0000884624false00008846242023-11-272023-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 27, 2023 |

ORTHOFIX MEDICAL INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-19961 |

98-1340767 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3451 Plano Parkway |

|

Lewisville, Texas |

|

75056 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (214) 937-2000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.10 par value per share |

|

OFIX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors of Principal Officers; Election of Directors; Appointment of Principal Officers.

Announcement of Massimo Calafiore as President and Chief Executive Officer

On November 28, 2023, Orthofix Medical Inc. (“Orthofix” or the “Company”) announced that Massimo Calafiore and the Company have agreed that Mr. Calafiore will become the Company’s President and Chief Executive Officer. Mr. Calafiore currently serves as Chief Executive Officer of LimaCorporate S.p.A., a global orthopedics company, and his appointment as Orthofix’s President and Chief Executive Officer is expected to be effective in early 2024, following the completion of LimaCorporate’s previously announced acquisition by Enovis Corporation. The terms of Mr. Calafiore’s appointment are further set forth in a letter agreement between Mr. Calafiore and the Company (the “Offer Letter Agreement”), entered into on November 27, 2023. The determination to offer Orthofix’s President and Chief Executive Officer position to Mr. Calafiore, and the terms of the Offer Letter Agreement, were each unanimously approved by the Company’s Board of Directors (the “Board”). Catherine M. Burzik, who currently serves as Interim Chief Executive Officer, will continue in that role until Mr. Calafiore begins employment.

Mr. Calafiore, 52, has served since September 2022 as the President and Chief Executive Officer of LimaCorporate S.p.A., a global orthopedic company focused on restoring motion through digital innovation and customized hardware, which is currently in the process of being acquired by Enovis Corporation. Previously, Mr. Calafiore served from September 2021 through August 2022 as Executive Vice President and Chief Commercial Officer of NuVasive, Inc., where he oversaw product marketing, commercial and commercial enablement functions, as well as NuVasive’s specialized orthopedics and clinical services. From October 2020 through August 2021, he served as NuVasive’s Executive Vice President, Global Business Units, where he was responsible for NuVasive’s product and services organization, including Spine, NuVasive Specialized Orthopedics (NSO) and NuVasive Clinical Services, and commercial enablement such as clinical professional development and global marketing. From 2017 until October 2020 he held various other leadership roles at NuVasive with increasing levels of responsibility, serving as Senior Vice President, Spine Business Unit, from January 2020 to October 2020, Senior Vice President, Global Implant Systems and General Manager of NSO, from February 2019 to December 2019, and Senior Vice President, General Manager of NSO from August 2017 to February 2019. Before his executive service at NuVasive, he spent more than 15 years supporting and leading the U.S. business for Waldemar Link, a leader in the orthopedics and medical device industry.

Under the terms of the Offer Letter Agreement, Mr. Calafiore will receive an annual base salary of $825,000 per year, and a target bonus opportunity under the Company’s annual incentive program of 110% of such base salary. As an inducement to entering into employment with the Company, he will receive (i) sign-on equity incentive awards with a grant date fair value of $3,500,000, and (ii) 2024 annual equity incentive awards with a grant date fair value of $4,000,000 (collectively, the “Inducement Awards”). The Inducement Awards, which will be granted effective as of Mr. Calafiore’s first date of employment with the Company pursuant to NASDAQ Marketplace Rule 5635(c)(4), will be allocated (i) 50% as performance-based vesting restricted stock units determined at the end of a 3-year performance period based on the Company’s total stockholder return relative to an industry peer group index during such period, (ii) 25% as stock options that vest upon achievement of both service- and performance-based criteria, whichever is the later of (a) the date certain service-based conditions are met (which will be met over three years) and (b) the date that the average closing price of the Company’s common stock over a one-month calendar period has been equal to or great than 150% of the closing price of the Company’s common stock on the grant date, and (iii) 25% as time-based restricted stock units vesting in equal tranches over three years. Mr. Calafiore will be provided an executive level after-tax relocation payment of $225,000 to support establishing residency in the San Diego, CA area.

The Compensation and Talent Development Committee of the Board, with the assistance of its independent compensation consultant, designed the sign-on package to be aligned with industry benchmarks, the Company’s pay-for-performance philosophy, and shareholder interests. The sign-on equity-based awards are being delivered as 75 percent at-risk performance-based component that delivers value only if the Company achieves sustained absolute or relative shareholder value creation goals and 25% as only a time-based element. The Committee will be setting performance metrics for its cash-based annual incentive program in the first quarter of 2024, consistent with its regular practice and corporate priorities established by the Board of Directors for the fiscal year.

In connection with his employment, Mr. Calafiore will be provided the opportunity to enter into a CEO change in control and severance agreement and indemnification agreement. The foregoing descriptions do not purport to be complete and are qualified in their entirety by reference to the full text of the Offer Letter Agreement, which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

Board Service of Catherine M. Burzik

In connection with the finalization of these matters, Ms. Burzik has informed the Board that she has elected not to stand for re-election to the Board at the Company’s annual meeting of shareholders in 2024 (the “2024 Annual Meeting”). Ms. Burzik’s decision not to stand for re-election to the Board is not due to any disagreement with the Company regarding its operations, policies or practices. Ms. Burzik will continue in her role of Chair of the Board until her Board service expires at the 2024 Annual Meeting.

Item 7.01 Regulation FD Disclosures.

On November 28, 2023, the Company issued a press release concerning the matters disclosed in Item 5.02 above. The information furnished in this Item 7.01 will not be treated as “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. This information will not be deemed incorporated by reference into any filing under the Securities Act, or into another filing under the Exchange Act, unless that filing expressly incorporates by reference this Item 7.01 of this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Orthofix Medical Inc. |

|

By: |

|

/s/ Catherine M. Burzik |

|

|

|

Catherine M. Burzik Interim Chief Executive Officer

and Chair of the Board of Directors |

|

Date: December 1, 2023

Exhibit 10.1

November 27, 2023

Massimo Calafiore

Via L. Castelvetro 18

Modena, Italy 41124

Dear Massimo:

It gives me great pleasure to present this offer of employment with Orthofix Medical, Inc. (with its subsidiaries and affiliates, “Orthofix”).

Position: The position we are offering you is that of President and Chief Executive Officer. We also expect that the Orthofix Board of Directors will appoint you as one of its members.

Start Date: Your anticipated starting date is expected to be effective mid- to late-January 2024, promptly following the completion of LimaCorporate’s previously announced acquisition by Enovis Corporation (NYSE: ENOV).

Base Salary: Your base salary will be $825,000 per year (the “Base Salary”), less applicable deductions and tax withholdings.

Annual Bonus: Subject to Orthofix policies and satisfaction of applicable performance criteria, you will be eligible to participate in the annual bonus program, with a target bonus opportunity of 110% of your Base Salary. Your 2024 annual bonus will not be pro-rated based on your start date. The annual bonus, if payable, will be paid at the same time that such bonuses are paid to other executives, and will be designed to either be exempt from or comply with Internal Revenue Code Section 409A, as determined by the Compensation and Talent Development Committee of Orthofix’s Board of Directors (the “C&TD Committee”) upon establishment each year.

Sign-On Equity Award ($3,500,000): As an inducement to and incentive for accepting this position, you will be receive a grant, effective as of your start date, of (i) performance-based restricted stock units (“P-RSUs”), valued at $1,750,000 (based on the closing price of Orthofix common stock on the grant date, subject to rounding to the nearest whole unit), (ii) Stock Options to purchase shares of Orthofix common stock, valued at $875,000 (based on the Black-Scholes value of Orthofix common stock on the grant date, subject to rounding to the nearest whole option share), and (iii) restricted stock units (“RSUs”) with respect to shares of Orthofix common stock, valued at $875,000 (based on the closing price of Orthofix common stock on the grant date, subject to rounding to the nearest whole unit). All such awards will be subject to continued employment through applicable vesting dates (subject to any applicable acceleration rights).

MACROBUTTON DocID 4161-1083-5021 v2

P-RSUs vesting determined at the end of the 3-year performance period based on Orthofix total shareholder return relative to an industry peer group index, which vesting may be anywhere from 0% to 200% of the target P-RSU amount based on the achievement of the performance goals. If during the term of the Stock Options the average closing price of the Company’s common stock over a one-month calendar period has been equal to or greater than 150% of the closing price of the Company’s common stock on the grant date (the “Sign-On Option Exercise Condition”), the Stock Options will vest upon the later of (i) the date on which the Sign-On Option Exercise Condition is achieved and (ii) the date on which you meet the applicable service-based conditions. The applicable service-based conditions will be met with respect to 1/3 of the Stock Options on the one-year anniversary of the Stock Options’ grant date and with respect to 1/12 of the Stock Options as of the end of each 3-month period during the two years following such one-year anniversary of the grant date. RSUs will vest in annual 33-1/3% installments, with the first tranche vesting on the one-year anniversary of the RSUs’ grant date and the second and third tranches vesting on the two and three year anniversaries of the grant date, respectively. Upon any future Change in Control (as defined under the Change in Control and Severance Agreement), (i) the performance goals for the P-RSUs will be deemed achieved at the greater of 100% of target or actual achievement through the Change in Control closing date and (ii) the Sign-On Option Exercise Condition will be deemed achieved. The sign-on equity awards will be subject to the terms and conditions of applicable award agreements.

Annual 2024 Equity Incentive Award ($4,000,000): As a further inducement to and incentive for accepting this position, you will receive a grant, effective as of your start date, of (i) P-RSUs, valued at $2,000,000 (based on the closing price of Orthofix common stock on the grant date, subject to rounding to the nearest whole unit), (ii) Stock Options to purchase shares of Orthofix common stock, valued at $1,000,000 (based on the Black-Scholes value of Orthofix common stock on the grant date, subject to rounding to the nearest whole option share), and (ii) RSUs with respect to shares of Orthofix common stock, valued at $1,000,000 (based on the closing price of Orthofix common stock on the grant date, subject to rounding to the nearest whole unit). All such awards will be subject to continued employment through applicable vesting dates (subject to any applicable acceleration rights).

P-RSUs vesting determined at the end of the 3-year performance period based on Orthofix total shareholder return relative to an industry peer group index, which vesting may be anywhere from 0% to 200% of the target P-RSU amount based on the achievement of the performance goals. If during the term of the Stock Options the average closing price of the Company’s common stock over a one-month calendar period has been equal to or greater than 150% of the closing price of the Company’s common stock on the grant date (the “2024 Option Exercise Condition”), the Stock Options will vest upon the later of (i) the date on which the Sign-On Option Exercise Condition is achieved and (ii) the date on which you meet the applicable service-based conditions. The applicable service-based conditions will be met with respect to 1/3 of the Stock Options on the one-year anniversary of the Stock Options’ grant date and with respect to 1/12 of the Stock Options as of the end of each 3-month period during the two years following such one-year anniversary of the grant date. RSUs will vest in annual 33-1/3% installments, with the first tranche vesting on the one-year anniversary of the RSUs’ grant date and the second and third tranches vesting on the two and three year anniversaries of the grant date, respectively. Upon any future Change in Control (as defined under the Change in Control and Severance Agreement), (i) the performance goals for the

MACROBUTTON DocID 4161-1083-5021 v2

P-RSUs will be deemed achieved at the greater of 100% of target or actual achievement through the Change in Control closing date and (ii) the 2024 Option Exercise Condition will be deemed achieved. These sign-on annual 2024 equity incentive awards will be subject to the terms and conditions of applicable award agreements. For the avoidance of doubt, the 2024 Option Exercise Condition is intended as a one-time performance incentive and will not necessarily apply to future stock awards (i.e., for 2025 and future years), the terms and conditions of which will be determined by the C&TD Committee.

Benefits: Orthofix will offer you medical, dental, and vision insurance, effective the first of the month after your first 30 days of employment. You will also be eligible to participate in the Orthofix 401(k) retirement plan as of the first of the month after your first 30 days of employment. This plan currently provides an employer match of 100% for the first 2% contribution and 50% for the next 4% contribution. A more detailed explanation of these benefits and other benefits will be provided to you under separate cover. Orthofix defers to the provisions of its employee benefits plans, which plans shall govern to the extent of any conflict and which plans may be changed unilaterally by Orthofix.

Relocation Assistance: Your position will be based in Orthofix’s Carlsbad, CA offices and as such, Orthofix will provide you with a relocation payment, to be paid to you on May 1, 2024, in an amount such that the estimated after-tax portion (calculated to assume that you are subject to U.S. federal and California state income tax, but not subject to income tax in any other jurisdiction) of such amount will be equal to $225,000, such payment to be used for expenses to support establishing residency in the San Diego, CA area on or before August 15, 2024.

Third-Party Confidentiality/Non-Compete Obligations: Orthofix recognizes that, while you were employed with your prior employers, you may have been exposed to confidential, proprietary, and/or trade secret information (“Third-Party Confidential Information”). Moreover, Orthofix recognizes that you have a legal duty and may have a contractual duty not to use or disclose Third-Party Confidential Information outside of your employment with your former employers. Orthofix also recognizes that you may owe your former employers a contractual duty not to solicit certain customers (“Restricted Customers”). Orthofix has no intention of obtaining any Third-Party Confidential Information in any form. In fact, Orthofix’s expectation is that you will abide by, and comply fully with, the terms of any agreements you may have with respect to such information. By signing below, you represent and warrant that you have complied, and will comply, with any such obligations, including, but not limited to, all confidentiality, non-solicitation, non-competition, and post-employment disclosure obligations. You further represent and warrant that you have not misappropriated any Third-Party Confidential Information and, to the extent you may have access to such information, you will not disclose or use it for any purpose contrary to the terms of any agreements you may have with respect to such information, or to benefit Orthofix in any way.

Orthofix also wishes to ensure that you are not placed in a position which might require you to solicit Restricted Customers or cause the disclosure or use of Third-Party Confidential Information, either intentionally or inadvertently. If you are ever involved in any job situation which could require you to solicit Restricted Customers or cause you to use or disclose any Third-Party Confidential Information, you agree to immediately notify Orthofix’s Chief Legal Officer

MACROBUTTON DocID 4161-1083-5021 v2

and advise Orthofix’s Chief Legal Officer of your concerns. In the event it is determined that a risk of improper solicitation, disclosure, or use does exist, Orthofix will take appropriate measures.

Employment-At-Will: You understand and acknowledge that, if you become employed by Orthofix, you will be an “at-will” employee at all times during your employment. As an at-will employee, both Orthofix and you will have the right to terminate your employment at any time, with or without cause, and with or without notice. At-will employment also means that your job duties, title, compensation, and benefits, as well as the company personnel policies and other procedures, may be changed or terminated at the sole discretion of Orthofix at any time. Please note that, while this offer letter summarizes your anticipated terms and conditions of employment with Orthofix, they may change, and it is not an employment contract.

Other Agreements: Under separate cover, you will receive a Change in Control and Severance Agreement, a Dispute Resolution Agreement, a Confidentiality and Invention Assignment Agreement, and an Indemnification Agreement (the “Other Agreements”), which will become effective as of your first day of employment. Additionally, OFIX agrees to promptly reimburse you for (a) tax planning/tax return preparation expenses incurred by you for your Italy, US, and state/local tax returns for each calendar year during which you are employed by the Company and (b) the cost of legal fees up to $25,000 to review these employment agreements. Any expense reimbursements or in kind benefits under this offer letter that constitute deferred compensation within the meaning of Section 409A of the Internal Revenue Code shall be made or provided in accordance with the requirements of Section 409A, including, without limitation, that: (i) the expenses eligible for reimbursement or the amount of in-kind benefits provided in one taxable year shall not affect the expenses eligible for reimbursement or the amount of in-kind benefits provided in any other taxable year; (ii) the reimbursement of an eligible expense shall be made no later than the end of the year after the year in which such expense was incurred; and (iii) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit.

Acceptance: Your signature at the end of this offer letter constitutes an acceptance of this offer and confirms that no promises, representations, or agreements that are inconsistent with any of the terms of this offer letter have been made to or with you by anyone at Orthofix. Upon acceptance of this Offer Letter the offer and the terms set forth herein are binding and irrevocable by Orthofix until and following the effectiveness of the Change of Control and Severance Agreement.

Massimo, we look forward to working with you. Your experience, background and leadership will be a significant asset to Orthofix.

Sincerely,

/s/ Catherine M. Burzik

Catherine M. Burzik

Chair of the Board and Interim President and Chief Executive Officer

ACKNOWLEDGED, ACCEPTED, AND AGREED:

MACROBUTTON DocID 4161-1083-5021 v2

/s/ Massimo Calafiore Date: November 27, 2023

Massimo Calafiore

MACROBUTTON DocID 4161-1083-5021 v2

Exhibit 99.1

Orthofix Medical Inc.

3451 Plano Parkway

Lewisville, TX 75056 USA

Tel 214 937 2000

Orthofix.com

News Release

Orthofix Names Massimo Calafiore as President and Chief Executive Officer

Value-Building Medical Device Executive with 20-Year Record of Driving Market-Leading Growth

Across Orthopedics and Spine Businesses

Global Leader with Extensive M&A Integration Expertise and Commercial and Operating Experience Across Key Orthofix Geographies

LEWISVILLE, TEXAS — November 28, 2023 — Orthofix Medical Inc. (NASDAQ:OFIX), a leading global spine and orthopedics company, announced today that Massimo Calafiore has been named incoming President and Chief Executive Officer. Mr. Calafiore is currently Chief Executive Officer of LimaCorporate S.p.A., a global orthopedics company, and his appointment to Orthofix is expected to be effective in early 2024, following the completion of LimaCorporate’s previously announced acquisition by Enovis Corporation (NYSE: ENOV). At that time, Mr. Calafiore is also expected to join Orthofix’s Board of Directors.

“The Board of Directors unanimously determined that Massimo is the right choice to lead Orthofix given his exceptional track record of delivering value creation and his extensive knowledge of the medical device industry, specifically within orthopedics and spine,” said Catherine Burzik, Chair of the Board of Directors and Interim CEO of Orthofix. “Throughout his career, Massimo has demonstrated his ability to unlock value opportunities for multi-segmented, global businesses. He has successfully driven sales and commercial operations to achieve both industry leading profitability and growth. Importantly, he has proven experience integrating companies and building high performing teams.”

“Having worked in orthopedics and spine throughout my entire career, I know Orthofix well and have long admired the Company and its talented team,” said Mr. Calafiore. “I was attracted to Orthofix given the many growth opportunities created by its unique, broad-based portfolio and high-quality distributor relationships. I am also impressed with the innovative solutions Orthofix has developed to meet the needs of surgeons and the patients it serves. At this pivotal time for the Company, I look forward to working with the Board and leadership team to capture Orthofix’s significant profitable growth potential and drive enhanced shareholder value.”

Mr. Calafiore is an accomplished global business leader with an excellent track record across multiple companies in the orthopedics and spine industry. Throughout his career he has demonstrated a commitment to operating excellence, ethical integrity and DE&I values.

He has been CEO of LimaCorporate since September 2022. During this time, Mr. Calafiore strengthened and reshaped the company’s strategy and culture priorities, with an emphasis on fostering, mentoring and retaining talent. His leadership resulted in consecutive quarter-over-quarter above-market growth; best-in-class EBITDA margins; and substantial improvement in employee engagement and retention. On September 25, 2023, LimaCorporate announced its sale to Enovis Corporation for €800 million.

Prior to LimaCorporate, he served as Executive Vice President and Chief Commercial Officer of NuVasive, Inc. and delivered consecutive quarter-over-quarter above-market growth in all core geographies, including the U.S., APAC, EMEA and Japan, and successfully launched multiple products globally, which became foundational to NuVasive’s portfolio offering.

At the beginning of his tenure at NuVasive, Mr. Calafiore served as President of NuVasive Specialized Orthopedics (formerly Ellipse Technologies). In this role, he helped to further integrate the Ellipse business with NuVasive, achieving multiple quarters of accelerated revenue growth with above-market operation margin expansion. NuVasive Specialized Orthopedics is today an important player in complex trauma and limb reconstruction for adults and children, a market segment where Orthofix is also a recognized leader.

Earlier in his career, Mr. Calafiore worked for Waldemar Link GmbH & Co. KG and served in various leadership roles across multiple business segments, including orthopedics, lower extremities and spine. He oversaw the sales of the STAR Ankle to Small Bone Innovations and the PCM Cervical disc to NuVasive.

He holds an M.Sc. in Mechanical Engineering from the University of Catania and an MBA from New York University.

The Company also announced that Ms. Burzik has notified the Board that she has elected to not stand for reelection to the Board at the 2024 Annual Meeting.

Ms. Burzik said, “It is an honor to serve as Interim CEO and work closely with Orthofix’s amazing employees. The organization is on solid footing, and I will be delighted to turn the Company over to Massimo’s very capable hands and plan to work closely with him in the following months to ensure a seamless transition.”

The Board retained Heidrick & Struggles, a leading global executive search firm, to assist in its search process.

About Orthofix

Orthofix is a leading global spine and orthopedics company with a comprehensive portfolio of biologics, innovative spinal hardware, bone growth therapies, specialized orthopedic solutions, and a leading surgical navigation system. Its products are distributed in approximately 68 countries worldwide.

The Company is headquartered in Lewisville, Texas and has primary offices in Carlsbad, CA, with a focus on spine and biologics product innovation and surgeon education, and Verona, Italy, with an emphasis on product innovation, production, and medical education for orthopedics. The combined Company’s global R&D, commercial and manufacturing footprint also includes facilities and offices in Irvine, CA, Toronto, Canada, Sunnyvale, CA, Wayne, PA, Olive Branch, MS, Maidenhead, UK, Munich, Germany, Paris, France and Sao Paulo, Brazil.

Forward-Looking Statements

This news release may include forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” “continue” or other comparable terminology. Orthofix cautions you that statements included in this news release that are not a description of historical facts are forward-looking statements that are based on the Company’s current expectations and assumptions. Each forward-looking statement contained in this news release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others: the ability of newly launched products to perform as designed and intended and to meet the needs of surgeons and patients, including as a result of the lack of robust clinical validation; and the risks identified under the heading “Risk Factors” in Orthofix Medical Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the Securities and Exchange Commission (SEC) on March 6, 2023. The Company’s public filings with the Securities and Exchange

Commission are available at www.sec.gov. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date when made. Orthofix does not intend to revise or update any forward-looking statement set forth in this news release to reflect events or circumstances arising after the date hereof, except as may be required by law.

Contacts:

Media Relations

Denise Landry

DeniseLandry@orthofix.com

214.937.2529

Investor Relations

Louisa Smith, Gilmartin Group

IR@orthofix.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

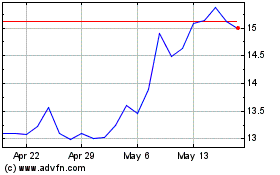

Orthofix Medical (NASDAQ:OFIX)

Historical Stock Chart

From Apr 2024 to May 2024

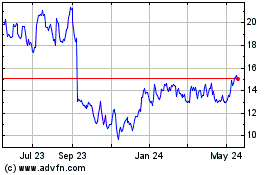

Orthofix Medical (NASDAQ:OFIX)

Historical Stock Chart

From May 2023 to May 2024