Transaction Expected to Enable Digital Virgo

to Significantly Enhance its Growth and Expand into North America

and Other Markets

Capital Will Allow Digital Virgo to Expand in the U.S. Market

and in Other Global Markets and Execute its Growth Strategy.

The proposed business combination is expected to provide at least

$100 million of growth capital to the company and allow it to

pursue significant opportunities in the North American and other

priority markets in addition to executing on its existing growth

strategy globally. Digital Virgo sees a strong and growing global

customer market demand regarding how they engage online—and is

building a one destination platform that meets their needs for

media, sports, entertainment, gaming, commerce, finance, and much

more, payable on their phone bill (using carrier billing

solutions). The company will target both customers who prefer the

simplicity of carrier billing solutions and those including

unbanked or underbanked customers who have limited alternatives,

building on its more than 2 billion connected users and 9 billion

yearly transactions managed worldwide. The company also intends to

offer alternative payment methods to its customers through

strategic partnerships.

- Strong Profitability and Future Growth. Digital Virgo

has been consistently profitable for the last seven years. The

company has a proven track record of success in all economic

environments, with 2022E gross revenue and adjusted EBITDA expected

to grow to 436 million euros (12% YoY growth) and 46 million euros

(15% YoY growth), respectively.

- Investing in Premium and Exclusive Content. Adding new

types of content is expected to boost engagement, Average Revenue

per User (ARPU), and margins. Fueling these key levers alone can

deliver substantial revenue and adjusted EBITDA growth.

- Significant Market Opportunity. In addition to its range

of offerings for consumers, Digital Virgo provides monetization,

digital marketing, and other related services, to help operators,

merchants, and digital advertising platforms optimize payment and

monetize content, services, and audiences in sports, gaming,

entertainment, urban mobility, and many other sectors. On the

fintech side, the company benefits from the global mobile-payment

user base being 5 times larger than those who pay with cards or

bank accounts.

- Democratize access to mobile entertainment and commerce.

Digital Virgo brings premium content and commerce to the unbanked

and underbanked who are often overlooked and underserved. Only 3%

of adults in low-income countries own a credit card, and just 4% of

adults own one in lower-middle-income countries, while over 80% of

the general population owns a smartphone.

- Proven Investors with Strong Business Relationships.

Digital Virgo’s deal partner, Goal Acquisitions, consists of

seasoned board members and proven business-builders who have deep

relationships in sports, media, telecom, investments, brand

building, and M&A, that will promote Digital Virgo’s success in

the U.S. market and beyond.

- Partnerships Fueling Global Growth. Digital Virgo

partners with the world’s largest telecommunications companies, or

“telcos”, with 150 telco operators and 300 merchant contracts

worldwide. Digital Virgo offers telco customers media, sports,

entertainment, gaming, and other content, payable via their phone

bill. Digital Virgo’s integration into carrier systems and its

proprietary customer acquisition engine is a significant technology

advantage, enabling precise user targeting and low marketing costs.

Digital Virgo believes that its trusted carrier relationships, the

majority of which it has partnered with for 10+ years, create a

barrier to entry.

- Experienced Management Team Ready to Commercialize Market

Opportunity. Digital Virgo’s leadership team has nearly 120

years of combined experience, including executive positions at

publicly traded companies.

- Alignment with Shareholder Interests. All Digital Virgo

equityholders will roll over a significant number of their shares,

tying their interest to future share performance and ensuring

complete alignment with shareholders.

Please replace the release with the following corrected version

due to revisions in the first bullet of the subhead, in the fourth

paragraph of the release, and in the "Advisors" section.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221117005610/en/

The updated release reads:

DIGITAL VIRGO, A LEADING GLOBAL MOBILE

ENTERTAINMENT AND COMMERCE NETWORK PARTNERED WITH THE WORLD’S

LARGEST TELCO COMPANIES, WILL GO PUBLIC VIA BUSINESS COMBINATION

WITH GOAL ACQUISITIONS CORP.

Transaction Expected to Enable Digital Virgo

to Significantly Enhance its Growth and Expand into North America

and Other Markets

Capital Will Allow Digital Virgo to Expand in the U.S. Market

and in Other Global Markets and Execute its Growth Strategy.

The proposed business combination is expected to provide at least

$100 million of growth capital to the company and allow it to

pursue significant opportunities in the North American and other

priority markets in addition to executing on its existing growth

strategy globally. Digital Virgo sees a strong and growing global

customer market demand regarding how they engage online—and is

building a one destination platform that meets their needs for

media, sports, entertainment, gaming, commerce, finance, and much

more, payable on their phone bill (using carrier billing

solutions). The company will target both customers who prefer the

simplicity of carrier billing solutions and those including

unbanked or underbanked customers who have limited alternatives,

building on its more than 2 billion connected users and 9 billion

yearly transactions managed worldwide. The company also intends to

offer alternative payment methods to its customers through

strategic partnerships.

- Strong Profitability and Future Growth. Digital Virgo

has been consistently profitable for the last seven years. The

company has a proven track record of success in all economic

environments, with 2022E gross revenue and adjusted EBITDA expected

to grow to 436 million euros (12% YoY growth) and 46 million euros

(15% YoY growth), respectively.

- Investing in Premium and Exclusive Content. Adding new

types of content is expected to boost engagement, Average Revenue

per User (ARPU), and margins. Fueling these key levers alone can

deliver substantial revenue and adjusted EBITDA growth.

- Significant Market Opportunity. In addition to its range

of offerings for consumers, Digital Virgo provides monetization,

digital marketing, and other related services, to help operators,

merchants, and digital advertising platforms optimize payment and

monetize content, services, and audiences in sports, gaming,

entertainment, urban mobility, and many other sectors. On the

fintech side, the company benefits from the global mobile-payment

user base being 5 times larger than those who pay with cards or

bank accounts.

- Democratize access to mobile entertainment and commerce.

Digital Virgo brings premium content and commerce to the unbanked

and underbanked who are often overlooked and underserved. Only 3%

of adults in low-income countries own a credit card, and just 4% of

adults own one in lower-middle-income countries, while over 80% of

the general population owns a smartphone.

- Proven Investors with Strong Business Relationships.

Digital Virgo’s deal partner, Goal Acquisitions, consists of

seasoned board members and proven business-builders who have deep

relationships in sports, media, telecom, investments, brand

building, and M&A, that will promote Digital Virgo’s success in

the U.S. market and beyond.

- Partnerships Fueling Global Growth. Digital Virgo

partners with the world’s largest telecommunications companies, or

“telcos”, with 150 telco operators and 300 merchant contracts

worldwide. Digital Virgo offers telco customers media, sports,

entertainment, gaming, and other content, payable via their phone

bill. Digital Virgo’s integration into carrier systems and its

proprietary customer acquisition engine is a significant technology

advantage, enabling precise user targeting and low marketing costs.

Digital Virgo believes that its trusted carrier relationships, the

majority of which it has partnered with for 10+ years, create a

barrier to entry.

- Experienced Management Team Ready to Commercialize Market

Opportunity. Digital Virgo’s leadership team has nearly 120

years of combined experience, including executive positions at

publicly traded companies.

- Alignment with Shareholder Interests. All Digital Virgo

equityholders will roll over a significant number of their shares,

tying their interest to future share performance and ensuring

complete alignment with shareholders.

Digital Virgo Group, a French corporation which has a leading

global platform for payment and monetization of digital content and

services that provides one destination for entertainment, sports,

lifestyle, and ultimately, transportation, education and everyday

needs, and Goal Acquisitions Corp. (Nasdaq: PUCK) (“Goal”), a

publicly-traded special purpose acquisition company, today

announced they have entered into a definitive agreement for a

business combination. Upon closing, Goal will be renamed Digital

Virgo Group, Inc., and its common stock is expected to be publicly

listed in the U.S.

The proposed business combination is expected to provide at

least $100 million in cash to Digital Virgo, allowing the company

to enhance growth and expand into North America and other priority

markets. Based on a $10 share price, the transaction values Digital

Virgo at an enterprise value of approximately $513

million.

Digital Virgo sees a strong and growing global customer market

demand for its mobile media, sports, entertainment, gaming,

commerce, finance, and much more and anticipates that North

American customers will be excited by the seamless, simple, and

secure “one destination platform”. Digital Virgo will provide a new

content distribution channel at a time when the shift of media

content consumption to mobile is accelerating. Digital Virgo’s

platform gives merchants access to previously unreachable

audiences. It also reduces customer acquisition costs and allows

telcos to develop direct merchant connections and build greater

customer loyalty.

Digital Virgo has been consistently profitable for the last

seven years. The company has a proven track record of success in

all economic environments, with 2022E gross revenue and adjusted

EBITDA expected to grow to 436 million euros (12% YoY growth) and

46 million euros (15% YoY growth), respectively. Building on its

more than 2 billion connected users and 9 billion yearly

transactions managed worldwide, Digital Virgo today operates in 40+

countries with offices in 28 countries. Digital Virgo will pursue

its significant expansion opportunity in the U.S. among customers

who prefer the one platform approach as well as the simplicity of

Digital Virgo’s direct carrier billing (DCB), in addition to

unbanked or underbanked customers too often left behind.

Digital Virgo partners with the world’s largest

telecommunications companies, or “telcos”, with 150 telco operators

and 300 merchant contracts worldwide. Digital Virgo offers telco

customers media, sports, entertainment, gaming, and other content,

payable via their phone bill. Digital Virgo’s integration into

carrier systems and its proprietary customer acquisition engine is

a significant technology advantage, enabling precise user targeting

and low marketing costs. Digital Virgo believes that its trusted

carrier relationships, the majority of which it has partnered with

for 10+ years, create a barrier to entry.

Guillaume Briche, Digital Virgo Chief Executive Officer, said of

the transaction, “After years of steady growth and profitability,

now is the time for us to go public and pursue more rapid growth by

satisfying customer demand for a one destination platform that

fulfills their content, commerce, and financial needs. It’s also

the right moment to bring our offerings to the U.S. market. We’ve

resisted previous pushes to go public, but in Goal Acquisitions

Corp., we found exactly the right partner. Their team not only has

the experience in building businesses and advising companies, but

also has the global relationships in sports, media, games, and

other areas that will allow us to develop new partnerships leading

to more rapid customer acquisition and premier content creation to

enhance the platform and grow revenue and profitability.”

Goal Acquisitions Founder and Advisor Alex Greystoke remarked,

“When we launched our SPAC, we set out to find a high-quality

company led by a first-rate management team operating in the

convergence of sports, media, games, and technology. Guillaume and

the Digital Virgo team certainly meet those criteria and more.

They’ve built an amazing company which is already a global leader.

This deal provides important capital for them to grow and execute

but it also brings our team’s experience and network of global

relationships in sports, media, entertainment, and other sectors

that will be essential in reaching more customers and expanding the

business. We have aligned our interests with them by our sponsor

agreeing to forfeit a portion of its shares and receiving a grant

of earnout shares which are subject to the post-combination company

meeting certain share price targets. We’re excited to work with

them in creating the one destination platform and building

something really remarkable.”

Transaction Overview

The transaction was unanimously approved by the Digital Virgo

Strategic Committee and the Goal Board of Directors. It is expected

to close in the first quarter of 2023, subject to the satisfaction

of customary closing conditions including Goal shareholder

approval, approval for listing on Nasdaq, European electronic money

institution approvals, a minimum of $20 million in cash being

available at closing, and the execution of definitive agreements

for a $100 million committed capital on demand facility.

Under the business combination agreement, Goal will acquire all

the shares of Digital Virgo in exchange for consideration equal to

$513 million (based on a value of the common stock at $10 per

share) plus the amount of cash that Digital Virgo has at closing,

minus the amount of financial indebtedness that Digital Virgo has

outstanding at closing. $125 million of the consideration will be

paid in cash and the remainder in newly-issued shares of common

stock of Goal, plus up to 5 million shares of common stock of Goal

(valued at $10 per share), subject to certain earn-out provisions,

which will be deposited in escrow and will be released if certain

adjusted EBITDA and share price targets are met. The transaction is

expected to provide at least $100 million in growth capital to

Digital Virgo to execute on management’s strategic growth plans and

will be funded by a committed capital on demand facility which is

expected to be executed at closing and will provide for the ability

to draw subsequent to the closing on the terms and conditions to be

provided for in definitive agreements.

Additional information regarding the proposed combination,

including a copy of the business combination agreement and other

relevant materials, will be filed by Goal on Form 8-K with the U.S.

Securities and Exchange Commission.

Investor Presentation

An investor presentation will follow.

Advisors

JMP Securities, a Citizens Company, and Amala Partners are

serving as financial advisors to Goal Acquisitions.

Winston & Strawn LLP and Peltier Juvigny Marpeau &

Associés are serving as legal counsel to Digital Virgo. Proskauer

Rose LLP is serving as legal counsel to Goal Acquisitions. Latham

& Watkins LLP is serving as legal counsel to JMP Securities, a

Citizens Company.

About Digital Virgo

Digital Virgo is one of the world’s leading mobile payment

specialists, implementing powerful monetization ecosystems for

telecom operators and merchants, serving as a single destination

for customers' mobile content, entertainment, and commerce needs.

Digital Virgo deploys global strategies to optimize the payment

that consider strategic aspects such as localization, monetization,

digital marketing, customer care or regulatory & compliance

framework. Digital Virgo’s technological hub made of innovative

platforms and tools enables them to respond to their partners' main

challenges of scalability, complexity and security to drive their

growth while improving their users’ experience. With more than 2

billion connected users and operating in 40+ countries, Digital

Virgo’s global network of local offices allows them to roll out

scalable and secure mobile commerce experiences worldwide.

About Goal Acquisitions.

Goal Acquisitions Corp. is a blank check company formed for the

purpose of affecting a merger, share exchange, asset acquisition,

stock purchase, recapitalization, reorganization, or other similar

business combination with one or more business entities. For more

information visit www.goalacquisitions.com.

Forward-Looking

Statements

Certain statements included in this presentation that are not

historical facts are forward-looking statements for purposes of the

safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. In some cases, you can identify

forward-looking statements by the following words: “may,” “will,”

“could,” “would,” “should,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “ongoing,” “target,” “seek” or the

negative or plural of these words, or other similar expressions

that are predictions or indicate future events or prospects,

although not all forward-looking statements contain these words.

Any statements that refer to expectations, projections or other

characterizations of future events or circumstances, including

strategies or plans as they relate to the proposed transaction, are

also forward-looking statements. These statements involve risks,

uncertainties and other factors that may cause actual results,

levels of activity, performance or achievements to be materially

different from those expressed or implied by these forward-looking

statements. Although each of Goal and Digital Virgo believes that

there is a reasonable basis for each forward-looking statement

contained in this press release, each of Goal and Digital Virgo

caution you that these statements are based on a combination of

facts and factors currently known and projections of the future,

which are inherently uncertain. In addition, there will be risks

and uncertainties described in the proxy statement relating to the

proposed transaction, which is expected to be filed by Goal with

the SEC, and other documents filed by Goal from time to time with

the SEC. These filings may identify and address other important

risks and uncertainties that could cause actual events and results

to differ materially from those expressed or implied in the

forward-looking statements in this press release. Forward-looking

statements in this press release include statements regarding the

proposed transaction, including the timing and structure of the

transaction, the proceeds of the transaction and the benefits of

the transaction. Neither Goal nor Digital Virgo can assure you that

the forward-looking statements in this press release will prove to

be accurate. These forward-looking statements are subject to a

number of risks and uncertainties, including: Digital Virgo’s

ability to enter into agreements with telecommunications companies,

content providers, and end users of its mobile payment services;

Digital Virgo’s dependence on advertising networks on the internet

and mobile devices and the impact of recent changes in demand for

internet and mobile advertising; risks associated with operating

internationally, including currency risks and legal, compliance,

and execution risks of operating internationally; risks associated

with the competitiveness of the mobile payment and targeted online

advertising markets; risks associated with the regulation of

targeted advertising, payment services, telecommunications, and the

processing of personal data; the volatility of economic conditions

in emerging markets where Digital Virgo conducts business; risks

associated with the development of mobile networks upon which

Digital Virgo relies in conducting its business; Digital Virgo’s

ability to manage its rapid growth; Digital Virgo’s ability to keep

pace with technological innovations in the mobile payment services

and targeted online advertising sectors; risks associated with

Digital Virgo’s acquisitions and geographic expansion strategy;

Digital Virgo’s ability to maintain favorable terms with its key

suppliers; risks associated with the non-recovery of receivables

from customers; risks associated with the non-recovery of debts

from telecom operators or aggregators; risks associated with

Digital Virgo’s business relationships with telecom operators and

advertising clients; Digital Virgo’s ability to obtain content

under attractive conditions; risks associated with cash flow and

liquidity; risks associated with intellectual property; the

potential inability of the parties to successfully or timely

consummate the proposed business combination; the risk that any

regulatory approvals are not obtained, are delayed or are subject

to unanticipated conditions that could adversely affect the

combined company or the expected benefits of the proposed business

combination; the approval of the stockholders of Goal is not

obtained; the risk of failure to realize the anticipated benefits

of the proposed business combination; the amount of redemption

requests made by Goal’s stockholders exceeds expectations or

current market norms; the ability of Digital Virgo or the combined

company to obtain equity or other financing in connection with the

proposed business combination or in the future; the outcome of any

potential litigation, government and regulatory proceedings,

investigations and inquiries; the risk that the proposed business

combination disrupts current plans and operations as a result of

the announcement and consummation of the transaction; costs related

to the proposed business combination; the impact of the global

COVID-19 pandemic; the effects of inflation and changes in interest

rates; an economic slowdown, recession or contraction of the global

economy; a financial or liquidity crisis; geopolitical factors,

including, but not limited to, the Russian invasion of Ukraine;

global supply chain concerns; the status of debt and equity markets

(including, market volatility and uncertainty); and other risks and

uncertainties, including those risks to be included under the

heading “Risk Factors” in the proxy statement to be filed by Goal

with the SEC and also those included under the heading “Risk

Factors” in Goal’s final prospectus relating to its initial public

offering dated February 16, 2021 and Goal’s other filings with the

SEC. In light of the significant uncertainties in these

forward-looking statements, you should not regard these statements

as a representation or warranty by Goal, Digital Virgo, their

respective directors, officers, affiliates, advisers or employees

(or any other person) that Goal and Digital Virgo will achieve

their objectives and plans in any specified time frame, or at all.

The forward-looking statements in this press release represent the

views of Goal and Digital Virgo as of the date of this press

release. Risks in addition to those set forth herein may also

materialize. Moreover, Goal’s and Digital Virgo’s assumptions may

prove to be incorrect. Actual results could differ materially from

the results implied or expressed by the forward-looking statements

in this press release. There may also be additional risks that

neither Goal nor Digital Virgo presently know, or that neither Goal

nor Digital Virgo currently believe are material, that could also

cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

do not reflect Goal’s or Digital Virgo’s expectations, plans or

forecasts of future events and views after the date of this press

release. Subsequent events and developments may cause Goal’s and

Digital Virgo’s assessments to materially change. While the Goal

and Digital Virgo may choose to update these forward-looking

statements in the future, there is no current intention or plan to

do so. Except to the extent required by applicable law, neither

Goal nor Digital Virgo undertakes to update, supplement or amend

any of the forward-looking statements in this press release at any

time after the date hereof. You should, therefore, not rely on

these forward-looking statements as representing the views of Goal

or Digital Virgo as of any date subsequent to the date of this

press release. Accordingly, undue reliance should not be placed

upon the forward-looking statements.

Financial Information and Non-IFRS Measures

Financial information of Digital Virgo included in this press

release are prepared in accordance with IFRS. This press release

includes adjusted EBITDA which is a financial measure not presented

in accordance with IFRS. Adjusted EBITDA is not a measure of

financial performance in accordance with IFRS and may exclude items

that are significant in understanding and assessing Digital Video’s

financial results. Therefore, these measures should not be

considered in isolation or as an alternative to net income, cash

flows from operations or other measures of profitability, liquidity

or performance under IFRS. You should be aware that the

presentation of this measure may not be comparable to

similarly-titled measures used by other companies. Digital Virgo

defines adjusted EBITDA as the Recurring Operating Profit in

accordance with IFRS (Operating Profit excluding non current costs

and revenues) plus the depreciation, amortization and impairment of

non current assets excluding the depreciation charges for the

right-of-use assets, plus the stock-based compensation expenses

(consumption of the fair value of free shares and stock options

granted to employees and managers).

Additional Information about the

Proposed Business Combination and Where to Find It

In connection with the proposed transaction, Goal will file a

preliminary proxy statement and a definitive proxy statement with

the U.S. Securities and Exchange Commission (“SEC”) with respect to

the stockholder meeting of Goal to vote on the proposed

transaction. STOCKHOLDERS OF GOAL AND OTHER INTERESTED PERSONS ARE

ADVISED TO READ, WHEN AVAILABLE, THE PRELIMINARY AND DEFINITIVE

PROXY STATEMENTS, ANY AMENDMENTS THERETO AS WELL AS ANY OTHER

RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN

CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS

WILL CONTAIN IMPORTANT INFORMATION ABOUT GOAL, DIGITAL VIRGO AND

THE PROPOSED TRANSACTION. THE DEFINITIVE PROXY STATEMENT WILL BE

MAILED TO STOCKHOLDERS OF GOAL AS OF A RECORD DATE TO BE

ESTABLISHED FOR VOTING ON THE PROPOSED TRANSACTION. ONCE AVAILABLE,

STOCKHOLDERS OF GOAL WILL ALSO BE ABLE TO OBTAIN A COPY OF THE

PROXY STATEMENTS AND OTHER DOCUMENTS FILED WITH THE SEC WITHOUT

CHARGE, BY DIRECTING A REQUEST TO: GOAL ACQUISITIONS CORP.,

ATTENTION: WILLIAM T. DUFFY, TELEPHONE: (888) 717-7678. THE

PRELIMINARY AND DEFINITIVE PROXY STATEMENTS, AND ANY OTHER RELEVANT

DOCUMENTS, ONCE AVAILABLE, CAN ALSO BE OBTAINED, WITHOUT CHARGE, AT

THE SEC’S WEBSITE (WWW.SEC.GOV).

Participants in the

Solicitation

Goal and Digital Virgo and their respective directors and

executive officers may be considered participants in the

solicitation of proxies from Goal’s stockholders with respect to

the potential transaction described in this press release under the

rules of the SEC. Information about the directors and executive

officers of Goal and their ownership of Goal’s securities is set

forth in Goal’s Final Prospectus filed with the SEC on February 16,

2021. Additional information regarding the persons who may, under

the rules of the SEC, be deemed participants in the solicitation of

Goal’s stockholders in connection with the potential transaction

will be set forth in the preliminary and definitive proxy

statements when those are filed with the SEC. These documents are

available free of charge at the SEC’s website at www.sec.gov or by

directing a request to Goal Acquisitions Corp., Attention: William

T. Duffy, telephone: (888) 717-7678.

No Offer or Solicitation

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of section 10 of the Securities Act, or an exemption

therefrom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221117005610/en/

For inquiries regarding Digital Virgo:

www.digitalvirgo.com/contact

Media For Digital Virgo,

Communications Director Émilie Roussel: press@digitalvirgo.com For

Goal Acquisitions: press@goalacquisitions.com

Investors For investor

inquiries at Digital Virgo: ir@digitalvirgo.com For investor

inquiries at Goal: info@goalacquisitions.com

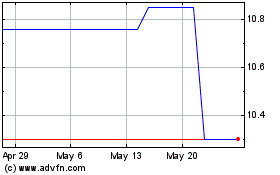

Goal Acquisition (NASDAQ:PUCK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Goal Acquisition (NASDAQ:PUCK)

Historical Stock Chart

From Dec 2023 to Dec 2024