false

0001892492

0001892492

2024-11-22

2024-11-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 22, 2024

| EIGHTCO

HOLDINGS INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41033 |

|

87-2755739 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

Larry Holmes Drive

Suite

313

Easton,

PA 18042 |

|

34695 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 765-8933

(Former

name or former address, if changed since last report)

Not

Applicable

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

OCTO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

On

November 22, 2024, Eightco Holdings Inc. (the “Company”) entered into an Asset Purchase Agreement (“Purchase Agreement”)

among Ferguson Containers, Inc., the Company’s wholly-owned subsidiary (the “Seller”), Ferguson Containers, LLC (the

“Buyer”) and Edward Reichard and Derick Reichard (the “Buyer’s Owners” and together with the Buyer, the

“Buying Parties”). Pursuant to the Purchase Agreement, the Company agreed to sell certain assets (the “Purchased Assets”)

constituting the business of the Seller to the Buyer. The purchase price for the Purchased Assets will be (i) an aggregate of $557,835

in cash, (ii) $2,500,000 issued in the form of a seller note, which note, assuming closing of the transaction by December 31, 2024, will

bear interest at the rate of 9.75% per year, payable in equal monthly installments of $32,692.56 beginning on January 1, 2025 and will

be due and payable in full on December 31, 2034, and (iii) the right to receive certain earnout consideration upon the achievement of

the following milestones:

| (i) | If

the Buying Parties achieve $1,000,000 of earnings before interest, taxes, depreciation and

amortization (“EBITDA”) for 2024 attributable to the Purchased Assets, the Seller

shall receive an additional Two Hundred Fifty Thousand Dollars ($250,000). If the EBITDA

for 2024 is between $900,000 and $1,000,000, the Seller is entitled to a prorated amount

of the Two Hundred Fifty Thousand Dollars ($250,000). |

| | | |

| (ii) | If

the Buying Parties achieve $1,000,000 of EBITDA for 2025 attributable to the Purchased Assets,

Seller shall receive an additional Two Hundred Fifty Thousand Dollars ($250,000). If the

EBITDA for 2025 is between $900,000 and $1,000,000, the Seller is entitled to a prorated

amount of the Two Hundred Fifty Thousand Dollars ($250,000). |

The

agreement is subject to certain conditions, including, among others, the approval of the Purchase Agreement and related transactions

by the stockholders of the Company. The Company intends to seek approval of its stockholders for such agreement and transaction at the

next meeting of its stockholders which is expected to be held prior to the end of 2024.

The

Purchase Agreement is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The foregoing description of the Purchase

Agreement does not purport to be complete and is qualified in its entirety by reference to such exhibit. The Purchase Agreement has been

included to provide investors and security holders with information regarding its terms.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits – The following exhibits are filed as part of this report:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

November 27, 2024 |

|

|

| |

Eightco

Holdings Inc. |

| |

|

|

| |

By: |

/s/

Paul Vassilakos |

| |

Name: |

Paul

Vassilakos |

| |

Title: |

Chief

Executive Officer |

Exhibit 2.1

ASSET

PURCHASE AGREEMENT

This

Asset Purchase Agreement (this “Agreement”), dated as of November 22, 2024, is entered into by and among Ferguson

Containers, Inc., a New Jersey Corporation (“Seller”), and Eightco Holdings, Inc., a Delaware Corporation (“Seller’s

Owner” and together with Seller, the “Selling Parties”) and Ferguson Containers, LLC, a New Jersey Limited

Liability Company (“Buyer”), and Edward Reichard and Derick Reichard, for the purposes of Article I, Section 1.03

( “Buyer’s Owners” and (together with Buyer, the “Buying Parties”).

RECITALS

A.

Selling Parties operate a consumer products company which develops, contract manufactures and sells a line of products in the corrugated

box industry.

B.

Selling Parties desire to sell, assign, transfer and deliver to Buyer, and Buyer desires to purchase from Seller, certain of the assets

and lines of business of Seller (“Purchased Assets”) upon the terms and subject to the conditions set forth in this

Agreement.

NOW,

THEREFORE, in consideration of the mutual covenants, promises, agreements, representations and warranties contained in this Agreement,

the parties hereto do hereby covenant, promise and agree as follows:

ARTICLE

I

Purchase

and Sale

Section

1.01 Purchase and Sale of Assets. Subject to the terms and conditions set forth herein, Seller shall sell, assign, transfer, convey

and deliver to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title and interest in the assets set forth on

Schedule 1.01 hereto (the “Purchased Assets”), free and clear of any mortgage, pledge, lien, charge, security

interest, claim or other encumbrance (“Encumbrance”).

Section

1.02 Excluded Assets. The Purchased Assets shall specifically not include the assets set forth in Schedule 1.02 (the “Excluded

Assets”).

Section

1.03 Purchase Price. The aggregate purchase price for the Purchased Assets (the “Purchase Price”) shall be as

follows:

| (a) | At

Closing, Buyer shall pay via wire transfer of immediately available funds to the account

designated in writing by the Selling Parties an amount equal to Five Hundred Thousand Dollars

($557,835), which amount includes $57,835 of estimated excess cash and Working Capital of

the Purchased Assets. |

| (b) | A

senior secured promissory note (the “Seller Note”) in an aggregate principal

amount of Two Million Five Hundred Thousand Dollars ($2,500,000) issued to the Seller. |

| (c) | The

right to receive additional earn out consideration upon the achievement of certain milestones

as follows: |

| (i) | If

the Buying Parties achieve $1,000,000 of earnings before interest, taxes, depreciation and

amortization (“EBITDA”) for 2024 attributable to the Purchased Assets, the Seller

shall receive an additional Two Hundred Fifty Thousand Dollars ($250,000). If the EBITDA

for 2024 is between $900,000 and $1,000,000, the Seller is entitled to a prorated amount

of the Two Hundred Fifty Thousand Dollars ($250,000). |

| (ii) | If

the Buying Parties achieve $1,000,000 of EBITDA for 2025 attributable to the Purchased Assets,

Seller shall receive an additional Two Hundred Fifty Thousand Dollars ($250,000). If the

EBITDA for 2025 is between $900,000 and $1,000,000, the Seller is entitled to a prorated

amount of the Two Hundred Fifty Thousand Dollars ($250,000). |

| (d) | The

assumption of liabilities set forth on Schedule 1.03(d) (the “Assumed Liabilities”). |

Other

than the Assumed Liabilities as set forth in Schedule 1.03(d), the Buying Parties shall not assume any liabilities or obligations of

the Selling Parties of any kind, whether known or unknown, contingent, matured or otherwise, whether currently existing or hereinafter

created.

For

the purposes of this Agreement, “Working Capital” shall mean the difference between the current assets included in the Purchased

Assets (such as accounts receivable, inventory, and other similar assets) and the current liabilities included in the Assumed Liabilities

(such as accounts payable and accrued expenses), as of the Closing Date, determined in accordance with Generally Accepted Accounting

Principles (GAAP) and consistent with past practices.

The

parties agree that the Purchase Price includes all cash and Working Capital of the Purchased Assets and there shall be no further adjustments

or reconciliations related to cash and Working Capital to the Purchase Price or otherwise.

Section

1.04 Review Period; Termination

(a)

Examination. After execution of this Agreement, Buyer shall have up to five (5) business days (the “Review Period”)

to review the relevant financial statements, books and records of Seller, which Seller shall provide, certify and warrant as full, complete

and accurate.

(b)

Termination. On or prior to 4:30 pm EST on the last day of the Review Period, Buyer shall have the right to terminate this Agreement

for any reason or no reason it its sole and complete discretion.

(c)

Effect of Termination. In the event this Agreement is terminated pursuant to Section 1.4(b) or if the failure to obtain the Necessary

Approval and Fairness Opinion (each as defined below), this Agreement shall terminate and be deemed null and void; provided, however,

that nothing herein will relieve any party from any liability for any willful breach of the terms of this Agreement.

ARTICLE

II

Closing

Section

2.01 Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place

on the later of (i) 5 days after the expiration of the Review Period in the event that this Agreement was not terminated by Buyer or

(ii) by the Selling Parties if the Necessary Approval and Fairness Opinion are not obtained(the “Closing Date”). The

consummation of the transactions contemplated by this Agreement shall be deemed to occur at 12:01 a.m. on the Closing Date.

Section

2.02 Closing Deliverables.

(a)

At the Closing, Seller shall deliver to Buyer the following:

(i)

a bill of sale in form and substance reasonably satisfactory to Buyer (the “Bill of Sale”) and duly executed by Seller,

transferring the Purchased Assets to Buyer;

(ii)

copies of all consents, approvals, waivers and authorizations referred to the Seller’s disclosure schedules (the “Disclosure

Schedules”); and,

(iii)

such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Buyer,

as may be required to give effect to this Agreement.

(b)

At the Closing, Buyer shall deliver to Seller the following:

(i)

the Purchase Price as set forth in Section 1.03; and

(ii)

an Assignment and Assumption Agreement duly executed by Buyer.

Section

2.03 Closing Conditions.

(a)

Conditions to Obligations of Both Buyer and Seller. The obligations of each of Buyer and Seller to consummate the transactions

contemplated hereby is subject to the satisfaction (or written waiver by each party) of the following conditions:

i.

Seller’s Owner receiving the approval of its shareholders required to consummate the transactions contemplated by the Agreement

(“Necessary Approval”); and

ii.

Seller obtaining an opinion from a qualified independent financial advisor or valuation firm affirming that the terms of the transactions

contemplated by the Agreement are fair, from a financial point of view, to the shareholders of Seller’s Owner (“Fairness

Opinion”).

(b)

Conditions to Obligations of Buyer. The obligation of Buyer to consummate the transactions contemplated hereby is subject to the

satisfaction (or written waiver by Buyer) of the following conditions:

i.

immediately preceding the Closing, the Seller shall have delivered a certificate in a form mutually and reasonably satisfactory to the

parties (the “Seller Certificate”) certifying that (i) the representations and warranties of Seller set forth in Article

III shall be true and correct at and as of such time, except for those representations and warranties that address matters only as of

a specified date (which representations and warranties shall be true and correct as of such specified date) and except where the failure

of such representations and warranties to be true and correct would not, individually or in the aggregate, reasonably be expected to

result in a material adverse effect to the Seller;

ii.

Seller shall have performed or complied in all material respects with the agreements and covenants required to be performed or complied

with by it under this Agreement as of or prior to the Closing; and

iii.

no judgment, order, decree, stipulation, or injunction by any governmental entity shall be in effect which prevents consummation of the

transactions contemplated hereby, nor shall any Action be pending or threatened seeking to enjoin the consummation of the transactions.

(c)

Conditions to Obligations of Seller. The obligations of Seller to consummate the transactions contemplated hereby are subject

to the satisfaction (or the written waiver by Seller) of the following conditions:

i.

the representations and warranties of Buyer set forth in Article IV shall be true and correct at and as of the Closing Date as if made

as of the Closing Date, except for those representations and warranties that address matters only as of a particular date (which shall

be true and correct as of such date) and except where the failure of such representations and warranties to be true and correct would

not, individually or in the aggregate, reasonably be expected to result in a material adverse effect to the Buyer;

ii.

Buyer shall have performed or complied in all material respects with the agreements and covenants required to be performed or complied

with by Buyer under this Agreement as of or prior to the Closing;

iii.

Buyer shall have delivered to Seller the Purchase Price; and

iv.

no judgment, order, decree, stipulation or injunction by any Governmental Entity shall be in effect which prevents consummation of any

of the transactions contemplated hereby, nor shall any Action be pending or threatened seeking to enjoin the consummation of the transactions

contemplated hereby.

ARTICLE

III

Representations

and warranties of seller

Except

as set forth in the correspondingly numbered Seller’s Disclosure Schedules, the Seller represents and warrants to Buyer as follows:

Section

3.01 Organization and Authority of Seller; Enforceability. Seller is a limited liability company duly organized, validly existing

and in good standing under the laws of the state of Delaware. Seller has full corporate power and authority to enter into this Agreement

and the documents to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby.

The execution, delivery and performance by Seller of this Agreement and the documents to be delivered hereunder and the consummation

of the transactions contemplated hereby have been duly authorized by all requisite corporate action on the part of Seller. This Agreement

and the documents to be delivered hereunder have been duly executed and delivered by Seller, and (assuming due authorization, execution

and delivery by Seller) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of

Seller, enforceable against Seller in accordance with their respective terms, except as enforceability may be limited by bankruptcy,

insolvency, reorganization, moratorium or other similar laws relating to or affecting the rights of creditors generally and by general

equitable principles, including those limiting the availability of specific performance, injunctive relief and other equitable remedies.

Section

3.02 No Conflicts; Consents. The execution, delivery and performance by Seller of this Agreement and the documents to be delivered

hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the certificate

of incorporation, by-laws or other organizational documents of Seller; (b) violate or conflict with any judgment, order, decree, statute,

law, ordinance, rule or regulation applicable to Seller or the Purchased Assets; (c) conflict with, or result in (with or without notice

or lapse of time or both) any violation of, or default under, or give rise to a right of termination, acceleration or modification of

any obligation or loss of any benefit under any material contract or other instrument to which Seller is a party or to which any of the

Purchased Assets are subject; or (d) result in the creation or imposition of any Encumbrance on the Purchased Assets. No consent, approval,

waiver or authorization is required to be obtained by Seller from any person or entity (including any governmental authority) in connection

with the execution, delivery and performance by Seller of this Agreement and the consummation of the transactions contemplated hereby.

Section

3.03 Title to Purchased Assets. Seller owns and has good title to the Purchased Assets, free and clear of Encumbrances, except as

set forth in Section 3.03 of Seller’s Disclosure Schedules.

Section

3.04 Condition of Assets. The tangible personal property included in the Purchased Assets is in good condition and adequate for the

uses to which they are being put, and none of such /tangible personal property is in need of maintenance or repairs except for ordinary,

routine maintenance and repairs that are not material in nature or cost.

Section

3.05 Non-foreign Status. Seller is not a “foreign person” as that term is used in Treasury Regulations Section 1.1445-2.

Section

3.06 Compliance With Laws Seller has complied since January 1, 2021, and is now complying, in all material respects with all applicable

federal, state and local laws and regulations applicable to ownership and use of the Purchased Assets.

Section

3.07 Legal Proceedings. There is no material claim, action, suit, proceeding or governmental investigation (“Action”)

of any nature pending or, to Seller’s knowledge, expected or threatened against or by Seller (a) relating to or affecting the Purchased

Assets or the Assumed Liabilities; or (b) that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated

by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action, except

as set forth in Section 3.10 of the Disclosure Schedules.

Section

3.08 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection

with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Seller.

Section

3.09 Undisclosed Liabilities. Seller has no material Liabilities with respect to the Business, except those which have been incurred

in the ordinary course of business consistent with past practice and which are not, individually or in the aggregate, material in amount.

Section

3.10 Governmental Orders. Except as set forth in the Disclosure Schedules, there are no outstanding Governmental Orders (as the term

is defined herein) and no unsatisfied judgments, penalties or awards against, relating to or affecting the Business. Seller is in compliance

with the terms of each Governmental Order set forth in the Disclosure Schedules. No event has occurred or circumstances exist that may

constitute or result in (with or without notice or lapse of time) a violation of any such Governmental Order. “Governmental

Order” means any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any federal,

state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political

subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the

extent that the rules, regulations or orders of such organization or authority have the force of law), or any arbitrator, court or tribunal

of competent jurisdiction.

Section

3.11 Full Disclosure. No representation or warranty by Seller in this Agreement and no statement contained in the Schedules, the

Disclosure Schedules to this Agreement or any certificate or other document furnished or to be furnished to Buyer pursuant to this Agreement

contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein,

in light of the circumstances in which they are made, not misleading.

Section

3.12 No Other Representations or Warranties. Neither Seller nor any of the Selling Parties has made (and Buyer is not entitled to

rely on) any representation or warranty (whether orally, in writing, express or implied) as to the Purchased Assets, the Assumed Liabilities

or the transactions contemplated hereby, except as expressly set forth in Article III of this Agreement (including the related portions

of the Disclosure Schedule), and Seller disclaims any and all other express or implied representations or warranties, whether written

or oral. Notwithstanding anything to the contrary, none of the representations and warranties of the Selling Parties contained herein

shall be deemed qualified in any respect by the substance of any agreements or documents delivered to the Buyer other than as set forth

in this Agreement and the Schedules hereto.

ARTICLE

IV

Representations

and warranties of buyer

Buyer

represents and warrants to Seller as follows.

Section

4.01 Organization and Authority of Buyer; Enforceability. Buyer is a corporation duly organized, validly existing and in good standing

under the laws of the state of Nevada. Buyer has full corporate power and authority to enter into this Agreement and the documents to

be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution,

delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder and the consummation of the transactions

contemplated hereby have been duly authorized by all requisite corporate action on the part of Buyer. This Agreement and the documents

to be delivered hereunder have been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by

Seller) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Buyer enforceable

against Buyer in accordance with their respective terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization,

moratorium or other similar laws relating to or affecting the rights of creditors generally and by general equitable principles, including

those limiting the availability of specific performance, injunctive relief and other equitable remedies.

Section

4.02 No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement and the documents to be delivered

hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the certificate

of incorporation, by-laws or other organizational documents of Buyer; or (b) violate or conflict with any judgment, order, decree, statute,

law, ordinance, rule or regulation applicable to Buyer. No consent, approval, waiver or authorization is required to be obtained by Buyer

from any person or entity (including any governmental authority) in connection with the execution, delivery and performance by Buyer

of this Agreement and the consummation of the transactions contemplated hereby.

Section

4.03 Legal Proceedings. There is no Action of any nature pending or, to Buyer’s knowledge, threatened against or by Buyer that

challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances

exist that may give rise to, or serve as a basis for, any such Action.

Section

4.04 Brokers. no broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection

with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyer.

Section

4.05 No Other Representations or Warranties. Neither Buyer nor any of the Buyer Parties has made (and Seller is not entitled to rely

on) any representation or warranty (whether orally, in writing, express or implied) as to the Buyer, except as expressly set forth in

Article IV of this Agreement, and Buyer disclaims any and all other express or implied representations or warranties, whether written

or oral. Notwithstanding anything to the contrary, none of the representations and warranties of Buyer contained herein shall be deemed

qualified in any respect by the substance of any agreements or documents delivered to the Seller, other than as set forth in this Agreement

and the Schedules hereto.

ARTICLE

V

Covenants

Section

5.01 Public Announcements. Unless otherwise required by applicable law, neither party shall make any public announcements regarding

this Agreement or the transactions contemplated hereby without the prior written consent of the other party (which consent shall not

be unreasonably withheld or delayed).

Section

5.02 Further Assurances. Following the Closing, each of the parties hereto shall execute and deliver such additional documents, instruments,

conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect

to the transactions contemplated by this Agreement and the documents to be delivered hereunder.

Section

5.03 Conduct of Business Prior to the Closing. From the date hereof until the Closing, except as otherwise provided in this Agreement

or consented to in writing by Buyer (which consent shall not be unreasonably withheld or delayed), Seller shall (x) conduct the Business

in the ordinary course of business consistent with past practice; and (y) use commercially reasonable efforts to maintain and preserve

intact its current Business organization, operations and franchise and to preserve the rights, franchises, goodwill and relationships

of its employees, customers, lenders, suppliers, regulators and others having relationships with the Business. Without limiting the foregoing,

from the date hereof until the Closing Date, Seller shall:

(a)

preserve and maintain all Permits required for the conduct of the Business as currently conducted or the ownership and use of the Purchased

Assets;

(b)

pay the debts, Taxes and other obligations of the Business when due;

(c)

continue to collect accounts receivable in a manner consistent with past practice, without discounting such Accounts Receivable;

(d)

maintain the properties and assets included in the Purchased Assets in the same condition as they were on the date of this Agreement,

subject to reasonable wear and tear;

(e)

continue in full force and effect without modification all insurance policies, except as required by applicable Law;

(f)

defend and protect the properties and assets included in the Purchased Assets from infringement or usurpation;

(g)

perform all of its obligations under all Assigned Contracts;

(h)

maintain the Books and Records in accordance with past practice;

(i)

comply in all material respects with all Laws applicable to the conduct of the Business or the ownership and use of the Purchased Assets;

and

(j)

not take or permit any action that would cause material adverse changes, events or conditions in the Purchased Assets.

Section

5.04 Access to Information. From the date hereof until the Closing, Seller shall (a) afford Buyer and its Representatives reasonable

access to and the right to inspect all of the Real Property, properties, assets, premises, books and records, Contracts and other documents

and data related to the Purchased Assets; (b) furnish Buyer and its Representatives with such financial, operating and other data and

information related to the Purchased Assets as Buyer or any of its Representatives may reasonably request; and (c) instruct the Representatives

of Seller to reasonably cooperate with Buyer in its investigation of the Purchased Assets. Any investigation pursuant to this Section

5.04 shall be conducted in such manner as not to interfere unreasonably with the conduct of the Purchased Assets or any other businesses

of Seller. No investigation by Buyer or other information received by Buyer shall operate as a waiver or otherwise affect any representation,

warranty or agreement given or made by Seller in this Agreement.

Section

5.05 Employees and Employee Benefits.

(a)

Buyer, at Buyer’s sole discretion, may offer employment, on an “at will” basis, to any or all of Seller’s employees.

However, Buyer shall have no obligation to offer employment to any of Seller’s employees.

(b)

Except as otherwise set forth herein, Seller shall be solely responsible, and Buyer shall have no obligation whatsoever for, any employment

agreement or Contract with any employee of Seller or compensation or other amounts payable to any current or former employee, officer,

director, independent contractor or consultant of the business conducted through the Purchased Assets, including, without limitation,

hourly pay, commission, bonus, salary, accrued vacation, fringe, pension or profit sharing benefits or severance pay for any period relating

to the service with Seller at any time on or prior to the Closing Date and Seller shall pay all such amounts to all entitled persons

on or prior to the Closing Date.

(c)

Seller shall remain solely responsible for the satisfaction of all claims for medical, dental, life insurance, health accident or disability

benefits brought by or in respect of current or former employees, officers, directors, independent contractors or consultants of the

business related to the Purchased Assets or the spouses, dependents or beneficiaries thereof, which claims relate to events occurring

on or prior to the Closing Date. Seller also shall remain solely responsible for all workers’ compensation claims of any current

or former employees, officers, directors, independent contractors or consultants of the business related to the Purchased Assets which

relate to events occurring on or prior to the Closing Date. Seller shall pay, or cause to be paid, all such amounts to the appropriate

persons as and when due.

ARTICLE

VI

Miscellaneous

Section

6.01 Expenses. All costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be

paid by the party incurring such costs and expenses.

Section

6.02 Notices. All notices, requests, consents, claims, demands, waivers and other communications hereunder shall be in writing and

shall be deemed to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee

if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by facsimile or e-mail of a PDF document

(with confirmation of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after

normal business hours of the recipient; or (d) on the [third] day after the date mailed, by certified or registered mail, return receipt

requested, postage prepaid. Such communications must be sent to the respective parties at the following addresses (or at such other address

for a party as shall be specified in a notice given in accordance with this Section 6.02):

If

to Selling Parties:

Ferguson

Containers, Inc.

101

Larry Holmes Boulevard

Suite

313

Easton,

PA 18042

Eightco

Holdings, Inc.

101

Larry Holmes Boulevard

Suite

313

Easton,

PA 18042

If

to Buying Parties:

Ferguson

Containers, LLC

Street

City,

State Zip

Edward

Reichard

Street

City,

State Zip

Derrick

Reichard

Street

City,

State Zip

Section

6.03 Headings. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section

6.04 Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity,

illegality or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such

term or provision in any other jurisdiction.

Section

6.05 Entire Agreement. This Agreement including all attachments and schedules and the documents to be delivered hereunder constitute

the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein, and supersede all

prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of

any inconsistency between the statements in the body of this Agreement and the documents to be delivered hereunder, the Exhibits and

Disclosure Schedules (other than an exception expressly set forth as such in the Disclosure Schedules), the statements in the body of

this Agreement will control.

Section

6.06 Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their

respective successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior written consent

of the other party, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning party of any

of its obligations hereunder.

Section

6.07 No Third-party Beneficiaries. This Agreement is for the sole benefit of the parties hereto and their respective successors and

permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other person or entity any legal or

equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

Section

6.08 Amendment and Modification. This Agreement may only be amended, modified or supplemented by an agreement in writing signed by

each party hereto.

Section

6.09 Waiver. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and

signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure, breach or

default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or

after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from this Agreement

shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege

hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

Section

6.10 Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the Commonwealth of

Pennsylvania without giving effect to any choice or conflict of law provision or rule (whether of the Commonwealth of Pennsylvania or

any other jurisdiction).

Section

6.11 Submission to Jurisdiction. Any legal suit, action or proceeding arising out of or based upon this Agreement or the transactions

contemplated hereby may be instituted in the federal courts of the United States of America or the courts of the Commonwealth of Pennsylvania,

and each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

Section

6.12 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together

shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic

transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

Section

6.13 Non-Survival. Notwithstanding anything herein or otherwise to the contrary, none of the representations, warranties, covenants,

obligations or other agreements of the parties contained in this Agreement or in any certificate delivered pursuant to this Agreement,

including any rights arising out of any breach of such representations, warranties, covenants, obligations, agreements and other provisions,

shall survive the Closing, and, from and after the Closing, no Action shall be brought and no recourse shall be had against or from any

person in respect of such non-surviving representations, warranties, covenants or agreements, other than in the case of Fraud. All such

representations, warranties, covenants, obligations and other agreements shall terminate and expire upon the occurrence of the Closing.

Notwithstanding the foregoing, (a) those covenants and agreements contained herein that by their terms expressly require performance

after the Closing shall survive the Closing but only with respect to that portion of such covenant or agreement that is expressly to

be performed following the Closing, and (b) this Article VI shall survive the Closing.

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their respective

officers thereunto duly authorized.

| Seller: |

| Ferguson

Containers, Inc. |

| |

|

|

| |

/s/

Paul Vassilakos |

|

| By: |

Paul

Vassilakos, Authorized Signatory |

|

| |

|

|

| Seller’s

Owner: |

| Eightco

Holdings, Inc. |

| |

|

|

| |

/s/

Paul Vassilakos |

|

| By: |

Paul

Vassilakos, Chairman and Chief Executive Officer |

|

| |

|

|

| Buyer: |

| Ferguson

Containers, LLC |

| |

|

|

| |

/s/

Edward Reichard |

|

| By: |

Edward

Reichard, Member/Authorized Signatory |

|

| |

|

|

| |

/s/

Derick Reichard |

|

| By: |

Derick

Reichard, Member/Authorized Signatory |

|

| |

|

|

| Buyer’s

Owners: |

| |

|

|

| |

/s/

Edward Reichard |

|

| By: |

Edward

Reichard, Individual |

|

| |

|

|

| |

/s/

Derick Reichard |

|

| By: |

Derick

Reichard, Individual |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

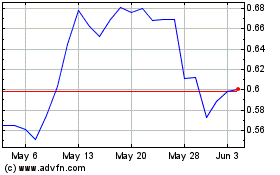

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Jan 2024 to Jan 2025