false

0001431567

0001431567

2024-10-18

2024-10-18

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934.

|

|

Date of Report: October 18, 2024

(Date of earliest event reported)

|

|

Oak Valley Bancorp

(Exact name of registrant as specified in its charter)

|

| |

|

CA

(State or other jurisdiction

of incorporation)

|

001-34142

(Commission File Number)

|

26-2326676

(IRS Employer

Identification Number)

|

| |

|

125 N. Third Ave. Oakdale, CA

(Address of principal executive offices)

|

95361

(Zip Code)

|

|

|

(209) 848-2265

(Registrant's telephone number, including area code)

|

| |

|

Not Applicable

(Former Name or Former Address, if changed since last report)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

OVLY

|

The Nasdaq Stock Market, LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 18, 2024, Oak Valley Bancorp issued a press release, a copy of which is attached as Exhibit 99.1 and incorporated herein by reference. The press release announced the Company’s operating results for the quarter ended September 30, 2024.

The information in this Item 2.02 in this Form 8-K and the Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

See “Item 2.02. Results of Operations and Financial Condition” which is incorporated by reference in this Item 7.01.

Item 9.01. Financial Statements and Exhibits

(a) Financial statements:

None

(b) Pro forma financial information:

None

(c) Shell company transactions:

None

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

|

Dated: October 21, 2024

|

OAK VALLEY BANCORP

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jeffrey A. Gall

|

|

|

|

|

Jeffrey A. Gall

|

|

|

|

|

Executive Vice President and Chief Financial Officer (Principal Financial Officer and duly authorized signatory)

|

|

|

Exhibit Index

|

|

Exhibit No.

|

Description

|

| |

|

|

99.1

|

Press Release of Oak Valley Bancorp dated October 18, 2024

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Exhibit 99.1

For Immediate Release

|

Contact:

|

Chris Courtney/Rick McCarty

|

OAK VALLEY BANCORP REPORTS 3rd QUARTER RESULTS

OAKDALE, CA – Oak Valley Bancorp (NASDAQ: OVLY) (the “Company”), the bank holding company for Oak Valley Community Bank and their Eastern Sierra Community Bank division, recently reported unaudited consolidated financial results. For the three months ended September 30, 2024, consolidated net income was $7,324,000, or $0.89 per diluted share (EPS), as compared to $5,889,000, or $0.71 EPS, for the prior quarter and $7,354,000, or $0.89 EPS, for the same period a year ago. Consolidated net income for the nine months ended September 30, 2024 was $18,940,000, or $2.30 EPS, compared to $24,983,000 or $3.04 EPS for the same period of 2023.

The increase in third quarter net income compared to the prior quarter was primarily due to loan recoveries that resulted in a reversal of allowance for credit losses of $1,620,000. The QTD and YTD decreases compared to the same periods of 2023 were related to an increase in deposit interest expense and general operating expenses.

Net interest income for the three months ended September 30, 2024 was $17,655,000, compared to $17,292,000 in the prior quarter, and $18,938,000 in the same period a year ago. The increase in net interest income over the prior quarter is attributed to earning asset growth and an increase of 3 basis points in the average earning asset yield. The decrease from the same period a year ago is due to an increase in deposit interest expense, as the average cost of funds increased to 0.83% bps for the third quarter of 2024, compared to 0.33% for the comparable period of 2023. The higher interest expense was partially offset by loan growth of $103.9 million over the same period. Net interest margin for the three months ended September 30, 2024 was 4.04%, compared to 4.11% for the prior quarter and 4.34% for the same period last year.

“Our strong core deposits have helped manage funding costs and maintain a healthy net interest margin. Loan growth is crucial to minimizing future margin compression amid possible interest rate drops. Oak Valley was founded on service-focused relationship banking, which drives these efforts. Our success in growing relationships relies on standing out from our competitors by meeting and surpassing client expectations,” stated Rick McCarty, President and Chief Operating Officer.

Non-interest income was $1,846,000 for the quarter ended September 30, 2024, compared to $1,760,000 for the prior quarter and $1,566,000 for the same period last year. The increases compared to prior periods was mainly due to unrealized gains on equity securities as a result of lower interest rates.

Non-interest expense totaled $11,324,000 for the quarter ended September 30, 2024, compared to $11,616,000 in the prior quarter and $10,578,000 in the same quarter a year ago. The decrease compared to the prior period is mainly due to charitable contributions and data processing expense. The third quarter increase compared to the same period a year ago is mainly due to staffing expense and general operating costs related to servicing the growing loan and deposit portfolios.

Total assets were $1.90 billion at September 30, 2024, an increase of $59.9 million and $65.1 million over June 30, 2024 and September 30, 2023, respectively. Gross loans were $1.08 billion at September 30, 2024, an increase of $5.1 million over June 30, 2024 and $103.9 million over September 30, 2023. The Company’s total deposits were $1.69 billion as of September 30, 2024, an increase of $45.6 million and $23.8 million from June 30, 2024 and September 30, 2023, respectively. Our liquidity position is very strong as evidenced by $213.9 million in cash and cash equivalents balances at September 30, 2024.

Non-performing assets (“NPA”) remained at zero as of September 30, 2024, as they were for all of 2024 and 2023. The allowance for credit losses (“ACL”) as a percentage of gross loans increased to 1.07% at September 30, 2024, compared to 1.04% at June 30, 2024 and 1.00% at September 30, 2023. The increase over the prior quarter is due to macro-economic forecasts, loan growth and other credit-risk factors included in the ACL calculation which dictated an increase of $358,000 in the ACL. Loan recoveries totaled $2.0 million during the third quarter of 2024, which consisted of two loans that dated back to the recession. The net impact of the $2.0 million loan recoveries and the $358,000 increase in the ACL calculation resulted in a reversal of ACL provisions totaling $1.62 million. Given industry concerns of credit risk specific to commercial real estate, management has performed a thorough analysis of this segment as part of the CECL credit risk model’s ACL computation, concluding that the credit loss reserves relative to gross loans remains at acceptable levels, and credit quality remains stable.

Oak Valley Bancorp operates Oak Valley Community Bank & their Eastern Sierra Community Bank division, through which it offers a variety of loan and deposit products to individuals and small businesses. They currently operate through 18 conveniently located branches: Oakdale, Turlock, Stockton, Patterson, Ripon, Escalon, Manteca, Tracy, Sacramento, Roseville, two branches in Sonora, three branches in Modesto, and three branches in their Eastern Sierra division, which includes Bridgeport, Mammoth Lakes, and Bishop.

For more information, call 1-866-844-7500 or visit www.ovcb.com.

This press release includes forward-looking statements about the corporation for which the corporation claims the protection of safe harbor provisions contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on management's knowledge and belief as of today and include information concerning the corporation's possible or assumed future financial condition, and its results of operations and business. Forward-looking statements are subject to risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. Those factors include fluctuations in interest rates, government policies and regulations (including monetary and fiscal policies), legislation, economic conditions, including increased energy costs in California, credit quality of borrowers, operational factors and competition in the geographic and business areas in which the company conducts its operations. All forward-looking statements included in this press release are based on information available at the time of the release, and the Company assumes no obligation to update any forward-looking statement.

###

Oak Valley Bancorp

Financial Highlights (unaudited)

|

($ in thousands, except per share)

|

|

3rd Quarter

|

|

|

2nd Quarter

|

|

|

1st Quarter

|

|

|

4th Quarter

|

|

|

3rd Quarter

|

|

|

Selected Quarterly Operating Data:

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

$ |

17,655 |

|

|

$ |

17,292 |

|

|

$ |

17,241 |

|

|

$ |

17,914 |

|

|

$ |

18,938 |

|

|

(Reversal of) provision for credit losses

|

|

|

(1,620 |

) |

|

|

- |

|

|

|

- |

|

|

|

1,130 |

|

|

|

300 |

|

|

Non-interest income

|

|

|

1,846 |

|

|

|

1,760 |

|

|

|

1,519 |

|

|

|

1,755 |

|

|

|

1,566 |

|

|

Non-interest expense

|

|

|

11,324 |

|

|

|

11,616 |

|

|

|

11,529 |

|

|

|

10,760 |

|

|

|

10,578 |

|

|

Net income before income taxes

|

|

|

9,797 |

|

|

|

7,436 |

|

|

|

7,231 |

|

|

|

7,779 |

|

|

|

9,626 |

|

|

Provision for income taxes

|

|

|

2,473 |

|

|

|

1,547 |

|

|

|

1,504 |

|

|

|

1,914 |

|

|

|

2,272 |

|

|

Net income

|

|

$ |

7,324 |

|

|

$ |

5,889 |

|

|

$ |

5,727 |

|

|

$ |

5,865 |

|

|

$ |

7,354 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share - basic

|

|

$ |

0.89 |

|

|

$ |

0.72 |

|

|

$ |

0.70 |

|

|

$ |

0.72 |

|

|

$ |

0.90 |

|

|

Earnings per common share - diluted

|

|

$ |

0.89 |

|

|

$ |

0.71 |

|

|

$ |

0.69 |

|

|

$ |

0.71 |

|

|

$ |

0.89 |

|

|

Dividends paid per common share

|

|

$ |

0.225 |

|

|

$ |

- |

|

|

$ |

0.225 |

|

|

$ |

- |

|

|

$ |

0.160 |

|

|

Return on average common equity

|

|

|

16.54 |

% |

|

|

14.19 |

% |

|

|

13.86 |

% |

|

|

16.44 |

% |

|

|

19.85 |

% |

|

Return on average assets

|

|

|

1.56 |

% |

|

|

1.30 |

% |

|

|

1.26 |

% |

|

|

1.27 |

% |

|

|

1.57 |

% |

|

Net interest margin (1)

|

|

|

4.04 |

% |

|

|

4.11 |

% |

|

|

4.09 |

% |

|

|

4.15 |

% |

|

|

4.34 |

% |

|

Efficiency ratio (2)

|

|

|

56.96 |

% |

|

|

59.12 |

% |

|

|

59.61 |

% |

|

|

53.08 |

% |

|

|

49.89 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital - Period End

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per common share

|

|

$ |

22.18 |

|

|

$ |

20.55 |

|

|

$ |

19.97 |

|

|

$ |

20.03 |

|

|

$ |

16.29 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Quality - Period End

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets / total assets

|

|

|

0.00 |

% |

|

|

0.00 |

% |

|

|

0.00 |

% |

|

|

0.00 |

% |

|

|

0.00 |

% |

|

Credit loss reserve / gross loans

|

|

|

1.07 |

% |

|

|

1.04 |

% |

|

|

1.05 |

% |

|

|

1.07 |

% |

|

|

1.00 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period End Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

1,900,455 |

|

|

$ |

1,840,521 |

|

|

$ |

1,805,739 |

|

|

$ |

1,842,422 |

|

|

$ |

1,835,402 |

|

|

Gross loans

|

|

|

1,075,138 |

|

|

|

1,070,036 |

|

|

|

1,039,509 |

|

|

|

1,016,579 |

|

|

|

971,243 |

|

|

Nonperforming assets

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Allowance for credit losses

|

|

|

11,479 |

|

|

|

11,121 |

|

|

|

10,922 |

|

|

|

10,896 |

|

|

|

9,738 |

|

|

Deposits

|

|

|

1,690,301 |

|

|

|

1,644,748 |

|

|

|

1,612,400 |

|

|

|

1,650,534 |

|

|

|

1,666,548 |

|

|

Common equity

|

|

|

185,393 |

|

|

|

171,799 |

|

|

|

166,916 |

|

|

|

166,092 |

|

|

|

135,095 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full-time equivalent staff

|

|

|

222 |

|

|

|

223 |

|

|

|

219 |

|

|

|

222 |

|

|

|

225 |

|

|

Number of banking offices

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period end

|

|

|

8,358,711 |

|

|

|

8,359,556 |

|

|

|

8,359,556 |

|

|

|

8,293,168 |

|

|

|

8,293,468 |

|

|

Period average - basic

|

|

|

8,221,475 |

|

|

|

8,219,699 |

|

|

|

8,209,617 |

|

|

|

8,200,177 |

|

|

|

8,197,083 |

|

|

Period average - diluted

|

|

|

8,263,790 |

|

|

|

8,248,295 |

|

|

|

8,244,648 |

|

|

|

8,236,897 |

|

|

|

8,232,338 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Price

|

|

$ |

26.57 |

|

|

$ |

24.97 |

|

|

$ |

24.78 |

|

|

$ |

29.95 |

|

|

$ |

25.08 |

|

|

Price/Earnings

|

|

|

7.52 |

|

|

|

8.69 |

|

|

|

8.86 |

|

|

|

10.55 |

|

|

|

7.05 |

|

|

Price/Book

|

|

|

1.20 |

|

|

|

1.22 |

|

|

|

1.24 |

|

|

|

1.50 |

|

|

|

1.54 |

|

| (1) |

Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%.

|

| (2) |

Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%.

|

| |

A marginal federal/state combined tax rate of 29.56%, was used for applicable revenue.

|

| |

|

NINE MONTHS ENDED

SEPTEMBER 30,

|

|

|

Profitability

|

|

2024

|

|

|

2023

|

|

|

($ in thousands, except per share)

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

$ |

52,188 |

|

|

$ |

57,888 |

|

|

Provision for (reversal of) credit losses

|

|

|

(1,620 |

) |

|

|

(160 |

) |

|

Non-interest income

|

|

|

5,125 |

|

|

|

4,876 |

|

|

Non-interest expense

|

|

|

34,469 |

|

|

|

30,397 |

|

|

Net income before income taxes

|

|

|

24,464 |

|

|

|

32,527 |

|

|

Provision for income taxes

|

|

|

5,524 |

|

|

|

7,544 |

|

|

Net income

|

|

$ |

18,940 |

|

|

$ |

24,983 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings per share - basic

|

|

$ |

2.30 |

|

|

$ |

3.05 |

|

|

Earnings per share - diluted

|

|

$ |

2.30 |

|

|

$ |

3.04 |

|

|

Dividends paid per share

|

|

$ |

0.450 |

|

|

$ |

0.320 |

|

|

Return on average equity

|

|

|

14.90 |

% |

|

|

23.71 |

% |

|

Return on average assets

|

|

|

1.38 |

% |

|

|

1.76 |

% |

|

Net interest margin (1)

|

|

|

4.08 |

% |

|

|

4.39 |

% |

|

Efficiency ratio (2)

|

|

|

58.55 |

% |

|

|

47.48 |

% |

| |

|

|

|

|

|

|

|

|

|

Capital - Period End

|

|

|

|

|

|

|

|

|

|

Book value per share

|

|

$ |

22.18 |

|

|

$ |

16.29 |

|

| |

|

|

|

|

|

|

|

|

|

Credit Quality - Period End

|

|

|

|

|

|

|

|

|

|

Nonperforming assets/ total assets

|

|

|

0.00 |

% |

|

|

0.00 |

% |

|

Credit loss reserve/ gross loans

|

|

|

1.07 |

% |

|

|

1.00 |

% |

| |

|

|

|

|

|

|

|

|

|

Period End Balance Sheet

|

|

|

|

|

|

|

|

|

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

1,900,455 |

|

|

$ |

1,835,402 |

|

|

Gross loans

|

|

|

1,075,138 |

|

|

|

971,243 |

|

|

Nonperforming assets

|

|

|

- |

|

|

|

- |

|

|

Allowance for credit losses

|

|

|

11,479 |

|

|

|

9,738 |

|

|

Deposits

|

|

|

1,690,301 |

|

|

|

1,666,548 |

|

|

Stockholders' equity

|

|

|

185,393 |

|

|

|

135,095 |

|

| |

|

|

|

|

|

|

|

|

|

Non-Financial Data

|

|

|

|

|

|

|

|

|

|

Full-time equivalent staff

|

|

|

222 |

|

|

|

225 |

|

|

Number of banking offices

|

|

|

18 |

|

|

|

18 |

|

| |

|

|

|

|

|

|

|

|

|

Common Shares outstanding

|

|

|

|

|

|

|

|

|

|

Period end

|

|

|

8,358,711 |

|

|

|

8,293,468 |

|

|

Period average - basic

|

|

|

8,216,947 |

|

|

|

8,191,749 |

|

|

Period average - diluted

|

|

|

8,252,286 |

|

|

|

8,228,869 |

|

| |

|

|

|

|

|

|

|

|

|

Market Ratios

|

|

|

|

|

|

|

|

|

|

Stock Price

|

|

$ |

26.57 |

|

|

$ |

25.08 |

|

|

Price/Earnings

|

|

|

8.65 |

|

|

|

6.15 |

|

|

Price/Book

|

|

|

1.20 |

|

|

|

1.54 |

|

|

(1)

|

Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%.

|

|

(2)

|

Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%.

|

| |

A marginal federal/state combined tax rate of 29.56%, was used for applicable revenue.

|

v3.24.3

Document And Entity Information

|

Oct. 18, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Oak Valley Bancorp

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 18, 2024

|

| Entity, Incorporation, State or Country Code |

CA

|

| Entity, File Number |

001-34142

|

| Entity, Tax Identification Number |

26-2326676

|

| Entity, Address, Address Line One |

125 N. Third Ave.

|

| Entity, Address, City or Town |

Oakdale

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

95361

|

| City Area Code |

209

|

| Local Phone Number |

848-2265

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

OVLY

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001431567

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

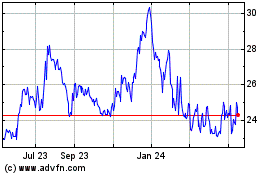

Oak Valley Bancorp (NASDAQ:OVLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

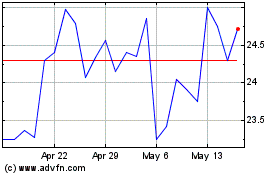

Oak Valley Bancorp (NASDAQ:OVLY)

Historical Stock Chart

From Jan 2024 to Jan 2025