Sixth Consecutive Quarter of Double-Digit

Growth

Reaffirms Full Year 2024 Outlook

Quanterix Corporation (NASDAQ: QTRX), a company fueling

scientific discovery through ultra-sensitive biomarker detection,

today announced preliminary financial results for the third quarter

ended September 30, 2024 and reaffirmed its full year 2024

guidance. The Company also disclosed the need to restate certain

prior period financial statements to correct non-cash errors

related to those periods.

“Quanterix continues to build on our strong momentum, achieving

our sixth consecutive quarter of double-digit growth. We are

pleased to reaffirm our full year 2024 outlook, which is especially

notable given the muted growth that continues to impact the tools

space,” said Masoud Toloue, Chief Executive Officer of Quanterix.

“With a focus on disciplined execution of our strategic priorities,

we are expanding the Quanterix portfolio of innovative products and

services, empowering our customers to break new ground in research,

and lead advancements in Alzheimer’s diagnostics.”

Preliminary Third Quarter 2024 Financial Highlights

- Revenue of $35.7 million, an increase of 13% compared to $31.6

million in the corresponding prior year period, as preliminarily

restated.

- GAAP gross margin of 58.9% and Non-GAAP gross margin of

53.4%.

- Net cash usage in the quarter was $3.3 million. The Company

ended the period with $296.1 million of cash, cash equivalents,

marketable securities, and restricted cash.

These preliminary financial results are based on current best

available information and are unaudited and subject to adjustment,

including in connection with the finalization of the restated

financial statements as further described below. The Company

expects to report its final results for the third quarter of 2024,

which could vary from the preliminary financial results disclosed

in this press release, in its Quarterly Report on Form 10-Q,

following the filing of the restated financial statements, as

further described below.

Third Quarter Operational and Business Highlights

- The Company announced the launch of LucentAD Complete, a

multi-marker test for Alzheimer’s Disease (AD) detection. The test

leverages a proprietary algorithm to generate an AD score by

analyzing five Alzheimer’s disease-related biomarkers (p-Tau 217,

Aβ42/40, NfL, GFAP), offering significantly improved amyloid

classification and reducing inconclusive results by up to

three-fold compared to traditional single-marker tests.

- In September 2024, Mt. Sinai Health System announced that they

would be deploying blood-based biomarkers as early detection tools

across primary and specialty care settings. Mt. Sinai will be

examining p-Tau 217, as well as NfL and GFAP using our assays

through a grant from the Davos Alzheimer’s Collaborative.

- The Company continues to advance its innovation rate and this

quarter released a new series of ultra-sensitive 4-marker panels in

neurology and immunology, as well as an extracellular vesicle

profiling tool kit, which has research applications in multiple

disease areas.

- The Company added two members to its Board of Directors, Jeff

Elliott, former CFO of Exact Sciences, and Ivana

Magovčević-Liebisch, Ph.D., J.D., President and CEO of Vigil

Neuroscience.

2024 Full Year Business Outlook

The Company reaffirms its 2024 revenue guidance range of $134

million to $138 million. This revenue range excludes revenue from

Lucent Diagnostics testing, which is expected to be immaterial for

2024. The Company also reaffirmed that it expects its research-use

only business (excluding Diagnostics) to achieve cash flow

breakeven when it reaches revenue between $170 and $190

million.

The Company continues to expect GAAP gross margin percentage to

be in the range of 57%-61%, and non-GAAP gross margin percentage to

be in the range of 51%-55%. The Company continues to anticipate

2024 cash usage (change in cash, cash equivalents, marketable

securities, and restricted cash) to be approximately $30

million.

For additional information on the preliminary non-GAAP financial

measures included in this press release, please see “Use of

Non-GAAP Financial Measures,” “Preliminary Restated Non-GAAP

Measures” and “Preliminary Restated GAAP to Non-GAAP

Reconciliation” below.

Restatement of Historical Financial Results

As previously reported, the Company has identified and continues

its efforts to remediate a material weakness in its internal

control over financial reporting relating to the operating

effectiveness of internal controls associated with the accounting

for inventory valuation.

In connection with these remediation efforts, and while

performing closing procedures for the third quarter 2024,

management identified an error related to the capitalization of

labor and overhead costs applied to prior periods, which impacted

the valuation of inventory. This error relates to a design

deficiency in the Company’s internal control over financial

reporting related to the accounting for inventory valuation. The

cumulative effect of this error, when taken together with unrelated

immaterial errors identified by the Company in prior periods,

resulted in the need for material adjustments to previously issued

financial statements.

The Audit Committee of the Board of Directors and management

therefore concluded that it is appropriate to restate the Company’s

audited consolidated financial statements as of December 31, 2023

and 2022 and for each of the three years in the period ended

December 31, 2023, and its unaudited consolidated financial

statements for the quarterly and year-to-date (as applicable)

periods ended March 31, 2022, June 30, 2022, September 30, 2022,

March 31, 2023, June 30, 2023, September 30, 2023, March 31, 2024

and June 30, 2024 (the “Restatement”) in order to correct all known

errors in accounting in the financial statements for such periods.

The Company intends, as promptly as possible, to complete the

Restatement and to file with the Securities and Exchange Commission

amendments to the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, and its Quarterly Reports on Form 10-Q for

the first and second quarters of 2024 and to file its Quarterly

Report on Form 10-Q for the third quarter of 2024. Although there

can be no assurance, the Company’s goal is to complete the

Restatement and all required filings by the end of 2024.

The Company currently estimates that the corrections to be made

as part of the Restatement will result in the following impact to

gross profit and operating loss:

GAAP Gross Profit

Increase

Operating Loss

Increase/(Decrease)

Year ended December 31, 2021

$1.6 million

$(0.6) million

Year ended December 31, 2022

$0.4 million

$0.5 million

Year ended December 31, 2023

$2.1 million

$(2.3) million

These preliminary figures are based on currently available

information and are unaudited and subject to adjustment. The

supplemental schedules in this press release provide additional

information regarding the preliminary anticipated impact of the

Restatement, but such additional information is also based on

currently available information and is unaudited and subject to

adjustment. The Company does not expect the errors to result in any

material impact on the previously reported amounts for total

revenues or cash in any completed fiscal period.

The Company expects to delay the filing of its Quarterly Report

on Form 10-Q for the third quarter of 2024, in order to complete

the Restatement and will file a Form 12b-25 with the Securities and

Exchange Commission. Additional information regarding the

Restatement and the preliminary anticipated effect of the

Restatement on the Company’s previously reported financial

information is included in the Company’s Current Report on Form 8-K

(and exhibits) filed on November 12, 2024.

Conference Call

In conjunction with this announcement, the Company will host a

conference call on November 12, 2024, at 4:30 PM E.T. Click here to

register for the conference call with a webcast link. For audio use

the following dial-in number and passcode: USA & Canada –

Toll-Free (800) 715-9871 Conference ID: 2720617.

Interested investors can also listen to the live webcast from

the Event Details page in the Investors section of the Quanterix at

https://ir.quanterix.com. An archived webcast replay will be

available on the Company’s website for one year.

Supplemental Schedules

Preliminary Restated GAAP Financials

FY21

FY22

Q1FY23

Q2FY23

Q3FY23

Q4FY23

FY23

Q1FY24

Q2FY24

Q3FY24

As Reported

Revenue

110.6

105.5

28.5

31.0

31.3

31.5

122.4

32.1

34.4

35.7

Gross Profit $

61.7

46.8

16.9

19.1

17.8

16.8

70.6

19.6

20.1

21.1

Gross Profit %

55.8%

44.4%

59.5%

61.7%

56.8%

53.2%

57.7%

61.2%

58.3%

58.9%

Operating Expense

120.3

148.5

26.3

28.7

31.6

33.8

120.3

33.6

33.2

32.3

Operating Loss

(58.6)

(101.7)

(9.4)

(9.6)

(13.8)

(17.0)

(49.7)

(14.0)

(13.1)

(11.2)

GAAP Adjustments

Revenue

0.0

0.0

0.0

(0.2)

0.2

0.0

0.0

0.0

0.1

0.0

Gross Profit $

1.6

0.4

(0.9)

0.4

1.1

1.5

2.1

(0.8)

1.5

0.0

Operating Expense

1.0

0.9

0.2

(0.5)

0.7

(0.7)

(0.3)

0.0

(0.1)

0.0

Operating Loss

0.6

(0.5)

(1.1)

0.9

0.5

2.2

2.3

(0.8)

1.6

0.0

Restated

Revenue

110.6

105.5

28.5

30.8

31.6

31.5

122.4

32.1

34.4

35.7

Gross Profit $

63.3

47.2

16.0

19.5

18.9

18.3

72.7

18.8

21.6

21.1

Gross Profit %

57.3%

44.7%

56.3%

63.4%

59.9%

57.8%

59.4%

58.7%

62.7%

58.9%

Operating Expense

121.3

149.4

26.6

28.2

32.2

33.1

120.1

33.6

33.1

32.3

Operating Loss

(58.0)

(102.2)

(10.6)

(8.7)

(13.3)

(14.8)

(47.4)

(14.8)

(11.5)

(11.2)

Use of Non-GAAP Financial Measures

To supplement the preliminary restated financial statements

presented on a U.S. GAAP basis, the Company also presents

preliminary restated non-GAAP gross profit, non-GAAP gross margin,

non-GAAP total operating expenses, and non-GAAP loss from

operations. These non-GAAP measures are calculated by including

shipping and handling costs for product sales within cost of

product revenue instead of within selling, general, and

administrative expenses. The Company uses these non-GAAP measures

to evaluate its operating performance in a manner that allows for

meaningful period-to-period comparison and analysis of trends in

its business and its competitors. The Company believes that

presentation of these non-GAAP measures provides useful information

to investors in assessing the Company’s operating performance

within its industry and to allow comparability to the presentation

of other companies in its industry where shipping and handling

costs are included in cost of goods sold for products. The non-GAAP

financial information presented here should be considered in

conjunction with, and not as a substitute for, the financial

information presented in accordance with U.S. GAAP.

Set forth below is the preliminary restated non-GAAP gross

profit, non-GAAP gross margin, non-GAAP total operating expenses,

and non-GAAP loss from operations and a reconciliation of these

preliminary restated non-GAAP measures to their most directly

comparable preliminary restated GAAP financial measures.

Preliminary Restated Non-GAAP Measures

FY21

FY22

Q1FY23

Q2FY23

Q3FY23

Q4FY23

FY23

Q1FY24

Q2FY24

Q3FY24

As Reported (Non-GAAP)

Revenue

110.6

105.5

28.5

31.0

31.3

31.5

122.4

32.1

34.4

35.7

Gross Profit $

54.8

39.6

15.1

17.5

15.2

14.7

62.5

17.5

18.0

19.1

Gross Profit %

49.6%

37.5%

53.1%

56.4%

48.6%

46.5%

51.1%

54.5%

52.3%

53.4%

Operating Expense

113.4

141.3

24.5

27.1

29.0

31.7

112.2

31.5

31.1

30.3

Operating Loss

(58.6)

(101.7)

(9.4)

(9.6)

(13.8)

(17.0)

(49.7)

(14.0)

(13.1)

(11.2)

Adjustments

Revenue

0.0

0.0

0.0

(0.2)

0.2

0.0

0.0

0.0

0.1

0.0

Gross Profit $

0.6

(0.3)

(0.9)

0.4

1.1

1.5

2.1

(0.8)

1.5

0.0

Operating Expense

0.0

0.2

0.2

(0.5)

0.7

(0.7)

(0.3)

0.0

(0.1)

0.0

Operating Loss

0.6

(0.5)

(1.1)

0.9

0.5

2.2

2.3

(0.8)

1.6

0.0

Restated (Non-GAAP)

Revenue

110.6

105.5

28.5

30.8

31.6

31.5

122.4

32.1

34.4

35.7

Gross Profit $

55.4

39.3

14.2

17.9

16.3

16.2

64.6

16.7

19.5

19.1

Gross Profit %

50.1%

37.2%

49.9%

58.2%

51.8%

51.1%

52.8%

52.0%

56.7%

53.4%

Operating Expense

113.4

141.5

24.8

26.6

29.6

31.0

112.0

31.5

31.0

30.3

Operating Loss

(58.0)

(102.2)

(10.6)

(8.7)

(13.3)

(14.8)

(47.4)

(14.8)

(11.5)

(11.2)

Preliminary Restated GAAP to Non-GAAP Reconciliation

FY21

FY22

Q1FY23

Q2FY23

Q3FY23

Q4FY23

FY23

Q1FY24

Q2FY24

Q3FY24

Preliminary Restated GAAP gross profit

63.3

47.2

16.0

19.5

18.9

18.3

72.7

18.8

21.6

21.1

Shipping and handling costs

(7.9)

(7.9)

(1.8)

(1.6)

(2.6)

(2.1)

(8.1)

(2.1)

(2.1)

(2.0)

Preliminary Restated Non-GAAP gross

profit

55.4

39.3

14.2

17.9

16.3

16.2

64.6

16.7

19.5

19.1

GAAP Revenue

110.6

105.5

28.5

30.8

31.6

31.5

122.4

32.1

34.4

35.7

Gross margin (gross profit as a % of GAAP

revenue)

57.3%

44.7%

56.3%

63.4%

59.9%

57.8%

59.4%

58.7%

62.7%

58.9%

Non-GAAP gross margin (non-GAAP gross

profit as a % of GAAP revenue)

50.1%

37.2%

49.9%

58.2%

51.8%

51.1%

52.8%

52.0%

56.7%

53.4%

Preliminary Restated GAAP total operating

expenses

121.3

149.4

26.6

28.2

32.2

33.1

120.1

33.6

33.1

32.3

Shipping and handling costs

(7.9)

(7.9)

(1.8)

(1.6)

(2.6)

(2.1)

(8.1)

(2.1)

(2.1)

(2.0)

Preliminary Restated Non-GAAP total

operating costs

113.4

141.5

24.8

26.6

29.6

31.0

112.0

31.5

31.0

30.3

Preliminary Restated GAAP loss from

operations

(58.0)

(102.2)

(10.6)

(8.7)

(13.3)

(14.8)

(47.4)

(14.8)

(11.5)

(11.2)

Preliminary Restated Non-GAAP loss from

operations

(58.0)

(102.2)

(10.6)

(8.7)

(13.3)

(14.8)

(47.4)

(14.8)

(11.5)

(11.2)

About Quanterix

From discovery to diagnostics, Quanterix’s ultra-sensitive

biomarker detection is driving breakthroughs only made possible

through its unparalleled sensitivity and flexibility. The Company’s

Simoa technology has delivered the gold standard for earlier

biomarker detection in blood, serum or plasma, with the ability to

quantify proteins that are far lower than the Level of

Quantification of conventional analog methods. Its industry-leading

precision instruments, digital immunoassay technology and

CLIA-certified Accelerator laboratory have supported research that

advances disease understanding and management in neurology,

oncology, immunology, cardiology and infectious disease. Quanterix

has been a trusted partner of the scientific community for nearly

two decades, powering research published in more than 3,100

peer-reviewed journals. Find additional information about the

Billerica, Massachusetts-based company at https://www.quanterix.com

or follow us on Twitter and LinkedIn.

Forward-Looking Statements

Quanterix’s current financial results, as discussed in this

press release, are preliminary and unaudited, and subject to

adjustment. This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Words such as “may,” “will,” “expect,” “plan,”

“anticipate,” “estimate,” “intend” and similar expressions (as well

as other words or expressions referencing future events, conditions

or circumstances) are intended to identify forward-looking

statements. These forward-looking statements include, but are not

limited to, statements about Quanterix’s financial performance,

including statements under the headers “Preliminary Third Quarter

2024 Financial Highlights,” “2024 Full Year Business Outlook,”

“Restatement of Historical Financial Results” and “Supplemental

Schedules” set forth above, and are subject to a number of risks,

uncertainties and assumptions. Forward-looking statements in this

press release are based on Quanterix’s expectations and assumptions

as of the date of this press release. Each of these forward-looking

statements involves risks and uncertainties. Factors that may cause

Quanterix’s actual results to differ from those expressed or

implied in the forward-looking statements in this press release

include, but are not limited to, that the Company may have

underestimated the scope and impact of the Restatement, risks and

uncertainties around the effectiveness of the Company’s internal

control over financial reporting, the risk that the Company’s

restated financial statements may take longer to complete than

expected, as well as those described in our periodic reports filed

with the U.S. Securities and Exchange Commission, including the

“Risk Factors” sections contained therein. Except as required by

law, Quanterix assumes no obligation to update any forward-looking

statements contained herein to reflect any change in expectations,

even as new information becomes available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112640948/en/

Media Contact: media@quanterix.com Investor Relations

Contact: Amy Achorn (978) 488-1854 ir@quanterix.com

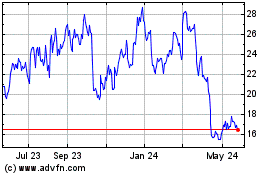

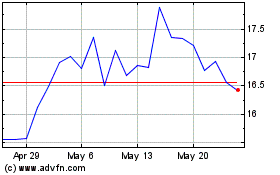

Quanterix (NASDAQ:QTRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Quanterix (NASDAQ:QTRX)

Historical Stock Chart

From Feb 2024 to Feb 2025