Form 8-K - Current report

August 02 2024 - 3:17PM

Edgar (US Regulatory)

0001315399FALSE00013153992023-06-282023-06-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 2, 2024

| | | | | | | | | | | | | | |

| | | | |

| PARKE BANCORP, INC. | |

| (Exact name of registrant as specified in its charter) | |

| | | | |

| | | | | | | | | | | | | | |

| New Jersey | | 0-51338 | | 65-1241959 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | |

| | | | | | | | |

601 Delsea Drive, Washington Township, New Jersey | | 08080 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (856) 256-2500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, Par Value $0.10 per share | | PKBK | | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

PARKE BANCORP, INC.

INFORMATION TO BE INCLUDED IN THE REPORT

Section 8 - Other Events

Item 8.01 Other Events.

On August 2, 2024, the Registrant announced that the Board of Directors had adopted a stock repurchase program pursuant to which up to 5% of the Company’s common stock may be repurchased during the next twelve months, unless completed sooner or otherwise extended. Open market purchases are intended to be conducted in accordance with applicable Securities and Exchange Commission regulations. The timing and actual number of shares repurchased will depend on a variety of factors including price, corporate and regulatory requirements and other market conditions.

A copy of the press release dated August 2, 2024 announcing the stock repurchase program is filed as Exhibit 99.1, and incorporated by reference herein.

Section 9 - Financial Statements and Exhibits

Item 9.01 Exhibits.

| | | | | | | | | | | | | | | | | |

| Exhibit No. | Description | | | | |

| 99.1 | | | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PARKE BANCORP, INC.

| | | | | | | | | | | | | | |

| Date: August 2, 2024 | By | /s/ Jonathan D. Hill | |

| | | Jonathan D. Hill | |

| | | Senior Vice President and Chief Financial Officer | |

| | | (Duly Authorized Representative) | |

| | | | |

| | | | | | | | |

| FOR IMMEDIATE RELEASE | | FOR FURTHER INFORMATION CONTACT: |

| August 2, 2024 | | Vito S. Pantilione, President and CEO |

| | Jonathan D. Hill, Senior Vice President and CFO |

| | (856) 256-2500 |

PARKE BANCORP, INC. ANNOUNCES STOCK REPURCHASE PLAN

WASHINGTON TOWNSHIP, NEW JERSEY – Parke Bancorp, Inc. (the “Company”) (NASDAQ: PKBK) today announced its Board of Directors approved a plan to repurchase up to 5% of the Company’s common stock during the next twelve months, unless completed sooner or otherwise extended. Open market purchases are intended to be conducted in accordance with the limitations set forth in Rule 10b-18 of the Securities Exchange Act of 1934.

Repurchases are subject to SEC regulations as well as certain price, market volume and timing constraints specified in the plan.

Vito S. Pantilione, President and Chief Executive Officer of Parke Bancorp and Parke Bank, provided the following statement:

"The stock repurchase program is an integral element of the Company's capital management strategies. As such, we believe that at current prices the Company's stock is a very attractive investment for the Company, and that repurchasing its common stock would enhance shareholder value.”

Parke Bancorp, Inc. was incorporated in January 2005, while Parke Bank commenced operations in January 1999. Parke Bancorp and Parke Bank maintain their principal offices at 601 Delsea Drive, Washington Township, New Jersey. Parke Bank conducts business through a branch office in Northfield, New Jersey, two branch offices in Washington Township, New Jersey, a branch office in Galloway Township, New Jersey, a branch office in Collingswood, New Jersey, a branch in center city Philadelphia and a branch in Chinatown in Philadelphia. Parke Bank is a full service commercial bank, with an emphasis on providing personal and business financial services to individuals and small-sized businesses primarily in Gloucester, Atlantic and Cape May counties in New Jersey and Philadelphia and surrounding counties in Pennsylvania. Parke Bank’s deposits are insured up to the maximum legal amount by the Federal Deposit Insurance Corporation (FDIC). Parke Bancorp’s common stock is traded on the NASDAQ Capital Market under the symbol “PKBK”.

This release may contain forward-looking statements. Such forward-looking statements are subject to risks and uncertainties which may cause actual results to differ materially from those currently anticipated due to a number of factors; our ability to maintain a strong capital base; our ability to continue to pay a dividend in the future; our ability to enhance shareholder value in the future; our earnings and shareholders’ equity; and the possibility of additional corrective actions or limitations on the operations of Parke Bancorp and Parke Bank being imposed by banking regulators, therefore, readers should not place undue reliance on any forward-looking statements. Parke Bancorp, Inc. does not undertake, and specifically disclaims, any obligations to publicly release the results of any

revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such circumstance.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

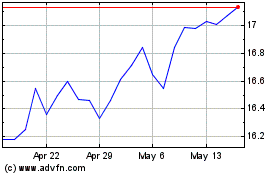

Parke Bancorp (NASDAQ:PKBK)

Historical Stock Chart

From Oct 2024 to Nov 2024

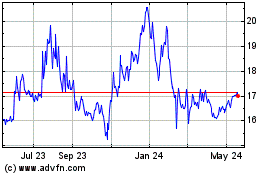

Parke Bancorp (NASDAQ:PKBK)

Historical Stock Chart

From Nov 2023 to Nov 2024