nCino, Inc. (NASDAQ: NCNO), the leading provider of intelligent,

best-in-class banking solutions, today announced that it has

entered into a definitive agreement to acquire FullCircl. FullCircl

is a leading UK-based SaaS platform, built to help financial

institutions and regulated companies grow revenue, automate and

accelerate onboarding, and improve client lifecycle management by

removing regulatory and verification roadblocks.

nCino and FullCircl formally partnered in 2023 to bring

FullCircl’s data capabilities into the nCino Platform to improve

the speed, efficiency, and compliance with which financial

institutions acquire, onboard, and serve clients. FullCircl and

nCino share several mutual customers, ranging from some of the

largest institutions in the UK to niche incumbents and neobanks

serving the SME space. The joint proposition can not only create a

better client and staff experience for financial institutions, but

can contribute to their growth and profitability gains, too.

"Our ongoing relationship with nCino and FullCircl’s integrated

offering will empower us to streamline our application processes,

improve our decisioning pace, and speed up loan completions,” said

Jake Brook, Lending Change Manager from Yorkshire Building Society.

“Automating client data collection and validation will enhance

transparency for borrowers and improve the client journey,

throughout their lifecycle, not just at onboarding."

The acquisition of FullCircl will provide nCino with new

capabilities for onboarding and client lifecycle management.

FullCircl offers a powerful business rules-engine that can simplify

the complexity of onboarding underpinned by an array of

pre-contracted premium data-supply. Additionally, FullCircl’s

technology provides frontline teams access to business development

tooling to profile a comprehensive graph-database of extensive

connected company-data, including news and insights, detailed

financial information, credit scores, risk profiles, ultimate

beneficial ownership, import/export, legal notices, adverse

director history and other critical profiling data.

"The acquisition of FullCircl is a strategic move for nCino that

will not only enhance our data and automation capabilities but also

enables us to expand our reach across the UK and more broadly in

Europe with an end-to-end experience for full client lifecycle

management,” said Pierre Naudé, Chairman and CEO at nCino. “Having

worked closely with the FullCircl team for some time now, we

recognized the value our joint technology can deliver, and this

acquisition marks an exciting step forward in our mission of

driving innovation and powering a new era in financial

services.”

Andrew Yates, CEO and Cofounder at FullCircl added, “We have

been working with the nCino team for several years, and the close

alignment in both organisations across vision, culture, customers,

product and market opportunity have contributed to this exciting

acquisition making perfect sense. We both serve regulated

industries who walk a tightrope between a strict operating rulebook

and a mandate to deliver growth and shareholder value, all while

providing a seamless client experience. This marks a significant

new chapter for FullCircl as we become part of nCino.”

The purchase price for FullCircl is One Hundred and Thirty-Five

Million Dollars ($135,000,000) in cash, subject to customary

adjustments (the “Purchase Price”). Fifteen Million Dollars

($15,000,000) of the Purchase Price will be retained by nCino for

two years following the closing of the transaction as security for

the performance of certain warranties and covenants arising under

the purchase agreement. nCino plans to provide an update on the

financial impact of this acquisition in connection with its third

quarter earnings release.

About nCino nCino (NASDAQ:

NCNO) is powering a new era in financial services. The Company was

founded to help financial institutions digitize and reengineer

business processes to boost efficiencies and create better banking

experiences. With over 1,800 customers worldwide - including

community banks, credit unions, independent mortgage banks, and the

largest financial entities globally - nCino offers a trusted

platform of best-in-class, intelligent solutions. By integrating

artificial intelligence and actionable insights into its platform,

nCino is helping financial institutions consolidate legacy systems

to enhance strategic decision-making, improve risk management, and

elevate customer satisfaction by cohesively bringing together

people, AI and data. For more information,

visit www.ncino.com.

About FullCirclFullCircl is a B2B SaaS company

that aligns regulation with customer acquisition to boost business

efficiency. Its global solutions enhance revenue growth, manage

risk and compliance, and streamline customer onboarding, which

reduces acquisition costs and fosters positive customer

relationships for accelerated growth. Providing millions of

actionable insights daily, FullCircl offers a near real-time record

of companies, officers, and shareholders, while simplifying due

diligence checks like KYB, KYC and AML. Serving over 400 customers

and 15,000+ users, FullCircl processes 300 million checks monthly

and supports the onboarding of 200,000+ customers and is backed by

top tier investors including Octopus Investments, Notion Capital

and Augmentum Fintech.

Media Contacts Natalia

Moosepress@ncino.com

Cautionary Language Concerning Forward-Looking

StatementsThis press release contains forward-looking

statements about nCino’s expectations, plans, future performance,

outlook and prospects regarding the benefits that may be derived

from the proposed transaction between nCino and FullCircl

(“FullCircl”) including, without limitation, with respect to the

benefits of integrating the FullCircl technology into the nCino

platform, cross and upsell opportunities, and the expansion of the

nCino Platform. Forward-looking statements generally include

actions, events, results, strategies and expectations and are often

identifiable by use of the words “believes,” “expects,” “intends,”

“anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,”

“will,” “could,” “might,” or “continues” or similar expressions and

the negatives thereof. Any forward-looking statements contained in

this press release are based upon nCino’s and/or FullCircl’s

historical performance and their current plans, estimates, and

expectations and are not a representation that such plans,

estimates, or expectations will be achieved. These forward-looking

statements represent nCino’s expectations as of the date of this

press release. Subsequent events may cause these expectations to

change and, except as may be required by law, nCino does not

undertake any obligation to update or revise these forward-looking

statements.

These forward-looking statements are subject to known and

unknown risks and uncertainties that may cause actual results to

differ materially including, but not limited to, risks related to:

(i) changes in economic conditions, (ii) retaining the employees of

FullCircl, (iii) nCino’s ability to successfully integrate the

FullCircl business, (iv) the ability to cross-sell the FullCircl

solution into the nCino customer base, and (v) possible

acquisition-related liabilities. Additional risks and uncertainties

that could affect nCino’s business and financial results and these

forward-looking statements are included in nCino’s reports filed

with the U.S. Securities and Exchange Commission (available on our

web site at www.ncino.com or the SEC's web site

at www.sec.gov). Further information on potential risks that

could affect actual results will be included in other filings nCino

makes with the SEC from time to time.

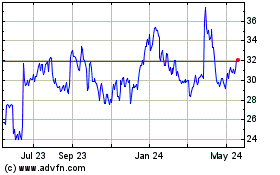

nCino (NASDAQ:NCNO)

Historical Stock Chart

From Mar 2025 to Apr 2025

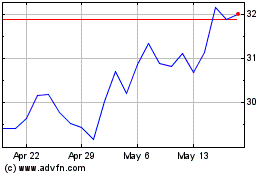

nCino (NASDAQ:NCNO)

Historical Stock Chart

From Apr 2024 to Apr 2025