OceanFirst Financial Corp. (NASDAQ:OCFC), today

announced the appointment of three members to its Board of

Directors.

- John F. Barros, Managing Principal,

Civitas Builder – Boston, MA, effective September 18, 2023;

- Robert C. Garrett, CEO, Hackensack

Meridian Health – Morris Township, NJ, effective October 1,

2023;

- Dalila Wilson-Scott, EVP and Chief

Diversity Officer, Comcast Corporation and President, Comcast

NBCUniversal Foundation – Philadelphia, PA, effective October 1,

2023.

Christopher D. Maher, OceanFirst Financial Corp.

Chairman and Chief Executive Officer, noted, “We are pleased to

welcome John, Bob, and Dalila to the existing seasoned

professionals on our Board of Directors.” Maher added, “Our new

Board members bring significant professional experience at large

and complex organizations, provide for enhanced geographic and

industry knowledge, and improve diversity. As OceanFirst’s business

has grown to encompass markets from Boston to Baltimore, it is

critical to ensure our Board has the requisite talent and

experience to support the Company’s growth.”

Also, effective October 1, 2023, Grace Vallacchi

will resign from the Board of Directors of the Company’s Bank

subsidiary, in connection with her planned retirement from her

position as Chief Risk Officer, which will take effect October 11,

2023. Upon Ms. Vallacchi’s retirement, David Berninger will join

OceanFirst Bank as Executive Vice President and Chief Risk

Officer.

Additionally, the Company announced that John E.

Walsh will retire from the Board of Directors at the end of his

term in May 2024. Mr. Walsh has served on the Board since 2000.

Mr. Maher commented, “Grace joined the Bank in

2017 and became a member of its Board of Directors in 2019. We

appreciate her many contributions, and the impact Grace has had on

the evolution of our risk management program during her tenure. Her

commitment, guidance, and professionalism during many significant

events over these past six years have been exceptional and on

behalf of the Board, management team, and employees we wish her

well.”

Maher continued, “We are pleased to welcome

David Berninger as our next Chief Risk Officer. David’s experience

as a senior risk management professional will make this a seamless

transition as we continue to grow the Bank and enhance our

enterprise risk management efforts.”

Maher added, “We are grateful to director John

Walsh for his leadership and dedication as a board member since

2000. In addition to serving as our longest tenured director, John

served as Independent Lead Director for over 19 years, a

responsibility that was critical to the success of the Company. I’m

grateful to have had the opportunity to experience John’s

thoughtful support and counsel during my career with the company.

John has decided he will not request re-election when his current

term expires in 2024.”

John F. Barros:Mr. Barros has

been a leader in the Boston market for almost 25 years including

seven years as the Chief of Economic Development for the City of

Boston. He is currently a managing principal at Civitas Builder, a

business focused on improving communities through the development

of responsive real estate, and serves on several charitable boards.

Mr. Barros received a bachelor’s degree from Dartmouth College and

a master’s degree in public policy from Tufts University.

Robert C. Garrett, FACHE:Mr.

Garrett’s career spans over 38 years in the healthcare industry and

since 2018 he has been the CEO of Hackensack Meridian Health, New

Jersey’s largest and most comprehensive health network, reaching

two-thirds of the state population. He has presented at numerous

international events including the World Economic Forum Annual

Meeting in Davos, Switzerland (2019-2023), where he now serves as

Chair of the Forum’s Health and Healthcare Governor’s Community,

and the International Vatican Healthcare Conference (2018-2021).

Mr. Garrett has a bachelor’s degree from Binghamton University and

a master’s degree in health administration from Washington

University.

Dalila Wilson-Scott:Ms.

Wilson-Scott has been at Comcast Corporation for seven years and

currently oversees all diversity, equity, and inclusion initiatives

and philanthropic strategy. Prior to joining Comcast, she spent 16

years at JPMorgan Chase & Co. where she served as head of

global philanthropy and president of the JPMorgan Chase Foundation.

Ms. Wilson-Scott has been recognized as one of the Most Powerful

Women in Business by Black Enterprise. She has a bachelor’s degree

from New York University and a MBA in Finance and Management from

New York University Stern School of Business.

David Berninger:Mr. Berninger

has served in a number of senior risk management roles in the

banking and financial services industry during a career spanning

nearly three decades, including the US Region of ICBC, Valley

National Bank, Hudson City Savings Bank and Societe Generale. He is

the treasurer and a board member of the NJ Community Development

Corporation, a former Chair of the Enterprise Risk Committee of the

New Jersey Bankers Association, and holds a BSBA degree from

Bucknell University and an MBA from Rutgers Graduate School of

Management.

About OceanFirst OceanFirst

Financial Corp.’s subsidiary, OceanFirst Bank N.A., founded in

1902, is a $13.5 billion regional bank providing financial services

throughout New Jersey and the major metropolitan markets of

Philadelphia, New York, Baltimore, and Boston. OceanFirst Bank

delivers commercial and residential financing, treasury management,

trust and asset management, and deposit services and is one of the

largest and oldest community-based financial institutions

headquartered in New Jersey.

OceanFirst Financial Corp.'s press releases are

available at http://www.oceanfirst.com.

Forward-Looking Statements

In addition to historical information, this news

release contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995

which are based on certain assumptions and describe future plans,

strategies and expectations of the Company. These forward-looking

statements are generally identified by use of the words "believe,"

"expect," "intend," "anticipate," "estimate," "project," "will,"

"should," "may," "view," "opportunity," "potential," or similar

expressions or expressions of confidence. The Company's ability to

predict results or the actual effect of future plans or strategies

is inherently uncertain. Factors which could have a material

adverse effect on the operations of the Company and its

subsidiaries include, but are not limited to: changes in interest

rates, inflation, general economic conditions, potential

recessionary conditions, levels of unemployment in the Bank’s

lending area, real estate market values in the Bank’s lending area,

future natural disasters, potential increases to flood insurance

premiums, the current or anticipated impact of military conflict,

terrorism or other geopolitical events, the level of prepayments on

loans and mortgage-backed securities, legislative/regulatory

changes, monetary and fiscal policies of the U.S. Government

including policies of the U.S. Treasury and the Board of Governors

of the Federal Reserve System, the quality or composition of the

loan or investment portfolios, demand for loan products, deposit

flows, changes in liquidity, including the size and composition of

the Company’s deposit portfolio, including the percentage of

uninsured deposits in the portfolio, competition, demand for

financial services in the Company’s market area, changes in

consumer spending, borrowing and saving habits, changes in

accounting principles, a failure or breach of the Company’s

operational or security systems or infrastructure, including

cyberattacks, the failure to maintain current technologies, failure

to retain or attract employees, the impact of the COVID-19 pandemic

or any other pandemic on our operations and financial results and

those of our customers and the Bank’s ability to successfully

integrate acquired operations. These risks and uncertainties are

further discussed in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022, under item 1A – Risk Factors and

elsewhere, and subsequent securities filings and should be

considered in evaluating forward-looking statements and undue

reliance should not be placed on such statements. The Company does

not undertake, and specifically disclaims any obligation, to

publicly release the result of any revisions which may be made to

any forward-looking statements to reflect events or circumstances

after the date of such statements or to reflect the occurrence of

anticipated or unanticipated events.

Company Contact:Jill HewittSenior Vice

PresidentOceanFirst Financial Corp.Tel: (732)240-4500, ext.

27513email: jhewitt@oceanfirst.com

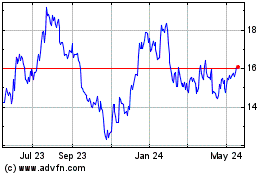

OceanFirst Financial (NASDAQ:OCFC)

Historical Stock Chart

From Nov 2024 to Dec 2024

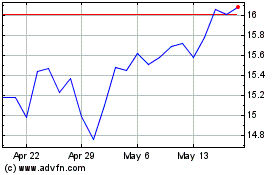

OceanFirst Financial (NASDAQ:OCFC)

Historical Stock Chart

From Dec 2023 to Dec 2024