Eightco Announces $100 million Revenue Forecast – Releases 2025 Strategic Plan

September 25 2024 - 6:00AM

Eightco Holdings Inc. (NASDAQ: OCTO) (the “Company” or “Eightco”)

is pleased to provide an update to its shareholders regarding its

achievements year to date and 2025 initiatives.

2024 Achievements

The Company has made significant progress in

2024 by improving its balance sheet, most notably through the

elimination of $5.4 million in convertible notes and increasing

shareholder equity by $23 million. An aggregate of 5,846,627

dilutive shares related to warrants and convertible securities were

cancelled in connection therewith, as well as several one-time

accounting events.

Operationally, during the 6 months ended June

30, 2024:

- Gross profit margin was increased

to 22%, versus 12% in the prior year period; and

- SG&A was reduced to $6.9

million, down 23% from $9.0 million in the prior year period

These improvements helped the Company regain

compliance with two NASDAQ requirements, as was announced

yesterday.

2025 Plan

The Company’s primary focus is the growth of its

primary operating subsidiary, Forever 8 Fund LLC (“Forever 8”),

which operates in two main areas: providing inventory solutions for

small to mid-sized e-commerce sellers in the US & UK, as well

as supplying refurbished Apple products for sellers in the UK and

Europe. Forever 8 buys existing inventory from e-commerce sellers

and commits to purchasing future inventory directly from their

suppliers, maintaining specific inventory levels to enhance sales

and growth. The sellers are invoiced after sales occur on a monthly

basis, at which point Forever 8 charges them its cost plus a

markup. Forever 8’s tech platform facilitates this entire process

end-to-end, making it seamless and scalable.

In the short term, the Company intends to seek

additional non-dilutive senior debt financing to replace the

capital used to repay its dilutive convertible notes in the first

quarter of 2024. The Company currently has approximately 1.8

million shares outstanding. By deploying this capital, the Company

aims to deliver 2025 revenues of $100 million, with the Company

achieving positive EBITDA at the public company level. Such funding

would also support further growth in 2025. Forever 8 believes it

can deploy significant additional capital via its scalable

platforms due to high inbound demand for its services from existing

and new customers.

Paul Vassilakos, CEO of Eightco and President of

Forever 8, said “The Company is excited to focus on prioritizing

the Forever 8 business to deliver growth and shareholder value

through 2025. With regaining compliance with the NASDAQ rules

behind us and a significantly improved balance sheet, we believe

2025 has the potential to be our best year since our inception in

2020."

About Eightco

Eightco (NASDAQ: OCTO) is committed to growth of

its subsidiaries, made up of Forever 8 Fund LLC, an inventory

capital and management platform for e-commerce sellers, and

Ferguson Containers, Inc., a provider of complete manufacturing and

logistical solutions for product and packaging needs, through

strategic management and investment. In addition, the Company is

actively seeking new opportunities to add to its portfolio of

technology solutions focused on the e-commerce ecosystem through

strategic acquisitions. Through a combination of innovative

strategies and focused execution, Eightco aims to create

significant value and growth for its portfolio companies and

stockholders.

For additional information, please

visit www.8co.holdings

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements in this press release other than

statements of historical fact could be deemed forward looking.

Words such as “plans,” “expects,” “will,” “anticipates,”

“continue,” “expand,” “advance,” “develop” “believes,” “guidance,”

“target,” “may,” “remain,” “project,” “outlook,” “intend,”

“estimate,” “could,” “should,” and other words and terms of similar

meaning and expression are intended to identify forward-looking

statements, although not all forward-looking statements contain

such terms. Forward-looking statements are based on management’s

current beliefs and assumptions that are subject to risks and

uncertainties and are not guarantees of future performance. Actual

results could differ materially from those contained in any

forward-looking statement as a result of various factors,

including, without limitation: Eightco’s ability to regain and

maintain compliance with the Nasdaq’s continued listing

requirements; unexpected costs, charges or expenses that reduce

Eightco’s capital resources; Eightco’s inability to raise adequate

capital to fund its business; the inability to innovate and attract

users for Eightco’s and its subsidiaries’ products; future

legislation and rulemaking negatively impacting digital assets; and

shifting public and governmental positions on digital asset mining

activity. Given these risks and uncertainties, you are cautioned

not to place undue reliance on such forward-looking statements. For

a discussion of other risks and uncertainties, and other important

factors, any of which could cause Eightco’s actual results to

differ from those contained in forward-looking statements, see

Eightco’s filings with the Securities and Exchange Commission (the

“SEC”), including in its Annual Report on Form 10-K filed with the

SEC on April 1, 2024, as amended. All information in this press

release is as of the date of the release, and Eightco undertakes no

duty to update this information or to publicly announce the results

of any revisions to any of such statements to reflect future events

or developments, except as required by law.

For further information, please

contact:Investor Relationsinvestors@8co.holdings

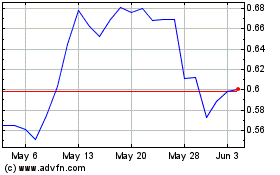

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Nov 2023 to Nov 2024