Declares Second Quarter Distribution of

$0.33 Per Share

OFS Capital Corporation (NASDAQ: OFS) (“OFS Capital,” the

“Company,” “we,” “us,” or “our”) today announced its financial

results for the fiscal quarter ended March 31, 2023.

FIRST QUARTER FINANCIAL HIGHLIGHTS

- Net investment income of $0.37 per common share for the quarter

ended March 31, 2023, an increase from $0.35 per common share for

the quarter ended December 31, 2022.

- Net loss on investments of $0.09 per common share, primarily

comprised of unrealized losses; there were no new non-accrual

loans.

- Net asset value (“NAV”) per common share decreased from $13.47

at December 31, 2022 to $13.42 at March 31, 2023.

- As of March 31, 2023, based on fair value, 94% of our loan

portfolio consisted of floating rate loans and approximately 99% of

our loan portfolio consisted of senior secured loans.

- For the quarter ended March 31, 2023, the investment

portfolio’s weighted-average performing income yield increased to

13.0% from 12.7% during the prior quarter.

- On March 31, 2023, we paid a quarterly distribution of $0.33

per common share and on May 2, 2023, our Board of Directors

declared a distribution of $0.33 per common share for the second

quarter of 2023, payable on June 30, 2023 to stockholders of record

as of June 23, 2023.

SELECTED FINANCIAL HIGHLIGHTS

(unaudited)

Quarter Ended

(Per common share)

March 31, 2023

December 31, 2022

Net Investment Income

Net investment income

$

0.37

$

0.35

Net Realized/Unrealized Gain

(Loss)

Net realized loss on investments(1)

$

—

$

(0.09

)

Net unrealized loss on investments

(0.09

)

(0.08

)

Net loss on investments

$

(0.09

)

$

(0.17

)

Earnings (Loss)

Earnings (loss)

$

0.28

$

0.18

Net Asset Value

Net asset value

$

13.42

$

13.47

Distributions paid

$

0.33

$

0.30

As of

(in millions)

March 31, 2023

December 31, 2022

Balance Sheet Highlights

(unaudited)

Investment portfolio, at fair value

$

499.8

$

500.6

Total assets

515.5

520.7

Net assets

179.8

180.4

(1)

For the quarter ended March 31, 2023, net

realized loss rounds to an amount of less than $0.01 per common

share.

“We are pleased to announce another increase in our quarterly

net investment income. We expect to continue to see the benefits of

our positioning in this rising interest rate environment with the

vast majority of our loan portfolio being floating rate and the

majority of our debt being fixed-rate,” said Bilal Rashid, OFS

Capital’s Chairman and Chief Executive Officer. “At the end of the

first quarter, approximately 85% of our outstanding debt matures in

2026 or later, and more than half of our outstanding debt is

unsecured.”

PORTFOLIO AND INVESTMENT

ACTIVITIES

($ in millions)

As of and for the Quarter

Ended

Portfolio Overview

March 31, 2023

December 31, 2022

Average interest-bearing investments, at

cost

$

410.0

$

422.7

Weighted-average performing income yield -

interest-bearing investments(2)

13.0

%

12.7

%

Weighted-average realized yield -

interest-bearing investments(3)

11.8

%

11.7

%

The weighted-average yield of our investments is not the same as

a return on investment for our stockholders, but rather relates to

our investment portfolio and is calculated before the payment of

all of our fees and expenses.

(2)

Performing income yield is calculated as

(a) the actual amount earned on performing interest-bearing

investments, including interest, prepayment fees and amortization

of net loan fees, divided by (b) the weighted-average of total

performing interest-bearing investments at amortized cost.

(3)

Realized yield is calculated as (a) the

actual amount earned on interest-bearing investments, including

interest, prepayment fees and amortization of net loan fees,

divided by (b) the weighted-average of total interest-bearing

investments at amortized cost, in each case, including debt

investments on non-accrual status and non-income producing

structured finance securities.

Quarter Ended

Portfolio Activity

March 31, 2023

December 31, 2022

Investments in debt and equity

investments

$

9.9

$

9.3

Investments in structured finance

securities

—

—

As of March 31, 2023, based on fair value, our investment

portfolio was comprised of the following:

- Total investments of $499.8 million, which was equal to

approximately 105% of amortized cost;

- Debt investments of $309.9 million in 47 portfolio

companies;

- Equity investments of $102.8 million in 17 portfolio

companies;

- Structured finance securities of $87.0 million in 23

investments; and

- Unfunded commitments of $21.3 million to 12 portfolio

companies.

During the quarter ended March 31, 2023, no new loans were

placed on non-accrual status.

RESULTS OF OPERATIONS

Investment Income

For the quarter ended March 31, 2023, total investment income

increased to $14.3 million from $14.0 million in the prior quarter,

primarily due to an increase in dividend income. For the quarter

ended March 31, 2023, dividend income of $0.8 million was primarily

related to a $0.5 million dividend from Pfanstiehl Holdings,

Inc.

Expenses

For the quarter ended March 31, 2023, total expenses increased

by $0.1 million to $9.3 million compared to the prior quarter,

primarily due to an increase in interest expense stemming from

increasing interest rates on our variable rate revolving credit

facility with BNP Paribas.

Net Gain (Loss) on Investments

For the quarter ended March 31, 2023, we recognized a net loss

on investments of $1.1 million, or $0.09 per common share,

primarily due to issuer specific declines on certain debt

investments and structured finance securities, partially offset by

net unrealized appreciation on our equity investments.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2023, we had $10.8 million in cash, which

includes $3.1 million held by our wholly owned small business

investment company, OFS SBIC I, LP (“SBIC I LP”), and $3.6 million

held by OFSCC-FS, LLC (“OFSCC-FS”), an indirect wholly owned

subsidiary. Our use of cash held by SBIC I LP and OFSCC-FS is

restricted by regulatory and contractual conditions, including

limitations on the amount of cash SBIC I LP and OFSCC-FS can

distribute to us.

As of March 31, 2023, we had an unused commitment of $20.0

million under our senior secured revolving credit facility with

Pacific Western Bank, as well as an unused commitment of $49.0

million under our revolving credit facility with BNP Paribas, both

of which are subject to borrowing base requirements and other

covenants. Based on our regulatory asset coverage ratio at March

31, 2023, we could access our aggregate unused lines of credit of

$69.0 million, subject to the provisions of the borrowing bases as

of any borrowing date, and remain in compliance with asset coverage

ratio requirements.

CONFERENCE CALL

OFS Capital will host a conference call to discuss these results

on Friday, May 5, 2023, at 10:00 AM Eastern Time. Interested

parties may participate in the call via the following:

INTERNET: Go to www.ofscapital.com at least 15 minutes prior to

the start time of the call to register, download, and install any

necessary audio software. A replay will be available for 90 days on

OFS Capital’s website at www.ofscapital.com.

TELEPHONE: Dial (844) 763-8274 (Domestic) or (412) 717-9224

(International) approximately 15 minutes prior to the call. A

telephone replay of the conference call will be available through

May 15, 2023 at 9:00 AM Eastern Time and may be accessed by calling

(877) 344-7529 (Domestic) or (412) 317-0088 (International) and

utilizing conference ID #6430152.

For more detailed discussion of the financial and other

information included in this press release, please refer to OFS

Capital’s Form 10-Q for the first quarter ended March 31, 2023.

OFS Capital Corporation and

Subsidiaries

Consolidated Statements of Assets and

Liabilities

(Dollar amounts in thousands, except

per share data)

March 31, 2023

December 31,

2022

(unaudited)

Assets

Total investments, at fair value

(amortized cost of $475,024 and $474,880, respectively)

$

499,759

$

500,576

Cash

10,773

14,937

Interest receivable

2,201

2,202

Prepaid expenses and other assets

2,750

3,002

Total assets

$

515,483

$

520,717

Liabilities

Revolving lines of credit

$

106,000

$

104,700

SBA debentures (net of deferred debt

issuance costs of $158 and $223, respectively)

45,762

50,697

Unsecured notes (net of deferred debt

issuance costs of $3,402 and $3,647, respectively)

176,598

176,353

Interest payable

2,104

3,947

Payable to adviser and affiliates

4,025

3,909

Accrued professional fees

419

444

Other liabilities

767

244

Total liabilities

335,675

340,294

Net assets

Preferred stock, par value of $0.01 per

share, 2,000,000 shares authorized, -0- shares issued and

outstanding as of March 31, 2023 and December 31, 2022,

respectively

$

—

$

—

Common stock, par value of $0.01 per

share, 100,000,000 shares authorized, 13,398,078 and 13,398,078

shares issued and outstanding as of March 31, 2023 and December 31,

2022, respectively

134

134

Paid-in capital in excess of par

184,841

184,841

Total distributable earnings (losses)

(5,167

)

(4,552

)

Total net assets

179,808

180,423

Total liabilities and net

assets

$

515,483

$

520,717

Number of shares outstanding

13,398,078

13,398,078

Net asset value per share

$

13.42

$

13.47

OFS Capital Corporation and

Subsidiaries

Consolidated Statements of Operations

(unaudited)

(Dollar amounts in thousands, except

per share data)

Three Months Ended March

31,

2023

2022

Investment income

Interest income

$

13,393

$

9,788

Dividend income

785

758

Fee income

105

400

Total investment income

14,283

10,946

Expenses

Interest expense

4,874

3,624

Management fee

1,894

2,020

Income Incentive Fee

1,238

—

Capital Gains Fee

—

1,072

Professional fees

436

407

Administration fee

482

451

Other expenses

409

367

Total expenses

9,333

7,941

Net investment income

4,950

3,005

Net realized and unrealized gain (loss)

on investments

Net realized gain (loss), net of taxes

(4

)

217

Net unrealized gain (loss), net of

taxes

(1,121

)

5,283

Net gain (loss) on investments

(1,125

)

5,500

Loss on extinguishment of debt

(19

)

(144

)

Net increase in net assets resulting

from operations

$

3,806

$

8,361

Net investment income per common share –

basic and diluted

$

0.37

$

0.22

Net increase in net assets resulting from

operations per common share – basic and diluted

$

0.28

$

0.62

Distributions declared per common

share

$

0.33

$

0.28

Basic and diluted weighted average shares

outstanding

13,398,078

13,422,447

ABOUT OFS CAPITAL

The Company is an externally managed, closed-end,

non-diversified management investment company that has elected to

be regulated as a business development company. The Company's

investment objective is to provide stockholders with both current

income and capital appreciation primarily through debt investments

and, to a lesser extent, equity investments. The Company invests

primarily in privately held middle-market companies in the United

States, including lower-middle-market companies, targeting

investments of $3 million to $20 million in companies with annual

EBITDA between $5 million and $50 million. The Company offers

flexible solutions through a variety of asset classes including

senior secured loans, which includes first-lien, second-lien and

unitranche loans, as well as subordinated loans and, to a lesser

extent, warrants and other equity securities. The Company's

investment activities are managed by OFS Capital Management, LLC,

an investment adviser registered under the Investment Advisers Act

of 1940(4), as amended, and headquartered in Chicago, Illinois,

with additional offices in New York and Los Angeles.

FORWARD-LOOKING STATEMENTS

Statements in this press release regarding management's future

expectations, beliefs, intentions, goals, strategies, plans or

prospects, including statements relating to: OFS Capital’s results

of operations, including net investment income, adjusted net

investment income, net asset value and net investment gains and

losses and the factors that may affect such results; management's

belief regarding the performance of the Company’s portfolio;

management's belief that the Company is well positioned in a rising

interest rate environment due to a high percentage of floating rate

loans in the portfolio and a majority of liabilities that have a

fixed rate of interest, when there can be no assurance that such a

composition will lead to future success; and other factors may

constitute forward-looking statements for purposes of the safe

harbor protection under applicable securities laws. Forward-looking

statements can be identified by terminology such as “anticipate,”

“believe,” “could,” “could increase the likelihood,” “estimate,”

“expect,” “intend,” “is planned,” “may,” “should,” “will,” “will

enable,” “would be expected,” “look forward,” “may provide,”

“would” or similar terms, variations of such terms or the negative

of those terms. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors including those

risks, uncertainties and factors referred to in OFS Capital’s

Annual Report on Form 10-K for the year ended December 31, 2022

filed with the Securities and Exchange Commission under the section

“Risk Factors,” and in “Part II, Item 1A. Risk Factors” in our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2023,

as well as other documents that may be filed by OFS Capital from

time to time with the Securities and Exchange Commission. As a

result of such risks, uncertainties and factors, actual results may

differ materially from any future results, performance or

achievements discussed in or implied by the forward-looking

statements contained herein. OFS Capital is providing the

information in this press release as of this date and assumes no

obligations to update the information included in this press

release or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

(4) Registration does not imply a certain level of skill or

training

Schedule

1

Non-GAAP Financial Measure – Adjusted Net

Investment Income

On a supplemental basis, we disclose adjusted net investment

income (“Adjusted NII”) (including on a per share basis), which is

a financial measure calculated and presented on basis other than in

accordance with GAAP. Adjusted NII represents net investment

income, excluding the capital gains incentive fee, in periods in

which such expense occurs. GAAP requires recognition of a capital

gains incentive fee in our financial statements when aggregate net

realized and unrealized capital gains, if any, on a cumulative

basis is positive from the date of the election to be a BDC through

the reporting date. Such fees are subject to further conditions

specified in the investment advisory agreement with OFS Capital

Management, LLC, principally related to the realization of such net

gains, before OFS Capital Management, LLC is entitled to payment,

and such recognized fees are subject to the risk of reversal should

unrealized gains diminish to become losses. Management believes

that Adjusted NII is a useful indicator of operations exclusive of

any net capital gains incentive fee, as net investment income does

not include the net gains, realized or unrealized, associated with

the capital gains incentive fee. Management believes Adjusted NII

facilitates the analysis of our results of operations and provides

greater transparency into the determination of incentive fees.

Adjusted NII is not meant as a substitute for net investment income

determined in accordance with GAAP and should be considered in the

context of the entirety of our reported results of operations,

financial position and cash flows determined in accordance with

GAAP.

The following table provides a reconciliation from net

investment income (the most comparable GAAP measure) to Adjusted

NII for the quarters ended March 31, 2023 and December 31, 2022,

and three months ended March 31, 2023 and 2022, respectively

(dollar amounts in thousands, except per share data)

(unaudited):

Quarter Ended

Three Months Ended March

31,

March 31, 2023

December 31, 2022

2023

2022

(000's)

Per Share

(000's)

Per Share

(000's)

Per Share

(000's)

Per Share

Net investment income

$

4,950

$

0.37

$

4,726

$

0.35

$

4,950

$

0.37

$

3,005

$

0.22

Capital gains incentive fee accrual

—

—

—

—

—

—

1,072

0.08

Adjusted NII

$

4,950

$

0.37

$

4,726

$

0.35

$

4,950

$

0.37

$

4,077

$

0.30

Although these non-GAAP financial measures are intended to

enhance investors’ understanding of our business and performance,

these non-GAAP financial measures should not be considered an

alternative to GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504005993/en/

INVESTOR RELATIONS CONTACT: Steve Altebrando 646-652-8473

saltebrando@ofsmanagement.com

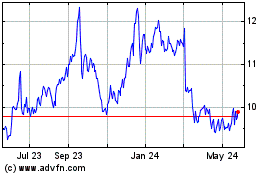

OFS Capital (NASDAQ:OFS)

Historical Stock Chart

From Oct 2024 to Nov 2024

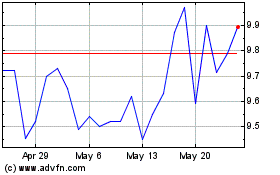

OFS Capital (NASDAQ:OFS)

Historical Stock Chart

From Nov 2023 to Nov 2024