moviegoers.”

Q3 2024 NCM LLC Results1

Total revenue for the third quarter ended September 26, 2024

decreased 10.3% to $62.4 million as compared to $69.6 million for

the third quarter of 2023. Operating loss decreased to $7.5 million

for the third quarter of 2024 from $150.7 million for the third

quarter of 2023. Adjusted OIBDA, a non-GAAP measure, decreased to

$8.8 million for the third quarter of 2024 from $11.3 million for

the third quarter of 2023, as adjusted to exclude depreciation,

amortization, share-based compensation costs, impairment of

long-lived assets, workforce reorganization costs, loss on

termination of Regal ESA, satellite transition costs, system

optimization costs and fees and expenses related to involvement in

the Cineworld proceeding and Chapter 11 case, each as previously

reported and described in the Company’s public filings made with

the U.S. Securities and Exchange Commission (the “SEC”).

Total revenue for the nine months ended September 26, 2024

decreased 8.5% to $154.5 million as compared to $168.9 million for

the nine months ended September 28, 2023. Operating loss decreased

to $39.4 million for the nine months ended September 26, 2024 from

$202.2 million for the nine months ended September 28, 2023.

Adjusted OIBDA decreased to $10.7 million for the nine months ended

September 26, 2024 from $12.9 million for the nine months ended

September 28, 2023, as adjusted to exclude depreciation,

amortization, share-based compensation costs, impairment of

long-lived assets, workforce reorganization costs, loss on

termination of Regal ESA, satellite transition costs, system

optimization costs and fees and expenses related to involvement in

the Cineworld proceeding and Chapter 11 case, each as previously

reported and described in the Company’s public filings made with

the SEC.

____________________

1With respect to operating data, all

activity during NCM LLC’s financial restructuring from April 11,

2023, to August 7, 2023, when NCM LLC was deconsolidated from NCM,

Inc., represents activity and balances for NCM, Inc. standalone.

All activity and balances prior to the deconsolidation of NCM LLC

on April 11, 2023, and after the reconsolidation of NCM LLC on

August 7, 2023, represent NCM, Inc. consolidated, inclusive of NCM

LLC. The operating results for NCM LLC, which management believes

better represent the Company's historical consolidated performance,

are presented within the body of this release.

Q3 2024 Consolidated Results

Total revenue for the third quarter ended September 26, 2024

increased 152.6% to $62.4 million as compared to $24.7 million for

the third quarter of 2023. Operating loss decreased to $7.5 million

for the third quarter of 2024 from $12.3 million for the third

quarter of 2023. Net loss for the third quarter of 2024 was $3.6

million, or negative $0.04 per diluted share, compared to net

income of $181.8 million, or $2.89 per diluted share, for the third

quarter of 2023.

Total revenue for the nine months ended September 26, 2024

increased 107.7% to $154.5 million as compared to $74.4 million for

the nine months ended September 28, 2023. Operating loss decreased

to $39.4 million for the nine months ended September 26, 2024 from

$47.7 million for the nine months ended September 28, 2023. Net

loss for the nine months ended September 26, 2024 was $47.0

million, or negative $0.49 per diluted share, compared to net

income of $681.5 million, or $20.72 per diluted share, for the nine

months ended September 28, 2023.

Q4 2024 Outlook

For the fourth quarter of 2024, NCM LLC expects to earn total

revenue of $82.0 million to $86.0 million, and Adjusted OIBDA in

the range of $28.0 million to $30.0 million for the fourth quarter

of 2024.

Supplemental Information

Integration and other encumbered theater payments due primarily

from AMC associated with Carmike Theaters for NCM LLC for the

quarter ended September 26, 2024 and September 28, 2023, and the

nine months ended September 26, 2024 and September 28, 2023, were

$1.2 million, $0.9 million, $2.2 million and $2.1 million,

respectively. These payments were recorded as a reduction of an

intangible asset on the Balance Sheet and are not included in

operating results or Adjusted OIBDA.

Conference Call

The Company will host a conference call and audio webcast with

investors, analysts, and other interested parties, November 5,

2024, at 5:00 P.M. Eastern Time. The live call can be accessed by

dialing 1-844-481-2522 or, for international participants,

1-412-317-0550. Participants should register at least 15 minutes

prior to the commencement of the call. Additionally, a live audio

webcast will be available to interested parties at www.ncm.com

under the Investor Relations section. Participants should allow at

least 15 minutes prior to the commencement of the call to register,

download and install necessary audio software.

The replay of the conference call will be available until

midnight Eastern Time, November 19, 2024, by dialing 1-844-512-2921

or, for international participants, 1-412-317-6671 and entering

conference ID 10194114.

About National CineMedia, Inc.

National CineMedia, Inc. (NCM, NASDAQ:NCMI) is the largest

cinema advertising platform in the US. With unparalleled reach and

scale, NCM connects brands to sought-after young, diverse audiences

through the power of movies and pop culture. A premium video,

full-funnel marketing solution for advertisers, NCM enhances

marketers' ability to measure and drive results. NCM’s Noovie® Show

is presented exclusively in 41 leading national and regional

theater circuits including the only three national chains, AMC

Entertainment Inc. (NYSE:AMC), Cinemark Holdings, Inc. (NYSE:CNK)

and Regal Entertainment Group (a subsidiary of Cineworld Group

PLC). NCM’s cinema advertising platform consists of more than

18,100 screens in over 1,400 theaters in 195 Designated Market

Areas® (all of the top 50). NCM is the managing member and owner of

approximately 100% of National CineMedia, LLC. For more

information, visit www.ncm.com and www.noovie.com.

Forward-Looking Statements

This press release contains various forward-looking statements

that reflect management’s current expectations or beliefs regarding

future events, including statements regarding the Company’s

anticipated future financial performance. Investors are cautioned

that reliance on these forward-looking statements involves risks

and uncertainties. Although the Company believes that the

assumptions used in the forward-looking statements are reasonable,

any of these assumptions could prove to be inaccurate and, as a

result, actual results could differ materially from those expressed

or implied in the forward-looking statements. The factors that

could cause actual results to differ materially from those

expressed or implied in the forward-looking statements are, among

others, 1) level of theater attendance or viewership of the Noovie®

show; 2) the availability and predictability of major motion

pictures displayed in theaters, including as a result of strikes or

other production delays in the entertainment industry; 3) increased

competition for advertising expenditures; 4) changes to the ESAs or

network affiliate agreements and the relationships with NCM LLC’s

ESA Parties and network affiliates; 5)inability to implement or

achieve new revenue opportunities; 6) failure to realize the

anticipated benefits of the post-showtime inventory in our network;

7) technological changes and innovations; 8) economic conditions,

including the level of expenditures on and perception of cinema

advertising; 9) our ability to renew or replace expiring

advertising and content contracts; 10) the ongoing effects of NCM

LLC’s emergence from bankruptcy; 11) reinvestment in our network

and product offerings may require significant funding and resulting

reallocation of resources; and 12) fluctuations in and timing of

operating costs. In addition, the outlook provided does not include

the impact of any future unusual or infrequent transactions; sales

and acquisitions of operating assets and investments; any future

non-cash impairments of intangible and fixed assets; amounts

related to litigation or the related impact of taxes that may occur

from time to time due to management decisions and changing business

circumstances. The Company is currently unable to forecast

precisely the timing and/or magnitude of any such amounts or

events. Please refer to the Company’s Securities and Exchange

Commission filings, including the “Risk Factor” section of the

Company’s Annual Report on Form 10-K for the year ended December

28, 2023, for further information about these and other risks.

Investors are cautioned not to place undue reliance on any such

forward-looking statements, which speak only as of the date they

are made. The Company undertakes no obligation to update any

forward-looking statement, whether as a result, of new information,

future events or otherwise, except as required by law.

This press release contains references to Non-GAAP financial

measures including Adjusted OIBDA (Operating Income Before

Depreciation and Amortization expense, adjusted to exclude non-cash

share-based compensation costs, impairment of long-lived assets,

workforce reorganization costs, loss on termination of Regal ESA,

satellite transition costs, system optimization costs and fees and

expenses related to involvement in the Cineworld proceeding and

Chapter 11 case). A reconciliation of these measures is available

in this press release and on the investor page of the Company’s

website at www.ncm.com.

NATIONAL CINEMEDIA,

INC.

Condensed Consolidated

Statements of Income

Unaudited

($ in millions, except per

share data)

Three Months Ended

Nine Months Ended

September 26, 2024

September 28, 2023

September 26, 2024

September 28, 2023

REVENUE

$

62.4

$

24.7

$

154.5

$

74.4

OPERATING EXPENSES:

Network operating costs

3.3

2.6

10.6

6.9

ESA Parties and network affiliate fees

32.9

14.5

82.1

42.8

Selling and marketing costs

10.1

6.3

29.6

16.9

Administrative and other costs

12.9

7.3

39.8

40.6

Depreciation expense

1.2

0.6

3.4

2.1

Amortization expense

9.5

5.7

28.4

12.8

Total

69.9

37.0

193.9

122.1

OPERATING LOSS

(7.5

)

(12.3

)

(39.4

)

(47.7

)

NON-OPERATING EXPENSE (INCOME):

Interest on borrowings

0.4

0.3

1.3

27.5

Interest income

(0.7

)

—

(1.7

)

—

Loss on modification and retirement of

debt, net

—

—

—

0.4

(Gain) loss on re-measurement of the

payable under the tax receivable agreement

(3.0

)

9.3

9.3

12.7

Gain on sale of asset

—

—

—

(0.3

)

Gain on deconsolidation of NCM LLC

—

—

—

(557.7

)

Gain on re-measurement of investment in

NCM LLC

—

(35.3

)

—

(35.5

)

Gain on reconsolidation of NCM LLC

—

(168.0

)

—

(168.0

)

Other non-operating (income) expense,

net

(0.6

)

(0.4

)

(1.3

)

0.2

Total

(3.9

)

(194.1

)

7.6

(720.7

)

(LOSS) INCOME BEFORE INCOME TAXES

(3.6

)

181.8

(47.0

)

673.0

Income tax expense

—

—

—

—

CONSOLIDATED NET (LOSS) INCOME

(3.6

)

181.8

(47.0

)

673.0

Less: Net loss attributable to

noncontrolling interests

—

—

—

(8.5

)

NET (LOSS) INCOME ATTRIBUTABLE TO NCM,

INC.

$

(3.6

)

$

181.8

$

(47.0

)

$

681.5

NET (LOSS) INCOME PER NCM, INC. COMMON

SHARE

Basic

$

(0.04

)

$

2.89

$

(0.49

)

$

21.58

Diluted

$

(0.04

)

$

2.89

$

(0.49

)

$

20.72

WEIGHTED AVERAGE SHARES OUTSTANDING:

Basic

95,221,502

62,765,418

96,183,328

31,574,026

Diluted

95,221,502

62,804,688

96,183,328

32,487,898

NATIONAL CINEMEDIA,

INC.

Selected Condensed Balance

Sheet Data

Unaudited

($ in millions)

As of

September 26, 2024

December 28, 2023

Cash, cash equivalents, marketable

securities and restricted cash

$

52.5

$

37.6

Receivables, net

$

62.8

$

96.6

Property and equipment, net

$

15.3

$

15.8

Total assets

$

526.1

$

567.7

Borrowings, gross

$

10.0

$

10.0

Total equity

$

385.5

$

434.5

Total liabilities and equity

$

526.1

$

567.7

NATIONAL CINEMEDIA,

LLC

Operating Data

Unaudited

Three Months Ended

September 26, 2024

September 28, 2023

Total Screens (100% Digital) at Period End

(1)(5)

18,141

18,489

ESA Party Screens at Period End (2)(5)

9,492

9,604

Three Months Ended

Nine Months Ended

September 26, 2024

September 28, 2023

September 26, 2024

September 28, 2023

Total Attendance for Period (3)(5) (in

millions)

121.6

131.7

290.2

356.6

ESA Party Attendance for Period (4)(5) (in

millions)

74.3

77.8

179.0

207.4

Capital Expenditures (6) (in millions)

$

1.0

$

0.6

$

3.3

$

2.3

(1)

Represents the total screens within NCM

LLC’s advertising network.

(2)

Represents the total ESA Party

screens.

(3)

Represents the total attendance within NCM

LLC’s advertising network.

(4)

Represents the total attendance within NCM

LLC’s advertising network in theaters operated by the ESA

Parties.

(5)

Excludes screens and attendance associated

with certain AMC Carmike theaters for each period presented.

(6)

Includes certain other implementation

costs associated with cloud computing arrangements.

NATIONAL CINEMEDIA,

LLC

Operating Data

Unaudited

($ in millions)

Three Months Ended

Nine Months Ended

September 26, 2024

September 28, 2023

September 26, 2024

September 28, 2023

Revenue breakout:

National advertising revenue

$

46.8

$

52.0

$

117.9

$

118.2

Local and regional advertising revenue

11.4

12.9

26.5

34.9

ESA Party advertising revenue from

beverage concessionaire agreements

4.2

4.7

10.1

15.8

Total advertising revenue (excluding

beverage)

$

62.4

$

69.6

$

154.5

$

168.9

Other operating data:

Operating loss

$

(7.5

)

$

(150.7

)

$

(39.4

)

$

(202.2

)

Adjusted OIBDA (1)

$

8.8

$

11.3

$

10.7

$

12.9

Adjusted OIBDA margin (1)

14.1

%

16.2

%

6.9

%

7.6

%

(1)

Adjusted OIBDA, Adjusted OIBDA margin and

adjusted loss per share are not financial measures calculated in

accordance with GAAP in the United States. See attached tables for

the non-GAAP reconciliations.

NATIONAL CINEMEDIA, LLC Non-GAAP

Reconciliations Unaudited

Adjusted OIBDA and Adjusted OIBDA Margin

Adjusted Operating Income Before Depreciation and Amortization

(“Adjusted OIBDA”) and Adjusted OIBDA margin are not financial

measures calculated in accordance with GAAP in the United

States.

Adjusted OIBDA represents operating income before depreciation

and amortization expense adjusted to also exclude non-cash

share-based compensation costs, impairment of long-lived assets,

workforce reorganization costs, loss on termination of Regal ESA,

satellite transition costs, system optimization costs and fees and

expenses related to involvement in the Cineworld proceeding and

Chapter 11 case. Our management use this non-GAAP financial measure

to evaluate operating performance, to forecast future results and

as a basis for compensation. The Company believes this is an

important supplemental measure of operating performance because it

eliminates items that have less bearing on its operating

performance and highlight trends in its core business that may not

otherwise be apparent when relying solely on GAAP financial

measures. The Company believes the presentation of this measure is

relevant and useful for investors because it enables them to view

performance in a manner similar to the method used by the Company’s

management, helps improve their ability to understand the Company’s

operating performance and makes it easier to compare the Company’s

results with other companies that may have different depreciation

and amortization policies, non-cash share-based compensation

programs, impairment of long-lived assets, workforce reorganization

costs, loss on termination of Regal ESA, satellite transition

costs, system optimization costs and fees and expenses related to

involvement in the Cineworld proceeding and Chapter 11 case,

interest rates, debt levels or income tax rates.

Adjusted OIBDA margin is calculated by dividing Adjusted OIBDA

by total revenue. Our management use this non-GAAP financial

measure to evaluate operating performance, to forecast future

results and as a basis for compensation. The Company believes this

is an important supplemental measure of operating performance

because it eliminates items that have less bearing on its operating

performance and highlight trends in its core business that may not

otherwise be apparent when relying solely on GAAP financial

measures. The Company believes the presentation of this measure is

relevant and useful for investors because it enables them to view

performance in a manner similar to the method used by the Company’s

management, helps improve their ability to understand the Company’s

operating performance and makes it easier to compare the Company’s

results with other companies that may have different depreciation

and amortization policies, non-cash share-based compensation

programs, impairment of long-lived assets, workforce reorganization

costs, loss on termination of Regal ESA, satellite transition

costs, system optimization costs and fees and expenses related to

involvement in the Cineworld proceeding and Chapter 11 case,

interest rates, debt levels or income tax rates.

A limitation of both of these measures, however, is that they

exclude depreciation and amortization, which represent a proxy for

the periodic costs of certain capitalized tangible and intangible

assets used in generating revenues in NCM LLC’s business. In

addition, Adjusted OIBDA and Adjusted OIBDA margin have the

limitation of not reflecting the effect of the Company’s

depreciation, amortization, non-cash share-based compensation

costs, impairment of long-lived intangibles, workforce

reorganization costs, loss on termination of Regal ESA, satellite

transition costs, system optimization costs and fees and expenses

related to involvement in the Cineworld proceeding and Chapter 11

case. Adjusted OIBDA should not be regarded as an alternative to

operating income, net income or as indicators of operating

performance, nor should it be considered in isolation of, or as

substitutes for financial measures prepared in accordance with

GAAP. The Company believes that operating income is the most

directly comparable GAAP financial measure to Adjusted OIBDA, and

operating margin is the most directly comparable GAAP financial

measure to Adjusted OIBDA margin. Because not all companies use

identical calculations, these non-GAAP presentations may not be

comparable to other similarly titled measures of other companies,

or calculations in NCM LLC’s debt agreement.

The Company has not provided a reconciliation of the

forward-looking non-GAAP Adjusted OIBDA measure to forward-looking

GAAP operating income due to the inability to predict the amount

and timing of impacts outside of the Company’s control on certain

items, including the timing of revenue and charges reflected in our

reconciliation of historic numbers, the amount of which, based on

historical experience, could be significant and are difficult to

reasonably predict. Accordingly, a reconciliation of this non-GAAP

measure is not available without unreasonable effort.

The following table reconciles NCM LLC's operating loss to

Adjusted OIBDA for the periods presented (dollars in millions):

Three Months Ended

Nine Months Ended

September 26, 2024

September 28, 2023

September 26, 2024

September 28, 2023

Operating loss

$

(7.5

)

$

(150.7

)

$

(39.4

)

$

(202.2

)

Depreciation expense

1.2

1.0

3.4

3.6

Amortization expense

9.5

7.8

28.4

20.3

Share-based compensation costs (1)

3.1

1.2

9.2

3.9

Impairment of long-lived assets (2)

—

9.6

—

9.6

Workforce reorganization costs (3)

0.2

—

3.1

—

Loss on termination of Regal ESA, net

(4)

—

125.6

—

125.6

Satellite transition costs (5)

0.2

—

0.5

—

System optimization costs (6)

0.1

—

0.1

—

Fees and expenses related to the Cineworld

proceeding and Chapter 11 case (7)

2.0

16.8

5.4

52.1

Adjusted OIBDA

$

8.8

$

11.3

$

10.7

$

12.9

Total revenue

$

62.4

$

69.6

$

154.5

$

168.9

Adjusted OIBDA margin

14.1

%

16.2

%

6.9

%

7.6

%

Adjusted OIBDA

$

8.8

$

11.3

$

10.7

$

12.9

Integration and encumbered theater

payments

1.2

0.9

2.2

2.1

Adjusted OIBDA after integration and

encumbered theater payments

$

10.0

$

12.2

$

12.9

$

15.0

(1)

Share-based compensation costs are

included in network operations, selling and marketing and

administrative expense in NCM LLC’s unaudited Condensed

Consolidated Financial Statements as shown in the following table

(dollars in millions).

Three Months Ended

Nine Months Ended

September 26, 2024

September 28, 2023

September 26, 2024

September 28, 2023

Share-based compensation costs included in

network costs

$

0.1

$

0.1

$

0.4

$

0.4

Share-based compensation costs included in

selling and marketing costs

0.5

0.2

1.3

0.8

Share-based compensation costs included in

administrative and other costs

2.5

0.9

7.5

2.7

Total share-based compensation costs

$

3.1

$

1.2

$

9.2

$

3.9

(2)

The impairment of long-lived assets

primarily relates to the write down of certain intangible assets

related to a purchased affiliate and leasehold improvements no

longer in use.

(3)

Workforce reorganization costs represents

redundancy costs associated with changes to the Company’s workforce

primarily implemented during the first quarter of 2024, as well as

related office relocations.

(4)

The net impact of Regal's termination of

the ESA resulting from the disposal of the intangible asset

partially offset by the surrender of Regal's ownership in the

Company and the forgiveness of prepetition claims.

(5)

One time costs of transitioning satellite

providers in the second and third quarter of 2024.

(6)

System optimization costs represents costs

incurred related to a one-time assessment of the technology

surrounding the Company's programmatic offerings incurred in the

third quarter of 2024.

(7)

Advisor and legal fees and expenses

incurred in connection with the Company’s involvement in the

Cineworld Proceeding and Chapter 11 Case and related litigation

during the first, second and third quarter of 2024, as well as

retention related expenses and retainers to the members of the

special and restructuring committees of the Company's Board of

Directors during the first, second and third quarter of 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105634507/en/

INVESTOR CONTACT: Chan Park investors@ncm.com

MEDIA CONTACT: Amy Tunick press@ncm.com

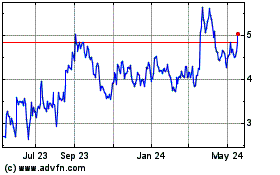

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Oct 2024 to Nov 2024

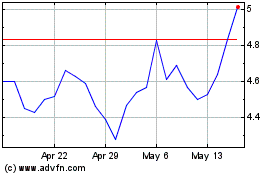

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Nov 2023 to Nov 2024