Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 16 2024 - 3:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-39032

PROFOUND MEDICAL

CORP.

(Translation of registrant's

name into English)

2400 Skymark Avenue, Unit 6, Mississauga, Ontario

L4W 5K5

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

EXHIBIT INDEX

The following document is attached as an exhibit hereto and is incorporated

by reference herein:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PROFOUND MEDICAL CORP. |

| |

(Registrant) |

| |

|

| Date: December 16, 2024 |

/s/ Rashed Dewan |

| |

Rashed Dewan |

| |

Chief Financial Officer |

| |

|

Exhibit 99.1

FORM 51-102F3

MATERIAL CHANGE REPORT

| 1. | Name and Address of Company |

Profound Medical Corp. (“Profound”

or the “Company”)

Unit 6, 2400 Skymark Avenue

Mississauga, Ontario

L4W 5K5

| 2. | Date of Material Change |

December 6, 2024

A press release relating to the material

change was disseminated via Globe Newswire on December 6, 2024 and was subsequently filed on SEDAR+.

| 4. | Summary of Material Change |

On December 6, 2024, the Company

announced the pricing of an underwritten public offering (the “Offering”) of 4,666,700 common shares (the “Common

Shares”) at a public offering price of $7.50 per Common Share.

| 5. | Full Description of Material

Change |

| 5.1 | Full Description of Material

Change |

On December 6, 2024, the Company

announced the pricing of an Offering of 4,666,700 Common Shares at a public offering price of $7.50 per Common Share. In addition, Profound

granted the underwriters a 30-day option to purchase up to an additional 700,005 Common Shares at the public offering price, less underwriting

discounts and commissions (the “Over-Allotment Option”). In connection with the Offering, the Company agreed to pay

to the underwriters an aggregate cash fee equal to 6.0% of the gross proceeds from the sale of the Common Shares in the Offering. The

Offering closed on December 10, 2024. The Over-Allotment Option was fully exercised in connection with the closing of the Offering.

All of the securities in the Offering were offered by Profound. The gross proceeds of the Offering to Profound, before deducting the underwriting

discounts and commissions and other offering expenses payable by Profound, were approximately US$40.25 million.

The net proceeds of the Offering are

expected to be used: (i) to fund the continued commercialization of the TULSA-PRO® system in the United States, (ii) to

fund the continued development and commercialization of the TULSA-PRO® system and the Sonalleve® system globally, and (iii) for

working capital and general corporate purposes.

The Offering was completed pursuant

to an underwriting agreement between the Company and Raymond James Ltd. and Lake Street Capital Markets as co-lead underwriters and joint

bookrunners. Titan Partners Group, a division of American Capital Partners, acted as lead manager for the Offering. Stifel, Nicolaus &

Company, Incorporated acted as an advisor to the Company. The Offering took place in each of the provinces and territories of Canada,

except the province of Québec, and in the United States.

In connection with the Offering, the

Company filed a final prospectus supplement (the “Final Prospectus Supplement”) to its short form base shelf prospectus

dated July 10, 2024 (the “Base Shelf Prospectus”) in each of the provinces and territories of Canada relating

to the Offering. The Final Prospectus Supplement was also filed in the United States with the U.S. Securities and Exchange Commission

(the “SEC”) as part of the Company’s effective registration statement on Form F-10 (File no. 333-280236),

as amended, previously filed under the multijurisdictional disclosure system adopted by the United States. A preliminary prospectus supplement

relating to the Offering was filed in each of the provinces and territories of Canada and in the United States with the SEC on December 5,

2024.

The Base Shelf Prospectus and the Final

Prospectus Supplement are accessible on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov. The Common Shares were offered under

the Final Prospectus Supplement.

No securities regulatory authority has

either approved or disapproved of the contents of the news release or this material change report. The news release and this material

change report shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities

in any province, territory, state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration

or qualification under the securities laws of any such province, territory, state or jurisdiction.

In connection with the Offering, Tom

Tamberrino, the Chief Commercial Officer of the Company, purchased 13,333 Common Shares. Mr. Tamberrino is a related party (within

the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI

61-101”)) and such issuance is considered a “related party transaction” for the purposes of MI 61-101. The Offering

did not result in a material change in the percentage holdings of any related party of the Company. Such related party transaction is

exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the Common

Shares issued to the related party, nor the consideration paid by the related party exceeds 25% of the Company's market capitalization.

The Board of Directors of the Company has unanimously approved the Private Placement. The proceeds raised under the Private Placement

from the related party subscriptions will be used for corporate development and general working capital purposes. The Company does not

expect the related party subscriptions to have any impact on the Company's business and affairs. The purchasers of the Common Shares and

the extent of such participation were not finalized until shortly prior to the completion of the Offering. Accordingly, it was not possible

to publicly disclose details of the nature and extent of related party participation in the transactions contemplated hereby pursuant

to a material change report filed at least 21 days prior to the completion of such transactions.

| 5.2 | Disclosure for Restructuring

Transactions |

Not applicable.

| 6. | Reliance on subsection 7.1(2) of

the National Instrument 51-102 |

Not applicable.

No information has been omitted in this

material change report on the basis that it is confidential information.

The following is the name and business

telephone number of an executive officer of the Company who is knowledgeable about the material change and this report.

Rashed Dewan

(647) 476-1350

rdewan@profoundmedical.com

December 16, 2024

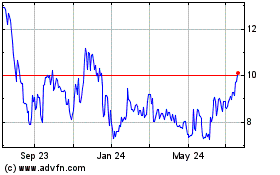

Profound Medical (NASDAQ:PROF)

Historical Stock Chart

From Jan 2025 to Feb 2025

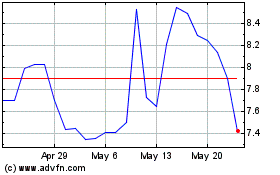

Profound Medical (NASDAQ:PROF)

Historical Stock Chart

From Feb 2024 to Feb 2025