- Total net revenue of $240.3 million (Total net revenue

excluding Contigo Health* of $232.2 million)

- GAAP net loss from continuing operations of $45.8 million,

or $(0.60) per fully diluted share, which includes a $126.8 million

impairment charge to goodwill related to the company's data and

technology business in the Performance Services segment

- Adjusted earnings per share excluding Contigo Health* of

$0.27

- Net cash provided by operating activities from continuing

operations of $193.7 million and free cash flow* of $73.9 million

for the first six months of fiscal 2025

- Reaffirming guidance midpoints for total net revenue

excluding Contigo Health and adjusted EBITDA; increasing the

midpoint of adjusted earnings per share guidance by $0.08

[1][2]

Premier, Inc. (NASDAQ: PINC), a leading technology-driven

healthcare improvement company, today reported financial results

for the fiscal-year 2025 second quarter ended December 31,

2024.

On October 1, 2024, the company announced that it had divested

the S2S Global direct sourcing business. As such, and unless stated

otherwise, all results presented in the following release reflect

those of continuing operations. In addition, as certain components

of the divestiture process for the Contigo Health business remain

ongoing, results presented in this release will continue to include

contributions from that business. As such, a table has been

included at the end of this release that reconciles the impact of

the Contigo Health business on certain financial measures in the

quarter.

"Our overall revenue and profitability for the first half of

fiscal 2025 were in line with our expectations resulting from

better than expected results in our Supply Chain Services segment,"

said Michael J. Alkire, Premier's President and CEO. "Importantly,

we are reaffirming the midpoints of our consolidated fiscal 2025

revenue and adjusted EBITDA guidance, despite challenges in our

Performance Services segment. We are also increasing our adjusted

earnings per share guidance to reflect the favorable impact of the

additional $200 million share repurchase completed in early

January, consistent with our commitment to returning capital to

stockholders."

Consolidated Financial Highlights of

Continuing Operations

Three Months Ended December

31,

Six Months Ended December

31,

(in thousands, except per share data)

2024

2023

% Change

2024

2023

% Change

Net revenue:

Supply Chain Services:

Net administrative fees

$

131,417

$

150,470

(13

%)

$

264,042

$

300,356

(12

%)

Software licenses, other services, and

support

17,329

15,752

10

%

36,092

29,142

24

%

Total Supply Chain Services

148,746

166,222

(11

%)

300,134

329,498

(9

%)

Performance Services

91,520

113,649

(19

%)

188,274

219,399

(14

%)

Performance Services excluding Contigo

Health

83,475

103,022

(19

%)

172,583

198,615

(13

%)

Net revenue

$

240,266

$

279,871

(14

%)

$

488,408

$

548,897

(11

%)

Net revenue excluding Contigo

Health*

$

232,221

$

269,244

(14

%)

$

472,717

$

528,113

(10

%)

Net (loss) income from continuing

operations

$

(45,837

)

$

50,448

(191

%)

$

27,103

$

92,217

(71

%)

Net (loss) income from continuing

operations attributable to stockholders

$

(56,629

)

$

51,884

(209

%)

$

15,759

$

96,004

(84

%)

Diluted (loss) earnings per share from

continuing operations attributable to stockholders

$

(0.60

)

$

0.43

(240

%)

$

0.16

$

0.80

(80

%)

Consolidated Non-GAAP Financial

Highlights of Continuing Operations

Three Months Ended December

31,

Six Months Ended December

31,

(in thousands, except per share data)

2024

2023

% Change

2024

2023

% Change

NON-GAAP FINANCIAL MEASURES*:

Adjusted EBITDA:

Supply Chain Services

$

73,740

$

96,532

(24

%)

$

151,251

$

197,919

(24

%)

Performance Services

9,123

31,205

(71

%)

24,072

54,135

(56

%)

Total segment adjusted EBITDA

82,863

127,737

(35

%)

175,323

252,054

(30

%)

Corporate

(32,773

)

(31,318

)

(5

%)

(62,805

)

(62,327

)

(1

%)

Adjusted EBITDA

$

50,090

$

96,419

(48

%)

$

112,518

$

189,727

(41

%)

Adjusted EBITDA excluding Contigo

Health

$

52,066

$

97,757

(47

%)

$

116,721

$

193,795

(40

%)

Adjusted net income

$

23,837

$

60,726

(61

%)

$

59,040

$

116,891

(49

%)

Adjusted earnings per share

(EPS)

$

0.25

$

0.51

(51

%)

$

0.60

$

0.97

(38

%)

Adjusted EPS excluding Contigo

Health

$

0.27

$

0.53

(49

%)

$

0.65

$

1.02

(36

%)

* These are non-GAAP financial measures.

Refer to "Premier's Use and Definition of Non-GAAP Measures" below

and the supplemental financial information at the end of this

release for information on the company's use of non-GAAP measures

and a reconciliation of reported GAAP results to non-GAAP

results.

Fiscal 2025 Guidance

Certain statements in this release, including without

limitation, those in this section, are forward-looking statements.

For additional information regarding the use and limitations of

such statements, refer to "Cautionary Note Regarding

Forward-Looking Statements" below.

Based on actual results for the first six months of fiscal 2025

and the current outlook for the remainder of the fiscal year, the

company is updating its guidance to the following:

Guidance Metric

Fiscal 2025

Guidance Range [1] [2] (as of

February 4, 2025)

Previous Fiscal 2025

Guidance Range [1] [2] (as of November 5, 2024)

Comments

Segment Net Revenue:

Supply Chain Services

$590 million to $630 million

$560 million to $610 million

Increased midpoint $25 million

Performance Services Excluding Contigo

Health

$350 million to $380 million

$370 million to $410 million

Decreased midpoint $25 million

Total Net Revenue Excluding Contigo

Health

$940 million to $1.01 billion

$930 million to $1.02 billion

No change to midpoint

Adjusted EBITDA

$237 million to $253 million

$235 million to $255 million

No change to midpoint

Adjusted Net Income

$119 million to $129 million

Not previously disclosed

New disclosure

Adjusted EPS

$1.26 to $1.34

$1.16 to $1.28

Increased midpoint $0.08

Diluted Weighted Average Shares

94 million to 96 million

Not previously disclosed

New disclosure

Fiscal 2025 guidance is based on the

realization of the following key assumptions:

- Net administrative fees revenue of $525 million to $545 million

(previously: $495 million to $525 million), which includes $60

million to $75 million in revenue related to non-healthcare member

purchasing

- Supply Chain Services segment software licenses, other services

and support revenue of $65 million to $85 million

- Capital expenditures of $90 million to $100 million

- Effective income tax rate in the range of 24% to 26%

(previously: 25% to 27%)

- Cash income tax rate of less than 5%

- Free cash flow[1][2] of 45% to 55% of adjusted

EBITDA[1][2]

[1]

Adjusted EBITDA, adjusted net income,

adjusted EPS and free cash flow presented in this financial

guidance are forward-looking non-GAAP measures. Refer to "Premier's

Use and Definitions of Non-GAAP Measures" below for information on

the company's use of non-GAAP measures. Premier, Inc. does not

provide forward-looking guidance on a GAAP basis as certain

financial information, the probable significance of which cannot be

determined, is not available and cannot be reasonably estimated.

Total Net Revenue Excluding Contigo Health is also a

forward-looking non-GAAP measure. Refer to "Premier's Use of

Forward-Looking Non-GAAP Measures" below for additional

explanation.

[2]

As a result of the company's previously

announced plan to divest a majority interest in the Contigo Health

business, guidance is being presented excluding financial

contributions from this business.

Results of Operations for the Three Months Ended December 31,

2024 (As compared with the three months ended December 31,

2023)

GAAP net revenue of $240.3 million decreased 14% from $279.9

million in the prior-year period. Refer to the "Supply Chain

Services" and "Performance Services" sections below for further

discussion on the factors that impacted the net revenue of each

segment during the quarter.

GAAP net loss from continuing operations of $45.8 million

decreased 191% from net income from continuing operations of $50.4

million in the prior-year period primarily as a result of a $126.8

million impairment charge to goodwill related to the company's data

and technology business in the Performance Services segment in the

current-year period and lower net revenue compared to the

prior-year period, partially offset by a $17.6 million cash

distribution received in the current-year period from a minority

investment, as well as lower selling, general and administrative

expenses, excluding the goodwill impairment, compared to the

prior-year period.

GAAP diluted EPS from continuing operations of $(0.60) decreased

240% from $0.43 in the prior-year period due to the aforementioned

drivers affecting GAAP net loss from continuing operations,

partially offset by a decrease in the diluted weighted average

shares outstanding as a result of share repurchases under the

company's $1 billion share repurchase authorization announced in

February 2024 ("Share Repurchase Authorization"), further discussed

below under "Return of Capital to Stockholders".

Adjusted EBITDA of $50.1 million decreased 48% from $96.4

million in the prior-year period primarily due to a decrease in net

administrative fees revenue as well as lower revenue in the

Performance Services segment.

Adjusted net income of $23.8 million decreased 61% from $60.7

million in the prior-year period primarily as a result of the same

factors that impacted adjusted EBITDA and a decrease in interest

income due to lower levels of cash on hand, partially offset by a

decrease in our effective income tax rate in the current-year

period. Adjusted EPS of $0.25 decreased 51% from $0.51 in the

prior-year period.

Segment Results (For the fiscal second quarter of 2025 as

compared with the fiscal second quarter of 2024)

Supply Chain Services

Supply Chain Services segment net revenue of $148.7 million

decreased 11% from $166.2 million in the prior-year period

primarily due to lower net administrative fees revenue, partially

offset by higher software license, other services and support

revenue.

Net administrative fees revenue of $131.4 million decreased 13%

from $150.5 million in the prior-year period, primarily driven by

the expected increase in the aggregate blended member fee share to

the low-60% level in the quarter, partially offset by continued

growth in member purchasing as a result of increased penetration of

contract spend with existing members and from the recruitment and

onboarding of new members.

Software license, other services and support revenue of $17.3

million increased 10% from $15.8 million in the prior-year period

mainly driven by new agreements for the supply chain co-management

business that were signed in the second half of fiscal 2024.

Segment adjusted EBITDA of $73.7 million decreased 24% from

$96.5 million in the prior-year period largely due to the decrease

in net administrative fees revenue and additional investments in

the supply chain co-management business to support ongoing

growth.

Performance Services

Performance Services segment net revenue of $91.5 million

decreased 19% from $113.6 million in the prior-year period

primarily due to lower demand in the consulting business and

product mix in the applied sciences business.

Segment adjusted EBITDA of $9.1 million decreased 71% from $31.2

million in the prior-year period mainly due to the decrease in net

revenue in the consulting and applied sciences businesses.

Liquidity and Cash Flows

As of December 31, 2024, cash and cash equivalents were $85.9

million compared with $125.1 million as of June 30, 2024, and the

company's five-year, $1.0 billion revolving credit facility had an

outstanding balance of $100.0 million, of which the company repaid

$65.0 million in January 2025.

Net cash provided by operating activities from continuing

operations ("operating cash flow") for the six months ended

December 31, 2024 of $193.7 million increased from $15.5 million in

the prior-year period mainly due to a decrease in cash taxes paid

related to the sale of non-healthcare GPO operations in the

prior-year period, cash received from the derivative lawsuit

settlement of $57.0 million in the current-year period and a $17.6

million cash distribution received from a minority investment.

These items were partially offset by higher performance-related

compensation payments.

Net cash used in investing activities for the six months ended

December 31, 2024 of $39.9 million decreased from the prior-year

period primarily due to lower spending of internally developed

software. Net cash used in financing activities for the six months

ended December 31, 2024 was $178.7 million compared to net cash

provided by financing activities for the six months ended December

31, 2023 of $295.0 million. The change in net cash used in

financing was primarily driven by net proceeds from the sale of the

company's non-healthcare GPO operations of $602.3 million in the

prior-year period and the use of $189.8 million (including

commissions) for market repurchases of Class A common stock

("Common Stock") in the current-year period under the company's

Share Repurchase Authorization. These uses of cash were partially

offset by proceeds from the revolving credit facility of $100.0

million in the current-year period and payments of $215.0 million

in the prior-year period.

Free cash flow for the six months ended December 31, 2024 was

$73.9 million compared with $40.7 million in the prior-year period.

The increase was mainly due to the same factors impacting operating

cash flow as well as lower purchases of property and equipment and

the timing of cash payments to OMNIA. Refer to "Premier's Use and

Definition of Non-GAAP Measures" below and the supplemental

financial information at the end of this release for information on

the company's use of this and other non-GAAP financial measures and

a reconciliation of reported GAAP results to non-GAAP results.

Return of Capital to Stockholders

In February 2024, the company announced that its Board of

Directors ("Board") approved the Share Repurchase Authorization and

that it entered into an accelerated share repurchase transaction

(the "ASR"). Under the ASR, in February 2024, the company received

initial deliveries of an aggregate of 15.0 million shares of Common

Stock. On July 11, 2024, as final settlement, the company received

an additional 4.8 million shares of Common Stock, resulting in a

total of 19.9 million shares repurchased under the ASR for a total

of $400.0 million.

On August 20, 2024, the Board approved execution of $200.0

million of repurchases under the Share Repurchase Authorization. As

of December 31, 2024, the Company had repurchased an aggregate of

9.2 million shares of Common Stock for $192.1 million in market

transactions in addition to the ASR repurchases and the remaining

amount of repurchases were completed on January 6, 2025.

During the first half of fiscal 2025, the company paid aggregate

dividends of $42.4 million to holders of its Common Stock. On

January 23, 2025, the Board declared a quarterly cash dividend of

$0.21 per share, payable on March 15, 2025 to stockholders of

record on March 1, 2025.

Conference Call and Webcast

Premier will host a conference call to provide additional detail

around the company's performance and outlook today at 8:00 a.m. ET.

The call will be webcast live from the company's website and, along

with the accompanying presentation, will be available at the

following link to our Event and Presentation page at

https://investors.premierinc.com/overview/default.aspx: Premier

Events. The webcast should be accessed 10 minutes prior to the

conference call start time. A replay of the webcast will be

available for one year following the conclusion of the live

broadcast and will be accessible on the company's website under

Events and Presentations at

https://investors.premierinc.com/overview/default.aspx.

For those parties who do not have internet access, the

conference call may be accessed by calling one of the below

telephone numbers and asking to join the Premier, Inc. call:

Domestic participant dial-in number

(toll-free):

(833) 953-2438

International participant dial-in

number:

(412) 317-5767

About Premier, Inc.

Premier, Inc. (NASDAQ: PINC) is a leading technology-driven

healthcare improvement company, providing solutions to two-thirds

of all healthcare providers in the U.S. Playing a critical role in

the rapidly evolving healthcare industry, Premier unites providers,

suppliers, payers and policymakers to make healthcare better with

national scale, smarter with actionable intelligence and faster

with novel technologies. Headquartered in Charlotte, N.C., Premier

offers integrated data and analytics, collaboratives, supply chain

solutions, consulting and other services in service of our mission

to improve the health of communities. Please visit Premier’s news

and investor sites on www.premierinc.com, as well as X, Facebook,

LinkedIn, YouTube, Instagram and Premier’s blog for more

information about the company.

Premier’s Use and Definition of Non-GAAP Measures

Premier uses EBITDA, adjusted EBITDA, segment adjusted EBITDA,

adjusted net income, adjusted earnings per share, and free cash

flow. These are non-GAAP financial measures that are not in

accordance with, or an alternative to, GAAP, and may be different

from non-GAAP financial measures used by other companies. We

include these non-GAAP financial measures to facilitate a

comparison of the company’s operating performance on a consistent

basis from period to period and to provide measures that, when

viewed in combination with its results prepared in accordance with

GAAP, we believe allow for a more complete understanding of factors

and trends affecting the company’s business than GAAP measures

alone.

Management believes EBITDA, adjusted EBITDA and segment adjusted

EBITDA assist the company’s board of directors, management and

investors in comparing the company’s operating performance on a

consistent basis from period to period by removing the impact of

the company’s earnings elements attributable to the company's asset

base (primarily depreciation and amortization), certain items

outside the control of management, e.g., taxes, other non-cash

items (such as impairment of intangible assets, purchase accounting

adjustments and stock-based compensation), non-recurring items

(such as strategic initiative and financial restructuring-related

expenses) and income and expense that have been classified as

discontinued operations from operating results.

Management believes adjusted net income and adjusted earnings

per share assist the company's board of directors, management and

investors in comparing our net income and earnings per share on a

consistent basis from period to period because these measures

remove non-cash items (such as impairment of intangible assets,

purchase accounting adjustments and stock-based compensation) and

non-recurring items (such as strategic initiative and financial

restructuring-related expenses) and eliminate the variability of

non-controlling interest and equity in net income of unconsolidated

affiliates.

Management believes free cash flow is an important measure

because it represents the cash that the company generates after

payments to certain former limited partners that elected to execute

a Unit Exchange and Tax Receivable Agreement (“Unit Exchange

Agreement") in connection with our August 2020 restructuring,

capital investment to maintain existing products and services and

ongoing business operations, as well as development of new and

upgraded products and services to support future growth and cash

payments to OMNIA for the sale of future revenues and tax payments

on proceeds received from the sale of future revenues. Free cash

flow is important because it enables the company to seek

enhancement of stockholder value through acquisitions,

partnerships, joint ventures, investments in related or

complementary businesses and/or debt reduction.

Also, adjusted EBITDA and free cash flow are supplemental

financial measures used by the company and by external users of our

financial statements and are considered to be indicators of the

operational strength and performance of our business. Adjusted

EBITDA and free cash flow measures allow us to assess our

performance without regard to financing methods and capital

structure and without the impact of other matters that we do not

consider indicative of the operating performance of our business.

More specifically, segment adjusted EBITDA is the primary earnings

measure we use to evaluate the performance of our business

segments.

Non-recurring items are income or expenses and other

items that have not been earned or incurred within the prior two

years and are not expected to recur within the next two years. Such

items include acquisition- and disposition-related expenses,

strategic initiative- and financial restructuring-related expenses,

loss on disposal of long-lived assets, income and expense that has

been classified as discontinued operations and other reconciling

items.

Non-cash items include stock-based compensation expense

and asset impairments.

Non-operating items include gains or losses on the

disposal of assets, interest and investment income or expense,

equity in net income of unconsolidated affiliates and operating

income from revenues sold to OMNIA in connection with the sale of

non-healthcare GPO member contracts, less royalty payments

retained.

EBITDA is defined as net income before income or loss

from discontinued operations, net of tax, interest and investment

income or expense, net, income tax expense, depreciation and

amortization and amortization of purchased intangible assets.

Adjusted EBITDA is defined as EBITDA before merger and

acquisition-related expenses and non-recurring, non-cash or

non-operating items.

Segment adjusted EBITDA is defined as the segment’s net

revenue less cost of revenue and operating expenses directly

attributable to the segment excluding depreciation and

amortization, amortization of purchased intangible assets, merger

and acquisition-related expenses and non-recurring or non-cash

items. Operating expenses directly attributable to the segment

include expenses associated with sales and marketing, general and

administrative, and product development activities specific to the

operation of each segment. General and administrative corporate

expenses that are not specific to a particular segment are not

included in the calculation of segment adjusted EBITDA. Segment

adjusted EBITDA also excludes any income and expense that has been

classified as discontinued operations and operating income from

revenues sold to OMNIA in connection with the sale of

non-healthcare GPO member contracts, less royalty payments

retained.

Adjusted net income is defined as net income attributable

to Premier (i) excluding income or loss from discontinued

operations, net, (ii) excluding income tax expense, (iii) excluding

the effect of non-recurring or non-cash items, including certain

strategic initiative- and financial restructuring-related expenses,

(iv) reflecting an adjustment for income tax expense on Non-GAAP

net income before income taxes at our estimated annual effective

income tax rate, adjusted for unusual or infrequent items, (v)

excluding the equity in net income of unconsolidated affiliates and

(vi) excluding operating income from revenues sold to OMNIA in

connection with the sale of non-healthcare GPO member contracts,

less royalty fees retained, imputed interest expense and associated

income tax expense.

Adjusted earnings per share is adjusted net income

divided by diluted weighted average shares.

Free cash flow is defined as net cash provided by

operating activities from continuing operations less (i) early

termination payments to certain former limited partners that

elected to execute a Unit Exchange Agreement in connection with our

August 2020 restructuring, (ii) purchases of property and equipment

and (iii) cash payments to OMNIA for the sale of future revenues

and tax payments on proceeds received from the sale of future

revenues. Free cash flow does not represent discretionary cash

available for spending as it excludes certain contractual

obligations such as debt repayments.

To properly and prudently evaluate our business, readers are

urged to review the reconciliation of these non-GAAP financial

measures, as well as the other financial tables, included at the

end of this release. Readers should not rely on any single

financial measure to evaluate the company’s business. In addition,

the non-GAAP financial measures used in this release are

susceptible to varying calculations and may differ from, and may

therefore not be comparable to, similarly titled measures used by

other companies.

The Company has revised the definitions for adjusted EBITDA,

segment adjusted EBITDA, adjusted net income and free cash flow

from the definitions reported in the 2024 Annual Report. Adjusted

EBITDA and segment adjusted EBITDA definitions were revised to

exclude operating income from revenues sold to OMNIA in connection

with the sale of non-healthcare GPO member contracts, less royalty

fees retained. The adjusted net income definition was revised to

exclude operating income from revenues sold to OMNIA in connection

with the sale of non-healthcare GPO member contracts, less royalty

fees retained, imputed interest expense and associated income tax

expense. Free cash flow was revised to exclude the cash payments to

OMNIA for the sale of future revenues and tax payments on proceeds

received from the sale of future revenues. For comparability

purposes, prior year non-GAAP financial measures are presented

based on the current definitions in the above section.

In addition to the foregoing, this release and the

reconciliations of our non-GAAP financial measures included at the

end of this release include the presentation of additional fiscal

2025 non-GAAP financial measures including net revenue excluding

Contigo Health, adjusted EBITDA excluding Contigo Health and

adjusted earnings per share excluding Contigo Health. The company

previously announced a plan to divest a majority interest in the

Contigo Health business; however, as of December 31, 2024, the

divestiture process for the Contigo Health business remains ongoing

and our GAAP financial results for the first three and six months

of fiscal 2025 presented in this release include contributions from

that business. As the company expects that the Contigo Health

business will be moved into discontinued operations in fiscal 2025,

guidance presented in this release excludes financial contributions

from this business. Accordingly, we believe that providing

supplemental non-GAAP financial measures that align with our fiscal

2025 guidance allow for a better understanding of that

guidance.

Further information on Premier’s use of non-GAAP financial

measures is available in the “Our Use of Non-GAAP Financial

Measures” section of Premier’s Form 10-Q for the quarter ended

December 31, 2024, expected to be filed with the SEC shortly after

this release, and which will also be made available on Premier's

website at investors.premierinc.com.

Premier's Use of Forward-Looking Non-GAAP Measures

The company does not meaningfully reconcile guidance for

non-GAAP adjusted EBITDA, non-GAAP adjusted net income and non-GAAP

adjusted earnings per share to net income attributable to

stockholders or earnings per share attributable to stockholders

(and accordingly does not meaningfully reconcile free cash flow

guidance, which is based on adjusted EBITDA) because the company

cannot provide guidance for the more significant reconciling items

between net income attributable to stockholders and each of these

metrics without unreasonable effort. This is due to the fact that

future period non-GAAP guidance includes adjustments for items not

indicative of our core operations, which may include, without

limitation, items included in the supplemental financial

information for reconciliation of reported GAAP results to non-GAAP

results. Such items include, but are not limited to, strategic and

acquisition related expenses for professional fees; mark to market

adjustments for put options and contingent liabilities; gains and

losses on stock-based performance shares; adjustments to its income

tax provision (such as valuation allowance adjustments and

settlements of income tax claims); items related to corporate and

facility restructurings; and certain other items the company

believes to be non-indicative of its ongoing operations. Such

adjustments may be affected by changes in ongoing assumptions,

judgements, as well as non-recurring, unusual or unanticipated

charges, expenses or gains/losses or other items that may not

directly correlate to the underlying performance of our business

operations. The exact amount of these adjustments is not currently

determinable but may be significant.

As noted above, as a result of the company's previously

announced plan to divest a majority interest in the Contigo Health

business, the forward-looking guidance presented in this release

(including Total Net Revenue Excluding Contigo Health, adjusted

EBITDA, adjusted net income, adjusted EPS and free cash flow),

excludes the financial contribution of this business, in addition

to any applicable adjustments for non-GAAP financial measures

described above under "Premier's Use and Definitions of Non-GAAP

Measures." With respect to these adjustments for Contigo Health,

the company does not meaningfully reconcile guidance to GAAP

measures because Contigo Health is expected to be moved into

discontinued operations in fiscal 2025.

Cautionary Note Regarding Forward-Looking Statements

Statements made in this release that are not statements of

historical or current facts, including, but not limited to, those

related to our ability to advance our business strategies and

improve healthcare, our ability to find a partner for our Contigo

Health business and the potential benefits thereof, our ability to

fund and conduct share repurchases pursuant to the outstanding

share repurchase authorization and the potential benefits thereof,

the payment of dividends at current levels or at all, guidance on

expected future financial performance and assumptions underlying

that guidance, and our expected effective income tax rate, are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may involve known and unknown risks, uncertainties and

other factors that may cause the actual results, performance or

achievements of Premier to be materially different from historical

results or from any future results or projections expressed or

implied by such forward-looking statements. Accordingly, readers

should not place undue reliance on any forward-looking statements,

the achievement of which cannot be guaranteed. In addition to

statements that explicitly describe such risks and uncertainties,

readers are urged to consider statements in the conditional or

future tenses or that include terms such as “believes,” “belief,”

“expects,” “estimates,” “intends,” “anticipates” or “plans” to be

uncertain and forward-looking. Forward-looking statements may

include comments as to Premier’s beliefs and expectations regarding

future events and trends affecting its business and are necessarily

subject to risks and uncertainties, many of which are outside

Premier’s control. More information on risks and uncertainties that

could affect Premier’s business, achievements, performance,

financial condition and financial results is included from time to

time in the “Cautionary Note Regarding Forward-Looking Statements,”

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of

Premier’s periodic and current filings with the SEC, including the

information in those sections of Premier’s Form 10-K for the year

ended June 30, 2024, and subsequent Quarterly Reports on Form 10-Q,

including the Form 10-Q for the quarter ended December 31, 2024

expected to be filed with the SEC shortly after the date of this

release. Premier's periodic and current filings with the SEC are

made available on Premier’s website at investors.premierinc.com.

Forward-looking statements speak only as of the date they are made,

and Premier undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events that occur after that date, or

otherwise.

Condensed Consolidated

Statements of Income

(Unaudited)

(In thousands, except per

share data)

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Net revenue:

Net administrative fees

$

131,417

$

150,470

$

264,042

$

300,356

Software licenses, other services, and

support

108,849

129,401

224,366

248,541

Net revenue

240,266

279,871

488,408

548,897

Cost of revenue:

Services and software licenses

69,058

65,990

136,782

130,122

Cost of revenue

69,058

65,990

136,782

130,122

Gross profit

171,208

213,881

351,626

418,775

Operating expenses:

Selling, general, and administrative

253,768

137,659

388,648

270,797

Research and development

726

928

1,312

1,791

Amortization of purchased intangible

assets

9,537

12,399

19,174

24,952

Operating expenses

264,031

150,986

409,134

297,540

Operating (loss) income

(92,823

)

62,895

(57,508

)

121,235

Equity in net income (loss) of

unconsolidated affiliates

9,502

(666

)

11,335

(2,392

)

Interest (expense) income, net

(3,787

)

1,881

(5,543

)

1,859

Other income, net

23,304

4,679

83,563

3,587

Other income, net

29,019

5,894

89,355

3,054

(Loss) income before income taxes

(63,804

)

68,789

31,847

124,289

Income tax (benefit) expense

(17,967

)

18,341

4,744

32,072

Net (loss) income from continuing

operations

(45,837

)

50,448

27,103

92,217

Net (loss) income from discontinued

operations, net of tax

(39,389

)

2,418

(40,993

)

3,059

Net (loss) income

(85,226

)

52,866

(13,890

)

95,276

Net (income) loss from continuing

operations attributable to non-controlling interest

(10,792

)

1,436

(11,344

)

3,787

Net (loss) income attributable to

stockholders

$

(96,018

)

$

54,302

$

(25,234

)

$

99,063

Calculation of GAAP Earnings per

Share

Numerator for basic and diluted (loss)

earnings per share:

Net (loss) income from continuing

operations attributable to stockholders

$

(56,629

)

$

51,884

$

15,759

$

96,004

Net (loss) income from discontinued

operations attributable to stockholders

(39,389

)

2,418

(40,993

)

3,059

Net (loss) income attributable to

stockholders

$

(96,018

)

$

54,302

$

(25,234

)

$

99,063

Denominator for (loss) earnings per

share:

Basic weighted average shares

outstanding

94,765

119,702

97,573

119,523

Effect of dilutive securities:

Restricted stock units

—

355

520

444

Performance share awards

—

—

—

128

Diluted weighted average shares

94,765

120,057

98,093

120,095

(Loss) earnings per share attributable

to stockholders:

Basic (loss) earnings per share from

continuing operations

$

(0.60

)

$

0.43

$

0.16

$

0.80

Basic (loss) earnings per share from

discontinued operations

(0.41

)

0.02

(0.42

)

0.03

Basic (loss) earnings per share

attributable to stockholders

$

(1.01

)

$

0.45

$

(0.26

)

$

0.83

Diluted (loss) earnings per share from

continuing operations

$

(0.60

)

$

0.43

$

0.16

$

0.80

Diluted (loss) earnings per share from

discontinued operations

(0.41

)

0.02

(0.42

)

0.02

Diluted (loss) earnings per share

attributable to stockholders

$

(1.01

)

$

0.45

$

(0.26

)

$

0.82

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands, except share

data)

December 31, 2024

June 30, 2024

Assets

Cash and cash equivalents

$

85,850

$

125,146

Accounts receivable (net of $6,377 and

$1,455 allowance for credit losses, respectively)

117,248

100,965

Contract assets (net of $1,206 and $1,248

allowance for credit losses, respectively)

328,907

335,831

Prepaid expenses and other current

assets

76,402

73,653

Current assets of discontinued

operations

—

119,662

Total current assets

608,407

755,257

Property and equipment (net of $780,995

and $742,063 accumulated depreciation, respectively)

203,082

205,711

Intangible assets (net of $313,507 and

$294,333 accumulated amortization, respectively)

250,085

269,259

Goodwill

869,034

995,852

Deferred income tax assets

783,017

773,002

Deferred compensation plan assets

46,796

54,422

Investments in unconsolidated

affiliates

270,240

228,562

Operating lease right-of-use assets

15,365

20,635

Other assets

96,349

98,749

Total assets

$

3,142,375

$

3,401,449

Liabilities and stockholders'

equity

Accounts payable

$

21,880

$

22,610

Accrued expenses

50,428

58,482

Revenue share obligations

333,345

292,792

Accrued compensation and benefits

53,347

100,395

Deferred revenue

20,552

19,642

Line of credit and current portion of

long-term debt

100,000

1,008

Current portion of notes payable to former

limited partners

50,994

101,523

Current portion of liability related to

the sale of future revenues

45,732

51,798

Other current liabilities

55,948

52,589

Current liabilities of discontinued

operations

423

45,724

Total current liabilities

732,649

746,563

Liability related to the sale of future

revenues, less current portion

618,386

599,423

Deferred compensation plan obligations

46,796

54,422

Operating lease liabilities, less current

portion

5,058

11,170

Other liabilities

21,595

27,640

Total liabilities

1,424,484

1,439,218

Commitments and contingencies

Stockholders' equity:

Class A common stock, $0.01 par value,

500,000,000 shares authorized; 91,675,524 shares issued and

outstanding at December 31, 2024 and 111,456,454 shares issued and

105,027,079 shares outstanding at June 30, 2024

917

1,115

Treasury stock, at cost; 6,429,375 shares

at June 30, 2024

—

(250,129

)

Additional paid-in capital

2,203,675

2,105,684

(Accumulated deficit) retained

earnings

(486,627

)

105,590

Accumulated other comprehensive loss

(74

)

(29

)

Total stockholders' equity

1,717,891

1,962,231

Total liabilities and stockholders'

equity

$

3,142,375

$

3,401,449

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

(In thousands)

Six Months Ended December

31,

2024

2023

Operating activities

Net (loss) income

$

(13,890

)

$

95,276

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Net loss (income) from discontinued

operations, net of tax

40,993

(3,059

)

Depreciation and amortization

58,827

65,547

Equity in net (income) loss of

unconsolidated affiliates

(11,335

)

2,392

Deferred income taxes

6,064

(154,933

)

Stock-based compensation

9,519

15,070

Impairment of assets

126,818

—

Other, net

(6,655

)

2,965

Changes in operating assets and

liabilities, net of the effects of acquisitions:

Accounts receivable

(5,012

)

(14,743

)

Contract assets

5,550

(33,178

)

Prepaid expenses and other assets

13,921

(4,077

)

Accounts payable

(3,717

)

(9,733

)

Revenue share obligations

40,553

17,567

Accrued expenses, deferred revenue, and

other liabilities

(67,903

)

36,371

Net cash provided by operating activities

from continuing operations

193,733

15,465

Net cash (used in) provided by operating

activities from discontinued operations

(14,418

)

19,915

Net cash provided by operating

activities

$

179,315

$

35,380

Investing activities

Purchases of property and equipment

$

(39,877

)

$

(49,068

)

Net cash used in investing

activities

$

(39,877

)

$

(49,068

)

Financing activities

Payments on notes payable

$

(51,537

)

$

(50,872

)

Proceeds from credit facility

100,000

—

Payments on credit facility

—

(215,000

)

Proceeds from sale of future revenues

42,325

629,820

Payments on liability related to the sale

of future revenues

(29,428

)

(14,611

)

Cash dividends paid

(42,368

)

(51,059

)

Repurchase of Class A common stock

(189,754

)

—

Other, net

(7,927

)

(3,296

)

Net cash (used in) provided by

financing activities

$

(178,689

)

$

294,982

Effect of exchange rate changes on cash

flows

(45

)

23

Net (decrease) increase in cash and cash

equivalents

(39,296

)

281,317

Cash and cash equivalents at beginning of

period

125,146

89,793

Cash and cash equivalents at end of

period

$

85,850

$

371,110

Supplemental Financial

Information

Reconciliation of Net Cash

Provided by Operating Activities from Continuing Operations to Free

Cash Flow

(Unaudited)

(In thousands)

Six Months Ended

December 31,

2024

2023

Net cash provided by operating activities

from continuing operations

$

193,733

$

15,465

Early termination payments to certain

former limited partners that elected to execute a Unit Exchange

Agreement (a)

(50,529

)

(49,600

)

Purchases of property and equipment

(39,877

)

(49,068

)

Cash payments to OMNIA for the sale of

future revenues (b)

(29,428

)

(14,611

)

Cash tax payments on proceeds received

from the sale of future revenues

—

138,476

Free cash flow

$

73,899

$

40,662

_________________________________

(a)

Early termination payments to certain

former limited partners that elected to execute a Unit Exchange

Agreement in connection with Premier's August 2020 restructuring

are presented in the Consolidated Statements of Cash Flows under

“Payments made on notes payable." During the six months ended

December 31, 2024, the company paid $51.3 million to members,

including imputed interest of $0.8 million which is included in net

cash provided by operating activities from continuing operations.

During the six months ended December 31, 2023, the company paid

$51.3 million to members, including imputed interest of $1.7

million which is included in net cash provided by operating

activities from continuing operations.

(b)

Cash payments to OMNIA for the sale of

future revenues in connection with our sale of non-healthcare

contracts to OMNIA are presented in the Consolidated Statements of

Cash Flows under "Payments on liability related to the sale of

future revenues." During the six months ended December 31, 2024,

the company paid $38.0 million to OMNIA, including imputed interest

of $8.6 million which is included in net cash provided by operating

activities from continuing operations. During the six months ended

December 31, 2023, the company paid $21.0 million to OMNIA,

including imputed interest of $6.4 million which is included in net

cash provided by operating activities from continuing

operations.

Supplemental Financial

Information

Reconciliation of Net Income

from Continuing Operations to Adjusted EBITDA

Reconciliation of Operating

Income to Segment Adjusted EBITDA

Reconciliation of Net Income

Attributable to Stockholders to Adjusted Net Income

(Unaudited)

(In thousands)

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Net (loss) income from continuing

operations

$

(45,837

)

$

50,448

$

27,103

$

92,217

Interest expense (income), net

3,787

(1,881

)

5,543

(1,859

)

Income tax (benefit) expense

(17,967

)

18,341

4,744

32,072

Depreciation and amortization

20,002

20,267

39,653

40,595

Amortization of purchased intangible

assets

9,537

12,399

19,174

24,952

EBITDA

(30,478

)

99,574

96,217

187,977

Stock-based compensation

2,691

8,495

9,831

15,388

Acquisition- and disposition-related

expenses

(1,970

)

1,198

914

7,403

Strategic initiative and financial

restructuring-related expenses

1,883

1,284

1,993

3,030

Operating income from revenues sold to

OMNIA

(15,571

)

(14,797

)

(31,281

)

(26,463

)

Equity in net (income) loss of

unconsolidated affiliates

(9,502

)

666

(11,335

)

2,392

Other non-operating gains

(5,430

)

—

(62,674

)

—

Impairment of assets

126,818

—

126,818

—

Other reconciling items, net

(18,351

)

(1

)

(17,965

)

—

Adjusted EBITDA

$

50,090

$

96,419

$

112,518

$

189,727

Less: Contigo Health

1,976

1,338

4,203

4,068

Adjusted EBITDA excluding Contigo

Health

$

52,066

$

97,757

$

116,721

$

193,795

(Loss) income before income

taxes

$

(63,804

)

$

68,789

$

31,847

$

124,289

Equity in net (income) loss of

unconsolidated affiliates

(9,502

)

666

(11,335

)

2,392

Interest expense (income), net

3,787

(1,881

)

5,543

(1,859

)

Other income, net

(23,304

)

(4,679

)

(83,563

)

(3,587

)

Operating (loss) income

(92,823

)

62,895

(57,508

)

121,235

Depreciation and amortization

20,002

20,267

39,653

40,595

Amortization of purchased intangible

assets

9,537

12,399

19,174

24,952

Stock-based compensation

2,691

8,495

9,831

15,388

Acquisition- and disposition-related

expenses

(1,970

)

1,198

914

7,403

Strategic initiative and financial

restructuring-related expenses

1,883

1,284

1,993

3,030

Operating income from revenues sold to

OMNIA

(15,571

)

(14,797

)

(31,281

)

(26,463

)

Deferred compensation plan expense

221

4,605

2,913

3,480

Impairment of assets

126,818

—

126,818

—

Other reconciling items, net

(698

)

73

11

107

Adjusted EBITDA

$

50,090

$

96,419

$

112,518

$

189,727

SEGMENT ADJUSTED EBITDA

Supply Chain Services

$

73,740

$

96,532

$

151,251

$

197,919

Performance Services

9,123

31,205

24,072

54,135

Corporate

(32,773

)

(31,318

)

(62,805

)

(62,327

)

Adjusted EBITDA

$

50,090

$

96,419

$

112,518

$

189,727

Net (loss) income attributable to

stockholders

$

(96,018

)

$

54,302

$

(25,234

)

$

99,063

Net loss (income) from discontinued

operations, net of tax

39,389

(2,418

)

40,993

(3,059

)

Income tax (benefit) expense

(17,967

)

18,341

4,744

32,072

Amortization of purchased intangible

assets

9,537

12,399

19,174

24,952

Stock-based compensation

2,691

8,495

9,831

15,388

Acquisition- and disposition-related

expenses

(1,970

)

1,198

914

7,403

Strategic initiative and financial

restructuring-related expenses

1,883

1,284

1,993

3,030

Operating income from revenues sold to

OMNIA

(15,571

)

(14,797

)

(31,281

)

(26,463

)

Equity in net (income) loss of

unconsolidated affiliates

(9,502

)

666

(11,335

)

2,392

Other non-operating gains

(5,430

)

—

(62,674

)

—

Impairment of assets

126,818

—

126,818

—

Other reconciling items, net

(2,495

)

3,717

3,741

5,347

Adjusted income before income taxes

31,365

83,187

77,684

160,125

Income tax expense on adjusted income

before income taxes

7,528

22,461

18,644

43,234

Adjusted net income

$

23,837

$

60,726

$

59,040

$

116,891

Supplemental Financial

Information

Reconciliation of GAAP EPS to

Adjusted EPS

(Unaudited)

(In thousands, except per

share data)

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Net (loss) income attributable to

stockholders

$

(96,018

)

$

54,302

$

(25,234

)

$

99,063

Net loss (income) from discontinued

operations, net of tax

39,389

(2,418

)

40,993

(3,059

)

Income tax (benefit) expense

(17,967

)

18,341

4,744

32,072

Amortization of purchased intangible

assets

9,537

12,399

19,174

24,952

Stock-based compensation

2,691

8,495

9,831

15,388

Acquisition- and disposition-related

expenses

(1,970

)

1,198

914

7,403

Strategic initiative and financial

restructuring-related expenses

1,883

1,284

1,993

3,030

Operating income from revenues sold to

OMNIA

(15,571

)

(14,797

)

(31,281

)

(26,463

)

Equity in net (income) loss of

unconsolidated affiliates

(9,502

)

666

(11,335

)

2,392

Other non-operating gains

(5,430

)

—

(62,674

)

—

Impairment of assets

126,818

—

126,818

—

Other reconciling items, net

(2,495

)

3,717

3,741

5,347

Adjusted income before income taxes

31,365

83,187

77,684

160,125

Income tax expense on adjusted income

before income taxes

7,528

22,461

18,644

43,234

Adjusted net income

$

23,837

$

60,726

$

59,040

$

116,891

Weighted average:

Basic weighted average shares

outstanding

94,765

119,702

97,573

119,523

Dilutive shares

429

355

520

572

Weighted average shares outstanding -

diluted

95,194

120,057

98,093

120,095

Basic (loss) earnings per share

attributable to stockholders

$

(1.01

)

$

0.45

$

(0.26

)

$

0.83

Net loss (income) from discontinued

operations, net of tax

0.42

(0.02

)

0.42

(0.03

)

Income tax (benefit) expense

(0.19

)

0.15

0.05

0.27

Amortization of purchased intangible

assets

0.10

0.10

0.20

0.21

Stock-based compensation

0.03

0.07

0.10

0.13

Acquisition- and disposition-related

expenses

(0.02

)

0.01

0.01

0.06

Strategic initiative and financial

restructuring-related expenses

0.02

0.01

0.02

0.03

Operating income from revenues sold to

OMNIA

(0.16

)

(0.12

)

(0.32

)

(0.22

)

Equity in net (income) loss of

unconsolidated affiliates

(0.10

)

0.01

(0.12

)

0.02

Other non-operating gains

(0.06

)

—

(0.64

)

—

Impairment of assets

1.34

—

1.30

—

Other reconciling items, net

(0.04

)

0.04

0.03

0.03

Impact of corporation taxes

(0.08

)

(0.19

)

(0.19

)

(0.36

)

Adjusted earnings per share

$

0.25

$

0.51

$

0.60

$

0.97

Less: Contigo Health

0.02

0.02

0.05

0.05

Adjusted earnings per share excluding

Contigo Health (a)

$

0.27

$

0.53

$

0.65

$

1.02

_________________________________

(a)

Contigo Health Adjusted EPS were losses

and therefore added back to the total.

Supplemental Financial

Information

Reconciliation of Certain

Financial Measures to Adjust for Contigo Health

(Unaudited)

(In thousands)

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Net revenue

$

240,266

$

279,871

$

488,408

$

548,897

Less: Contigo Health

(8,045

)

(10,627

)

(15,691

)

(20,784

)

Net revenue excluding Contigo

Health

$

232,221

$

269,244

$

472,717

$

528,113

Adjusted EBITDA

$

50,090

$

96,419

$

112,518

$

189,727

Less: Contigo Health (a)

1,976

1,338

4,203

4,068

Adjusted EBITDA excluding Contigo

Health

$

52,066

$

97,757

$

116,721

$

193,795

Adjusted EPS

$

0.25

$

0.51

$

0.60

$

0.97

Less: Contigo Health (a)

0.02

0.02

0.05

0.05

Adjusted EPS excluding Contigo

Health

$

0.27

$

0.53

$

0.65

$

1.02

_________________________________

(a)

Contigo Health Adjusted EBITDA and

Adjusted EPS were losses and therefore added back to the total.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204349407/en/

Investor contact: Ben Krasinski Senior Director, Investor

Relations 704.816.5644 ben_krasinski@premierinc.com

Media contact: Amanda Forster Vice President, Integrated

Communications 202.879.8004 amanda_forster@premierinc.com

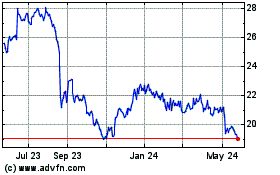

Premier (NASDAQ:PINC)

Historical Stock Chart

From Feb 2025 to Mar 2025

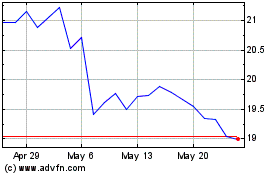

Premier (NASDAQ:PINC)

Historical Stock Chart

From Mar 2024 to Mar 2025