ShiftPixy Announces Pricing of $2.5 Million Offering

August 26 2024 - 7:00AM

Business Wire

ShiftPixy, Inc. (Nasdaq: PIXY) ("ShiftPixy" or the "Company"), a

Florida-based national staffing enterprise which designs, manages,

and sells access to a disruptive, revolutionary platform that

facilitates employment in the rapidly growing Gig Economy, today

announced the pricing of its "reasonable best efforts" offering of

2,403,847 common shares (or common share equivalents in lieu

thereof) together with series A warrants to purchase up to

2,403,847 common shares and series B warrants to purchase up to

2,403,847 common shares at an offering price of $1.04 per common

share and accompanying series A and B warrants. Each series A

warrant is exercisable upon receipt of shareholder approval for one

share of common stock at an exercise price of $1.04 per share and

will expire five years from the effective date of shareholder

approval. Each series B warrant is exercisable upon receipt of

shareholder approval for one share of common stock at an exercise

price of $1.04 per share and will expire two years from the

effective date of shareholder approval. Gross proceeds from the

offering, before deducting the placement agent’s fees and other

offering expenses, are expected to be approximately $2.5

million.

The closing of the offering is expected to occur on or about

August 27, 2024, subject to the satisfaction of customary closing

conditions. The Company intends to use the net proceeds from the

offering for general corporate purposes, including working

capital.

A.G.P./Alliance Global Partners is acting as the sole placement

agent for the offering.

A registration statement on Form S-1 (File No. 333-280566)

relating to the sale of these securities was declared effective by

the Securities and Exchange Commission (the “SEC”) on August 22,

2024. This offering is being made only by means of a prospectus. A

final prospectus relating to the offering will be filed with the

SEC and will be available on the SEC’s website at

http://www.sec.gov. Electronic copies of the prospectus may be

obtained, when available, from A.G.P./Alliance Global Partners, 590

Madison Avenue, 28th Floor, New York, NY 10022, or by telephone at

(212) 624-2060, or by email at prospectus@allianceg.com.

In connection with the offering, the Company has entered into an

agreement with an existing investor of the Company to reduce the

exercise price of outstanding warrants to purchase up to 1,403,417

shares of common stock that were issued in the Company's previous

offerings in July 2022, September 2022, July 2023, October 2023 and

March 2024 to $1.04 per share and extend the term such that the

July 2022, September 2022, July 2023, October 2023 and March 2024

warrants will expire on the date that is five years following the

date shareholder approval for the amendment is received, effective

upon the receipt of shareholder approval.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About ShiftPixy

ShiftPixy is a disruptive human capital services enterprise,

revolutionizing employment in the Gig Economy by delivering a

next-gen platform for workforce management that helps businesses

with shift-based employees navigate regulatory mandates, minimize

administrative burdens and better connect with a ready-for-hire

workforce. With expertise rooted in management’s more than 25 years

of workers’ compensation and compliance programs experience,

ShiftPixy adds a needed layer for addressing compliance and

continued demands for equitable employment practices in the growing

Gig Economy.

Forward Looking Statements

Any statements contained in this press release that do not

describe historical facts may constitute forward-looking

statements. These forward-looking statements include, among other

things, statements regarding the anticipated use of proceeds from

the offering and the anticipated closing date of the offering.

Although such forward-looking statements are based upon what

management of the Company believes are reasonable assumptions,

there can be no assurance that forward-looking statements will

prove to be accurate. If any of the risks or uncertainties,

including those set forth below, materialize or if any of the

assumptions proves incorrect, the results of the Company, could

differ materially from the results expressed or implied by the

forward-looking statements we make. The risks and uncertainties

include, but are not limited to, risks associated with the nature

of the Company’s business model; the Company’s ability to execute

its vision and growth strategy; the Company’s ability to attract

and retain clients; the Company’s ability to assess and manage

risks; changes in the law that affect the Company’s business and

its ability to respond to such changes and incorporate them into

its business model, as necessary; the Company’s ability to insure

against and otherwise effectively manage risks that affect its

business; competition; reliance on third-party systems and

software; the Company’s ability to protect and maintain its

intellectual property; and general developments in the economy and

financial markets. These and other risks are discussed in the

Company’s filings with the SEC, including, without limitation, its

Annual Report on Form 10-K, and its periodic and current reports on

Form 10-Q and Form 8-K. The Company undertakes no obligation to

update forward-looking statements if circumstances or management's

estimates or opinions should change, except as required by

applicable securities laws. The information in this press release

shall not be deemed to be "filed" for the purpose of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of that section, and will not be deemed

an admission as to the materiality of any information that is

required to be disclosed solely by Regulation FD. Further

information on these and other factors that could affect the

financial results of the Company, is included in the filings we

make with the SEC from time to time. These documents are available

on the "SEC Filings" subsection of the "Investor Information"

section of the Company’s website at https://ir.shiftpixy.com, or

directly from the SEC’s website at https://www.sec.gov.

Consistent with the SEC’s April 2013 guidance on using social

media outlets like Facebook and Twitter to make corporate

disclosures and announce key information in compliance with

Regulation FD, the Company is alerting investors and other members

of the general public that the Company will provide updates on

operations and progress required to be disclosed under Regulation

FD through its social media on Facebook, Twitter, LinkedIn and

YouTube. Investors, potential investors, shareholders and

individuals interested in the Company are encouraged to keep

informed by following us on Facebook, Twitter, LinkedIn and

YouTube.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240826862918/en/

INVESTOR CONTACT: InvestorRelations@shiftpixy.com

800.475.3655

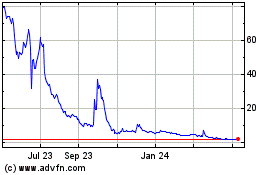

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Jan 2025 to Feb 2025

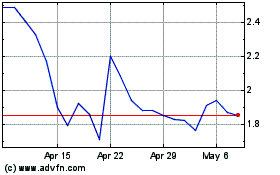

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Feb 2024 to Feb 2025