OceanFirst Bank Announces Voluntary Settlement of Fair Lending Claims by the U.S. Department of Justice and U.S. Department of Housing and Urban Development

September 18 2024 - 2:40PM

OceanFirst Financial Corp. (NASDAQ:OCFC) (the “Company”), the

holding company for OceanFirst Bank N.A. (the “Bank” or

“OceanFirst”), announced today that the Bank has voluntarily

entered into settlement agreements (the “Agreements”) with the

United States Department of Justice (the “DOJ”) and United States

Department of Housing and Urban Development to resolve claims that

the Bank violated the Equal Credit Opportunity Act and Fair Housing

Act in the New Brunswick-Lakewood, New Jersey lending area, which

includes Middlesex, Monmouth and Ocean counties.

The settlement is one of approximately a dozen

agreements reached by the DOJ with mortgage lenders since 2021,

totaling over $120 million in investments in mortgage lending

subsidies, financial education and outreach.

Founded in 1902, OceanFirst Bank, named after

its county of origin, maintained its physical locations primarily

in Ocean County, New Jersey for more than eight decades. Starting

in 2015, the Bank began expanding its footprint into other parts of

southern New Jersey and northern Pennsylvania. In 2018, the Bank

acquired Sun National Bank, which was the first time it established

a significant presence in central New Jersey, including Middlesex

and Monmouth counties. While the acquisition of Sun expanded the

physical footprint of OceanFirst in the New Brunswick market,

residential mortgage lending opportunities initially were limited

due to the time needed to build the corresponding operations and

volume as Sun National Bank had discontinued consumer lending

several years prior to their sale. Since 2019, OceanFirst has made

significant commitments to minority market lending and outreach

initiatives in the New Brunswick area and continues to explore ways

to build and deepen relationships for further growth in these

communities. These efforts are anchored in the Bank’s full-service

branch in New Brunswick, New Jersey.

Christopher D. Maher, Chairman and Chief

Executive Officer, of OceanFirst Financial Corp., stated, “The

commitments we are announcing today are consistent with our Bank’s

122-year history of providing credit and other financial services

to all residents of the communities we serve. We look forward to

continuing the Bank’s efforts in the New Brunswick-Lakewood market

to help meet the lending and banking needs of families, businesses,

schools and organizations.”

Under the Agreements, the Bank has committed to

invest at least $14 million in a mortgage loan subsidy fund for

eligible residents in Middlesex and Monmouth counties over a

five-year period. The Bank also has agreed to invest $400,000 in

community partnerships, spend $140,000 per year in targeted

marketing, advertising and outreach in the New Brunswick-Lakewood

area which includes Middlesex, Monmouth and Ocean counties, and

provide financial education workshops designed to expand access to

home mortgage credit.

The Bank also will continue lending and

community development initiatives that pre-date the settlement, and

which are designed to increase access to residential lending and

other financial services in the New Brunswick market and across its

footprint. Since 2020, the Bank has provided over $625 million in

loans and investments benefitting thousands of people in the

communities it serves. Specific initiatives include:

| OCEANFIRST

BANK COMMUNITY LENDING AND INVESTMENT PROGRAMS*Time period

is 1/1/20 through 6/30/24 unless otherwise noted. |

|

|

Program |

Total Loans or Investments* |

# benefitting |

Description |

|

|

NeighborFirst |

$119.5 million |

422 |

Down payment assistance, discounted interest rates and other

benefits for home purchases by residents of majority-Black,

Hispanic and Asian census tracts and low- and moderate-income

applicants. Eligible homebuyers may qualify for grants towards

closing costs. |

|

|

Community Development Loans & Investments |

$495 million |

--- |

Loans and investments for community development-related purposes,

including $236 million to build and revitalize affordable

housing. |

|

|

Small Business Lending |

$410,000+ |

--- |

Loans to minority- and women-owned businesses. |

|

|

Home Buyer Dream Program (formerly First Home Club) |

$14.1 million |

65 |

OceanFirst participated in Federal Home Loan Bank program,

providing loans and grants to facilitate home purchase. |

|

|

New Brunswick Branch |

|

200+ |

Opened in December 2023, offers a full range of financial services

solutions throughout the community. |

|

|

Consumer Financial Education |

|

840+ |

Over 800 hours of financial education programs at more than 145

events, often in conjunction with nonprofit organizations and

schools throughout the Bank's footprint, since 2021. |

|

|

Employee Community Engagement |

|

1,000+ |

In 2023, over 7,000 hours of volunteering throughout the Bank's

footprint. |

|

|

OceanFirst Foundation |

$48+ million in grants (since 1996) |

thousands+ |

Established by OceanFirst Bank in 1996 in conjunction with the

Initial Public Offering (IPO), the Foundation provides grants to

organizations in central and southern NJ that promote access to

housing, youth development, health and wellness and other

services. |

|

| |

|

|

|

|

About OceanFirst Financial

Corp.OceanFirst Financial Corp.’s subsidiary, OceanFirst

Bank N.A., founded in 1902, is a $13.3 billion regional bank

providing financial services throughout New Jersey and in the major

metropolitan areas between Massachusetts and Virginia. OceanFirst

Bank delivers commercial and residential financing, treasury

management, trust and asset management, and deposit services and is

one of the largest and oldest community-based financial

institutions headquartered in New Jersey. To learn more about

OceanFirst, go to www.oceanfirst.com.

Forward-Looking StatementsIn

addition to historical information, this current report contains

certain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, which are based

on certain assumptions and describe future plans, strategies and

expectations of the Company. These forward-looking statements are

generally identified by use of the words “believe,” “expect,”

“intend,” “anticipate,” “estimate,” “project,” “will,” “should,”

“may,” “view,” “opportunity,” “potential,” or similar expressions

or expressions of confidence. The Company’s ability to predict

results or the actual effect of future plans or strategies is

inherently uncertain. Factors which could have a material adverse

effect on the operations of the Company and its subsidiaries

include, but are not limited to: changes in interest rates,

inflation, general economic conditions, potential recessionary

conditions, levels of unemployment in the Company’s lending area,

real estate market values in the Company’s lending area, potential

goodwill impairment, natural disasters, potential increases to

flood insurance premiums, the current or anticipated impact of

military conflict, terrorism or other geopolitical events, the

level of prepayments on loans and mortgage-backed securities,

legislative/regulatory changes, monetary and fiscal policies of the

U.S. Government including policies of the U.S. Treasury and the

Board of Governors of the Federal Reserve System, the quality or

composition of the loan or investment portfolios, demand for loan

products, deposit flows, the availability of low-cost funding,

changes in liquidity, including the size and composition of the

Company’s deposit portfolio, and the percentage of uninsured

deposits in the portfolio, changes in capital management and

balance sheet strategies and the ability to successfully implement

such strategies, competition, demand for financial services in the

Company’s market area, changes in consumer spending, borrowing and

saving habits, changes in accounting principles, a failure in or

breach of the Company’s operational or security systems or

infrastructure, including cyberattacks, the failure to maintain

current technologies, failure to retain or attract employees, the

effect of the Company’s rating under the Community Reinvestment

Act, the impact of pandemics on our operations and financial

results and those of our customers and the Bank’s ability to

successfully integrate acquired operations. These risks and

uncertainties are further discussed in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023, under Item 1A -

Risk Factors and elsewhere, and subsequent securities filings and

should be considered in evaluating forward-looking statements and

undue reliance should not be placed on such statements. The Company

does not undertake, and specifically disclaims any obligation, to

publicly release the result of any revisions which may be made to

any forward-looking statements to reflect events or circumstances

after the date of such statements or to reflect the occurrence of

anticipated or unanticipated events.

Company Contact:Jill Apito HewittDirector

Corporate CommunicationsOceanFirst Financial Corp.Tel: (732)

240-4500, ext. 27513Email: jhewitt@oceanfirst.com

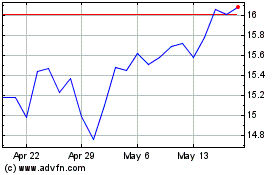

OceanFirst Financial (NASDAQ:OCFC)

Historical Stock Chart

From Jan 2025 to Feb 2025

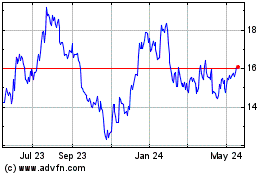

OceanFirst Financial (NASDAQ:OCFC)

Historical Stock Chart

From Feb 2024 to Feb 2025