Optinose (NASDAQ:OPTN), a pharmaceutical company focused on

patients treated by ear, nose and throat (ENT) and allergy

specialists, today reported financial results for the quarter ended

September 30, 2024, and provided recent operational highlights.

“While our revenue in third quarter was not in line with our

expectations, we believe that we are now observing a clear

inflection in new prescription demand," stated CEO Ramy Mahmoud,

MD, MPH. "We believe the recent accelerating trend in new

prescription demand reinforces the magnitude of the longer-term

opportunity. In addition, we believe that our experience in the

initial phases of the launch has improved our understanding of the

key drivers of adoption and that this experience will help support

achievement of our peak year objective."

Third Quarter 2024 and Recent Highlights

New Prescriptions (NRx)The

four-week moving average of weekly NRx ranged between approximately

1,760 to 1,960 for the weeks ended June 28, 2024 through September

6, 2024. With the inflection first observed in September, the

moving average increased to approximately 2,300 to 2,500 NRx per

week in October (through the week ended October 25) an increase of

approximately 20% to 40% percent compared to the prior range. In

addition, NRx for the most recent six weeks ending the week of

October 25th include the top five ranked weeks for NRx in 2024.

Third Quarter 2024 Financial

Results

Total revenuesThe Company reported

$20.4 million in net revenue from sales of XHANCE during the

three-month period ended September 30, 2024, an increase of 3%

compared to $19.8 million during the three-month period ended

September 30, 2023. For the nine-month period ended September 30,

2024, the Company reported $55.8 million in net revenue from sales

of XHANCE, an increase of 9% compared to the nine-month period

ended September 30, 2023.

Costs and expenses and net lossFor the

three-month and nine-month periods ended September 30, 2024,

research and development expenses were $0.9 million and $3.1

million, respectively. Selling, general and administrative expenses

were $19.5 million and $64.1 million, respectively, for the

three-month and nine-month periods ended September 30, 2024.

The net income for the three-month period ended September 30,

2024 was $0.5 million, or $0.00 per share (diluted). The net loss

for the nine-month period ended September 30, 2024 was $21.2

million, or $0.20 per share (diluted).

Balance SheetThe Company had

cash and cash equivalents of $82.5 million as of September 30,

2024.

Financial Guidance

XHANCE Net Revenue The Company

expects XHANCE net revenues for the full year of 2024 to be between

$75.0 to $79.0 million. Previously the Company expected XHANCE net

revenues for the full year of 2024 to be between $85.0 to $90.0

million.

XHANCE Average Net Revenue per

PrescriptionThe Company expects full year 2024 XHANCE

average net revenue per prescription to be approximately $270.

Previously the Company expected full year 2024 XHANCE average net

revenue per prescription to exceed $250.

Operating ExpensesThe Company

expects total GAAP operating expenses (selling, general &

administrative expenses and research & development expenses)

for 2024 to be between $90.0 to $93.0 million, of which the Company

expects stock-based compensation to be approximately $6.0 million.

Previously the Company expected total GAAP operating expenses for

2024 to be between $95.0 to $101.0 million, of which the Company

expected stock-based compensation to be approximately $6.0

million.

Company to Host Conference CallMembers of the

Company’s leadership team will host a conference call and

presentation to discuss financial results and corporate updates

beginning at 8:00 a.m. Eastern Time today.

Participants may access the conference call live via webcast by

visiting the Investors section of Optinose’s website

at http://ir.optinose.com/presentations. To participate via

telephone, please register in advance at this link. Upon

registration, all telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number and a personal PIN that can be used to

access the call. In addition, a replay of the webcast will be

available on the Company website for 60 days following the

event.

|

|

|

OptiNose, Inc. |

|

Condensed Consolidated Statement of

Operations |

|

(in thousands, except share and per share

data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

| Net

product revenues |

|

$ |

20,437 |

|

|

$ |

19,823 |

|

|

$ |

55,807 |

|

|

$ |

51,122 |

|

|

Total revenues |

|

|

20,437 |

|

|

|

19,823 |

|

|

|

55,807 |

|

|

|

51,122 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

$ |

2,065 |

|

|

$ |

2,225 |

|

|

$ |

5,277 |

|

|

$ |

6,502 |

|

|

Research and development |

|

|

949 |

|

|

|

1,281 |

|

|

|

3,083 |

|

|

|

4,017 |

|

|

Selling, general and administrative |

|

|

19,475 |

|

|

|

18,011 |

|

|

|

64,121 |

|

|

|

60,839 |

|

|

Total costs and expenses |

|

|

22,489 |

|

|

|

21,517 |

|

|

|

72,481 |

|

|

|

71,358 |

|

|

Loss from operations |

|

|

(2,052 |

) |

|

|

(1,694 |

) |

|

|

(16,674 |

) |

|

|

(20,236 |

) |

|

Other (income) expense |

|

|

(2,519 |

) |

|

|

7,600 |

|

|

|

4,507 |

|

|

|

5,280 |

|

| Net

income (loss) |

|

$ |

467 |

|

|

$ |

(9,294 |

) |

|

$ |

(21,181 |

) |

|

$ |

(25,516 |

) |

|

|

|

|

|

|

|

|

|

|

|

Less: undistributed earnings to participating shareholders |

|

|

(74 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net

income (loss) - basic |

|

$ |

393 |

|

|

$ |

(9,294 |

) |

|

$ |

(21,181 |

) |

|

$ |

(25,516 |

) |

| Net

income (loss) per share of common stock - basic |

|

$ |

— |

|

|

$ |

(0.08 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.23 |

) |

|

Weighted average common shares outstanding - basic |

|

|

174,328,570 |

|

|

|

112,230,155 |

|

|

|

144,900,726 |

|

|

|

111,996,456 |

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) - basic |

|

$ |

393 |

|

|

$ |

(9,294 |

) |

|

$ |

(21,181 |

) |

|

$ |

(25,516 |

) |

|

Add: Unrealized gain on the fair value of warrants |

|

|

— |

|

|

|

— |

|

|

|

(8,700 |

) |

|

|

— |

|

| Net

income (loss) - diluted |

|

$ |

393 |

|

|

$ |

(9,294 |

) |

|

$ |

(29,881 |

) |

|

$ |

(25,516 |

) |

| Net

income (loss) per share of common stock - diluted |

|

$ |

— |

|

|

$ |

(0.08 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.23 |

) |

|

Weighted average common shares outstanding - diluted |

|

|

174,369,875 |

|

|

|

112,230,155 |

|

|

|

149,634,133 |

|

|

|

111,996,456 |

|

|

OptiNose, Inc. |

|

Condensed Consolidated Balance Sheet Data |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

(unaudited) |

|

|

|

Cash and cash equivalents |

|

$ |

82,497 |

|

|

$ |

73,684 |

|

|

Other assets |

|

|

48,523 |

|

|

|

34,045 |

|

|

Total assets |

|

$ |

131,020 |

|

|

$ |

107,729 |

|

|

|

|

|

|

|

|

Total current liabilities (1) |

|

$ |

162,430 |

|

|

$ |

176,524 |

|

|

Other liabilities |

|

|

9,687 |

|

|

|

17,811 |

|

|

Total stockholders' equity |

|

|

(41,097 |

) |

|

|

(86,606 |

) |

|

Total liabilities and stockholders' equity |

|

$ |

131,020 |

|

|

$ |

107,729 |

|

|

|

|

|

|

|

| (1)

– All outstanding principal and fees payable upon maturity have

been classified as a current liability in accordance with Generally

Accepted Accounting Principles ("GAAP") because, as of the date

hereof, the Company believes that it is probable that it will not

maintain compliance with certain financial covenants contained in

its Amended and Restated Note Purchase Agreement for at least the

next 12-months. As a result, the Company's unaudited financial

statements for the three and nine months ended September 30, 2024

(“3Q2024 Financial Statements”) will state that there is

substantial doubt about the Company's ability to continue as a

going concern (i.e., a "going concern" paragraph). Please refer to

the Company’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024 (including the 3Q2024 Financial Statements)

which will be filed after the issuance of this press release for

additional information. |

|

|

About OptinoseOptinose is a

specialty pharmaceutical company focused on serving the needs of

patients cared for by ear, nose and throat (ENT) and allergy

specialists. To learn more, visit www.optinose.com or follow

us on X and LinkedIn.

About XHANCEXHANCE is a drug-device combination

product that uses the Exhalation Delivery System™ (also referred to

as the EDS®) designed to deliver a topical steroid to the high and

deep regions of the nasal cavity where sinuses ventilate and drain.

XHANCE is approved by the U.S. Food and Drug

Administration for both the treatment of chronic

rhinosinusitis without nasal polyps (also called chronic sinusitis)

and chronic rhinosinusitis with nasal polyps (also called nasal

polyps) in patients 18 years of age or older.

IMPORTANT SAFETY INFORMATION

CONTRAINDICATIONS: Hypersensitivity to any

ingredient in XHANCE.

WARNINGS AND PRECAUTIONS:

- Local nasal adverse reactions,

including epistaxis, erosion, ulceration, septal perforation,

Candida albicans infection, and impaired wound healing, can occur.

Monitor patients periodically for signs of possible changes on the

nasal mucosa. Avoid use in patients with recent nasal ulcerations,

nasal surgery, or nasal trauma until healing has occurred.

- Glaucoma and cataracts may occur

with long-term use. Consider referral to an ophthalmologist in

patients who develop ocular symptoms or use XHANCE long-term.

- Hypersensitivity reactions (e.g.,

anaphylaxis, angioedema, urticaria, contact dermatitis, rash,

hypotension, and bronchospasm) have been reported after

administration of fluticasone propionate. Discontinue XHANCE if

such reactions occur.

- Immunosuppression and infections

can occur, including potential increased susceptibility to or

worsening of infections (e.g., existing tuberculosis; fungal,

bacterial, viral, or parasitic infection; ocular herpes simplex).

Use with caution in patients with these infections. More serious or

even fatal course of chickenpox or measles can occur in susceptible

patients.

- Hypercorticism and adrenal

suppression may occur with very high dosages or at the regular

dosage in susceptible individuals. If such changes occur,

discontinue XHANCE slowly.

- Assess for decrease in bone mineral

density initially and periodically thereafter.

ADVERSE REACTIONS:

- Chronic rhinosinusitis without

nasal polyps: The most common adverse reactions (incidence ≥3%) are

epistaxis, headache, and nasopharyngitis.

- Chronic rhinosinusitis with nasal

polyps: The most common adverse reactions (incidence ≥3%) are

epistaxis, nasal septal ulceration, nasopharyngitis, nasal mucosal

erythema, nasal mucosal ulcerations, nasal congestion, acute

sinusitis, nasal septal erythema, headache, and pharyngitis.

DRUG INTERACTIONS: Strong cytochrome P450

3A4 inhibitors (e.g., ritonavir, ketoconazole): Use not

recommended. May increase risk of systemic corticosteroid

effects.

USE IN SPECIFIC POPULATIONS: Hepatic

impairment. Monitor patients for signs of increased drug

exposure.Please see full Prescribing Information, including

Instructions for Use.

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. All statements that are not historical facts are hereby

identified as forward-looking statements for this purpose and

include, among others, statements relating to the potential

benefits of XHANCE as the first FDA-approved drug treatment for

chronic rhinosinusitis without nasal polyps (also referred to as

chronic sinusitis) and expanded market opportunities relating

thereto; the potential benefits of the Exhalation Delivery System;

the Company’s expectations for XHANCE net revenue and average net

revenue per prescription for full year 2024; the Company’s

expectations for GAAP operating expenses (selling, general and

administrative expenses and research & development expenses)

and stock-based compensation for 2024; key drivers that generate

promotional response for XHANCE; the Company's believe that the

inflection in new prescription demand which started in September

reinforces the magnitude of the longer-term opportunity for XHANCE;

the Company's belief that its experience in the initial phases of

the launch has improved its understanding of the key drivers of

adoption and that this experience will help support achievement of

its peak year objective for XHANCE; the Company's belief that it is

probable that it will not maintain compliance with certain

financial covenants contained in its Amended and Restated Note

Purchase Agreement for at least the next 12-months and the

consequences thereof; and other statements regarding the Company's

future operations, financial performance, financial position,

prospects, objectives, strategies and other future events.

Forward-looking statements are based upon management’s current

expectations and assumptions and are subject to a number of risks,

uncertainties and other factors that could cause actual results and

events to differ materially and adversely from those indicated by

such forward-looking statements including, among others: physician

and patient acceptance of XHANCE for its new indication; the

Company’s ability to maintain adequate third-party reimbursement

for XHANCE (including its new indication); the prevalence of

chronic sinusitis and market opportunities for XHANCE may be

smaller than expected; the Company’s ability to efficiently

generate XHANCE prescriptions and net revenues; unanticipated costs

and expenses; the Company's ability to achieve its financial

guidance; the risk that the positive inflection in new XHANCE

prescriptions starting in September does not continue and grow; the

Company’s ability to comply with the covenants and other terms of

its Amended and Restated Note Purchase Agreement; the Company’s

ability to continue as a going concern; risks and uncertainties

relating to intellectual property and competitive products; and the

risks, uncertainties and other factors discussed under the caption

"Item 1A. Risk Factors" and elsewhere in the Company’s most recent

Form 10-K and Form 10-Q filings with the Securities and Exchange

Commission - which are available at www.sec.gov. As a result, you

are cautioned not to place undue reliance on any forward-looking

statements. Any forward-looking statements made in this press

release speak only as of the date of this press release, and the

Company undertakes no obligation to update such forward-looking

statements, whether as a result of new information, future

developments or otherwise.

Optinose Investor Contact Jonathan Neely

jonathan.neely@optinose.com 267.521.0531

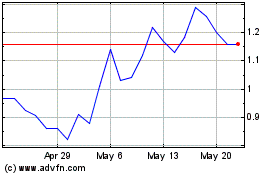

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Nov 2024 to Dec 2024

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Dec 2023 to Dec 2024