Opthea Receives A$8.8 million R&D Tax Incentive

December 19 2023 - 5:00AM

Opthea Limited (ASX:OPT; Nasdaq:OPT), a clinical stage

biopharmaceutical company developing novel therapies to treat

highly prevalent and progressive retinal diseases, announced today

that it has received an A$8.8 million (US$5.9 million) research and

development (R&D) tax credit from the Australian Taxation

Office. The cash incentive is for research and development costs

incurred in the 2022/2023 financial year, and represents the amount

disclosed in the company’s audited financial statements at 30 June

2023.

The R&D tax incentive credit relates to both

Australian and eligible overseas expenditure for the development of

Opthea’s lead candidate OPT-302. The R&D Tax Incentive is as an

Australian Federal Government program under which companies can

receive cash incentives for 43.5% of eligible research and

development expenditure.

Fred Guerard, CEO of Opthea, commented, “The

receipt of this A$8.8 million R&D tax incentive credit further

strengthens our cash position as Opthea continues to advance its

Phase 3 registrational trials, ShORe and COAST, investigating

OPT-302 to address the unmet medical need in wet AMD.”

About Opthea Limited

Opthea (Nasdaq:OPT; ASX:OPT) is a

biopharmaceutical company developing novel therapies to address the

unmet need in the treatment of highly prevalent and progressive

retinal diseases, including wet age-related macular degeneration

(wet AMD) and diabetic macular edema (DME). Opthea’s lead product

candidate OPT-302 is in pivotal Phase 3 clinical trials and being

developed for use in combination with anti-VEGF-A monotherapies to

achieve broader inhibition of the VEGF family, with the goal of

improving overall efficacy and demonstrating superior vision gains

over that which can be achieved by inhibiting VEGF-A alone.

Inherent risks of Investment in

Biotechnology Companies

There are a number of inherent risks associated

with the development of pharmaceutical products to a marketable

stage. The lengthy clinical trial process is designed to assess the

safety and efficacy of a drug prior to commercialization and a

significant proportion of drugs fail one or both of these criteria.

Other risks include uncertainty of patent protection and

proprietary rights, whether patent applications and issued patents

will offer adequate protection to enable product development, the

obtaining of necessary drug regulatory authority approvals and

difficulties caused by the rapid advancements in technology.

Companies such as Opthea are dependent on the success of their

research and development projects and on the ability to attract

funding to support these activities. Investment in research and

development projects cannot be assessed on the same fundamentals as

trading and manufacturing enterprises. Therefore, investment in

companies specializing in drug development must be regarded as

highly speculative. Opthea strongly recommends that professional

investment advice be sought prior to such investments.

Authorized for release to ASX by Fred

Guerard, CEO

Company & Media Enquiries:

Rudi MichelsonMonsoon CommunicationsTel: +61 (0) 3 9620

3333

Investor:Hershel BerryBlueprint Life Science

GroupTel: +1 415 505 3749hberry@bplifescience.com

Join our email database to receive program

updates:Tel: +61 (0) 3 9826 0399 Email: info@opthea.com

Web: www.opthea.com

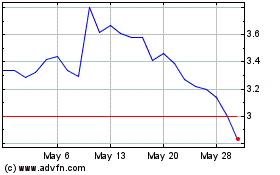

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

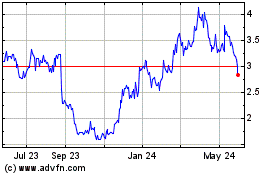

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Mar 2024 to Mar 2025