UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

| Filed

by the Registrant ☒ |

| |

| Filed

by a Party other than the Registrant ☐ |

| |

| Check

the appropriate box: |

| |

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under § 240.14a-12 |

POLAR

POWER, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

POLAR

POWER, INC.

249

E. Gardena Boulevard

Gardena,

California 90248

[ ], 2024

Dear

Fellow Stockholder:

We

cordially invite you to attend the 2024 annual meeting (“Annual Meeting”) of stockholders of Polar Power, Inc., which will

be held at 10:00 a.m., local time, on [ ], [ ], 2024 at our corporate headquarters at 249 E. Gardena Boulevard, Gardena, California 90248.

All stockholders of record at the close of business on [ ], 2024 are entitled to vote at the Annual Meeting. The formal meeting notice

and Proxy Statement are attached.

At

the Annual Meeting, stockholders will be asked to (i) elect four directors; (ii) ratify the appointment of Weinberg & Company, P.A.

to serve as our independent registered public accounting firm for the year ending December 31, 2024; (iii) approve an amendment to the

Company’s Certificate of Incorporation, in substantially the form attached to the accompanying proxy statement as Appendix A, to

allow our Board of Directors to effect, in its discretion prior to December 31, 2024, a reverse stock split of all of our issued and

outstanding common stock, par value $0.0001 per share, at a specific ratio, ranging from one-for-three (1:3) to one-for-twenty

(1:20) (the “Approved Split Ratios”), with the timing and ratio to be determined by the Board if effected (the

“Reverse Split”); and (iv) approve a proposal to grant discretionary authority to the Chairman of the Annual Meeting to adjourn

the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual

Meeting to approve Proposal 3. In addition, stockholders will transact any other business that may properly come before the Annual Meeting.

Whether

or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting and we urge you

to vote as soon as possible. As an alternative to voting in person at the Annual Meeting, you may vote electronically over the Internet

or by email, or if you receive a proxy card or voting instruction form in the mail, by mailing the completed proxy card or voting instruction

form. Timely voting by any of these methods will ensure your representation at the Annual Meeting.

For

admission to the Annual Meeting, each stockholder may be asked to present valid picture identification, such as a driver’s license

or passport, and proof of ownership of our capital stock as of the record date, such as the enclosed proxy card or a brokerage statement

reflecting stock ownership.

We

look forward to seeing you on [ ], 2024.

| |

Sincerely, |

| |

|

| |

|

| |

Arthur

D. Sams |

| |

Chairman

of the Board, President, |

| |

Chief

Executive Officer and Secretary |

POLAR

POWER, INC.

NOTICE

OF THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD [ ], 2024

NOTICE

IS HEREBY GIVEN that the 2024 annual meeting (“Annual Meeting”) of stockholders of Polar Power, Inc., a Delaware corporation,

will be held at 10:00 a.m., local time, on [ ], [ ], 2024 at our corporate headquarters at 249 E. Gardena Boulevard, Gardena, California

90248, for the following purposes, as more fully described in the Proxy Statement accompanying this notice:

| |

1. |

To

elect four directors to serve on our Board of Directors until the next annual meeting of stockholders and/or until their successors

are duly elected and qualified. The nominees for election are Arthur D. Sams, Keith Albrecht, Michael G. Field and Katherine Koster. |

| |

|

|

| |

2. |

To

ratify the appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for the year ending December

31, 2024. |

| |

|

|

| |

3. |

To

approve an amendment to the Company’s Certificate of Incorporation (the “Charter”), in substantially the form attached

to this proxy statement as Appendix A (the “Reverse Split Charter Amendment”) to allow our Board of Directors to effect,

in its discretion prior to December 31, 2024, a reverse stock split of all of our issued and outstanding common stock, par value

$0.0001 per share, at a specific ratio, ranging from one-for-three (1:3) to one-for-twenty (1:20) (the “Approved

Split Ratios”), with the timing and ratio to be determined by the Board if effected (the “Reverse Split”). |

| |

|

|

| |

4. |

To

approve a proposal to grant discretionary authority to the Chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary,

to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve Proposal

3. |

| |

|

|

| |

5. |

To

transact such other business as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof. |

All

stockholders of record at the close of business on [ ], 2024 are entitled to notice of and to vote at the Annual Meeting and any adjournment(s)

or postponement(s) thereof.

We

cordially invite all stockholders to attend the Annual Meeting in person. Whether or not you plan to attend, it is important that your

shares be represented and voted at the meeting. As an alternative to voting in person at the Annual Meeting, you can vote your shares

electronically over the Internet, or if you receive a proxy card or voting instruction form in the mail, by mailing the completed proxy

card or voting instruction form. For detailed information regarding voting instructions, please refer to the section entitled “How

do I vote?” on page 2 of the Proxy Statement.

For

admission to the Annual Meeting, each stockholder may be asked to present valid picture identification, such as a driver’s license

or passport, and proof of ownership of our capital stock as of the record date, such as the enclosed proxy card or a brokerage statement

reflecting stock ownership.

| |

By

Order of the Board of Directors, |

| |

|

| |

|

| |

Arthur

D. Sams |

| |

Chairman

of the Board, President, |

| |

Chief

Executive Officer and Secretary |

Gardena,

California

[

], 2024

YOUR

VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY. TO ENSURE YOUR

REPRESENTATION AT THE ANNUAL MEETING, PLEASE PROMPTLY SUBMIT YOUR PROXY OR VOTING INSTRUCTION ELECTRONICALLY OVER THE INTERNET OR BY

EMAIL, OR IF YOU RECEIVE A PAPER PROXY CARD OR VOTING INSTRUCTION FORM, YOU MAY MAIL THE COMPLETED PROXY CARD OR VOTING INSTRUCTION FORM

IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

POLAR

POWER, INC.

PROXY

STATEMENT

FOR

THE 2024 ANNUAL MEETING OF STOCKHOLDERS

[

], 2024

TABLE

OF CONTENTS

POLAR

POWER, INC.

249

E. Gardena Boulevard

Gardena,

California 90248

PROXY

STATEMENT

FOR

THE 2024 ANNUAL MEETING OF STOCKHOLDERS

VOTING

AND PROXY

This

proxy statement (“Proxy Statement”) is being furnished in connection with the solicitation of proxies by Polar Power, Inc.

(“we,” “us,” the “Company,” or “Polar Power”)’s Board of Directors (“Board”)

for use at the 2024 annual meeting (“Annual Meeting”) of stockholders to be held on [ ], [ ], 2024, at 10:00 a.m., local

time, at our corporate headquarters at 249 E. Gardena Boulevard, Gardena, California 90248, and at any adjournment(s) or postponement(s)

of the Annual Meeting. We are providing this Proxy Statement and the accompanying proxy card to our stockholders on or about [ ], 2024.

Our stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

A

copy of our Annual Report on Form 10-K for the year ended December 31, 2023 (“Annual Report”) is provided concurrently with

this Proxy Statement (or made available electronically, for stockholders who elected to access these materials over the Internet) to

all stockholders entitled to notice of and to vote at the Annual Meeting. The Annual Report is not to be regarded as proxy soliciting

material or as a communication through which any solicitation of proxies is made.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER

MEETING TO BE HELD ON [ ], [ ], 2024

The

Company’s Proxy Statement and Annual Report are available on our website at https://ir.polarpower.com/annual-meeting. You

are encouraged to access and review all of the important information contained in the proxy materials before voting.

What

items will be voted on at the Annual Meeting?

Stockholders

will vote on four items at the Annual Meeting:

| |

Proposal

One — |

Election

to our Board of the four nominees named in this Proxy Statement; |

| |

|

|

| |

Proposal

Two — |

Ratification

of the appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for the year ending December

31, 2024; |

| |

|

|

| |

Proposal

Three — |

Approval

of an amendment to the Company’s Certificate of Incorporation (the “Charter”), in substantially the form attached

to this proxy statement as Appendix A (the “Reverse Split Charter Amendment”) to allow our Board of Directors to effect,

in its discretion prior to December 31, 2024, a reverse stock split of all of our issued and outstanding common stock, par value

$0.0001 per share, at a specific ratio, ranging from one-for-three (1:3) to one-for-twenty (1:20) (the “Approved

Split Ratios”), with the timing and ratio to be determined by the Board if effected (the “Reverse Split”); and |

| |

|

|

| |

Proposal

Four — |

Approval

granting discretionary authority to the Chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, to solicit additional

proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve Proposal Three. |

What

are the Board’s Voting Recommendations?

The

Board recommends that you vote your shares a “FOR” all of the Director Nominees, and “FOR” each of the other

proposals.

Who

is entitled to vote?

To

be able to vote, you must have been a stockholder on [ ], 2024, the record date for determination of stockholders entitled to notice

of and to vote at the Annual Meeting. As of the record date, 17,561,612 shares of our voting common stock, par value $0.0001 per share

(“common stock”) were outstanding.

How

many votes do I have?

Holders

of common stock will vote at the Annual Meeting on all matters. Each holder of common stock is entitled to one vote per share held. As

a result, a total of 17,561,612 votes may be cast at the Annual Meeting.

What

is a quorum?

For

business to be conducted at the Annual Meeting, a quorum must be present. The presence at the Annual Meeting, either in person or by

proxy, of holders of shares of outstanding common stock entitled to vote and representing at least a majority of our outstanding voting

power will constitute a quorum for the transaction of business. Accordingly, shares representing 8,780,807 votes must be present in person

or by proxy at the Annual Meeting to constitute a quorum.

Abstentions

and broker non-votes will be counted for the purpose of determining whether a quorum is present for the transaction of business.

If

a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

What

are abstentions and broker non-votes?

An

“abstention” is the voluntary act of not voting by a stockholder who is present at a meeting in person or by proxy and entitled

to vote. “Broker non-votes” refers to shares held by a brokerage firm or other nominee (for the benefit of its client) that

are represented at the meeting, but with respect to which such broker or nominee is not instructed to vote on a particular proposal and

does not have discretionary authority to vote on that proposal.

If

you are a beneficial owner whose shares are held in street name and you do not submit voting instructions to your broker, your broker

may generally vote your shares in its discretion on routine matters. We believe that Proposals Two, Three and Four are routine and may

be voted on by your broker if you do not submit voting instructions. However, pursuant to rules of The Nasdaq Stock Market (“Nasdaq”),

brokers do not have the discretion to vote their clients’ shares on non-routine matters, unless the broker receives voting instructions

from the beneficial owner. Proposal One is considered a non-routine matter. Consequently, if your shares are held in street name, you

must provide your broker with instructions on how to vote your shares in order for your shares to be voted on Proposal One.

What

are the general effects of abstentions and broker non-votes?

Brokers

who hold shares for the accounts of their clients may vote such shares either as directed by their clients or in their own discretion

as permitted under the Nasdaq Listing Rules. For purposes of the Annual Meeting, brokers or nominees are permitted to vote their clients’

proxies in their own discretion as to the ratification of the appointment of our independent registered public accounting firm, the authorization

of the Reverse Split and the adjournment, if the clients have not furnished voting instructions within 10 days of the meeting. Abstentions

and broker non-votes will not be counted as a vote “for” or “against” any matter and accordingly will not affect

the outcome with respect to any matter to be voted on at the Annual Meeting. The election of directors proposal is “non-discretionary”

and brokers or nominees who have received no instructions from their clients do not have discretion to vote on those items.

Please

note that brokers may not vote your shares on the election of directors or other non-routine matters in the absence of your specific

instructions as to how to vote, thus we strongly encourage you to provide instructions to your broker regarding the voting of your shares

you hold in “street name” or through a broker or other nominee.

What

vote is required to approve each proposal?

Proposal

One

The

four nominees receiving the highest number of affirmative votes of the outstanding shares of common stock, present at the Annual Meeting

in person or represented by proxy and entitled to vote, will be elected as directors to serve until the next annual meeting of stockholders

and/or until their successors are duly elected and qualified. Abstentions will have no effect on the outcome of the election of nominees

for director. Should any nominee(s) become unavailable to serve before the Annual Meeting, the proxies will be voted by the proxy holders

for such other person(s) as may be designated by our Board or for such lesser number of nominees as may be prescribed by the Board. Votes

cast for the election of any nominee who has become unavailable will be disregarded.

Proposals

Two, Three and Four

The

affirmative vote of a majority of the votes of the shares of our common stock cast at the Annual Meeting in person or represented by

proxy and entitled to vote, is required for approval of Proposals Two, Three and Four. Abstentions and broker non-votes will not affect

the outcome of the vote on Proposals Two, Three and Four.

How

do I vote?

If

you are a “registered holder,” that is, your shares are registered in your own name through our transfer agent, and you are

viewing this proxy over the Internet you may vote electronically over the Internet. For those stockholders who receive a paper proxy

in the mail, you may also vote electronically over the Internet or by email, or by completing and mailing the proxy card provided. The

website identified in our proxy card provides specific instructions on how to vote electronically over the Internet. Those stockholders

who receive a paper proxy by mail, and who elect to vote by mail, should complete and return the mailed proxy card in the addressed,

postage paid envelope that was enclosed with the proxy materials.

If

your shares are held in “street name,” that is, your shares are held in the name of a brokerage firm, bank or other nominee,

you will receive instructions from your record holder that must be followed for your record holder to vote your shares per your instructions.

If you receive paper copies of our proxy materials from your brokerage firm, bank or other nominee, you will also receive a voting instruction

form. Please complete and return the enclosed voting instruction form in the addressed, postage paid envelope provided.

Stockholders

who have previously elected to access our proxy materials and annual report electronically over the Internet will continue to receive

an email, referred to in this Proxy Statement as an email notice, with information on how to access the proxy information and voting

instructions.

Only

proxy cards and voting instruction forms that have been signed, dated and timely returned, and only shares that have been timely voted

electronically, by mail or by email will be counted in the quorum and voted. The Internet voting facilities will close at 11:59 p.m.

Eastern Time, [ ], [ ], 2024 for shares held directly and at 11:59 p.m. Eastern Time, [ ], [ ], 2024 for shares held in a plan.

Stockholders

who vote over the Internet or by email need not return a proxy card or voting instruction form by mail, but may incur costs, such as

usage charges, from Internet service providers. You may also vote your shares in person at the Annual Meeting. If you are a registered

holder, you may request a ballot at the Annual Meeting. If your shares are held in street name and you wish to vote in person at the

meeting, you must obtain a proxy issued in your name from the record holder (e.g., your broker) and bring it with you to the Annual Meeting.

We recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend

the Annual Meeting.

What

if I receive more than one email notice, proxy card or voting instruction form?

If

you receive more than one email notice, proxy card or voting instruction form because your shares are held in multiple accounts or registered

in different names or addresses, please vote your shares held in each account to ensure that all of your shares will be voted.

Who

will count the votes and how will my vote(s) be counted?

All

votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will separately tabulate affirmative and

negative votes, abstentions and broker non-votes.

If

your proxy is properly submitted, the shares represented thereby will be voted at the Annual Meeting in accordance with your instructions.

If you are a registered holder and you do not specify how the shares represented thereby are to be voted, your shares will be voted “FOR”

the election of each of the four nominees to our Board listed in this Proxy Statement and “FOR” the approval of Proposals

Two, Three and Four, and in the discretion of the proxy holder(s) as to any other matters that may properly come before the Annual Meeting

or any adjournment(s) or postponement(s) of the Annual Meeting, as well as any procedural matters. If your shares are held in street

name and you do not specify how the shares represented thereby are to be voted, your broker may exercise its discretionary authority

to vote on Proposals Two, Three and Four.

Can

I change my vote after I have voted?

If

your shares are registered in your name, you may revoke or change your vote at any time before the Annual Meeting by voting again electronically

over the Internet or by email, or by filing a notice of revocation or another proxy card with a later date with our Secretary at Polar

Power, Inc., 249 E. Gardena Boulevard, Gardena, California 90248. If you are a registered stockholder and attend the Annual Meeting and

vote by ballot, any proxy that you submitted previously to vote the same shares will be revoked automatically and only your vote at the

Annual Meeting will be counted. If your shares are held in street name, you should contact the record holder to obtain instructions if

you wish to revoke or change your vote before the Annual Meeting. Please note that if your shares are held in street name, your vote

in person at the Annual Meeting will not be effective unless you have obtained and present a proxy issued in your name from the record

holder.

Who

will bear the cost of soliciting proxies?

We

will bear the entire cost of soliciting proxies for the Annual Meeting, including the cost of preparing, assembling, printing and mailing

this Proxy Statement, the proxy card and any additional solicitation materials furnished to our stockholders. Copies of solicitation

materials will be furnished to brokerage firms, fiduciaries and custodians holding shares in their names that are beneficially owned

by others so that they may forward the solicitation materials to the beneficial owners. We may reimburse such persons for their reasonable

expenses in forwarding solicitation materials to beneficial owners. The original solicitation of proxies may be supplemented by solicitation

by personal contact, telephone, facsimile, email or any other means by our directors, officers or employees, and we will reimburse any

reasonable expenses incurred for that purpose. No additional compensation will be paid to those individuals for any such services.

The

matters to be considered and acted upon at the Annual Meeting are referred to in the preceding notice and are discussed below more fully.

PROPOSAL

ONE

ELECTION

OF DIRECTORS

Our

bylaws provide for a number of directors fixed by resolution of the whole Board. Our Board has fixed the number of directors at five

unless otherwise changed by resolution of our Board. Directors are elected annually and hold office until the next annual meeting of

stockholders and/or until their respective successors are duly elected and qualified. Stockholders who desire to nominate any person

for election to our Board must comply with our bylaws, including our advance-notice bylaw provisions relating to the nomination of persons

for election to our Board. See “Information about our Board of Directors, Board Committees and Related Matters—Board Committees

and Meetings, Nominating and Corporate Governance Committee” below. It is intended that the proxies solicited by our Board will

be voted “FOR” election of the following four nominees unless a contrary instruction is made on the proxy: Arthur

D. Sams, Keith Albrecht, Michael G. Field and Katherine Koster. If the four nominees are elected, there will be four directors serving

on our Board, leaving one vacancy to be filled at a later date in accordance with our certificate of incorporation and bylaws. If, for

any reason, one or more of the nominees is unavailable as a candidate for director, an event that is not expected, the person named in

the proxy will vote for another candidate or candidates nominated by our Nominating and Corporate Governance Committee. However, under

no circumstances may a proxy be voted in favor of a greater number of persons than the number of nominees named above.

Required

Vote of Stockholders

The

four nominees receiving the highest number of affirmative votes of the outstanding shares of our common stock, present at the Annual

Meeting in person or by proxy and entitled to vote, will be elected as directors to serve until the next annual meeting of stockholders

and/or until their successors are duly elected and qualified. Votes against a candidate, abstentions and broker non-votes will be counted

for purposes of determining whether a quorum is present for this proposal, but will not be included in the vote totals for this proposal

and, therefore, will have no effect on the vote.

Recommendation

of the Board of Directors

OUR

BOARD unanimously recommends a vote “FOR” the election of EACH OF the FOUR director nominees listed above.

INFORMATION

ABOUT OUR BOARD OF DIRECTORS,

BOARD

COMMITTEES AND RELATED MATTERS

Directors

and Director Nominees

The

following table sets forth certain information regarding our directors and director nominees as of [ ], 2024:

| Name |

|

Age |

|

Positions

Held |

| Arthur

D. Sams |

|

73 |

|

Chairman

of the Board, President, Chief Executive Officer, Secretary and Director Nominee |

| Keith

Albrecht |

|

73 |

|

Director

and Director Nominee |

| Michael

G. Field |

|

61 |

|

Director

and Director Nominee |

| Katherine

Koster |

|

62 |

|

Director

and Director Nominee |

Arthur

D. Sams has served as our President, Chief Executive Officer and Chairman of our Board since August 1991 and as our Secretary since

October 2016. Under his leadership, we have grown to be a leading brand name in the design and manufacturing of DC power systems for

the telecommunications, military, automotive, marine and industrial markets. He specializes in the design of thermodynamics and power

generation systems. During his early career, he gained vast industry experience while working as a machinist, engineer, project manager,

chief technical officer and consultant for various Fortune 500 companies and the U.S. Department of Defense and the U.S. Department of

Energy. Mr. Sams studied at California State Polytechnic University Pomona and the University California at Irvine with a dual major

in biology and engineering.

In

nominating Mr. Sams, our Board considered his Board and executive level leadership, broad international exposure, and extensive global

experience in engineering and manufacturing as key attributes in his selection. The Board believes that through his experience in product

development and international operations over the past three decades he can provide our company with particular insight into global opportunities

and new markets for our current and planned future product lines.

Keith

Albrecht has served as a member of our Board since May 2016 and serves as a member of each of our Audit Committee, Compensation Committee

and Nominating and Corporate Governance Committee. Mr. Albrecht has extensive experience as a commercial real estate appraiser for commercial

banks and local governments. Mr. Albrecht was an appraiser for commercial buildings for the County of Orange, California, from 1996 to

2007, where he was responsible for the assessment of property values of shopping malls, office buildings, hotels and apartment buildings.

Prior thereto, Mr. Albrecht was an appraiser for Security Pacific and Bank of America, from 1985 to 1996. Mr. Albrecht is currently retired

and invests in startups and small cap companies.

In

nominating Mr. Albrecht, our Board considered his Board and executive level leadership, high level financial expertise, and extensive

expertise in risk management as key attributes in his selection. The Board believes Mr. Albrecht can provide our Company particular insight

into analysis of financial statements, debt analysis, and risk oversight.

Michael

G. Field has served as a member of our Board since July 2024 and serves as a member of each of our Audit Committee, Compensation

Committee and Nominating and Corporate Governance Committee. Mr. Field has been the President and Chief Executive Officer of The Raymond

Corporation (“Raymond”), a company providing intralogistics solutions, since June 2014. From May 2010 to June 2014, he was

Raymond’s president of operations and engineering division. From January 2009 to April 2010, he was the executive vice president

of operations and engineering. From January 2004 to December 2008, he was the vice president of engineering. Mr. Field is also a Board

member of Industrial Truck Association. Mr. Field received his bachelor of science in mechanical engineering from Rochester Institute

of Technology in 1986, his master of science in manufactured systems engineering and his MBA in international operations management,

both from Boston University in 1995.

In

nominating Mr. Field, our Board considered his Board and executive level leadership, his extensive engineering expertise, and experience

with global business operations as key attributes in his selection. Our Board believes that Mr. Field will provide critical leadership

as we expand our product and customer diversification strategies worldwide.

Katherine

Koster has served as a member of our Board since December 2019 and serves as a member of each of our Audit Committee and Nominating

and Corporate Governance Committee. Ms. Koster retired from over 30-years career in Investment Banking/Public Finance in May of 2024.

Most recently she was Senior Managing Director and Regional Manager for Hilltop Securities, LLC, where she assists

municipalities and developers in accessing the capital markets to fund critical infrastructure since February 2022. Ms. Koster was a

managing director of public finance at D.A. Davidson from February 2021 to February 2022 and with Piper Sandler Companies from June 2008

to February 2021. Ms. Koster holds a Bachelor of Arts Degree in Theater/Business Administration from Pepperdine University and has completed

the “Women in Governance: Preparing for Board Membership” corporate governance program at the UCLA Anderson School of Management.

Ms. Koster holds the SIE, Series 7, Series 24 and Series 79TO licenses issued by the Financial Industry Regulatory Authority, Series

50, 52TO and Series 53 licenses issued by the Municipal Securities Rulemaking Board and a Series 63 certificate issued by the North American

Securities Administrators Association.

In

nominating Ms. Koster, our Board considered her Board and executive level leadership, extensive experience with capital markets, and

high level financial expertise as key attributes in her selection. Our Board believes that Ms. Koster’s investment banking experience

and her high level of financial literacy and expertise and experience in capital raising activities will provide strategic insight to

financial decisions for future Company initiatives.

Election

of Officers; Family Relationships

Our

executive officers are appointed by, and serve at the discretion of, our Board. There are no family relationships among any of our directors

or executive officers.

Board

Composition

Our

Board currently consists of four members: Arthur D. Sams, Keith Albrecht, Michael G. Field, and Katherine Koster. Our directors hold

office until their successors have been elected and qualified or until the earlier of their resignation or removal.

Our

certificate of incorporation and bylaws provide that the authorized number of directors may be changed only by resolution of the entire

Board. Our certificate of incorporation and bylaws also provide that any vacancy on our Board, including a vacancy resulting from an

expansion of our Board, may be filled only by vote of a majority of our directors then in office, although less than a quorum or by a

sole remaining director.

We

recognize the value of diversity on the Board. Although our priority in selection of board members is identification of members who will

further the interests of our stockholders through his or her established record of professional accomplishment, the ability to contribute

positively to the collaborative culture among board members, knowledge of our business and understanding of the competitive landscape,

we are currently focusing on female candidates and candidates from underrepresented communities.

Board

Diversity Matrix

The

matrix below summarizes certain information regarding the diversity of our Board as of the date of this Proxy Statement. Each of the

categories listed in the table below has the meaning set forth in Nasdaq Rule 5605(f).

| Board Diversity Matrix (As of [ ], 2024) |

| Total Number of Directors | |

4 |

| | |

Female | |

Male |

| Part I: Gender Identity | |

| |

|

| Directors | |

1 | |

3 |

| Part II: Demographic Background | |

| |

|

| African American or Black | |

0 | |

1 |

| White | |

1 | |

2 |

Independence

of our Board of Directors and Board Committees

Rule

5605 of the Nasdaq Listing Rules requires a majority of a listed company’s board of directors to be comprised of “independent

directors,” as defined in such rule, subject to specified exceptions. In addition, the Nasdaq Listing Rules require that, subject

to specified exceptions: each member of a listed company’s audit, compensation and nominating committees be independent as defined

under the Nasdaq Listing Rules; audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”); and compensation committee members also satisfy an additional independence

test for compensation committee members under the Nasdaq Listing Rules.

Our

Board has evaluated the independence of its members based upon the rules of the Nasdaq Stock Market and the Securities and Exchange Commission.

Applying these standards, our Board determined that none of the directors, other than Mr. Sams, have a relationship that would interfere

with the exercise of independent judgment in carrying out the responsibilities of a director and that each of those directors is “independent”

as that term is defined under Rule 5605(a)(2) of the Nasdaq Listing Rules. Mr. Sams is not considered independent because he is an officer

of Polar Power, Inc. As such, a majority of our Board is comprised of “independent directors” as defined under the Nasdaq

Listing Rules.

Role

of Board in Risk Oversight Process

One

of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management

committee, but rather administers this oversight function directly through the Board as a whole, as well as through its standing committees

that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing

strategic risk exposure. Our Audit Committee is responsible for reviewing and discussing our major financial risk exposures and the steps

our management has taken to monitor and control these exposures, including guidelines and policies with respect to risk assessment and

risk management. Our Audit Committee also monitors compliance with legal and regulatory requirements and reviews related party transactions,

in addition to oversight of the performance of our external audit function. Our Board monitors the effectiveness of our corporate governance

guidelines. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential

to encourage excessive risk-taking. The Board believes its leadership structure is consistent with and supports the administration of

its risk oversight function.

Board

Committees and Meetings

Our

business, property and affairs are managed under the direction of our Board. Our directors are kept informed of our business through

discussions with our executive officers, by reviewing materials provided to them and by participating in meetings of our Board and its

committees. During 2023, our Board held four meetings. All directors attended 100% of the aggregate of the meetings of our Board and

of the committees on which they served or that were held during the period they were directors or committee members.

During

2023, members of the Board and its committees consulted informally with management from time to time and also acted by written consent

five times without a meeting.

It

is our policy to invite and encourage our directors to attend our annual meetings of stockholders. One director attended our 2023 annual

meeting of stockholders.

Our

Board has established standing committees in connection with the discharge of its responsibilities. These committees include an Audit

Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each charter is available at our website at

http://www.polarpower.com. The composition and responsibilities of each committee are described below. Members serve on committees until

their resignation or until otherwise determined by our Board. Each of these committees has adopted a written charter that satisfies the

applicable standards of the Securities and Exchange Commission and the Nasdaq Listing Rules, which we have posted on the investor relations

section of our website.

Audit

Committee

The

members of our Audit Committee are Mr. Albrecht, Mr. Field and Ms. Koster. Mr. Albrecht is the chair of the Audit Committee. Each

member of the Audit Committee satisfies the heightened audit committee independence requirements under the Nasdaq Listing Rules and

Rule 10A-3 of the Exchange Act. During 2023, our Audit Committee held four meetings. The Audit Committee Report for 2023 can be

found on page 24 of this Proxy Statement. In addition, our Board has determined that Mr. Albrecht qualifies as an audit

committee financial expert, as that term is defined under Securities and Exchange Commission rules, and possesses the requisite

financial sophistication, as defined under the Nasdaq Listing Rules. Our Audit Committee assists our Board in its oversight of our

accounting and financial reporting process and the audits of our financial statements.

Under

its charter, our Audit Committee is responsible for, among other things:

| |

● |

overseeing

accounting and financial reporting process; |

| |

|

|

| |

● |

selecting,

retaining and replacing independent auditors and evaluating their qualifications, independence and performance; |

| |

|

|

| |

● |

reviewing

and approving scope of the annual audit and audit fees; |

| |

|

|

| |

● |

discussing

with management and independent auditors the results of annual audit and review of quarterly financial statements; |

| |

|

|

| |

● |

reviewing

adequacy and effectiveness of internal control policies and procedures; |

| |

|

|

| |

● |

approving

retention of independent auditors to perform any proposed permissible non-audit services; |

| |

|

|

| |

● |

overseeing

internal audit functions and annually reviewing audit committee charter and committee performance; |

| |

|

|

| |

● |

preparing

the audit committee report that the Securities and Exchange Commission requires in our annual proxy statement; and |

| |

|

|

| |

● |

reviewing

and evaluating the performance of the Audit Committee, including compliance with its charter. |

Compensation

Committee

The

members of our Compensation Committee are Messrs. Field and Albrecht. Mr. Field is the chair of the Compensation Committee. Each member

of our Compensation Committee is independent as defined under the Nasdaq Listing Rules and satisfies Nasdaq’s additional independence

standards for compensation committee members. Messrs. Field and Albrecht are non-employee directors within the meaning of Rule 16b-3

under the Exchange Act and outside directors as defined by Section 162(m) of the Internal Revenue Code. Our Compensation Committee assists

our Board in the discharge of its responsibilities relating to the compensation of our executive officers. During 2023, our Compensation

Committee held one meeting.

Under

its charter, our Compensation Committee is responsible for, among other things:

| |

● |

developing

and maintaining an executive compensation policy and monitoring the results of that policy; |

| |

|

|

| |

● |

recommending

to our Board for approval compensation and benefit plans; |

| |

|

|

| |

● |

reviewing

and approving annually corporate and personal goals and objectives to serve as the basis for the CEO’s compensation, evaluating

the CEO’s performance in light of those goals and objectives and determining the CEO’s compensation based on that evaluation; |

| |

|

|

| |

● |

determining

and approving the annual compensation for other executive officers; |

| |

|

|

| |

● |

retaining

or obtaining the advice of a compensation consultant, outside legal counsel or other advisor; |

| |

|

|

| |

● |

approving

any grants of stock options, restricted stock, performance shares, stock appreciation rights, and other equity-based incentives to

the extent provided under our equity compensation plans; |

| |

|

|

| |

● |

reviewing

and making recommendations to our Board regarding the compensation of non-employee directors; and |

| |

|

|

| |

● |

reviewing

and evaluating the performance of the Compensation Committee, including compliance with its charter. |

Nominating

and Corporate Governance Committee

The

members of our Nominating and Corporate Governance Committee are Mr. Field, Mr. Albrecht and Ms. Koster. Mr. Field is the chair of the

Nominating and Corporate Governance Committee. Each member of our Nominating and Corporate Governance Committee is independent as defined

under the Nasdaq Listing Rules. During 2023, our Nominating and Corporate Governance Committee held one meeting.

Under

its charter, our Nominating and Corporate Governance Committee is responsible for, among other things:

| |

● |

considering

and reviewing periodically the desired composition of our Board; |

| |

|

|

| |

● |

establishing

any qualifications and standards for individual directors; |

| |

|

|

| |

● |

identifying,

evaluating and nominating candidates for election to our Board; |

| |

|

|

| |

● |

ensuring

that the members of our Board satisfy Securities and Exchange Commission and Nasdaq independence and other requirements relating

to membership on our Board and committees; |

| |

|

|

| |

● |

making

recommendations to our Board regarding the size of the Board, the tenure and classifications of directors, and the composition of

the committees of the Board; |

| |

|

|

| |

● |

considering

other corporate governance and related matters as requested by our Board; and |

| |

|

|

| |

● |

reviewing

and evaluating the performance of the Nominating and Corporate Governance Committee, including compliance with its charter. |

Compensation

of Non-Employee Directors

Currently,

our non-employee directors receive a quarterly cash retainer of $7,500. Mr. Field has the option, solely during the first year of service,

to choose between receiving a cash payment in the amount of $7,500 per quarter or receiving 18,750 shares of the Company’s common

stock, to be issued pursuant to the Company’s 2016 Omnibus Incentive Plan (the “2016 Plan”). In addition, we reimburse

all of our non-employee directors for travel and other necessary business expenses incurred in the performance of director services and

extend coverage to them under our directors’ and officers’ indemnity insurance policies.

Compensation

of Employee Director

Mr.

Sams was compensated as a full-time employee and officer and therefore received no additional compensation for service as member of the

Board during 2023. Information regarding the compensation awarded to Mr. Sams is included in “Executive Compensation and Related

Information—Summary Compensation Table” below.

Compensation

Committee Interlocks and Insider Participation

Since

July 2016, all officer compensation and bonuses for executive officers has been determined by our Compensation Committee which is currently

comprised of three independent directors.

None

of our executive officers serves, or in the past has served, as a member of our Board or Compensation Committee, or other committee serving

an equivalent function, of any entity that has one or more executive officers serving as members of our Board or our Compensation Committee.

None of the members of our Compensation Committee is or has been an officer or employee of Polar Power, Inc.

Stockholder

Recommendations for Nominations to our Board of Directors

Our

Nominating and Corporate Governance Committee will consider recommendations for candidates to our Board from our stockholders. A stockholder

that wishes to recommend a candidate for consideration by the committee as a potential candidate for director must direct the recommendation

in writing to Polar Power, Inc., 249 E. Gardena Boulevard, Gardena, California 90248, Attention: Corporate Secretary, and must include

the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, class and number

of shares of our capital stock that are held by the nominee, a signed letter from the candidate confirming willingness to serve, information

regarding any relationships between us and the candidate and evidence of the recommending stockholder’s ownership of our stock.

Such recommendation must also include a statement from the recommending stockholder in support of the candidate, particularly within

the context of the criteria for board membership, including issues of character, integrity, judgment, and diversity of experience, independence,

area of expertise, corporate experience, potential conflicts of interest, other commitments and the like and personal references. Our

Nominating and Corporate Governance Committee will consider the recommendation but will not be obligated to take any further action with

respect to the recommendation.

Communications

with the Board of Directors

In

cases where stockholders or other interested parties wish to communicate directly with our non-management directors, messages can be

sent to Polar Power, Inc., 249 E. Gardena Boulevard, Gardena, California 90248, Attention: Corporate Secretary. Our corporate secretary

monitors these communications and will forward to our designated legal counsel to provide a summary of all received messages to the Board

at each regularly scheduled meeting. Where the nature of a communication warrants, our designated legal counsel, may determine, in his

or her judgment, to obtain the more immediate attention of the appropriate committee of the Board or non-management director, of independent

advisors or of our management, as our designated legal counsel considers appropriate. Our designated legal counsel may decide in the

exercise of his or her judgment whether a response to any stockholder or interested party communication is necessary. This procedure

for stockholder and other interested party communications with the non-management directors is administered by our Board. This procedure

does not apply to (i) communications to non-management directors from our officers or directors who are stockholders, (ii) stockholder

proposals submitted pursuant to Rule 14a-8 under the Exchange Act, or (iii) communications to the Audit Committee pursuant to our procedures

for complaints regarding accounting and auditing matters.

Code

of Business Conduct and Ethics

We

have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal

executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

A copy of the code is available on the investor relations section of our website, which is located at https://polarpower.com/. If we

make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we

will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Director

Compensation Table

The

following table summarizes the compensation of our non-employee directors for the year ended December 31, 2023.

| Name | |

Fees

Earned or Paid

in Cash ($) | | |

Option

Awards

($) | | |

Total Return($)(1) | |

| Keith Albrecht | |

| 30,000 | | |

| — | | |

| 30,000 | |

| Peter Gross(2) | |

| 30,000 | | |

| — | | |

| 30,000 | |

| Katherine Koster | |

| 30,000 | | |

| — | | |

| 30,000 | |

| Michael G. Field(3) | |

| — | | |

| — | | |

| — | |

| (1) |

The

value of perquisites and other personal benefits was less than $10,000 in aggregate for each director. |

| (2) |

Peter

Gross resigned from our Board, effective December 18, 2023. |

| (3) |

Michael

G. Field was appointed as a director on July 25, 2024. |

Indemnification

of Directors and Officers

Section

145 of the Delaware General Corporation Law, or the DGCL, provides that a corporation may indemnify directors and officers as well as

other employees and individuals against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually

and reasonably incurred by such person in connection with any threatened, pending or completed actions, suits or proceedings in which

such person is made a party by reason of such person being or having been a director, officer, employee or agent to the corporation.

The DGCL provides that Section 145 is not exclusive of other rights to which those seeking indemnification may be entitled under any

bylaw, agreement, vote of stockholders or disinterested directors or otherwise. Sections of our certificate of incorporation and our

bylaws provide for indemnification by us of our directors, officers, employees and agents to the fullest extent permitted by the DGCL.

Article

XI of our certification of incorporation eliminates the liability of a director or stockholder for monetary damages for breach of fiduciary

duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL. Under Section

102(b)(7) of the DGCL, a director shall not be exempt from liability for monetary damages for any liabilities arising (i) from any breach

of the director’s duty of loyalty to the corporation or its stockholders, (ii) from acts or omissions not in good faith or which

involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which

the director derived an improper personal benefit.

We

have entered into agreements to indemnify our directors and officers as determined by our Board. These agreements provide for indemnification

of related expenses including attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in

any action or proceeding. We believe that these indemnification agreements are necessary to attract and retain qualified persons as directors

and officers. We also maintain directors’ and officers’ liability insurance.

The

limitation of liability and indemnification provisions in our certificate of incorporation and our bylaws may discourage stockholders

from bringing a lawsuit against our directors for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation

against our directors and officers, even though an action, if successful, might benefit us and other stockholders. Furthermore, a stockholder’s

investment may be adversely affected to the extent that we pay the costs of settlement and damage awards against directors and officers

as required by these indemnification provisions.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted

to our directors, officers and controlling persons under the foregoing provisions of our certificate of incorporation or our bylaws,

or otherwise, we have been informed that in the opinion of the Securities and Exchange Commission, this indemnification is against public

policy as expressed in the Securities Act and is therefore unenforceable.

PROPOSAL

TWO

RATIFICATION

OF APPOINTMENT OF

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Our

Audit Committee has appointed the independent registered public accounting firm of Weinberg & Company, P.A. to audit and comment

on our financial statements for the year ending December 31, 2024, and to conduct whatever audit functions are deemed necessary. Weinberg

& Company, P.A. audited our financial statements for the year ended December 31, 2023 that were included in our most recent Annual

Report on Form 10-K.

A

representative of Weinberg & Company, P.A. will not be present at the Annual Meeting.

Required

Vote of Stockholders

Although

a vote of stockholders is not required on this proposal, our Board is asking our stockholders to ratify the appointment of our independent

registered public accounting firm. The ratification of the appointment of our independent registered public accounting firm requires

the affirmative votes of a majority of the votes of the shares of our common stock, present at the Annual Meeting in person or by proxy

and entitled to vote.

In

the event that our stockholders do not ratify the appointment of Weinberg & Company, P.A. as our independent registered public accounting

firm, the appointment will be reconsidered by our Audit Committee. Even if the appointment is ratified, our Audit Committee, in its discretion,

may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee

believes that such a change would be in our and our stockholders’ best interests.

Recommendation

of the Board of Directors

OUR

BOARD unanimously recommends a vote “FOR” RATIFICATION

OF THE APPOINTMENT OF WEINBERG & COMPANY, P.A. TO SERVE AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING

DECEMBER 31, 2024.

PROPOSAL

THREE

APPROVAL

OF AN AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

General

Our

Board has determined that it is advisable and in the best interests of the Company and our stockholders to amend the Company’s

Charter in substantially the form attached to this Proxy Statement as Appendix A (“Reverse Split Charter Amendment”), to

effect a reverse stock split of all of our issued and outstanding common stock, par value $0.0001 per share, at a specific ratio, ranging

from one-for-three (1:3) to one-for-twenty (1:20) (the “Approved Split Ratios”), with the timing and

ratio to be determined by the Board if effected (the “Reverse Split”).

The

primary goal of the Reverse Split is to increase the per share market price of our common stock to meet the minimum per share bid price

requirements for continued listing on Nasdaq. We believe that a range of reverse split ratios provides us with the most flexibility to

achieve the desired results of the Reverse Split.

A

vote for this Proposal 3 will constitute approval of the Reverse Split that, if and when effected by our Board by filing the Reverse

Split Charter Amendment with the Secretary of State of the State of Delaware, would combine up to every 30 shares of our outstanding

common stock into one share of our common stock. If implemented, the Reverse Split will have the effect of decreasing the number of shares

of our common stock issued and outstanding. Because the number of authorized shares of our common stock will not be reduced in connection

with the Reverse Split, the Reverse Split will result in an effective increase in the authorized number of shares of our common stock

available for issuance in the future.

Accordingly,

stockholders are asked to approve the Reverse Split Charter Amendment set forth in Appendix A for a Reverse Split consistent with those

terms set forth in this Proposal 3, and to grant authorization to the Board to determine, in its sole discretion, whether or not to implement

the Reverse Split, as well as its specific ratio within the range of the Approved Split Ratios. The text of Appendix A remains subject

to modification to include such changes as may be required by the Secretary of State of the State of Delaware and as our Board deems

necessary or advisable to implement the Reverse Split.

If

approved by the holders of our outstanding voting securities and pursued by the Board, the Reverse Split would be applied at an Approved

Split Ratio approved by the Board prior to December 31, 2024, and would become effective upon the time specified in the Reverse Split

Charter Amendment as filed with the Secretary of State of the State of Delaware. The Board reserves the right to elect to abandon the

Reverse Split if it determines, in its sole discretion, that the Reverse Split is no longer in the best interests of us and our stockholders.

Purpose

and Rationale for the Reverse Split

Avoid

Delisting from the Nasdaq.

We

are submitting this proposal to our stockholders for approval in order to increase the trading price of our common stock to meet the

minimum per share bid price requirement for continued listing on The Nasdaq Capital Market. We believe increasing the trading price of

our common stock may also assist in our capital-raising efforts by making our common stock more attractive to a broader range of investors.

Accordingly, we believe that the Reverse Split is in our stockholders’ best interests.

The

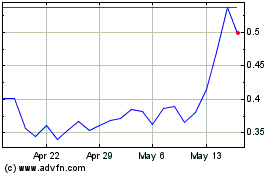

Nasdaq Stock Market LLC requires that the Company maintain a minimum bid price for continued listing on the Nasdaq. On November 24, 2023,

we received a deficiency letter from the Listing Qualifications Department of Nasdaq indicating that, based upon the closing bid price

of the Company’s common stock over the preceding 30 consecutive business days, the Company did not meet the minimum bid price of

$1.00 per share (the “Bid Price Requirement”) required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq

Listing Rule 5550(a)(2). The letter indicated that we would be provided with a compliance period of 180 calendar days, or until May 22,

2024 (the “First Compliance Period”), in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(A) by having

our common stock meet a minimum closing bid price of at least $1.00 for at least ten consecutive business days during the First Compliance

Period.

As

of May 22, 2024, we had not regained compliance with the Bid Price Requirement. As a result, we notified Nasdaq and applied for an extension

of the compliance period, as permitted under the deficiency letter. In the application, we indicated that the Company met the continued

listing requirement for market value of publicly-held shares and all other initial listing standards for the Nasdaq Capital Market, with

the exception of the minimum closing bid price requirement, and provided written notice of our intention to cure the deficiency during

the second compliance period of an additional 180 days by effecting a reverse stock split, if necessary. On May 30, 2024, we received

a notification from Nasdaq that the date to achieve compliance has been extended an additional 180 days until November 18, 2024 (the

“Second Compliance Period”).

Failure

to approve the Reverse Split may potentially have serious, adverse effects on us and our stockholders. Our common stock could be delisted

from Nasdaq if our common stock continues to trade below the requisite $1.00 per share price needed to maintain our listing in accordance

with the Bid Price Requirement. If our common stock is delisted from Nasdaq, our common stock could then trade on the OTC Bulletin Board

or other small trading markets, such as the pink sheets, which are generally considered to be less efficient markets. In that event,

our common stock could trade thinly as a microcap or penny stock, adversely decrease to nominal levels of trading, and may be avoided

by retail and institutional investors, resulting in the impaired liquidity and increased transaction costs of trading in shares of our

common stock.

The

Reverse Split, if effected, would have the immediate effect of increasing the price of our common stock as reported on Nasdaq, therefore

allowing us to maintain compliance with Nasdaq Listing Rule 5550(a)(2).

Our

Board strongly believes that the Reverse Split is necessary to maintain our listing on Nasdaq. Accordingly, the Board has proposed the

Charter Amendment for approval by our stockholders at the Annual Meeting to permit the Board to effect the Reverse Split if the Board

determines it is advisable prior to December 31, 2024.

Other

Effects.

The

Board also believes that the increased market price of our common stock expected as a result of implementing the Reverse Split could

improve the marketability and liquidity of our common stock and will encourage interest and trading in our common stock. The Reverse

Split, if effected, could allow a broader range of institutions to invest in our common stock (namely, funds that are prohibited from

buying stock whose price is below a certain threshold), potentially increasing the trading volume and liquidity of our common stock.

The Reverse Split could help increase analyst and broker’s interest in common stock, as their policies can discourage them from

following or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced stocks,

many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced

stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices

may make the processing of trades in low-priced stocks economically unattractive to brokers. Additionally, because brokers’ commissions

on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, a low average

price per share of our common stock can result in individual stockholders paying transaction costs representing a higher percentage of

their total share value than would be the case if the share price were higher.

Having

an increased number of authorized but unissued shares of common stock available would provide additional flexibility regarding the potential

use of shares of our common stock for business and financial purposes in the future and allow us to take prompt action with respect to

corporate opportunities that develop, without the delay and expense of convening a special meeting of stockholders for the purpose of

approving an increase in our authorized shares. The additional shares could be used for various purposes without further stockholder

approval. These purposes may include: (i) raising capital, if we have an appropriate opportunity, through offerings of common stock or

securities that are convertible into common stock; (ii) expanding our business through potential strategic transactions, including mergers,

acquisitions, licensing transactions and other business combinations or acquisitions of new product candidates or products; (iii) establishing

strategic relationships with other companies; (iv) exchanges of common stock or securities that are convertible into common stock for

other outstanding securities; (v) providing equity incentives pursuant to our 2016 Plan, or another plan we may adopt in the future,

to attract and retain employees, officers or directors; and (vi) other general corporate purposes. We intend to use the additional shares

of common stock that will be available to undertake any such issuances described above. Because it is anticipated that our directors

and executive officers will be granted additional equity awards under our 2016 Plan, or another plan we adopt in the future, they may

be deemed to have an indirect interest in the Charter Amendment, because absent the Charter Amendment, we may not have sufficient authorized

shares to grant such awards.

An

increase in authorized shares of our common stock available for issuance would not have any immediate effect on the rights of existing

stockholders. However, because the holders of our common stock do not have any preemptive rights, future issuance of shares of common

stock or securities exercisable for or convertible into shares of common stock could have a dilutive effect on our earnings per share,

book value per share, voting rights of stockholders and could have a negative effect on the price of our common stock.

Disadvantages

to an increase in the number of authorized shares of common stock may include:

| |

● |

Stockholders

may experience further dilution of their ownership; |

| |

● |

Stockholders

will not have any preemptive or similar rights to subscribe for or purchase any additional shares of common stock that may be issued

in the future, and therefore, future issuances of common stock, depending on the circumstances, will have a dilutive effect on the

earnings per share, voting power, and other interests of our existing stockholders; |

| |

● |

The

additional shares of common stock that would become available for issuance due to this Proposal 3 would be part of the existing class

of common stock and, if and when issued, would have the same rights and privileges as the shares of common stock presently outstanding;

and |

| |

● |

The

issuance of authorized but unissued shares of common stock could be used to deter a potential takeover of us that may otherwise be

beneficial to stockholders by diluting the shares held by a potential suitor or issuing shares to a stockholder that will vote in

accordance with the Board’s desires. A takeover may be beneficial to independent stockholders because, among other reasons,

a potential suitor may offer such stockholders a premium for their shares of stock compared to the then-existing market price. We

do not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences. |

Our

Board does not intend for this transaction to be the first step in a series of plans or proposals effect a “going private transaction”

within the meaning of Rule 13e-3 of the Exchange Act.

We

have no specific plan, commitment, arrangement, understanding, or agreement, either oral or written, regarding the issuance of common

stock subsequent to this proposed Reverse Split at this time, and we have not allocated any specific portion of the proposed effective

increase in the authorized number of shares to any particular purpose. However, we have in the past conducted certain public and private

offerings of common stock and warrants, and we may continue to require additional capital in the future to fund our operations. As a

result, it is foreseeable that we may seek to issue such additional shares of common stock in connection with any such capital raising

activities, or any of the other activities described above. The Board does not intend to issue any common stock or securities convertible

into common stock except on terms that the Board deems to be in the best interests of us and our stockholders.

Risks

of the Proposed Reverse Split

We

cannot assure you that the proposed Reverse Split will increase the price of our common stock and have the desired effect of maintaining

compliance with Nasdaq.

If

the Reverse Split is implemented, our Board expects that it will increase the market price of our common stock so that we are able to

maintain compliance with the Nasdaq minimum bid price requirement. However, the effect of the Reverse Split upon the market price of

our common stock cannot be predicted with any certainty, and we cannot assure you that the Reverse Split will accomplish this objective

for any meaningful period of time, or at all. It is possible that (i) the per share price of our common stock after the Reverse Split

will not rise in proportion to the reduction in the number of shares of our common stock outstanding resulting from the Reverse Split,

(ii) the market price per post-Reverse Split share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained

period of time, or (iii) the Reverse Split may not result in a per share price that would attract brokers and investors who do not trade

in lower priced stocks. Even if the Reverse Split is implemented, the market price of our common stock may decrease due to factors unrelated

to the Reverse Split. In any case, the market price of our common stock will be affected by other factors which may be unrelated to the

number of shares outstanding, including our business and financial performance, general market conditions, and prospects for future success.

Even if the market price per post-Reverse Split share of our common stock remains in excess of $1.00 per share, we may be delisted due

to a failure to meet other continued listing requirements, including Nasdaq requirements related to the minimum number of shares that

must be in the public float and the minimum market value of the public float.

The

proposed Reverse Split may decrease the liquidity of our common stock.

The

Board believes that the Reverse Split will result in an increase in the market price of our common stock, which could lead to increased

interest in our common stock and possibly promote greater liquidity for our stockholders. However, the Reverse Split will also reduce

the total number of outstanding shares of common stock, which may lead to reduced trading and a smaller number of market makers for our

common stock, particularly if the price per share of our common stock does not increase as a result of the Reverse Split.

The

Reverse Split may result in some stockholders owning “odd lots” that may be more difficult to

sell or require greater transaction costs per share to sell.

If

the Reverse Split is implemented, it will increase the number of stockholders who own “odd lots” of less than 100 shares

of common stock. A purchase or sale of less than 100 shares of common stock (an “odd lot” transaction) may result in incrementally

higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own

fewer than 100 shares of common stock following the Reverse Split may be required to pay higher transaction costs if they sell their

common stock.

The

Reverse Split may lead to a decrease in our overall market capitalization.

The

Reverse Split may be viewed negatively by the market and, consequently, could lead to a decrease in our overall market capitalization.

If the per share market price of our common stock does not increase in proportion to the split ratio, or following such increase does

not maintain or exceed such price, then the value of our Company, as measured by our market capitalization, will be reduced. Additionally,

any reduction in our market capitalization may be magnified as a result of the smaller number of total shares of common stock outstanding

following the Reverse Split.

Determination

of the Ratio for the Reverse Split

If

Proposal 3 is approved by stockholders and the Board determines that it is in the best interests of the Company and its stockholders

to move forward with the Reverse Split, the Approved Split Ratio will be selected by the Board, in its sole discretion. However, the

Approved Split Ratio will not be less than a ratio of one-for-three (1:3) or exceed a ratio of one-for-twenty (1:20).

In determining which Approved Split Ratio to use, the Board will consider numerous factors, including, among other things:

| |

● |

our

ability to maintain the listing of our common stock on The Nasdaq Capital Market; |

| |

|

|

| |

● |

the

per share price of our common stock immediately prior to the Reverse Split; |

| |

|

|

| |

● |

the

expected stability of the per share price of our common stock following the Reverse Split; |

| |