UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ |

|

Filed by a party other than the Registrant ☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

PSYCHEMEDICS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

October 18, 2024

Dear Stockholders:

We cordially invite you to attend the 2024 Annual Meeting

of Stockholders of Psychemedics Corporation (the “Company”), which will be held virtually on November 25, 2024 at 10:00 a.m.

Eastern Time (the “Annual Meeting”).

The accompanying notice and proxy statement contain

details concerning the matters to be considered during the Annual Meeting. At the Annual Meeting, you will be asked to consider and vote

on the following matters:

|

1. |

Re-election of our current directors to our Board of Directors (the “Board”) |

|

2. |

Approval, on a non-binding basis, of our executive compensation |

|

3. |

Ratification of the appointment of our independent registered public accounting firm |

|

4. |

Proposals to (a) amend our amended and restated certificate of incorporation to effect a reverse stock split

of our common stock, at a ratio not less than 1-for- 4,000 and not greater than 1-for-6,000 (the “Reverse Stock Split”), followed

immediately by a forward stock split of our common stock at the same ratio but inverse (i.e., if the Reverse Stock Split were 1-for-5,000,

then the Forward Stock Split would be 5,000-for-1) (the “Forward Stock Split,” and together with the Reverse Stock Split,

the “Stock Split”), and (b) ratify the terms and conditions of a Stock Purchase Agreement entered into by us on August 12,

2024 providing for, among other terms, the issuance and sale of up to 1,595,744 shares of our common stock to Mr. Kamin or his designee

at a purchase price of $2.35 per share, for an aggregate purchase price of up to $3,750,000 (the “Stock Purchase Agreement,”

and the Stock Purchase Agreement, including the transactions contemplated thereby, the Stock Split and the subsequent delisting and deregistration

of the Company’s common stock as described herein, collectively, the “Transaction”) and approve the transactions contemplated

by the Stock Purchase Agreement (such proposals, collectively, the “Transaction Proposals”). |

If the Transaction Proposals are approved, we will file with

the Secretary of State of the State of Delaware certificates of amendment to our amended and restated certificate of incorporation to

effectuate the Reverse Stock Split, at which time (the “effective time”) each share of our common stock held by a stockholder

of record owning immediately prior to the effective time fewer than the minimum number of shares, which, depending on the Stock Split

ratios chosen by the Board, would be between 4,000 and 6,000 shares (the “Minimum Number”) would be converted into the right

to receive $2.35 in cash, without interest (the “Cash Payment”), and such stockholders would no longer be our stockholders.

Stockholders owning a number of shares of common stock equal to or greater than the Minimum Number immediately prior to the effective

time (the “Continuing Stockholders”) would not be entitled to receive any cash for their fractional share interests resulting

from the Reverse Stock Split, if any. The Forward Stock Split, which would immediately follow the Reverse Stock Split, would reconvert

whole shares and fractional share interests held by the Continuing Stockholders back into the same number of shares of our common stock

held by such Continuing Stockholders immediately prior to the effective time. As a result of the Forward Stock Split, the total number

of shares of our common stock held by a Continuing Stockholder would not change as a result of the Stock Split.

The Stock Split and the transactions contemplated by the Stock

Purchase Agreement are being undertaken as part of our plan to terminate the registration of (or “deregister”) our common

stock under Section 12(g) of the Securities Exchange Act of 1934, as amended, and suspend our duty to file periodic reports and other

information with the Securities and Exchange Commission (the “SEC”) under Section 13(a) thereunder, and to delist our common

stock from The Nasdaq Stock Market. As a result, (i) we would cease to file annual, quarterly, current and other reports and documents

with the SEC, and stockholders would cease to receive annual reports and proxy statements required by the SEC, and (ii) our common stock

would no longer be listed on The Nasdaq Stock Market. The primary purpose of the Stock Split is to enable us to maintain the number of

record holders of our common stock below 300, which is the level at which SEC public reporting is required. As described below, the Board

and the Transaction Committee of the Board (the “Transaction Committee”) have determined that the costs of being a public

reporting company outweigh the benefits thereof.

|

5. |

Proposal to approve the adjournment of the Annual Meeting, from time to time, if necessary or appropriate,

including to solicit additional proxies in favor of any proposal if there are insufficient votes at the time of such adjournment to approve

such proposal or to ensure that any supplement or amendment to the proxy statement is timely provided to our stockholders |

The Board recommends that you vote “FOR”

approval of all of the proposals presented at the Annual Meeting. The accompanying proxy statement and its exhibits explain the various

proposals and provide specific information about the Annual Meeting. Please read these materials carefully.

THE TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED

BY THE SEC OR ANY STATE SECURITIES COMMISSION, NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF

THE TRANSACTION OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS

A CRIMINAL OFFENSE.

Your vote is important. Whether or not you plan

to attend the Annual Meeting, we urge you to please complete, sign and date the enclosed proxy card and return it in the enclosed envelope.

The envelope requires no postage if mailed in the United States. If you attend the Annual Meeting, you may vote at the Annual Meeting,

even if you have previously returned your proxy card, as described in the attached proxy statement.

Your prompt attention would be greatly appreciated.

| |

Sincerely, |

| |

|

| |

|

| |

|

| |

Brian Hullinger |

| |

Chief Executive Officer and President |

PSYCHEMEDICS CORPORATION

5220 Spring Valley Road

Dallas, Texas 75254

(800) 527-7424

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 25, 2024

The 2024 Annual Meeting of Stockholders of Psychemedics

Corporation (the “Company”) will be held on November 25, 2024, at 10:00 a.m. Eastern Time (the “Annual Meeting”).

There will be no physical meeting location for the Annual Meeting. The Annual Meeting will be a virtual stockholder meeting, conducted

via live audio webcast, through which you can submit questions and vote online. To access the Annual Meeting, you must register to attend

by visiting the website located at www.proxydocs.com/PMD and following the on-screen instructions.

Once registration is complete, you will receive a custom meeting link at least one hour prior to the start of the meeting. The Annual

Meeting will be held for the following purposes, as more fully described in the proxy statement (the “Proxy Statement”):

|

1. |

To elect directors of the Company for the ensuing year and until their respective successors are chosen and

qualified. |

|

2. |

To conduct a non-binding advisory vote on the compensation of the Company’s named executive officers. |

|

3. |

To ratify the Audit Committee’s appointment of Whitley Penn LLP as the Company’s independent registered

public accounting firm for the year ending December 31, 2024. |

|

4. |

To consider and vote upon a proposal to amend the Company’s amended and restated certificate of incorporation

to effect a reverse stock split of the Company’s common stock at a ratio not less than 1-for-4,000 and not greater than 1-for-6,000

(the “Reverse Stock Split”), with the exact Reverse Stock Split ratio to be set within the foregoing range at the discretion

of the Company’s Board of Directors (the “Reverse Stock Split Proposal”). |

|

5. |

To consider and vote upon a proposal to amend the Company’s amended and restated certificate of incorporation

to effect, immediately after the Reverse Stock Split, a forward stock split of the Company’s common stock at the same ratio but

inverse (i.e., if the Reverse Stock Split were 1-for-5,000, then the Forward Stock Split would be 5,000-for-1) (the “Forward Stock

Split”), with the exact Forward Stock Split ratio to be set within the foregoing range at the discretion of the Company’s

Board of Directors (the “Forward Stock Split Proposal”). As a result of the Reverse Stock Split and the Forward Stock Split: |

|

• |

each share of common stock held by a stockholder of record owning fewer than the minimum number of shares

of the Company’s common stock immediately prior to the effective time of the Reverse Stock Split (the “effective time”),

which, depending on the Stock Split ratios chosen by the Company’s Board of Directors (the “Board”), would be between

4,000 and 6,000 shares (the “Minimum Number”) will be converted into the right to receive $2.35 in cash, without interest,

at the effective time; and |

|

• |

each share of common stock held by a stockholder of record owning a number of shares of common stock equal

to or greater than the Minimum Number immediately prior to the effective time will continue to represent one share of common stock after

completion of the Reverse Stock Split and the Forward Stock Split. |

Copies of the proposed amendments to the Company’s amended

and restated certificate of incorporation are attached as Annex A and Annex B to the accompanying proxy statement.

|

6. |

To consider and vote on a proposal to ratify the terms and conditions of the Stock Purchase Agreement, dated

August 12, 2024, by and among the Company, 3K Limited Partnership, Peter H. Kamin, the Peter H. Kamin Revocable Trust dated February 2003,

the Peter H. Kamin Childrens Trust dated March 1997, the Peter H. Kamin GST Trust and the Peter H. Kamin Family Foundation (the “Stock

Purchase Agreement”) and approve the transactions contemplated thereby (the “Stock Purchase Agreement Proposal”). |

A copy of the Stock Purchase Agreement is attached as Annex C to the accompanying

proxy statement.

|

7. |

To consider and vote on a proposal to approve the adjournment of the Annual Meeting, from time to time, if

necessary or appropriate, including to solicit additional proxies in favor of any proposal if there are insufficient votes at the time

of such adjournment to approve such proposal or establish a quorum or to ensure that any supplement or amendment to the proxy statement

is timely provided to our stockholders. |

|

8. |

To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements

of the Annual Meeting. |

The Board has fixed the close of business on October

8, 2024 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting.

| |

By order of the Board of Directors, |

| |

|

| |

/s/ Patrick J. Kinney, Jr. |

| |

Patrick J. Kinney, Jr. |

| |

Secretary |

YOUR VOTE IS IMPORTANT

YOU ARE URGED TO VOTE, SIGN, DATE, AND RETURN THE

ACCOMPANYING ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN THE POSTAGE-PAID ENVELOPE ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE

GIVEN YOUR PROXY, THE PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE EXERCISE BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION,

BY EXECUTING A PROXY WITH A LATER DATE, OR BY ATTENDING AND VOTING AT THE VIRTUAL ANNUAL MEETING.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY

MATERIALS FOR OUR ANNUAL MEETING TO BE HELD VIRTUALLY ON NOVEMBER 25, 2024: This Proxy

Statement, our Annual Report for the fiscal year ended December 31, 2023 and the Proxy Card are available at our website, www.proxydocs.com/PMD.

To view these materials please have your control number(s) available that appears on your proxy card.

TABLE OF CONTENTS

| ABOUT

THE ANNUAL MEETING |

1 |

| SUMMARY TERM

SHEET |

2 |

| The Transaction |

2 |

| Purpose of and Reasons for the Transaction |

2 |

| Effects of the Transaction |

3 |

| Transaction Committee and Board Recommendations of the Transaction |

4 |

| Reservation of Rights |

4 |

| Fairness of the Transaction |

5 |

| Position of the Investors as to the Fairness of the Transaction |

5 |

| Advantages of the Transaction |

6 |

| Disadvantages of the Transaction |

7 |

| The Stock Purchase Agreement and Funding of the Reverse Stock Split |

8 |

| Potential Conflicts of Interests of Officers, Directors, and Certain

Affiliated Persons |

8 |

| Vote Required for Approval of the Transaction Proposals at the Annual

Meeting |

9 |

| Treatment of Beneficial Holders (Stockholders Holding Shares in “Street

Name”) |

9 |

| Determination of Stockholders of Record |

10 |

| Effectiveness of the Stock Split |

10 |

| Financing for the Stock Split |

10 |

| Recent Market Prices of the Company’s Common Stock |

10 |

| No Appraisal or Dissenters’ Rights |

11 |

| Material U.S. Federal Income Tax Consequences |

11 |

| QUESTIONS AND ANSWERS ABOUT THE

TRANSACTION |

11 |

| What proposals am I being asked to vote on relating to the Transaction? |

11 |

| What is the purpose of the Stock Split? |

12 |

| What does the deregistration of our common stock mean? |

12 |

| What is the OTC Pink Market? |

12 |

| What will I receive in the Stock Split? |

12 |

| What potential conflicts of interest are posed by the Transaction? |

12 |

| Why is the Company proposing to carry out a Forward Stock Split following

the Reverse Stock Split? |

13 |

| What if I hold fewer than the Minimum Number and hold all of my shares

in “street name”? |

13 |

| What happens if I own beneficially a total number of shares of common

stock equal to or greater than the Minimum Number of shares or more shares of common stock, but I hold fewer than the Minimum Number of

record in my name and fewer than the Minimum Number with my broker in “street name”? |

13 |

| If I own fewer than the Minimum Number, is there any way I can continue

to be a stockholder of the Company after the Reverse Stock Split? |

14 |

| Is there anything I can do if I own a number of shares of common stock

equal to or greater than the Minimum Number, but would like to take advantage of the opportunity to receive cash for my shares as a result

of the Reverse Stock Split? |

14 |

| Could the Stock Split not happen? |

14 |

| What are the material terms of the Stock Purchase Agreement? |

14 |

| Will my shares be voted if I do not vote? |

14 |

| What vote is required to approve the Transaction Proposals? |

15 |

| What will happen if the Transaction Approvals are approved by the Company’s

stockholders? |

15 |

| What will happen if the Transaction Proposals are not approved? |

15 |

| If the Transaction Proposals are approved by the stockholders, can the

Board determine not to proceed with the Stock Split? |

15 |

| What are the federal income tax consequences of the Stock Split to me? |

16 |

| Should I send in my certificates now? |

16 |

| What is the total cost of the Transaction to the Company? |

16 |

| Am I entitled to appraisal rights in connection with the Transaction? |

16 |

| SPECIAL FACTORS RELATING TO THE

TRANSACTION |

16 |

| Purpose of and Reasons for the Transaction |

16 |

| Background of the Transaction |

19 |

| Alternatives to the Transaction |

26 |

| Effects of the Transaction |

26 |

| Reservation of Rights |

32 |

| Nasdaq Capital Market Listing; OTC Pink Market |

32 |

| Fairness of the Transaction |

32 |

| Disadvantages of the Transaction |

34 |

| Position of the Investors as to the Fairness of the Transaction |

36 |

| Fairness Opinion of Financial Advisor |

41 |

| Financial Forecast Information |

52 |

| Material U.S. Federal Income Tax Consequences |

62 |

| Potential Conflicts of Interests of Officers, Directors, and Certain

Affiliated Persons |

65 |

| Source of Funds and Expenses |

66 |

| Stockholder Approval |

66 |

| Effective Date |

67 |

| Termination of Transaction |

67 |

| Exchange of Certificates and Payment for Fractional Shares |

68 |

| No Appraisal or Dissenters’ Rights |

70 |

| Escheat Laws |

70 |

| Regulatory Approvals |

70 |

| Litigation |

70 |

| BOARD OF DIRECTORS AND DIRECTOR

NOMINEES |

71 |

| CORPORATE GOVERNANCE |

73 |

| General |

73 |

| Independence |

73 |

| Corporate Governance Guidelines |

73 |

| Certain Relationships and Related Transactions |

74 |

| Board of Directors Meetings and Committees |

74 |

| Diversity |

75 |

| Board Leadership Structure, Risk Oversight, Executive Sessions of Nonemployee

Directors, and Communications Between Stockholders and the Board |

76 |

| Fees Payable to Our Independent Auditor for 2023 and 2022 |

77 |

| Report of the Audit Committee |

77 |

| Director Compensation |

78 |

| CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS |

80 |

| PROPOSAL 1 ELECTION

OF DIRECTORS |

82 |

| EXECUTIVE OFFICERS |

83 |

| EXECUTIVE COMPENSATION |

84 |

| Overview of Compensation Program |

84 |

| Compensation Philosophy and Objectives |

84 |

| Role of Executive Officers in Compensation Decisions |

84 |

| Setting Executive Compensation |

84 |

| 2023 Executive Compensation Components |

85 |

| Tax and Accounting Implications |

86 |

| Summary of Cash and Certain Other Compensation |

86 |

| Employment Contracts |

87 |

| Potential Payments upon Termination and Change in Control |

89 |

| Equity Compensation Plan Information |

89 |

| Pay Versus Performance |

89 |

| PRINCIPAL STOCKHOLDERS

AND STOCKHOLDINGS OF MANAGEMENT |

92 |

| PROPOSAL 2 ADVISORY

VOTE ON EXECUTIVE COMPENSATION |

94 |

| PROPOSAL 3 RATIFICATION

OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

96 |

| PROPOSAL 4 AMENDMENTS

TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT |

97 |

| PROPOSAL 5 AMENDMENT

TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A FORWARD STOCK SPLIT |

99 |

| PROPOSAL 6 RATIFICATION

OF THE TERMS AND CONDITIONS OF THE STOCK PURCHASE AGREEMENT AND THE TRANSACTIONS CONTEMPLATED BY THE STOCK PURCHASE AGREEMENT |

100 |

| PROPOSAL 7 APPROVAL

OF THE ADJOURNMENT OF THE ANNUAL MEETING, IF NECESSARY OR APPROPRIATE, INCLUDING TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT

VOTES AT THE TIME OF THE ANNUAL MEETING TO APPROVE ANY PROPOSAL OR TO ESTABLISH QUORUM |

103 |

| INFORMATION ABOUT THE COMPANY |

104 |

| Market Price of Common Stock |

104 |

| Dividends |

104 |

| Stockholders |

105 |

| The Filing Persons |

105 |

| Stock Purchases by Filing Persons |

105 |

| Directors and Executive Officers |

105 |

| OTHER MATTERS |

106 |

| Voting Procedures |

106 |

| Other Proposed Action |

106 |

| Stockholder Communications |

106 |

| Stockholder Proposals and Nominations for Director |

106 |

| Delinquent Section 16(a) Reports |

107 |

| Can I Change My Vote After I Have Voted? |

108 |

| Incorporation By Reference |

108 |

| Annual Report on Form 10-K |

108 |

| FINANCIAL INFORMATION |

109 |

| Summary Historical Financial Information |

109 |

| Pro Forma Consolidated Financial Statements (Unaudited) |

109 |

| |

|

| Annex A – FORM OF CERTIFICATE OF AMENDMENT OF THE AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION OF PSYCHEMEDICS CORPORATION |

A-1 |

| |

|

| Annex B – FORM OF CERTIFICATE OF AMENDMENT OF THE AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION OF PSYCHEMEDICS CORPORATION |

B-1 |

| |

|

| Annex C – STOCK PURCHASE AGREEMENT |

C-1 |

| |

|

| Annex D – FAIRNESS OPINION OF FINANCIAL ADVISOR |

D-1 |

ABOUT THE ANNUAL MEETING

This proxy statement is furnished in connection with

the solicitation of proxies by the Board of Directors (the “Board”) of Psychemedics Corporation, a Delaware corporation (“we,”

“us,” “our,” or the “Company”), with its principal executive offices at 5220 Spring Valley Road, Dallas,

Texas 75254, for use at the 2024 Annual Meeting of Stockholders to be held on November 25, 2024 and at any adjournment or postponement

thereof (the “Annual Meeting”). The enclosed proxy relating to the Annual Meeting is solicited on behalf of the Board. We

have retained Alliance Advisors, LLC to assist in the solicitation of proxies for a fee of approximately $15,000, plus reimbursement of

related expenses. In addition to solicitation by mail, our directors, officers and employees may solicit proxies on behalf of the Company,

without additional compensation, by telephone, facsimile, mail, on the Internet or at the Annual Meeting. We may reimburse banks, brokerage

firms, other custodians, nominees and fiduciaries for reasonable expenses incurred in sending proxy materials to beneficial owners of

our stock. It is expected that this proxy statement and the accompanying proxy will be mailed to stockholders on or about October 18,

2024.

Only stockholders of record at the close of business

on October 8, 2024 will be entitled to receive notice of, and to vote at, the Annual Meeting. As of that date, there were outstanding

and entitled to vote 5,894,461 shares of our common stock, $0.005 par value (the “common stock”). Each such stockholder is

entitled to one vote for each share of common stock so held and may vote such shares either personally or by proxy.

The Annual Meeting will be held as a virtual meeting

only, via a live audio webcast. There will be no physical meeting location for the Annual Meeting. You will be able to attend the meeting

online and vote your shares electronically during the meeting by visiting www.proxydocs.com/PMD and entering your control number included

in your proxy materials or on your proxy card. You must register by November 24, 2024 by 5:00 p.m. Eastern Time to participate in the

Annual Meeting. Upon completing your registration, you will receive further instructions by email, including a unique link that will allow

you to access the Annual Meeting. Even though the Annual Meeting is being held virtually, stockholders will have the ability to participate

in, hear others, and ask questions during the Annual Meeting.

Your vote is important. Even if you plan to attend

the Annual Meeting, we urge you to vote by proxy in advance. You may vote your shares by using one of the following methods in advance

of the Annual Meeting:

(1)

you may vote by mail by marking your proxy card, and then date, sign and return it in the postage-paid envelope provided; or

(2)

you may vote electronically by accessing the website located at www.proxydocs.com/PMD and following the on-screen instructions; or

(3)

you may vote by using a telephone at (866) 586-3113 and following the voting instructions.

Please have your proxy card in hand when going online.

If you instruct the voting of your shares electronically or by telephone, you do not need to return your proxy card.

If your shares are held in “street name”

(held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow

the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders

owning shares through certain banks or brokers. If your shares are not registered in your own name and you plan to vote your shares at

the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and vote your shares

online at the time of the meeting.

The meeting webcast will begin promptly at 10:00 a.m.

Eastern Time on November 25, 2024. Online check-in will begin promptly at 9:45 a.m. Eastern Time on that date, and you should allow ample

time for the online check-in procedures. We will have technicians ready to assist you with any technical difficulties you may have accessing

the virtual meeting.

SUMMARY TERM SHEET

The following summary term sheet, together with the

“Questions and Answers” section that follows, highlights certain information about the Transaction (as defined below), but

may not contain all of the information that is important to you. For a more complete description of the Transaction, including the Stock

Split and the Stock Purchase Agreement (each as defined below) and the transactions contemplated thereby, we urge you to carefully read

this proxy statement and all of its annexes before you vote. For your convenience, we have directed your attention to the location in

this proxy statement where you can find a more complete discussion of the items listed below.

The Transaction

| |

· |

A Transaction Committee of the Board comprised solely of independent directors (the “Transaction

Committee”) has recommended to the Board, and participating members of the Board have each approved, the Transaction, which consists

of (1) amendments to the Company’s amended and restated certificate of incorporation to effect a reverse stock split of the Company’s

common stock, par value $0.005 per share (the “common stock”), at a ratio not less than 1-for-4,000 and not greater than 1-for-6,000

(the “Reverse Stock Split”), followed immediately by a forward stock split of the Company’s common stock at a ratio

not less than 4,000-for-1 and not greater than 6,000-for-1 (the “Forward Stock Split,” and together with the Reverse Stock

Split, the “Stock Split”), and (2) the entry into the Stock Purchase Agreement entered into by us on August 12, 2024 for the

issuance and sale of up to 1,595,744 shares of our common stock to Mr. Kamin or his designee at a purchase price of $2.35 per share, for

an aggregate purchase price of up to $3,750,000 (the “Stock Purchase Agreement,” and the Stock Purchase Agreement, including

the transactions contemplated thereby, the Stock Split and the subsequent delisting and deregistration of the Company’s common stock

as described in this proxy statement, collectively, the “Transaction”) and the transactions contemplated thereby, in each

case as part of the Company’s plan to terminate the registration of (or “deregister”) the common stock under

Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and suspend the Company’s duty

to file periodic reports and other information with the Securities and Exchange Commission (the “SEC”) under Section 13(a)

thereunder, and to delist the common stock from the Nasdaq Capital Market. |

| |

· |

Stockholders owning fewer than the minimum number of shares

immediately prior to the effective time of the Reverse Stock Split, which, depending on the Stock Split ratios chosen by the Board, would

be between 4,000 and 6,000 (the “Minimum Number”), whom we refer to as “Cashed Out Stockholders,” will receive

$2.35 in cash, without interest, for each share held at the effective time of the Reverse Stock Split (the “effective time”),

and they will no longer be stockholders of the Company. |

| |

· |

Stockholders who own a number of shares of common stock equal

to or greater than the Minimum Number immediately prior to the effective time, whom we refer to as “Continuing Stockholders,”

will not be entitled to receive any cash for their fractional share interests resulting from the Reverse Stock Split, if any. The Forward

Stock Split that will immediately follow the Reverse Stock Split will reconvert whole shares and fractional share interests held by the

Continuing Stockholders back into the same number of shares of common stock they held immediately before the effective time. As a result,

the total number of shares of common stock held by a Continuing Stockholder will not change. |

See “Special Factors Relating to the Transaction — Effects

of the Transaction” beginning on page 26.

Purpose of and Reasons for the Transaction

| |

· |

The primary purpose of the Transaction is to enable the Company

to maintain the number of record holders of its common stock below 300, which is the level at which SEC public reporting is required.

After the completion of the Transaction, we intend to delist our common stock from the Nasdaq Capital Market and cease registration of

our common stock under the Exchange Act. As a result, effective on and following the termination of the registration of our common stock

under the Exchange Act, the Company would no longer be subject to the reporting requirements under the Exchange Act, or other requirements

applicable to a public company, including requirements under the Sarbanes-Oxley Act and the listing standards of a national stock exchange.

Our common stock would not be eligible for listing on the New York Stock Exchange, the Nasdaq Global Select Market, the Nasdaq Global

Market or the Nasdaq Capital Market. |

| |

· |

The Transaction Committee and the Board has determined that

the costs of being an SEC reporting company outweigh the benefits and, thus, it is no longer in the best interests of our stockholders,

including our unaffiliated stockholders (consisting of stockholders other than our executive officers, directors and stockholders who

own more than 10% of our outstanding common stock), for us to remain an SEC reporting company. |

| |

· |

The principal reasons for the Board approving the proposed

“going dark” transaction and recommending that stockholders approve each of the Transaction Proposals (as defined below) are

as follows: (1) the Company’s public cost structure is disproportionate to the sales level of its business; (2) the Company’s

revenues have declined in recent years, making our public company cost structure even more unsustainable; (3) the Company currently realizes

none of the traditional benefits of public company status; (4) public company status requires significant management time and limits operational

flexibility; (5) our common stock has limited trading volume and liquidity for small stockholdings and the Transaction will allow our

smallest stockholders with the ability to liquidate their holdings in the Company and receive a fair price in cash for their shares, without

incurring brokerage commissions; and (6) the Board decision to approve the proposed “going dark” transaction and its specific

terms was the result of an independent and rigorous process to determine the best course for all the Company’s stockholders. |

See “Special Factors Relating to the Transaction — Purpose

of and Reasons for the Transaction” beginning on page 16.

Purpose and Reasons of the Investors for the Transaction

|

· |

Under the SEC rules governing “going-private” transactions, the Investors are affiliates of the

Company who may be engaged directly or indirectly in the Stock Split and, therefore, required to express their reasons for the Transaction

to the Company’s unaffiliated stockholders, as defined in Rule 13e-3 of the Exchange Act. The Investors are making the statements

included in this section solely for the purpose of complying with the requirements of Rule 13e-3 and related rules under the Exchange Act.

For the Investors, the primary purpose of the Transaction is to enable the Company to maintain the number of record holders of its common

stock below 300, which is the level at which SEC public reporting is required. After the completion of the Transaction, the Company intends

to delist the common stock from the Nasdaq Capital Market and to cease registration of our common stock under the Exchange Act. As a result,

effective on and following the termination of the registration of the Company’s common stock under the Exchange Act, the Company

would no longer be subject to the reporting requirements under the Exchange Act, or other requirements applicable to a public company,

including requirements under the Sarbanes-Oxley Act and the listing standards of a national stock exchange. The Transaction Committee

and the Board have determined that the costs of being an SEC reporting company outweigh the benefits and, thus, it is no longer in the

best interests of Comapny stockholders, including Company unaffiliated stockholders (consisting of stockholders other than Company executive

officers, directors and stockholders who own more than 10% of Company outstanding common stock), for the Company to remain an SEC reporting

company. |

|

· |

The Investors believe that the structuring of the Transaction is appropriate

because it will result in significant cost and time savings for the Company, which is expected to save approximately $845,000 annually

by eliminating the costs associated with public reporting and related obligations. In addition, management and employees will be able

to focus more on the Company’s operations instead of dedicating substantial time to compliance tasks. The Transaction also provides

an opportunity for stockholders holding fewer than the Minimum Number to liquidate their holdings at a fair price without incurring brokerage

fees, particularly given the limited liquidity of the Company’s common stock. |

Effects of the Transaction

As a result of the Transaction:

| |

· |

We expect to maintain the number of our stockholders of record

below 300, which will allow us to cease the registration of our shares of common stock under the Exchange Act. Effective on and following

the termination of the registration of our common stock under the Exchange Act, we will no longer be subject to any reporting requirements

under the Exchange Act or the rules of the SEC applicable to SEC reporting companies. We will, therefore, cease to file annual, quarterly,

current, and other reports and documents with the SEC, and stockholders will cease to receive annual reports and proxy statements required

by the SEC. |

| |

· |

We will no longer be subject to the provisions of the Sarbanes-Oxley

Act and other requirements applicable to a public company, including those required by the listing standards of a national stock exchange. |

| |

· |

Our executive officers, directors and 10% stockholders will

no longer be subject to the reporting requirements of Section 16 of the Exchange Act or be subject to the prohibitions against retaining

short-swing profits in our shares of common stock. Persons acquiring 5% of our common stock will no longer be required to report their

beneficial ownership under the Exchange Act. |

| |

· |

We will have no ability to access the public capital markets

or to use public securities in attracting and retaining executives and other employees, and we will have a decreased ability to use stock

to acquire other companies. |

| |

· |

Our shares of common stock will no longer be traded on the

Nasdaq Capital Market and will not be eligible for listing on the New York Stock Exchange or The Nasdaq Stock Market. Any trading in our

common stock after the Stock Split and deregistration under the Exchange Act will only occur in privately negotiated sales and potentially

on the OTC Pink Market, if one or more brokers chooses to make a market for our common stock there, subject to applicable regulatory requirements;

however, there can be no assurances regarding any such trading. |

| |

· |

Holders of fewer than the Minimum Number immediately prior

to the effective time of the Reverse Stock Split will receive a cash payment of $2.35, without interest, for each share of common stock

they hold, will no longer have any ownership interest in us, and will cease to participate in any of our future earnings and growth. |

| |

· |

Holders of a number of shares of common stock equal to or greater

than the Minimum Number immediately prior the effective time of the Reverse Stock Split will not receive any payment for their shares

and, immediately following the Forward Stock Split, will continue to hold the same number of shares as before the Reverse Stock Split. |

| |

· |

Options evidencing rights to purchase shares of our common

stock would be unaffected by the Stock Split because such options will, after the Stock Split, be exercisable into the same number of

shares of our common stock as they were before the Stock Split. |

| |

· |

Since our obligation to file periodic and other filings with

the SEC will be suspended, Continuing Stockholders will no longer have access to publicly filed audited financial statements, information

about executive compensation and other information about us and our business, operations and financial performance. We intend to continue

to prepare audited annual financial statements and periodic unaudited financial statements and plan to make available to our stockholders

audited annual financial statements only. Nonetheless, Continuing Stockholders will have significantly less information about the Company

and our business, operations, and financial performance than they have currently. We will continue to hold stockholder meetings as required

under Delaware law, including annual meetings, or take actions by written consent of our stockholders in lieu of meetings. |

|

· |

The Continuing Stockholders will have less influence on all matters submitted to a vote

of the stockholders because Mr. Kamin’s beneficial ownership will increase from approximately 10.99%, as of October 8, 2024, to

34.94% of our outstanding common stock, based on an assumed Reverse Stock Split of 1-for-5,000, and Mr. Kamin, through 3K, will have rights

to designate directors to serve on the Board, as described below. Pursuant to the terms of the Stock Purchase Agreement, in connection

with each annual or special meeting of stockholders of the Company occurring after the closing of the transactions contemplated by the

Stock Purchase Agreement at which directors of the Company are to be elected, the Company will be required to include two individuals

designated by 3K, an affiliate of Mr. Kamin, as nominees for election to the Board and the Company will not be permitted to increase the

size of the Board to more than five directors, in each case subject to certain exceptions. The combined effect of Mr. Kamin’s increased

beneficial ownership and director designation rights will reduce the influence of other Continuing Stockholders. |

| |

· |

See “Special Factors Relating to the Transaction — Effects of the Transaction”

beginning on page 26, “Special Factors Relating to the Transaction — Fairness of the Transaction” beginning on page

32, and “Special Factors Relating to the Transaction — Potential Conflicts of Interests of Officers, Directors, and Certain

Affiliated Persons” beginning on page 65. |

Transaction Committee and Board Recommendations of the Transaction

| |

· |

The Board established the Transaction Committee to consider

the potential benefits and costs of a “going dark” transaction to the Company’s stockholders, develop the specific terms

of such transaction and make a recommendation to the Board. |

| |

· |

The Transaction Committee consists of Robyn Davis (Chair) and

Drew Reynolds, each of whom is independent within the meaning of Rule 4200 of the Nasdaq Marketplace Rules and Rule 10A-3(b) of the Exchange

Act. The Transaction Committee retained Mirus Securities, Inc. (“Mirus”), an investment banking firm, which has provided the

Transaction Committee with a fairness opinion as to the Cash Payment to be paid in the Reverse Stock Split, a copy of which is attached

to this proxy statement as Annex D. No member of the Transaction Committee received any compensation for their work on the

Transaction Committee, other than their regular Board fees paid pursuant to the Board compensation policy described elsewhere in this

proxy statement. |

| |

· |

The Transaction Committee and the Board determined that the

Transaction is substantively and procedurally fair to, and in the best interests of, and the price to be paid per fractional share as

a result of the Reverse Stock Split is fair to, our stockholders, including unaffiliated Cashed Out Stockholders and unaffiliated Continuing

Stockholders. The participating members of the Board approved the Transaction and recommended the Transaction to the stockholders of the

Company for approval. |

See “Special Factors Relating to the Transaction — Fairness

of the Transaction” beginning on page 32.

Reservation of Rights

|

· |

The Board has reserved the right to abandon the proposed Transaction at any time if it believes the Transaction

is no longer in the best interests of our stockholders, whether prior to or following the Annual Meeting and the Company may terminate

the transactions contemplated by the Stock Purchase Agreement upon written notice to the Investors prior to the Closing Date. |

See “Special Factors Relating to the Transaction

— Background of the Transaction” beginning on page 19 and “Special Factors Relating to the Transaction — Fairness

of the Transaction” beginning on page 32.

Fairness of the Transaction

|

· |

The Transaction Committee and the Board fully considered and reviewed the terms, purpose, alternatives, effects

and disadvantages of the Transaction, and each has determined that the Transaction, taken as a whole, is procedurally and substantively

fair to, and in the best interests of, the unaffiliated Cashed Out Stockholders as well as the unaffiliated Continuing Stockholders. |

|

· |

The Transaction Committee and the Board considered a number of factors in reaching their determinations, including: |

| |

· |

the fairness opinion prepared by Mirus that the $2.35 cash

out price is fair from a financial point of view to unaffiliated stockholders; |

| |

· |

the limited trading volume and liquidity of our shares of common

stock and the effect of enabling our smallest stockholders, who represent a disproportionately large number of our record holders, to

liquidate their holdings in the Company and receive a fair price in cash for their shares, without incurring brokerage commissions; |

|

· |

the effect of the proposed transaction on the relative voting power of Continuing Stockholders,

including Mr. Kamin, who, as a result of the Transaction will beneficially own approximately 34.94% of our outstanding common stock, compared

with 10.99% as of October 8, 2024, based on an assumed Reverse Stock Split ratio of 1-for-5,000; and |

| |

· |

that our business and operations are expected to continue following

the completion of the Transaction substantially as presently conducted. |

|

· |

Nonetheless, the Board believes that it is prudent to recognize that, between the date of this proxy statement

and the date that the Stock Split will become effective, factual circumstances could possibly change such that it might not be appropriate

or desirable to effect the Stock Split at that time or on the terms currently proposed. Such factual circumstances could include a superior

offer to our stockholders, a material change in our business or litigation affecting our ability to proceed with the Stock Split. In addition,

if the Board determines the Reverse Stock Split would not have the intended effect of maintaining the number of record holders of the

Company’s common stock below 300, it would strongly consider changing the split ratio to a higher number. While unlikely, this could

occur as a result of stockholders buying additional shares of our common stock in the open market prior to the Reverse Stock Split becoming

effective. |

Position of the Investors as to the Fairness of the Transaction

|

· |

Under the SEC rules governing “going-private” transactions, the Investors are affiliates of the

Company who may be engaged directly or indirectly in the Stock Split and, therefore, required to express their beliefs as to the fairness

of the Transaction to the unaffiliated Cashed Out Stockholders. The Investors have carefully reviewed the terms, purpose, alternatives,

effects, and disadvantages of the Transaction, and have determined that the Transaction, taken as a whole, is procedurally and substantively

fair to, and in the best interests of, the unaffiliated Cashed Out Stockholders. |

|

· |

The Investors considered several factors in reaching their determinations, including, but not limited to: |

|

· |

the Company’s business and operations are expected to continue largely unchanged following the completion

of the Transaction; |

|

· |

that the Transaction Committee (which is comprised of two independent directors of the Board) determined that

the Transaction is procedurally and substantively fair to, and in the best interests of, all stockholders, including the unaffiliated

stockholders, regardless of whether a stockholder receives cash or continues to be a stockholder following the Stock Split, and that the

$2.35 per-share Cash Payment constitutes fair consideration for those stockholders holding less than the Minimum Number and unanimously

recommended the Transaction to the Board for approval; |

|

· |

that the Transaction will provide liquidity for certain of the unaffiliated Cashed Out Stockholders without

the delays that would otherwise be necessary in order to liquidate the positions of larger holders, and without incurring brokerage and

other costs typically associated with market sales; |

|

· |

that consummation of the Transaction will allow the unaffiliated Cashed Out Stockholders the option to avoid

exposure to risks and uncertainties relating to the prospects of the Company, including the costs and dilution associated with additional

capital raising necessary to support growth, address upcoming debt maturities, and provide sufficient operating liquidity following the

Transaction; and |

|

· |

that the limited trading volume of the Company’s common stock and the opportunity provided to smaller

stockholders to liquidate their holdings at a fair price, without incurring brokerage commissions. |

|

· |

The Investors believe that these factors, along with the independent assessment by the Transaction Committee

and its financial advisors, support the procedural and substantive fairness of the Transaction. However, the Investors also acknowledge

potential disadvantages, including those discussed in the section of this proxy statement entitled “Special Factors Relating to

the Transaction — Position of the Investors as to the Fairness of the Transaction”. |

See “Special Factors Relating to the Transaction — Fairness

of the Transaction” beginning on page 32 and “Special Factors Relating to the Transaction — Fairness Opinion

of Financial Advisor” beginning on page 41.

Advantages of the Transaction

If the transactions contemplated by the Stock Purchase

Agreement are consummated and the Stock Split occurs, there will be certain advantages to stockholders, including the following:

| |

· |

By completing the Transaction, deregistering our shares and

eliminating our obligations under the Sarbanes-Oxley Act and our periodic reporting obligations under the Exchange Act, we expect to save

approximately $845,000 per year (inclusive of anticipated savings resulting from our recent change in auditors). |

| |

· |

We will also save the significant amount of time and effort

expended by our management and employees on the preparation of SEC filings and compliance with the Sarbanes-Oxley Act. |

| |

· |

There is a relatively illiquid and limited trading market in

our shares. Our smallest stockholders, who represent a large number of our record holders, will have the opportunity to liquidate their

holdings in the Company and receive a fair price in cash for their shares, without incurring brokerage commissions. |

| |

· |

The Company’s directors and executive officers will be

treated no differently in the Stock Split than unaffiliated stockholders, including unaffiliated Cashed Out Stockholders and unaffiliated

Continuing Stockholders; however, because the number of shares owned by a stockholder is a factor considered in determining affiliate

status, as a practical matter, the stock held by affiliated stockholders will not be cashed out in the Reverse Stock Split. |

| |

· |

Our business and operations are expected to continue following

the Transaction substantially as presently conducted. |

See “Special Factors Relating to the Transaction — Purpose

of and Reasons for the Transaction” beginning on page 16 and “Special Factors Relating to the Transaction — Fairness

of the Transaction” beginning on page 32.

Disadvantages of the Transaction

If the transactions contemplated by the Stock Purchase

Agreement are consummated and the Stock Split occurs, there will be certain disadvantages to stockholders, including the following:

| |

· |

Cashed Out Stockholders will no longer have any ownership interest

in the Company and will no longer participate in our future earnings and growth. |

| |

· |

We will cease to file annual, quarterly, current, and other

reports and documents with the SEC and stockholders will cease to receive annual reports and proxy statements required by the SEC. We

intend to continue to prepare audited annual financial statements and periodic unaudited financial statements and plan to make available

to our stockholders audited annual financial statements only. Nonetheless, Continuing Stockholders will have significantly less information

about the Company and our business, operations, and financial performance than they have currently. We will continue to hold stockholder

meetings as required under Delaware law, including annual meetings, or take actions by written consent of our stockholders in lieu of

meetings. |

| |

· |

We will no longer be listed on the Nasdaq Capital Market. Any

trading in our common stock after the Stock Split and deregistration under the Exchange Act will only occur in privately negotiated sales

and potentially on the OTC Pink Market, if one or more brokers chooses to make a market for our common stock there, subject to applicable

regulatory requirements; however, there can be no assurances regarding any such trading. Because of the possible limited liquidity for

our common stock, the termination of our obligation to publicly disclose financial and other information following the Stock Split, and

the deregistration of our common stock under the Exchange Act, Continuing Stockholders may potentially experience a significant decrease

in the value of their common stock. |

| |

· |

We will no longer be subject to the provisions of the Sarbanes-Oxley

Act, the liability provisions of the Exchange Act or the oversight of the Nasdaq Capital Market. |

| |

· |

Our executive officers, directors and 10% stockholders will

no longer be required to file reports relating to their transactions in our common stock with the SEC. In addition, our executive officers,

directors and 10% stockholders will no longer be subject to the recovery of profits provision of the Exchange Act, and persons acquiring

5% of our common stock will no longer be required to report their beneficial ownership under the Exchange Act. |

| |

· |

We will have no ability to access the public capital markets

or to use public securities in attracting and retaining executives and other employees, and we will have a decreased ability to use stock

to acquire other companies. |

| |

· |

We estimate that the cost of payment to Cashed Out Stockholders,

professional fees and other expenses will total approximately $3,692,947, based on an assumed Reverse Stock Split ratio of 1-for-5,000.

We expect that funds received in connection with the transactions contemplated by the Stock Purchase Agreement will provide us sufficient

funds for payments to Cashed Out Stockholders and an additional $500,000 designated for working capital and general corporate purposes. |

| |

· |

Our public reporting obligations could be reinstated. If on

the first day of any fiscal year after the suspension of our filing obligations we have more than 300 stockholders of record, then we

must resume reporting pursuant to Section 15(d) of the Exchange Act. |

| |

· |

Under Delaware law, our amended and restated certificate of

incorporation and our amended and restated bylaws, no appraisal or dissenters’ rights are available to our stockholders who vote

against (or abstain from voting on) the Transaction Proposals. |

| |

· |

Approval of the Reverse Stock Split requires the affirmative

vote of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting, and not a majority vote of unaffiliated

stockholders. |

|

· |

The Continuing Stockholders will have less influence on all matters submitted to a vote

of the stockholders because Mr. Kamin’s beneficial ownership will increase from approximately 10.99%, as of October 8, 2024, to

34.94% of our outstanding common stock, based on an assumed Reverse Stock Split of 1-for-5,000, and Mr. Kamin, through 3K, will have rights

to designate directors to serve on the Board, as described below. Pursuant to the terms of the Stock Purchase Agreement, in connection

with each annual or special meeting of stockholders of the Company occurring after the closing of the transactions contemplated by the

Stock Purchase Agreement at which directors of the Company are to be elected, the Company will be required to include two individuals

designated by 3K, an affiliate of Mr. Kamin, as nominees for election to the Board and the Company will not be permitted to increase the

size of the Board to more than five directors, in each case subject to certain exceptions. The combined effect of Mr. Kamin’s increased

beneficial ownership and director designation rights will reduce the influence of other Continuing Stockholders. |

See “Special Factors Relating to the Transaction

— Fairness of the Transaction — Disadvantages of the Transaction” beginning on page 34.

The Stock Purchase Agreement and Funding of the Reverse Stock Split

| |

· |

On August 12, 2024, in connection with the Transaction, we

entered into the Stock Purchase Agreement with Mr. Kamin, 3K Limited Partnership (“3K” and together with Mr. Kamin, the “Investors”),

the Peter H. Kamin Revocable Trust dated February 2003, the Peter H. Kamin Children’s Trust dated March 1997, the Peter H. Kamin

GST Trust and the Peter H. Kamin Family Foundation (collectively, with the Investors, the “Kamin Parties”). Pursuant to the

Stock Purchase Agreement, the Investors have agreed to purchase, subject to the terms and conditions thereof, up to 1,595,744 shares of

our common stock at a purchase price of $2.35 per share, for an aggregate purchase price of up to $3,750,000. We intend to use the proceeds

from the Stock Purchase Agreement to make payments to Cashed Out Stockholders and for working capital and general corporate purposes.

Prior to the closing of the transactions contemplated by the Stock Purchase Agreement (the “Closing Date”), we will determine

the number of shares to be issued (not to exceed 1,595,744 shares) so as to provide us with (i) proceeds sufficient to purchase the fractional

shares of common stock resulting from the proposed Reverse Stock Split and (ii) an additional $500,000 designated for working capital

and general corporate purposes. Pursuant to the terms of the Stock Purchase Agreement, Mr. Kamin has informed us that 3K will be the sole

purchaser of the shares of our common stock thereunder. |

| |

· |

In addition, under the terms of the Stock Purchase Agreement,

in connection with each of our annual or special meeting of stockholders occurring after the Closing Date at which directors are to be

elected, (i) we shall include two individuals designated by 3K and satisfying certain eligibility criteria (each, a “3K Director

Nominee”) as nominees for election to the Board in its proxy materials and (ii) the Board shall recommend to our stockholders the

election of such 3K Director Nominees to the Board in the same manner as it recommends the election of our other director nominees. Additionally,

pursuant to the terms of the Stock Purchase Agreement, from and after the Closing Date, we shall not, without 3K’s prior written

consent, increase the size of the Board to more than five directors. In the event our stockholders are permitted to elect directors by

action by written consent pursuant to our amended and restated bylaws and applicable law, the foregoing provisions shall be applied mutatis

mutandis in connection with any such action. We have also granted the Kamin Parties certain indemnification rights with respect to

the transactions contemplated by the Stock Purchase Agreement. |

| |

· |

The consummation of the transactions contemplated by the Stock

Purchase Agreement is subject to the satisfaction of customary closing conditions, including receiving the requisite approval by our stockholders

of (i) the terms and conditions of the Stock Purchase Agreement and the proposed Reverse Stock Split and (ii) the filing with the Secretary

of State of the State of Delaware (the “Delaware Secretary”) of a certificate of amendment to our amended and restated

certificate of incorporation to effect the Reverse Stock Split. |

Potential Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons

| |

· |

Mr. Kamin is a member of our Board and the Kamin Parties are parties to the Stock Purchase

Agreement, which provides for the issuance of up to 1,595,744 shares of our common stock at a purchase price of $2.35 per share. We intend

that payments to Cashed Out Stockholders and the costs of the Transaction will be paid from funds received in connection with the transactions

contemplated by the Stock Purchase Agreement and, therefore, Mr. Kamin has a direct interest in the Transaction. Pursuant to the terms

of the Stock Purchase Agreement, Mr. Kamin has informed us that 3K will be the sole purchaser of the shares of our common stock thereunder.

Mr. Kamin, through 3K, also is entitled to designate two directors on the Board pursuant to the terms of the Stock Purchase Agreement. |

| |

· |

Our directors and executive officers may have interests in the Stock Split that are different

from your interests as a stockholder in the Company, and have relationships that may present conflicts of interest, including Mr. Kamin’s

interest described above. As of October 8, 2024, approximately 12.94% of the issued and outstanding shares of our common stock was beneficially

owned by our directors and executive officers, including 10.99% beneficially owned by Mr. Kamin. As a result of the Transaction, Mr. Kamin

will beneficially own approximately 34.94% of our outstanding common stock, compared to 10.99% as of October 8, 2024, based on an assumed

Reverse Stock Split ratio of 1-for- 5,000. In addition, Mr. Kamin, through 3K, will also have director designation rights under the terms

of the Stock Purchase Agreement. |

| |

· |

At the outset of discussions about the potential Transaction, the Board instituted appropriate

corporate governance measures, including the formation of an independent Transaction Committee consisting of Ms. Davis and Mr. Reynolds,

each an independent and disinterested director of the Company. The members of the Transaction Committee did not have any relationships

that would represent a conflict of interest with respect to a potential transaction with Mr. Kamin. Neither Mr. Kamin nor Mr. Nevin participated

in any meetings of the Transaction Committee or in any substantive discussions of the Board regarding the Transaction, other than routine

non-substantive updates provided to the Board by the Transaction Committee regarding the status of negotiations and timing of a potential

transaction. |

See “Special Factors Relating to the Transaction — Potential

Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons” beginning on page 65.

Vote Required for Approval of the Transaction Proposals at the Annual Meeting

| |

· |

A majority of the outstanding shares of our common stock entitled

to vote will constitute a quorum for the purposes of the Annual Meeting. The affirmative vote of a majority of the outstanding shares

of our common stock entitled to vote at the Annual Meeting is required for the adoption of the Reverse Stock Split Proposal and, accordingly,

to proceed with the Transaction, and the affirmative of a majority of the shares cast (represented in person or by proxy) and entitled

to vote at the Annual Meeting is required for the adoption of each other Transaction Proposal. |

| |

· |

As of October 8, 2024, approximately 12.94% of the issued and outstanding shares of our common

stock was beneficially owned by our directors and executive officers, including 10.99% beneficially owned by Mr. Kamin. Our directors

and executive officers have indicated that they intend to vote all of the shares of our common stock beneficially owned by them (762,918

shares) “FOR” each of the Transaction Proposals. |

See “Special Factors Relating to the Transaction — Stockholder

Approval” beginning on page 66.

Treatment of Beneficial Holders (Stockholders Holding Shares in “Street Name”)

| |

· |

We intend to treat stockholders holding our common stock in

“street name” in the same manner as record holders. Prior to the Stock Split, we will conduct an inquiry of all brokers, banks

and other nominees that hold shares of our common stock in “street name,” ask them to provide us with information on how many

shares held by beneficial holders will be cashed out, and request that they effect the Stock Split for those beneficial holders. However,

these banks, brokers and other nominees may have different procedures than registered stockholders for processing the Stock Split. Accordingly,

if you hold your shares of common stock in “street name,” we encourage you to contact your bank, broker or other nominee. |

See “Special Factors Relating to the Transaction — Effects

of the Transaction” beginning on page 26.

Determination of Stockholders of Record

| |

· |

In determining whether the number of our stockholders of record

remains below 300 for regulatory purposes, we will count stockholders of record in accordance with Rule 12g5-1 under the Exchange Act.

Rule 12g5-1 provides, with certain exceptions, that in determining whether issuers, including the Company, are subject to the registration

provisions of the Exchange Act, securities are considered to be “held of record” by each person who is identified as the owner

of such securities on the respective records of security holders maintained by or on behalf of the issuers. However, institutional custodians

such as Cede & Co. and other commercial depositories are not considered a single holder of record for purposes of these provisions.

Rather, Cede & Co.’s and these depositories’ accounts are treated as the record holder of shares. Based on information

available to us, as of October 8, 2024, there were approximately 201 holders of record of our shares of common stock. |

See “Special Factors Relating to the Transaction — Effects

of the Transaction” beginning on page 26.

Effectiveness of the Stock Split

| |

· |

We anticipate that the Stock Split will be effected as soon

as possible after the date of the Annual Meeting, although the Board has reserved the right not to proceed with the Stock Split if it

believes it is no longer in the best interests of the Company’s stockholders. Following the effective date of the Stock Split, transmittal

materials will be sent to those stockholders entitled to a cash payment that will describe how to turn in their stock certificates and

receive the cash payments. Those stockholders entitled to a cash payment should not turn in their share certificates at this time. The

transactions contemplated by the Stock Purchase Agreement are expected to be consummated concurrently with the filing by the Company with

the Delaware Secretary of a certificate of amendment to the Company’s amended and restated certificate

of incorporation to effect the Reverse Stock Split. |

See “Special Factors Relating to the Transaction — Effective

Date” on page 67.

Financing for the Stock Split

| |

· |

Based on information we have received as of October 8, 2024

from our transfer agent, Computershare Trust Company, N.A. (“Computershare”), and from Mediant Communications, Say Technologies

and Broadridge Corporate Issuer Services, a division of Broadridge Financial Solutions, Inc., we estimate that the total funds required

to pay the consideration to Cashed Out Stockholders and other costs of the Stock Split will be approximately $3,692,947, based on an assumed

Reverse Stock Split ratio of 1-for-5,000. This total amount could be larger or smaller depending on, among other things, the number of

shares of common stock that will be outstanding after the Stock Split as a result of purchases, sales and other transfers of our shares

of common stock by our stockholders, or an increase in the costs and expenses of the Transaction. |

| |

· |

We intend that payments to Cashed Out Stockholders and the

costs of the Stock Split will be paid from funds received in connection with the transactions contemplated under the Stock Purchase Agreement.

We understand that 3K intends to use cash on hand to fund the purchase of the shares of common stock under the Stock Purchase Agreement. |

See “Special Factors Relating to the Transaction — Source

of Funds and Expenses” beginning on page 66.

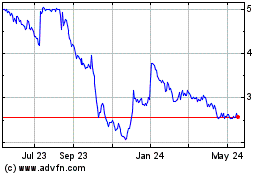

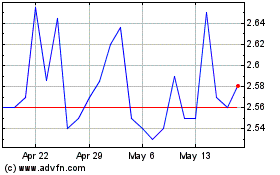

Recent Market Prices of the Company’s Common Stock

| |

· |

The closing prices of our common stock on August 9, 2024, the

last trading day before the public announcement of the approval of the Transaction by the Board, and on the record date, were $1.65 per

share and $2.31 per share, respectively. |

See “Information About the Company — Market

Price of Common Stock” beginning on page 104.

No Appraisal or Dissenters’ Rights

| |

· |

Under Delaware law, our amended and restated certificate of

incorporation and our amended and restated bylaws, no appraisal or dissenters’ rights are available to our stockholders who vote

against (or abstain from voting on) the Transaction Proposals. |

See “Special Factors Relating to the Transaction — No

Appraisal or Dissenters’ Rights” beginning on page 70.

Material U.S. Federal Income Tax Consequences

|

· |

Generally, a Cashed Out Stockholder who receives cash for a fractional share as a result of the Stock Split

will recognize capital gain or loss for U.S. federal income tax purposes. A Continuing Stockholder who does not receive cash for a fractional

share as a result of the Stock Split generally will not recognize any gain or loss for U.S. federal income tax purposes. |

See “Special Factors Relating to the Transaction — Material

U.S. Federal Income Tax Consequences” beginning on page 62.

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION

Following are some commonly asked questions that may be

raised by our stockholders and answers to each of those questions.

What proposals am I being asked to vote on relating to the Transaction?

Our stockholders will consider and vote on three proposals

relating to the Transaction:

| |

1. |

Two proposals relating to the amendment of our amended and

restated certificate of incorporation to effect a reverse stock split of our shares of common stock at a ratio not less than 1-for-4,000

and not greater than 1-for-6,000, followed immediately by a forward stock split of our shares of common stock at a ratio not less than

4,000-for-1 and not greater than 6,000-for-1. Stockholders whose shares are converted into less than one share of our common stock as

a result of the Reverse Stock Split (meaning they own fewer than the Minimum Number immediately prior to the effective time of the Stock

Split — which is the time that the certificate of amendment to our amended and restated certificate of incorporation

to effect the Reverse Stock Split is filed with the Secretary of State of the State of Delaware) will receive $2.35 in cash, without interest,

for each share of our common stock held by them immediately before the Reverse Stock Split. Stockholders who own a number of shares of

common stock equal to or greater than the Minimum Number immediately prior to the effective time of the Stock Split will continue to own

the same number of shares of our common stock after the completion of the Stock Split. Although the Reverse Stock Split and the Forward

Stock Split will be voted on separately, we will not effect either the Reverse Stock Split or the Forward Stock Split unless the proposals

to approve the Reverse Stock Split and the Forward Stock Split and the Stock Purchase Agreement Proposal are each approved by the stockholders

of the Company. |

| |

2. |

A proposal to ratify the terms and conditions of, and the transactions

contemplated by, the Stock Purchase Agreement entered into by us for the issuance and sale of up to 1,595,744 shares of our common stock

to affiliated stockholders at a purchase price of $2.35 per share, for an aggregate purchase price of up to $3,750,000. We intend that

payments to Cashed Out Stockholders and the costs of the Stock Split will be paid from funds received in connection with the transactions

contemplated under the Stock Purchase Agreement. If the Reverse Stock Split Proposal is not approved by the stockholders of the Company,

we will not consummate the transactions contemplated by the Stock Purchase Agreement, even if the stockholders of the Company approve

the Stock Purchase Agreement Proposal. |

What is the purpose of the Stock Split?

The primary purpose of the Stock Split is to enable us

to maintain the number of record holders of our common stock below 300, which is the level at which SEC public reporting is required.

After the Stock Split, we intend to delist our common stock from the Nasdaq Capital Market and cease registration of our common stock

under the Exchange Act. As a result, effective on and following the termination of the registration of our common stock under the Exchange

Act, we would no longer be subject to the reporting requirements under the Exchange Act, or other requirements applicable to a public

company, including requirements under the Sarbanes-Oxley Act and the listing standards of a national stock exchange. Our common stock

also would would not be eligible for listing on the New York Stock Exchange or The Nasdaq Stock Market.

What does the deregistration of our common stock mean?

Effective on and following the termination of the registration

of our common stock under the Exchange Act, we will no longer have to file annual, quarterly and other reports with the SEC, and our executive

officers, directors and 10% stockholders will no longer be required to file reports relating to their transactions in our common stock.

Persons acquiring 5% of our common stock will no longer be required to report their beneficial ownership under the Exchange Act. In addition,

we will take action to delist our common stock from the Nasdaq Capital Market and we will no longer be subject to its rules. Any trading

in our common stock after the Stock Split and deregistration under the Exchange Act will only occur in privately negotiated sales and

potentially on the OTC Pink Market, if one or more brokers chooses to make a market for our common stock there, subject to applicable

regulatory requirements; however, there can be no assurances regarding any such trading.

What is the OTC Pink Market?

The Pink Open Market is the lowest tier of the three marketplaces

for trading on the OTC securities market, which is a broker platform for trading securities operated by the OTC Markets Group Inc. For

more information about the OTC Markets Group, see www.otcmarkets.com. To be traded there, a broker dealer would need to submit a Form

211 with the Financial Industry Regulatory Authority (FINRA) and obtain FINRA approval for trading in our common stock, subject to applicable

regulatory requirements. For more information about The Pink Open Market, see www.otcmarkets.com/corporate-services/information-for-pink-companies.

Since September 2021, Exchange Act Rule 15c2-11 prohibits brokers from quoting securities of issuers that fail to make publicly available

certain current information as described in Rule 15c2-11. There can be no assurance that any trading market will emerge following the

deregistration and delisting of our common stock, or, if it does, how long it might last.

What will I receive in the Stock Split?

If you own fewer than the Minimum Number immediately prior

to the effective time of the Stock Split, you will receive $2.35 in cash, without interest, from us for each pre-Reverse Stock Split share

that you own. If you own a number of shares of our common stock equal to or greater than the Minimum Number immediately prior to the effective