OPKO Health Reports Second Quarter 2024 Business Highlights and Financial Results

August 07 2024 - 3:06PM

OPKO Health, Inc. (NASDAQ: OPK) reports business

highlights and financial results for the three and six months ended

June 30, 2024.

Highlights from the second quarter and recent

weeks include the following:

- Enrollment underway in the

MDX2001 Phase 1 trial for the treatment of solid tumor

cancers. MDX2001, a tetraspecific

antibody, is designed to optimize T-cell function to stimulate

tumor regression while minimizing the likelihood of antigen escape.

This Phase 1 open-label trial is expected to enroll 45 cancer

patients with a variety of solid tumors at six clinical trial

sites, and to evaluate safety, tolerability, pharmacokinetics and

early evidence of anti-tumor activity.

- The global commercial

launch of NGENLA® is ongoing by OPKO’s partner,

Pfizer. NGENLA has been launched in all major markets.

OPKO is entitled to gross profit sharing based on sales of both

NGENLA and Pfizer’s daily growth hormone product, Genotropin®. In

addition, OPKO is entitled to an additional $100 million in

potential milestone payments associated with approvals for an adult

indication for growth hormone deficiency and additional pediatric

indications.

- Entered into a $250 million

note purchase agreement with HealthCare Royalty secured by profit

share payments related to NGENLA. Under the terms of the

agreement, OPKO retains a significant portion of the profit share

payments from Pfizer received pursuant to its license agreement

relating to NGENLA in the near term with upside over the long term,

as well as the full $100 million of remaining potential milestone

payments.

- OPKO’s Board of Directors

authorized a $100 million share repurchase program. Under

the program, OPKO may repurchase shares of its common stock from

time to time through open market purchases, block trades, privately

negotiated transactions, accelerated share repurchase transactions

and/or pursuant to Rule 10b5-1 plans, in compliance with applicable

securities laws and other legal requirements. The Company had

approximately 697 million shares outstanding as of June 30, 2024.

This new authorization represented approximately 10.1% of shares

outstanding at the stock price at the time of the

announcement.

- Sale of select assets of

BioReference Health expected to close toward the end of the third

quarter. OPKO entered into an agreement in March 2024 to

sell BioReference Health’s laboratory testing businesses focused on

clinical diagnostics and women’s health, excluding operations in

New York and New Jersey, for $237.5 million. BioReference Health

will continue to offer oncology and urology diagnostic services

nationwide, as well as maintain its full operations in New York and

New Jersey. Continuing operations accounted for net sales of more

than $400 million in 2023. This transaction is expected to

streamline BioReference Health’s laboratory services business while

retaining its core operations to better position the division for

sustained growth and profitability.

Second Quarter Financial

Results

- Pharmaceuticals:

Revenue from products in the second quarter of 2024 was $40.5

million compared with $43.5 million in the second quarter of 2023,

reflecting lower sales in OPKO’s international operating companies

primarily due to foreign currency exchange fluctuations. Revenue

from sales of Rayaldee was $7.2 million compared with $7.7 million

in the same period in 2023. Revenue from the transfer of

intellectual property and other was $12.3 million in the second

quarter of 2024, which included $5.0 million from the BARDA

contract, compared with $94.9 million in the 2023 period, which

included milestone revenue of $90.0 million triggered by the FDA

approval of NGENLA. Gross profit share and royalty payments for

NGENLA and Pfizer's Genotropin was $6.3 million in the 2024 quarter

compared with $3.8 million in the same period for 2023. Total costs

and expenses increased to $77.6 million in the second quarter of

2024 from $74.7 million in the prior-year period primarily due to

higher research and development expenses related to increased

activity within the ModeX development programs. Operating loss was

$24.8 million in the second quarter of 2024, which included $17.9

million of depreciation and amortization expense, compared with

operating income of $63.6 million in the second quarter of 2023,

after giving effect to the $90.0 million milestone payment as

described above and also included $17.8 million of depreciation and

amortization expense.

- Diagnostics:

Revenue from services in the second quarter of 2024 was $129.4

million compared with $127.0 million in the prior-year period, with

the increase primarily due to higher clinical test reimbursement

partially offset by lower clinical test volume. Total costs and

expenses were $156.0 million in the second quarter of 2024 compared

with $171.3 million in the second quarter of 2023, reflecting

continued progress with cost-reduction initiatives. Included in

second quarter 2024 results were revenue from services of

approximately $25.5 million and total costs and expenses of

approximately $32.5 million related to assets being acquired by

Labcorp. Operating loss was $26.6 million in the second quarter of

2024 compared with $44.3 million in the 2023 period and included

$6.2 million and $8.6 million of depreciation and amortization

expense, respectively.

- Consolidated:

Consolidated total revenues for the second quarter of 2024 were

$182.2 million compared with $265.4 million for the comparable

period of 2023. Operating loss for the second quarter of 2024 was

$61.7 million compared with operating income of $7.0 million for

the 2023 quarter, with the 2023 quarter benefiting from the $90.0

million milestone payment described above. The second quarter of

2024 included non-cash other income of $60.5 million compared with

non-cash other expense of $19.9 million in the year-ago quarter

related to the change in the fair value of the GeneDx Holdings

investment. As a result, net loss for the second quarter of 2024

was $10.3 million, or $0.01 per share, compared with net loss of

$19.6 million, or $0.03 per share, for the 2023 quarter.

- Cash and cash

equivalents: Cash and cash equivalents were $40.6 million

as of June 30, 2024 and OPKO’s Investments included liquid equity

securities which had a market value of $101.5 million, primarily

from the ownership interest in GeneDx. Subsequent to the end of the

second quarter, OPKO entered into a $250 million note purchase

agreement secured by OPKO’s profit share payments to be received

from Pfizer relating to NGENLA. OPKO is also entitled to receive

$237.5 million upon closing of the Labcorp transaction anticipated

toward the end of the third quarter of 2024.

Conference Call and Webcast

Information

OPKO’s senior management will provide a business

update, discuss second quarter financial results, provide financial

guidance and answer questions during a conference call and live

audio webcast today beginning at 4:30 p.m. Eastern time.

Participants are encouraged to pre-register for the conference call

here. Callers who pre-register will receive a unique PIN to gain

immediate access to the call and bypass the live operator.

Participants may register at any time, including up to and after

the call start time. Those unable to pre-register may participate

by dialing 833-630-0584 (U.S.) or 412-317-1815 (International). A

webcast of the call can also be accessed at OPKO’s Investor

Relations page and here.

A telephone replay will be available until

August 14, 2024, by dialing 877-344-7529 (U.S.) or 412-317-0088

(International) and providing the passcode 6314261. A webcast

replay will be available beginning approximately one hour after the

completion of the live conference call here.

About OPKO Health

OPKO is a multinational biopharmaceutical and

diagnostics company that seeks to establish industry-leading

positions in large, rapidly growing markets by leveraging its

discovery, development, and commercialization expertise and novel

and proprietary technologies. For more information, visit

www.opko.com.

Cautionary Statement Regarding Forward

Looking Statements

This press release contains "forward-looking

statements," as that term is defined under the Private Securities

Litigation Reform Act of 1995 (PSLRA), which statements may be

identified by words such as "expects," "plans," "projects," "will,"

"may," "anticipates," "believes," "should," "intends," "estimates,"

and other words of similar meaning, including statements regarding

expected financial performance and expectations regarding the

market for and sales of our products, whether our products will

launch in all the territories in which they have been approved for

sale, the timing of such launches, whether Pfizer will obtain

approvals for an adult indication for growth hormone deficiency or

additional pediatric indications and accordingly, whether we will

be entitled to any additional milestone payments, whether our

product development efforts will be successful and whether the

expected benefits of our products will be realized, including

whether enrollment in a Phase 1 clinical trial for MDX2001will be

successful and whether the data will be positive, whether and how

many of our shares we will repurchase under a buyback program,

whether NGENLA profits will be sufficient to provide long term

upside after satisfying our obligations under the note purchase

agreement, whether the relationship with our commercial and

strategic partners will be successful, whether our commercial and

strategic partners will be able to commercialize our products and

successfully utilize our technologies, our ability to market and

sell any of our products in development, whether we will continue

to successfully advance products in our pipeline and whether they

can be commercialized, whether the sale of selected BioReference

assets will be completed in the third quarter or at all, and if

this transaction is completed, whether BioReference will be able to

streamline its laboratory services business and better position the

division for sustained growth and profitability, whether

BioReference’s attempts at returning its core business to

profitability will be successful, as well as other non-historical

statements about our expectations, beliefs or intentions regarding

our business, technologies and products, financial condition,

strategies or prospects. Many factors could cause our actual

activities or results to differ materially from the activities and

results anticipated in forward-looking statements. These factors

include those described in our Annual Reports on Form 10-K filed

and to be filed with the Securities and Exchange Commission and

under the heading “Risk Factors” in our other filings with the

Securities and Exchange Commission, as well as the continuation and

success of our relationship with our commercial partners, liquidity

issues and the risks inherent in funding, developing and obtaining

regulatory approvals of new, commercially-viable and competitive

products and treatments. In addition, forward-looking statements

may also be adversely affected by general market factors,

competitive product development, product availability, federal and

state regulations and legislation, the regulatory process for new

products and indications, manufacturing issues that may arise,

patent positions and litigation, among other factors. The

forward-looking statements contained in this press release speak

only as of the date the statements were made, and we do not

undertake any obligation to update forward-looking statements. We

intend that all forward-looking statements be subject to the

safe-harbor provisions of the PSLRA.

Contacts:LHA Investor

RelationsYvonne Briggs, 310-691-7100ybriggs@lhai.com

orBruce Voss, 310-691-7100 bvoss@lhai.com

—Tables to Follow—

|

OPKO Health, Inc. and SubsidiariesCondensed Consolidated Balance

Sheets(in millions)Unaudited |

| |

| |

As of |

| |

June 30, 2024 |

|

December 31, 2023 |

|

Assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

40.6 |

|

|

$ |

95.9 |

|

|

Assets held for sale |

|

119.7 |

|

|

|

0.0 |

|

|

Other current assets |

|

197.7 |

|

|

|

213.6 |

|

| Total current assets |

|

358.0 |

|

|

|

309.5 |

|

| In-process research and

development and goodwill |

|

725.1 |

|

|

|

793.3 |

|

| Other assets |

|

896.8 |

|

|

|

908.9 |

|

|

Total Assets |

$ |

1,979.9 |

|

|

$ |

2,011.7 |

|

| |

|

|

|

|

|

|

|

| Liabilities and Equity: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

82.2 |

|

|

$ |

69.7 |

|

|

Accrued expenses |

|

94.5 |

|

|

|

90.1 |

|

|

Liabilities associated with assets held for sale |

|

8.9 |

|

|

|

0.0 |

|

|

Current portion of convertible notes |

|

0.2 |

|

|

|

0.0 |

|

|

Other current liabilities |

|

33.7 |

|

|

|

40.3 |

|

|

Total current liabilities |

|

219.5 |

|

|

|

200.1 |

|

|

Long-term portion of convertible notes |

|

175.9 |

|

|

|

214.3 |

|

|

Deferred tax liabilities, net |

|

119.1 |

|

|

|

126.8 |

|

|

Other long-term liabilities, principally leases, and lines of

credit |

|

70.1 |

|

|

|

81.3 |

|

|

Total Liabilities |

|

584.6 |

|

|

|

622.5 |

|

|

Equity |

|

1,395.3 |

|

|

|

1,389.2 |

|

|

Total Liabilities and Equity |

$ |

1,979.9 |

|

|

$ |

2,011.7 |

|

|

|

|

|

|

|

|

|

|

|

OPKO Health, Inc. and SubsidiariesCondensed Consolidated Statements

of Operations(in millions, except share and per share

data)Unaudited |

| |

| |

For the three months endedJune 30, |

|

For the six months endedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from services |

$ |

129.4 |

|

|

$ |

127.0 |

|

|

$ |

256.3 |

|

|

$ |

259.4 |

|

|

Revenue from products |

|

40.5 |

|

|

|

43.5 |

|

|

|

78.5 |

|

|

|

83.9 |

|

|

Revenue from transfer of intellectual property and other |

|

12.3 |

|

|

|

94.9 |

|

|

|

21.1 |

|

|

|

159.7 |

|

|

Total revenues |

|

182.2 |

|

|

|

265.4 |

|

|

|

355.9 |

|

|

|

503.0 |

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of service revenues |

|

107.1 |

|

|

|

113.0 |

|

|

|

216.9 |

|

|

|

227.1 |

|

|

Cost of product revenues |

|

23.5 |

|

|

|

25.9 |

|

|

|

45.2 |

|

|

|

50.2 |

|

|

Selling, general and administrative |

|

68.8 |

|

|

|

79.8 |

|

|

|

139.0 |

|

|

|

155.4 |

|

|

Research and development |

|

24.1 |

|

|

|

18.2 |

|

|

|

46.0 |

|

|

|

50.8 |

|

|

Contingent consideration |

|

0.0 |

|

|

|

(0.0 |

) |

|

|

0.0 |

|

|

|

0.1 |

|

|

Amortization of intangible assets |

|

20.4 |

|

|

|

21.5 |

|

|

|

41.9 |

|

|

|

43.0 |

|

|

Total costs and expenses |

|

243.9 |

|

|

|

258.4 |

|

|

|

489.0 |

|

|

|

526.6 |

|

|

Operating loss (income) |

|

(61.7 |

) |

|

|

7.0 |

|

|

|

(133.1 |

) |

|

|

(23.6 |

) |

| Other income (expense),

net |

|

51.1 |

|

|

|

(23.5 |

) |

|

|

39.4 |

|

|

|

(9.8 |

) |

| Loss before income taxes and

investment losses |

|

(10.6 |

) |

|

|

(16.5 |

) |

|

|

(93.7 |

) |

|

|

(33.4 |

) |

| Income tax benefit

(provision) |

|

0.3 |

|

|

|

(3.1 |

) |

|

|

1.6 |

|

|

|

(4.4 |

) |

| Loss before investment

losses |

|

(10.3 |

) |

|

|

(19.6 |

) |

|

|

(92.1 |

) |

|

|

(37.8 |

) |

| Loss from investments in

investees |

|

(0.0 |

) |

|

|

(0.0 |

) |

|

|

(0.0 |

) |

|

|

(0.1 |

) |

| Net loss |

$ |

(10.3 |

) |

|

$ |

(19.6 |

) |

|

$ |

(92.1 |

) |

|

$ |

(37.9 |

) |

|

Loss per share, basic and diluted |

$ |

(0.01 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.05 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

697,211,592 |

|

|

|

751,727,383 |

|

|

|

702,036,148 |

|

|

|

751,617,431 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

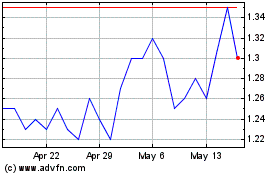

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Dec 2023 to Dec 2024