0001801169FALSE00018011692025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 8-K

__________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

Opendoor Technologies Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39253 | 30-1318214 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

410 N. Scottsdale Road, Suite 1600 | |

| Tempe, | AZ | 85288 |

(Address of principal executive offices) | (Zip Code) |

(480) 618-6760

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

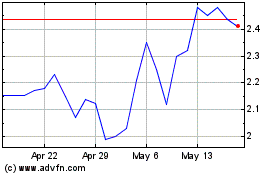

| Common stock, $0.0001 par value per share | | OPEN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02Results of Operations and Financial Condition

On February 27, 2025, Opendoor Technologies Inc. (the “Company”) issued a press release and a shareholder letter announcing its financial results for the fourth quarter and year ended December 31, 2024. A copy of the press release and the shareholder letter is furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure

On February 27, 2025, the Company posted an earnings supplement (the “Supplement”) in the “Investor Relations” portion of its website at investor.opendoor.com. A copy of the Supplement is attached to this Current Report on Form 8-K as Exhibit 99.3.

The information contained in Items 2.02 and 7.01 of this Current Report (including Exhibits 99.1, 99.2, and 99.3 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01Financial Statements and Exhibits

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (Cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Opendoor Technologies Inc. |

| | |

Date: February 27, 2025 | By: | /s/ Selim Freiha |

| Name: | Selim Freiha |

| Title: | Chief Financial Officer |

Exhibit 99.1

Opendoor Announces Fourth Quarter and Full Year 2024 Financial Results

SAN FRANCISCO, California - February 27, 2025 - Opendoor Technologies Inc. (Nasdaq: OPEN), a leading e-commerce platform for residential real estate transactions, today reported financial results for its fourth quarter and year ended December 31, 2024. Opendoor’s fourth quarter and year-end 2024 financial results and management commentary can be accessed through the Company’s shareholder letter on the “Quarterly Reports” page of Opendoor’s investor relations website at https://investor.opendoor.com/financials-filings/quarterly-reports.

"In 2024, we took decisive actions to streamline operations and optimize our cost structure to better position the Company to navigate the persistent housing market headwinds and drive toward our longer-term profitability target. As a result, we significantly reduced Adjusted Net Losses in the fourth quarter and for the year while delivering year-over-year revenue growth and improvements to Contribution Profit and Adjusted EBITDA," said Carrie Wheeler, CEO of Opendoor.

Wheeler continued, "We enter 2025 as a leaner, more efficient business, focused on reaching sustained profitability in the coming years as we further monetize our seller funnel and build a company that can thrive despite real estate headwinds. As the largest digital platform for home sellers, we remain committed to strengthening our position as the simplest, most certain way to sell a home."

Full Year 2024 Key Highlights

•Revenue of $5.2 billion, down (26)% versus 2023; with 13,593 total homes sold, down (27)% versus 2023

•Gross profit of $433 million, versus $487 million in 2023; Gross Margin of 8.4% versus 7.0% in 2023

•Net loss of $(392) million, versus $(275) million in 2023

•Purchased 14,684 homes, versus 11,246 homes in 2023

Non-GAAP Key Highlights*

•Contribution Profit (Loss) of $242 million, versus $(258) million in 2023; Contribution Margin of 4.7%, versus (3.7)% in 2023

•Adjusted EBITDA of $(142) million, versus $(627) million in 2023; Adjusted EBITDA Margin of (2.8)%, versus (9.0)% in 2023

•Adjusted Net Loss of $(258) million, versus $(778) million in 2023

*See “—Use of Non-GAAP Financial Measures” below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

Fourth Quarter 2024 Key Highlights

•Revenue of $1.1 billion, up 25% versus 4Q23 and down (21)% versus 3Q24; with 2,822 total homes sold, up 19% versus 4Q23 and down (22)% versus 3Q24

•Gross profit of $85 million, versus $72 million in 4Q23 and $105 million in 3Q24; Gross Margin of 7.8%, versus 8.3% in 4Q23 and 7.6% in 3Q24

•Net loss of $(113) million, versus $(91) million in 4Q23 and $(78) million in 3Q24

•Inventory balance of $2.2 billion, representing 6,417 homes, up 22% versus 4Q23 and up 1% versus 3Q24

•Purchased 2,951 homes, down (20)% versus 4Q23 and down (16)% versus 3Q24

•Ended the quarter with 1,705 homes under contract for purchase, down (19)% versus 4Q23 and up 69% versus 3Q24

Non-GAAP Key Highlights*

•Contribution Profit of $38 million, versus $30 million in 4Q23 and $52 million in 3Q24; Contribution Margin of 3.5%, versus 3.4% in 4Q23 and 3.8% in 3Q24

•Adjusted EBITDA of $(49) million, versus $(69) million in 4Q23 and $(38) million in 3Q24; Adjusted EBITDA Margin of (4.5)%, versus (7.9)% in 4Q23 and (2.8)% in 3Q24

•Adjusted Net Loss of $(77) million, versus $(97) million in 4Q23 and $(70) million in 3Q24

*See “—Use of Non-GAAP Financial Measures” below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

First Quarter 2025 Financial Outlook

•1Q25 revenue guidance of $1.0 billion to $1.075 billion

•1Q25 Contribution Profit1 guidance of $40 million to $50 million

•1Q25 Adjusted EBITDA1 guidance of $(50) million to $(40) million

Conference Call and Webcast Details

Opendoor will host a conference call to discuss its financial results on February 27, 2025, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from Opendoor’s Investor Relations website at https://investor.opendoor.com. An archived version of the webcast will be available from the same website after the call.

About Opendoor

Opendoor is a leading e-commerce platform for residential real estate transactions whose mission is to power life’s progress, one move at a time. Since 2014, Opendoor has provided people across the U.S. with a simple and certain way to sell and buy a home. Opendoor is a team of problem solvers, innovators, and operators who are leading the future of real estate. Opendoor currently operates in markets nationwide.

For more information, please visit www.opendoor.com

Forward Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking, including statements regarding the current and future health and stability of the real estate housing market and

1 Opendoor has not provided a quantitative reconciliation of forecasted Contribution Profit (Loss) to forecasted GAAP gross profit (loss) nor a reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this press release because the Company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to, inventory valuation adjustment and equity securities fair value adjustment. These items, which could materially affect the computation of forward-looking GAAP gross profit (loss) and net income (loss), are inherently uncertain and depend on various factors, some of which are outside of the Company’s control. For more information regarding the non-GAAP financial measures discussed in this press release, please see “Use of Non-GAAP Financial Measures” following the financial tables below.

general economy; anticipated future results of operations and financial performance, including our first quarter and full-year 2025 financial outlook; our ability to operate efficiently, optimize our cost structure, and drive sustained profitability in a challenging housing and macroeconomic market; our ability to realize cost savings as a result of certain streamlining initiatives; our product offerings and ability to monetize our seller funnel; the future health and status of our financial condition; our ability to strengthen our competitive position as the simplest, most certain way to sell a home; and our business strategy and plans, including plans to continue to invest in and enhance our products. These forward-looking statements generally are identified by the words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “intend”, “may”, “might”, “opportunity”, “outlook”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “strategy”, “strive”, “target”, “vision”, “will”, or “would”, any negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. The factors that could cause or contribute to actual future events to differ materially from the forward-looking statements in this press release include but are not limited to: the current and future health and stability of the economy, financial conditions and residential housing market, including any extended downturns or slowdowns; changes in general economic and financial conditions (including federal monetary policy, the imposition of tariffs and price or exchange controls, interest rates, inflation, actual or anticipated recession, home price fluctuations, and housing inventory), as well as the probability of such changes occurring, that may impact demand for our products and services, lower our profitability or reduce our access to future financings; actual or anticipated fluctuations in our financial condition and results of operations; changes in projected operational and financial results; our real estate assets and increased competition in the U.S. residential real estate industry; our ability to operate and grow our core business products, including the ability to obtain sufficient financing and resell purchased homes; investment of resources to pursue strategies and develop new products and services that may not prove effective or that are not attractive to customers and/or partners or that do not allow us to compete successfully; our ability to acquire and resell homes profitably; our ability to grow market share in our existing markets or any new markets we may enter; our ability to manage our growth effectively; our ability to expeditiously sell and appropriately price our inventory; our ability to access sources of capital, including debt financing and securitization funding to finance our real estate inventories and other sources of capital to finance operations and growth; our ability to maintain and enhance our products and brand, and to attract customers; our ability to manage, develop and refine our digital platform, including our automated pricing and valuation technology; our ability to realize expected benefits from our restructuring and cost reduction efforts; our ability to comply with multiple listing service rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers; our ability to obtain or maintain licenses and permits to support our current and future business operations; acquisitions, strategic partnerships, joint ventures, capital-raising activities or other corporate transactions or commitments by us or our competitors; actual or anticipated changes in technology, products, markets or services by us or our competitors; our ability to protect our brand and intellectual property; our success in retaining or recruiting, or changes required in, our officers, key employees and/or directors; the impact of the regulatory environment and potential regulatory instability associated with the new U.S. presidential administration within our industry and complexities with compliance related to such environment; any future impact of pandemics, epidemics, or other public health crises on our ability to operate, demand for our products and services, or general economic conditions; changes in laws or government regulation affecting our business; and the impact of pending or future litigation or regulatory actions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on or about February 27, 2025, as updated by our periodic reports and other filings with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations.

Contact Information

Investors:

investors@opendoor.com

Media:

press@opendoor.com

OPENDOOR TECHNOLOGIES INC.

FINANCIAL HIGHLIGHTS AND OPERATING METRICS

(In millions, except percentages, homes sold, number of markets, homes purchased, and homes in inventory)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Year Ended

December 31, | | |

| | December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | | | 2024 | | 2023 | | |

| Revenue | | $ | 1,084 | | | $ | 1,377 | | | $ | 1,511 | | | $ | 1,181 | | | $ | 870 | | | | | $ | 5,153 | | | $ | 6,946 | | | |

Gross profit | | $ | 85 | | | $ | 105 | | | $ | 129 | | | $ | 114 | | | $ | 72 | | | | | $ | 433 | | | $ | 487 | | | |

| Gross Margin | | 7.8 | % | | 7.6 | % | | 8.5 | % | | 9.7 | % | | 8.3 | % | | | | 8.4 | % | | 7.0 | % | | |

Net loss | | $ | (113) | | | $ | (78) | | | $ | (92) | | | $ | (109) | | | $ | (91) | | | | | $ | (392) | | | $ | (275) | | | |

| Number of markets (at period end) | | 50 | | | 50 | | | 50 | | | 50 | | | 50 | | | | | 50 | | | 50 | | | |

| Homes sold | | 2,822 | | | 3,615 | | | 4,078 | | | 3,078 | | | 2,364 | | | | | 13,593 | | | 18,708 | | | |

| Homes purchased | | 2,951 | | | 3,504 | | | 4,771 | | | 3,458 | | | 3,683 | | | | | 14,684 | | | 11,246 | | | |

| Homes in inventory (at period end) | | 6,417 | | | 6,288 | | | 6,399 | | | 5,706 | | | 5,326 | | | | | 6,417 | | | 5,326 | | | |

| Inventory (at period end) | | $ | 2,159 | | | $ | 2,145 | | | $ | 2,234 | | | $ | 1,881 | | | $ | 1,775 | | | | | $ | 2,159 | | | $ | 1,775 | | | |

Percentage of homes “on the market” for greater than 120 days (at period end) | | 46 | % | | 23 | % | | 14 | % | | 15 | % | | 18 | % | | | | 46 | % | | 18 | % | | |

Non-GAAP Financial Highlights (1) | | | | | | | | | | | | | | | | | | |

Contribution Profit (Loss) | | $ | 38 | | | $ | 52 | | | $ | 95 | | | $ | 57 | | | $ | 30 | | | | | $ | 242 | | | $ | (258) | | | |

| Contribution Margin | | 3.5 | % | | 3.8 | % | | 6.3 | % | | 4.8 | % | | 3.4 | % | | | | 4.7 | % | | (3.7) | % | | |

| Adjusted EBITDA | | $ | (49) | | | $ | (38) | | | $ | (5) | | | $ | (50) | | | $ | (69) | | | | | $ | (142) | | | $ | (627) | | | |

| Adjusted EBITDA Margin | | (4.5) | % | | (2.8) | % | | (0.3) | % | | (4.2) | % | | (7.9) | % | | | | (2.8) | % | | (9.0) | % | | |

| Adjusted Net Loss | | $ | (77) | | | $ | (70) | | | $ | (31) | | | $ | (80) | | | $ | (97) | | | | | $ | (258) | | | $ | (778) | | | |

(1) See “—Use of Non-GAAP Financial Measures” for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share amounts which are presented in thousands, and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended

December 31, |

| December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | 2024 | | 2023 |

| REVENUE | $ | 1,084 | | | $ | 1,377 | | | $ | 870 | | | $ | 5,153 | | | $ | 6,946 | |

| COST OF REVENUE | 999 | | | 1,272 | | | 798 | | | 4,720 | | | 6,459 | |

| GROSS PROFIT | 85 | | | 105 | | | 72 | | | 433 | | | 487 | |

| OPERATING EXPENSES: | | | | | | | | | |

| Sales, marketing and operations | 88 | | | 96 | | | 89 | | | 413 | | | 486 | |

| General and administrative | 41 | | | 46 | | | 48 | | | 182 | | | 206 | |

| Technology and development | 33 | | | 30 | | | 46 | | | 141 | | | 167 | |

| | | | | | | | | |

| Restructuring | 17 | | | — | | | 4 | | | 17 | | | 14 | |

| Total operating expenses | 179 | | | 172 | | | 187 | | | 753 | | | 873 | |

| LOSS FROM OPERATIONS | (94) | | | (67) | | | (115) | | | (320) | | | (386) | |

| | | | | | | | | |

| (LOSS) GAIN ON EXTINGUISHMENT OF DEBT | (1) | | | — | | | 34 | | | (2) | | | 216 | |

| INTEREST EXPENSE | (32) | | | (34) | | | (37) | | | (133) | | | (211) | |

| OTHER INCOME – Net | 14 | | | 23 | | | 27 | | | 64 | | | 107 | |

LOSS BEFORE INCOME TAXES | (113) | | | (78) | | | (91) | | | (391) | | | (274) | |

| INCOME TAX EXPENSE | — | | | — | | | — | | | (1) | | | (1) | |

NET LOSS | $ | (113) | | | $ | (78) | | | $ | (91) | | | $ | (392) | | | $ | (275) | |

| | | | | | | | | |

| | | | | | | | | |

Net loss per share attributable to common shareholders: | | | | | | | | | |

| Basic | $ | (0.16) | | | $ | (0.11) | | | $ | (0.14) | | | $ | (0.56) | | | $ | (0.42) | |

| Diluted | $ | (0.16) | | | $ | (0.11) | | | $ | (0.14) | | | $ | (0.56) | | | $ | (0.42) | |

| Weighted-average shares outstanding: | | | | | | | | | |

| Basic | 716,317 | | | 705,359 | | | 672,662 | | | 699,457 | | | 657,111 | |

| Diluted | 716,317 | | | 705,359 | | | 672,662 | | | 699,457 | | | 657,111 | |

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | December 31,

2024 | | December 31,

2023 |

| ASSETS | | | | |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents | | $ | 671 | | | $ | 999 | |

| Restricted cash | | 92 | | | 541 | |

| Marketable securities | | 8 | | | 69 | |

| Escrow receivable | | 6 | | | 9 | |

| | | | |

| Real estate inventory, net | | 2,159 | | | 1,775 | |

Other current assets | | 61 | | | 52 | |

| Total current assets | | 2,997 | | | 3,445 | |

| PROPERTY AND EQUIPMENT – Net | | 48 | | | 66 | |

| RIGHT OF USE ASSETS | | 18 | | | 25 | |

| GOODWILL | | 3 | | | 4 | |

| INTANGIBLES – Net | | — | | | 5 | |

| OTHER ASSETS | | 60 | | | 22 | |

| TOTAL ASSETS | | $ | 3,126 | | | $ | 3,567 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable and other accrued liabilities | | $ | 92 | | | $ | 64 | |

| Non-recourse asset-backed debt – current portion | | 432 | | | — | |

| | | | |

| | | | |

| | | | |

| Interest payable | | 3 | | | 1 | |

| Lease liabilities – current portion | | 2 | | | 5 | |

| Total current liabilities | | 529 | | | 70 | |

| NON-RECOURSE ASSET-BACKED DEBT – Net of current portion | | 1,492 | | | 2,134 | |

| CONVERTIBLE SENIOR NOTES | | 378 | | | 376 | |

| | | | |

| LEASE LIABILITIES – Net of current portion | | 13 | | | 19 | |

| OTHER LIABILITIES | | 1 | | | 1 | |

| Total liabilities | | 2,413 | | | 2,600 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| SHAREHOLDERS’ EQUITY: | | | | |

Common stock, $0.0001 par value; 3,000,000,000 shares authorized; 719,990,121 and 677,636,163 shares issued, respectively; 719,990,121 and 677,636,163 shares outstanding, respectively | | — | | | — | |

| Additional paid-in capital | | 4,438 | | | 4,301 | |

| Accumulated deficit | | (3,725) | | | (3,333) | |

| Accumulated other comprehensive loss | | — | | | (1) | |

| Total shareholders’ equity | | 713 | | | 967 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 3,126 | | | $ | 3,567 | |

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | |

| Year Ended

December 31, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (392) | | | $ | (275) | |

| Adjustments to reconcile net loss to cash, cash equivalents, and restricted cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 48 | | | 65 | |

| Amortization of right of use asset | 5 | | | 7 | |

| | | |

| Stock-based compensation | 114 | | | 126 | |

| | | |

| | | |

| Inventory valuation adjustment | 57 | | | 65 | |

| | | |

| | | |

| Change in fair value of equity securities | 7 | | | 1 | |

| | | |

| | | |

| | | |

| Other | 7 | | | 13 | |

| | | |

| Proceeds from sale and principal collections of mortgage loans held for sale | — | | | 1 | |

| Loss (gain) on early extinguishment of debt | 2 | | | (216) | |

| Gain on deconsolidation, net | (14) | | | — | |

| Changes in operating assets and liabilities: | | | |

| Escrow receivable | 3 | | | 21 | |

| Real estate inventory | (449) | | | 2,613 | |

| Other assets | (10) | | | (19) | |

| Accounts payable and other accrued liabilities | 31 | | | (38) | |

| Interest payable | 2 | | | (10) | |

| Lease liabilities | (6) | | | (10) | |

| Net cash (used in) provided by operating activities | (595) | | | 2,344 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchase of property and equipment | (25) | | | (37) | |

| | | |

| | | |

| Proceeds from sales, maturities, redemptions and paydowns of marketable securities | 55 | | | 80 | |

| | | |

| Proceeds from sale of non-marketable equity securities | — | | | 1 | |

| | | |

| | | |

| Cash impact of deconsolidation of subsidiaries | (2) | | | — | |

| Net cash provided by investing activities | 28 | | | 44 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Repurchase of convertible senior notes | — | | | (362) | |

| | | |

| Settlement of capped calls related to convertible senior notes | 2 | | | — | |

| Proceeds from exercise of stock options | — | | | 3 | |

| Proceeds from issuance of common stock for ESPP | 5 | | | 2 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from non-recourse asset-backed debt | 498 | | | 238 | |

| Principal payments on non-recourse asset-backed debt | (715) | | | (2,515) | |

| | | |

| | | |

| Payment of loan origination fees and debt issuance costs | — | | | (1) | |

| | | |

| | | |

| | | |

| | | |

| Payment for early extinguishment of debt | — | | | (4) | |

| Net cash used in financing activities | (210) | | | (2,639) | |

| NET DECREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (777) | | | (251) | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – Beginning of period | 1,540 | | | 1,791 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – End of period | $ | 763 | | | $ | 1,540 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION – Cash paid during the period for interest | $ | 121 | | | $ | 203 | |

| DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Stock-based compensation expense capitalized for internally developed software | $ | 15 | | | $ | 23 | |

| | | |

| Investment in non-marketable equity securities due to deconsolidation | $ | 39 | | | $ | — | |

| RECONCILIATION TO CONDENSED CONSOLIDATED BALANCE SHEETS: | | | |

| Cash and cash equivalents | $ | 671 | | | $ | 999 | |

| Restricted cash | 92 | | | 541 | |

| Cash, cash equivalents, and restricted cash | $ | 763 | | | $ | 1,540 | |

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding the Company’s financial results, this press release includes references to certain non-GAAP financial measures that are used by management. The Company believes these non-GAAP financial measures including Adjusted Gross Profit, Contribution Profit (Loss), Adjusted Net Loss, Adjusted EBITDA, and any such non-GAAP financial measures expressed as a Margin, are useful to investors as supplemental operational measurements to evaluate the Company’s financial performance.

The non-GAAP financial measures should not be considered in isolation or as a substitute for the Company’s reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled measures reported by other companies. Management uses these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the Company’s performance by excluding certain items that may not be indicative of the Company’s recurring operating results.

Adjusted Gross Profit and Contribution Profit (Loss)

To provide investors with additional information regarding our margins and return on inventory acquired, we have included Adjusted Gross Profit and Contribution Profit (Loss), which are non-GAAP financial measures. We believe that Adjusted Gross Profit and Contribution Profit (Loss) are useful financial measures for investors as they are supplemental measures used by management in evaluating unit level economics and our operating performance. Each of these measures is intended to present the economics related to homes sold during a given period. We do so by including revenue generated from homes sold (and adjacent services) in the period and only the expenses that are directly attributable to such home sales, even if such expenses were recognized in prior periods, and excluding expenses related to homes that remain in inventory as of the end of the period. Contribution Profit (Loss) provides investors a measure to assess Opendoor’s ability to generate returns on homes sold during a reporting period after considering home purchase costs, renovation and repair costs, holding costs and selling costs.

Adjusted Gross Profit and Contribution Profit (Loss) are supplemental measures of our operating performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, costs required to be recorded under GAAP in the same period. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit.

Adjusted Gross Profit / Margin

We calculate Adjusted Gross Profit as gross profit under GAAP adjusted for (1) inventory valuation adjustment in the current period, and (2) inventory valuation adjustment in prior periods. Inventory valuation adjustment in the current period is calculated by adding back the inventory valuation adjustments recorded during the period on homes that remain in inventory at period end. Inventory valuation adjustment in prior periods is calculated by subtracting the inventory valuation adjustments recorded in prior periods on homes sold in the current period. Adjusted Gross Margin is Adjusted Gross Profit as a percentage of revenue.

We view this metric as an important measure of business performance as it captures gross margin performance isolated to homes sold in a given period and provides comparability across reporting periods. Adjusted Gross Profit helps management assess home pricing, service fees and renovation performance for a specific resale cohort.

Contribution Profit (Loss) / Margin

We calculate Contribution Profit (Loss) as Adjusted Gross Profit, minus certain costs incurred on homes sold during the current period including: (1) holding costs incurred in the current period, (2) holding costs incurred in prior periods, and (3) direct selling costs. Contribution Margin is Contribution Profit (Loss) as a percentage of revenue.

We view this metric as an important measure of business performance as it captures the unit level performance isolated to homes sold in a given period and provides comparability across reporting periods. Contribution Profit (Loss) helps management assess inflows and outflows directly associated with a specific resale cohort.

OPENDOOR TECHNOLOGIES INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(In millions, except percentages, and homes sold)

(Unaudited)

The following table presents a reconciliation of our Adjusted Gross Profit and Contribution Profit (Loss) to our gross profit, which is the most directly comparable GAAP measure, for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended

December 31, |

| (in millions, except percentages and homes sold, or as noted) | | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | 2024 | | 2023 |

| Revenue (GAAP) | | $ | 1,084 | | | $ | 1,377 | | | $ | 1,511 | | | $ | 1,181 | | | $ | 870 | | | $ | 5,153 | | | $ | 6,946 | |

Gross profit (GAAP) | | $ | 85 | | | $ | 105 | | | $ | 129 | | | $ | 114 | | | $ | 72 | | | $ | 433 | | | $ | 487 | |

| Gross Margin | | 7.8 | % | | 7.6 | % | | 8.5 | % | | 9.7 | % | | 8.3 | % | | 8.4 | % | | 7.0 | % |

| Adjustments: | | | | | | | | | | | | | | |

Inventory valuation adjustment – Current Period(1)(2) | | 6 | | | 10 | | | 34 | | | 7 | | | 11 | | | 25 | | | 23 | |

Inventory valuation adjustment – Prior Periods(1)(3) | | (16) | | | (16) | | | (9) | | | (17) | | | (17) | | | (26) | | | (455) | |

| | | | | | | | | | | | | | |

Adjusted Gross Profit | | $ | 75 | | | $ | 99 | | | $ | 154 | | | $ | 104 | | | $ | 66 | | | $ | 432 | | | $ | 55 | |

| Adjusted Gross Margin | | 6.9 | % | | 7.2 | % | | 10.2 | % | | 8.8 | % | | 7.6 | % | | 8.4 | % | | 0.8 | % |

| Adjustments: | | | | | | | | | | | | | | |

Direct selling costs(4) | | (23) | | | (32) | | | (43) | | | (34) | | | (26) | | | (132) | | | (197) | |

Holding costs on sales – Current Period(5)(6) | | (4) | | | (6) | | | (5) | | | (5) | | | (3) | | | (44) | | | (50) | |

Holding costs on sales – Prior Periods(5)(7) | | (10) | | | (9) | | | (11) | | | (8) | | | (7) | | | (14) | | | (66) | |

Contribution Profit (Loss) | | $ | 38 | | | $ | 52 | | | $ | 95 | | | $ | 57 | | | $ | 30 | | | $ | 242 | | | $ | (258) | |

| Homes sold in period | | 2,822 | | | 3,615 | | | 4,078 | | | 3,078 | | | 2,364 | | | 13,593 | | | 18,708 | |

Contribution Profit (Loss) per Home Sold (in thousands) | | $ | 13 | | | $ | 14 | | | $ | 23 | | | $ | 19 | | | $ | 13 | | | $ | 18 | | | $ | (14) | |

| Contribution Margin | | 3.5 | % | | 3.8 | % | | 6.3 | % | | 4.8 | % | | 3.4 | % | | 4.7 | % | | (3.7) | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

________________

(1)Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value.

(2)Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end.

(3)Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented.

(4)Represents selling costs incurred related to homes sold in the relevant period. This primarily includes broker commissions, external title and escrow-related fees and transfer taxes, and are included in Sales, marketing and operations.

(5)Holding costs include mainly property taxes, insurance, utilities, homeowners association dues, cleaning and maintenance costs. Holding costs are included in Sales, marketing, and operations on the Condensed Consolidated Statements of Operations.

(6)Represents holding costs incurred in the period presented on homes sold in the period presented.

(7)Represents holding costs incurred in prior periods on homes sold in the period presented.

Adjusted Net Loss and Adjusted EBITDA

We also present Adjusted Net Loss and Adjusted EBITDA, which are non-GAAP financial measures that management uses to assess our underlying financial performance. These measures are also commonly used by investors and analysts to compare the underlying performance of companies in our industry. We believe these measures provide investors with meaningful period over period comparisons of our underlying performance, adjusted for certain charges that are non-cash, not directly related to our revenue-generating operations, not aligned to related revenue, or not reflective of ongoing operating results that vary in frequency and amount.

Adjusted Net Loss and Adjusted EBITDA are supplemental measures of our operating performance and have important limitations. For example, these measures exclude the impact of certain costs required to be recorded under GAAP. These measures also include inventory valuation adjustments that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, inventory valuation adjustments required to be recorded under GAAP in the same period. These measures could differ substantially from similarly titled measures presented by other companies in our industry or companies in other industries. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is net loss.

Adjusted Net Loss

We calculate Adjusted Net Loss as GAAP net loss adjusted to exclude non-cash expenses of stock-based compensation, equity securities fair value adjustment, and intangibles amortization expense. It excludes expenses that are not directly related to our revenue-generating operations such as restructuring and legal contingency accruals. It excludes loss (gain) on extinguishment of debt as these expenses or gains were incurred as a result of decisions made by management to repay portions of our outstanding credit facilities and the 0.25% convertible senior notes due in 2026 (the "2026 Notes") early; these expenses are not reflective of ongoing operating results and vary in frequency and amount. Adjusted Net Loss also aligns the timing of inventory valuation adjustments recorded under GAAP to the period in which the related revenue is recorded in order to improve the comparability of this measure to our non-GAAP financial measures of unit economics, as described above. Our calculation of Adjusted Net Loss does not currently include the tax effects of the non-GAAP adjustments because our taxes and such tax effects have not been material to date.

Adjusted EBITDA / Margin

We calculated Adjusted EBITDA as Adjusted Net Loss adjusted for depreciation and amortization, property financing and other interest expense, interest income, and income tax expense. Adjusted EBITDA is a supplemental performance measure that our management uses to assess our operating performance and the operating leverage in our business. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of revenue.

The following table presents a reconciliation of our Adjusted Net Loss and Adjusted EBITDA to our net loss, which is the most directly comparable GAAP measure, for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended

December 31, |

| (in millions, except percentages) | | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | 2024 | | 2023 |

| Revenue (GAAP) | | $ | 1,084 | | | $ | 1,377 | | | $ | 1,511 | | | $ | 1,181 | | | $ | 870 | | | $ | 5,153 | | | $ | 6,946 | |

| Net loss (GAAP) | | $ | (113) | | | $ | (78) | | | $ | (92) | | | $ | (109) | | | $ | (91) | | | $ | (392) | | | $ | (275) | |

| Adjustments: | | | | | | | | | | | | | | |

| Stock-based compensation | | 23 | | | 25 | | | 33 | | | 33 | | | 32 | | | 114 | | | 126 | |

Equity securities fair value adjustment(1) | | — | | | 3 | | | 2 | | | 2 | | | (3) | | | 7 | | | 1 | |

| | | | | | | | | | | | | | |

Intangibles amortization expense(2) | | — | | | 1 | | | 1 | | | 2 | | | 2 | | | 4 | | | 7 | |

Inventory valuation adjustment – Current Period(3)(4) | | 6 | | | 10 | | | 34 | | | 7 | | | 11 | | | 25 | | | 23 | |

Inventory valuation adjustment — Prior Periods(3)(5) | | (16) | | | (16) | | | (9) | | | (17) | | | (17) | | | (26) | | | (455) | |

Restructuring(6) | | 17 | | | — | | | — | | | — | | | 4 | | | 17 | | | 14 | |

| | | | | | | | | | | | | | |

Loss (gain) on extinguishment of debt | | 1 | | | — | | | 1 | | | — | | | (34) | | | 2 | | | (216) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Legal contingency accrual and related expenses | | 5 | | | — | | | — | | | — | | | — | | | 5 | | | — | |

Other(7) | | — | | | (15) | | | (1) | | | 2 | | | (1) | | | (14) | | | (3) | |

Adjusted Net Loss | | $ | (77) | | | $ | (70) | | | $ | (31) | | | $ | (80) | | | $ | (97) | | | $ | (258) | | | $ | (778) | |

| Adjustments: | | | | | | | | | | | | | | |

| Depreciation and amortization, excluding amortization of intangibles | | 7 | | | 10 | | | 7 | | | 11 | | | 15 | | | 35 | | | 45 | |

Property financing(8) | | 28 | | | 30 | | | 26 | | | 32 | | | 32 | | | 116 | | | 174 | |

Other interest expense(9) | | 4 | | | 4 | | | 4 | | | 5 | | | 5 | | | 17 | | | 37 | |

Interest income(10) | | (11) | | | (12) | | | (12) | | | (18) | | | (24) | | | (53) | | | (106) | |

| Income tax expense | | — | | | — | | | 1 | | | — | | | — | | | 1 | | | 1 | |

| Adjusted EBITDA | | $ | (49) | | | $ | (38) | | | $ | (5) | | | $ | (50) | | | $ | (69) | | | $ | (142) | | | $ | (627) | |

| Adjusted EBITDA Margin | | (4.5) | % | | (2.8) | % | | (0.3) | % | | (4.2) | % | | (7.9) | % | | (2.8) | % | | (9.0) | % |

________________

(1)Represents the gains and losses on certain financial instruments, which are marked to fair value at the end of each period.

(2)Represents amortization of acquisition-related intangible assets. The acquired intangible assets had useful lives ranging from 1 to 5 years and amortization was expected until the intangible assets were fully amortized in 2024.

(3)Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value.

(4)Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end.

(5)Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented.

(6)Restructuring costs consist primarily of severance and employee termination benefits and bonuses incurred in connection with the elimination of employees’ roles. Additionally, these costs include expenses related to the termination of certain non-cancelable leases and consulting fees incurred during the restructuring process.

(7)Includes primarily gain on deconsolidation, net, sublease income, impairment of internally developed software projects related to restructuring, and income from equity method investments.

(8)Includes interest expense on our non-recourse asset-backed debt facilities.

(9)Includes amortization of debt issuance costs and loan origination fees, commitment fees, unused fees, other interest related costs on our asset-backed debt facilities, and interest expense related to the 2026 Notes outstanding.

(10)Consists mainly of interest earned on cash, cash equivalents, restricted cash and marketable securities.

Shareholder Letter 4Q24 Letter to Shareholders 4Q24 Exhibit 99.2

Shareholder Letter 4Q24 At Opendoor, we are on a mission to transform the U.S. residential real estate industry. In 2024, we took decisive steps to simplify our business and sharpen our strategic focus to drive the Company towards sustainable, profitable growth. While home acquisitions grew in the first half of the year, macro signals indicated potential destabilization late in the second quarter. In response, we proactively raised spreads to mitigate risk, driving lower acquisitions in the second half of the year. We also took actions to better align our operations with our current scale and profitability targets. In the third quarter, we completed the separation of Mainstay from our business, and in the fourth quarter, we launched a cost-efficiency program alongside a workforce reduction. In 2024, we demonstrated strong execution despite persistent macro headwinds. We purchased over 30% more homes than in the prior year, delivered a full-year gross margin of 8.4%, up from 7.0% in 2023, and achieved a Contribution Margin of 4.7%, up from (3.7)% in 2023 and just shy of our annual target range, all while significantly reducing our Adjusted Net Losses. The progress we made in 2024 was reflected in our fourth quarter results, which demonstrated year-over-year improvement in revenue, Contribution Profit, and Adjusted EBITDA. Specifically, we: Opendoor Shareholders, 2 A letter from our CEO Note: Adjusted Operating Expenses, Adjusted Gross Profit, Contribution Profit, Contribution Margin, Adjusted Net Loss, and Adjusted EBITDA are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” following the financial tables below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures. Sold 2,822 homes, generating $1.1 billion in revenue, up 25% versus 4Q23. Net Loss was $(113) million (versus $(91) million in 4Q23), with Adjusted Net Loss of $(77) million (versus $(97) million in 4Q23). Adjusted EBITDA Loss was $(49) million (versus $(69) million in 4Q23). Gross profit reached $85 million (versus $72 million in 4Q23), representing a 7.8% gross margin. Contribution Profit was $38 million (versus $30 million in 4Q23), representing a 3.5% Contribution Margin.

Shareholder Letter 4Q24 We are committed to achieving sustainable, profitable growth. Four key focus areas which we expect will improve the profitability of our cash offer business are: As we enter 2025, we are observing a particularly slow start to the year, with signs of a worsening macro environment compared to 20241. On the supply side, clearance rates, or how quickly homes go under contract, are pacing approximately 25% below last year. And, while the number of new listings coming on to the market remains in-line with last year's levels, active listings have risen nearly 20% year-over-year amid a slowing market. On the demand side, visits to new listings are down about 20% compared to last year, and delistings have climbed over 30% to decade highs as more sellers exit the market. With no near-term rate relief in sight, the lock-in effect of low mortgage rates and affordability challenges for buyers are likely to persist. To strengthen our business on our path to profitability, we are further refining our approach. This includes optimizing for Contribution Profit dollars and pursuing incremental monetization opportunities to enhance resilience throughout market cycles and drive long-term value. 3 Driving Towards Profitability: 1All macroeconomic indicators referenced here reflect MLS data filtered to Opendoor markets and buybox. 1. Setting spread levels to optimize for Contribution Margin amid the ongoing macroeconomic environment. Throughout the year, we will continuously monitor key macroeconomic indicators and make prudent adjustments to spreads, with a bias towards optimizing for Contribution Profit.

Shareholder Letter 4Q24 3. Refining our marketing strategy to further align with seasonal buying and selling patterns. We expect to focus our marketing efforts during periods when our spreads tend to be lower. Accordingly, we expect to acquire more homes in Q4 and Q1, positioning us to sell those homes in the spring and summer selling seasons (Q2 and Q3) when buying demand typically peaks. Conversely, we plan to reduce our focus on marketing in Q2 and Q3, resulting in fewer acquisitions in those quarters, and thus fewer resales in Q4 and Q1 when there is lower demand and lower home price appreciation. This approach more closely aligns our marketing spend with how our spreads change throughout the year and should enable us to better capitalize on typical seasonal price swings and maximize value in every transaction. 4 2. Improving the customer experience through product and process enhancements, driving higher conversion. We implemented improvements to our pricing models, including adjusting price segmentation methodology and market-level spread accuracy, to better differentiate spreads across price points. By making these pricing and model adjustments, we expect to more effectively distribute spreads and expand conversion. Pricing Models Seller Engagement We also continue to refine how we engage with sellers on our platform. We have a large base of registered sellers who have received an offer from Opendoor but have yet to sell. Over 70% of our 2024 acquisition contracts were from sellers who did not act on their initial offer but subsequently acted on a refreshed offer, so our ability to re-engage this customer base could represent an important source of future acquisition growth. For 2025, we are strengthening these re-engagement strategies to ensure Opendoor remains top of mind when those sellers are ready to transact.

Shareholder Letter 4Q24 4. Operating with discipline. We entered 2025 with a leaner, flatter, and more efficient organization. We will continue our transformation efforts and identify incremental cost-efficiency opportunities over the course of the year. 5 Click to watch Campaign Consistent with this shift, in the fourth quarter, we launched the “Whatever the Reason, Whatever the Season” campaign to help flatten the seasonality curve in what is traditionally a lower-volume quarter for home transactions. By engaging sellers with relevant, compelling solutions, we aim to drive consistent demand and momentum, even during slower periods. Over the past decade, the success of our cash offer business has created a powerful, high-intent seller funnel. This year, we are enhancing the customer experience to better monetize this unique asset and serve more sellers in an effort to solidify our position as the “Best Place to Sell.” To capitalize on this advantage, we are refining our List with Opendoor and Marketplace products, as well as expanding solutions for sellers outside of our buybox. Incremental Future Growth Opportunities:

Shareholder Letter 4Q24 6 We continue to be driven by our mission to reinvent the real estate experience and make selling and buying seamless, convenient, and certain. Importantly, positive customer feedback validates how uniquely valuable our product and experience are. Our focus remains on reaching profitability over time through ongoing operating efficiency improvements and the optimization of Contribution Margin. Longer term, we expect that our efforts to leverage our platform and the strong infrastructure we have put in place will result in our ability to build a profitable, sustainable business that delivers innovative solutions for home sellers, buyers, and agents. Thank you for your trust and partnership as we continue building the future of real estate together. Carrie Wheeler, CEO In addition, many high-intent sellers visit our website daily, and we're expanding our approach to help those who may fall outside of our buybox continue to move forward in their selling journey. We see opportunities to help more customers successfully transact by providing our high quality seller leads to agents. With the scale of our seller funnel, we are uniquely positioned to offer a suite of solutions tailored to meet their needs. Our List with Opendoor and Marketplace products allow us to serve more sellers, unlock new revenue opportunities, and reduce our exposure to macro volatility. In 2024, we expanded List with Opendoor to nearly all Opendoor markets and launched Marketplace in Charlotte and Raleigh, offering more options for sellers to navigate their home-selling journey. In 2025, we plan to enhance and expand these offerings.

Shareholder Letter 4Q24 Unit Economics GAAP Gross Profit was $85 million in 4Q24, versus $72 million in 4Q23. GAAP Gross Margin was 7.8% in 4Q24, versus 8.3% in 4Q23. Adjusted Gross Profit was $75 million in 4Q24, versus $66 million in 4Q23. For the full year, GAAP Gross Profit was $433 million, versus $487 million in 2023. GAAP Gross Margin was 8.4% in 2024, versus 7.0% in 2023. Adjusted Gross Profit was $432 million for the year, versus $55 million in 2023, as we saw a significant reduction in our inventory valuation adjustments. Contribution Profit was $38 million in the fourth quarter, versus $30 million in 4Q23. Contribution Margin of 3.5% compares to 3.4% in 4Q23. For the full year, Contribution Profit was $242 million versus $(258) million in 2023, or an improvement of $500 million. Contribution Margin was 4.7%, versus (3.7)% in 2023, despite the challenging macro environment. GAAP Operating Expenses were $179 million in 4Q24, down from $187 million in 4Q23. For the full year, GAAP Operating Expenses were $753 million, versus $873 million in 2023. Adjusted Operating Expenses, defined as the delta between Contribution Profit (Loss) and Adjusted EBITDA, were $87 million in 4Q24, down from $99 million in 4Q23. For the full year, Adjusted Operating Expenses were $384 million, versus $369 million in 2023. Growth In the fourth quarter, we delivered $1.1 billion of revenue, up 25% versus 4Q23, representing 2,822 homes sold. Revenue for the full year was $5.2 billion, compared to $6.9 billion in 2023, due primarily to a lower starting inventory balance entering 2024. On the acquisition side, we purchased 2,951 homes in the fourth quarter, versus 3,683 homes in 4Q23 as spread levels remained elevated compared to the same time last year. However, we were able to accelerate our pace of acquisition as we moved through the quarter, driven by improvements in conversion at given spread levels. These gains in conversion were enabled by enhancements to our product flow and improvements to our pricing models. For the full year, we acquired 14,684 homes, up 31% versus 2023, driven by lower spreads in the first half as compared to the same period in the prior year, combined with improved conversion despite higher spreads in the second half of the year, as a result of the aforementioned durable model enhancements we have been rolling out. 7 We exceeded the high end of our outlook for acquisitions, revenue, Contribution Margin, and Adjusted EBITDA in the fourth quarter. Financial Highlights

Shareholder Letter 4Q24 Inventory and Other Balance Sheet Items We ended the year with 6,417 homes, representing $2.2 billion in net inventory, up 22% from 4Q23, and $1.1 billion in capital, which is primarily composed of $679 million in unrestricted cash and marketable securities and $306 million of equity invested in homes and related assets (net of inventory valuation adjustments). At year-end, we had $6.9 billion in non-recourse, asset-backed borrowing capacity, comprising $3.0 billion of senior revolving credit facilities and $3.9 billion of senior and mezzanine term debt facilities, of which total committed borrowing capacity was $2.2 billion. In early 2025, we strengthened our capital position by amending and extending the term of certain debt facilities. We successfully renewed three revolving credit facilities and one term debt facility at consistent or improved credit spreads. Additionally, both of our mezzanine facilities were extended through at least 2027. The successful extension of these credit facilities is a testament to the ongoing support and confidence of our capital partners and positions us well to continue executing on our business plan. Net Loss and Adjusted EBITDA GAAP Net Loss was $(113) million in 4Q24, versus $(91) million in 4Q23. Adjusted Net Loss was $(77) million in 4Q24, versus $(97) million in 4Q23. GAAP Net Loss was $(392) million for the full year, versus $(275) million in 2023. Full year Adjusted Net Loss improved significantly to $(258) million, versus $(778) million in 2023. Adjusted EBITDA loss improved to $(49) million in 4Q24, compared to $(69) million in 4Q23. Adjusted EBITDA loss was $(142) million for the full year, versus $(627) million in 2023. 8

Shareholder Letter 4Q24 We expect home acquisitions to be over 3,500 in the first quarter, or up slightly year-over-year. Normalizing for bulk purchases made in 1Q24 that are not expected to repeat this quarter, acquisition growth would be up over 10% year-over-year. Given adjustments to our marketing strategy, coupled with recent increases in spreads given the challenging macro environment, we expect to see a sequential decline in acquisitions in the second quarter of this year. While we continue to believe 5% to 7% is an appropriate annual Contribution Margin target, seasonality and market conditions will result in variability in margins quarter to quarter. Finally, we believe that the successful implementation of our 2025 priorities will allow us to meaningfully improve our Adjusted Net Loss for the year as compared to 2024. 9 Guidance As we enter 2025, we are focused on ensuring attractive unit economics in our cash offer business, operating with strong cost discipline, and making progress on our path to profitability, notwithstanding the persistent macro real estate pressures. We expect the following results for the first quarter of 2025: 2 Opendoor has not provided a quantitative reconciliation of forecasted forecasted Contribution Profit (Loss) to forecasted GAAP gross profit (loss), forecasted Contribution Margin to forecasted GAAP Gross Margin, nor forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this shareholder letter because the Company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to, inventory valuation adjustment and equity securities fair value adjustment. These items, which could materially affect the computation of forward-looking GAAP gross profit (loss), GAAP gross margin, operating expenses and net income (loss), are inherently uncertain and depend on various factors, some of which are outside of the Company’s control. For more information regarding the non-GAAP financial measures discussed in this shareholder letter, please see “Use of Non-GAAP Financial Measures” following the financial tables below. Revenue is expected to be between $1.0 billion and $1.075 billion Contribution Profit2 is expected to be between $40 million and $50 million, or Contribution Margin2 of 4.0% to 4.7% Non-cash stock-based compensation expense is expected to range from $13 million to $15 million Adjusted EBITDA2 loss is expected to be between $(50) million to $(40) million

Shareholder Letter 4Q24 “Working with Opendoor was the least stressful way to sell.” 10 Customer Story Breona Calvert | Bowie, Maryland Sold to Opendoor When California-based military member Breona Calvert received an exciting job offer in Maryland, the 38-year-old knew it was time to start a new chapter. After 20 years of service, she was ready to move her family across the country — but it was her first time selling a home, and she was on a time crunch as she was due to report into her new role quickly. That’s when the first-time seller turned to Opendoor. “It was the least stressful way to sell,” she said. “My kids had lived in that home their whole lives, and the last thing I wanted was to add to their anxiety.” From moving away from neighbors to feeling unsure of how everything would go, it was undoubtedly an emotional time for the Calvert family. Breona credits Opendoor for removing a huge weight from her shoulders, giving her more time to focus on her family’s new East Coast home and key considerations like schools and neighborhood safety. “With Opendoor, we could take our time packing,” she said. That allowed her to be more strategic about what they would bring with her during the cross-country move – and what they would leave behind. “As soon as I did my part, Opendoor did theirs so I could enter the next phase of my life. I’m very happy with the decision to go with Opendoor. I went with my gut with this one.” “I couldn’t stage my home and get it ready for showings in such a short time,” Breona said. “For me, selling my home was about convenience and stresslessness for me and my family.”

Shareholder Letter 4Q24 Carrie Wheeler, CEO Selim Freiha, Chief Financial Officer Opendoor will host a conference call to discuss its financial results on February 27, 2025 at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from Opendoor’s Investor Relations website at https://investor.opendoor.com. An archived version of the webcast will be available from the same website after the call. February 27, 2025 at 2 p.m. PT investor.opendoor.com Conference Call Information 11 Live Webcast

Shareholder Letter 4Q24/ Opendoor/ OpendoorHQ Company / Opendoor-com investor.opendoor.com

Shareholder Letter 4Q24 Definitions & Financial Tables 1 5

This shareholder letter contains certain forward-looking statements within the meaning of Section 27A the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking, including, without limitation, statements regarding: current and future health and stability of the real estate housing market and general economy; volatility of mortgage interest rates, changes in resale clearance rates, delistings and expectations regarding future behavior of consumers and partners; the health and status of our financial condition; our ongoing transformation efforts and cost-efficiency opportunities; whether our efforts to optimize spread and adjusting our marketing strategy for seasonality trends will improve profitability; whether we are able to capitalize on our seller funnel and expand solutions for sellers outside our buybox; anticipated future results of operations or financial performance, including our first quarter and full-year 2025 outlook and projections; our ability to achieve other long- term performance targets; our expectations regarding the impact of trends in seasonality on the real estate industry and our business; priorities of the Company to achieve future financial and business goals; our ability to continue to effectively navigate the markets in which we operate; anticipated future and ongoing impacts and benefits of acquisitions, advertising, product innovations and other business decisions; health of our balance sheet to weather ongoing market transitions; our ability to adopt an effective approach to manage economic and industry risk, as well as inventory health; business strategy and plans, including any plans to expand into additional markets, market opportunity and expansion and objectives of management for future operations, including statements regarding the benefits and timing of the roll out of new markets, products or technology; and the expected benefits of refinancing efforts. Forward-looking statements generally are identified by the words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “intend”, “may”, “might”, “opportunity”, “outlook”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “strategy”, “strive”, “target”, “vision”, “will”, or “would”, any negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. The factors that could cause or contribute to actual future events to differ materially from the forward-looking statements in this shareholder letter include but are not limited to: the current and future health and stability of the economy, financial conditions and the residential housing market, including any extended downturns or slowdowns; changes in general economic and financial conditions (including federal monetary policy, the imposition of tariffs and price or exchange controls, interest rates, inflation, actual or anticipated recession, home price fluctuations, and housing inventory), as well as the probability of such changes occurring, that may impact demand for our products and services, lower our profitability or reduce our access to future financings; our real estate assets and increased competition in the U.S. residential real estate industry; our ability to operate and grow our core business products, including the ability to obtain sufficient financing and resell purchased homes; investment of resources to pursue strategies and develop new products and services that may not prove effective or that are not attractive to customers and real estate partners or that do not allow us to compete successfully; our ability to acquire and resell homes profitably; our ability to grow market share in our existing markets or any new markets we may enter; our ability to manage our growth effectively; our ability to expeditiously sell and appropriately price our inventory; our ability to access sources of capital, including debt financing and securitization funding to finance our real estate inventories and other sources of capital to finance operations and growth; our ability to maintain and enhance our products and brand, and to attract customers; our ability to manage, develop and refine our digital platform, including our automated pricing and valuation technology; our ability to realize expected benefits from our restructuring and cost reduction efforts; our ability to comply with multiple listing service rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers; our ability to obtain or maintain licenses and permits to support our current and future business operations; acquisitions, strategic partnerships, joint ventures, capital-raising activities or other corporate transactions or commitments by us or our competitors; actual or anticipated changes in technology, products, markets or services by us or our competitors; our success in retaining or recruiting, or changes required in, our officers, key employees and/or directors; any future impact of pandemics, epidemics, or other public health crises on our ability to operate, demand for our products and services, or other general economic conditions; the impact of the regulatory environment and potential regulatory instability associated with the new U.S. presidential administration within our industry and complexities with compliance related to such environment; changes in laws or government regulation affecting our business; and the impact of pending or future litigation or regulatory actions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on or about February 27, 2025, as updated by our periodic reports and other filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations. 14 Forward-Looking Statements

Use of Non-GAAP Financial Measures To provide investors with additional information regarding the Company’s financial results, this shareholder letter includes references to certain non-GAAP financial measures that are used by management. The Company believes these non-GAAP financial measures including Adjusted Gross Profit, Contribution Profit (Loss), Adjusted Net Loss, Adjusted EBITDA, Adjusted Operating Expenses, and any such non-GAAP financial measures expressed as a Margin, are useful to investors as supplemental operational measurements to evaluate the Company’s financial performance. The non-GAAP financial measures should not be considered in isolation or as a substitute for the Company’s reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled measures reported by other companies. Management uses these non- GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the Company’s performance by excluding certain items that may not be indicative of the Company’s recurring operating results. Adjusted Gross Profit and Contribution Profit (Loss) To provide investors with additional information regarding our margins and return on inventory acquired, we have included Adjusted Gross Profit and Contribution Profit (Loss), which are non-GAAP financial measures. We believe that Adjusted Gross Profit and Contribution Profit (Loss) are useful financial measures for investors as they are supplemental measures used by management in evaluating unit level economics and our operating performance. Each of these measures is intended to present the economics related to homes sold during a given period. We do so by including revenue generated from homes sold (and adjacent services) in the period and only the expenses that are directly attributable to such home sales, even if such expenses were recognized in prior periods, and excluding expenses related to homes that remain in inventory as of the end of the period. Contribution Profit (Loss) provides investors a measure to assess Opendoor’s ability to generate returns on homes sold during a reporting period after considering home purchase costs, renovation and repair costs, holding costs and selling costs. Adjusted Gross Profit and Contribution Profit (Loss) are supplemental measures of our operating performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, costs required to be recorded under GAAP in the same period. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit. 15 Definitions

Adjusted Gross Profit / Margin We calculate Adjusted Gross Profit as gross profit under GAAP adjusted for (1) inventory valuation adjustment in the current period, and (2) inventory valuation adjustment in prior periods. Inventory valuation adjustment in the current period is calculated by adding back the inventory valuation adjustments recorded during the period on homes that remain in inventory at period end. Inventory valuation adjustment in prior periods is calculated by subtracting the inventory valuation adjustments recorded in prior periods on homes sold in the current period. Adjusted Gross Margin is Adjusted Gross Profit as a percentage of revenue. We view this metric as an important measure of business performance as it captures gross margin performance isolated to homes sold in a given period and provides comparability across reporting periods. Adjusted Gross Profit helps management assess home pricing, service fees and renovation performance for a specific resale cohort. Contribution Profit (Loss) / Margin We calculate Contribution Profit (Loss) as Adjusted Gross Profit, minus certain costs incurred on homes sold during the current period including: (1) holding costs incurred in the current period, (2) holding costs incurred in prior periods, and (3) direct selling costs. The composition of our holding costs is described in the footnotes to the reconciliation table below. Contribution Margin is Contribution Profit (Loss) as a percentage of revenue. We view this metric as an important measure of business performance as it captures the unit level performance isolated to homes sold in a given period and provides comparability across reporting periods. Contribution Profit (Loss) helps management assess inflows and outflows directly associated with a specific resale cohort. 16 Definitions

17 Adjusted Net Loss and Adjusted EBITDA / Margin We also present Adjusted Net Loss and Adjusted EBITDA, which are non-GAAP financial measures that management uses to assess our underlying financial performance. These measures are also commonly used by investors and analysts to compare the underlying performance of companies in our industry. We believe these measures provide investors with meaningful period over period comparisons of our underlying performance, adjusted for certain charges that are non-cash, not directly related to our revenue-generating operations, not aligned to related revenue, or not reflective of ongoing operating results that vary in frequency and amount. Adjusted Net Loss and Adjusted EBITDA are supplemental measures of our operating performance and have important limitations. For example, these measures exclude the impact of certain costs required to be recorded under GAAP. These measures also include inventory valuation adjustments that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, inventory valuation adjustments required to be recorded under GAAP in the same period. These measures could differ substantially from similarly titled measures presented by other companies in our industry or companies in other industries. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is net loss. We calculate Adjusted Net Loss as GAAP net loss adjusted to exclude non-cash expenses of stock-based compensation, equity securities fair value adjustment, and intangibles amortization expense. It excludes expenses that are not directly related to our revenue-generating operations such as restructuring and legal contingency accruals. It excludes loss (gain) on extinguishment of debt as these expenses or gains were incurred as a result of decisions made by management to repay portions of our outstanding credit facilities and the 0.25% convertible senior notes due in 2026 (the "2026 Notes") early; these expenses are not reflective of ongoing operating results and vary in frequency and amount. Adjusted Net Loss also aligns the timing of inventory valuation adjustments recorded under GAAP to the period in which the related revenue is recorded in order to improve the comparability of this measure to our non-GAAP financial measures of unit economics, as described above. Our calculation of Adjusted Net Loss does not currently include the tax effects of the non-GAAP adjustments because our taxes and such tax effects have not been material to date. We calculated Adjusted EBITDA as Adjusted Net Loss adjusted for depreciation and amortization, property financing and other interest expense, interest income, and income tax expense. Adjusted EBITDA is a supplemental performance measure that our management uses to assess our operating performance and the operating leverage in our business. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of revenue. Definitions