SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

RULE 13e-3 TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 4)

Psychemedics Corporation

(Name of the Issuer and Name of Person Filing Statement)

Common Stock, $0.005 par value per

share

(Title of Class of Securities)

744375304

(CUSIP Number of Class of Securities)

Brian Hullinger

President and Chief Executive Officer Psychemedics

Corporation

5220 Spring Valley Road Dallas, Texas 75254

(800) 527-7424

(Name, Address and Telephone Number of Persons Authorized

to Receive Notices and Communications on Behalf of Persons Filing Statement)

Copies to:

Matthew J. Gardella, Esq.

Matthew W. Tikonoff, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

One Financial Center

Boston, Massachusetts 02111

(617) 542-6000

This statement is filed in connection with (check the appropriate box):

| a. ☒ | The filing of solicitation materials or an information statement subject to Regulation

14A, Regulation 14C, or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. ☐ | The filing of a registration statement under the Securities Act of 1933. |

Check the following box if the soliciting materials or information statement referred to in

checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the

transaction: ☒

RULE 13e-3 TRANSACTION STATEMENT INTRODUCTION

This Amendment No. 4 to Rule 13e-3 Transaction

Statement on Schedule 13E-3 is being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Rule

13e-3(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), by Psychemedics Corporation (the

“Company”), a Delaware corporation, Peter H. Kamin, a natural person, and 3K Limited Partnership, a limited partnership

(“3K” and together with Mr. Kamin, the “Investors”), to amend and supplement the Rule 13e-3 Transaction

Statement on Schedule 13E-3 initially filed with the SEC on September 3, 2024 by the Company, as amended by Amendment No. 1, Amendment

No. 2, and Amendment No. 3 to Rule 13e-3 Transaction Statement on Schedule 13E-3 filed with the SEC on October 4, 2024, October 16, 2024,

and October 18, 2024, respectively, by the Company (the “Prior Schedule 13E-3”), as a final amendment to the Prior

Schedule 13E-3 to report the results of the transactions described below (the Prior Schedule 13E-3 as so amended and supplemented, this

“Schedule 13E-3”).

On November 25, 2024, the Company held

an annual meeting of its stockholders (the “Annual Meeting”). At the Annual Meeting, among other matters, the holders

of a majority of the Company’s issued and outstanding shares of common stock, par value $0.005 per share (the “common stock”),

entitled to vote approved amendments to the Company’s amended and restated certificate of incorporation to effect a reverse stock

split of the common stock, at a ratio not less than 1-for-4,000 and not greater than 1-for-6,000 (the “Reverse Stock Split”),

followed immediately by a forward stock split of the common stock at the same ratio, but inverse (the “Forward Stock Split,”

and together with the Reverse Stock Split, the “Stock Split”). Such amendments were approved with (i) 3,002,727 shares

of common stock voting in favor of the Reverse Stock Split, 1,099,996 shares of common stock voting against the Reverse Stock Split and

10,366 shares abstaining, and (ii) 3,003,718 shares of common stock voting in favor of the Forward Stock Split, 1,096,691 shares of common

stock voting against the Forward Stock Split and 12,680 shares abstaining.

Following the approval of such amendments

to the Company’s amended and restated certificate of incorporation at the Annual Meeting, on November 25, 2025, the Company’s

Board of Directors (the “Board”) determined to effectuate (i) the Reverse Stock Split at a ratio of 1-for-5,000 and

(ii) the Forward Stock Split at a ratio of 5,000-for-1 (collectively, the “Stock Split Ratios”), which Stock Split

Ratios were within the ranges approved by the Company’s stockholders at the Annual Meeting.

At the direction of the Board, the

Company filed the amendments to the Company’s amended and restated certificate of incorporation with the Secretary of State of

the State of Delaware to effectuate the Stock Split at the Stock Split Ratios, which became effective on December 3, 3024. As a

result of the Reverse Stock Split, each share of common stock held by a stockholder of record who owned immediately prior to the effective

time of the Reverse Stock Split fewer than 5,000 shares was converted into the right to receive $2.35 in cash, without interest, and

such stockholders are no longer stockholders of the Company. Stockholders of record who owned 5,000 or more shares immediately prior

the effective time of the Reverse Stock Split (the “Continuing Stockholders”) are not entitled to receive any cash

for their fractional share interests resulting from the Reverse Stock Split, if any. The Forward Stock Split, which immediately followed

the Reverse Stock Split, reconverted whole shares and fractional share interests held by the Continuing Stockholders back into the same

number of shares of the common stock held by such Continuing Stockholders immediately prior to the effective time. As a result of the

Forward Stock Split, the total number of shares of common stock held by a Continuing Stockholder did not change as a result of the Stock

Split.

The primary purpose of the Reverse Stock

Split was to enable the Company to maintain the number of its record holders of common stock below 300. The Reverse Stock Split was undertaken

as part of the Company’s plan to terminate the registration of the common stock under the Exchange Act and suspend the Company’s

duty to file periodic reports and other information with the SEC under Section 13(a) thereunder, and to delist the common stock from the

Nasdaq Capital Market. On December 3, 2024, the Company provided advance notice to the Nasdaq Stock Market LLC of its intent to voluntarily

withdraw the common stock from listing on the Nasdaq Capital Market and to deregister the common stock under Section 12(b) of the Securities

Exchange Act of 1934, as amended. The Company intends to file a Form 25 Notification of Removal from Listing and/or Registration with

the SEC as soon as permissible under applicable law and a Form 15 with the SEC and cease reporting as a public company.

As previously disclosed, in connection

with the Stock Split, the Company entered into a stock purchase agreement on August 12, 2024 (the “Purchase Agreement”)

pursuant to which the Investors agreed to purchase, subject to the terms and conditions thereof, up to 1,595,744 shares of common stock

at a purchase price of $2.35 per share, for an aggregate purchase price of up to $3,750,000. In connection with the completion of the

Reverse Stock Split, the Company closed the transactions contemplated by the Purchase Agreement on December 3, 2024, and issued 1,409,712

shares of common stock to 3K pursuant to the Purchase Agreement based on available estimates of the funds required for the Company to

purchase all of the fractional share interests that resulted from the Reverse Stock Split, and thereafter, the Company repurchased 320,708

of such shares of common stock from 3K at the same price once confirmation of the total required funds was available from the Company’s

transfer agent. 3K provided the Company sufficient funds to purchase all of the fractional share interests that resulted from the Reverse

Stock Split and $500,000 for working capital and general corporate purposes.

On October 18, 2024, the Company filed

a definitive proxy statement on Schedule 14A (the “Proxy Statement”) pursuant to Regulation 14A under the Exchange

Act. The information contained in the Proxy Statement, including all annexes thereto, is expressly incorporated herein by reference and

the responses to each item of this Schedule 13E-3 are qualified in their entirety by reference to the information contained in the Proxy

Statement. Capitalized terms used and not otherwise defined herein have the meanings ascribed to such terms in the Proxy Statement.

| Item 1. | Summary Term Sheet |

The information set forth in the Proxy Statement under the caption “SUMMARY

TERM SHEET” is incorporated herein by reference.

| Item 2. | Subject Company Information |

(a) Name and Address.

The name of the subject company is Psychemedics Corporation, a Delaware corporation. The Company’s principal executive offices

are located at 5220 Spring Valley Road, Dallas, Texas 75254. The Company’s telephone number is (800) 527-7424.

(b) Securities. The subject

class of equity securities to which this Schedule 13E-3 relates is the Company’s common stock, $0.005 par value per share, of which

5,894,461 shares were outstanding as of October 8, 2024.

(c) Trading Market and Price.

The information set forth in the Proxy Statement under “INFORMATION ABOUT THE COMPANY — Market Price of Common Stock”

is incorporated herein by reference.

(d) Dividends. The information set forth

in the Proxy Statement under “INFORMATION ABOUT THE COMPANY — Dividends” is incorporated herein by reference.

(e)

Prior Public Offerings. The Company has not made an underwritten public offering of its common stock for cash during the three

years preceding the date of the filing of this Schedule 13E-3 (as amended hereby).

(f)

Prior Stock Purchases. Neither the Company nor the Investors have purchased any subject securities during the two years preceding

the date of the filing of this Schedule 13E-3 (as amended hereby), other than the purchase by 3K and the repurchase by the Company of

certain shares of the Company’s common stock pursuant to the Purchase Agreement as described above.

| Item 3. | Identity and Background of Filing Persons |

(a)

Name and Address. The Company is a filing person and also the subject company, with its address and telephone number provided in

Item 2(a) above. The name of each director and executive officer is set forth below.

| Name | |

Position |

| Robyn C. Davis | |

Director |

| Peter H. Kamin | |

Director |

| Darius G. Nevin | |

Chairman |

| Andrew M. Reynolds | |

Director |

| Brian Hullinger | |

Director, Chief Executive Officer and President |

| Shannon Shoemaker | |

Vice President and Chief Revenue Officer |

| Daniella Mehalik | |

Vice President of Finance |

The address of each director and executive officer of the Company is c/o Psychemedics

Corporation, 5220 Spring Valley Road. Dallas, Texas 75254.

The Investors are also filing persons. The address of Mr. Kamin is 2720 Donald

Ross Road, #311, Palm Beach Gardens, FL 33410.

The address of 3K is 2720 Donald Ross Road, #311, Palm Beach Gardens, FL 33410. Mr.

Kamin is the sole general partner of 3K. 3K does not have a business telephone number.

(b)

Business and Background of Entities. 3K is a Delaware limited partnership. The principal business of 3K is to invest in public

and privately held businesses. 3K has not been convicted in a criminal proceeding during the past five years and has not been party to

any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining them

from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal

or state securities laws.

(c)

Business and Background of Natural Persons. The information set forth in the Proxy Statement under “INFORMATION ABOUT THE

COMPANY — Directors and Executive Officers” is incorporated herein by reference.

Neither Mr. Kamin, nor to the Company’s

and the Investors' knowledge, have any of the Company’s other directors or executive officers, been convicted in a criminal proceeding

during the past five years (excluding traffic violations or similar misdemeanors) or has been a party to any judicial or administrative

proceeding during the past five years (except for matters that were dismissed without sanction or settlement) that resulted in a judgment,

decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities

laws, or a finding of any violation of federal or state securities laws.

Each of Mr. Kamin and the Company’s other directors and executive officers

is a citizen of the United States.

| Item 4. | Terms of the Transaction |

(a)

Material Terms. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET” and “SPECIAL FACTORS

RELATING TO THE TRANSACTION” is incorporated herein by reference.

(c)

Different Terms. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — The Transaction,”

“— Effects of the Transaction,” “— Fairness of the Transaction,” “— Treatment of Beneficial

Holders (Stockholders Holding Shares in “Street Name”),” and “— Material U.S. Federal Income Tax Consequences;”

and SPECIAL FACTORS RELATING TO THE TRANSACTION — Effects of the Transaction,” “— Fairness of the Transaction,”

“— Purpose and Reasons of the Investors for the Transaction,” and “— Material U.S. Federal Income Tax Consequences”

is incorporated herein by reference.

(d)

Appraisal Rights. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — No Appraisal or Dissenters’

Rights” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — No Appraisal or Dissenters’ Rights” is incorporated

herein by reference.

(e)

Provisions for Unaffiliated Security Holders. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING

TO THE TRANSACTION — Fairness of the Transaction” is incorporated herein by reference.

(f) Eligibility

for Listing or Trading. Not applicable.

| Item 5. | Past Contracts, Transactions, Negotiations and Agreements |

(a)

Transactions. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION —Background

of the Transaction” is incorporated herein by reference.

(b)

Significant Corporate Events. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION

— Background of the Transaction” and “— Effects of the Transaction” are incorporated herein by reference.

(c)

Negotiations or Contacts. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION

—Background of the Transaction” and “— Effects of the Transaction” are incorporated herein by reference.

(e)

Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under “SUMMARY

TERM SHEET — Potential Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons,” “— Vote

Required for Approval of the Transaction Proposals at the Annual Meeting;” “SPECIAL FACTORS RELATING TO THE TRANSACTION —

Potential Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons,” and “— Stockholder Approval”

is incorporated herein by reference.

| Item 6. | Purposes of the Transaction and Plans or Proposals |

(b)

Use of Securities Acquired. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION

— Effective Date” is incorporated herein by reference.

(c)

Plans. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Purpose of and Reasons for the

Transaction,” “— Effects of the Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Purpose

of and Reasons for the Transaction,” “— Background of the Transaction,” “— Effects of the Transaction,”

“— Nasdaq Capital Market Listing; OTC Pink Market,” and “— Fairness of the Transaction,” is incorporated

herein by reference.

| Item 7. | Purposes, Alternatives, Reasons and Effects |

(a)

Purposes. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Purpose of and Reasons for the

Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Purpose of and Reasons for the Transaction,”

“— Purpose and Reasons of the Investors for the Transaction,” and “— Background of the Transaction”

is incorporated herein by reference.

(b)

Alternatives. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION —

Background of the Transaction” and “— Alternatives to the Transaction” is incorporated herein by reference.

(c)

Reasons. The information set forth in the Proxy Statement under SUMMARY TERM SHEET — Purpose of and Reasons for the Transaction;”

and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Purpose of and Reasons for the Transaction,” “— Background

of the Transaction,” “— Alternatives to the Transaction,” and “— Fairness of the Transaction”

is incorporated herein by reference.

(d)

Effects. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — The Transaction,” “—

Effects of the Transaction,” and “— Material U.S. Federal Income Tax Consequences;” and “SPECIAL FACTORS

RELATING TO THE TRANSACTION — Purpose of and Reasons for the Transaction,” “— Effects of the Transaction,”

“— Nasdaq Capital Market Listing; OTC Pink Market,” and “— Material U.S. Federal Income Tax Consequences”

is incorporated herein by reference.

| Item 8. | Fairness of the Transaction |

(a)

Fairness. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Transaction Committee and Board

Recommendations of the Transaction,” and “— Fairness of the Transaction;” and “SPECIAL FACTORS RELATING

TO THE TRANSACTION — Background of the Transaction,” “— Fairness of the Transaction,” and “—Position

of the Investors as to the Fairness of the Transaction” is incorporated herein by reference.

(b)

Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET —

Purpose of and Reasons for the Transaction,” “— Transaction Committee and Board Recommendations of the Transaction,”

“— Reservation of Rights,” and “— Fairness of the Transaction;” and “SPECIAL FACTORS RELATING

TO THE TRANSACTION — Purpose of and Reasons for the Transaction,” “— Background of the Transaction,” “—

Alternatives to the Transaction,” “— Fairness of the Transaction,” and “— Fairness Opinion of Financial

Advisor” is incorporated herein by reference.

(c)

Approval of Security Holders. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Potential

Conflicts of Interest of Officers, Directors, and Certain Affiliated Persons,” and “— Vote Required for Approval of

the Transaction Proposals at the Annual Meeting;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Fairness of the

Transaction,” “— Potential Conflicts of Interests of Officers, Directors, and Certain Affiliated Persons,” and

“— Stockholder Approval” is incorporated herein by reference.

(d)

Unaffiliated Representatives. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Fairness

of the Transaction;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,” “—

Fairness of the Transaction,” and “— Fairness Opinion of Financial Advisor” is incorporated herein by reference.

(e)

Approval of Directors. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Transaction Committee

and Board Recommendations of the Transaction,” and “— Fairness of the Transaction;” and “SPECIAL FACTORS

RELATING TO THE TRANSACTION — Background of the Transaction,” and “— Fairness of the Transaction” is incorporated

herein by reference.

(f) Other Offers.

None.

| Item 9. | Reports, Opinions, Appraisals and Negotiations |

(a)

Report, Opinion or Appraisal. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Transaction

Committee and Board Recommendations of the Transaction” and “— Fairness of the Transaction;” and “SPECIAL

FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,” “— Fairness of the Transaction,” and

“— Fairness Opinion of Financial Advisor” is incorporated herein by reference.

(b)

Preparer and Summary of the Report, Opinion or Appraisal. The information set forth in the Proxy Statement under “SUMMARY

TERM SHEET — Transaction Committee and Board Recommendations of the Transaction” and “— Fairness of the Transaction;”

and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,” “— Fairness of the Transaction,”

and “— Fairness Opinion of Financial Advisor” is incorporated herein by reference.

(c)

Availability of Documents. The full text of the fairness opinion of Mirus Securities, Inc. (“Mirus”) dated August 12,

2024, is attached as Annex D to the Proxy Statement. The fairness opinion of Mirus and the Valuation Presentations of Mirus dated August

12, 2024, June 5, 2024 and April 10, 2024 are each available for inspection and copying at the Company’s principal executive offices,

5220 Spring Valley Road, Dallas, Texas 75254 during its regular business hours by any interested equity security holder of the Company

or representative who has been so designated in writing.

| Item 10. | Source and Amounts of Funds or Other Consideration |

(a)

Source of Funds. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Financing for the Stock

Split;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Effects of the Transaction” and “— Source

of Funds and Expenses” is incorporated herein by reference.

(b)

Conditions. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Financing for the Stock Split;”

and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Effects of the Transaction” and “— Source of Funds and

Expenses” is incorporated herein by reference.

(c)

Expenses. The information set forth in the Proxy Statement under “SPECIAL FACTORS RELATING TO THE TRANSACTION — Source

of Funds and Expenses” is incorporated herein by reference.

(d) Borrowed

Funds. None.

| Item 11. | Interest in Securities of the Subject Company |

(a)

Securities Ownership. The information set forth in the Proxy Statement under “PRINCIPAL STOCKHOLDERS AND STOCKHOLDINGS OF

MANAGEMENT” is incorporated herein by reference.

(b) Securities

Transactions. None.

| Item 12. | The Solicitation or Recommendation |

(d)

Intent to Tender or Vote in a Going Private Transaction. The information set forth in the Proxy Statement under “SUMMARY

TERM SHEET — Effects of the Transaction,” “—Potential Conflicts of Interests of Officers, Directors, and Certain

Affiliated Persons,” and “— Vote Required for Approval of the Transaction Proposals at the Annual Meeting;” “SPECIAL

FACTORS RELATING TO THE TRANSACTION — Effects of the Transaction,” “— Potential Conflicts of Interests of Officers,

Directors, and Certain Affiliated Persons,” and “— Stockholder Approval” is incorporated herein by reference.

(e)

Recommendation of Others. The information set forth in the Proxy Statement under “SUMMARY TERM SHEET — Potential Conflicts

of Interests of Officers, Directors, and Certain Affiliated Persons,” and “— Vote Required for Approval of the Transaction

Proposals at the Annual Meeting;” and “SPECIAL FACTORS RELATING TO THE TRANSACTION — Background of the Transaction,”

and “— Fairness of the Transaction” is incorporated herein by reference.

| Item 13. |

Financial Statements |

(a)

Financial Information. The audited financial statements of the Company for the years ended December 31, 2023 and December 31, 2022

appearing in the Annual Report on Form 10- K for the fiscal year ended December 31, 2023 (filed with the SEC on March 28, 2024) are incorporated

herein by reference. The interim financial statements of the Company for the three months ended March 31, 2024 appearing in the Quarterly

Report on Form 10-Q for the fiscal quarter ended March 31, 2024 (filed with the SEC on May 14, 2024), the interim financial statements

of the Company for the three and six months ended June 30, 2024 appearing in the Quarterly Report on Form 10-Q for the fiscal quarter

ended June 30, 2024 (filed with the SEC on August 13, 2024) and the interim financial statements of the Company for the three and nine months ended September 30, 2024 appearing in the Quarterly

Report on Form 10-Q for the fiscal quarter ended September 30, 2024 (filed with the SEC on November 12, 2024), are each incorporated herein by reference.

(b)

Pro forma Information. The information set forth in the Proxy Statement under "PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

- UNAUDITED" is incorporated herein by reference.

(c)

Summary Information. The information set forth in the Proxy Statement under “FINANCIAL INFORMATION — Summary Historical

Financial Information” is incorporated herein by reference.

| Item 14. |

Persons/Assets, Retained, Employed, Compensated or Used |

(a) Solicitations or Recommendations.

The information set forth in the Proxy Statement under “ABOUT THE ANNUAL MEETING” is incorporated herein by reference.

(b)

Employees and Corporate Assets. The information set forth in the Proxy Statement under “ABOUT THE ANNUAL MEETING” is

incorporated herein by reference.

| Item 15. |

Additional Information |

(b)

Not applicable.

(c) Other Material

Information. The information contained in the Proxy Statement, including all appendices attached thereto, is incorporated herein

by reference.

(a)(i) Notice of Meeting and Definitive Proxy Statement of the Company (incorporated herein by reference to the Company’s Schedule 14A filed with the Securities and Exchange Commission on October 18, 2024).

(a) (ii) Annual financial statements for the years ended December 31, 2023 and December 31, 2022 of Psychemedics Corporation appearing in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (filed with the SEC on March 28, 2024 and incorporated herein by reference).

(a) (iii) Interim financial statements for the three months ended March 31, 2024 of Psychemedics Corporation appearing in the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024 (filed with the SEC on May 14, 2024 and incorporated herein by reference).

(a) (iv) Interim financial statements for the three and six months ended June 30, 2024 of Psychemedics Corporation appearing in the Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024 (filed with the SEC on August 13, 2024 and incorporated herein by reference).

(a) (v) Interim financial statements for the three and nine months ended September 30, 2024 of Psychemedics Corporation appearing in the Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024 (filed with the SEC on November 12, 2024 and incorporated herein by reference).

(a) (vi) Press Release issued by the Company, dated August 12, 2024 (filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on August 12, 2024 and incorporated herein by reference).

(c)(i) Opinion of Mirus, dated August 12, 2024 (incorporated herein by reference to Annex D of the Company’s Schedule 14A filed with the Securities and Exchange Commission on October 18, 2024).

(c) (ii) Presentation, dated August 12, 2024 of Mirus to the Board of Directors of the Company (previously filed as Exhibit (c) (ii) to the Schedule 13E-3 filed on September 3, 2024).

(c) (iii) Presentation, dated June 5, 2024 of Mirus to the Board of Directors of the Company (previously filed as Exhibit (c) (iii) to the Schedule 13E-3 filed on September 3, 2024).

(c) (iv) Presentation, dated April 10, 2024 of Mirus to the Board of Directors of the Company (previously filed as Exhibit (c) (iv) to the Schedule 13E-3 filed on September 3, 2024).

(d) Stock Purchase Agreement, dated August 12, 2024, by and among the Company, 3K Limited Partnership, Peter H. Kamin, the Peter H. Kamin Revocable Trust dated February 2003, the Peter H. Kamin Childrens Trust dated March 1997, the Peter H. Kamin GST Trust and the Peter H. Kamin Family Foundation (filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on August 12, 2024 and incorporated herein by reference).

107 Filing Fee Table (previously filed as Exhibit 107 to the Schedule 13E-3 filed on September 3, 2024).

SIGNATURE

After due inquiry and to the best of its knowledge and belief, the undersigned certifies that

the information set forth in this statement is true, complete and correct.

| |

PSYCHEMEDICS CORPORATION |

| |

|

| |

By: |

/s/ Brian Hullinger |

|

| |

|

Brian Hullinger |

| |

|

President and Chief Executive Officer |

| |

|

| |

|

| |

PETER KAMIN |

| |

|

| |

|

/s/ Peter Kamin |

|

| |

|

Peter Kamin |

| |

|

|

| |

|

|

| |

3K LIMITED PARTNERSHIP |

| |

|

|

| |

By: |

/s/ Peter Kamin |

|

| |

|

Peter Kamin |

| |

|

General Partner |

Dated: December 10, 2024

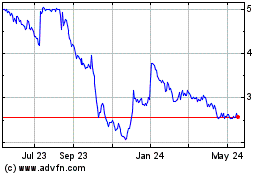

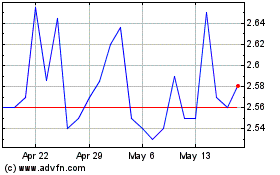

Psychemedics (NASDAQ:PMD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Psychemedics (NASDAQ:PMD)

Historical Stock Chart

From Mar 2024 to Mar 2025