- Operating income was $11.3 million, compared to an operating

loss of $4.8 million in the year-ago period

- Revenue decreased 4% year-over-year to $56.2 million

- Subscription revenue increased 29% year-over-year to $33.6

million

- Annual Recurring Revenue (ARR) increased 9% year-over-year to

$163.9 million1

- Net Retention Rate (NRR) of 106%2

OneSpan Inc. (NASDAQ: OSPN) today reported financial results for

the third quarter ended September 30, 2024.

“We reported another strong quarter of subscription growth,

profitability and cash generation driven by our team’s hard work

and operational focus,” stated OneSpan CEO, Victor Limongelli. “The

OneSpan team has done a tremendous job in delivering value to our

customers while increasing our profitability. We are now much

better positioned to drive efficient revenue growth over the

long-term.”

Third Quarter 2024 Financial Highlights

- Total revenue was $56.2 million, a decrease of 4%

compared to $58.8 million for the same quarter of 2023. Digital

Agreements revenue was $15.4 million, an increase of 18%

year-over-year. Security Solutions revenue was $40.8 million, a

decrease of 11% year-over-year.

- ARR increased 9% year-over-year to $163.9 million.

- Gross profit was $41.5 million, or 74% gross margin,

compared to $40.7 million, or 69% in the same period last

year.

- Operating income was $11.3 million, compared to

operating loss of $4.8 million in the same period last year.

- Net income was $8.3 million, or $0.21 per diluted share,

compared to net loss of $4.1 million, or $(0.10) per diluted share,

in the same period last year. Non-GAAP net income was $13.1

million, or $0.33 per diluted share, compared to net income of $3.6

million, or $0.09 per diluted share in the same period last

year.3

- Adjusted EBITDA was $16.7 million, compared to $6.3

million in the same period last year.3

- Cash and cash equivalents were $77.5 million at

September 30, 2024 compared to $43.0 million at December 31,

2023.

Financial Outlook

For the full year 2024, OneSpan is narrowing the range of its

previously issued revenue guidance to reflect a reduction in

anticipated hardware token shipments, partially offset by stronger

than previously expected subscription revenues. The Company is

affirming its ARR guidance and is increasing its Adjusted EBITDA

guidance to reflect stronger than originally anticipated operating

leverage driven by improved execution of its cost savings

initiatives.

More specifically, for the Full Year 2024, OneSpan expects:

- Revenue to be in the range of $238 million to $242 million, as

compared to its previous guidance range of $238 million to $246

million.

- ARR to finish the year in the range of $166 million to $170

million.

- Adjusted EBITDA to be in the range of $65 million to $67

million, as compared to its previous guidance range of $55 million

to $59 million.

Conference Call Details

In conjunction with this announcement, OneSpan Inc. will host a

conference call today, October 30, 2024, at 4:30 p.m. ET. During

the conference call, Mr. Victor Limongelli, CEO, and Mr. Jorge

Martell, CFO, will discuss OneSpan’s results for the third quarter

2024.

For investors and analysts accessing the conference call by

phone, please refer to the press release dated October 16, 2024,

announcing the date of OneSpan’s third quarter 2024 earnings

release. It can be found on the OneSpan investor relations website

at investors.onespan.com.

The conference call is also available in listen-only mode at

investors.onespan.com. Shortly after the conclusion of the call, a

replay of the webcast will be available on the same website for

approximately one year.

____________________________________________

- ARR is calculated as the approximate annualized value of our

customer recurring contracts as of the measurement date. These

include subscription, term-based license, and maintenance and

support contracts and exclude one-time fees. To the extent that we

are negotiating a renewal with a customer within 90 days after the

expiration of a recurring contract, we continue to include that

revenue in ARR if we are actively in discussion with the customer

for a new recurring contract or renewal and the customer has not

notified us of an intention to not renew. See our Quarterly Report

on Form 10-Q for the quarter ended September 30, 2024 for

additional information describing how we define ARR, including how

ARR differs from GAAP revenue.

- NRR is defined as the approximate year-over-year growth in ARR

from the same set of customers at the end of the prior year

period.

- An explanation of the use of Non-GAAP financial measures is

included below under the heading “Non-GAAP Financial Measures.” A

reconciliation of each Non-GAAP financial measure to the most

directly comparable GAAP financial measure has also been provided

in the tables below. We are not providing a reconciliation of

Adjusted EBITDA guidance to GAAP net income, the most directly

comparable GAAP measure, because we are unable to predict certain

items included in GAAP net income without unreasonable

efforts.

About OneSpan

OneSpan provides security, identity, electronic signature

(“e-signature”) and digital workflow solutions that protect and

facilitate digital transactions and agreements. The Company

delivers products and services that automate and secure

customer-facing and revenue-generating business processes for use

cases ranging from simple transactions to workflows that are

complex or require higher levels of security. Trusted by global

blue-chip enterprises, including more than 60% of the world’s 100

largest banks, OneSpan processes millions of digital agreements and

billions of transactions in 100+ countries annually.

For more information, go to www.onespan.com. You can also follow

@OneSpan on X (Twitter) or visit us on LinkedIn and Facebook.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of applicable U.S. securities laws, including

statements regarding our 2024 financial guidance and our plans to

drive efficient revenue growth, profitability and cash flow and our

general expectations regarding our operational or financial

performance in the future. Forward-looking statements may be

identified by words such as "seek", "believe", "plan", "estimate",

"anticipate", “expect", "intend", "continue", "outlook", "may",

"will", "should", "could", or "might", and other similar

expressions. These forward-looking statements involve risks and

uncertainties, as well as assumptions that, if they do not fully

materialize or prove incorrect, could cause our results to differ

materially from those expressed or implied by such forward-looking

statements. Factors that could materially affect our business and

financial results include, but are not limited to: our ability to

execute our updated business transformation plan and cost reduction

and restructuring actions in the expected timeframe and to achieve

the outcomes we expect from them; unintended costs and consequences

of our cost reduction and restructuring actions, including higher

than anticipated restructuring charges, disruption to our

operations, litigation or regulatory actions, or employee turnover;

our ability to attract new customers and retain and expand sales to

existing customers; our ability to successfully develop and market

new product offerings and product enhancements; changes in customer

requirements; the potential effects of technological changes; the

loss of one or more large customers; difficulties enhancing and

maintaining our brand recognition; competition; lengthy sales

cycles; challenges retaining key employees and successfully hiring

and training qualified new employees; security breaches or

cyber-attacks; real or perceived malfunctions or errors in our

products; interruptions or delays in the performance of our

products and solutions; reliance on third parties for certain

products and data center services; our ability to effectively

manage third party partnerships, acquisitions, divestitures,

alliances, or joint ventures; economic recession, inflation, and

political instability; claims that we have infringed the

intellectual property rights of others; changing laws, government

regulations or policies; pressures on price levels; component

shortages; delays and disruption in global transportation and

supply chains; impairment of goodwill or amortizable intangible

assets causing a significant charge to earnings; actions of

activist stockholders; and exposure to increased economic and

operational uncertainties from operating a global business, as well

as other factors described in the “Risk Factors” section of our

most recent Annual Report on Form 10-K, as updated by the “Risk

Factors” section of our subsequent Quarterly Reports on Form 10-Q

(if any). Our filings with the Securities and Exchange Commission

(the “SEC”) and other important information can be found in the

Investor Relations section of our website at investors.onespan.com.

We do not have any intent, and disclaim any obligation, to update

the forward-looking information to reflect events that occur,

circumstances that exist or changes in our expectations after the

date of this press release, except as required by law.

Unless otherwise noted, references in this press release to

“OneSpan”, “Company”, “we”, “our”, and “us” refer to OneSpan Inc.

and its subsidiaries.

OneSpan Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

Product and license

$

28,640

$

31,732

$

98,875

$

95,461

Services and other

27,602

27,106

83,133

76,717

Total revenue

56,242

58,838

182,008

172,178

Cost of goods sold

Product and license

7,394

11,004

28,347

36,330

Services and other

7,300

7,165

24,377

21,599

Total cost of goods sold

14,694

18,169

52,724

57,929

Gross profit

41,548

40,669

129,284

114,249

Operating costs

Sales and marketing

10,138

16,664

33,574

56,388

Research and development

7,533

10,133

24,133

29,686

General and administrative

11,343

11,559

32,907

44,038

Restructuring and other related

charges

697

6,524

3,905

13,076

Amortization of intangible assets

585

583

1,766

1,749

Total operating costs

30,296

45,463

96,285

144,937

Operating income (loss)

11,252

(4,794

)

32,999

(30,688

)

Interest income, net

624

587

1,246

1,675

Other income (expense), net

(1,915

)

353

(1,293

)

342

Income (loss) before income taxes

9,961

(3,854

)

32,952

(28,671

)

Provision for income taxes

1,688

279

4,658

1,569

Net income (loss)

$

8,273

$

(4,133

)

$

28,294

$

(30,240

)

Net income (loss) per share

Basic

$

0.21

$

(0.10

)

$

0.74

$

(0.75

)

Diluted

$

0.21

$

(0.10

)

$

0.73

$

(0.75

)

Weighted average common shares

outstanding

Basic

38,695

40,454

38,323

40,529

Diluted

39,458

40,454

38,864

40,529

OneSpan Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands,

unaudited)

September 30,

December 31,

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

77,478

$

43,001

Restricted cash

350

529

Accounts receivable, net of allowances of

$1,414 at September 30, 2024 and $1,536 at December 31, 2023

28,841

64,387

Inventories, net

13,019

15,553

Prepaid expenses

6,703

6,575

Contract assets

6,390

5,139

Other current assets

9,092

11,159

Total current assets

141,873

146,343

Property and equipment, net

20,838

18,722

Operating lease right-of-use assets

7,872

6,171

Goodwill

96,132

93,684

Intangible assets, net of accumulated

amortization

8,117

10,832

Deferred income taxes

1,770

1,721

Other assets

12,672

11,718

Total assets

$

289,274

$

289,191

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

13,279

$

17,452

Deferred revenue

48,418

69,331

Accrued wages and payroll taxes

9,452

14,335

Short-term income taxes payable

3,160

2,646

Other accrued expenses

5,903

10,684

Deferred compensation

232

382

Total current liabilities

80,444

114,830

Long-term deferred revenue

2,929

4,152

Long-term lease liabilities

7,431

6,824

Deferred income taxes

1,104

1,067

Other long-term liabilities

2,780

3,177

Total liabilities

94,688

130,050

Commitments and contingencies

Stockholders' equity

Preferred stock: 500 shares authorized,

none issued and outstanding at September 30, 2024 and December 31,

2023

—

—

Common stock: $0.001 par value per share,

75,000 shares authorized; 41,634 and 41,243 shares issued; 37,910

and 37,519 shares outstanding at September 30, 2024 and December

31, 2023, respectively

38

38

Additional paid-in capital

122,098

118,620

Treasury stock, at cost: 3,724 shares

outstanding at September 30, 2024 and December 31, 2023

(47,377

)

(47,377

)

Retained earnings

127,233

98,939

Accumulated other comprehensive loss

(7,406

)

(11,079

)

Total stockholders' equity

194,586

159,141

Total liabilities and stockholders'

equity

$

289,274

$

289,191

OneSpan Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands,

unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

28,294

$

(30,240

)

Adjustments to reconcile net income (loss)

from operations to net cash used in operations:

Depreciation and amortization of

intangible assets

6,086

4,524

Write-off of intangible assets

804

—

Write-off of property and equipment,

net

1,053

2,712

Impairments of inventories, net

—

1,568

Deferred tax (benefit) expense

(14

)

44

Stock-based compensation

6,110

10,192

Provision for credit losses, net

(124

)

62

Changes in operating assets and

liabilities:

Accounts receivable

35,552

26,334

Inventories, net

2,639

(5,277

)

Contract assets

(2,080

)

(542

)

Accounts payable

(4,197

)

(834

)

Income taxes payable

519

(2,826

)

Accrued expenses

(9,491

)

(4,620

)

Deferred compensation

(150

)

(67

)

Deferred revenue

(22,165

)

(15,425

)

Other assets and liabilities

405

557

Net cash provided by (used in) operating

activities

43,241

(13,838

)

Cash flows from investing activities:

Maturities of short-term investments

—

2,330

Additions to property and equipment

(7,273

)

(9,035

)

Additions to intangible assets

(53

)

(31

)

Cash paid for acquisition of business

—

(1,800

)

Net cash used in investing activities

(7,326

)

(8,536

)

Cash flows from financing activities:

Contingent payment related to

acquisition

(200

)

—

Tax payments for restricted stock

issuances

(2,632

)

(2,335

)

Repurchase of common stock

—

(3,527

)

Net cash used in financing activities

(2,832

)

(5,862

)

Effect of exchange rate changes on

cash

1,215

145

Net increase (decrease) in cash

34,298

(28,091

)

Cash, cash equivalents, and restricted

cash, beginning of period

43,530

97,375

Cash, cash equivalents, and restricted

cash, end of period

$

77,828

$

69,284

Operating Segments

Since the quarter ended June 30, 2022, we have reported our

financial results under the following two lines of business, which

are our reportable operating segments: Digital Agreements and

Security Solutions.

- Digital Agreements. Digital Agreements consists of

solutions that enable our clients to secure and automate business

processes associated with their digital agreement and customer

transaction lifecycles that require consent, non-repudiation and

compliance. These solutions, which are largely cloud-based, include

OneSpan Sign e-signature, OneSpan Notary, and Identity

Verification. This segment also includes costs attributable to our

transaction cloud platform.

- Security Solutions. Security Solutions consists of our

broad portfolio of software products, software development kits

(SDKs) and Digipass authenticator devices that are used to build

applications designed to defend against attacks on digital

transactions across online environments, devices, and applications.

The software products and SDKs included in the Security Solutions

segment are largely on-premises software products and include

multi-factor authentication and transaction signing solutions, such

as mobile application security and mobile software tokens.

Segment operating income consists of the revenues generated by a

segment, less the direct costs of revenue, sales and marketing,

research and development expenses, amortization expense, and

restructuring and other related charges that are incurred directly

by a segment. Unallocated corporate costs include costs related to

administrative functions that are performed in a centralized manner

that are not attributable to a particular segment.

Segment and consolidated operating results

(unaudited):

Three Months Ended

September 30,

Nine Months Ended

September 30,

(In thousands, except percentages)

2024

2023

2024

2023

Digital Agreements

Revenue

$

15,405

$

13,012

$

45,280

$

36,426

Gross profit (1)

$

11,031

$

9,808

$

30,664

$

26,839

Gross margin

72

%

75

%

68

%

74

%

Operating income (loss) (2)

$

3,419

$

(4,666

)

$

3,000

$

(17,820

)

Security Solutions

Revenue

$

40,837

$

45,826

$

136,728

$

135,752

Gross profit (3)

$

30,517

$

30,861

$

98,620

$

87,410

Gross margin

75

%

67

%

72

%

64

%

Operating income (4)

$

20,200

$

15,673

$

66,770

$

39,827

Total Company:

Revenue

$

56,242

$

58,838

$

182,008

$

172,178

Gross profit

$

41,548

$

40,669

$

129,284

$

114,249

Gross margin

74

%

69

%

71

%

66

%

Statements of Operations

reconciliation:

Segment operating income

$

23,619

$

11,007

$

69,770

$

22,007

Corporate operating expenses not allocated

at the segment level

12,367

15,801

36,771

52,695

Operating income (loss)

$

11,252

$

(4,794

)

$

32,999

$

(30,688

)

Interest income, net

624

587

1,246

1,675

Other income (expense), net

(1,915

)

353

(1,293

)

342

Income (loss) before income taxes

$

9,961

$

(3,854

)

$

32,952

$

(28,671

)

(1)

Digital Agreements gross profit includes

intangible asset write-off of $0.8 million and internal capitalized

software write-off of $0.7 million for the nine months ended

September 30, 2024.

(2)

Digital Agreements operating income (loss)

includes $0.6 million and $1.9 million of amortization of

intangible assets expense for the three and nine months ended

September 30, 2024, respectively, and $0.6 million and $1.7 million

of amortization of intangible assets expense for the three and nine

months ended September 30, 2023, respectively.

(3)

Security Solutions gross profit includes

$1.6 million of inventory impairments related to discontinuation of

investments in our Digipass CX product for the nine months ended

September 30, 2023.

(4)

Security Solutions operating income

includes $1.6 million of inventory impairments and $1.4 million of

capitalized software write-offs related to discontinuation of

investments in our Digipass CX product for the nine months ended

September 30, 2023.

Revenue by major products and services (unaudited):

Three Months Ended September

30,

2024

2023

(In thousands)

Digital

Agreements

Security

Solutions

Digital

Agreements

Security

Solutions

Subscription

$

15,045

$

18,603

$

11,807

$

14,378

Maintenance and support

327

9,317

995

11,276

Professional services and other (1)

33

820

210

1,333

Hardware products

—

12,097

—

18,839

Total Revenue

$

15,405

$

40,837

$

13,012

$

45,826

Nine Months Ended September

30,

2024

2023

(In thousands)

Digital

Agreements

Security

Solutions

Digital

Agreements

Security

Solutions

Subscription

$

43,641

$

59,642

$

32,641

$

46,485

Maintenance and support

1,321

29,125

3,121

31,914

Professional services and other (1)

318

3,548

664

4,002

Hardware products

—

44,413

—

53,351

Total Revenue

$

45,280

$

136,728

$

36,426

$

135,752

(1)

Professional services and other includes

perpetual software licenses revenue, which was less than 1% of

total revenue for both the three and nine months ended September

30, 2024 and approximately 1% of total revenue for both the three

and nine months ended September 30, 2023.

Non-GAAP Financial Measures

We report financial results in accordance with GAAP. We also

evaluate our performance using certain Non-GAAP financial metrics,

namely Adjusted EBITDA, Non-GAAP Net Income (Loss) and Non-GAAP Net

Income (Loss) Per Diluted Share. Our management believes that these

measures, when taken together with the corresponding GAAP financial

metrics, provide useful supplemental information regarding the

performance of our business, as further discussed in the

descriptions of each of these Non-GAAP metrics below.

These Non-GAAP financial measures are not measures of

performance under GAAP and should not be considered in isolation or

as alternatives or substitutes for the most directly comparable

financial measures calculated in accordance with GAAP. While we

believe that these Non-GAAP financial measures are useful for the

purposes described below, they have limitations associated with

their use, since they exclude items that may have a material impact

on our reported results and may be different from similar measures

used by other companies. Additional information about the Non-GAAP

financial measures and reconciliations to their most directly

comparable GAAP financial measures appear below.

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss) before interest,

taxes, depreciation, amortization, long-term incentive

compensation, restructuring and other related charges, and certain

non-recurring items, including acquisition related costs,

rebranding costs, and non-routine shareholder matters. We use

Adjusted EBITDA as a simplified measure of performance for use in

communicating our performance to investors and analysts and for

comparisons to other companies within our industry. As a

performance measure, we believe that Adjusted EBITDA presents a

view of our operating results that is most closely related to

serving our customers. By excluding interest, taxes, depreciation,

amortization, long-term incentive compensation, restructuring

costs, and certain other non-recurring items, we are able to

evaluate performance without considering decisions that, in most

cases, are not directly related to meeting our customers’

requirements and were either made in prior periods (e.g.,

depreciation, amortization, long-term incentive compensation,

non-routine shareholder matters), deal with the structure or

financing of the business (e.g., interest, one-time strategic

action costs, restructuring costs, impairment charges) or reflect

the application of regulations that are outside of the control of

our management team (e.g., taxes). In addition, removing the impact

of these items helps us compare our core business performance with

that of our competitors.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(in thousands,

unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(In thousands)

2024

2023

2024

2023

Net income (loss)

$

8,273

$

(4,133

)

$

28,294

$

(30,240

)

Interest income, net

(624

)

(587

)

(1,246

)

(1,675

)

Provision for income taxes

1,688

279

4,658

1,569

Depreciation and amortization of

intangible assets (1)

1,941

1,689

6,086

4,524

Long-term incentive compensation (2)

2,744

1,933

6,358

10,426

Restructuring and other related charges

(3)

720

6,524

5,454

13,076

Other non-recurring items (4)

1,983

599

3,060

3,160

Adjusted EBITDA

$

16,725

$

6,304

$

52,664

$

840

(1)

Includes cost of sales depreciation and

amortization expense directly related to delivering cloud

subscription revenue of $0.7 million and $2.4 million for the three

and nine months ended September 30, 2024, respectively, and $0.4

million and $0.7 million for the three and nine months ended

September 30, 2023, respectively. Costs are recorded in "Services

and other cost of goods sold" on the condensed consolidated

statements of operations.

(2)

Long-term incentive compensation includes

stock-based compensation and cash incentive grants awarded to

employees located in jurisdictions where we do not issue

stock-based compensation due to tax, regulatory or similar reasons.

The immaterial expense associated with these cash incentive grants

was $0.1 million for both the three months ended September 30, 2024

and 2023 and $0.2 million for both the nine months ended September

30, 2024 and 2023.

(3)

Includes write-offs of intangible assets

and property and equipment, net, of $0.8 million and $1.0 million,

respectively, for the nine months ended September 30, 2024 and $0

for both the three and nine months ended September 30, 2023. Costs

are recorded in "Services and other cost of goods sold" and

"Restructuring and other related charges," respectively, on the

condensed consolidated statements of operations.

Includes restructuring and other related

charges of less than $0.1 million and $0.1 million, for the three

and nine months ended September 30, 2024, respectively, and $0 for

both the three and nine months ended September 30, 2023. These

charges are recorded in "Services and other cost of goods sold" on

the condensed consolidated statements of operations.

(4)

For the three months ended September 30,

2024 and 2023, other non-recurring items consist of $2.0 million

and $0.6 million, respectively, of fees related to non-recurring

projects.

For the nine months ended September 30,

2024, other non-recurring items consist of $3.1 million of fees

related to non-recurring projects. For the nine months ended

September 30, 2023, other non-recurring items consist of $1.6

million of inventory impairment charges and $1.6 million of fees

related to non-recurring projects and our acquisition of

ProvenDB.

Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) Per

Diluted Share

We define Non-GAAP Net Income (Loss) and Non-GAAP Net Income

(Loss) Per Diluted Share as net income (loss) or net income (loss)

per diluted share, as applicable, before the consideration of

long-term incentive compensation expenses, the amortization of

intangible assets, restructuring costs, and certain other

non-recurring items. We use these measures to assess the impact of

our performance excluding items that can significantly impact the

comparison of our results between periods and the comparison to

competitor results.

We exclude long-term incentive compensation expense because our

long-term incentives generally reflect the use of restricted stock

unit grants or cash incentive grants, including incentives directly

tied to the performance of the business, while other companies may

use different forms of incentives that have different cost impacts,

which makes comparison difficult. We exclude amortization of

intangible assets as we believe the amount of such expense in any

given period may not be correlated directly to the performance of

the business operations and that such expenses can vary

significantly between periods as a result of new acquisitions, the

full amortization of previously acquired intangible assets, or the

write down of such assets due to an impairment event. However,

intangible assets contribute to current and future revenue, and

related amortization expense will recur in future periods until

expired or written down.

We also exclude certain non-recurring items including one-time

strategic action costs and non-recurring shareholder matters, as

these items are unrelated to the operations of our core business.

By excluding these items, we are better able to compare the

operating results of our underlying core business from one

reporting period to the next.

We make a tax adjustment based on the above adjustments

resulting in an effective tax rate on a Non-GAAP basis, which may

differ from the GAAP tax rate. We believe the effective tax rates

we use in the adjustment are reasonable estimates of the overall

tax rates for the Company under its global operating structure.

Reconciliation of Net Income

(Loss) to Non-GAAP Net Income (Loss)

(in thousands, except per

share data)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income (loss)

$

8,273

$

(4,133

)

$

28,294

$

(30,240

)

Amortization of intangible assets (1)

585

583

1,967

1,749

Long-term incentive compensation (2)

2,744

1,933

6,358

10,426

Restructuring and other related charges

(3)

720

6,524

5,454

13,076

Other non-recurring items (4)

1,983

599

3,060

3,160

Tax impact of adjustments (5)

(1,206

)

(1,928

)

(3,368

)

(5,682

)

Non-GAAP net income (loss)

$

13,099

$

3,578

$

41,765

$

(7,511

)

Non-GAAP net income (loss) per share

$

0.33

$

0.09

$

1.07

$

(0.19

)

Shares

39,458

40,999

38,864

40,529

(1)

Includes cost of sales amortization

expense directly related to delivering cloud subscription revenue

of $0 and $0.2 million for the three and nine months ended

September 30, 2024, respectively, and $0.1 million and $0.3 million

for the three and nine months ended September 30, 2023,

respectively. Costs are recorded in "Services and other cost of

goods sold" on the condensed consolidated statements of

operations.

(2)

Long-term incentive compensation includes

stock-based compensation and cash incentive grants awarded to

employees located in jurisdictions where we do not issue

stock-based compensation due to tax, regulatory or similar reasons.

The immaterial expense associated with these cash incentive grants

was $0.1 million for both the three months ended September 30, 2024

and 2023 and $0.2 million for both the nine months ended September

30, 2024 and 2023.

(3)

Includes write-offs of intangible assets

and property and equipment, net, of $0.8 million and $1.0 million,

respectively, for the nine months ended September 30, 2024 and $0

for both the three and nine months ended September 30, 2023. Costs

are recorded in "Services and other cost of goods sold" and

"Restructuring and other related charges," respectively, on the

condensed consolidated statements of operations.

Includes restructuring and other related

charges of less than $0.1 million and $0.1 million, for the three

and nine months ended September 30, 2024, respectively, and $0 for

both the three and nine months ended September 30, 2023. These

charges are recorded in "Services and other cost of goods sold" on

the condensed consolidated statements of operations.

(4)

See the footnotes to the Reconciliation of

Net Income (Loss) to Adjusted EBITDA for a description of the

components of other non-recurring items for each period

presented.

(5)

The tax impact of adjustments is

calculated as 20% of the adjustments in all periods.

Copyright© 2024 OneSpan North America Inc., all rights reserved.

OneSpan™ is a registered or unregistered trademark of OneSpan North

America Inc. or its affiliates in the U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030491620/en/

Investor Contact: Joe Maxa Vice President of Investor

Relations +1-312-766-4009 joe.maxa@onespan.com

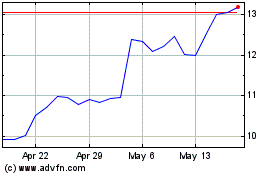

OneSpan (NASDAQ:OSPN)

Historical Stock Chart

From Dec 2024 to Jan 2025

OneSpan (NASDAQ:OSPN)

Historical Stock Chart

From Jan 2024 to Jan 2025