Second Quarter Financial Results

- Second quarter revenue grew 9% year-over-year to $60.9

million

- Second quarter subscription revenue grew 29% year-over-year to

$29.6 million

- Annual Recurring Revenue (ARR) increased 15% year-over-year to

$165.3 million1

- Net Retention Rate (NRR) of 112%2

OneSpan Inc. (NASDAQ: OSPN), the digital agreements security

company, today reported financial results for the second quarter

ended June 30, 2024.

“I’m extremely proud of our team, as their hard work and

continued focus on operational rigor delivered a strong quarter

with 9% revenue growth, 15% ARR growth, and significantly improved

profitability,” stated OneSpan CEO, Victor Limongelli. “Looking

ahead, we will continue to focus on driving efficient revenue

growth, profitability, and cash flow as we continue to work to

improve our long-term operating profile.”

Second Quarter 2024 Financial Highlights

- Total revenue was $60.9 million, an increase of 9%

compared to $55.7 million for the same quarter of 2023. Digital

Agreements revenue was $15.5 million, an increase of 30%

year-over-year. Security Solutions revenue was $45.5 million, an

increase of 4% year-over-year.

- ARR increased 15% year-over-year to $165.3 million.

- Gross profit was $40.3 million, or 66% gross margin,

compared to $34.3 million, or 62% in the same period last

year.

- Operating income was $7.6 million, compared to operating

loss of $17.8 million in the same period last year.

- Net income was $6.6 million, or $0.17 per diluted share,

compared to net loss of $17.8 million, or $(0.44) per diluted

share, in the same period last year. Non-GAAP net income was $12.0

million, or $0.31 per diluted share, compared to net loss of $7.3

million, or $(0.18) per diluted share in the same period last

year.3

- Adjusted EBITDA was $16.1 million, compared to $(3.8)

million in the same period last year.

- Cash and cash equivalents were $63.8 million at June 30,

2024 compared to $43.0 million at December 31, 2023.

Financial Outlook

For the Full Year 2024, OneSpan expects:

- Revenue to be in the range of $238 million to $246

million.

- ARR to finish the year in the range of $166 million to $170

million, as compared to its previous guidance range of $160 million

to $168 million.

- Adjusted EBITDA to be in the range of $55 million to $59

million, as compared to its previous guidance range of $51 million

to $55 million.3

Conference Call Details

In conjunction with this announcement, OneSpan Inc. will host a

conference call today, August 1, 2024, at 4:30 p.m. ET. During the

conference call, Mr. Victor Limongelli, CEO, and Mr. Jorge Martell,

CFO, will discuss OneSpan’s results for the second quarter

2024.

For investors and analysts accessing the conference call by

phone, please refer to the press release dated July 9, 2024,

announcing the date of OneSpan’s second quarter 2024 earnings

release. It can be found on the OneSpan investor relations website

at investors.onespan.com.

The conference call is also available in listen-only mode at

investors.onespan.com. Shortly after the conclusion of the call, a

replay of the webcast will be available on the same website for

approximately one year.

____________________________________________

- ARR is calculated as the approximate annualized value of our

customer recurring contracts as of the measurement date. These

include subscription, term-based license, and maintenance and

support contracts and exclude one-time fees. To the extent that we

are negotiating a renewal with a customer within 90 days after the

expiration of a recurring contract, we continue to include that

revenue in ARR if we are actively in discussion with the customer

for a new recurring contract or renewal and the customer has not

notified us of an intention to not renew. See our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2024 for additional

information describing how we define ARR, including how ARR differs

from GAAP revenue.

- NRR is defined as the approximate year-over-year growth in ARR

from the same set of customers at the end of the prior year

period.

- An explanation of the use of Non-GAAP financial measures is

included below under the heading “Non-GAAP Financial Measures.” A

reconciliation of each Non-GAAP financial measure to the most

directly comparable GAAP financial measure has also been provided

in the tables below. We are not providing a reconciliation of

Adjusted EBITDA guidance to GAAP net income, the most directly

comparable GAAP measure, because we are unable to predict certain

items included in GAAP net income without unreasonable

efforts.

About OneSpan

OneSpan provides security, identity, electronic signature

(“e-signature”) and digital workflow solutions that protect and

facilitate digital transactions and agreements. The Company

delivers products and services that automate and secure

customer-facing and revenue-generating business processes for use

cases ranging from simple transactions to workflows that are

complex or require higher levels of security. Trusted by global

blue-chip enterprises, including more than 60% of the world’s 100

largest banks, OneSpan processes millions of digital agreements and

billions of transactions in 100+ countries annually.

For more information, go to www.onespan.com. You can also follow

@OneSpan on X (Twitter) or visit us on LinkedIn and Facebook.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of applicable U.S. securities laws, including

statements regarding our 2024 financial guidance and our plans to

continue to focus on driving efficient revenue growth,

profitability and cash flow as we work to improve our long-term

operating profile; and our general expectations regarding our

operational or financial performance in the future. Forward-looking

statements may be identified by words such as "seek", "believe",

"plan", "estimate", "anticipate", “expect", "intend", "continue",

"outlook", "may", "will", "should", "could", or "might", and other

similar expressions. These forward-looking statements involve risks

and uncertainties, as well as assumptions that, if they do not

fully materialize or prove incorrect, could cause our results to

differ materially from those expressed or implied by such

forward-looking statements. Factors that could materially affect

our business and financial results include, but are not limited to:

our ability to execute our updated business transformation plan and

cost reduction and restructuring actions in the expected timeframe

and to achieve the outcomes we expect from them; unintended costs

and consequences of our cost reduction and restructuring actions,

including higher than anticipated restructuring charges, disruption

to our operations, litigation or regulatory actions, reduced

employee morale, attrition of valued employees, adverse effects on

our reputation as an employer, loss of institutional know-how,

slower customer service response times, and reduced ability to

complete or undertake new product development projects and other

business, product, technical, compliance or risk mitigation

initiatives; our ability to attract new customers and retain and

expand sales to existing customers; our ability to successfully

develop and market new product offerings and product enhancements;

changes in customer requirements; the potential effects of

technological changes; the loss of one or more large customers;

difficulties enhancing and maintaining our brand recognition;

competition; lengthy sales cycles; challenges retaining key

employees and successfully hiring and training qualified new

employees; security breaches or cyber-attacks; real or perceived

malfunctions or errors in our products; interruptions or delays in

the performance of our products and solutions; reliance on third

parties for certain products and data center services; our ability

to effectively manage third party partnerships, acquisitions,

divestitures, alliances, or joint ventures; economic recession,

inflation, and political instability; claims that we have infringed

the intellectual property rights of others; price competitive

bidding; changing laws, government regulations or policies;

pressures on price levels; component shortages; delays and

disruption in global transportation and supply chains; impairment

of goodwill or amortizable intangible assets causing a significant

charge to earnings; actions of activist stockholders; and exposure

to increased economic and operational uncertainties from operating

a global business, as well as other factors described in the “Risk

Factors” section of our most recent Annual Report on Form 10-K, as

updated by the “Risk Factors” section of our subsequent Quarterly

Reports on Form 10-Q (if any). Our filings with the Securities and

Exchange Commission (the “SEC”) and other important information can

be found in the Investor Relations section of our website at

investors.onespan.com. We do not have any intent, and disclaim any

obligation, to update the forward-looking information to reflect

events that occur, circumstances that exist or changes in our

expectations after the date of this press release, except as

required by law.

Unless otherwise noted, references in this press release to

“OneSpan”, “Company”, “we”, “our”, and “us” refer to OneSpan Inc.

and its subsidiaries.

OneSpan Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

Product and license

$

32,438

$

30,583

$

70,236

$

63,729

Services and other

28,486

25,150

55,531

49,611

Total revenue

60,924

55,733

125,767

113,340

Cost of goods sold

Product and license

11,247

14,038

20,953

25,326

Services and other

9,336

7,401

17,078

14,434

Total cost of goods sold

20,583

21,439

38,031

39,760

Gross profit

40,341

34,294

87,736

73,580

Operating costs

Sales and marketing

10,510

19,713

23,437

39,724

Research and development

8,341

10,090

16,600

19,553

General and administrative

11,557

15,826

21,564

32,479

Restructuring and other related

charges

1,711

5,846

3,208

6,552

Amortization of intangible assets

585

583

1,180

1,166

Total operating costs

32,704

52,058

65,989

99,474

Operating income (loss)

7,637

(17,764

)

21,747

(25,894

)

Interest income, net

521

585

622

1,088

Other income (expense), net

331

29

622

(11

)

Income (loss) before income taxes

8,489

(17,150

)

22,991

(24,817

)

Provision for income taxes

1,936

601

2,970

1,290

Net income (loss)

$

6,553

$

(17,751

)

$

20,021

$

(26,107

)

Net income (loss) per share

Basic

$

0.17

$

(0.44

)

$

0.52

$

(0.65

)

Diluted

$

0.17

$

(0.44

)

$

0.52

$

(0.65

)

Weighted average common shares

outstanding

Basic

38,529

40,399

38,229

40,435

Diluted

39,007

40,399

38,680

40,435

OneSpan Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands,

unaudited)

June 30,

December 31,

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

63,843

$

43,001

Restricted cash

460

529

Accounts receivable, net of allowances of

$1,506 at June 30, 2024 and $1,536 at December 31, 2023

43,799

64,387

Inventories, net

12,507

15,553

Prepaid expenses

6,126

6,575

Contract assets

6,036

5,139

Other current assets

11,096

11,159

Total current assets

143,867

146,343

Property and equipment, net

20,251

18,722

Operating lease right-of-use assets

7,262

6,171

Goodwill

93,072

93,684

Intangible assets, net of accumulated

amortization

8,679

10,832

Deferred income taxes

1,693

1,721

Other assets

12,039

11,718

Total assets

$

286,863

$

289,191

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

14,593

$

17,452

Deferred revenue

55,928

69,331

Accrued wages and payroll taxes

12,386

14,335

Short-term income taxes payable

2,521

2,646

Other accrued expenses

8,124

10,684

Deferred compensation

151

382

Total current liabilities

93,703

114,830

Long-term deferred revenue

3,374

4,152

Long-term lease liabilities

7,003

6,824

Deferred income taxes

992

1,067

Other long-term liabilities

3,212

3,177

Total liabilities

108,284

130,050

Commitments and contingencies

Stockholders' equity

Preferred stock: 500 shares authorized,

none issued and outstanding at June 30, 2024 and December 31,

2023

—

—

Common stock: $0.001 par value per share,

75,000 shares authorized; 41,510 and 41,243 shares issued; 37,786

and 37,519 shares outstanding at June 30, 2024 and December 31,

2023, respectively

38

38

Additional paid-in capital

120,237

118,620

Treasury stock, at cost: 3,724 shares

outstanding at June 30, 2024 and December 31, 2023

(47,377

)

(47,377

)

Retained earnings

118,960

98,939

Accumulated other comprehensive loss

(13,279

)

(11,079

)

Total stockholders' equity

178,579

159,141

Total liabilities and stockholders'

equity

$

286,863

$

289,191

OneSpan Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands,

unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

20,021

$

(26,107

)

Adjustments to reconcile net income (loss)

from operations to net cash used in operations:

Depreciation and amortization of

intangible assets

4,145

2,835

Write-off of intangible assets

804

—

Write-off of property and equipment,

net

955

2,087

Impairments of inventories, net

—

1,568

Deferred tax benefit

(108

)

66

Stock-based compensation

3,448

8,315

Allowance for credit losses

(31

)

(49

)

Changes in operating assets and

liabilities:

Accounts receivable

19,877

27,356

Inventories, net

2,621

(4,299

)

Contract assets

(1,666

)

(1,017

)

Accounts payable

(2,634

)

35

Income taxes payable

(107

)

(2,638

)

Accrued expenses

(4,046

)

(1,728

)

Deferred compensation

(231

)

(122

)

Deferred revenue

(13,662

)

(13,940

)

Other assets and liabilities

(124

)

1,248

Net cash provided by (used in) operating

activities

29,262

(6,390

)

Cash flows from investing activities:

Maturities of short-term investments

—

2,330

Additions to property and equipment

(5,321

)

(6,491

)

Additions to intangible assets

(39

)

(14

)

Cash paid for acquisition of business

—

(1,800

)

Net cash used in investing activities

(5,360

)

(5,975

)

Cash flows from financing activities:

Contingent payment related to

acquisition

(200

)

—

Tax payments for restricted stock

issuances

(1,831

)

(1,546

)

Net cash used in financing activities

(2,031

)

(1,546

)

Effect of exchange rate changes on

cash

(1,098

)

624

Net increase (decrease) in cash

20,773

(13,287

)

Cash, cash equivalents, and restricted

cash, beginning of period

43,530

97,374

Cash, cash equivalents, and restricted

cash, end of period

$

64,303

$

84,087

Operating Segments

In May 2022, we announced a three-year strategic transformation

plan that began on January 1, 2023. In conjunction with the

strategic transformation plan and to enable a more efficient

capital deployment model, effective with the quarter ended June 30,

2022, we began reporting under the following two lines of business,

which are our reportable operating segments: Digital Agreements and

Security Solutions.

- Digital Agreements. Digital Agreements consists of

solutions that enable our clients to secure and automate business

processes associated with their digital agreement and customer

transaction lifecycles that require consent, non-repudiation and

compliance. These solutions, which are largely cloud-based, include

OneSpan Sign e-signature, OneSpan Notary, and Identity

Verification. This segment also includes costs attributable to our

transaction cloud platform.

- Security Solutions. Security Solutions consists of our

broad portfolio of software products, software development kits

(SDKs) and Digipass authenticator devices that are used to build

applications designed to defend against attacks on digital

transactions across online environments, devices, and applications.

The software products and SDKs included in the Security Solutions

segment are largely on-premises software products and include

multi-factor authentication and transaction signing solutions, such

as mobile application security and mobile software tokens.

Segment operating income consists of the revenues generated by a

segment, less the direct costs of revenue, sales and marketing,

research and development expenses, amortization expense, and

restructuring and other related charges that are incurred directly

by a segment. Unallocated corporate costs include costs related to

administrative functions that are performed in a centralized manner

that are not attributable to a particular segment.

Segment and consolidated operating

results (unaudited):

Three Months Ended June

30,

Six Months Ended June

30,

(In thousands, except percentages)

2024

2023

2024

2023

Digital Agreements

Revenue

$

15,463

$

11,862

$

29,876

$

23,414

Gross profit (1)

$

9,741

$

8,583

$

19,632

$

17,031

Gross margin

63

%

72

%

66

%

73

%

Operating loss (2)

$

(155

)

$

(7,121

)

$

(420

)

$

(13,154

)

Security Solutions

Revenue

$

45,461

$

43,871

$

95,891

$

89,926

Gross profit (3)

$

30,600

$

25,711

$

68,104

$

56,549

Gross margin

67

%

59

%

71

%

63

%

Operating income (4)

$

20,693

$

8,523

$

46,571

$

24,154

Total Company:

Revenue

$

60,924

$

55,733

$

125,767

$

113,340

Gross profit

$

40,341

$

34,294

$

87,736

$

73,580

Gross margin

66

%

62

%

70

%

65

%

Statements of Operations

reconciliation:

Segment operating income

$

20,538

$

1,402

$

46,151

$

11,000

Corporate operating expenses not allocated

at the segment level

12,901

19,166

24,404

36,894

Operating income (loss)

$

7,637

$

(17,764

)

$

21,747

$

(25,894

)

Interest income, net

521

585

622

1,088

Other income (expense), net

331

29

622

(11

)

Income (loss) before income taxes

$

8,489

$

(17,150

)

$

22,991

$

(24,817

)

(1)

Digital Agreements gross profit includes

intangible asset write-off of $0.8 million and internal capitalized

software write-off of $0.7 million for the three and six months

ended June 30, 2024.

(2)

Digital Agreements operating loss includes

$0.6 million and $1.1 million of amortization of intangible assets

expense for the three and six months ended June 30, 2024,

respectively, and $0.6 million and $1.1 million of amortization of

intangible assets expense for the three and six months ended June

30, 2023, respectively.

(3)

Security Solutions gross profit includes

$1.6 million of inventory impairments related to discontinuation of

investments in our Digipass CX product for the three and six months

ended June 30, 2023.

(4)

Security Solutions operating income

includes $1.6 million of inventory impairments and $1.4 million of

capitalized software write-offs related to discontinuation of

investments in our Digipass CX product for the three and six months

ended June 30, 2023.

Revenue by major products and services

(unaudited):

Three Months Ended June

30,

2024

2023

(In thousands)

Digital Agreements

Security Solutions

Digital Agreements

Security Solutions

Subscription

$

14,785

$

14,857

$

10,486

$

12,499

Maintenance and support

490

9,742

1,130

10,473

Professional services and other (1)

188

1,123

246

1,253

Hardware products

—

19,739

—

19,646

Total Revenue

$

15,463

$

45,461

$

11,862

$

43,871

Six Months Ended June

30,

2024

2023

(In thousands)

Digital Agreements

Security Solutions

Digital Agreements

Security Solutions

Subscription

28,597

41,039

20,834

32,107

Maintenance and support

994

19,808

2,126

20,638

Professional services and other (1)

285

2,728

454

2,669

Hardware products

—

32,316

—

34,512

Total Revenue

$

29,876

$

95,891

$

23,414

$

89,926

(1)

Professional services and other includes

perpetual software licenses revenue, which was approximately 1% of

total revenue for both the three and six months ended June 30, 2024

and approximately 1% of total revenue for both the three and six

months ended June 30, 2023.

Non-GAAP Financial Measures

We report financial results in accordance with GAAP. We also

evaluate our performance using certain Non-GAAP financial metrics,

namely Adjusted EBITDA, Non-GAAP Net Income (Loss) and Non-GAAP Net

Income (Loss) Per Diluted Share. Our management believes that these

measures, when taken together with the corresponding GAAP financial

metrics, provide useful supplemental information regarding the

performance of our business, as further discussed in the

descriptions of each of these Non-GAAP metrics below.

These Non-GAAP financial measures are not measures of

performance under GAAP and should not be considered in isolation or

as alternatives or substitutes for the most directly comparable

financial measures calculated in accordance with GAAP. While we

believe that these Non-GAAP financial measures are useful for the

purposes described below, they have limitations associated with

their use, since they exclude items that may have a material impact

on our reported results and may be different from similar measures

used by other companies. Additional information about the Non-GAAP

financial measures and reconciliations to their most directly

comparable GAAP financial measures appear below.

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss) before interest,

taxes, depreciation, amortization, long-term incentive

compensation, restructuring and other related charges, and certain

non-recurring items, including acquisition related costs,

rebranding costs, and non-routine shareholder matters. We use

Adjusted EBITDA as a simplified measure of performance for use in

communicating our performance to investors and analysts and for

comparisons to other companies within our industry. As a

performance measure, we believe that Adjusted EBITDA presents a

view of our operating results that is most closely related to

serving our customers. By excluding interest, taxes, depreciation,

amortization, long-term incentive compensation, restructuring

costs, and certain other non-recurring items, we are able to

evaluate performance without considering decisions that, in most

cases, are not directly related to meeting our customers’

requirements and were either made in prior periods (e.g.,

depreciation, amortization, long-term incentive compensation,

non-routine shareholder matters), deal with the structure or

financing of the business (e.g., interest, one-time strategic

action costs, restructuring costs, impairment charges) or reflect

the application of regulations that are outside of the control of

our management team (e.g., taxes). In addition, removing the impact

of these items helps us compare our core business performance with

that of our competitors.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(in thousands,

unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(In thousands)

2024

2023

2024

2023

Net income (loss)

$

6,553

$

(17,751

)

$

20,021

$

(26,107

)

Interest income, net

(521

)

(585

)

(622

)

(1,088

)

Provision for income taxes

1,936

601

2,970

1,290

Depreciation and amortization of

intangible assets (1)

2,063

1,516

4,145

2,835

Long-term incentive compensation (2)

1,994

4,571

3,615

8,494

Restructuring and other related charges

(3)

3,218

5,846

4,734

6,552

Other non-recurring items (4)

906

1,974

1,077

2,559

Adjusted EBITDA

$

16,149

$

(3,828

)

$

35,940

$

(5,465

)

(1)

Includes cost of sales depreciation and

amortization expense directly related to delivering cloud

subscription revenue of $0.9 million and $1.7 million for the

three and six months ended June 30, 2024, respectively, and

$0.2 million and $0.3 million for the three and six months ended

June 30, 2023, respectively. Costs are recorded in "Services

and other cost of goods sold" on the condensed consolidated

statements of operations.

(2)

Long-term incentive compensation includes

stock-based compensation and cash incentive grants awarded to

employees located in jurisdictions where we do not issue

stock-based compensation due to tax, regulatory or similar reasons.

The immaterial expense associated with these cash incentive grants

was $0.1 million for both the three months ended June 30, 2024

and 2023 and $0.2 million for both the six months ended

June 30, 2024 and 2023.

(3)

Includes write-offs of intangible assets

and property and equipment, net of $0.8 million and $1.0 million,

respectively, for the three and six months ended June 30, 2024

and $0 for both the three and six months ended June 30, 2023.

Costs are recorded in "Services and other cost of goods sold" and

"Restructuring and other related charges," respectively, on the

condensed consolidated statements of operations.

Includes immaterial restructuring and

other related charges of less than $0.1 million for both the three

and six months ended June 30, 2024 and $0 for both the three

and six months ended June 30, 2023. These charges are recorded

in "Services and other cost of goods sold" on the condensed

consolidated statements of operations.

(4)

For the three months ended June 30,

2024, other non-recurring items consist of $0.9 million of

fees related to non-recurring projects.

For the three months ended June 30,

2023, other non-recurring items consist of $1.6 million of

inventory impairment charges and $0.4 million of fees related to

non-recurring projects.

For the six months ended June 30,

2024, other non-recurring items consist of $1.1 million of

fees related to non-recurring projects.

For the six months ended June 30,

2023, other non-recurring items consist of $1.6 million of

inventory impairment charges and $1.0 million of fees related to

non-recurring projects and our acquisition of ProvenDB.

Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) Per

Diluted Share

We define Non-GAAP Net Income (Loss) and Non-GAAP Net Income

(Loss) Per Diluted Share as net income (loss) or net income (loss)

per diluted share, as applicable, before the consideration of

long-term incentive compensation expenses, the amortization of

intangible assets, restructuring costs, and certain other

non-recurring items. We use these measures to assess the impact of

our performance excluding items that can significantly impact the

comparison of our results between periods and the comparison to

competitor results.

We exclude long-term incentive compensation expense because our

long-term incentives generally reflect the use of restricted stock

unit grants or cash incentive grants, including incentives directly

tied to the performance of the business, while other companies may

use different forms of incentives that have different cost impacts,

which makes comparison difficult. We exclude amortization of

intangible assets as we believe the amount of such expense in any

given period may not be correlated directly to the performance of

the business operations and that such expenses can vary

significantly between periods as a result of new acquisitions, the

full amortization of previously acquired intangible assets, or the

write down of such assets due to an impairment event. However,

intangible assets contribute to current and future revenue, and

related amortization expense will recur in future periods until

expired or written down.

We also exclude certain non-recurring items including one-time

strategic action costs and non-recurring shareholder matters, as

these items are unrelated to the operations of our core business.

By excluding these items, we are better able to compare the

operating results of our underlying core business from one

reporting period to the next.

We make a tax adjustment based on the above adjustments

resulting in an effective tax rate on a Non-GAAP basis, which may

differ from the GAAP tax rate. We believe the effective tax rates

we use in the adjustment are reasonable estimates of the overall

tax rates for the Company under its global operating structure.

Reconciliation of Net Income

(Loss) to Non-GAAP Net Income (Loss)

(in thousands, except per

share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss)

$

6,553

$

(17,751

)

$

20,021

$

(26,107

)

Amortization of intangible assets (1)

666

704

1,381

1,327

Long-term incentive compensation (2)

1,994

4,571

3,615

8,494

Restructuring and other related charges

(3)

3,218

5,846

4,734

6,552

Other non-recurring items (4)

906

1,974

1,077

2,559

Tax impact of adjustments (5)

(1,357

)

(2,619

)

(2,161

)

(3,786

)

Non-GAAP net income (loss)

$

11,980

$

(7,275

)

$

28,667

$

(10,961

)

Non-GAAP net income (loss) per share

$

0.31

$

(0.18

)

$

0.74

$

(0.27

)

Shares

39,007

40,399

38,680

40,435

(1)

Includes cost of sales amortization

expense directly related to delivering cloud subscription revenue

of $0.1 million and $0.2 million for the three and six months ended

June 30, 2024, respectively, and $0.1 million and $0.2 million for

the three and six months ended June 30, 2023, respectively. Costs

are recorded in "Services and other cost of goods sold" on the

condensed consolidated statements of operations.

(2)

Long-term incentive compensation includes

stock-based compensation and cash incentive grants awarded to

employees located in jurisdictions where we do not issue

stock-based compensation due to tax, regulatory or similar reasons.

The immaterial expense associated with these cash incentive grants

was $0.1 million for both the three months ended June 30, 2024 and

2023 and $0.2 million for both the six months ended June 30, 2024

and 2023.

(3)

Includes write-offs of intangible assets

and property and equipment, net of $0.8 million and $1.0 million,

respectively, for the three and six months ended June 30, 2024 and

$0 for both the three and six months ended June 30, 2023. Costs are

recorded in "Services and other cost of goods sold" and

"Restructuring and other related charges," respectively, on the

condensed consolidated statements of operations.

Includes immaterial restructuring and

other related charges of less than $0.1 million for both the three

and six months ended June 30, 2024, and $0 for both the three and

six months ended June 30, 2023. These charges are recorded in

"Services and other cost of goods sold" on the condensed

consolidated statements of operations.

(4)

See the footnotes to the Reconciliation of

Net Income (Loss) to Adjusted EBITDA for a description of the

components of other non-recurring items for each period

presented.

(5)

The tax impact of adjustments is

calculated as 20% of the adjustments in all periods.

Copyright© 2024 OneSpan North America Inc., all rights reserved.

OneSpan™ is a registered or unregistered trademark of OneSpan North

America Inc. or its affiliates in the U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801904449/en/

Investor Contact: Joe Maxa Vice President of Investor

Relations +1-312-766-4009 joe.maxa@onespan.com

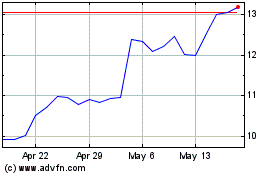

OneSpan (NASDAQ:OSPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

OneSpan (NASDAQ:OSPN)

Historical Stock Chart

From Nov 2023 to Nov 2024