SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

RULE 13e-3 TRANSACTION STATEMENT UNDER SECTION 13(e) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Psychemedics Corporation

(Name of the Issuer and Name of Person Filing Statement)

Common Stock, $0.005 par value per share

(Title of Class of Securities)

744375205

(CUSIP Number of Class of Securities)

Brian Hullinger

President and Chief Executive Officer

Psychemedics Corporation

5220 Spring Valley Road

Dallas, Texas 75254

(800) 527-7424

(Name, Address and Telephone Number of Persons Authorized to

Receive Notices and Communications on Behalf of Persons Filing Statement)

Copies to:

Matthew J. Gardella, Esq.

Matthew W. Tikonoff, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

One Financial Center

Boston, Massachusetts 02111

(617) 542-6000

This statement is filed in connection with (check the appropriate box):

| a. ☒ | | The filing of solicitation materials or an information statement subject to Regulation

14A, Regulation 14C, or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. ☐ | | The filing of a registration statement under the Securities Act of 1933. |

Check the following box if the soliciting materials or information statement

referred to in checking box (a) are preliminary copies: ☒

Check the following box if the filing is a final amendment reporting the

results of the transaction: ☐

RULE 13e-3 TRANSACTION STATEMENT

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule 13E-3

(this “Schedule 13E-3”) is being filed with the Securities and Exchange Commission (the “SEC”) pursuant

to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), by Psychemedics Corporation

(the “Company”), a Delaware corporation.

The Company proposes to hold an annual

meeting of its stockholders to consider, among other matters, amendments to the Company’s certificate of incorporation to effect

a reverse stock split of the Company’s common stock, par value $0.005 per share (the “common stock”), at a ratio

not less than 1-for-4,000 and not greater than 1-for- 6,000 (the “Reverse Stock Split”), followed immediately by a

forward stock split of the common stock at a ratio not less than 4,000-for-1 and not greater than 6,000-for-1 (the “Forward

Stock Split,” and together with the Reverse Stock Split, the “Stock Split”). As a result of the Reverse

Stock Split, each share of common stock held by a stockholder of record owning immediately prior to the effective time of the Reverse

Stock Split fewer than the minimum number of shares, which, depending on the Reverse Stock Split ratio chosen by the Company’s

Board of Directors (the “Board”) would be between 4,000 and 6,000 shares (the “Minimum Number”), will

be converted into the right to receive $2.35 in cash, without interest (the “Cash Payment”), and such stockholders

would no longer be stockholders of the Company. Stockholders owning a number of shares of common stock equal to or greater than the Minimum

Number immediately prior the effective time of the Reverse Stock Split (“Continuing Stockholders”) would not be entitled

to receive any cash for their fractional share interests resulting from the Reverse Stock Split, if any. The Forward Stock Split, which

would immediately follow the Reverse Stock Split, would reconvert whole shares and fractional share interests held by the Continuing

Stockholders back into the same number of shares of the common stock held by such Continuing Stockholders immediately prior to the effective

time. As a result of the Forward Stock Split, the total number of shares of common stock held by a Continuing Stockholder would not change

as a result of the Stock Split.

The primary purpose of the Reverse Stock

Split is to enable the Company to maintain the number of its record holders of common stock below 300. The Reverse Stock Split is being

undertaken as part of the Company’s plan to terminate the registration of the common stock under the Exchange Act and suspend the

Company’s duty to file periodic reports and other information with the SEC under Section 13(a) thereunder, and to delist the common

stock from the Nasdaq Capital Market.

This Schedule 13E-3 is being filed with the SEC concurrently

with the filing of the Company’s preliminary proxy statement on Schedule 14A (the “Proxy Statement”) pursuant

to Regulation 14A under the Exchange Act. The information contained in the Proxy Statement, including all annexes thereto, is expressly

incorporated herein by reference and the responses to each item of this Schedule 13E-3 are qualified in their entirety by reference to

the information contained in the Proxy Statement. As of the date hereof, the Proxy Statement is in preliminary form and is subject to

completion or amendment. This Schedule 13E-3 will be amended to reflect such completion or amendment of the Proxy Statement. Capitalized

terms used and not otherwise defined herein have the meanings ascribed to such terms in the Proxy Statement.

| Item 1. | Summary Term Sheet |

The information set forth in the Proxy Statement under

the caption “TERMS OF THE TRANSACTION” is incorporated herein by reference.

| Item 2. | Subject Company Information |

(a) Name and Address. The

name of the subject company is Psychemedics Corporation, a Delaware corporation. The Company’s principal executive offices are located

at 5220 Spring Valley Road, Dallas, Texas 75254. The Company’s telephone number is (800) 527-7424.

(b) Securities. The subject

class of equity securities to which this Schedule 13E-3 relates is the Company’s common stock, $0.005 par value per share, of which

5,805,611 shares were outstanding as of August 9, 2024.

(c) Trading Market and Price.

The information set forth in the Proxy Statement under “INFORMATION ABOUT THE COMPANY — Market Price of Common Stock”

is incorporated herein by reference.

(d) Dividends. The information

set forth in the Proxy Statement under “INFORMATION ABOUT THE COMPANY — Dividends” is incorporated herein by reference.

(e) Prior Public Offerings.

The Company has not made an underwritten public offering of its common stock for cash during the three years preceding the date of the

filing of this Schedule 13E-3.

(f) Prior Stock Purchases.

The Company has not purchased any subject securities during the two years preceding the date of the filing of this Schedule 13E-3.

| Item 3. | Identity and Background of Filing Person |

(a) Name and Address. The

filing person, the Company, is also the subject company, with its address and telephone number provided in Item 2(a) above. The name of

each director and executive officer is set forth below.

| Name |

|

Position |

| Robyn C. Davis |

|

Director |

| Peter H. Kamin |

|

Director |

| Darius G. Nevin |

|

Chairman |

| Andrew M. Reynolds |

|

Director |

| Brian Hullinger |

|

Director, Chief Executive Officer and President |

| Shannon Shoemaker |

|

Vice President and Chief Revenue Officer |

| Daniella Mehalik |

|

Vice President of Finance |

The address of each director and executive officer of the Company is c/o

Psychemedics Corporation, 5220 Spring Valley Road. Dallas, Texas 75254.

(b) Business and Background

of Entities. Not applicable.

(c) Business and Background

of Natural Persons. The information set forth in the Proxy Statement under “INFORMATION ABOUT THE COMPANY — Directors

and Executive Officers” is incorporated herein by reference.

To the Company’s knowledge, none of the Company’s

directors or executive officers have been convicted in a criminal proceeding during the past five years (excluding traffic violations

or similar misdemeanors) or has been a party to any judicial or administrative proceeding during the past five years (except for matters

that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining the person from future

violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state

securities laws.

Each of the Company’s directors and executive

officers is a citizen of the United States.

| Item 4. | Terms of the Transaction |

(a) Material Terms. The

information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION” and “SPECIAL FACTORS RELATING TO THE TRANSACTION”

is incorporated herein by reference.

(c) Different Terms. The

information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — The Transaction,” “— Effects

of the Transaction,” “— Fairness of the Transaction,” “— Treatment of Beneficial Holders (Stockholders

Holding Shares in “Street Name”),” and “— Material U.S. Federal Income Tax Consequences;” and SPECIAL

FACTORS RELATING TO THE TRANSACTION — Effects of the Transaction,” “— Fairness of the Transaction,” and

“— Material U.S. Federal Income Tax Consequences” is incorporated herein by reference.

(d) Appraisal Rights. The

information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — No Appraisal or Dissenters’ Rights;”

and “SPECIAL FACTORS RELATING TO THE TRANSACTION — No Appraisal or Dissenters’ Rights” is incorporated herein

by reference.

(e) Provisions for Unaffiliated

Security Holders. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION —

Fairness of the Transaction” is incorporated herein by reference.

(f) Eligibility for Listing

or Trading. Not applicable.

| Item 5. | Past Contracts, Transactions, Negotiations and Agreements |

(a) Transactions. Not applicable.

(b) Significant Corporate Events.

Not applicable.

(c) Negotiations or Contacts.

Not applicable.

(e) Agreements Involving the

Subject Company’s Securities. The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION —

Potential Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons,” and “— Vote Required for Approval

of the Transaction Proposals at the Annual Meeting;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Potential Conflicts

of Interests of Officers, Directors, and Certain Affiliated Persons,” “and “— Stockholder Approval” is incorporated

herein by reference.

| Item 6. | Purposes of the Transaction and Plans or Proposals |

(b) Use of Securities Acquired.

The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION — Effective Date”

is incorporated herein by reference.

(c) Plans. The information

set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Purpose of and Reasons for the Transaction,” “—

Effects of the Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Purpose of and Reasons for the Transaction,”

“— Background of the Transaction,” “— Effects of the Transaction,” “— Nasdaq Capital Market

Listing; OTC Pink Market,” and “— Fairness of the Transaction,” is incorporated herein by reference.

| Item 7. | Purposes, Alternatives, Reasons and Effects |

(a) Purposes. The information

set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Purpose of and Reasons for the Transaction;” and

“SPECIAL FACTORS RELATING TO THE TRANSACTION — Purpose of and Reasons for the Transaction” and “— Background

of the Transaction” is incorporated herein by reference.

(b) Alternatives. The information

set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,”

and “— Alternatives to the Transaction” is incorporated herein by reference.

(c) Reasons. The information

set forth in the Proxy Statement under TERMS OF THE TRANSACTION — Purpose of and Reasons for the Transaction;” and “SPECIAL

FACTORS RELATING TO THE TRANSACTION — Purpose of and Reasons for the Transaction,” “— Background of the Transaction,”

“— Alternatives to the Transaction,” and “— Fairness of the Transaction” is incorporated herein by

reference.

(d) Effects. The information

set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — The Transaction,” “— Effects of the Transaction,”

and “— Material U.S. Federal Income Tax Consequences;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION —

Purpose of and Reasons for the Transaction,” “— Effects of the Transaction,” “— Nasdaq Capital Market

Listing; OTC Pink Market,” and “— Material U.S. Federal Income Tax Consequences” is incorporated herein by reference.

| Item 8. | Fairness of the Transaction |

(a) Fairness. The information

set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Transaction Committee and Board Recommendations of the

Transaction,” and “— Fairness of the Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION —

Background of the Transaction,” and “— Fairness of the Transaction” is incorporated herein by reference.

(b) Factors Considered in Determining

Fairness. The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Purpose of and Reasons for

the Transaction,” “— Transaction Committee and Board Recommendations of the Transaction,” “— Reservation

of Rights,” and “— Fairness of the Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION —

Purpose of and Reasons for the Transaction,” “— Background of the Transaction,” “— Alternatives to

the Transaction,” “— Fairness of the Transaction,” and “— Fairness Opinion of Financial Advisor”

is incorporated herein by reference.

(c) Approval of Security Holders.

The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Potential Conflicts of Interest of Officers,

Directors, and Certain Affiliated Persons,” and “— Vote Required for Approval of the Transaction Proposals at the Annual

Meeting;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Fairness of the Transaction,” “— Potential

Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons,” and “— Stockholder Approval” is

incorporated herein by reference.

(d) Unaffiliated Representatives.

The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Fairness of the Transaction;” and

“SPECIAL FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,” “— Fairness of the Transaction,”

and “— Fairness Opinion of Financial Advisor” is incorporated herein by reference.

(e) Approval of Directors.

The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Transaction Committee and Board Recommendations

of the Transaction,” and “— Fairness of the Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION

— Background of the Transaction,” and “— Fairness of the Transaction” is incorporated herein by reference.

(f) Other Offers. None.

| Item 9. | Reports, Opinions, Appraisals and Negotiations |

(a) Report, Opinion or Appraisal.

The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Transaction Committee and Board Recommendations

of the Transaction” and “— Fairness of the Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION

— Background of the Transaction,” “— Fairness of the Transaction,” and “— Fairness Opinion of

Financial Advisor” is incorporated herein by reference.

(b) Preparer and Summary of

the Report, Opinion or Appraisal. The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Transaction

Committee and Board Recommendations of the Transaction” and “— Fairness of the Transaction;” and “SPECIAL

FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,” “— Fairness of the Transaction,” and

“— Fairness Opinion of Financial Advisor” is incorporated herein by reference.

(c) Availability of Documents.

The full text of the fairness opinion of Mirus Securities, Inc. (“Mirus”) dated August 12, 2024, is attached as Annex D to

the Proxy Statement. The fairness opinion of Mirus and the Valuation Presentations of Mirus dated August 12, 2024, June 5, 2024 and April

10, 2024 are each available for inspection and copying at the Company’s principal executive offices, 5220 Spring Valley Road, Dallas,

Texas 75254 during its regular business hours by any interested equity security holder of the Company or representative who has been so

designated in writing.

| Item 10. | Source and Amounts of Funds or Other Consideration |

(a) Source of Funds. The

information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Financing for the Stock Split;” and “SPECIAL

FACTORS RELATING TO THE TRANSACTION — Effects of the Transaction” and “— Source of Funds and Expenses” is

incorporated herein by reference.

(b) Conditions. The information

set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Financing for the Stock Split;” and “SPECIAL

FACTORS RELATING TO THE TRANSACTION — Effects of the Transaction” and “— Source of Funds and Expenses” is

incorporated herein by reference.

(c) Expenses. The information

set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION — Source of Funds and Expenses”

is incorporated herein by reference.

(d) Borrowed Funds. None.

| Item 11. | Interest in Securities of the Subject Company |

(a) Securities Ownership.

The information set forth in the Proxy Statement under “PRINCIPAL STOCKHOLDERS AND STOCKHOLDINGS OF MANAGEMENT” is incorporated

herein by reference.

(b) Securities Transactions.

None.

| Item 12. | The Solicitation or Recommendation |

(d) Intent to Tender or Vote

in a Going Private Transaction. The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Effects

of the Transaction,” “—Potential Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons,”

and “— Vote Required for Approval of the Transaction Proposals at the Annual Meeting;” “SPECIAL FACTORS RELATING

TO THE TRANSACTION — Effects of the Transaction,” “— Potential Conflicts of Interests of Officers, Directors,

and Certain Affiliated Persons,” and “— Stockholder Approval” is incorporated herein by reference.

(e) Recommendation of Others.

The information set forth in the Proxy Statement under “TERMS OF THE TRANSACTION — Potential Conflicts of Interests of Officers,

Directors, and Certain Affiliated Persons,” and “— Vote Required for Approval of the Transaction Proposals at the Annual

Meeting;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,” and “—

Fairness of the Transaction” is incorporated herein by reference.

| Item 13. | Financial Statements |

(a) Financial Information. The audited financial statements of the

Company for the years ended December 31, 2023 and December 31, 2022 appearing in the Annual Report on Form 10- K for the fiscal year

ended December 31, 2023 (filed with the SEC on March 28, 2024) are incorporated herein by reference. The interim financial statements

of the Company for the three months ended March 31, 2024 appearing in the Quarterly Report on Form 10-Q for the fiscal quarter ended

March 31, 2024 (filed with the SEC on May 14, 2024) and the interim financial statements of the Company for the three and six months

ended June 30, 2024 appearing in the Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024 (filed with the SEC on

August 13, 2024), are each incorporated herein by reference.

(b) Pro forma Information.

Not applicable.

(c) Summary Information.

The information set forth in the Proxy Statement under “FINANCIAL INFORMATION — Financial Information”

is incorporated herein by reference.

| Item 14. | Persons/Assets, Retained, Employed, Compensated or Used |

(a) Solicitations or Recommendations.

The information set forth in the Proxy Statement under “ABOUT THE ANNUAL MEETING” is incorporated herein by reference.

(b) Employees and Corporate

Assets. The information set forth in the Proxy Statement under “ABOUT THE ANNUAL MEETING” is incorporated herein by reference.

| Item 15. | Additional Information |

(b) Not applicable.

(c) Other Material Information.

The information contained in the Proxy Statement, including all appendices attached thereto, is incorporated herein by reference.

(a)(i) Notice of Meeting and Preliminary Proxy Statement of the Company (incorporated herein by reference to the Company’s Schedule 14A filed with the Securities and Exchange Commission on September 3, 2024).

(a)(ii) Annual financial statements for the years ended December 31, 2023 and December 31, 2022 of Psychemedics Corporation appearing in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (filed with the SEC on March 28, 2024 and incorporated herein by reference).

(a)(iii) Interim financial statements for the three months ended March 31, 2024 of Psychemedics Corporation appearing in the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024 (filed with the SEC on May 14, 2024 and incorporated herein by reference).

(a)(iv) Interim financial statements for the three and six months ended June 30, 2024 of Psychemedics Corporation appearing in the Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024 (filed with the SEC on August 13, 2024 and incorporated herein by reference).

(a)(v) Press Release issued by the Company, dated August 12, 2024 (filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on August 12, 2024 and incorporated herein by reference).

(b) Not applicable.

(c)(i) Opinion of Mirus, dated August 12, 2024 (incorporated herein by reference to Annex D of the Company’s Schedule 14A filed with the Securities and Exchange Commission on September 3, 2024).

(c)(ii) Presentation, dated August 12, 2024 of Mirus to the Board of Directors of the Company.

(c)(iii) Presentation, dated June 5, 2024 of Mirus to the Board of Directors of the Company.

(c)(iv) Presentation,

dated April 10, 2024 of Mirus to the Board of Directors of the Company.

(d) Stock Purchase Agreement, dated August 12, 2024, by and among the Company, 3K Limited Partnership, Peter H. Kamin, the Peter H. Kamin Revocable Trust dated February 2003, the Peter H. Kamin Childrens Trust dated March 1997, the Peter H. Kamin GST Trust and the Peter H. Kamin Family Foundation (filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on August 12, 2024 and incorporated herein by reference).

(e) Not applicable.

(f) Not applicable.

(g) Not applicable.

(h) Not applicable.

107 Filing Fee Table.

SIGNATURE

After due inquiry and to the best of its knowledge

and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

| |

PSYCHEMEDICS CORPORATION |

| |

|

| |

By: |

/s/ Brian Hullinger |

|

| |

|

Brian Hullinger |

| |

|

President and Chief Executive Officer |

Dated: September 3, 2024

Exhibit (c)(ii)

1 DRAFT – CONFIDENTIAL PREPARED JULY 2022 FOR: Prepared April 2024 for: Project Northern Lights Presentation prepared for the Transaction Committee of the Board of Directors August 12, 2024

2 DRAFT – CONFIDENTIAL • Mirus Securities, Inc. (“ Mirus ”) has relied upon and assumed the accuracy and completeness of all information that was publicly available or provided to us by the Company, and has not independently verified such information. • Mirus has not conducted any valuation or appraisal of any assets or liabilities. • We have assumed that financial analyses and forecasts have been reasonably prepared based on assumptions reflecting the best currently available estimates and judgments by management as to the expected future results of operations of the Company. • We are not legal, regulatory or tax experts and have relied on the assessments made by the Company and its advisors with respect to such issues. • Our opinion is based on economic, market and other conditions as in effect on, and the information made available to us as of , the date of this Presentation. • We have not acted as financial advisor to the Company with respect to the proposed Transaction, and we will not receive any compensation that is contingent upon the successful completion of the Transaction. Mirus has provided advisory services to the Transaction Committee of the Board of Directors related our opinion work, including a review and analysis of precedent transactions, advice with respect to cash - out value for fractional shares resulting from the reverse stock split, support with analyzing the Company’s shareholder data to confirm the appropriate range of reverse stock split ratios for the Transaction ( in collaboration with the Company and its other advisors), and providing a draft of the summary of our analysis. The Company ha s agreed to indemnify us for certain liabilities arising out of our engagement, including liabilities arising under the Federal se curities laws. • This Presentation is not intended to represent an opinion, but rather to serve as discussion materials for the Committee to r evi ew and as a basis upon which Mirus may render an opinion. This Presentation does not address the underlying business decision by the Company to pursue, consider or approve a transaction involving the Company, and this Presentation does not constitute a recommendation to the Company, the Committee, or any other person or entity as to any specific action that should be taken (o r omitted to be taken) in connection with a transaction involving the Company or as to any strategic or financial alternatives to a proposed transaction or the timing thereof. • Please see our Fairness Opinion for additional disclaimers and limitations. Disclaimer and limiting factors

3 DRAFT – CONFIDENTIAL Agenda • Engagement overview • Northern Lights financial overview • Valuation analyses

ENGAGEMENT OVERVIEW

5 DRAFT – CONFIDENTIAL • The Board of Northern Lights (the “Company”, or “Northern Lights”) is considering executing a reverse stock split, to be foll owe d by a reciprocal forward stock split (the “Stock Splits”). The Company does not intend to issue any fractional shares in the Stock Spl its. In lieu of fractional shares, shareholders that own less shares than the reverse stock split ratio as of the record date would b e p aid a cash amount per share (the “Cash Payment”) and no longer be shareholders of the Company. Shareholders owning at least as many shares as the reverse stock split ratio would not be entitled to receive any cash for resulting fractional shares, if any. Ra the r, they would end up with the same number of shares as immediately preceding the Stock Splits. The Company is considering a range of reverse split ratios (including but not necessarily limited to 1 - for - 4,000, 1 - for - 5,000, and 1 - for - 6,000) and a Cash Payment of $2.35 per share. • The intent of the Stock Splits and Cash Payments would be to reduce the number of shareholders to fewer than 300, which, subj ect to additional documentation and procedures, would make the Company eligible to file a Form 15 with the SEC and terminate its registration obligations under the Exchange Act of 1934, as amended (in conjunction with the Stock Splits and Cash Payments, the “Transaction”). • Northern Lights is considering the Transaction due to the significant costs and expenses associated with being a reporting co mpa ny. • Mirus has been engaged to provide a written opinion (the “Opinion”) to the Transaction Committee. The Opinion will be as to the fairness, from a financial point of view, of the Transaction to the common shareholders of the Company excluding affiliated shareholders including Independent Director Peter Kamin and entities affiliated with him. • The Opinion was approved and authorized for issuance by Mirus’s Fairness Opinion Committee. Transaction and engagement overview

NORTHERN LIGHTS FINANCIAL OVERVIEW

7 DRAFT – CONFIDENTIAL Forecast Historical and projected income Source: Company filings and documents. 1) Net income (loss) as reported in company filings. 2) EBITDA calculated as gross profit less operating expenses, plus depreciation and amortization. Inclusive of stock - based compensa tion expense. Excludes any potential savings as a result of “going dark.” Historical financials TTM Mar 31, Year ending Dec 31, 2024 2023 2022 2021 2020 $'000s 21,596 22,098 25,240 24,909 21,360 Revenues 13,266 13,685 15,949 14,645 16,474 Cost of revenues 8,330 8,413 9,291 10,264 4,886 Gross profit 38.6% 38.1% 36.8% 41.2% 22.9% Gross profit margin % Operating expenses 7,334 7,192 5,857 6,126 6,095 General and administrative 2,901 2,998 3,191 2,799 3,577 Marketing and selling 1,055 1,144 1,326 1,130 1,280 Research and development 11,290 11,334 10,374 10,055 10,952 Total operating expenses (2,960) (2,921) (1,083) 209 (6,066) Operating income (loss) Other income (expense) - - - 2,181 - Gain on forgiveness of PPP loan (509) (507) - (3,150) - Settlements (8) (10) 43 (61) (140) Other income (expense) (517) (517) 43 (1,030) (140) Total other income (expense) (3,477) (3,438) (1,040) (821) (6,206) Net loss before tax 981 716 44 (156) (2,347) Provision for (benefit from) income tax (4,458) (4,154) (1,084) (665) (3,859) Net income (loss) 1 1,573 1,731 2,367 2,784 2,691 Depreciation & amortization (1,387) (1,190) 1,284 2,993 (3,375) EBITDA 2 - 6% - 5% 5% 12% - 16% EBITDA Margin % 21.4 24.9 25.2 22.1 21.0 21.6 23.6 (3.4) 3.0 1.3 (1.2) 0.3 0.8 1.3 (5.0) - 5.0 10.0 15.0 20.0 25.0 30.0 2020 2021 2022 2023 2024F 2025F 2026F Revenue and EBITDA (2022A - 2026F) 2 Revenue Unadjusted EBITDA

8 DRAFT – CONFIDENTIAL Historical balance sheets Source: Company filings and documents. Mar 31, Year ending Dec 31, Mar 31, Year ending Dec 31, 2024 2023 2022 2021 $'000s 2024 2023 2022 2021 $'000s Liabilities Assets 1,131 752 448 994 Accounts payable 1,421 1,964 4,750 1,992 Cash and equivalents 1,780 2,604 3,939 3,188 Accrued expenses 3,883 3,687 3,739 4,116 Accounts receivable, net 230 305 294 664 Current portion of debt 870 1,136 1,136 1,499 Prepaid expenses and other current assets 1,043 1,048 1,037 984 Current portion of operating lease liabilities 13 18 339 2,678 Income tax receivable 4,184 4,709 5,718 5,830 Total current liabilities 6,187 6,805 9,964 10,285 Total Current Assets - - 305 599 Long - term debt Property and equipment 687 945 1,938 2,880 Long - term portion of operating lease liabilities 4,774 4,648 4,521 Computer software 4,871 5,654 7,961 9,309 Total liabilities 2,253 2,247 2,195 Office furniture and equipment 16,038 16,013 16,005 Laboratory equipment 3,629 3,629 3,629 Leasehold improvements - - - - Preferred - stock (23,633) (21,964) (19,659) Accumulated depreciation 32 32 32 31 Common stock 2,759 3,061 4,573 6,691 Net property and equipment 35,426 35,129 34,275 33,478 Additional paid - in capital (10,082) (10,082) (10,082) (10,082) Treasury stock 608 632 823 864 Other assets (17,461) (16,773) (11,820) (9,550) Accumulated deficit - - 691 160 Deferred tax asset (1,634) (1,634) (1,634) (1,634) Accumulated other comprehensive loss 1,598 1,828 2,681 3,552 Operating lease right - of - use assets 6,281 6,672 10,771 12,243 Total equity 11,152 12,326 18,732 21,552 Total liabilities & shareholders' equity 11,152 12,326 18,732 21,552 Total Assets Capitalization ('000s) 5,806 Shares outstanding (as of May 10, 2024) $9,579 Market capitalization (at $1.65/share as of August 9, 2024) $1,004 Plus: total debt (May 31, 2024) ($1,815) Less: cash (May 31, 2024) $8,768 Enterprise value

9 DRAFT – CONFIDENTIAL Name Shares pre- transaction % of common outstanding Change (reverse split) 3 Change (financing) 4 Shares post- transaction % post- transaction Insiders Kamin, Peter H. (Independent Director) 647,737 11.2% 1,425,745 2,073,482 34.5% Weinert, Fred J. (Former Lead Independent Director) 260,064 4.5% 260,064 4.3% Kubacki, Raymond C. (Former Chairman, CEO & President) 246,737 4.2% 246,737 4.1% Nevin, Darius G. (Independent Chairman) 29,681 0.5% 29,681 0.5% Schaffer Ph.D., Michael I. (Former Vice President of Laboratory Operations) 26,989 0.5% 26,989 0.4% Davis, Robyn C. (Independent Director) 25,000 0.4% 25,000 0.4% Reynolds, Andrew M. (Independent Director) 14,000 0.2% 14,000 0.2% Total insider holdings 1,250,208 21.5% - 1,425,745 2,675,953 44.5% Institutions >0.75% of outstanding Powell Anderson Capital Partners 323,500 5.6% 323,500 5.4% 22NW, LP 274,418 4.7% 274,418 4.6% Renaissance Technologies LLC 259,863 4.5% 259,863 4.3% The Vanguard Group, Inc. 251,283 4.3% 251,283 4.2% RBF Capital LLC 142,142 2.4% 142,142 2.4% BlackRock, Inc. (NYSE:BLK) 76,748 1.3% 76,748 1.3% Wedbush Asset Management, LLC 50,341 0.9% 50,341 0.8% Institutions and individuals >0.75% of outsanding 1,378,295 23.7% - - 1,378,295 22.9% All other holdings 3,177,108 54.7% (1,212,979) - 1,964,129 32.6% Total shares outstanding 3 5,805,611 100.0% (1,212,979) 1,425,745 6,018,377 100.0% Shareholders (estimate) 3 7,700 (7,560) - 140 Summary of shareholders Source: shareholdings per Company documents, filings, and Capital IQ as of August 9, 2024. Does not include stock options and stock unit awards, which are all presently anti - dilutive per Company documents and filings. Total shares outstanding as of May 10, 2024 per Company filings. 1) Includes 44,980 shares held by 3K Limited Partnership, of which Peter Kamin is founder and Managing Partner. 2) Includes 11,301 shares held by R. Adam Lindsay, Managing Member of Powell Anderson. 3) Estimated based on Company documents, shareholder reports, and illustrative 1 - for - 5,000 reverse split. 4) Assumes investment amount equal to cash out price plus $500,000 incremental equity investment at $2.35 per share. AS OF AUGUST 9, 2024 AND ESTIMATED PRO FORMA The Company is considering a range of reverse split ratios. The pro forma shareholding below reflect an illustrative 1 - for - 5,000 reverse split ratio, followed by a reciprocal forward stock split. Cash out and incremental $500,000 investment at $2.35 per share to be funded by Independent Director Peter Kamin and entities affiliated with him. (1) (2) Current Pro forma estimate

VALUATION ANALYSES

11 DRAFT – CONFIDENTIAL Confidential Valuation methods considered • Historical valuation approach: Mirus reviewed Northern Lights’ historical common equity trading prices and volumes, and historical enterprise value/revenue multiples. Due to Northern Lights’ recent low or negative EBITDA margins, EV/EBITDA multi ple s were reviewed but not utilized in Mirus’s analyses • Public companies approach: Mirus reviewed select public companies and their implied valuation multiples • Transactions approach: Mirus reviewed select merger and acquisition transactions and their implied valuation multiples • Premia paid approach: Mirus reviewed the implied premia paid in recent M&A transactions and “going dark” reverse stock split transactions • Discounted cash flow approach: Mirus conducted a DCF analysis utilizing the forecast developed by management • Leveraged buyouts approach: Mirus conducted a buyout analysis utilizing the forecast developed by management, assuming modest incremental leverage and adjustments for estimated costs incurred as a public company and transaction costs

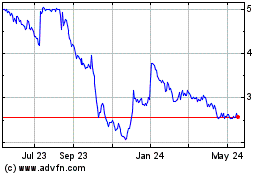

12 DRAFT – CONFIDENTIAL $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 August 2022 August 2023 August 2024 Trading volumes and share price Volume (shares) Close Price Confidential TRAILING 2 YEARS AND TTM SUMMARY STATISTICS Historical valuation: stock price and volumes Source: Capital IQ as of August 9, 2024. 1) Volume bucketed by daily VWAP (volume weighted average price). 2) Trailing volume weighted average price. August 10, 2023 - August 9, 2024 $ 5.04 Intraday high: $ 1.63 Intraday low: $ 5.00 High close: $ 1.64 Low close: $ 3.16 Volume weighted average price 1 : $ 1.65 Last close price: - 67% % off TTM high: +1% % off TTM low: % of Total Estimated volume 1 Price Range 2% 53,780 < $2.00 20% 592,330 $2.01 - $2.50 29% 835,620 $2.51 - $3.00 19% 542,560 $3.01 - $3.50 16% 467,390 $3.51 - $4.00 4% 114,600 $4.01 - $4.50 11% 309,060 > $4.51 100% 2,915,340 Total 12 mo. 2 : $3.16 3 mo. 2 : $2.26 1 mo. 2 : $2.06

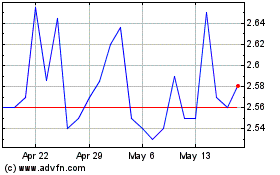

13 DRAFT – CONFIDENTIAL $1.60 $1.80 $2.00 $2.20 $2.40 $2.60 $2.80 0 5,000 10,000 15,000 20,000 25,000 30,000 May 2024 June 2024 July 2024 August 2024 Trading volumes and share price Volume (shares) Close Price Confidential TRAILING 3 MONTHS AND SUMMARY STATISTICS Historical valuation: stock price and volumes Source: Capital IQ as of August 9, 2024. Note: no trading activity on May 13, 2024. 1) Volume bucketed by daily VWAP (volume weighted average price). 2) Trailing volume weighted average price. May 10, 2024 - August 9, 2024 $ 2.69 Intraday high: $ 1.63 Intraday low: $ 2.69 High close: $ 1.64 Low close: $ 2.26 Volume weighted average price 1 : $ 1.65 Last close price: - 39% % off 3mo. high: +1% % off 3mo. low: % of Total Estimated volume 1 Price Range 11% 38,800 < $1.80 4% 14,980 $1.81 - $2.00 17% 58,640 $2.01 - $2.20 32% 112,630 $2.21 - $2.40 31% 108,320 $2.41 - $2.60 5% 17,950 $2.61 - $2.80 100% 351,320 Total

14 DRAFT – CONFIDENTIAL Confidential TRAILING 2 YEARS AND SUMMARY STATISTICS Historical valuation: enterprise value/TTM revenue Source: Capital IQ as of August 9, 2024. 1) Enterprise Value (EV) calculated as Market Capitalization plus Net Debt. For each data point, Market Capitalization calculated daily, and the Debt values are bas ed on each day’s most recent public financial filings, not taking into account delay in financial reporting. For example, January 2024 EV is c alc ulated as daily Market Capitalization, plus Net Debt as of December 31, 2023 (FY 2023 10 - K filed on March 28, 2024). TTM Revenue ($M) EV/Revenue $21.6 0.4x Aug 09, 2024 $23.6 1.1x Aug 09, 2023 $26.1 1.4x Aug 10, 2022 0.4x Low 0.9x Median 1.4x High 0 5 10 15 20 25 30 0.00x 0.25x 0.50x 0.75x 1.00x 1.25x 1.50x August 2022 August 2023 August 2024 ($M) EV/TTM revenue and TTM revenue EV/TTM Revenue TTM Revenue

15 DRAFT – CONFIDENTIAL Confidential Historical valuation: summary High 3rd Quartile VWAP 1 1st Quartile Low Northern Lights close prices $5.00 $3.16 $3.16 $2.43 $1.64 52 - Week Stock History $3.18 $2.93 $2.65 $2.33 $1.64 6 - Month Stock History $2.69 $2.43 $2.26 $2.27 $1.64 3 - Month Stock History $2.43 $2.33 $2.06 $2.03 $1.64 1 - Month Stock History $1.85 $1.81 $1.76 $1.65 $1.64 1 - Week Stock History August 9, 2024 High 3rd Quartile Mean Median 1st Quartile Low Northern Lights trailing 2 - year valuation multiples 0.4x 1.4x 1.1x 0.9x 0.9x 0.7x 0.4x EV/TTM Revenue 1) Source: Capital IQ. Volume weighted average price for periods estimated for based on daily volume weighted average price.

16 DRAFT – CONFIDENTIAL Confidential Selected comparable publicly traded companies Source: Capital IQ. Market Capitalization as of August 9, 2024. Figures in millions of dollars. Metrics as of each company’s fou r most recently reported quarters. Northern Lights shown for reference, but not included in calculation of descriptive statistics. VALUATION METRICS Company Market Cap Enterprise Value TTM Revenue TTM Revenue Growth LTM EBITDA EBITDA Margin EV / LTM Revenue EV / LTM EBITDA TTM Revenue <$100M Northern Lights 10 8 22 (12%) (1) (6%) 0.4x NM Lab services Labcorp Holdings Inc. 19,014 23,994 12,488 5% 1,655 13% 1.9x 14.5x SGS SA 20,100 23,703 7,426 (0%) 1,268 17% 3.2x 18.7x Quest Diagnostics Incorporated 16,621 20,890 9,346 (1%) 1,813 19% 2.2x 11.5x Bureau Veritas SA 13,755 15,486 6,420 (1%) 1,175 18% 2.4x 13.2x Eurofins Scientific SE 11,048 14,235 7,204 1% 1,402 19% 2.0x 10.2x NeoGenomics, Inc. 2,121 2,273 628 14% (14) (2%) 3.6x NM OPKO Health, Inc. 1,046 1,214 716 (17%) (165) (23%) 1.7x NM Transcat, Inc. 1,061 1,042 266 12% 37 14% 3.9x 28.3x Mesa Laboratories, Inc. 647 829 224 2% 40 18% 3.7x 20.9x Specialty testing and diagnostics QuidelOrtho Corporation 2,798 5,255 2,835 (10%) 590 21% 1.9x 8.9x Neogen Corporation 3,640 4,358 924 12% 191 21% 4.7x 22.8x Guardant Health, Inc. 3,568 3,775 644 26% (382) (59%) 5.9x NM Castle Biosciences, Inc. 744 495 288 72% (3) (1%) 1.7x NM Quanterix Corporation 419 122 129 16% (46) (35%) 0.9x NM OraSure Technologies, Inc. 315 48 274 (43%) 31 12% 0.2x 1.5x Other microcap diagnostics companies MDxHealth SA 71 97 75 65% (19) (26%) 1.3x NM Yes Centogene N.V. 9 61 54 6% (37) (68%) 1.1x NM Yes Interpace Biosciences, Inc. 7 58 42 12% 5 12% 1.4x 12.0x Yes Genetic Technologies Limited 4 1 7 (4%) (7) (96%) 0.2x NM Yes Precipio, Inc. 8 7 16 62% (5) (34%) 0.5x NM Yes All public companies in set Companies in set <$100M TTM revenue Low 0.2x 1.5x 0.2x 12.0x 1st Quartile 1.3x 10.8x Median 1.9x 13.2x 1.1x 12.0x Mean 2.2x 14.8x 0.9x 12.0x 3rd Quartile 3.3x 19.8x High 5.9x 28.3x 1.4x 12.0x

17 DRAFT – CONFIDENTIAL Confidential Selected comparable publicly traded companies IMPLIED NORTHERN LIGHTS VALUATION Source: Company filings and documents. 1) Public company multiples calculated on page 16 . Value Sample Calculation 0.2x Low EV/TTM revenue of public companies <$100M revenue A = $21.2 M Northern Lights’ TTM revenue (as of May 31, 2024) B = $3.9M Northern Lights’ implied enterprise value C = A x B = $1.8M Northern Lights’ cash balance (as of May 31, 2024) D = $1.0M Northern Lights’ debt balance (as of May 31, 2024) E = $4.7M Northern Lights’ implied equity value F = C + D – E 5.8M Northern Lights’ common equity shares outstanding (as of May 10, 2024) G = $0.80 Northern Lights’ implied price per s hare (as of August 9, 2024) H = F ÷ G High Mean Median Low Public company multiples 1 1.4x 0.9x 1.1x 0.2x EV/TTM revenue (<$100M TTM revenue) Implied price per share $5.26 $3.41 $4.29 $0.80 EV/TTM revenue (<$100M TTM revenue)

18 DRAFT – CONFIDENTIAL Confidential Selected comparable transactions Source: Capital IQ, company filings and documents. 1) Target’s revenue and EBITDA for the four most recent quarters before the transaction was announced, with exception of LifeLabs (revenue metric is a forward estimate). 2) Disclosed consideration of CAD 1.35 billion on estimated CAD 970 million forward twelve - month revenue as of July 3, 2024. USD eq uivalent of $986 million valuation and $708 million revenue as of August 9, 2024. 3) Disclosed consideration of CHF 33 million in shares and CHF 87 million cash. USD equivalent of $139 million as of August 9, 2 024 . 4) $4.29 billion consideration consisting of $1.75 billion cash, $2.50 billion of shares (25.055 million shares at closing date share price of $99.60 per share), and $0.05 billion replacement equity awards. 5) $322 million consideration at close consisting of $150 million cash and $172 million of shares (2.4 million shares at closing date share price of $70.95 per share). Up to $150 million of incremental consideration based on two revenue - based milestones, of which $37.5 million was ultimately earned. VALUATION METRICS (5) (4) ( 3 ) EV / EV / Target's Target's Implied Enterprise Percent Transaction ($ in millions) EBITDA Revenue EBITDA 1 revenue 1 Value Sought closed date Acquirer Target NM 1.4x - 707 984 100% Announced Jul 2024 Quest Diagnostics, Inc. LifeLabs NM 2.4x - 100 238 100% Announced Mar 2024 Labcorp Holdings Inc. BioReference Health's laboratory testing business NM 1.1x - 118 139 100% Announced Mar 2024 Sonic Healthcare Limited Dr. Risch Shared Services Ag NM 1.1x (2) 38 41 100% Sep 2023 Novacyt UK Holdings Limited Yourgene Health Plc NM 0.5x (16) 50 24 100% Apr 2023 Biosynex SA Chembio Diagnostics, Inc. 13.9x 1.6x 71 605 979 100% Apr 2023 GI Manager L.P. Atlas Technical Consultants, Inc. NM 0.5x - 3 2 100% Mar 2023 EKF Diagnostics Holdings plc. Advanced Diagnostic Laboratory LLC 22.4x 0.9x 187 4,621 4,183 76% Oct 2022 Clayton, Dubilier & Rice, LLC; TPG Capital, L.P. Covetrus, Inc. 17.8x 2.4x 3 25 60 100% Aug 2022 Australian Laboratory Services Pty. Ltd. HRL Holdings Limited 8.4x 2.1x 511 2,038 4,291 100% May 2022 Quidel Corporation (nka:QuidelOrtho Corporation) Ortho Clinical Diagnostics Holdings plc NM 2.8x - 117 322 100% Apr 2022 Sema4 Holdings Corp. (nka:GeneDx Holdings Corp.) GeneDx, Inc. NM 2.6x - 20 53 100% Jan 2022 Inotiv, Inc. Integrated Laboratory Systems, Inc. 8.4x 0.5x Low 12.5x 1.0x 1st Quartile 15.8x 1.5x Median 15.6x 1.6x Mean 18.9x 2.4x 3rd Quartile 22.4x 2.8x High ( 2 )

19 DRAFT – CONFIDENTIAL Confidential Selected comparable transactions IMPLIED NORTHERN LIGHTS VALUATION Value Sample Calculation 0.5x Low EV/TTM revenue of M&A transactions A = $21.2 M Northern Lights’ TTM revenue (as of May 31, 2024) B = $10.4M Northern Lights’ implied enterprise value C = A x B = $1.8M Northern Lights’ cash balance (as of May 31, 2024) D = $1.0M Northern Lights’ debt balance (as of May 31, 2024) E = $11.2M Northern Lights’ implied equity value F = C + D – E 5.8M Northern Lights’ common equity shares outstanding (as of May 10, 2024) G = $1.92 Northern Lights’ implied price per s hare (as of August 9, 2024) H = F ÷ G High 3rd Quartile Mean Median 1st Quartile Low Transaction multiples 2.8x 2.4x 1.6x 1.5x 1.0x 0.5x EV/TTM Revenue Implied price per share $10.24 $8.83 $6.06 $5.65 $3.94 $1.92 EV/TTM Revenue Source: Capital IQ and company filings and press releases. Excludes transaction costs.

20 DRAFT – CONFIDENTIAL Confidential STATISTICS AND IMPLIED NORTHERN LIGHTS VALUATION Premia paid Mirus reviewed 284 US - based mergers and acquisitions and going dark reverse stock split transactions closed between January 1, 2019 and August 9, 2024 with transaction value less than $250 million • Excludes M&A transactions in which less than 75% of the business was acquired • Excludes outliers with target stock premiums above 300% or below - 20% vs. 1 - month prior stock price • Includes eight closed going dark reverse stock split transactions (see following page) High 3rd Quartile Mean Median 1st Quartile Low Premia paid statistics (%) 380.8% 63.3% 46.8% 36.0% 14.3% (26.7%) 1 - day prior 334.8% 68.0% 47.2% 38.1% 14.5% (23.1%) 1 - week prior 281.7% 66.8% 45.2% 38.7% 13.7% (19.2%) 1 - month prior Implied price per share $7.93 $2.69 $2.42 $2.24 $1.89 $1.21 1 - day prior (vs. Aug 9, 2024, $1.65) $8.70 $3.36 $2.94 $2.76 $2.29 $1.54 1 - week prior (vs. Aug 2, 2024, $2.00) $9.27 $4.05 $3.53 $3.37 $2.76 $1.96 1 - month prior (vs. Jul 10, 2024, $2.43) Value Sample Calculation 14.5% 1 st quartile premia paid in M&A and going dark reverse stock split transactions relative to price week prior to announcement A = $2.00 Northern Lights’ prior week stock price per share B = $2.29 Northern Lights’ implied price per share in a transaction (as of August 9, 2024) C = (1 + A) x B = Source: Capital IQ and company filings and press releases. Excludes transaction costs.

21 DRAFT – CONFIDENTIAL Confidential SELECT GOING DARK REVERSE STOCK SPLIT PRECEDENTS Premia paid Source: Capital IQ, company filings and press releases. 1) Estimated shares cashed out multiplied by cash out price. Excludes advisory or other costs. 2) Historical price data adjusted for subsequent stock split. Close price and implied premium 1-day prior 1-week prior 1-month prior Ashford Apr 02, 2024 $5.00 $2.22 $2.21 $3.17 1,100,000 32.0% $5,500,000 1-for-10,000 125% 126% 58% Safeguard Scientifics Oct 05, 2023 $1.65 $1.01 $1.01 $1.13 4,305 0.0% $7,103 1-for-100 63% 63% 46% A.M. Castle & Co. 2 Oct 30, 2020 $0.70 $0.50 $0.50 $0.85 1,065 0.0% $746 1-for-10 40% 40% -18% Reliv Oct 19, 2020 $3.75 $3.81 $3.76 $3.16 672,491 38.5% $2,521,841 1-for-2,000 -2% 0% 19% Westell Technologies Jul 10, 2020 $1.48 $0.87 $0.79 $0.83 4,900,000 39.7% $7,252,000 1-for-1,000 70% 87% 78% Harvest Oil & Gas Corp. May 08, 2020 $22.08 $20.20 $20.60 $23.00 1,170 0.0% $25,834 1-for-10 9% 7% -4% Parker Drilling Sep 10, 2019 $30.00 $20.03 $17.10 $11.56 59,329 0.4% $1,779,870 1-for-50 50% 75% 160% Capstone Therapeutics May 31, 2019 $0.025 $0.02 $0.03 $0.03 379,000 0.7% $9,475 1-for-1,000 25% -4% -7% Dynasil May 02, 2019 $1.15 $1.09 $1.11 $1.13 2,825,268 16.1% $3,249,058 1-for-8,000 6% 4% 2% Estimated cost 1 Split ratio Date of cash out price announcement Going dark reverse stock split cash out price Estimated shares cashed out Estimated % of shares cashed out

22 DRAFT – CONFIDENTIAL Confidential FORECAST AND IMPLIED NORTHERN LIGHTS VALUATION Discounted cash flow analysis • Mirus conducted a DCF analysis utilizing the forecast developed by management assuming Northern Lights continues as a reporting company (i.e. no cost savings associated with “going dark”) • A range of WACC’s were considered, based on the estimated cost of capital for Northern Lights • Mirus selected a terminal EV/EBITDA multiple range of 8 - 10x Source: Management forecast. Excludes transaction costs. Assumes June 30, 2024 valuation date. FY 2026 FY 2025 2H 2024 ($ millions) 23.60 21.61 10.71 Revenue 10.79 9.61 5.17 Gross profit 1.30 0.78 0.94 EBITDA Implied Northern Lights price per share Terminal EV/EBITDA multiple 1.67$ 8.0x 9.0x 10.0x Low High WACC 16.0% $1.71 $1.86 $2.02 $1.62 $2.02 17.5% $1.67 $1.81 $1.96 19.0% $1.62 $1.77 $1.91

23 DRAFT – CONFIDENTIAL Confidential ADJUSTED FORECAST AND IMPLIED NORTHERN LIGHTS VALUATION Leveraged buyout analysis • Mirus conducted a leveraged buyout analysis utilizing the forecast developed by management, including an adjustment for public company costs estimated by management and an estimate of transaction costs • A range of equity IRRs were considered, based on $2 million of pro forma debt • Mirus selected a terminal EV/EBITDA multiple range of 8 - 10x Source: Management forecast plus midpoint of management’s estimate of public company cost savings. Transaction costs included in price per share analysis, not EBITDA figures. Assumes June 30, 2024 valuation date. FY 2026 FY 2025 2H 2024 ($ millions) 23.60 21.61 10.71 Revenue 10.79 9.61 5.17 Gross profit 1.30 0.78 0.94 Unadjusted EBITDA 0.80 0.80 0.40 Plus: estimated public company cost savings 2.10 1.58 1.34 Adjusted EBITDA Implied Northern Lights price per share Terminal EV/EBITDA multiple 2.51$ 8.0x 9.0x 10.0x Low High Equity 20.0% $2.39 $2.62 $2.85 $2.20 $2.85 IRR 22.5% $2.29 $2.51 $2.73 25.0% $2.20 $2.41 $2.61

24 DRAFT – CONFIDENTIAL Legend (unless otherwise noted): Low 1 st Quartile High Confidential Summary range of price per share N=5. Blue bar represents Low to Median $2.35 per share Cash Payment Gray bar represents Low to High - 1.00 2.00 3.00 4.00 5.00 6.00 Leveraged buyout Discounted cash flows Premia paid 30-days prior Premia paid 1-week prior Premia paid 1-day prior Transaction comps EV/TTM revenue Public comps EV/TTM revenue (<$100M TTM revenue) Northern Lights 2-year historical EV/TTM revenue Northern Lights 1-week Trading Range Northern Lights 1-month trading range Northern Lights 3-month trading range Northern Lights 6-month trading range Northern Lights 52-week trading range Price per share ($)

25 DRAFT – CONFIDENTIAL Confidential Summary range of price per share 1) For trading range data points, median represents VWAP. High 3rd Quartile Median 1 1st Quartile Low $5.00 $3.16 $3.16 $2.43 $1.64 Northern Lights 52 - week trading range $3.18 $2.93 $2.65 $2.33 $1.64 Northern Lights 6 - month trading range $2.69 $2.43 $2.26 $2.27 $1.64 Northern Lights 3 - month trading range $2.43 $2.33 $2.06 $2.03 $1.64 Northern Lights 1 - month trading range $1.85 $1.81 $1.76 $1.65 $1.64 Northern Lights 1 - week trading range $5.40 $4.26 $3.58 $2.63 $1.55 Northern Lights 2 - year historical EV/TTM revenue $5.26 $4.29 $0.80 Public comps EV/TTM revenue (<$100M TTM revenue) $10.24 $8.83 $5.65 $3.94 $1.92 Transaction comps EV/TTM revenue $7.93 $2.69 $2.24 $1.89 $1.21 Premia paid 1 - day prior $8.70 $3.36 $2.76 $2.29 $1.54 Premia paid 1 - week prior $9.27 $4.05 $3.37 $2.76 $1.96 Premia paid 30 - days prior $2.02 $1.62 Discounted cash flows $2.85 $2.20 Leveraged buyout

Exhibit (c)(iii)

1 DRAFT – CONFIDENTIAL PREPARED JULY 2022 FOR: Prepared April 2024 for: Project Northern Lights Presentation prepared for the Transaction Committee of the Board of Directors June 5, 2024

2 DRAFT – CONFIDENTIAL • Mirus has relied upon and assumed the accuracy and completeness of all information that was publicly available or provided to us by the Company, and has not independently verified such information. • Mirus has not conducted any valuation or appraisal of any assets or liabilities. • We have assumed that financial analyses and forecasts have been reasonably prepared based on assumptions reflecting the best currently available estimates and judgments by management as to the expected future results of operations of the Company. • We are not legal, regulatory or tax experts and have relied on the assessments made by the Company and its advisors with respect to such issues. • Our opinion is based on economic, market and other conditions as in effect on, and the information made available to us as of , the date of this Presentation. • We have not acted as financial advisor to the Company with respect to the proposed Transaction, and we will not receive any compensation that is contingent upon the successful completion of the Transaction. Mirus has provided advisory services to the Transaction Committee of the Board of Directors related our opinion work, including a review and analysis of precedent transactions, advice with respect to cash - out value for fractional shares resulting from the reverse stock split and a draft of the summary of our analysis. The Company has agreed to indemnify us for certain liabilities arising out of our engagement, includ ing liabilities arising under the Federal securities laws. • This Presentation is not intended to represent an opinion, but rather to serve as discussion materials for the Committee to r evi ew and as a basis upon which Mirus may render an opinion. This Presentation does not address the underlying business decision by the Company to pursue, consider or approve a transaction involving the Company, and this Presentation does not constitute a recommendation to the Company, the Committee, or any other person or entity as to any specific action that should be taken (o r omitted to be taken) in connection with a transaction involving the Company or as to any strategic or financial alternatives to a proposed transaction or the timing thereof. Disclaimer and limiting factors

3 DRAFT – CONFIDENTIAL Agenda • Engagement overview • Northern Lights financial overview • Valuation analyses

ENGAGEMENT OVERVIEW

5 DRAFT – CONFIDENTIAL • The Board of Northern Lights (the “Company”, or “Northern Lights”) is considering executing a reverse stock split, to be foll owe d by a reciprocal forward stock split (the “Stock Splits”). The Company does not intend to issue any fractional shares in the Stock Spl its. In lieu of fractional shares, shareholders that own fewer shares than the reverse stock split ratio as of the record date would be paid a cash amount per share (the “Cash Payment”, amount to be determined) and no longer be shareholders of the Company. Shareholders owning at least as many shares as the reverse stock split ratio would not be entitled to receive any cash for fr act ional shares, rather they would end up with the same number of shares as immediately preceding the Stock Splits. • The intent of the Stock Splits and Cash Payments would be to reduce the number of shareholders to fewer than 300, which, subj ect to additional documentation and procedures, would make the Company eligible to file a Form 15 with the SEC and terminate its registration obligations under the Exchange Act of 1934, as amended (in conjunction with the Stock Splits and Cash Payments, the “Transaction”). • Terms for the Transaction are not yet determined. • Northern Lights is considering the Transaction due to the significant costs and expenses associated with being a reporting co mpa ny. • Mirus Capital Advisors (“ Mirus ”) has been engaged to provide a written opinion (the “Opinion”) to the Transaction Committee of the Board as to the fairness, from a financial point of view, of the Transaction to the common shareholders of the Company, inclu din g all unaffiliated shareholders. Mirus will also provide related advisory services to the Transaction Committee, including review and analysis of precedent transactions, advice with respect to cash - out value for fractional shares resulting from the reverse stock split, support with analyzing the Company’s shareholder data to confirm the appropriate range of reverse stock split ratios for the Transaction (in collaboration with the Company and its other advisors) and providing a draft of the summary of the Mirus analysis and Fairness Opinion for the proxy statement to be filed by the Company in connection with the Transaction. Engagement overview

NORTHERN LIGHTS FINANCIAL OVERVIEW

7 DRAFT – CONFIDENTIAL Forecast Historical and projected income Source: Company filings and documents. 1) Net income (loss) as reported in company filings. 2) EBITDA calculated as gross profit less operating expenses, plus depreciation and amortization. Inclusive of stock - based compensa tion expense. Historical financials TTM Mar 31, Year ending Dec 31, 2024 2023 2022 2021 2020 $'000s 21,596 22,098 25,240 24,909 21,360 Revenues 13,266 13,685 15,949 14,645 16,474 Cost of revenues 8,330 8,413 9,291 10,264 4,886 Gross profit 38.6% 38.1% 36.8% 41.2% 22.9% Gross profit margin % Operating expenses 7,334 7,192 5,857 6,126 6,095 General and administrative 2,901 2,998 3,191 2,799 3,577 Marketing and selling 1,055 1,144 1,326 1,130 1,280 Research and development 11,290 11,334 10,374 10,055 10,952 Total operating expenses (2,960) (2,921) (1,083) 209 (6,066) Operating income (loss) Other income (expense) - - - 2,181 - Gain on forgiveness of PPP loan (509) (507) - (3,150) - Settlements (8) (10) 43 (61) (140) Other income (expense) (517) (517) 43 (1,030) (140) Total other income (expense) (3,477) (3,438) (1,040) (821) (6,206) Net loss before tax 981 716 44 (156) (2,347) Provision for (benefit from) income tax (4,458) (4,154) (1,084) (665) (3,859) Net income (loss) 1 1,573 1,731 2,367 2,784 2,691 Depreciation & amortization (1,387) (1,190) 1,284 2,993 (3,375) EBITDA 2 - 6% - 5% 5% 12% - 16% EBITDA Margin % 21.4 24.9 25.2 22.1 21.4 22.7 25.1 (3.4) 3.0 1.3 (1.2) (0.1) 1.3 2.2 (5.0) - 5.0 10.0 15.0 20.0 25.0 30.0 2020 2021 2022 2023 2024F 2025F 2026F Revenue and EBITDA (2020A - 2026F) 2 Revenue Unadjusted EBITDA

8 DRAFT – CONFIDENTIAL Historical balance sheets Source: Company filings. Mar 31, Year ending Dec 31, Mar 31, Year ending Dec 31, 2024 2023 2022 2021 $'000s 2024 2023 2022 2021 $'000s Liabilities Assets 1,131 752 448 994 Accounts payable 1,421 1,964 4,750 1,992 Cash 1,780 2,604 3,939 3,188 Accrued expenses 3,883 3,687 3,739 4,116 Accounts receivable, net 230 305 294 664 Current portion of debt 870 1,136 1,136 1,499 Prepaid expenses and other current assets 1,043 1,048 1,037 984 Current portion of operating lease liabilities 13 18 339 2,678 Income tax receivable 4,184 4,709 5,718 5,830 Total current liabilities 6,187 6,805 9,964 10,285 Total Current Assets - - 305 599 Long - term debt Property and equipment 687 945 1,938 2,880 Long - term portion of operating lease liabilities 4,774 4,648 4,521 Computer software 4,871 5,654 7,961 9,309 Total liabilities 2,253 2,247 2,195 Office furniture and equipment 16,038 16,013 16,005 Laboratory equipment 3,629 3,629 3,629 Leasehold improvements - - - - Preferred - stock (23,633) (21,964) (19,659) Accumulated depreciation 32 32 32 31 Common stock 2,759 3,061 4,573 6,691 Net property and equipment 35,426 35,129 34,275 33,478 Additional paid - in capital (10,082) (10,082) (10,082) (10,082) Treasury stock 608 632 823 864 Other assets (17,461) (16,773) (11,820) (9,550) Accumulated deficit - - 691 160 Deferred tax asset (1,634) (1,634) (1,634) (1,634) Accumulated other comprehensive loss 1,598 1,828 2,681 3,552 Operating lease right - of - use assets 6,281 6,672 10,771 12,243 Total equity 11,152 12,326 18,732 21,552 Total liabilities & shareholders' equity 11,152 12,326 18,732 21,552 Total Assets Capitalization ('000s) 5,806 Shares outstanding (as of May 10, 2024) $13,933 Market capitalization (at $2.40/share as of May 31, 2024) $230 Plus: total debt (March 31, 2024) ($1,421) Less: cash (March 31, 2024) $12,742 Enterprise value

9 DRAFT – CONFIDENTIAL Summary of shareholders Source: shareholdings per Capital IQ as of May 31, 2024. Does not include stock options. Total shares outstanding as of May 10, 2024 per Company filings. 1) Includes 44,980 shares held by 3K Limited Partnership, of which Peter Kamin is founder and Managing Partner. REPORT AS OF MAY 31, 2024 % of common outstanding Shares held Name Insiders 10.8% 629,237 Kamin , Peter H. (Independent Director) 4.2% 246,737 Kubacki , Raymond C. (Former Chairman, CEO & President) 3.1% 178,564 Weinert, Fred J. (Former Lead Independent Director) 0.5% 26,989 Schaffer Ph.D., Michael I. (Former Vice President of Laboratory Operations) 0.3% 19,000 Davis, Robyn C. (Independent Director) 0.1% 7,000 Reynolds, Andrew M. (Independent Director) 0.1% 4,500 Nevin, Darius G. (Independent Chairman) 19.2% 1,112,027 Total insider holdings Institutions >0.75% of outstanding 5.4% 312,199 Powell Anderson Capital Partners 4.7% 274,418 22NW, LP 4.5% 259,863 Renaissance Technologies LLC 4.3% 251,283 The Vanguard Group, Inc. 2.4% 142,142 RBF Capital LLC 1.3% 76,748 BlackRock, Inc. (NYSE:BLK) 0.9% 50,443 Wedbush Asset Management, LLC 23.5% 1,367,096 Institutions and individuals >0.75% of outstanding 57.3% 3,326,488 All other holdings 100.0% 5,805,611 Total shares outstanding (1) 10.8% 4.2% 3.1% 1.0% 5.4% 4.7% 4.5% 4.3% 2.4% 1.3% 0.9% 57.3% Top shareholders Kamin, Peter H. (Independent Director) Kubacki, Raymond C. (Former Chairman, CEO & President) Weinert, Fred J. (Former Lead Independent Director) Other insiders Powell Anderson Capital Partners 22NW, LP Renaissance Technologies LLC The Vanguard Group, Inc. RBF Capital LLC BlackRock, Inc. (NYSE:BLK) Wedbush Asset Management, LLC Other

VALUATION ANALYSES

11 DRAFT – CONFIDENTIAL Confidential Valuation methods considered • Historical valuation approach: Mirus reviewed Northern Lights’ historical common equity trading prices and volumes, and historical enterprise value/revenue multiples. Due to Northern Lights’ recent low or negative EBITDA margins, EV/EBITDA multi ple s were reviewed but not utilized in Mirus’s analyses • Public companies approach: Mirus reviewed select public companies and their implied valuation multiples • Transactions approach: Mirus reviewed select merger and acquisition transactions and their implied valuation multiples • Premia paid approach: Mirus reviewed the implied premia paid in recent M&A transactions and “going dark” reverse stock split transactions • Discounted cash flow approach: Mirus conducted a DCF analysis utilizing the forecast developed by management • Leveraged buyouts approach: Mirus conducted a buyout analysis utilizing the forecast developed by management, assuming modest incremental leverage and adjustments for estimated costs incurred as a public company and transaction costs

12 DRAFT – CONFIDENTIAL Confidential TRAILING 2 YEARS AND TTM SUMMARY STATISTICS Historical valuation: stock price and volumes Source: Capital IQ as of May 31, 2024. 1) Volume bucketed by daily VWAP (volume weighted average price). June 1, 2023 - May 31, 2024 $ 5.15 Intraday high: $ 2.06 Intraday low: $ 5.05 High close: $ 2.06 Low close: $ 3.59 Volume weighted average price 1 : $ 2.40 Last close price: - 53% % off TTM high: 17% % off TTM low: % of Total Estimated volume 1 Price Range 11% 384,330 < $2.50 24% 803,260 $2.50 - $2.99 15% 513,340 $3.00 - $3.49 16% 528,970 $3.50 - $3.99 5% 182,700 $4.00 - $4.49 23% 789,640 $4.50 - $4.99 5% 174,620 $5.00 - $5.49 100% 3,376,860 Total $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 May 2022 May 2023 May 2024 Trading volumes and share price Volume (shares) Close Price

13 DRAFT – CONFIDENTIAL Confidential TRAILING 2 YEARS AND SUMMARY STATISTICS Historical valuation: enterprise value/TTM revenue Source: Capital IQ as of May 31, 2024. 1) Enterprise Value (EV) calculated as Market Capitalization plus Net Debt. For each data point, Market Capitalization calculated daily, and the Debt values are bas ed on each day’s most recent public financial filings, not taking into account delay in financial reporting. For example, January 2024 EV is c alc ulated as daily Market Capitalization, plus Net Debt as of December 31, 2023 (FY 2023 10 - K filed on March 28, 2024). EV/Revenue 0.6x May 31, 2024 0.9x May 31, 2023 1.3x Jun 02, 2022 0.5x Low 1.0x Median 1.4x High 0.00x 0.25x 0.50x 0.75x 1.00x 1.25x 1.50x 1.75x 2.00x May 2022 May 2023 May 2024 EV/Revenue

14 DRAFT – CONFIDENTIAL Confidential Historical valuation: summary High 3rd Quartile VWAP 1 1st Quartile Low Northern Lights close prices $5.05 $4.19 $3.59 $2.66 $2.06 52 - Week Stock History $3.79 $3.10 $3.07 $2.65 $2.40 6 - Month Stock History $3.12 $2.96 $2.82 $2.57 $2.40 3 - Month Stock History $2.69 $2.60 $2.55 $2.54 $2.40 1 - Month Stock History $2.59 $2.57 $2.51 $2.50 $2.40 1 - Week Stock History May 31, 2024 High 3rd Quartile Mean Median 1st Quartile Low Northern Lights trailing 2 - year valuation multiples 0.6x 1.4x 1.2x 1.0x 1.0x 0.8x 0.5x EV/TTM Revenue 1) Source: CapitalIQ . Volume weighted average price for periods estimated for based on daily volume weighted average price.

15 DRAFT – CONFIDENTIAL Confidential Selected comparable publicly traded companies Source: Capital IQ. Market Capitalization as of May 31, 2024. Figures in millions of dollars. Metrics as of each company’s fo ur most recently reported quarters. Northern Lights shown for reference, but not included in calculation of descriptive statistics. VALUATION METRICS Company Market Cap Enterprise Value LTM Revenue LTM EBITDA EBITDA Margin EV / LTM Revenue EV / LTM EBITDA TTM Revenue <$100M Northern Lights 14 13 22 (1) (7%) 0.6x NM Lab services Labcorp Holdings Inc. 16,430 21,597 12,300 1,623 13% 1.8x 13.3x SGS SA 17,597 20,815 7,864 1,373 17% 2.6x 15.2x Quest Diagnostics Incorporated 15,772 20,122 9,287 1,804 19% 2.2x 11.2x Bureau Veritas SA 13,580 15,121 6,486 1,160 18% 2.3x 13.0x Eurofins Scientific SE 11,578 14,573 7,201 1,313 18% 2.0x 11.1x NeoGenomics, Inc. 1,751 1,905 611 (21) (3%) 3.1x NM OPKO Health, Inc. 955 1,236 800 (94) (12%) 1.5x NM Transcat, Inc. 1,164 1,133 259 35 13% 4.4x 32.3x Mesa Laboratories, Inc. 516 729 216 36 17% 3.4x 20.2x Specialty testing and diagnostics QuidelOrtho Corporation 2,959 5,283 2,863 620 22% 1.8x 8.5x Neogen Corporation 2,848 3,569 929 247 27% 3.8x 14.5x Guardant Health, Inc. 3,316 3,360 604 (402) (67%) 5.6x NM Castle Biosciences, Inc. 642 413 251 (29) (12%) 1.6x NM Quanterix Corporation 611 309 126 (43) (34%) 2.5x NM OraSure Technologies, Inc. 350 87 305 35 12% 0.3x 2.5x Other microcap diagnostics companies MDxHealth SA 75 102 75 (19) (26%) 1.3x NM Yes Centogene N.V. 11 78 54 (37) (68%) 1.5x NM Yes Interpace Biosciences, Inc. 6 59 41 4 9% 1.4x 15.8x Yes Genetic Technologies Limited 9 7 7 (7) (96%) 0.9x NM Yes Precipio, Inc. 8 8 16 (5) (34%) 0.5x NM Yes All public companies in set Companies in set <$100M TTM revenue Low 0.3x 2.5x 0.5x 15.8x 1st Quartile 1.5x 11.1x Median 1.9x 13.3x 1.3x 15.8x Mean 2.2x 14.3x 1.1x 15.8x 3rd Quartile 2.8x 15.5x High 5.6x 32.3x 1.5x 15.8x

16 DRAFT – CONFIDENTIAL Confidential Selected comparable publicly traded companies IMPLIED NORTHERN LIGHTS VALUATION Source: Company filings and documents. 1) Public company multiples calculated on page 15 . Value Sample Calculation 1.3x Median EV/TTM revenue of public companies <$200M revenue (as of May 31, 2024) A = $21.6 M Northern Lights’ TTM revenue (as of March 31, 2024) B = $29.1M Northern Lights’ implied enterprise value C = A x B = $1.4M Northern Lights’ cash balance (as of March 31, 2024) D = $0.2M Northern Lights’ debt balance (as of March 31, 2024) E = $30.3M Northern Lights’ implied equity value F = C + D – E 5.8M Northern Lights’ common equity shares outstanding (as of May 10, 2024) G = $5.22 Northern Lights’ implied price per s hare (as of May 31, 2024) H = F ÷ G High Mean Median Low Public company multiples 1 1.5x 1.1x 1.3x 0.5x EV/TTM revenue (<$100M TTM revenue) Implied price per share $5.64 $4.45 $5.22 $2.10 EV/TTM revenue (<$100M TTM revenue)

17 DRAFT – CONFIDENTIAL Confidential Selected comparable transactions Source: Capital IQ, company filings and documents. 1) Target’s revenue and EBITDA for the four most recent quarters before the transaction was announced. 2) Disclosed consideration of $131 million USD equivalent as of March 20, 2024 consisting of CHF 30 million of shares and CHF 87 mi llion cash. 3) $4.29 billion consideration consisting of $1.75 billion cash, $2.50 billion of shares (25.055 million shares at closing date share price of $99.60 per share), and $0.05 billion replacement equity awards. 4) $322 million consideration at close consisting of $150 million cash and $172 million of shares (2.4 million shares at closing date share price of $70.95 per share). Up to $150 million of incremental consideration based on two revenue - based milestones, of which $37.5 million was ultimately earned. VALUATION METRICS (4) (3) ( 2 ) EV / EV / Target's Target's Implied Enterprise Percent Transaction ($ in millions) EBITDA Revenue EBITDA 1 revenue 1 Value Sought closed date Acquirer Target NM 2.4x - 100 238 100% Announced Mar 2024 Labcorp Holdings Inc. BioReference Health's laboratory testing business NM 1.1x - 115 131 100% Announced Mar 2024 Sonic Healthcare Limited Dr. Risch Shared Services Ag NM 1.1x (2) 38 41 100% Sep 2023 Novacyt UK Holdings Limited Yourgene Health Plc NM 0.5x (16) 50 24 100% Apr 2023 Biosynex SA Chembio Diagnostics, Inc. 13.9x 1.6x 71 605 979 100% Apr 2023 GI Manager L.P. Atlas Technical Consultants, Inc. NM 0.5x - 3 2 100% Mar 2023 EKF Diagnostics Holdings plc. Advanced Diagnostic Laboratory LLC 22.4x 0.9x 187 4,621 4,183 76% Oct 2022 Clayton, Dubilier & Rice, LLC; TPG Capital, L.P. Covetrus, Inc. 17.8x 2.4x 3 25 60 100% Aug 2022 Australian Laboratory Services Pty. Ltd. HRL Holdings Limited 8.4x 2.1x 511 2,038 4,291 100% May 2022 Quidel Corporation (nka:QuidelOrtho Corporation) Ortho Clinical Diagnostics Holdings plc NM 2.8x - 117 322 100% Apr 2022 Sema4 Holdings Corp. (nka:GeneDx Holdings Corp.) GeneDx, Inc. NM 2.6x - 20 53 100% Jan 2022 Inotiv, Inc. Integrated Laboratory Systems, Inc. 8.4x 0.5x Low 12.5x 1.0x 1st Quartile 15.8x 1.6x Median 15.6x 1.6x Mean 18.9x 2.4x 3rd Quartile 22.4x 2.8x High

18 DRAFT – CONFIDENTIAL Confidential Selected comparable transactions IMPLIED NORTHERN LIGHTS VALUATION Value Sample Calculation 1.0x 1 st quartile EV/TTM revenue of M&A transactions A = $21.6 M Northern Lights’ TTM revenue (as of March 31, 2024) B = $21.5M Northern Lights’ implied enterprise value C = A x B = $1.4M Northern Lights’ cash balance (as of March 31, 2024) D = $0.2M Northern Lights’ debt balance (as of March 31, 2024) E = $22.7M Northern Lights’ implied equity value F = C + D – E 5.8M Northern Lights’ common equity shares outstanding (as of May 10, 2024) G = $3.90 Northern Lights’ implied price per s hare (as of May 31, 2024) H = F ÷ G High 3rd Quartile Mean Median 1st Quartile Low Transaction multiples 2.8x 2.4x 1.6x 1.6x 1.0x 0.5x EV/TTM Revenue Implied price per share $10.48 $9.05 $6.29 $6.23 $3.90 $2.02 EV/TTM Revenue Source: Capital IQ and company filings and press releases. Excludes transaction costs.

19 DRAFT – CONFIDENTIAL Confidential STATISTICS AND IMPLIED NORTHERN LIGHTS VALUATION Premia paid Mirus reviewed 272 US - based mergers and acquisitions and going dark reverse stock split transactions closed between January 1, 2019 and May 31, 2024 with transaction value less than $250 million • Excludes M&A transactions in which less than 75% of the business was acquired • Excludes outliers with target stock premiums above 300% or below - 20% • Includes five closed going dark reverse stock split transactions (see following page) High 3rd Quartile Mean Median 1st Quartile Low Premia paid statistics (%) 380.8% 63.3% 47.5% 37.1% 15.2% (19.1%) 1 - day prior 334.8% 68.0% 48.0% 39.2% 15.8% (19.1%) 1 - week prior 281.7% 66.8% 46.0% 39.6% 14.5% (19.2%) 30 - days prior Implied price per share $11.54 $3.92 $3.54 $3.29 $2.76 $1.94 1 - day prior (vs. May 31, 2024, $2.40) $11.17 $4.32 $3.80 $3.58 $2.98 $2.08 1 - week prior (vs. May 24, 2024, $2.57) $10.00 $4.37 $3.83 $3.66 $3.00 $2.12 30 - days prior (vs. May 1, 2024, $2.62) Value Sample Calculation 16% 1 st quartile premia paid in M&A and going dark reverse stock split transactions relative to price on day prior to Announcement (272 transactions from Jan 1, 2019 – May 31, 2024) A = $2.40 Northern Lights’ prior day stock price per share (as of May 31, 2024) B = $2.76 Northern Lights’ implied price per share in a transaction (as of May 31, 2024) C = (1 + A) x B = Source: Capital IQ and company filings and press releases. Excludes transaction costs.

20 DRAFT – CONFIDENTIAL Confidential SELECT GOING DARK REVERSE STOCK SPLIT PRECEDENTS Premia paid Source: Capital IQ, company filings and press releases. 1) Estimated shares cashed out multiplied by cash out price. Excludes advisory or other costs. 2) Transaction announced but not closed. Shareholder meeting expected to take place in the summer of 2024. Reverse split ratio Estimated cost 1 Estimated % of shares cashed out Estimated shares cashed out Close price and implied premium Going dark reverse stock split cash out price Date of cash out price announcement 1 - month prior 1 - week prior 1 - day prior 1 - for - 10,000 $5,500,000 32.1% 1,100,000 $3.17 $2.21 $2.22 $5.00 April 02, 2024 Ashford 2 58% 126% 125% 1 - for - 100 $7,103 0.0% 4,305 $1.13 $1.01 $1.01 $1.65 Oct 05, 2023 Safeguard Scientifics 46% 63% 63% 1 - for - 2,000 $1,400,000 21.4% 373,333 $3.16 $3.76 $3.81 $3.75 Oct 19, 2020 Reliv 19% 0% - 2% 1 - for - 1,000 $7,252,000 39.7% 4,900,000 $0.83 $0.79 $0.87 $1.48 Jul 10, 2020 Westell Technologies 78% 87% 70% 1 - for - 50 $1,779,870 0.4% 59,329 $11.56 $17.10 $20.03 $30.00 Sep 10, 2019 Parker Drilling 160% 75% 50% 1 - for - 8,000 $3,249,058 16.1% 2,825,268 $1.13 $1.11 $1.09 $1.15 May 02, 2019 Dynasil 2% 4% 6%

21 DRAFT – CONFIDENTIAL Confidential FORECAST AND IMPLIED NORTHERN LIGHTS VALUATION Discounted cash flow analysis • Mirus conducted a DCF analysis utilizing the forecast developed by management assuming Northern Lights continues as a reporting company (i.e. no cost savings associated with “going dark”) • A range of WACC’s were considered, based on the estimated cost of capital for Northern Lights • Mirus selected a terminal EV/EBITDA multiple range of 8 - 10x Source: Management forecast. Excludes transaction costs. Assumes June 30, 2024 valuation date. FY 2026 FY 2025 2H 2024 ($ millions) 25.08 22.71 10.94 Revenue 12.09 10.55 5.09 Gross profit 2.16 1.34 0.49 EBITDA Implied Northern Lights price per share Terminal EV/EBITDA multiple 2.78$ 8.0x 9.0x 10.0x Low High WACC 16.0% $2.61 $2.86 $3.12 $2.47 $3.12 17.5% $2.53 $2.78 $3.03 19.0% $2.47 $2.71 $2.95

22 DRAFT – CONFIDENTIAL Implied Northern Lights price per share Terminal EV/EBITDA multiple 3.40$ 8.0x 9.0x 10.0x Low High Equity 20.0% $3.23 $3.56 $3.88 $2.96 $3.88 IRR 22.5% $3.09 $3.40 $3.71 25.0% $2.96 $3.25 $3.54 Confidential ADJUSTED FORECAST AND IMPLIED NORTHERN LIGHTS VALUATION Leveraged buyout analysis • Mirus conducted a leveraged buyout analysis utilizing the forecast developed by management, including an adjustment for public company costs estimated by management and an estimate of transaction costs • A range of equity IRRs were considered, based on $2 million of pro forma debt • Mirus selected a terminal EV/EBITDA multiple range of 8 - 10x Source: Management forecast plus midpoint of management’s estimate of public company cost savings. Transaction costs included in price per share analysis, not EBITDA figures. Assumes June 30, 2024 valuation date. FY 2026 FY 2025 2H 2024 ($ millions) 25.08 22.71 10.94 Revenue 12.09 10.55 5.09 Gross profit 2.16 1.34 0.49 Unadjusted EBITDA 0.80 0.80 0.40 Plus: estimated public company cost savings 2.96 2.13 0.89 Adjusted EBITDA

23 DRAFT – CONFIDENTIAL Legend: Low 3 rd Quartile 1 st Quartile High Confidential Summary range of price per share < N=6. Deep blue bar represents range from median to average

24 DRAFT – CONFIDENTIAL Confidential Summary range of price per share 1) For trading range data points, median represents VWAP. High 3rd Quartile Median 1 1st Quartile Low $5.05 $4.19 $3.59 $2.66 $2.06 Northern Lights 52 - week trading range $3.79 $3.10 $3.07 $2.65 $2.40 Northern Lights 6 - month trading range $3.12 $2.96 $2.82 $2.57 $2.40 Northern Lights 3 - month trading range $2.69 $2.60 $2.55 $2.54 $2.40 Northern Lights 1 - month trading range $2.59 $2.57 $2.51 $2.50 $2.40 Northern Lights 1 - week trading range $5.56 $4.78 $3.95 $3.04 $1.99 Northern Lights 2 - year historical EV/TTM revenue $5.64 $5.22 $2.10 Public comps EV/TTM revenue (<$100M TTM revenue) $10.48 $9.05 $6.23 $3.90 $2.02 Transaction comps EV/TTM revenue $11.54 $3.92 $3.29 $2.76 $1.94 Premia paid 1 - day prior $11.17 $4.32 $3.58 $2.98 $2.08 Premia paid 1 - week prior $10.00 $4.37 $3.66 $3.00 $2.12 Premia paid 30 - days prior $3.12 $2.47 Discounted cash flows $3.88 $2.96 Leveraged buyout

Exhibit (c)(iv)

1 DRAFT – CONFIDENTIAL PREPARED JULY 2022 FOR: Prepared April 2024 for: Project Northern Lights Presentation prepared for the Transaction Committee of the Board of Directors April 10, 2024