false

0000070487

0000070487

2024-08-05

2024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 5, 2024

National Research Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-35929

|

47-0634000

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

1245 Q Street, Lincoln, Nebraska

|

68508

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(402) 475-2525

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

$.001 Par Value Common Stock

|

NRC

|

The NASDAQ Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

| |

On August 5, 2024, National Research Corporation, a Delaware corporation (the “Company”), entered into a Third Amendment to Amended and Restated Credit Agreement (the “Third Amendment”) with First National Bank of Omaha, a national banking association (“FNB”), that amends the terms of that certain Amended and Restated Credit Agreement, dated May 28, 2020, as amended by that certain First Amendment thereto dated as of September 30, 2022, and that certain Second Amendment thereto dated as of June 16, 2023, by and among the Company and FNB (the “Credit Agreement”).

Among other changes, the Third Amendment: (i) extended the maturity date of the revolving loan from May 28, 2025 to May 28, 2027, (ii) extended the commitment date until which FNB will make loans available under the delayed draw-down term facility (the “Delayed Draw Term Loan”) from May 28, 2025 to May 28, 2026, (iii) made the outstanding balances on the term loan (the “Term Loan”) and both current and any future Delayed Draw Term Loans payable in equal monthly installments amortized over ten-year periods, (iv) changed the applicable interest rate for the Term Loan from a fixed rate of 5% per annum to a rate per annum equal to the secured overnight financing rate or “SOFR,” plus 2.35%, (v) extended the use of the Delayed Draw Term Loan to include dividends, stock repurchases, acquisitions, and capital expenditures, and (vi) increased the building renovations excluded from the fixed charge coverage ratio covenant from $25 million to $27.5 million. The Third Amendment also made certain other updates to the definitions, terms, principal amounts outstanding, and conditions of the Credit Agreement to reflect the above-described changes.

The foregoing summary of the terms and conditions of the Third Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Third Amendment, a copy of which will be filed with the Company’s Form 10-Q for the quarter ending September 30, 2024.

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

| |

On August 6, 2024, the Company issued a press release announcing its financial and operating results for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

| |

EXHIBIT

NUMBER

|

EXHIBIT DESCRIPTION

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

| |

The information contained in Items 2.02 and 9.01 of this report and the exhibits hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

| |

|

| |

The information in Items 2.02 and 9.01 of this report and the exhibits hereto may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements are made based on the current beliefs and expectations of the Company's management and are subject to significant risks and uncertainties. Actual results or events may differ from those anticipated by forward-looking statements. Please refer to the paragraph at the end of the attached press release and various disclosures by the Company in its press releases, stockholder reports, and filings with the Securities and Exchange Commission for information concerning risks, uncertainties, and other factors that may affect future results.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NATIONAL RESEARCH CORPORATION

|

| |

(Registrant)

|

|

| |

|

|

|

Date: August 6, 2024

|

By:

|

/s/ Linda Stacy

|

| |

|

Linda Stacy

|

| |

|

Secretary, Principal Financial Officer, and Principal Accounting Officer

|

Exhibit 99.1

|

|

1245 Q Street, Lincoln, NE 68508

P: 1 800 388 4264 | F: 402 475 9061

nrchealth.com

|

|

|

Principal Financial Officer

|

NATIONAL RESEARCH CORPORATION ANNOUNCES

SECOND QUARTER RESULTS

LINCOLN, Nebraska (August 6, 2024) — National Research Corporation, dba NRC Health, (NASDAQ:NRC) today announced results for the second quarter 2024 and several other corporate developments.

Financial Results

Revenue for the quarter was approximately $35 million compared with approximately $36 million in the 2023 quarter. Earnings per diluted share were $0.26 compared with $0.29 for the 2023 quarter. At June 30, 2024, the Company’s net indebtedness (total borrowing minus cash and cash equivalents) was approximately $42 million. Total recurring contract value (TRCV) was approximately $138 million at June 30, 2024.

Credit Agreement Amendment

Effective August 5, 2024, the Company and its lender entered into a Third Amendment to Amended and Restated Credit Agreement, with material amendments including the following: (i) extended the maturity of the revolving loan facility to May 28, 2027, (ii) provided that all term loans will amortize over a ten-year amortization schedule (rather than the prior seven-year schedule) and bear interest at floating annual rate of SOFR + 235 basis points, with the maturity date for all term loans remaining May 28, 2027, (iii) extended the commitment period for making delayed draw-down term loans to May 28, 2026, (iv) expanded the permitted uses of delayed draw-down term loans to include dividends, stock repurchases, acquisitions, and capital expenditures as permitted by the agreement, and (v) increased the amount of capital expenditures to be excluded from fixed charge coverage ratio by $2.5 million.

Stock Repurchase Plan

The Company has approximately 1.1 million shares remaining under its existing stock repurchase plan. The Company did not repurchase any shares in the second quarter of 2024 pending the credit agreement amendments discussed above. Management is authorized to complete the plan in its discretion, credit agreement limitations, and future capital allocation decisions.

NRC Announces Second Quarter 2024 Results

Page 2

August 6, 2024

Dividend

The Company’s Board of Directors has declared a quarterly cash dividend of $0.12 (twelve cents) per share payable Friday, October 11, 2024, to stockholders of record as of the close of business on Friday, September 27, 2024.

Portfolio and Strategy Update

On July 15, 2024, the Company acquired NOBL Health, a leading provider of patient rounding insights and workflow applications. The enterprise value of the acquisition was approximately $6 million paid in cash at closing plus a potential earnout of up to $1 million based on future performance of the acquired products. NOBL had approximately $2 million of TRCV at the acquisition date.

The Company’s has and will, over the next 30 days, release acquired and internally developed products and features including:

| |

●

|

Consumer experience (CX) capabilities designed to build loyalty and growth for health systems.

|

| |

●

|

Employee experience (EX) capabilities powered by one of the leading consumer experience technology platforms.

|

| |

●

|

NOBL Health’s rounding tool, which provides real time feedback from patients and healthcare employees.

|

| |

●

|

A proprietary AI engine powering new products and features.

|

In Lieu of Conference Call

The Company has elected to include strategic updates normally discussed in earning calls to a broader group of current and potential stockholders via its quarterly earnings releases.

About NRC Health

For more than 40 years, NRC Health (NASDAQ: NRC) has led the charge to humanize healthcare and support organizations in their understanding of each unique individual. NRC Health’s commitment to Human Understanding® helps leading healthcare systems get to know each person they serve not as point-in-time insights, but as an ongoing relationship. Guided by its uniquely empathic heritage, NRC Health’s patient-focused approach, unmatched market research, and emphasis on consumer preferences are transforming the healthcare experience, creating strong outcomes for patients and entire healthcare systems. For more information, email info@nrchealth.com, or visit www.nrchealth.com.

NRC Announces Second Quarter 2024 Results

Page 3

August 6, 2024

This press release contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements may be identified by their use of terms or phrases such as “believes,” “expect,” “focus,” “potential,” “will,” derivations thereof, and similar terms and phrases. In this press release, the statements related to releasing new products and features, future quarterly conference calls and other communications, and stock repurchases are forward-looking statements. Forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements, including those risks and uncertainties as set forth in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2023, and various disclosures in our press releases, stockholder reports, and other filings with the Securities and Exchange Commission. We disclaim any obligation to update or revise any forward-looking statements to reflect actual results or changes in the factors affecting the forward-looking information.

NRC Announces Second Quarter 2024 Results

Page 4

August 6, 2024

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

Unaudited Condensed Consolidated Statements of Income

(In thousands, except per share data)

| |

|

Three months ended

June 30

|

|

|

Six months ended

June 30

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

35,021 |

|

|

$ |

36,161 |

|

|

$ |

70,334 |

|

|

$ |

72,634 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct

|

|

|

13,422 |

|

|

|

13,309 |

|

|

|

27,278 |

|

|

|

27,589 |

|

|

Selling, general and administrative

|

|

|

11,221 |

|

|

|

11,966 |

|

|

|

22,471 |

|

|

|

23,750 |

|

|

Depreciation and amortization

|

|

|

1,513 |

|

|

|

1,521 |

|

|

|

2,960 |

|

|

|

2,915 |

|

|

Total operating expenses

|

|

|

26,156 |

|

|

|

26,796 |

|

|

|

52,709 |

|

|

|

54,254 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

8,865 |

|

|

|

9,365 |

|

|

|

17,625 |

|

|

|

18,380 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

25 |

|

|

|

273 |

|

|

|

69 |

|

|

|

523 |

|

|

Interest expense

|

|

|

(555 |

) |

|

|

(192 |

) |

|

|

(1,160 |

) |

|

|

(433 |

) |

|

Other, net

|

|

|

(11 |

) |

|

|

(2 |

) |

|

|

(16 |

) |

|

|

(15 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense)

|

|

|

(541 |

) |

|

|

79 |

|

|

|

(1,107 |

) |

|

|

75 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

8,324 |

|

|

|

9,444 |

|

|

|

16,518 |

|

|

|

18,455 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

2,149 |

|

|

|

2,171 |

|

|

|

3,984 |

|

|

|

4,219 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

6,175 |

|

|

$ |

7,273 |

|

|

$ |

12,534 |

|

|

$ |

14,236 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share of Common Stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings Per Share

|

|

$ |

0.26 |

|

|

$ |

0.30 |

|

|

$ |

0.53 |

|

|

$ |

0.58 |

|

|

Diluted Earnings Per Share

|

|

$ |

0.26 |

|

|

$ |

0.29 |

|

|

$ |

0.52 |

|

|

$ |

0.58 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares and share equivalents outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

23,871 |

|

|

|

24,578 |

|

|

|

23,870 |

|

|

|

24,582 |

|

|

Diluted

|

|

|

23,915 |

|

|

|

24,716 |

|

|

|

23,934 |

|

|

|

24,727 |

|

NRC Announces Second Quarter 2024 Results

Page 5

August 6, 2024

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

Unaudited Condensed Consolidated Balance Sheets

(Dollars in thousands, except share amounts and par value)

| |

|

June 30,

2024

|

|

|

December 31,

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

485 |

|

|

$ |

6,653 |

|

|

Accounts receivable, net

|

|

|

10,057 |

|

|

|

12,378 |

|

|

Other current assets

|

|

|

6,408 |

|

|

|

5,329 |

|

|

Total current assets

|

|

|

16,950 |

|

|

|

24,360 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

33,741 |

|

|

|

28,205 |

|

|

Goodwill

|

|

|

61,614 |

|

|

|

61,614 |

|

|

Other, net

|

|

|

6,794 |

|

|

|

8,258 |

|

|

Total assets

|

|

$ |

119,099 |

|

|

$ |

122,437 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Current portion of notes payable, net of unamortized debt issuance costs

|

|

$ |

7,566 |

|

|

$ |

7,214 |

|

|

Line of credit

|

|

|

9,000 |

|

|

|

-- |

|

|

Accounts payable and accrued expenses

|

|

|

6,675 |

|

|

|

6,194 |

|

|

Accrued compensation

|

|

|

4,370 |

|

|

|

3,953 |

|

|

Deferred revenue

|

|

|

14,514 |

|

|

|

14,834 |

|

|

Dividends payable

|

|

|

2,865 |

|

|

|

2,906 |

|

|

Other current liabilities

|

|

|

738 |

|

|

|

1,102 |

|

|

Total current liabilities

|

|

|

45,728 |

|

|

|

36,203 |

|

| |

|

|

|

|

|

|

|

|

|

Notes payable, net of current portion and unamortized debt issuance costs

|

|

|

25,655 |

|

|

|

29,470 |

|

|

Other non-current liabilities

|

|

|

7,518 |

|

|

|

7,809 |

|

|

Total liabilities

|

|

|

78,901 |

|

|

|

73,482 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, authorized 2,000,000 shares, none issued

|

|

|

-- |

|

|

|

-- |

|

|

Common stock, $0.001 par value; authorized 110,000,000 shares, issued 31,072,144 in 2024 and 31,002,919 in 2023, outstanding 23,871,257 in 2024 and 24,219,887 in 2023

|

|

|

31 |

|

|

|

31 |

|

|

Additional paid-in capital

|

|

|

179,872 |

|

|

|

178,213 |

|

|

Retained earnings (accumulated deficit)

|

|

|

(23,726 |

) |

|

|

(30,530 |

) |

|

Treasury stock

|

|

|

(115,979 |

) |

|

|

(98,759 |

) |

|

Total shareholders’ equity

|

|

|

40,198 |

|

|

|

48,955 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

119,099 |

|

|

$ |

122,437 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

National Research Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 05, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35929

|

| Entity, Tax Identification Number |

47-0634000

|

| Entity, Address, Address Line One |

1245 Q Street

|

| Entity, Address, City or Town |

Lincoln

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68508

|

| City Area Code |

402

|

| Local Phone Number |

475-2525

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NRC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000070487

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

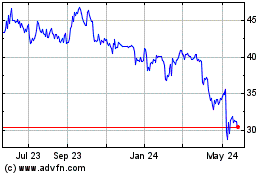

National Research (NASDAQ:NRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

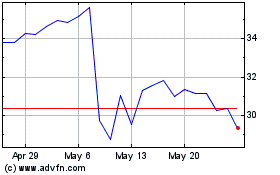

National Research (NASDAQ:NRC)

Historical Stock Chart

From Nov 2023 to Nov 2024