Natera, Inc. (NASDAQ: NTRA), a global leader in cell-free DNA

and genetic testing, today reported its financial results for the

fourth quarter and full year ended December 31, 2024.

Recent Financial Highlights

- Generated total revenues of $476.1 million in the fourth

quarter of 2024, compared to $311.1 million in the fourth quarter

of 2023, an increase of 53.0%. Product revenues grew 53.9% over the

same period.

- Generated a gross margin of 62.9% in the fourth quarter of

2024, compared to a gross margin of 51.4% in the fourth quarter of

2023.

- Generated total revenues of $1,696.9 million in the full year

of 2024, compared to $1,082.6 million in the full year 2023, an

increase of 56.7%. Product revenues grew 57.7% over the same

period.

- Generated a gross margin of 60.3% in the full year of 2024,

compared to a gross margin of 45.5% in the full year of 2023.

- Processed approximately 792,800 tests in the fourth quarter of

2024, compared to approximately 626,800 tests in the fourth quarter

of 2023, an increase of 26.5%.

- Processed approximately 3,064,600 tests in the full year of

2024, compared to approximately 2,496,100 tests in the full year of

2023, an increase of 22.8%.

- Performed approximately 150,800 oncology tests in the fourth

quarter of 2024, compared to approximately 97,500 in the fourth

quarter of 2023, an increase of 54.7%.

- Performed approximately 528,200 oncology tests in the full year

2024, compared to approximately 341,000 in the full year 2023, an

increase of 54.9%.

- Achieved positive cash flow of approximately $45.7 million1 in

the fourth quarter of 2024.

“We had a strong finish to the year, with excellent performance

across the board,” said Steve Chapman, chief executive officer of

Natera. “Our ongoing success can be attributed to the

mission-driven mindset of our team and our focus on patients. We

have significant momentum, with several potential catalysts in 2025

and beyond.”

Fourth Quarter and Year Ended December 31, 2024 Financial

Results

Total revenues were $476.1 million in the fourth quarter of 2024

compared to $311.1 million in the fourth quarter of 2023, an

increase of 53.0%. The increase in total revenues was driven

primarily by a 53.9% increase in product revenues, which were

$472.9 million in the fourth quarter of 2024 compared to $307.3

million in the fourth quarter of 2023. The increase in product

revenues was primarily driven by an increase in volume and average

selling price improvements.

Natera processed approximately 792,800 tests in the fourth

quarter of 2024, including approximately 778,400 tests accessioned

in its laboratory, compared to approximately 626,800 tests

processed, including approximately 610,100 tests accessioned in its

laboratory, in the fourth quarter of 2023.

In the fourth quarter of 2024, Natera recognized revenue on

approximately 771,700 tests for which results were reported to

customers in the period (tests reported), including approximately

758,200 tests reported from its laboratory, compared to

approximately 619,800 tests reported, including approximately

604,200 tests reported from its laboratory, in the fourth quarter

of 2023, an increase of 24.5% from the prior period.

Total revenues were $1,696.9 million in the full year 2024

compared to $1,082.6 million in the full year 2023, an increase of

56.7%. The increase in total revenues was driven primarily by a

57.7% increase in product revenues, which were $1,685.1 million in

the full year 2024 compared to $1,068.5 million in the full year

2023. The increase in product revenues was primarily driven by an

increase in volume and average selling price improvements.

Natera processed approximately 3,064,600 tests in the full year

2024, including approximately 3,001,900 tests accessioned in its

laboratory, compared to approximately 2,496,100 tests processed,

including approximately 2,426,500 tests accessioned in its

laboratory, in the full year 2023.

In the full year 2024, Natera recognized revenue on

approximately 2,926,400 tests for which results were reported to

customers in the period (tests reported), including approximately

2,867,400 tests reported from its laboratory, compared to

approximately 2,388,200 tests reported, including approximately

2,323,400 tests reported from its laboratory, in the full year

2023, an increase of 22.5% from the prior period.

Gross profit2 for the three months ended December 31, 2024 and

2023 was $299.6 million and $159.9 million, respectively,

representing a gross margin of 62.9% and 51.4%, respectively. Gross

profit2 for the year ended December 31, 2024 and 2023 was $1,023.2

million and $492.7 million, respectively, representing a gross

margin of 60.3% and 45.5%, respectively. Natera had higher gross

margin in the fourth quarter of 2024 and for the full year 2024

primarily as a result of higher revenues and continued progress in

reducing cost of revenues associated with tests processed. Total

operating expenses, representing research and development expenses

and selling, general and administrative expenses, for the fourth

quarter of 2024 were $364.4 million, compared to $244.4 million in

the same period of the prior year, an increase of 49.1%. Total

operating expenses, representing research and development expenses

and selling, general and administrative expenses, for the full year

2024 were $1,245.5 million, compared to $939.0 million in the same

period of the prior year, an increase of 32.6%. The increases in

both periods were primarily driven by headcount growth to support

new product offerings as well as increases in consulting and legal

expenses.

Loss from operations for the fourth quarter of 2024 was $64.7

million compared to $84.5 million for the same period of the prior

year. Loss from operations for full year 2024 was $222.3 million

compared to $446.3 million for the same period of the prior

year.

Natera reported a net loss for the fourth quarter of 2024 of

$53.8 million, or ($0.41) per diluted share, compared to a net loss

of $78.0 million, or ($0.65) per diluted share, for the same period

in 2023. Weighted average shares outstanding were approximately

131.4 million in the fourth quarter of 2024 compared to 119.3

million in the fourth quarter of the prior year. Natera’s net loss

for the full year 2024 was $190.4 million, or ($1.53) per diluted

share, compared to a net loss of $434.8 million, or ($3.78) per

diluted share, in 2023. Weighted average shares outstanding were

124.7 million in the full year 2024 compared to 115.0 million for

the same period in the prior year.

At December 31, 2024, Natera held approximately $968.3 million

in cash, cash equivalents, short-term investments and restricted

cash, compared to $879.0 million as of December 31, 2023. As of

December 31, 2024, Natera had a total outstanding debt balance of

$80.4 million including accrued interest under its line of credit

with UBS at a variable interest rate of 30-day SOFR plus 50 bps.

The Company previously had convertible senior notes which were

redeemed or converted on October 11, 2024.

Financial Outlook

Natera anticipates 2025 total revenue of $1.87 billion to $1.95

billion; 2025 gross margin to be approximately 60% to 64% of

revenues; selling, general and administrative costs to be

approximately $950 million to $975 million; research and

development costs to be $525 million to $550 million; and net cash

inflow to be positive3.

Test Volume Summary

Unit

Q4 2024

Q4 2023

FY 2024

FY 2023

Definition

Tests processed

792,800

626,800

3,064,600

2,496,100

Tests accessioned in our laboratory plus

units processed outside of our laboratory

Tests accessioned

778,400

610,100

3,001,900

2,426,500

Test accessioned in our laboratory

Tests reported

771,700

619,800

2,926,400

2,388,200

Total tests reported

Tests reported in our laboratory

758,200

604,200

2,867,400

2,323,400

Total tests reported in our laboratory

less units reported outside of our laboratory

About Natera

Natera™ is a global leader in cell-free DNA and genetic testing,

dedicated to oncology, women’s health, and organ health. We aim to

make personalized genetic testing and diagnostics part of the

standard of care to protect health and enable earlier, more

targeted interventions that help lead to longer, healthier lives.

Natera’s tests are validated by more than 250 peer-reviewed

publications that demonstrate high accuracy. Natera operates ISO

13485-certified and CAP-accredited laboratories certified under the

Clinical Laboratory Improvement Amendments (CLIA) in Austin, Texas

and San Carlos, California. For more information, visit

www.natera.com.

Conference Call Information

Event:

Natera’s Fourth Quarter and Full

Year 2024 Financial Results Conference Call

Date:

Thursday, February 27, 2025

Time:

1:30 p.m. PT (4:30 p.m. ET)

Live Dial-In:

1-888-770-7321 (Domestic)

1-929-201-7107 (International)

Conference ID:

7684785

Webcast Link:

https://events.q4inc.com/attendee/538630796

Forward-Looking Statements

This press release contains forward-looking statements under the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical facts, including

statements regarding its market opportunity, anticipated products

and launch schedules, reimbursement coverage and product costs,

commercial and strategic partnerships and acquisitions, user

experience, clinical trials and studies, and its strategies, goals

and general business and market conditions, are forward-looking

statements. Any forward-looking statements contained in this press

release are based upon Natera’s current plans, estimates, and

expectations, as of the date of this release, and are not a

representation that such plans, estimates, or expectations will be

achieved.

These forward-looking statements are subject to known and

unknown risks and uncertainties that may cause actual results to

differ materially, including: we face numerous uncertainties and

challenges in achieving our financial projections and goals; we may

be unable to further increase the use and adoption of our products

through our direct sales efforts or through our laboratory

partners; we have incurred net losses since our inception and we

anticipate that we will continue to incur net losses for the

foreseeable future; our quarterly results may fluctuate from period

to period; our estimates of market opportunity and forecasts of

market growth may prove to be inaccurate; we may be unable to

compete successfully with existing or future products or services

offered by our competitors; we may engage in acquisitions,

dispositions or other strategic transactions that may not achieve

our anticipated benefits and could otherwise disrupt our business,

cause dilution to our stockholders or reduce our financial

resources; our products may not perform as expected; the results of

our clinical studies may not support the use and reimbursement of

our tests, particularly for microdeletions screening, and may not

be able to be replicated in later studies required for regulatory

approvals or clearances; if either of our primary CLIA-certified

laboratories becomes inoperable, we will be unable to perform our

tests and our business will be harmed; we rely on a limited number

of suppliers or, in some cases, single suppliers, for some of our

laboratory instruments and materials and may not be able to find

replacements or immediately transition to alternative suppliers; if

we are unable to successfully scale our operations, our business

could suffer; the marketing, sale, and use of Panorama and our

other products could result in substantial damages arising from

product liability or professional liability claims that exceed our

resources; we may be unable to expand, obtain or maintain

third-party payer coverage and reimbursement for our tests, and we

may be required to refund reimbursements already received;

third-party payers may withdraw coverage or provide lower levels of

reimbursement due to changing policies, billing complexities or

other factors; we could incur substantial costs and delays

complying with governmental regulations, including recently enacted

FDA regulations regarding LDTs; litigation and other regulatory or

governmental proceedings, related to our intellectual property or

the commercialization of our tests, are costly, time- consuming,

could result in our obligation to pay material judgments or incur

material settlement costs, and could limit our ability to

commercialize our tests; and any inability to effectively protect

our proprietary technology could harm our competitive position or

our brand.

We discuss these and other risks and uncertainties in greater

detail in the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in our periodic reports on Forms 10-K and 10-Q and in

other filings that we make with the SEC from time to time. These

documents are available on our website at www.natera.com under the

Investor Relations section and on the SEC’s website at

www.sec.gov.

We operate in a very competitive and rapidly changing

environment. New risks emerge from time to time. It is not possible

for our management to predict all risks, nor can we assess the

impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statement. In light of these risks, uncertainties and assumptions,

you should not place undue reliance on our forward-looking

statements. Except as required by law, we undertake no obligation

to update publicly any forward-looking statements for any reason

after the date of this presentation to conform these statements to

actual results or to changes in our expectations.

References

- Positive cash inflow for the quarter ended December 31, 2024,

is derived from the GAAP Statement of Cash Flows as follows: net

cash provided by operating activities of $52.9 million, net cash

provided by financing activities of $10.9 million, offset by net

cash used in investing activities for purchases of property and

equipment, investment in related party and cash paid for

acquisition of intangible assets of $18.1 million.

- Gross profit is calculated as GAAP total revenues less GAAP

cost of revenues. Gross margin is calculated as gross profit

divided by GAAP total revenues.

- Cash (outflow) inflow is calculated as the sum of GAAP net cash

provided by (used in) operating activities, GAAP net cash provided

by (used in) financing activities, and GAAP net cash provided by

(used in) investing activities for purchases of property and

equipment, investment in related party, and acquisition of

intangible assets.

Natera, Inc.

Consolidated Balance

Sheets

(Unaudited)

(in thousands, except shares)

December 31,

December 31,

2024

2023

(1)

Assets

Current assets:

Cash, cash equivalents and restricted

cash

$

945,587

$

642,095

Short-term investments

22,689

236,882

Accounts receivable, net of allowance of

$7,259 in 2024 and $6,481 in 2023

314,165

278,289

Inventory

44,744

40,759

Prepaid expenses and other current

assets

48,635

60,524

Total current assets

1,375,820

1,258,549

Property and equipment, net

162,046

111,210

Operating lease right-of-use assets

86,149

56,537

Other assets

36,720

15,403

Total assets

$

1,660,735

$

1,441,699

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

34,922

$

14,998

Accrued compensation

62,114

45,857

Other accrued liabilities

146,893

149,405

Deferred revenue, current portion

19,754

16,612

Short-term debt financing

80,362

80,402

Total current liabilities

344,045

307,274

Long-term debt financing

—

282,945

Deferred revenue, long-term portion and

other liabilities

24,682

19,128

Operating lease liabilities, long-term

portion

96,588

67,025

Total liabilities

465,315

676,372

Commitments and contingencies

Stockholders’ equity:

Common stock (2)

12

11

Additional paid in capital

3,763,614

3,145,837

Accumulated deficit

(2,567,862

)

(2,377,436

)

Accumulated other comprehensive loss

(344

)

(3,085

)

Total stockholders’ equity

1,195,420

765,327

Total liabilities and stockholders’

equity

$

1,660,735

$

1,441,699

(1)

The consolidated balance sheet at December

31, 2023 has been derived from the audited consolidated financial

statements at that date included in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2023.

(2)

As of December 31, 2024 and December 31,

2023, there were approximately 132,646,000 and 119,581,000 shares

of common stock issued and outstanding, respectively.

Natera, Inc.

Consolidated Statements of

Operations and Comprehensive Loss

(Unaudited)

(in thousands, except per share

data)

Year ended December

31,

2024

2023

2022

Revenues

Product revenues

$

1,685,074

$

1,068,522

$

797,307

Licensing and other revenues

11,837

14,049

22,915

Total revenues

1,696,911

1,082,571

820,222

Cost and expenses

Cost of product revenues

672,304

588,564

453,632

Cost of licensing and other revenues

1,449

1,267

2,624

Research and development

404,138

320,678

316,415

Selling, general and administrative

841,314

618,307

588,591

Total cost and expenses

1,919,205

1,528,816

1,361,262

Loss from operations

(222,294

)

(446,245

)

(541,040

)

Interest expense

(10,685

)

(12,638

)

(9,319

)

Interest and other income, net

43,248

24,353

3,538

Loss before income taxes

(189,731

)

(434,530

)

(546,821

)

Income tax expense

(695

)

(271

)

(978

)

Net loss

$

(190,426

)

$

(434,801

)

$

(547,799

)

Unrealized gain (loss) on

available-for-sale securities, net of tax

2,741

13,277

(14,075

)

Comprehensive loss

$

(187,685

)

$

(421,524

)

$

(561,874

)

Net loss per share:

Basic and diluted

$

(1.53

)

$

(3.78

)

$

(5.57

)

Weighted-average number of shares used in

computing basic and diluted net loss per share:

Basic and diluted

124,718

114,997

98,408

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227586173/en/

Investor Relations Mike Brophy,

CFO, Natera, Inc., 510-826-2350

Media Lesley Bogdanow, VP of

Corporate Communications, Natera, Inc., pr@natera.com

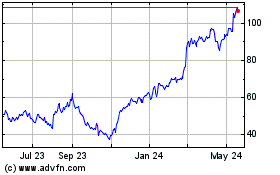

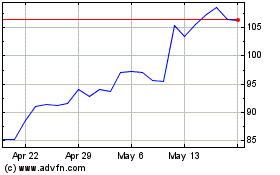

Natera (NASDAQ:NTRA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Natera (NASDAQ:NTRA)

Historical Stock Chart

From Mar 2024 to Mar 2025