Nasdaq Stockholm Streamlines Dual Listing Process for US-Listed Companies to access European markets

December 02 2024 - 8:00AM

Nasdaq (Nasdaq: NDAQ) announced today an update to the Nasdaq

Stockholm Main Market rulebook, effective from 1 January 2025. This

update will streamline the listing review process for companies

seeking to list on Nasdaq Stockholm simultaneously with or within

12 months of a listing on the U.S. exchanges, including the Nasdaq

Stock Exchange and the New York Stock Exchange.

As the first of several listing simplification initiatives,

Nasdaq Europe is focused on driving capital markets integration and

leading the development of EU capital markets and listing

environment.

Currently, the dual listing process is largely conducted

independently in the US and Sweden, resulting in the duplication of

time and resource-intensive tasks. Under the new model, companies

approved to list in the US will still be reviewed through the

Nasdaq Stockholm listing process but will no longer require a

separate review by a listing auditor when applying for a dual

listing on Nasdaq Stockholm. This task, associated with costs and

efforts, is redundant for a company that has already been validated

according to standards that are equivalent or similar.

Adam Kostyál, President of Nasdaq Stockholm, stated,

“Simplifying the process for European companies to dual list in the

US and Europe represents a significant milestone in our ability to

strengthen the competitiveness of Europe’s markets and economies,

and further enhance Europe’s long-term economic growth – two key

objectives underpinning the Capital Market Union’s policy platform.

The new rule removes friction for companies to attract both

European and U.S. investors, benefiting not just our European

companies but also providing retail investors with better access to

a wider range of investment opportunities.”

Roland Chai, President of Nasdaq European Markets, added:

“Reducing obstacles in the listing processes for issuers to access

European markets is key to increasing European competitiveness and

we are determined to ensure issuers have maximum access to European

investors. Nasdaq has been continuously implementing a program of

simplification across Nasdaq’s European exchanges, and further

market access efficiencies will be rolled out across Nasdaq’s six

EU markets. With top rankings in leading tech sectors like medtech,

biotech, and renewable energy, as well as delivering annual returns

of over eight percent on average over the period 1966-2023, the

highest globally, Nasdaq’s Europe’s leadership demonstrates the

transformative power of well-executed capital markets integration

in the EU.”

For more information regarding the upcoming rulebook changes:

https://www.nasdaq.com/market-regulation/nordic/main-market-rules

Nasdaq Media Contact

Erik Gruvfors+46 73 449 78 12erik.gruvfors@nasdaq.com

About Nasdaq

Nasdaq (Nasdaq: NDAQ) is a leading global technology company

serving corporate clients, investment managers, banks, brokers, and

exchange operators as they navigate and interact with the global

capital markets and the broader financial system. We aspire to

deliver world-leading platforms that improve the liquidity,

transparency, and integrity of the global economy. Our diverse

offering of data, analytics, software, exchange capabilities, and

client-centric services enables clients to optimize and execute

their business vision with confidence. To learn more about the

company, technology solutions, and career opportunities, visit us

on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

-NDAQG-

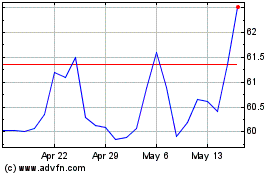

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

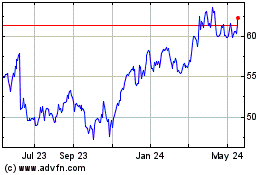

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Dec 2023 to Dec 2024