false

0001460602

0001460602

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 21, 2024

ORGENESIS

INC.

(Exact name of registrant as specified in its charter)

| Nevada

|

|

001-38416 |

|

98-0583166

|

| (State

or other jurisdiction

|

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation |

|

Number)

|

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS

|

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

Debt

Exchange Agreements

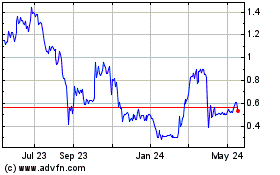

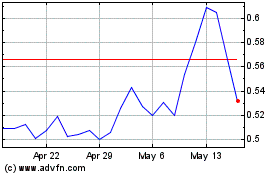

Orgenesis Inc. (the “Company”) entered into debt exchange agreements

with three convertible debt holders pursuant to which a total of $16,007,372 of outstanding principal and accrued interest will be exchanged

for an aggregate of 15,776,947 shares of common stock, par value $0.0001 per share, of the Company (the “Common Stock”), of

which $14,860,422 will be exchanged for shares at an exchange price of $1.03 per share of Common Stock and $1,146,950 will be exchanged

for shares at an exchange price of $0.85 per share of Common Stock representing premiums of 102% and 67%, respectively compared to the

closing price on May 21, 2024 as further described below.

On

May 21, 2024, the Company and Yehuda Nir entered into a debt exchange agreement (the “Nir Debt Exchange Agreement”),

pursuant to which Mr. Nir agreed to exchange $13,176,000 of outstanding principal amount and accrued interest under certain convertible

debt agreements and instruments (the “Nir Debt”) for an aggregate of 12,955,611 shares (the “Nir Shares”) of

Common Stock. Under no circumstances whatsoever may the aggregate number of Nir Shares issued to Mr. Nir in connection with the

exchange of the Nir Debt at any time exceed 19.99% of the total number of shares of Common Stock outstanding or of the voting power of

the Company (the “Beneficial Ownership Limitation”) unless the Company has obtained either (i) its shareholders’ approval

of the issuance of more than such number of shares of Common Stock pursuant to Nasdaq Marketplace Rule 5635(b) or (ii) a waiver from

The Nasdaq Stock Market of the Company’s compliance with Rule 5635(b). To the extent that Mr. Nir’s right to receive the

full amount of the Nir Shares would result in Mr, Nir exceeding the Beneficial Ownership Limitation, then Mr. Nir shall not be entitled

to participate in such exchange to the full extent (or in the beneficial ownership of any Shares as a result of such exchange to such

extent) and the portion of such Nir Shares (subject to adjustment for stock splits and similar transactions) shall be held in abeyance

for the benefit of Mr. Nir until such time, if ever, as its right thereto would not result in Mr. Nir exceeding the Beneficial Ownership

Limitation. At the end of each fiscal quarter, the Company shall determine whether any portion of the Nir Shares held in abeyance for

Mr. Nir may be issued by the Company to Mr. Nir without exceeding the Beneficial Ownership Limitation and following such determination

shall issue any such Nir Shares to Mr. Nir up to the Beneficial Ownership Limitation.

On

May 21, 2024, the Company and Aharon Lukach entered into a debt exchange agreement (the “Lukach Debt Exchange Agreement”),

pursuant to which Mr. Lukach agreed to exchange $1,458,171 of outstanding principal amount and accrued interest under certain convertible

debt agreements and instruments (the “Lukach Debt”) for an aggregate of 1,488,132 shares (the “Lukach Shares”)

of Common Stock.

On

May 21, 2024, the Company and Yosef Dotan entered into a debt exchange agreement (the “Dotan Debt Exchange Agreement”), pursuant

to which Mr. Dotan agreed to exchange $1,373,201 of outstanding principal amount and accrued interest under certain convertible debt

agreements and instruments (the “Dotan Debt”) for an aggregate of 1,333,204 shares (the “Dotan Shares”) of Common

Stock.

| Item

3.02 | Unregistered

Sales of Equity Securities. |

The

Nir Shares, the Lukach Shares and the Dotan Shares will be issued pursuant to the Debt Exchange Agreements in reliance upon an exemption

for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation

D of the Securities Act and in reliance on similar exemptions under applicable state laws. Each of Mr. Nir, Mr. Lukach and Mr. Dotan

represented that he is an accredited investor within the meaning of Rule 501(a) of Regulation D, and was acquiring the securities for

investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The securities

were offered without any general solicitation by the Company or its representatives.

| Item

9.01. | Financial

Statements and Exhibits. |

The

exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ORGENESIS

INC. |

| |

|

| Date:

May 23, 2024 |

By:

|

/s/

Victor Miller |

| |

|

Victor

Miller |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary

|

Exhibit

10.1

DEBT

EXCHANGE AGREEMENT

DEBT

EXCHANGE AGREEMENT, dated as of May 21, 2024 (this “Agreement”), by and between Orgenesis Inc., a Nevada corporation

(the “Company”), and Yehuda Nir (the “Purchaser”).

R

E C I T A L S

WHEREAS,

the Company and/or its wholly-owned subsidiary Koligo Therapeutics Inc. (“Koligo”) owe the US $ 13,176,000 including outstanding

principal amount and interest to the Purchaser under certain convertible debt agreements or instruments (collectively, the “Nir

Debt”):

WHEREAS,

the Company has agreed that, pursuant to this Agreement, it will issue to the Purchaser, in exchange for the Nir Debt, an aggregate of

12,955,611 shares of common stock, par value $0.0001 per share, of the Company (the “Shares”), which number of Shares

has been calculated to effect a conversion of US $ 12,381,350 at a conversion price of $1.03 resulting in 12,020,729 shares and $ 794,650

at a conversion price of $0.85 resulting in 934,882 shares; and

WHEREAS,

the Company and the Purchaser desire to enter into this Agreement to set forth certain matters relating to such exchange.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements herein contained, the parties hereto hereby agree as follows:

ARTICLE

I.

Exchange

Section

1.1. Exchange of Nir Debt for Shares. Upon the following terms and conditions, and in consideration of and in express reliance

upon such terms and conditions and the representations, warranties and covenants of this Agreement, the Purchaser shall release the Company

of all obligations owing in respect of the Nir Debt and shall surrender to the Company for exchange all documents evidencing the Nir

Debt, together with all appropriate instruments of transfer, and, in exchange therefor, the Company shall issue to the Purchaser the

Shares. The exchange described in this Section 1.1 is referred to herein as the “Exchange”. Following the Exchange,

the Nir Debt will be extinguished in full.

Section

1.2. Beneficial Ownership Limitation. Under no circumstances whatsoever may the aggregate number of Shares issued to Purchaser

in connection with the exchange of the Nir Debt at any time exceed 19.99% of the total number of shares of Common Stock outstanding or

of the voting power (the “Beneficial Ownership Limitation”) unless the Company has obtained either (i) its shareholders’

approval of the issuance of more than such number of shares of Common Stock pursuant to Nasdaq Marketplace Rule 5635(b) or (ii) a waiver

from The Nasdaq Stock Market of the Company’s compliance with Rule 5635(b). To the extent that the Purchaser’s right to receive

the full amount of the Shares would result in the Purchaser exceeding the Beneficial Ownership Limitation, then the Purchaser shall not

be entitled to participate in such Exchange to the full extent (or in the beneficial ownership of any Shares as a result of such Exchange

to such extent) and the portion of such Shares (subject to adjustment for stock splits and similar transactions) shall be held in abeyance

for the benefit of the Purchaser until such time, if ever, as its right thereto would not result in the Purchaser exceeding the Beneficial

Ownership Limitation. At the end of each fiscal quarter, the Company shall determine whether any portion of the Shares held in abeyance

for the Purchaser may be issued by the Company to the Purchaser without exceeding the Beneficial Ownership Limitation and following such

determination shall issue any such Shares to the Purchaser up to the Beneficial Ownership Limitation.

Section

1.3. Closing. The closing (the “Closing”) of the Exchange under this Agreement shall take place at the offices

of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., 919 Third Avenue, New York, New York at 10:00 a.m., New York time (i) on or before

May 17, 2024, provided, that all of the conditions set forth in this Agreement shall have been fulfilled or waived in accordance herewith,

or (ii) at such other time and place or on such date as the Purchaser and the Company may agree upon (such date on which the Closing

occurs, the “Closing Date”). At the Closing, the Purchaser shall deliver or cause to be delivered to the Company the

Nir Debt that the Purchaser is exchanging pursuant to the terms hereof, together with all appropriate instruments of transfer. At the

Closing, the Company shall deliver the Shares to the Purchaser in book entry form on the records of the transfer agent of the Company.

ARTICLE

II.

Representations

and Warranties

Section

2.1. Representations and Warranties of the Company. The Company hereby represents and warrants to the Purchaser, as of the date

hereof and the Closing Date, as follows:

(a)

Organization, Good Standing and Power. The Company is a corporation duly incorporated, validly existing and in good standing under

the laws of the State of Nevada and has the requisite power to own, lease and operate its properties and assets and to conduct its business

as it is now being conducted. The Company is duly qualified as a foreign corporation to do business and is in good standing in every

jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary except for any

jurisdictions (alone or in the aggregate) in which the failure to be so qualified will not have a Material Adverse Effect. For the purposes

of this Agreement, “Material Adverse Effect” means any condition, circumstance, or situation that would prohibit or

hinder the Company from executing this Agreement and/or performing any of its obligations hereunder or thereunder in any material respect.

(b)

Authorization; Enforcement. The Company has the requisite power and authority to enter into and perform this Agreement and to

consummate the Exchange. The execution, delivery and performance of this Agreement by the Company have been duly and validly authorized

by all necessary corporate action, and no further consent or authorization is required for the Company to effect the transactions contemplated

hereby. When executed and delivered by the Company, the Agreement shall constitute a valid and binding obligation of the Company, enforceable

against the Company in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, reorganization,

moratorium, liquidation, conservatorship, receivership or similar laws relating to, or affecting generally the enforcement of, creditor’s

rights and remedies or by other equitable principles of general application.

(c)

Issuance of Shares. The Shares have been duly authorized by all necessary corporate action and, when issued in accordance with

the terms hereof upon surrender of the Nir Debt in the Exchange, the Shares shall be validly issued and outstanding, fully paid and non-assessable,

free of restrictions on transfer other than as described herein and under applicable state and federal securities laws, and assuming

the accuracy of the Purchaser’s representations and warranties set forth in Section 2.2 hereof, such Shares will have been issued

in compliance with all applicable state and federal securities laws.

(d)

No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of

the transactions contemplated hereby does not and will not (i) violate any provision of the Company’s Certificate of Incorporation

or Bylaws, each as amended to date, (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both

would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any material

agreement, mortgage, deed of trust, indenture, note, bond, license, lease agreement, instrument or obligation to which the Company is

a party or by which any of the Company’s properties or assets are bound, or (iii) result in a violation of any federal, state,

local or foreign statute, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations) applicable

to the Company or by which any property or asset of the Company is bound or affected, except, in all cases, other than violations pursuant

to clauses (i) or (iii) (with respect to federal and state securities laws) above, except, for such conflicts, defaults, terminations,

amendments, acceleration, cancellations and violations as would not, individually or in the aggregate, have a Material Adverse Effect.

The Company is not required under federal, state, foreign or local law, rule or regulation to obtain any consent, authorization or order

of, or make any filing or registration with, any court or governmental agency in order for it to execute, deliver or perform any of its

obligations under this Agreement or consummate the Exchange in accordance with the terms hereof (other than any filings, consents and

approvals which may be required to be made by the Company under applicable state and federal securities laws, rules or regulations, or

the rules of the Nasdaq Capital Market, prior to or subsequent to the Closing).

(e)

Offering. No form of general solicitation or general advertising (as defined in Regulation D of the Securities Act of 1933, as

amended) was used by the Company or any of its respective representatives in connection with the offer and sale of the Shares hereby,

including, but not limited to, articles, notices or other communications published in any newspaper, magazine or similar medium or broadcast

over television or radio, or any seminar or other meeting whose attendees have been invited by any general solicitation or general advertising.

Section

2.2. Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants to the Company, as of the date

hereof and as of the Closing Date, as follows:

(a)

Organization and Standing of the Purchaser. The Purchaser is a corporation duly incorporated, validly existing and in good standing

under the laws of the jurisdiction of its incorporation.

(b)

Authorization and Power. The Purchaser has the requisite power and authority to enter into and perform this Agreement and to consummate

the Exchange. The execution, delivery and performance of this Agreement the Purchaser and the consummation by it of the transactions

contemplated hereby have been duly authorized by all necessary corporate action, and no further consent or authorization is required

for the Purchaser to effect the transactions contemplated hereby. When executed and delivered by the Purchaser, this Agreement shall

constitute valid and binding obligations of the Purchaser enforceable against the Purchaser in accordance with their terms, except as

such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation, conservatorship, receivership

or similar laws relating to, or affecting generally the enforcement of, creditor’s rights and remedies or by other equitable principles

of general application.

(c)

No Conflict. The execution, delivery and performance of this Agreement by the Purchaser and the consummation by the Purchaser

of the transactions contemplated hereby does not and will not (i) if applicable, violate any provision of the Purchaser’s Certificate

of Incorporation or Bylaws, each as amended to date, (ii) assuming the execution and delivery of those documents set forth in Section

4.2(e) hereof, conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default)

under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, mortgage, deed of trust,

indenture, note, bond, license, lease agreement, instrument or obligation to which the Purchaser is a party or by which the Purchaser’s

properties or assets are bound, or (iii) result in a violation of any federal, state, local or foreign statute, rule, regulation, order,

judgment or decree (including federal and state securities laws and regulations) applicable to the Purchaser or by which any property

or asset of the Purchaser is bound or affected, except, in all cases, other than violations pursuant to clauses (i) or (iii) (with respect

to federal and state securities laws) above, except, for such conflicts, defaults, terminations, amendments, acceleration, cancellations

and violations as would not, individually or in the aggregate, materially and adversely affect Purchaser’s ability to perform its

obligations hereunder.

(d)

Acquisition for Investment. The Purchaser is acquiring the Shares solely for its own account and not with a view to or for sale

in connection with any distribution.

(e)

Assessment of Risks. The Purchaser acknowledges that it (i) has such knowledge and experience in financial and business matters

that such Purchaser is capable of evaluating the merits and risks of such Purchaser’s investment in the Company (by virtue of its

purchase of Shares hereunder), (ii) is able to bear the financial risks associated with an investment in the Shares and (iii) has been

given full access to such records of the Company and to the officers of the Company as it has deemed necessary or appropriate to conduct

its due diligence investigation with respect to the Shares.

(f)

No General Solicitation. The Purchaser acknowledges that the Shares were not offered to the Purchaser by means of any form of

general or public solicitation or general advertising, or publicly disseminated advertisements or sales literature, including (i) any

advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast over television

or radio or (ii) any seminar or meeting to which the Purchaser was invited by any of the foregoing means of communications.

(g)

Accredited Investor. The Purchaser is an “accredited investor” (as defined in Rule 501 of Regulation D under the Securities

Act of 1933, as amended).

(h)

Legend. The Purchaser hereby acknowledges and agrees that the certificates or other documents representing the Shares may contain

the following, or a substantially similar, legend, which legend shall be removed only upon receipt by the Company of an opinion of its

counsel, which opinion shall be satisfactory to the Company, that such legend may be so removed:

THE

SECURITIES REPRESENTED HEREBY (THE “SECURITIES”) HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“SECURITIES ACT”) OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED OF UNLESS REGISTERED

UNDER THE SECURITIES ACT AND UNDER APPLICABLE STATE SECURITIES LAWS OR THE COMPANY SHALL HAVE RECEIVED AN OPINION OF ITS COUNSEL THAT

REGISTRATION OF SUCH SECURITIES UNDER THE SECURITIES ACT AND UNDER THE PROVISIONS OF APPLICABLE STATE SECURITIES LAWS IS NOT REQUIRED.

(i)

Certain Fees. The Purchaser has not employed any broker or finder or incurred any liability for any brokerage, investment banking,

commission, finders’, structuring or financial advisory fees or other similar fees in connection with this Agreement or the transactions

contemplated hereby.

ARTICLE

III.

Covenants

of the Parties

Section

3.1. Covenants. The parties hereto hereby covenant with each other as follows, which covenants, as applicable, are for the benefit

of such parties and their respective permitted assigns:

(a)

Further Assurances. From and after the Closing Date, upon the request of the Purchaser or the Company, the Company and the Purchaser

shall execute and deliver such instruments, documents and other writings as may be reasonably necessary or desirable to confirm and carry

out and to effectuate fully the intent and purposes of this Agreement, including, without limitation, authorizing the Company’s

transfer agent to issue shares of the Company’s common stock to the purchasers of the Shares sold by the Purchaser.

(b)

Commercially Reasonable Efforts. Each party hereto will use commercially reasonable efforts to take, or cause to be taken, all

action, and to do, or cause to be done, all things necessary, proper or advisable, consistent with applicable law, to consummate and

make effective in the most expeditious manner practicable the transactions contemplated hereby, including without limitation, making

all required regulatory and other filings required by applicable law as promptly as practicable after the date hereof.

ARTICLE

IV.

Conditions

Section

4.1. Conditions Precedent to the Obligation of the Company to Close. The obligation hereunder of the Company to close and effect

the Exchange at the Closing is subject to the satisfaction or waiver, at or before the Closing of the conditions set forth below:

(a)

Accuracy of the Purchaser’s Representations and Warranties. The representations and warranties of the Purchaser shall be

true and correct in all material respects as of the date when made and as of the Closing Date as though made at that time, except for

representations and warranties that are expressly made as of a particular date, which shall be true and correct in all material respects

as of such date.

(b)

Performance by the Purchaser. The Purchaser shall have performed, satisfied and complied in all material respects with all covenants,

agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Purchaser at or prior to the

Closing.

(c)

No Injunction, Statute or Rule. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted,

entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction which prohibits the consummation of

any of the transactions contemplated by this Agreement.

(d)

Surrender of Nir Debt. The Purchaser shall have released and surrendered to the Company all documents evidencing the Nir Debt

together with all appropriate instruments of transfer.

The

conditions set forth in this Section 4.1 are for the Company’s sole benefit and may be waived only by the Company at any time in

its sole discretion.

Section

4.2. Conditions Precedent to the Obligation of the Purchaser to Close. The obligation hereunder of the Purchaser to close and

effect the Exchange is subject to the satisfaction or waiver, at or before the Closing, of each of the conditions set forth below:

(a)

Accuracy of the Company’s Representations and Warranties. Each of the representations and warranties of the Company in this

Agreement shall be true and correct in all material respects as of the Closing Date, except for representations and warranties that speak

as of a particular date, which shall be true and correct in all material respects as of such date.

(b)

Performance by the Company. The Company shall have performed, satisfied and complied in all material respects with all covenants,

agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Company at or prior to the Closing.

(c)

No Injunction, Statute or Rule. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted,

entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction which prohibits the consummation of

any of the transactions contemplated by this Agreement.

(d)

Delivery of Shares. The Company shall have delivered instructions to the Company’s transfer agent instructing the transfer

agent to deliver on an expedited basis via a certificate or book entry statement evidencing the number of Shares being acquired by the

Purchaser at the Closing.

The

conditions set forth in this Section 4.2 are for the Purchaser’s sole benefit and may be waived only by the Purchaser at any time

in its sole discretion.

ARTICLE

V.

Miscellaneous

Section

5.1. Fees and Expenses. Each party hereto shall pay the fees and expenses of its advisors, counsel, accountants and other experts,

if any, and all other expenses, incurred by such party incident to the negotiation, preparation, execution, delivery and performance

of this Agreement.

Section

5.2. Entire Agreement; Amendment. This Agreement contains the entire understanding and agreement (written or oral) of the parties

hereto with respect to the subject matter hereof and, except as specifically set forth herein, neither the Company nor the Purchaser

make any representation, warranty, covenant or undertaking with respect to such matters, and they supersede all prior understandings

and agreements with respect to said subject matter, all of which are merged herein. No provision of this Agreement may be waived or amended

other than by a written instrument signed by each party hereto. Any amendment or waiver effected in accordance with this Section 5.2

shall be binding upon each such party and its permitted assigns.

Section

5.3. Notices. Any notice, demand, request, waiver or other communication required or permitted to be given hereunder shall be

in writing and shall be effective (a) upon hand delivery by telecopy or e-mail at the address or number designated below (if delivered

on a business day during normal business hours where such notice is to be received), or the first business day following such delivery

(if delivered other than on a business day during normal business hours where such notice is to be received) or (b) on the second business

day following the date of mailing by express courier service, fully prepaid, addressed to such address, or upon actual receipt of such

mailing, whichever shall first occur. The addresses for such communications shall be:

| If

to the Company: |

Orgenesis

Inc. |

| |

20271

Goldenrod Lane |

| |

Germantown,

Maryland 20876 |

| |

Attention:

Chief Financial Officer |

| |

E-mail: |

| with

copies (which copies |

|

| shall

not constitute notice |

|

| to

the Company) to: |

Mintz,

Levin, Cohn, Ferris, Glovsky and Popeo, P.C. |

| |

919

Third Avenue |

| |

New

York, New York 10017 |

| |

Attention:

Jeffrey Schultz |

| |

E-mail:

jschultz@mintz.com |

| |

|

| If

to the Purchaser: |

__________________________ |

| |

__________________________ |

| |

__________________________ |

| |

__________________________ |

| |

Attn:

______________________ |

| |

E-mail:

_____________________ |

| |

|

| with

copies (which copies |

|

| shall

not constitute notice |

|

| to

the Purchaser) to: |

[ADDRESS] |

| |

Attn: |

| |

|

| |

E-mail: |

Any

party hereto may from time to time change its address for notices by giving written notice of such changed address to the other party

hereto.

Section

5.4. Waivers. No waiver by either party of any default with respect to any provision, condition or requirement of this Agreement

shall be deemed to be a continuing waiver in the future or a waiver of any other provision, condition or requirement hereof, nor shall

any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right accruing to it

thereafter.

Section

5.5. Headings. The article, section and subsection headings in this Agreement are for convenience only and shall not constitute

a part of this Agreement for any other purpose and shall not be deemed to limit or affect any of the provisions hereof.

Section

5.6. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors

and assigns. Neither party hereto may assign its rights or obligations under this Agreement (by operation of law or otherwise) without

the prior written consent of each other party hereto, and any attempted assignment without such consent shall be void ab initio.

Section

5.7. No Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted

successors and assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other person or entity.

Section

5.8. Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of New

York, without giving effect to the choice of law provisions thereof. This Agreement shall not be interpreted or construed with any presumption

against the party causing this Agreement to be drafted.

Section

5.9. Counterparts. This Agreement may be executed in any number of counterparts, all of which taken together shall constitute

one and the same instrument and shall become effective when counterparts have been signed by each party and delivered to the other parties

hereto, it being understood that all parties need not sign the same counterpart.

Section

5.10. Severability. The provisions of this Agreement are severable and, in the event that any court of competent jurisdiction

shall determine that any one or more of the provisions or part of the provisions contained in this Agreement shall, for any reason, be

held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other

provision or part of a provision of this Agreement and this Agreement shall be reformed and construed as if such invalid or illegal or

unenforceable provision, or part of such provision, had never been contained herein, so that such provisions would be valid, legal and

enforceable to the maximum extent possible.

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK]

IN

WITNESS WHEREOF, the parties hereto have caused this Debt Exchange Agreement to be duly executed by their respective authorized officers

as of the date first above written.

| |

ORGENESIS

INC. |

| |

|

|

| |

By: |

/s/ Vered Caplan |

| |

Name: |

Vered Caplan |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

KOLIGO

THERAPEUTICS INC. |

| |

|

|

| |

By: |

/s/ Vered Caplan |

| |

Name: |

Vered Caplan |

| |

Title: |

Director |

| |

|

|

| |

PURCHASER: |

| |

|

|

| |

/s/ Yehuda

Nir |

| |

Yehuda Nir |

Exhibit

10.2

DEBT

EXCHANGE AGREEMENT

DEBT

EXCHANGE AGREEMENT, dated as of May 21, 2024 (this “Agreement”), by and between Orgenesis Inc., a Nevada corporation

(the “Company”), and Aharon Lukach (the “Purchaser”).

R

E C I T A L S

WHEREAS,

the Company and/or its wholly-owned subsidiary Orgenesis Ltd. (“Orgenesis Ltd.”) owe the US $1,458,171 including outstanding

principal amount and interest to the Purchaser under certain convertible debt agreements or instruments (collectively, the “Lukach

Debt”):

WHEREAS,

the Company has agreed that, pursuant to this Agreement, it will issue to the Purchaser, in exchange for the Lukach Debt, an aggregate

of 1,488,132 shares of common stock, par value $0.0001 per share, of the Company (the “Shares”), which number of Shares

has been calculated to effect a conversion of US $1,105,871 at a conversion price of $1.03 resulting in 1,073,661 shares and $352,300

at a conversion price of $0.85 resulting in 414,471 shares; and

WHEREAS,

the Company and the Purchaser desire to enter into this Agreement to set forth certain matters relating to such exchange.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements herein contained, the parties hereto hereby agree as follows:

ARTICLE

I.

Exchange

Section

1.1. Exchange of Lukach Debt for Shares. Upon the following terms and conditions, and in consideration of and in express reliance

upon such terms and conditions and the representations, warranties and covenants of this Agreement, the Purchaser shall release the Company

of all obligations owing in respect of the Lukach Debt and shall surrender to the Company for exchange all documents evidencing the Lukach

Debt, together with all appropriate instruments of transfer, and, in exchange therefor, the Company shall issue to the Purchaser the

Shares. The exchange described in this Section 1.1 is referred to herein as the “Exchange”. Following the Exchange,

the Lukach Debt will be extinguished in full.

Section

1.2. Beneficial Ownership Limitation. Under no circumstances whatsoever may the aggregate number of Shares issued to Purchaser

in connection with the exchange of the Lukach Debt at any time exceed 19.99% of the total number of shares of Common Stock outstanding

or of the voting power (the “Beneficial Ownership Limitation”) unless the Company has obtained either (i) its shareholders’

approval of the issuance of more than such number of shares of Common Stock pursuant to Nasdaq Marketplace Rule 5635(b) or (ii) a waiver

from The Nasdaq Stock Market of the Company’s compliance with Rule 5635(b). To the extent that the Purchaser’s right to receive

the full amount of the Shares would result in the Purchaser exceeding the Beneficial Ownership Limitation, then the Purchaser shall not

be entitled to participate in such Exchange to the full extent (or in the beneficial ownership of any Shares as a result of such Exchange

to such extent) and the portion of such Shares (subject to adjustment for stock splits and similar transactions) shall be held in abeyance

for the benefit of the Purchaser until such time, if ever, as its right thereto would not result in the Purchaser exceeding the Beneficial

Ownership Limitation. At the end of each fiscal quarter, the Company shall determine whether any portion of the Shares held in abeyance

for the Purchaser may be issued by the Company to the Purchaser without exceeding the Beneficial Ownership Limitation and following such

determination shall issue any such Shares to the Purchaser up to the Beneficial Ownership Limitation.

Section

1.3. Closing. The closing (the “Closing”) of the Exchange under this Agreement shall take place at the offices

of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., 919 Third Avenue, New York, New York at 10:00 a.m., New York time (i) on or before

May 17, 2024, provided, that all of the conditions set forth in this Agreement shall have been fulfilled or waived in accordance herewith,

or (ii) at such other time and place or on such date as the Purchaser and the Company may agree upon (such date on which the Closing

occurs, the “Closing Date”). At the Closing, the Purchaser shall deliver or cause to be delivered to the Company the

Lukach Debt that the Purchaser is exchanging pursuant to the terms hereof, together with all appropriate instruments of transfer. At

the Closing, the Company shall deliver the Shares to the Purchaser in book entry form on the records of the transfer agent of the Company.

ARTICLE

II.

Representations

and Warranties

Section

2.1. Representations and Warranties of the Company. The Company hereby represents and warrants to the Purchaser, as of the date

hereof and the Closing Date, as follows:

(a)

Organization, Good Standing and Power. The Company is a corporation duly incorporated, validly existing and in good standing under

the laws of the State of Nevada and has the requisite power to own, lease and operate its properties and assets and to conduct its business

as it is now being conducted. The Company is duly qualified as a foreign corporation to do business and is in good standing in every

jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary except for any

jurisdictions (alone or in the aggregate) in which the failure to be so qualified will not have a Material Adverse Effect. For the purposes

of this Agreement, “Material Adverse Effect” means any condition, circumstance, or situation that would prohibit or

hinder the Company from executing this Agreement and/or performing any of its obligations hereunder or thereunder in any material respect.

(b)

Authorization; Enforcement. The Company has the requisite power and authority to enter into and perform this Agreement and to

consummate the Exchange. The execution, delivery and performance of this Agreement by the Company have been duly and validly authorized

by all necessary corporate action, and no further consent or authorization is required for the Company to effect the transactions contemplated

hereby. When executed and delivered by the Company, the Agreement shall constitute a valid and binding obligation of the Company, enforceable

against the Company in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, reorganization,

moratorium, liquidation, conservatorship, receivership or similar laws relating to, or affecting generally the enforcement of, creditor’s

rights and remedies or by other equitable principles of general application.

(c)

Issuance of Shares. The Shares have been duly authorized by all necessary corporate action and, when issued in accordance with

the terms hereof upon surrender of the Lukach Debt in the Exchange, the Shares shall be validly issued and outstanding, fully paid and

non-assessable, free of restrictions on transfer other than as described herein and under applicable state and federal securities laws,

and assuming the accuracy of the Purchaser’s representations and warranties set forth in Section 2.2 hereof, such Shares will have

been issued in compliance with all applicable state and federal securities laws.

(d)

No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of

the transactions contemplated hereby does not and will not (i) violate any provision of the Company’s Certificate of Incorporation

or Bylaws, each as amended to date, (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both

would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any material

agreement, mortgage, deed of trust, indenture, note, bond, license, lease agreement, instrument or obligation to which the Company is

a party or by which any of the Company’s properties or assets are bound, or (iii) result in a violation of any federal, state,

local or foreign statute, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations) applicable

to the Company or by which any property or asset of the Company is bound or affected, except, in all cases, other than violations pursuant

to clauses (i) or (iii) (with respect to federal and state securities laws) above, except, for such conflicts, defaults, terminations,

amendments, acceleration, cancellations and violations as would not, individually or in the aggregate, have a Material Adverse Effect.

The Company is not required under federal, state, foreign or local law, rule or regulation to obtain any consent, authorization or order

of, or make any filing or registration with, any court or governmental agency in order for it to execute, deliver or perform any of its

obligations under this Agreement or consummate the Exchange in accordance with the terms hereof (other than any filings, consents and

approvals which may be required to be made by the Company under applicable state and federal securities laws, rules or regulations, or

the rules of the Nasdaq Capital Market, prior to or subsequent to the Closing).

(e)

Offering. No form of general solicitation or general advertising (as defined in Regulation D of the Securities Act of 1933, as

amended) was used by the Company or any of its respective representatives in connection with the offer and sale of the Shares hereby,

including, but not limited to, articles, notices or other communications published in any newspaper, magazine or similar medium or broadcast

over television or radio, or any seminar or other meeting whose attendees have been invited by any general solicitation or general advertising.

Section

2.2. Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants to the Company, as of the date

hereof and as of the Closing Date, as follows:

(a)

Organization and Standing of the Purchaser. The Purchaser is a corporation duly incorporated, validly existing and in good standing

under the laws of the jurisdiction of its incorporation.

(b)

Authorization and Power. The Purchaser has the requisite power and authority to enter into and perform this Agreement and to consummate

the Exchange. The execution, delivery and performance of this Agreement the Purchaser and the consummation by it of the transactions

contemplated hereby have been duly authorized by all necessary corporate action, and no further consent or authorization is required

for the Purchaser to effect the transactions contemplated hereby. When executed and delivered by the Purchaser, this Agreement shall

constitute valid and binding obligations of the Purchaser enforceable against the Purchaser in accordance with their terms, except as

such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation, conservatorship, receivership

or similar laws relating to, or affecting generally the enforcement of, creditor’s rights and remedies or by other equitable principles

of general application.

(c)

No Conflict. The execution, delivery and performance of this Agreement by the Purchaser and the consummation by the Purchaser

of the transactions contemplated hereby does not and will not (i) if applicable, violate any provision of the Purchaser’s Certificate

of Incorporation or Bylaws, each as amended to date, (ii) assuming the execution and delivery of those documents set forth in Section

4.2(e) hereof, conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default)

under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, mortgage, deed of trust,

indenture, note, bond, license, lease agreement, instrument or obligation to which the Purchaser is a party or by which the Purchaser’s

properties or assets are bound, or (iii) result in a violation of any federal, state, local or foreign statute, rule, regulation, order,

judgment or decree (including federal and state securities laws and regulations) applicable to the Purchaser or by which any property

or asset of the Purchaser is bound or affected, except, in all cases, other than violations pursuant to clauses (i) or (iii) (with respect

to federal and state securities laws) above, except, for such conflicts, defaults, terminations, amendments, acceleration, cancellations

and violations as would not, individually or in the aggregate, materially and adversely affect Purchaser’s ability to perform its

obligations hereunder.

(d)

Acquisition for Investment. The Purchaser is acquiring the Shares solely for its own account and not with a view to or for sale

in connection with any distribution.

(e)

Assessment of Risks. The Purchaser acknowledges that it (i) has such knowledge and experience in financial and business matters

that such Purchaser is capable of evaluating the merits and risks of such Purchaser’s investment in the Company (by virtue of its

purchase of Shares hereunder), (ii) is able to bear the financial risks associated with an investment in the Shares and (iii) has been

given full access to such records of the Company and to the officers of the Company as it has deemed necessary or appropriate to conduct

its due diligence investigation with respect to the Shares.

(f)

No General Solicitation. The Purchaser acknowledges that the Shares were not offered to the Purchaser by means of any form of

general or public solicitation or general advertising, or publicly disseminated advertisements or sales literature, including (i) any

advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast over television

or radio or (ii) any seminar or meeting to which the Purchaser was invited by any of the foregoing means of communications.

(g)

Accredited Investor. The Purchaser is an “accredited investor” (as defined in Rule 501 of Regulation D under the Securities

Act of 1933, as amended).

(h)

Legend. The Purchaser hereby acknowledges and agrees that the certificates or other documents representing the Shares may contain

the following, or a substantially similar, legend, which legend shall be removed only upon receipt by the Company of an opinion of its

counsel, which opinion shall be satisfactory to the Company, that such legend may be so removed:

THE

SECURITIES REPRESENTED HEREBY (THE “SECURITIES”) HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“SECURITIES ACT”) OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED OF UNLESS REGISTERED

UNDER THE SECURITIES ACT AND UNDER APPLICABLE STATE SECURITIES LAWS OR THE COMPANY SHALL HAVE RECEIVED AN OPINION OF ITS COUNSEL THAT

REGISTRATION OF SUCH SECURITIES UNDER THE SECURITIES ACT AND UNDER THE PROVISIONS OF APPLICABLE STATE SECURITIES LAWS IS NOT REQUIRED.

(i)

Certain Fees. The Purchaser has not employed any broker or finder or incurred any liability for any brokerage, investment banking,

commission, finders’, structuring or financial advisory fees or other similar fees in connection with this Agreement or the transactions

contemplated hereby.

ARTICLE

III.

Covenants

of the Parties

Section

3.1. Covenants. The parties hereto hereby covenant with each other as follows, which covenants, as applicable, are for the benefit

of such parties and their respective permitted assigns:

(a)

Further Assurances. From and after the Closing Date, upon the request of the Purchaser or the Company, the Company and the Purchaser

shall execute and deliver such instruments, documents and other writings as may be reasonably necessary or desirable to confirm and carry

out and to effectuate fully the intent and purposes of this Agreement, including, without limitation, authorizing the Company’s

transfer agent to issue shares of the Company’s common stock to the purchasers of the Shares sold by the Purchaser.

(b)

Commercially Reasonable Efforts. Each party hereto will use commercially reasonable efforts to take, or cause to be taken, all

action, and to do, or cause to be done, all things necessary, proper or advisable, consistent with applicable law, to consummate and

make effective in the most expeditious manner practicable the transactions contemplated hereby, including without limitation, making

all required regulatory and other filings required by applicable law as promptly as practicable after the date hereof.

ARTICLE

IV.

Conditions

Section

4.1. Conditions Precedent to the Obligation of the Company to Close. The obligation hereunder of the Company to close and effect

the Exchange at the Closing is subject to the satisfaction or waiver, at or before the Closing of the conditions set forth below:

(a)

Accuracy of the Purchaser’s Representations and Warranties. The representations and warranties of the Purchaser shall be

true and correct in all material respects as of the date when made and as of the Closing Date as though made at that time, except for

representations and warranties that are expressly made as of a particular date, which shall be true and correct in all material respects

as of such date.

(b)

Performance by the Purchaser. The Purchaser shall have performed, satisfied and complied in all material respects with all covenants,

agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Purchaser at or prior to the

Closing.

(c)

No Injunction, Statute or Rule. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted,

entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction which prohibits the consummation of

any of the transactions contemplated by this Agreement.

(d)

Surrender of Lukach Debt. The Purchaser shall have released and surrendered to the Company all documents evidencing the Lukach

Debt together with all appropriate instruments of transfer.

The

conditions set forth in this Section 4.1 are for the Company’s sole benefit and may be waived only by the Company at any time in

its sole discretion.

Section

4.2. Conditions Precedent to the Obligation of the Purchaser to Close. The obligation hereunder of the Purchaser to close and

effect the Exchange is subject to the satisfaction or waiver, at or before the Closing, of each of the conditions set forth below:

(a)

Accuracy of the Company’s Representations and Warranties. Each of the representations and warranties of the Company in this

Agreement shall be true and correct in all material respects as of the Closing Date, except for representations and warranties that speak

as of a particular date, which shall be true and correct in all material respects as of such date.

(b)

Performance by the Company. The Company shall have performed, satisfied and complied in all material respects with all covenants,

agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Company at or prior to the Closing.

(c)

No Injunction, Statute or Rule. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted,

entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction which prohibits the consummation of

any of the transactions contemplated by this Agreement.

(d)

Delivery of Shares. The Company shall have delivered instructions to the Company’s transfer agent instructing the transfer

agent to deliver on an expedited basis via a certificate or book entry statement evidencing the number of Shares being acquired by the

Purchaser at the Closing.

The

conditions set forth in this Section 4.2 are for the Purchaser’s sole benefit and may be waived only by the Purchaser at any time

in its sole discretion.

ARTICLE

V.

Miscellaneous

Section

5.1. Fees and Expenses. Each party hereto shall pay the fees and expenses of its advisors, counsel, accountants and other experts,

if any, and all other expenses, incurred by such party incident to the negotiation, preparation, execution, delivery and performance

of this Agreement.

Section

5.2. Entire Agreement; Amendment. This Agreement contains the entire understanding and agreement (written or oral) of the parties

hereto with respect to the subject matter hereof and, except as specifically set forth herein, neither the Company nor the Purchaser

make any representation, warranty, covenant or undertaking with respect to such matters, and they supersede all prior understandings

and agreements with respect to said subject matter, all of which are merged herein. No provision of this Agreement may be waived or amended

other than by a written instrument signed by each party hereto. Any amendment or waiver effected in accordance with this Section 5.2

shall be binding upon each such party and its permitted assigns.

Section

5.3. Notices. Any notice, demand, request, waiver or other communication required or permitted to be given hereunder shall be

in writing and shall be effective (a) upon hand delivery by telecopy or e-mail at the address or number designated below (if delivered

on a business day during normal business hours where such notice is to be received), or the first business day following such delivery

(if delivered other than on a business day during normal business hours where such notice is to be received) or (b) on the second business

day following the date of mailing by express courier service, fully prepaid, addressed to such address, or upon actual receipt of such

mailing, whichever shall first occur. The addresses for such communications shall be:

| If

to the Company: |

Orgenesis

Inc. |

| |

20271

Goldenrod Lane |

| |

Germantown,

Maryland 20876 |

| |

Attention:

Chief Financial Officer |

| |

E-mail:

|

| with

copies (which copies |

|

| shall

not constitute notice |

|

| to

the Company) to: |

Mintz,

Levin, Cohn, Ferris, Glovsky and Popeo, P.C. |

| |

919

Third Avenue |

| |

New

York, New York 10017 |

| |

Attention:

Jeffrey Schultz |

| |

E-mail:

jschultz@mintz.com |

| If

to the Purchaser: |

____________________ |

| |

____________________ |

| |

____________________ |

| |

____________________ |

| |

Attn:

________________ |

| |

E-mail:

_______________ |

| with

copies (which copies |

|

| shall

not constitute notice |

|

| to

the Purchaser) to: |

[ADDRESS] |

| |

Attn: |

| |

|

| |

E-mail: |

Any

party hereto may from time to time change its address for notices by giving written notice of such changed address to the other party

hereto.

Section

5.4. Waivers. No waiver by either party of any default with respect to any provision, condition or requirement of this Agreement

shall be deemed to be a continuing waiver in the future or a waiver of any other provision, condition or requirement hereof, nor shall

any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right accruing to it

thereafter.

Section

5.5. Headings. The article, section and subsection headings in this Agreement are for convenience only and shall not constitute

a part of this Agreement for any other purpose and shall not be deemed to limit or affect any of the provisions hereof.

Section

5.6. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors

and assigns. Neither party hereto may assign its rights or obligations under this Agreement (by operation of law or otherwise) without

the prior written consent of each other party hereto, and any attempted assignment without such consent shall be void ab initio.

Section

5.7. No Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted

successors and assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other person or entity.

Section

5.8. Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of New

York, without giving effect to the choice of law provisions thereof. This Agreement shall not be interpreted or construed with any presumption

against the party causing this Agreement to be drafted.

Section

5.9. Counterparts. This Agreement may be executed in any number of counterparts, all of which taken together shall constitute

one and the same instrument and shall become effective when counterparts have been signed by each party and delivered to the other parties

hereto, it being understood that all parties need not sign the same counterpart.

Section

5.10. Severability. The provisions of this Agreement are severable and, in the event that any court of competent jurisdiction

shall determine that any one or more of the provisions or part of the provisions contained in this Agreement shall, for any reason, be

held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other

provision or part of a provision of this Agreement and this Agreement shall be reformed and construed as if such invalid or illegal or

unenforceable provision, or part of such provision, had never been contained herein, so that such provisions would be valid, legal and

enforceable to the maximum extent possible.

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK]

IN

WITNESS WHEREOF, the parties hereto have caused this Debt Exchange Agreement to be duly executed by their respective authorized officers

as of the date first above written.

| |

ORGENESIS

INC. |

| |

|

| |

By: |

/s/ Vered

Caplan |

| |

Name:

|

Vered Caplan |

| |

Title:

|

Chief Executive Officer |

| |

|

|

| |

ORGENESIS

LTD. |

| |

|

| |

By: |

/s/

Vered Caplan |

| |

Name:

|

Vered Caplan |

| |

Title:

|

Director |

| |

PURCHASER: |

| |

/s/ Aharon Lukach |

| |

Aharon

Lukach |

Exhibit

10.3

DEBT

EXCHANGE AGREEMENT

DEBT

EXCHANGE AGREEMENT, dated as of May 21, 2024 (this “Agreement”), by and between Orgenesis Inc., a Nevada corporation

(the “Company”), and Yosef Dotan (the “Purchaser”).

R

E C I T A L S

WHEREAS,

the Company and/or its wholly-owned subsidiary Orgenesis Ltd. (“Orgenesis Ltd.”) owe $1,373,201 outstanding principal

amount and interest to the Purchaser under certain convertible debt agreements or instruments (collectively, the “Dotan Debt”):

WHEREAS,

the Company has agreed that, pursuant to this Agreement, it will issue to the Purchaser, in exchange for the Dotan Debt, an aggregate

of 1,333,204 shares of common stock, par value $0.0001 per share, of the Company (the “Shares”), which number of Shares

has been calculated by dividing the total outstanding amount under the Dotan Debt by $1.03; and

WHEREAS,

the Company and the Purchaser desire to enter into this Agreement to set forth certain matters relating to such exchange.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements herein contained, the parties hereto hereby agree as follows:

ARTICLE

I.

Exchange

Section

1.1. Exchange of Dotan Debt for Shares. Upon the following terms and conditions, and in consideration of and in express reliance

upon such terms and conditions and the representations, warranties and covenants of this Agreement, the Purchaser shall release the Company

of all obligations owing in respect of the Dotan Debt and shall surrender to the Company for exchange all documents evidencing the Dotan

Debt, together with all appropriate instruments of transfer, and, in exchange therefor, the Company shall issue to the Purchaser the

Shares. The exchange described in this Section 1.1 is referred to herein as the “Exchange”. Following the Exchange,

the Dotan Debt will be extinguished in full.

Section

1.2. Closing. The closing (the “Closing”) of the Exchange under this Agreement shall take place at the offices

of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., 919 Third Avenue, New York, New York at 10:00 a.m., New York time (i) on or before

May 17, 2024, provided, that all of the conditions set forth in this Agreement shall have been fulfilled or waived in accordance herewith,

or (ii) at such other time and place or on such date as the Purchaser and the Company may agree upon (such date on which the Closing

occurs, the “Closing Date”). At the Closing, the Purchaser shall deliver or cause to be delivered to the Company the

Dotan Debt that the Purchaser is exchanging pursuant to the terms hereof, together with all appropriate instruments of transfer. At the

Closing, the Company shall deliver the Shares to the Purchaser in book entry form on the records of the transfer agent of the Company.

ARTICLE

II.

Representations and Warranties

Section

2.1. Representations and Warranties of the Company. The Company hereby represents and warrants to the Purchaser, as of the date

hereof and the Closing Date, as follows:

(a)

Organization, Good Standing and Power. The Company is a corporation duly incorporated, validly existing and in good standing under

the laws of the State of Nevada and has the requisite power to own, lease and operate its properties and assets and to conduct its business

as it is now being conducted. The Company is duly qualified as a foreign corporation to do business and is in good standing in every

jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary except for any

jurisdictions (alone or in the aggregate) in which the failure to be so qualified will not have a Material Adverse Effect. For the purposes

of this Agreement, “Material Adverse Effect” means any condition, circumstance, or situation that would prohibit or

hinder the Company from executing this Agreement and/or performing any of its obligations hereunder or thereunder in any material respect.

(b)

Authorization; Enforcement. The Company has the requisite power and authority to enter into and perform this Agreement and to

consummate the Exchange. The execution, delivery and performance of this Agreement by the Company have been duly and validly authorized

by all necessary corporate action, and no further consent or authorization is required for the Company to effect the transactions contemplated

hereby. When executed and delivered by the Company, the Agreement shall constitute a valid and binding obligation of the Company, enforceable

against the Company in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, reorganization,

moratorium, liquidation, conservatorship, receivership or similar laws relating to, or affecting generally the enforcement of, creditor’s

rights and remedies or by other equitable principles of general application.

(c)

Issuance of Shares. The Shares have been duly authorized by all necessary corporate action and, when issued in accordance with

the terms hereof upon surrender of the Dotan Debt in the Exchange, the Shares shall be validly issued and outstanding, fully paid and

non-assessable, free of restrictions on transfer other than as described herein and under applicable state and federal securities laws,

and assuming the accuracy of the Purchaser’s representations and warranties set forth in Section 2.2 hereof, such Shares will have

been issued in compliance with all applicable state and federal securities laws.

(d)

No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of

the transactions contemplated hereby does not and will not (i) violate any provision of the Company’s Certificate of Incorporation

or Bylaws, each as amended to date, (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both

would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any material

agreement, mortgage, deed of trust, indenture, note, bond, license, lease agreement, instrument or obligation to which the Company is

a party or by which any of the Company’s properties or assets are bound, or (iii) result in a violation of any federal, state,

local or foreign statute, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations) applicable

to the Company or by which any property or asset of the Company is bound or affected, except, in all cases, other than violations pursuant

to clauses (i) or (iii) (with respect to federal and state securities laws) above, except, for such conflicts, defaults, terminations,

amendments, acceleration, cancellations and violations as would not, individually or in the aggregate, have a Material Adverse Effect.

The Company is not required under federal, state, foreign or local law, rule or regulation to obtain any consent, authorization or order

of, or make any filing or registration with, any court or governmental agency in order for it to execute, deliver or perform any of its

obligations under this Agreement or consummate the Exchange in accordance with the terms hereof (other than any filings, consents and

approvals which may be required to be made by the Company under applicable state and federal securities laws, rules or regulations, or

the rules of the Nasdaq Capital Market, prior to or subsequent to the Closing).

(e)

Offering. No form of general solicitation or general advertising (as defined in Regulation D of the Securities Act of 1933, as

amended) was used by the Company or any of its respective representatives in connection with the offer and sale of the Shares hereby,

including, but not limited to, articles, notices or other communications published in any newspaper, magazine or similar medium or broadcast

over television or radio, or any seminar or other meeting whose attendees have been invited by any general solicitation or general advertising.

Section

2.2. Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants to the Company, as of the date

hereof and as of the Closing Date, as follows:

(a)

Organization and Standing of the Purchaser. The Purchaser is a corporation duly incorporated, validly existing and in good standing

under the laws of the jurisdiction of its incorporation.

(b)

Authorization and Power. The Purchaser has the requisite power and authority to enter into and perform this Agreement and to consummate

the Exchange. The execution, delivery and performance of this Agreement the Purchaser and the consummation by it of the transactions

contemplated hereby have been duly authorized by all necessary corporate action, and no further consent or authorization is required

for the Purchaser to effect the transactions contemplated hereby. When executed and delivered by the Purchaser, this Agreement shall

constitute valid and binding obligations of the Purchaser enforceable against the Purchaser in accordance with their terms, except as

such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation, conservatorship, receivership

or similar laws relating to, or affecting generally the enforcement of, creditor’s rights and remedies or by other equitable principles

of general application.

(c)

No Conflict. The execution, delivery and performance of this Agreement by the Purchaser and the consummation by the Purchaser

of the transactions contemplated hereby does not and will not (i) if applicable, violate any provision of the Purchaser’s Certificate

of Incorporation or Bylaws, each as amended to date, (ii) assuming the execution and delivery of those documents set forth in Section

4.2(e) hereof, conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default)

under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, mortgage, deed of trust,

indenture, note, bond, license, lease agreement, instrument or obligation to which the Purchaser is a party or by which the Purchaser’s

properties or assets are bound, or (iii) result in a violation of any federal, state, local or foreign statute, rule, regulation, order,

judgment or decree (including federal and state securities laws and regulations) applicable to the Purchaser or by which any property

or asset of the Purchaser is bound or affected, except, in all cases, other than violations pursuant to clauses (i) or (iii) (with respect

to federal and state securities laws) above, except, for such conflicts, defaults, terminations, amendments, acceleration, cancellations

and violations as would not, individually or in the aggregate, materially and adversely affect Purchaser’s ability to perform its

obligations hereunder.

(d)

Acquisition for Investment. The Purchaser is acquiring the Shares solely for its own account and not with a view to or for sale

in connection with any distribution.

(e)

Assessment of Risks. The Purchaser acknowledges that it (i) has such knowledge and experience in financial and business matters

that such Purchaser is capable of evaluating the merits and risks of such Purchaser’s investment in the Company (by virtue of its

purchase of Shares hereunder), (ii) is able to bear the financial risks associated with an investment in the Shares and (iii) has been

given full access to such records of the Company and to the officers of the Company as it has deemed necessary or appropriate to conduct

its due diligence investigation with respect to the Shares.

(f)

No General Solicitation. The Purchaser acknowledges that the Shares were not offered to the Purchaser by means of any form of

general or public solicitation or general advertising, or publicly disseminated advertisements or sales literature, including (i) any

advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast over television

or radio or (ii) any seminar or meeting to which the Purchaser was invited by any of the foregoing means of communications.

(g)

Accredited Investor. The Purchaser is an “accredited investor” (as defined in Rule 501 of Regulation D under the Securities

Act of 1933, as amended).

(h)

Legend. The Purchaser hereby acknowledges and agrees that the certificates or other documents representing the Shares may contain

the following, or a substantially similar, legend, which legend shall be removed only upon receipt by the Company of an opinion of its

counsel, which opinion shall be satisfactory to the Company, that such legend may be so removed:

THE

SECURITIES REPRESENTED HEREBY (THE “SECURITIES”) HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“SECURITIES ACT”) OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED OF UNLESS REGISTERED

UNDER THE SECURITIES ACT AND UNDER APPLICABLE STATE SECURITIES LAWS OR THE COMPANY SHALL HAVE RECEIVED AN OPINION OF ITS COUNSEL THAT

REGISTRATION OF SUCH SECURITIES UNDER THE SECURITIES ACT AND UNDER THE PROVISIONS OF APPLICABLE STATE SECURITIES LAWS IS NOT REQUIRED.

(i)

Certain Fees. The Purchaser has not employed any broker or finder or incurred any liability for any brokerage, investment banking,

commission, finders’, structuring or financial advisory fees or other similar fees in connection with this Agreement or the transactions

contemplated hereby.

ARTICLE

III.

Covenants of the Parties

Section

3.1. Covenants. The parties hereto hereby covenant with each other as follows, which covenants, as applicable, are for the benefit

of such parties and their respective permitted assigns:

(a)

Further Assurances. From and after the Closing Date, upon the request of the Purchaser or the Company, the Company and the Purchaser

shall execute and deliver such instruments, documents and other writings as may be reasonably necessary or desirable to confirm and carry

out and to effectuate fully the intent and purposes of this Agreement, including, without limitation, authorizing the Company’s

transfer agent to issue shares of the Company’s common stock to the purchasers of the Shares sold by the Purchaser.

(b)

Commercially Reasonable Efforts. Each party hereto will use commercially reasonable efforts to take, or cause to be taken, all

action, and to do, or cause to be done, all things necessary, proper or advisable, consistent with applicable law, to consummate and

make effective in the most expeditious manner practicable the transactions contemplated hereby, including without limitation, making

all required regulatory and other filings required by applicable law as promptly as practicable after the date hereof.

ARTICLE

IV.

Conditions

Section